The Path Forward for Cryptocurrencies

This article was published on November 5, 2020

First, I’ll start with my opinion on bitcoin, then cryptocurrencies in general. Later on in the article, we’ll look at the path forward for cryptocurrencies more broadly.

This will include the financial and non-financial uses and applications of crypto assets, and how traders and investors will need to view them as the niche matures beyond its current primary ties to speculative activity.

Bitcoin

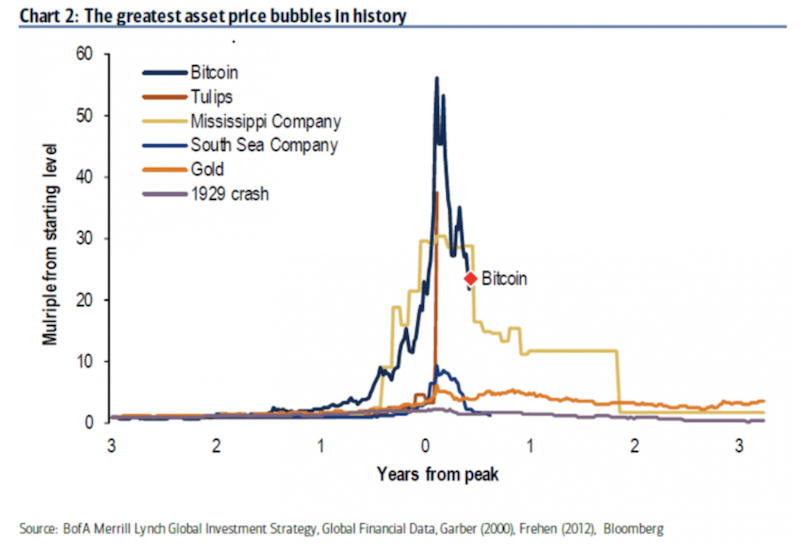

Bitcoin is the most popular cryptocurrency, and saw a huge surge in price and attention in 2017 due to a speculative bubble. More or less, the ascent and initial descent followed the pattern present in previous speculative frenzies, such as tulip bulbs (1630s), the Mississippi Company (late-1710s to 1720), and the South Sea company (1720s).

It has since retraced about 60 percent of that price move, topping in December 2017 at around $20,000 per “coin”, coinciding with the launch of bitcoin futures markets.

Its issues at the moment include:

– It’s easy to copy; there are thousands of other “coin” variants on the market

– The market is full of smaller speculators mostly looking to benefit from profiting off on its price movement (basically a big game of the “greater fool theory”)

– It has uncertain value as a currency, given it’s too volatile to be a store-hold of wealth and has limited transactional utility

– It has uncertain value as an investment (nothing about it defers consumption to the future) or as a currency hedge (central banks and big institutional investors don’t view it this way and its performance during turbulent market conditions is unknown)

Bitcoin has first-mover status in a niche (digital currencies) that has potential going forward and can be a store-hold of wealth and have transactional use in certain circumstances. So, it does have some value.

Cryptocurrencies

With cryptocurrencies, there are four main elements to consider:

1) Economics

2) Technology

3) Governance

4) Application and use cases

For something to have long-run value, there needs to be more to it than simply its use as an instrument for speculative activity (i.e., trying to make money off of its price movement). Any asset’s viability will be challenged in the long-term if it lacks practical use cases.

– Does it increase the operational efficiency for companies?

– How robust is the technology – is it secure, is it reliable?

– How is the governance system? Is it fair to all parties involved?

– Is it scalable – can many people use it on a widely dispersed network as a transactional medium to maximize its value?

– Is its value relatively stable?

– What is the regulatory response likely to be?

Cryptocurrencies, if they are technologically robust and governments allow people and business to transact in them, could eventually play a tangible role as currency alternatives. Certain governments will respond differently.

For countries who operate policy in a certain way – e.g., fixed exchange rate, closed capital account – cryptocurrencies are more likely to fall under a more stringent regulatory regime, such as banning access to the online marketplaces (digital currency exchanges) that host them.

This is used to control capital flows and deter certain other forms of behavior, such as using cryptocurrencies as an off-the-grid payments system to limit tax liability.

Right now, cryptocurrencies have a very long way to go to become attractive to central banks as reserves.

Moreover, institutional investors, when thinking about traditional fiat currencies, will look to see whether they can act as currency hedges to protect against monetizations when inflation-adjusted interest rates become unsatisfactorily low.

Cryptocurrencies don’t currently provide much in the way of value in that context. So, flows from the market participants who matter most are virtually non-existent. (Some smaller investment vehicles do participate in cryptocurrency market making or trading.)

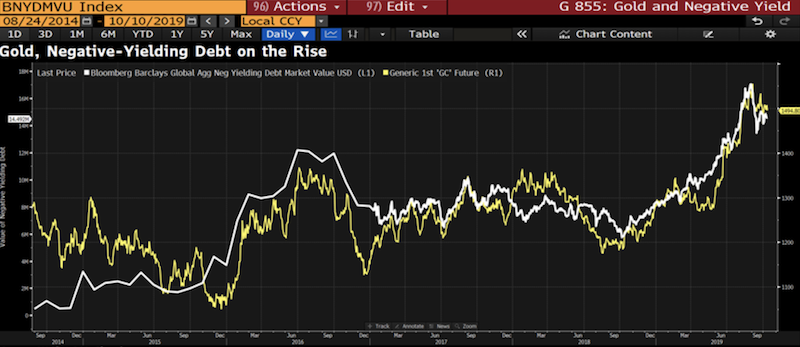

The purchase of alternative currencies for purposes of fiat currency hedging is where something like gold has traditionally come into play.

Central banks value it as a source of reserves and large institutional investors value it primarily as a reliable currency hedge, with its value proportional to global currency and reserves in circulation relative to the global gold supply.

This is why we see such relations as gold prices increasing in conjunction with the supply of negative yielding debt. Investors largely look to it as a hedge that offsets depreciation in fiat currencies. That heavily drives the behavior in its price.

At the same time, gold is a fairly small market, valued at somewhere around $2.7-$2.8 trillion. This is tiny in comparison to global equities markets (around $100 trillion) and global credit markets (over $250 trillion).

So, it’s unrealistic for gold to take in large amounts of capital outflows from credit and equities markets as an alternative store of wealth.

Gold is an asset that has a certain type of environment where it does well and a certain type of environment where it does horribly, so having it as part of a balanced portfolio in a smaller quantity can make sense as a cash alternative. (More on that topic here.)

Cryptocurrencies also lack an established track record like gold. During times in the market where investors seek to reduce risk, we do not know whether cryptocurrencies will serve as a “safe haven” to preserve capital, such as such currencies like the yen (creditor country), Swiss franc (creditor country), US dollar (world’s top reserve currency), and gold (no government’s liability).

The path forward for cryptocurrencies

Mainstream companies, such as banks, non-bank financial institutions (e.g., fintech firms), and large technology companies are initiating launches of digital currencies. Some are in the exploratory stages of using cryptocurrencies in their business operations through various digital platforms. The primary goal and purpose will be to extract efficiency improvements via an increasingly digitized financial system.

Current limitations to the widespread adoption include the security, reliability, and scalability of these digital currencies and the associated networks.

Categorically, we could place cryptocurrencies into four main baskets:

1) Speculative instruments

2) Technological implementations to improve existing payment infrastructures

3) New transactional mediums designed to allow consumers and businesses to access goods, services, and other financial assets within a proprietary platform

4) Use as a new medium of exchange or store-hold of wealth

Cryptocurrencies, which are a subset of digital currencies, prominently remain speculative instruments among mostly smaller traders trying to benefit from movements in its price. A large drop in their price may hurt some traders financially but not at a level that they pose systemic risk on a broader level.

Cryptocurrencies have the potential to help do away with certain intermediary functions that financial institutions traditionally perform. Distributed ledger technology can help improve transparency, operational auditability, and can execute transactions more quickly relative to executing the transactions via traditional corporate databases.

Lenders and borrowers traditionally rely on financial intermediaries to create trust and carry out certain functions related to the transactions. The potential to eliminate intermediaries is a matter of lowering costs and taking back control from entrenched centralized institutions.

In financial services, banks having separate ledgers for transactions creates a large degree of duplicate information. This can create conflict, confusion, and delays in various forms of financial transactions. For instance, when a group of lenders participate in syndicating a loan, a common ledger between all involved parties would avoid the need for each lender to track all information independently. Corporate stocks records and cross-border payment transactions are additional examples of financial service functions that require intermediation and duplicate record-keeping commitments.

Blockchain, the technology that underlies various digital currencies and crypto assets, is at its core a form of shared record-keeping. But this also requires many different actors to collaborate and join the system. This isn’t a trivial hurdle and could inhibit widespread adoption.

Part of the rising popularity of digital assets resides in the fact that our modern payment systems are too slow and cross-border payments are inefficient. Transactions are slow because they typically have to be processed through an intermediary, which normally takes a fee and temporarily uses the amount transferred as an asset to collect interest income.

Stablecoins

To get around the volatility and value issues, a class of cryptocurrencies known as stablecoins are pegged to the value of a traditional asset. Tether, for example, is one of the most popular digital currency assets globally.

It is backed by the value of various fiat currencies, such as the US dollar, euro, and Japanese yen, which are held in a separate account.

Nonetheless, Tether has never been audited. And when transactions don’t require the confirmation of real-world identities, this makes networks susceptible to suspicious or outright criminal activity.

Emerging markets or unstable economies

For those in unstable economies where there is a widespread lack of trust in the government and central bank, such as Venezuela and Zimbabwe, cryptocurrencies provide a way to preserve capital in some sense.

While cryptocurrencies have their own set of instabilities, it affords a type of protection in countries undergoing hyperinflation and rapid currency devaluations.

Many individuals in emerging and frontier markets also don’t use banking services, though many now have access to the internet.

The ability to make transactions efficiently and without needing to be tied directly to financial service providers is positive for economic and financial development and overall global inclusion.

This contrasts with developed markets where the primary focus will be to use the technology underlying cryptocurrencies to help modernize financial infrastructure.

Less reliance on financial intermediaries improves convenience and efficiency even though banks in developed markets are broadly trusted.

Non-financial corporate strategy

With respect to non-financial corporate strategy, cryptocurrencies can provide new functionalities where expanding the scope of digital platforms is the primary goal.

Other firms will look toward distributed ledger technology and “permissioned blockchain” to enhance their supply chains, inventory management systems, transparency and traceability of their financial operations, and other forms of internal business systems.

Their ultimate value will depend on increasing operational efficiency for the business in excess of their constraints, such as concerns regarding their security, reliability, and scalability, and potential regulatory response to their use.

Governance

The development of cryptocurrency and crypto asset systems and the resultant value they support and create will rely, in part, on the principled behavior by validators and developers of the technology.

The development of cryptocurrencies and initial coin offerings (ICOs) has been partially driven by greed. Many of the crypto assets in circulation were created out of a desire by developers to opportunistically capitalize on a speculative frenzy undertaken by unsophisticated investors.

As mentioned, most of those participating in cryptocurrency markets are simply looking to speculate on movements in the price and pay no recourse toward use cases and any value creative properties of the underlying asset that would provide it with long-run value.

Right now, it doesn’t make much sense to rapidly integrate new crypto technologies into the financial system until the governance structure is better worked out.

Governance remains a major roadblock toward large-scale adoption. It is not difficult for a smaller number of companies running miners and validators in a network to collude and affect its integrity.

This is a work in progress as most crypto activity is tied to speculation and not toward legitimate value creation purposes.

Central banks’ progress on digital currencies

The Federal Reserve, the world’s most prominent central bank, is in no rush to issue a digital currency.

But many central banks globally are stepping up their research on the costs and benefits of central bank digital currencies to help supplement existing national sovereign currencies.

China is ahead of other countries, rolling out a digital currency in April 2020 as part of a pilot program in four cities.

Benefits include faster and less expensive transactions globally. Information moves instantly while money moves significantly slower.

All central banks need to consider the risk of cyberattacks, fraud, and counterfeiting, in addition to the impacts on financial stability and their broader monetary policy mandates.

The US dollar’s role in the global payments system at some ~60 percent of international transactions makes it particularly important to get a digital currency right.

About $2 trillion worth of dollar notes are currently in circulation. About half of those are held outside of the US.

Conclusion

For investors in these crypto assets, the ultimate driver of their value will depend on how well they streamline operational processes, reduce costs, create value for customers, and adapt to the competitive pressures from incumbents and new entrants.

Robust governance, a comprehensive legal framework, and appropriate regulation are necessary to produce dependable and sound systems that can scale up to broader adoption in financial and non-financial contexts. Addressing the valid concerns of governments without excessively inhibiting the potential innovation potential will be necessary and a process that will continue over time.