How to Calculate Cash Flow in Real Estate

When I talk about real estate – and how to calculate cash flow in real estate specifically – I’m getting slightly sidetracked from the idea of day trading, or trading over short intervals. But I’m also a firm proponent of having multiple diverse streams of income. This includes trading short-term (i.e., day trading), medium intervals (i.e., swing trading), over long periods (i.e., buy and hold), and in different asset classes.

In trading, the range of things that you don’t know is always going to be greater than whatever it is that you do know. There are very few no-brainers. Therefore, you should not be too dependent on any given outcome or strategy.

Not everything will fall perfectly in line with a short trading interval. Moreover, trading activity is not at all correlated to how much money you’re going to make. Accounting for fees, trading too much can actually hurt you if you don’t have a systematic advantage justifying the high trading frequency.

Real estate is one of these income streams that is more longer term in nature. You don’t necessarily need to hold yourself to a single mandate.

When performing any type of fundamental analysis on a business, cash flow is ultimately what it always boils down to. A company has value if it produces cash.

Fundamentally, the value of a business is the amount of cash it produces discounted back to the present. (The discount rate is the expected or desired return.) Companies that can’t generate cash over their life ultimately aren’t worth anything.

In real estate, you can benefit from capital appreciation (selling a property for more than you paid for it in excess of the expenses put into it) and certain benefits like depreciation write-offs to reduce taxable income. But having a positive cash flowing property is still nonetheless important and should be the ultimate goal.

Below we will go over the steps in how to calculate cash flow in real estate.

How to Calculate Cash Flow in Real Estate: The Steps

1. Gross income

First, you need to calculate gross income. This is all income before expenses.

Generally, there are two types of gross income:

a) actual income, and

b) projected income

Actual income is the rent actually being generated. This includes the rent of the entire property. This is the sum of all dwelling units, and any income derived from storage, laundry, parking, and so on.

Projected income is an estimation of what income could be if the building became vacant and you could rent it out at current market value.

In other words, if hypothetically the current tenant moves out and a new tenant moves in, how much could you theoretically get if you were to rent it out right now. And this would form the gross income that could possibly be had.

But many real estate investors will ignore projected income. Often, the estimate is optimistic. Moreover, this figure is often done by the owner (i.e., the seller of the property) who will often overestimate the amount.

Let’s say we have a $500K building and it has four units renting for $1,000 apiece per month. That’s $4,000 in rent per month or $48,000 per year. Assume that there are no other forms of income – the owner is a nice guy, so parking, laundry, storage, and whatever else is free.

So, our gross income is $48,000 per year.

2. Expenses

Our second step in this process involves expenses.

No matter if you bought the property in cash and don’t have a mortgage, there will be some level of fixed expenses.

We’ll use reasonable monthly figures for a $500K property. These include:

- Property tax: $800

- Homeowners’ association: $500

- Utilities: $0

- Insurance: $200

- Services (e.g., pest control, landscape): $100

- Maintenance: $500

- Vacancy rate: $200

- Management fee*: $0

*The management fee is a layer between you and the tenant. Owners generally will use a property manager to free up their time or because they live far away. Real estate is heavily location-based, so if your local property market isn’t attractive, you can always go elsewhere. But because of this distance, you may need to factor in the need to use a property manager.

The mortgage payment is a fixed expense, but we’ll calculate this later.

The mortgage payment assumes a standard 3.5 percent loan off a 20 percent down payment, leaving 80 percent of the property’s value to be taken out on a loan.

Property taxes depend on your jurisdiction, but can approximate around 2 percent of the total value of the property per year.

Homeowners’ association (HOA) fees cover the costs of common amenities, such as janitorial work, gardening, and so forth. They can be very expensive or nothing at all. In my home real estate market, Manhattan (NY), they happen to be very high almost everywhere in the city.

Utilities might be passed on to the tenant or you could pay them yourself. In this case, we’ll assume the tenant puts all of them in their name, as they’re the one consuming them.

Insurance is necessary and will often run around $200 per month.

Maintenance repairs will need to be done at some point. Homes and properties need upkeep and have repair needs. Often, these may come “in bulk” since you usually don’t continually do relatively minor repairs. They often average about 1 percent of the value of the property per year just as a simple general rule of thumb

Vacancy will also occur at a certain rate and counts as a fixed expense (i.e., lost income). This is not entirely predictable. But it is inevitable at some point that there will be some level of vacancy. If your rents are around market value, having a low single-digit percentage value makes sense. At 5 percent, this would come to around $200 for this particular example.

A property manager will typically take around 10 percent of your rent. They will often save you time and take care of all communications with the client, including rent collection and basic repair or maintenance needs.

3. Net income

If you don’t have a mortgage, then gross income minus the above-mentioned expenses will represent your net income. Some will call this net operating income (NOI).

We have $4,000 in gross income and $2,300 in fixed expenses.

Subtracting the two, we have $1,700. That’s, of course, per month. Over a year, that comes to $20,400.

Taking that as a percentage return, $20,400 divided by $500,00 comes to 4.1 percent. This is what is commonly referred to as the capitalization rate (cap rate) of a property.

If there is a mortgage on the property, this can leverage your return to have the property yield more than 4.1 percent per year.

If you get a 30-year fixed rate mortgage of $400k at 3.5 percent, the monthly payment will come to around $1,800 per month.

Subtracting that $1,800 from $1,700, that comes to negative-$100 per month.

Now your net income is somewhat negative.

Your down payment was $100k. You also had closing costs of around 2 percent of the total cost of the property, which would come to $10k. So, your total upfront investment was $110k, giving a net return of negative-0.09 percent, or around breakeven.

But that’s not all because part of your mortgage goes toward building up your equity in the property. This is absolutely a positive source of return. In many places, this counts as income and taxes will need to be paid on it.

4. Equity buildup

As mentioned, when you pay down the loan, some of that goes toward paying down interest (what you pay to the bank or lender) and some to building up your equity in the property (value you are adding to your investment).

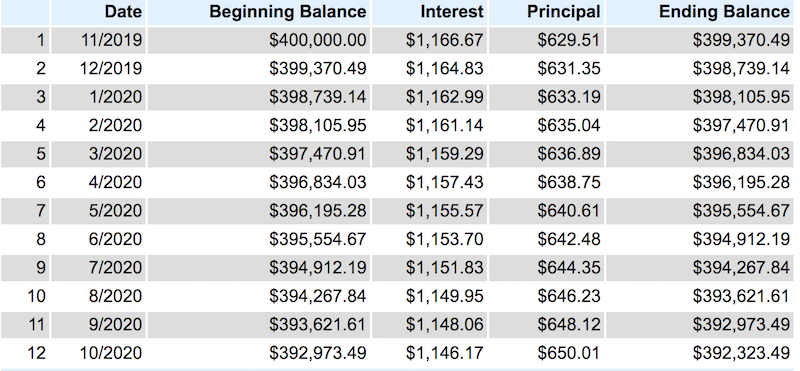

There are numerous mortgage calculators you can use online. Calculator.net has one and we can type in the info we’ve used in this article:

– 30-year mortgage

– $400k loan

– 3.5 percent interest rate

We have a mortgage payment of around $1,800 per month. During the first payment, the interest being paid is highest and the equity being paid in is lowest.

This improves in your favor going forward with lower interest and more equity.

By year 11, you’ll be paying more into equity than you do paying out interest under this particular set of circumstances.

You can find the total amortization table for this here.

Starting out, you’re getting about $630 in equity each month.

This gets your net income from negative-$100 to +$530 adding the two together.

That $530 divided by your total investment in the first year ($110k) is +0.48 percent.

If you do this calculation after one year excluding closing costs and see a boost in per-month equity value rise to $652, the return would rise to $552 (adding the negative-$100) divided by $100k, or +0.55 percent.

In this case, the property would barely be breaking above even. Considering the range of other assets out there for you to invest in that are safer and less time-intensive – cash, government bonds, corporate bonds – you would probably pass on this deal if this was something you were number-crunching on your own.

The general idea

You can use your own numbers to do the calculations.

You can also use this process to help determine what a property is actually worth. If you evaluate one property against another using the same type of formula, you can determine whether something is underpriced, overpriced, or in line with the overall market.

It’s also, of course, a way to generally think about how much of a return you could theoretically be making. If you can buy below-market value, make upgrades, and continue to add value to the properties, you will be able to increase the market for it as a rental and earn more. And ideally more relative to what you put in to improve it.

If you are interest in real estate and get used to doing this practice, you will understand it fully, and be able to use it going forward to help you evaluate real estate deals.

Applicable to all asset classes

This is also the general process for determining the fundamental value of any asset, not just real estate. If you are determining the fair value of a stock, you will need to understand how the company makes money, what it’s likely to earn, and what it’s likely to pay out to determine its earnings and cash flow.

All asset classes are fundamentally priced according to what an investor would pay for the future cash flows. That’s what investing is at its basis. You put up a lump sum for a future stream of cash flows, whether that’s a stock, bond, piece of real estate, private equity, venture capital, and so on. The most important driver of return is therefore when the expectation of that income stream changes.