Fundamentals of The Swiss Franc (CHF)

The Swiss franc (CHF) is fifth in terms of global FX liquidity, behind the US dollar (USD), euro (EUR), Japanese yen (JPY), and British pound (GBP). Having at least a basic understanding of the fundamentals of the Swiss franc is essential for anyone trading the currency.

As a day trader, working on a very small timeframe often causes you to lose sight of the broader picture of what’s going on in the markets.

The Best Brokers For CHF Trading

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

For example, in 2018 Turkey was having a balance of payments problem that caused its currency and credit and equity markets to decline. If you were day trading the USD/TRY and trying to profit from small moves in the market that end up looking infinitesimal on a broader time horizon, you might have had problems if you kept on the side of the Turkish lira.

If you aren’t aware of the broader picture, you may end up with a losing streak of trades that you believe are simply “bad luck”. But in reality, it could be indicative of something that’s systematically amiss. For example, if a day trader has a “contrarian” strategy and is inclined to buy dips and sell rallies at anticipated reversal points, but what’s driving the trend is very mechanical and logical – for instance, a country is having trouble paying its debts – that can lead to a series of bad trades. And usually when traders make bad trades, the losses tend to compound on themselves because it clouds their judgment and they may start taking more risk to recoup previous losses. This usually exacerbates the problem.

In short, to whatever extent possible, studying fundamentals and longer-term price patterns on the assets you trade is supremely helpful for day traders. It might seem incongruous with the entire concept of “day trading”. But I can assure you that staying abreast of these matters is very important.

Fundamentals of the Swiss Franc

Whether a currency is strong or weak often depends on what the country’s or jurisdiction’s leading policymakers want it to be. This is largely within the purview of monetary policy run by the central bank who can influence this.

In the case of Switzerland, the Swiss National Bank (SNB) wants a weak franc. It is doing this because it wants to boost inflation to rid the country of its deflationary problems that have plagued it for the better part of the past decade.

First, I should explain why deflation is bad because this is an important part of understanding the current dynamics surrounding fundamentals of the Swiss franc.

So, why is deflation bad?

If monetary policy is run with a deflationary bias, this means you will run an economy that never runs into its capacity constraints – e.g., “full employment”. Some amount of inflation will always be present when this is achieved because of structural flaws in our economic system stemming from imperfect competition, such as monopoly, duopoly, and oligopoly.

Therefore, some amount of inflation will always be present when full employment is truly reached. This is why inflation targeting as a central bank mandate is a no-brainer.

When an economy doesn’t achieve full employment it won’t maximize output. Unemployment as a whole will be high, because companies rarely cut nominal wages. Instead, they tend to lay off labour. People won’t earn as much income accordingly. Spending will decline, cash hoarding will become more common, and GDP – in developed economies, consumption is the majority of GDP – will contract and living standards will decline as a direct result.

Deflation produces permanent economic anaemia as not enough money and credit are being spent on goods, services, and financial assets. These cycles tend to be self-reinforcing. Lower incomes lead to lower spending, which leads to lower capacity to borrow, which produces even lower incomes and spending and overall output in a downward spiral.

Equity markets will remain below their peak with declining incomes and contractive (or insufficiently expansionary) monetary policy. Japan’s deflationary problems that have persisted for nearly three decades has left the country with a stock market that is still approximately 42% below its 1989 peak. This is obviously not good for domestic wealth.

The Swiss National Bank’s Effect

In the hope of permanently fixing Switzerland’s deflationary problems, the SNB has resorted to negative interest rates. This can seem counterintuitive because it means that the buyer has to pay in order to hold short-term debt.

In deflationary environments, it can make sense to hold a negative yielding bond if your real (inflation-adjusted) return is positive. In other words, if the negative rate on the bond is higher than the rate at which prices are declining on goods and services in the economy. It also serves as an incentive to get economic actors to put their money into riskier assets to increase collective returns and create a “wealth effect”. Theoretically, this should also boost spending and investment behaviour.

The SNB’s primary rate-setting mechanism, the SARON (Swiss Average Rate Overnight), is minus-75bps and overnight CHF LIBOR is minus-78 to minus-80bps. This helps stimulate outflows (exports) by working to make the currency cheaper. The Swiss franc becomes less desirable when its rate of return – and the rate of return of the assets that are denominated in francs – is not attractive.

The SNB also does their quantitative easing (asset buying) program much differently than the US Federal Reserve, European Central Bank, and Bank of Japan. Instead of buying domestic assets, the SNB buys outside assets, such as US large cap stocks, to push out liquidity and weaken the franc. When you buy domestic assets, this has the effect of increasing the value of the currency because these assets are what create demand for it. The SNB is doing the reverse process.

As an antidote to the SNB’s moves, traders largely recognize that Switzerland is in relatively solid shape economically. It has a fiscal surplus and large current account surplus. It also has low indebtedness, high wages, and high GDP per capita. This makes the Swiss franc in demand as it is a structurally sound currency.

Current Dynamics of the Swiss Franc

The Swiss franc is the most attractive currency to use for short legs in FX trades, holding all else equal, as Switzerland’s overnight interest rate is the lowest in the world. You get 0.75% annualized, on an unleveraged basis, to short it in the spot FX market. (Note that the actual return you’ll get will depend on your broker.)

That means in strong global economic environments, the franc is often used by traders as the short leg in buying currencies with high interest rates. This is called carry trading. This borrowing dampens demand for it because it is in effect being sold, which decreases its price.

But when the market is weak you often see strong buying activity in the franc because traders unwind their carry trades. These types of trades often involve being long a riskier asset or currency.

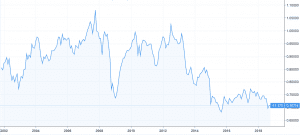

For example, note the large spike in the franc to emerging market equities ratio in 2008 during the financial crisis.

This is a product of carry trades being unwound. Short positions in the franc were covered – effectively francs were bought – causing a large rally.

The Bottom Line on the Fundamentals of the Swiss Franc

The most broadly helpful thing to know about the fundamentals of the Swiss franc is that it serves as a safe haven currency.

This is because its low interest rates make it attractive to borrow in, and covering these borrowed funds during periods of market turmoil means buying activity will take place.

Therefore, many consider the Swiss franc as a market hedge, similar to gold, or else a basic way to diversify a portfolio.

In good times, you will typically see it appreciate relative to positive-carry assets, such as currencies like the Australian dollar (AUD) or the emerging market equities example.

These rates of depreciation in the franc will generally be of a steadier magnitude than the sharp rates of appreciation during market weakness, given contractions tend to be much swifter and volatile than good economic periods.

Here is the AUD/CHF:

Note the modest rise in the AUD against the CHF before the sharp drop in 2008. There was another drop in 2013 to late 2015 as commodity markets became oversupplied and dropped in price from 2014 to early 2016. Australia is a big commodity exporter and its currency is therefore sensitive to fluctuations in commodity markets.