Digital Yuan: What Does It Mean For Markets?

The digital yuan is China’s latest development in establishing itself as a global power economically.

In the mid-1980s, about 90 percent of China’s population lived in poverty. A generation later they’re challenging the United States and the West for superiority in a variety of different ways:

- Trade (already the largest)

- Economy and capital (second-largest economy and capital markets)

- Technology

- Geopolitical

- Military

A key part of this is the development and overall internationalization of their currency, the yuan (also known as the renminbi, CNY, or RMB).

Every great empire throughout time has had a reserve currency, which is developed through international trade, economic power, the desirability of the country for investment, technological advancement, a strong military, among other important factors.

A reserve currency is the biggest economic advantage a country can have.

Up until about a thousand years ago, money meant coins, precious metals, and whatever you could barter in (e.g., services, goods, and whatever was deemed to have value).

To make things easier, China used paper currency as something that all parties to a transaction could agree to had value.

Throughout history, paper money has commonly been backed by a certain amount of a commodity (China used silver, and gold has been historically popular as well). A certain amount of paper currency can be exchanged for a specific quantity of metal in commodity-linked systems.

However, paper money can have value by fiat – it has value because the government says so. This is the world we’re currently in. Because of the problems of each system, we tend to cycle between the two systems historically.

Now the Chinese government is issuing its national currency in digital form. This is one step to help challenge what’s still a big pillar of American power – the US dollar’s status as the world’s leading reserve currency.

Is the digital yuan truly novel?

While it seems like a lot of money is already virtual, services like Apple Pay, PayPal, China’s WeChat, and so on, are simply ways to move money electronically.

They eliminate the need for physical money. But they don’t actually turn legal tender into computer code itself, which is what digitized national currencies like the digital yuan are doing.

Cryptocurrencies represent a privatized version of this, but they are not legal tender. It’s more of an “off-the-grid” payments system, or an alternative store of value, similar to gold.

Read more: What Is the Difference Between Money and Credit?

The benefits of a digital yuan

China’s digital yuan is controlled by the People’s Bank of China (PBOC), its central bank, which issues it.

It will enable China’s government to better monitor spending behavior. One of the key advantages of cryptocurrency is the privatized nature of it. The digital yuan enables tracking of the user.

China also wants the digital yuan to be international. But at the same time, it does not want it intimately tied to the global financial system.

Since the establishment of the American world order beginning with the end of World War II in 1945, the US dollar has been the world’s dominant reserve currency with little robust competition from Japan, Europe (collectively), or the Soviet Union.

China’s use of digitization in many forms, now in their domestic currency, is being used to gain more centralized control. It will also help get a leg up on other technologies that are still being developed and can work into this ecosystem.

Mu Changchun, who is the head of the digital yuan project at the PBOC, asserted, “In order to protect our currency sovereignty and legal currency status, we have to plan ahead.”

How Washington responds

During a recent Senate appearance, Fed Chairman Jerome Powell was asked whether the dollar could be digitized and whether it makes sense to help the US defend its currency status.

Powell affirmed that researching a digital dollar was a “very high-priority project.”

“We don’t need to be the first,” he said. “We need to get it right.”

China is the US’s biggest rival and is likely to surpass the US and the West in many respects in time in terms of size of the economy, dominance in certain technologies, potential geopolitical influence, and military power.

That China has taken the lead in introducing a national digital currency is a source of unease in Washington. Anything that challenges the dollar is a national security concern. Treasury Secretary Janet Yellen has also said that the issue of a digital dollar is being studied in earnest.

Will the US fend off the digital yuan similar to the euro?

The euro was put into place to form a currency union that could better challenge the dollar as a reserve currency.

Given the importance of having a reserve currency – e.g., being able to borrow cheaply and derive an income effect, its influence in wielding geopolitical power – European policymakers established the euro in 1999.

However, the euro has many shortcomings and still lags the dollar.

The euro unifies many different countries together that have different economic characteristics. It is difficult for individual European countries to pursue monetary policies that are best for their own domestic circumstances.

The euro, for example, tends to be too weak for Germany, leading to the buildup of surpluses, and too strong for weaker economies like Spain, Portugal, Italy, and Greece.

European countries are also highly fragmented on a number of different issues, both within and between countries, and the region is weak militarily and in terms of productivity and overall economic growth.

Leading technologies now predominantly come out of the US and China.

Europe’s share of global growth is falling from its current level of about 15 percent.

So, for various reasons the euro has had various shortcomings that have kept the dollar in charge.

In international FX transactions, the dollar is part of 88 percent of them. The yuan/renminbi is still used in only four percent.

Digitization by itself does not make the yuan a rival to the dollar in interbank wire transfers. But it can gain ground in less regulated parts of the international financial system.

US sanctions have increasingly tightened on Chinese individuals or companies. A digital yuan can help skirt them. This is always the goal of many actors internationally, as US sanctions, when applied, tend to be pretty effective.

Moreover, for people internationally who want to transfer money, a digital yuan could help it gain traction.

So, there are many differences between the yuan today versus the euro. The euro was never great fundamentally while the yuan, as explained in this article, is the only one of the bunch listed (USD, EUR, JPY, GBP) that is attractive on a fundamental basis.

Where does the digital yuan exist?

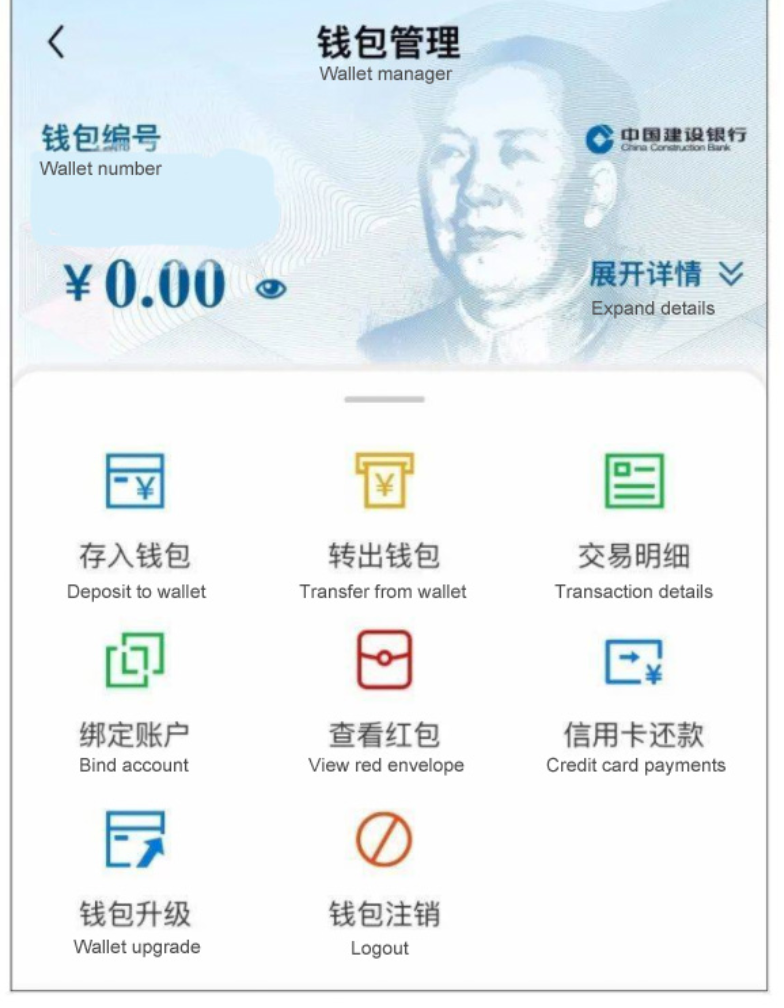

The digital yuan exists in the form of computer code. It’s available on a card or the owner’s mobile phone. Spending it doesn’t require having access to an online connection.

It appears on the screen just like paper money, with the illustration of Mao Zedong.

The rollout of the digital yuan

As a pilot test, more than 100,000 Chinese residents were invited to download an app on their mobile phone from the central bank.

This enabled them to spend small test allotments of the digital yuan. Merchants included Chinese locations of popular chain restaurants like Starbucks and McDonald’s.

Payment can be done by pointing an iPhone toward a scanner. The Chinese Communist Party (CCP) has also allowed its members to pay monthly due with digital cash.

Coexistence with physical money

The Chinese government has indicated that the digital yuan will circulate in tandem with physical money (i.e., bills and coins) for years going forward.

Beijing has yet to announce whether it intends to turn all of its currency in circulation into digital form. Many expect that it will. It’s only a matter of practicality that some time will need to pass.

Naturally, a country wants to have control over all money and credit within its borders.

A digital currency can be a great tool for the issuing government wanting to track who is spending money, how much, and to whom.

It can be useful to flag suspicious activity and also expedite transfer payments to households.

This can help tighten the CCP’s control of its domestic monetary affairs.

Digital payments are already very common in China.

Policymakers can also have greater flexibility with a digital currency. For example, when the economy needs stimulation, they can direct money to targeted individuals and entities and incentivize them to spend it, such as making it disappear after a period of time.

It may enable monetary and fiscal policies to be better coordinated, when necessary.

It can also serve as a way to pay certain fees instantly. The government has hundreds of millions of facial recognition cameras throughout the country. So, if someone commits an infraction, such as littering or jaywalking, the fine could be applied and collected as soon as it’s detected.

Residents’ concerns

Naturally, many Chinese residents have concerns over the government’s expansion, fearing there is little upside but plenty of downside to the government viewing every transaction.

More people accumulated cash in the time leading up to the issuance of the digital yuan. This helps ensure that more of their transactions can be done in cash or outside the surveillance of the digital system.

Is there any potential for traders to arbitrage physical renminbi vs. digital renminbi?

The potential scarcity of cash in circulation can also bring up a valuation argument.

Even when there are two identical things, scarcity of something in one location can cause price differentials between the two markets.

For example, natural gas is a highly localized market. Gold markets can get out of whack when shipments between major hubs are difficult to come by to get prices in line.

But China will strictly control its digital currency to ensure no differences in price between the digitized version of money and physical bills and coins.

As a result, it’s unlikely that traders will be able to speculate in the digital yuan market, looking to take advantage of price disparities, as it sometimes common with private digital money like cryptocurrencies.

Is counterfeiting a risk?

It will be virtually impossible for anyone to counterfeit the digital yuan. Only the PBOC will be able to make it.

Will the digital yuan be used as a way to expand the money supply?

The digital yuan is not intended to be a stimulus measure. It could make future stimulus easier by speeding the rate at which it can be delivered.

Even though legislation hasn’t been finalized for the digital yuan project, it won’t be used to get more money in circulation. Digital yuan is essentially being used to replace physical currency in circulation over a period of many years.

The PBOC may, at least initially, limit how much of the digital currency can be used as a way to limit how much can circulate.

Bitcoin’s influence on the digital yuan

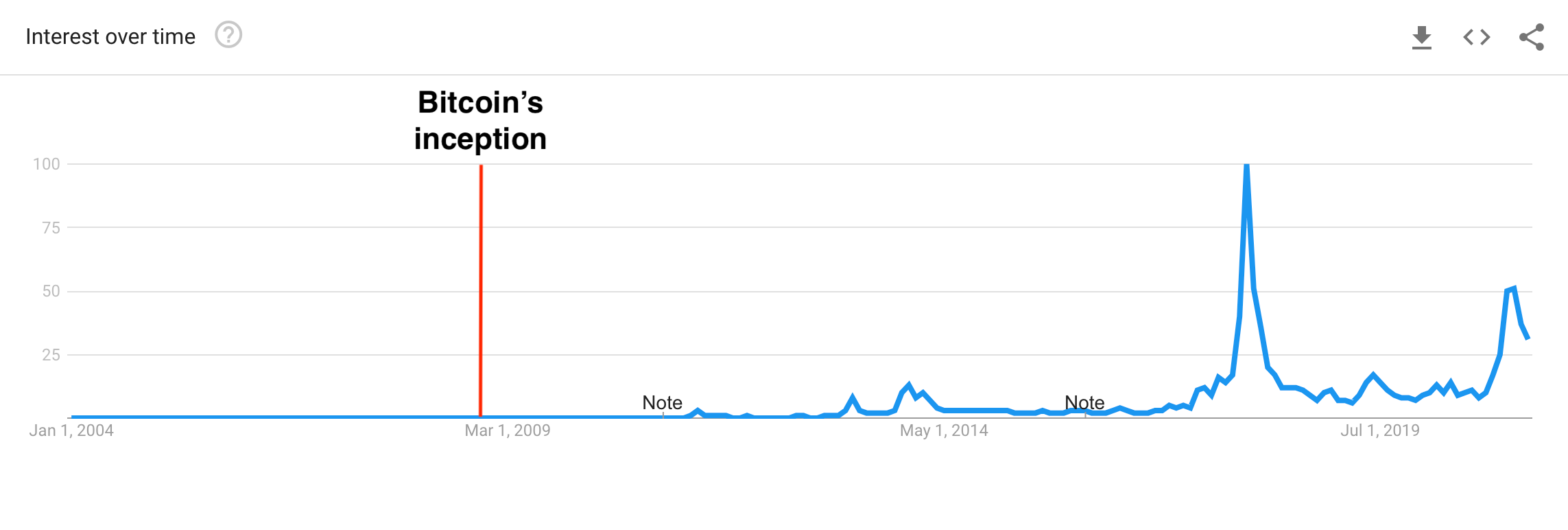

Bitcoin launched in January 2009. For the first 2+ years, bitcoin received little interest from the media. It picked up more in late-2013 before dying down again until the 2017 euphoria led it into the mainstream.

Interest in the search term ‘bitcoin’ over time

(Source: Google Trends)

Over the course of that time, most policymakers didn’t think much of bitcoin. It was essentially an experiment and had been scarcely marketed. But China is more aware of these matters.

Given a central bank wants to have all control over its money, Chinese policymakers are aware that alternative currency systems can undermine the government’s power if it becomes material enough. It lots of people want to transact in a different currency, it undermines their policy measures.

Zhou Xiaochuan was China’s top monetary policymaker from 2002 to 2018 and asserted that bitcoin was a source of both marvel as an invention and anxiety in terms of what it could turn into. American policymakers largely ignored it.

You could say these differences are because China is more “authoritarian”. But they also have a longer history and study it more. They are generally going to be more concerned over the risks because of historical analogues.

Throughout history, governments have imposed foreign exchange controls and banned alternative stores of value like gold to maintain control.

China formally looked into a digital yuan starting in 2014. Back then, there was more concern over possible capital controls in China, given their desire to have more control over their economy relative to Western policymakers.

However, it was clear back then that China wanted to become a global power. And every great empire throughout history has had a reserve currency.

Capital controls are not good for China because:

a) They set back the internationalization of a currency.

b) They are not good for countries with a lot of international trade and investment.

Instead, more of the focus was on keeping the exchange rate stable. Typically a country wants to keep its exchange rate in line with its closest trade partners. This helps avoid undermining any import/export competitiveness or backlash from the other country. For China, the yuan has largely been managed against a mix of currencies called the CFETS basket.

Fintech innovations

China knows that the country that’s technologically superior tends to be superior in most other ways. With that comes economic, military, and geopolitical power.

WeChat and AliPay are mobile phone apps that make holding physical cash mostly unnecessary. Some electronic payment apps are standalone companies while others are integrated within other conglomerates.

Facebook announced it would pursue the launch of its own cryptocurrency Libra in the middle of 2019.

Given Facebook’s user base – most notably includes the flagship platform, Instagram, and WhatsApp messaging – this gave rise to the notion that an alternative currency could circulate among a group of people that is far larger than any one country. This meant one currency circulating among potentially billions of people.

The implication is that it could challenge traditional currencies in some capacity.

US regulators succeeded in clamping down on Facebook’s Libra project. At the same time, China went deeper into developing its digital currency, launching test trials in April 2020.

Of course, the US has no recourse to stopping what China wants to do in developing a digital currency. While Facebook is a large multinational corporation, China is a powerful sovereign government.

Sanctions

The US has an interest in cross-border payments as the issuer of dollars that the world’s banks do business with.

The US has the ability to freeze institutions and individuals out of the global financial systems through sanctions, also often termed “dollar weaponization”.

This prevents banks from doing transactions with them and is one of the great privileges of having a leading reserve currency.

For example, US sanctions on Iran and North Korea pressure their economies. They are pretty good at preventing them from becoming powerful in ways that could be very risky, such as enabling the development of nuclear warheads.

The US Treasury has a database of sanctioned firms and individuals known as the “Specially Designated Nationals and Blocked Persons List”.

This register covers just about every country in some way to prevent various entities from moving money and wealth through the global banking system.

Banks in Switzerland were well-known as a place for people to discreetly stash wealth to evade taxes. Swiss banks eventually complied with Washington’s demands

China is quickly becoming a bigger part of this sanctions list. It now contains hundreds of Chinese companies and individuals. In total, there are over 10,000 US sanctions in place that are targeted at governments, companies, and individuals.

The sanctions have been applied for various reasons, anywhere from standard accusations (e.g., money laundering) to human rights abuses, such as clamping down on freedoms in Hong Kong to the treatment of Uighurs and Tibetans in the country’s eastern provinces.

Hong Kong’s chief executive Carrie Lam has been refused by many banks, believing accepting her money would expose them to American sanctions.

In general, sactions include:

i) Financial asset freezing or seizure

ii) Blocking financial access

iii) Embargoes of key trade items

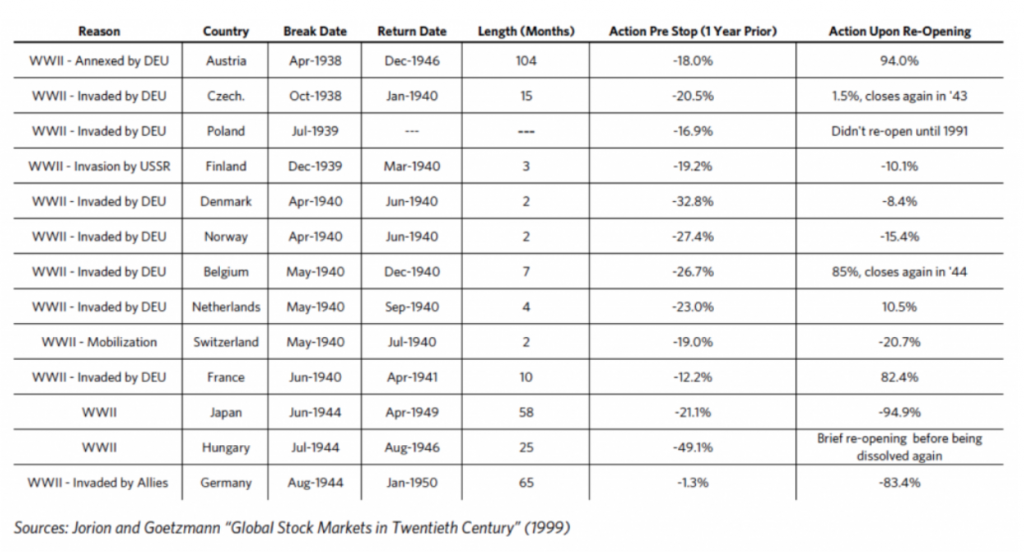

During major wars, some countries have shut down their capital markets. During World War II, many did:

The ultimate goal is to restrict what the opposition can do. No money equals no power.

Sanctions can take many different forms beyond just financial and economic. Diplomatic and military sanctions are common as well to go along with many sub-categories within them and methods of applying them.

The country with the world’s top reserve currency – people all over the world want to transact in it and use it as a store of value – will have the biggest lever over international sanctions and the largest influence over the global financial system.

At the same time, many sanctioned entities are highly creditworthy. So, banks would otherwise want to do business with them if they could.

To enforce sanctions, they can threaten these financial institutions from being cut off from the global financial markets if they choose to do so.

US sanctions generally work pretty well, which is why they are so pervasive.

And because they are generally so effective, countries naturally want to develop ways to get around them if they are harmed by them.

China, growing in power in many ways, feels they are in a position to ease the grasp of US influence. This is especially true as Beijing and its ally Russia are at risk of encountering more sanctions.

So, naturally, they want to:

a) develop an alternative payments system

b) weaken the US’s power to apply them

All central banks will want to have a digital currency under the purview of a government.

The digital yuan is one piece of the puzzle is helping the currency become more of a broadly accepted reserve asset globally.

Naturally, that will come at the expense of the dollar and is a material part of the ongoing capital and economic conflict that will go on. It’s part of the decoupling phase that both countries will go through.

Digital yuan doesn’t require SWIFT

Those sanctioned by the US could use the digital yuan as a way to bypass SWIFT, which is involved in money transfers between commercial banks. It is monitored by the US government. With digital yuan exchanges untied to SWIFT, money can be exchanged without the knowledge of the US.

Weakening US power is central to the digital yuan

The US has had a monopoly on global geopolitical power since 1945. The rise of China and the rise of its economy, technologies, currency, capital markets, and military are providing a chance to weaken some of that power and remove some of the sanctions leverage that the US can use.

The digital yuan can help with that process and help bring along the yuan more broadly while helping offset the widespread use of the dollar, which works against their interests.

China has aimed to use the digital yuan as a way to protect what they’ve called China’s “monetary sovereignty”.

Because of the digital yuan’s potential power to undercut sanctions leverage, the US is likely to view the currency itself as more of a national security threat than whatever it can buy – e.g., if North Korea developed a nuclear warhead funded by digital yuan.

The digital yuan is not much of a game changer for now

The digital currency won’t change how the yuan moves through China’s financial system.

The six largest commercial banks in China are all government-owned entities and will distribute digital yuan to smaller banks and to certain non-bank entities like WeChat and AliPay that are widely used.

The digital yuan will also be used to move payments instantly, instead of electronic transactions today that use intermediary services to exchange money from bank to bank (e.g., PayPal).

This can present a potential challenge for banks and fintech apps that are not needed to serve as the middleman. The only entity needed to intermediate is the central bank.

So, in this regard, it takes power out of the hands of private companies where payments transfers dominate the current landscape. Beijing believes it reduces risks to the financial system by having a state-backed system in place instead.

Spreading the digital yuan internationally

Athletes at the Beijing Winter Olympics games are expected to be given digital yuan to spend during their 2-3 weeks in the spotlight as part of its marketing.

Beijing is currently working with the central banks of the United Arab Emirates, Thailand, and Hong Kong, as well as the Bank for International Settlements to develop how digital currencies can be used for cross-border payments.

More than 60 countries are working on developing a digital currency. According to the World Bank, nearly two billion people globally lack a bank account, so digital fiat currencies may be a way to better help get money to underserved populations.

For example, for migrant workers who send remittances back to their home country, the ease of transfer that could come with digital currencies could save time and money.

It’s also a reminder to the US that its payments infrastructure needs to be modernized and cross-border payments are slow and cumbersome.

International remittances can still take days through traditional wire services. The efficiency and speed of a digital yuan could make it the preferred choice among many. More and more countries are deepening their financial ties and economic relations with China as its economy grows.

Digital money is one of the many areas in which China is looking to outcompete the US. Being ahead of the curve in developing its own digital cash is one way to attempt to seize the potential to set rules for digital currencies on an international level.

This is similar to China’s desire to have influence in various advanced technologies, such as quantum computing, 5G telecommunications, artificial intelligence, facial recognition software, driverless cars, data and information management, among others.

Conclusion

China is the first to issue a digitized currency through the digital yuan. It essential turns its national currency into computer code. It enables better ease and targeting of distribution and can help track who is spending money, how much, and to whom it’s being paid.

This represents some competition to private digital currencies like bitcoin. There is the general anxiety of another currency circulating among citizens that makes monetary policy harder to control.

Any currency that becomes material within a country’s borders such that it affects policy initiatives – including gold – has been banned throughout history.

The development of the digital yuan sets the stage for other countries to come out with their own digital currencies. This is also an important priority for the US. The digital yuan can undercut its sanctions leverage. Losing its grip on this power represents a national security risk.

The amount of arbitrage to be gained between the physical and digital yuan market is likely to be close to zero.

But it does show that the US’s technological edge over the rest of the world is declining and China is developing its own technologies very quickly.

About half of the world’s supercomputers are in China. Supercomputing companies in China have been sanctioned by the US.

The US leads in artificial intelligence (AI) and big data. However, it is behind in overall 5G telecommunications development.

China is also ahead in multiple dimensions of the race in AI and machine learning, big data, encryptions, digital security, and computing.

China also has more mobile financial payments and a larger volume of e-commerce transactions. The digital yuan fits into this ecosystem particularly well.

There are also, of course, other technologies that are being developed without broad knowledge of the world.