The Complete Guide to Trading and Investing in Consumer Staples

Consumer staples are among the most stable types of stocks that return fairly consistently.

The volatility of stocks is one of the main reasons why many traders and investors are hesitant to commit to them.

What are consumer staples and what makes them attractive?

Certain businesses involve selling products people need to physically live. This can make them good stores of value over time.

If a company’s earnings are reliable, they don’t rely on interest rate cuts to help offset a loss in income.

One particular risk factor associated with owning stocks with interest rates so low is that you can’t rely on interest rate cuts to help you in the event of a recession.

When the economy is in its later stages – characterised by low unemployment and rising inflation – it can make sense to adjust your portfolio toward more defensive sectors.

Among equities, consumer staples are typically seen as the most defensive flavor of equities. These are the firms providing everyday essentials – products people continue buying regardless of economic conditions.

While the specific companies in this category may shift over time, the broader sector has a track record of delivering steady earnings through the ups and downs of the cycle.

Investors looking for exposure to this area can consider sector-specific ETFs like XLP from SPDR and VDC from Vanguard, both of which offer diversified access to leading consumer staples stocks.

For those seeking more flexibility or lower upfront capital requirements, futures contracts are also available – IXR on Globex tracks the consumer staples space, while IXU covers utilities, another defensive segment with similar resilience.

Consumer staples and economic cycles

Consumer staples are less affected by economic cycles than other types of investments because they sell “needs” (necessities) rather than “wants” (luxuries).

The products associated with consumer staples – e.g., food, beverages, basic medicine, the everyday basics – will always have demand.

People may cut back on their spending levels on certain things.

If people see their income drop, that means they’re probably going to cut out travel and hotels, delay the purchase of big spending items (e.g., cars, electronics), luxury shopping, and so on. But they’ll still need the everyday stuff.

A quality consumer staple business to invest in would be one whose consumer product or service sees negligible changes in consumer demand regardless of the condition of the economy, household wealth, or the current level of aggregate spending.

The general absence of cyclicality means their sales are not generally correlated with the economy’s health.

This is opposed to companies that are sensitive to interest rates (because of the nature of their cash flows or because they have a lot of debt) or highly interconnected with how the economy performs, like a manufacturing business.

Every financial asset is controlled by interest rates. But as long as the losses in income aren’t substantial, the level of interest rates isn’t as important.

For example, in 2008, one of the historically bad recessions, one of the few members of the S&P 500 that actually saw gains that year was Wal-Mart.

Wal-Mart sells a lot of the basics like groceries and personal care items. So this stock held its value quite well.

Interestingly, a company like Proctor & Gamble (PG) or Coca-Cola (KO) does not typically experience a drop in sales when the economy performs poorly (or when it’s booming).

Some consumer staples like Costco (COST) fit a “growth plus staple” type of character.

This makes consumer staple stock an attractive proposition for many traders and investors who are looking to better balance their portfolios with more stable, non-cyclical stocks.

Other stocks in consumer staple industries include consumer food manufacturers (e.g., General Mills), consumer tobacco manufacturers (e.g., Phillip Morris International), and consumer beverage (e.g., PepsiCo).

Traders and investors can feel pretty good about the idea that these companies or companies similar to them, on aggregate, are very likely to see their earnings increase fairly reliably at about the rate of nominal GDP growth.

Consumer staples vs. Other types of stocks

Stocks represent ownership in a company that entitles you to receive the earnings of the business over time.

For most stocks, this is a positive over the long run, but stocks move around a lot in price, which makes them risky. It’s easier for capital losses to exceed any dividends or distribution received from them. Many don’t have any payout in this regard and are dependent on capital gains.

However, research has shown that buying more defensive stocks – like consumer staples – helps to lower a stock portfolio’s volatility while still getting nearly the same returns as those associated with riskier business models (e.g., fast-growing tech companies).

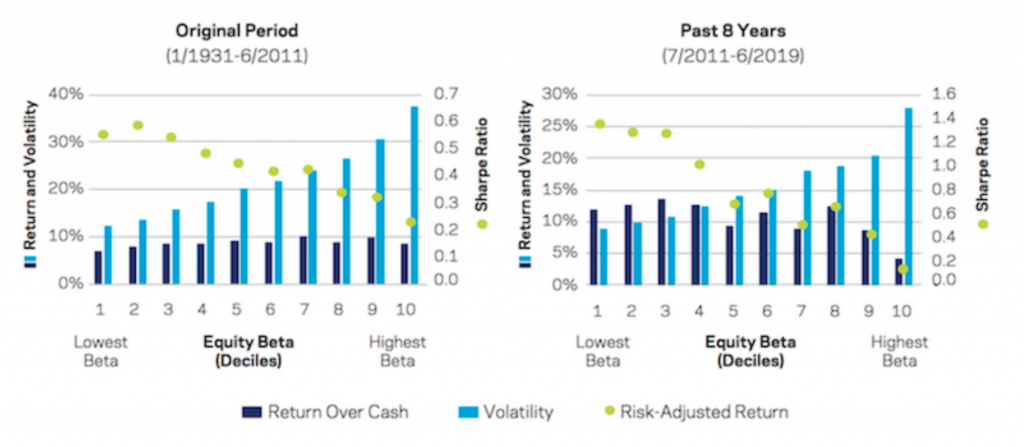

A 2019 study by the investment management firm AQR found that the lowest beta parts of the market tend to have higher risk-adjusted returns than the highest beta components.

The green dots indicate the risk-adjusted return.

The 1931-2011 period (on the left image above) shows superior risk-adjusted returns in the lowest beta equities.

From 2011 to the present (right image), this relationship became even starker with the lowest beta stocks outperforming the higher beta ones.

The 2011-2019 period was also a relatively steady bull run.

This indicates that it might not be a bad idea to tilt a stock portfolio to lower beta sectors like utilities and consumer staples relative to higher beta, cyclical sectors like consumer discretionary, industrials, and low-/no-earnings tech companies.

When building a stock portfolio or an asset portfolio in general, we can think of things in a few ways:

Cyclical cash flow vs. Stable cash flow

We can increase our reward relative to our risk by balancing sector weights in a more efficient way.

To bring more stability to a portfolio, we can limit our allocation to more cyclical forms of cash flow and increase allocations to sectors that generate more stable cash flow.

Correlation

To balance risks more optimally, we should allocate more heavily toward sectors that are less correlated to the market and toward sectors that have lower beta to the market.

Value and growth

An important aspect of any portfolio is not about the one thing you should have, but rather having a blend of various things that can help improve your return relative to each unit of risk you take on.

So ideally, we should strive to have a healthy balance between value and growth.

Though tech is cyclical and volatile (because future cash flows are highly unknown) and has high drawdowns when people concentrate their bets in this sector, it is still an important growth leg and source of balance in a portfolio.

There is often what’s referred to as rotation in equity markets where capital moves from one sector to another.

Capital isn’t destroyed so much as it just circulates.

So if you can balance well between different assets, different sectors, different asset classes, different countries, and different currencies, you’ll have a better balanced and more consistently returning portfolio relative to one where you’re just concentrated in a few things.

Everybody’s favorite asset class will draw down more than 50 percent over the course of their lifetime.

That’s borderline intolerable when it comes to your life savings, so diversification is a key element to any portfolio strategy.

Size / market capitalization

We should also balance to a degree based on market capitalization or size.

A portfolio that’s split between:

- small caps (like the Russell 2000)

- large caps (e.g., Dow Jones Industrial Average), and

- the NASDAQ (i.e., a more tech- and growth-focused index)…

…in equivalent parts improves the reward relative to the risk in comparison to just, e.g., the S&P 500 alone.

Most consumer staples stocks tend to be larger conglomerates that are better diversified.

The best environments to own consumer staples

Consumer staples are a source of stable cash flows.

What environments are best for stable cash flows?

The latter stages of business cycles

A major one is toward the end of business cycles.

The end of a business cycle is characterized by inflation heating up and central bankers starting to slow things down to maintain price stability.

This includes measures like raising interest rates and slowing down purchases of bonds and other assets that they do as part of the QE programs.

As this starts to happen, you’ll generally see rotation in the stock market.

You’ll see the assets that are dependent on this liquidity start to underperform. The money isn’t disappearing, it’s simply shifting into safer forms of equities and other assets.

Long-duration equities like low-/no-earning tech which perform well in the early cycle start to give way to lower-duration (lower earnings multiples) stocks like consumer staples.

Characteristics of a late-cycle economy

During the late cycle, the unemployment rate is generally low. In the US, the U-3 rate is typically less than 4-5 percent.

In this case, as a trader, you’d probably want to pull back a bit on sources of cyclical cash flow in your portfolio – e.g., companies that sell autos, machinery, engage in manufacturing – and have more stable sources of cash flow.

As the cycle goes on, getting the mix right between growth and price stability is hard. Inevitably there’s a recession at some point.

But even in a recession, people still need to spend on the basics even if they’re pulling back their spending on things like restaurants, vacations, big purchases, and so on.

They still need food, basic medicine, and so on.

Moreover, these companies don’t rely on a cut in interest rates to offset the lost income to stabilize their stock prices.

Periods of high nominal GDP growth

The 2021-2022 period is a good example.

In the US and most of the developed world, policymakers were giving you the basic set of factors:

- high nominal GDP growth (real growth plus inflation)

- super-low nominal interest rates

The high nominal GDP growth came from lots of fiscal spending while central banks pinned short-term rates at very low levels as well as longer term rates through QE programs.

High nominal GDP growth is good for things that correlate closely with it.

Stuff that people always need (consumer staples) is a good proxy.

On the other hand, when GDP growth is low but policymakers are trying to get it going again, this tends to favor longer duration equities like tech, and consumer staples don’t perform as well.

Consumer staples stocks for inflationary or stagflationary environments

In terms of coming up with an inflation playbook or game-planning for a stagflationary environment, you have opportunities with consumer staples

Most portfolios are not very well prepared for inflation because they’re long a mix of stocks and bonds. The majority of both asset classes perform poorly when inflation runs above expectation.

Consumer staples can perform well in an inflationary environment because they benefit from aggregate spending.

A policymaker will have to worry about how much of that is real growth and how much of that is inflation. But for someone in the financial markets receiving that stream of income, it’s just cash flow.

Most portfolios also typically don’t own commodities, which will tend to do well in an inflationary environment.

This is because commodities are either producing the inflation in the first place because their prices are going up or because of the lack of supply relative to demand.

Most types of stocks and bonds are likely to suffer in real terms when inflation runs above expectations for an elongated period. This was true in the 1970s. A stocks and bonds portfolio gained in nominal terms but lost value in real terms.

So the general goal of those in the markets during periods of higher inflation and higher-than-normal nominal GDP is to try to lock in cash flows that approximate the level of growth in the real economy.

And they may even want to go short things like interest rates – e.g., Treasury futures, borrowing cash within reasonable levels, shorting eurodollar futures (which approximate fed funds futures).

This is because the general risk to a low interest rates / high nominal GDP environment is a rise in interest rates.

When this happens, credit creation in an economy falls, which hits nominal GDP, which hits incomes, which hits spending.

This causes the market to go from discounting a higher level of spending to a lower level of spending. When combined with a rise in interest rates, stocks decline.

Consumer staples are best equipped to handle this. They’re still likely to get hit, but outperform most other sectors and probably the broader market.

But the basic strategy in such a scenario is to arbitrage the difference between nominal GDP and the very low level of interest rates you’re receiving.

So if nominal GDP is 8-10 percent, for example, and interest rates are 0-2 percent, then that general menu is going to incentivize you to go long nominal GDP against interest rates. There’s a 6-10 percent spread to capture.

Consumer staples are a good way to own cash flows that correlate well with this level of spending in the real economy.

Their revenue should roughly mirror nominal GDP, plus they don’t always have costs that vary linearly with inflation. But it depends on the business, as each is different.

In other words, the pricing of consumer staples companies does a pretty good job of aligning with the inflationary pressure and aggregate demand and spending in the economy…

…but without having the variables costs tied to those pressures.

So, this can mean companies like consumer staples, utilities, and other some other equities (depending on the business) can effectively serve as a quality store of value, which roughly grow at the rate nominal GDP does.

They can also pass along a lot of pricing pressure off to consumers. We saw this during the rise in inflation in the US in 2021. Consumer staples companies like Proctor & Gamble raised their prices on consumers to handle the inflationary pressure.

The stock price reacted well in this scenario, as demand for these things wasn’t likely to fall much because of the price increases and it would help these companies’ margins.

Risks to consumer staples

The biggest risk is generally not the cash flows declining over time – central banks will always target an inflation rate of at least zero to avoid deflation – but rather the interest rates going up.

This is why it makes sense to short interest rates so you can benefit if your spread starts to close in low interest rates / high nominal GDP scenarios.

Most portfolios don’t hedge this main risk.

The main risk is interest rates rising because of the aforementioned factor of inflation. It’s not deflation, because if there’s deflation (e.g., 2008) they’ll stimulate and spend money, which will end up supporting the prices of various things.

The big risk to overstimulation is stagflation. This is where real growth doesn’t go up much, but inflation does.

And most portfolios – because they generally own mostly stocks while sprinkling in some bonds – are vulnerable under this situation because both underperform in real terms under such an environment.

Part of the reason why portfolios heavy on equities and more 60/40 stocks/bonds mixes are so popular is that they’ve worked for decades.

So most traders and investors start to extrapolate what they’ve become used to even when conditions are changing that make the future likely to be different from what it looked like in the rear-view mirror.

Most portfolios are heavily exposed to the rest of inflation.

Owning equities that can correlate better with inflation, like consumer staples, is just one step.

Owning consumer staples could also become challenging if policy tightening coincides with organically slowing growth and inflation.

In this case, consumer staples would be hit on both the interest rate aspect of their valuations in addition to the drop in nominal growth and nominal spending, which could hurt their revenue, earnings, and overall cash flow.

What is and what isn’t consumer staples?

The basic idea we’ve mentioned is to buy stuff that people always need and doesn’t fluctuate much no matter how good or how bad economic conditions might be.

Still, there’s some blurriness in terms of what’s a need and what’s more discretionary.

For example, is tobacco a consumer staple?

Many would argue that it is since the people who use it have a tendency to consume the same amount on a regular basis.

It’s not something that’s needed to physically live, though it has characteristics of something that does when it becomes a part of people’s lifestyles.

On the other hand, something like going to see a movie isn’t a consumer staple because you don’t need to go to the movie theater.

What you can do is measure how stable the amount of spending is on a good or service when aggregate spending behavior changes.

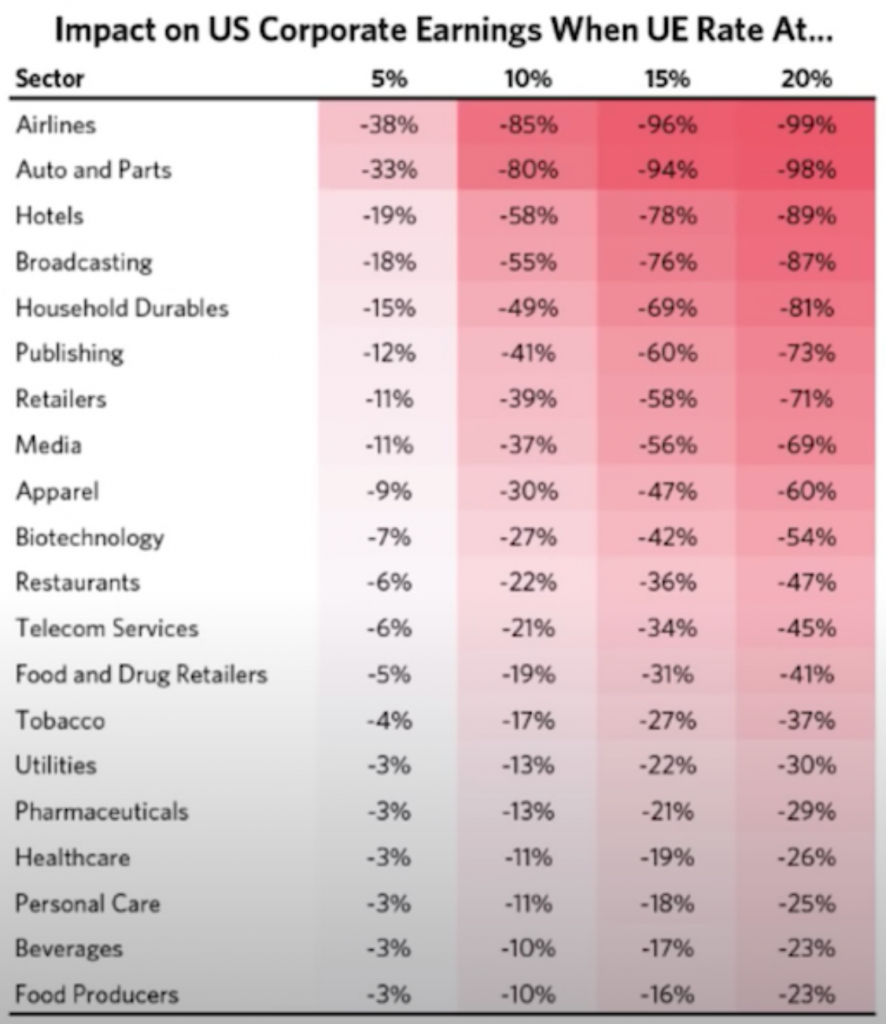

For example, you can take variations in the employment rate as a proxy for falls in income. Then you can look at how that impacts spending in different types of products and services in the economy.

Then, you can take a look at how that flows through into earnings.

You can set the unemployment rate at increments like 5 percent (near full employment), 10 percent (bad recession – e.g., 2008), 15 percent, and 20 percent (very bad recessions – e.g., 2020).

For example, things that are very hard hit like airlines, travel, and restaurants see very large impacts.

If unemployment hits 10 percent in those sectors, their earnings decline very close to zero.

This means you need very large declines in interest rates to offset the lost income to get a bottom in their share prices.

However, when rates are at or near zero percent, then you’re not going to get that. In a normal recession, you need 500bps of easing. Short-term rates are well short of five percent throughout the developed world.

Things like durable goods are somewhere in the middle. They aren’t true consumer staples but they aren’t decimated like things such as gaming, lodging, and leisure.

In our earlier example of tobacco, their earnings are hit 17 to 37 percent running unemployment from 10 to 20 percent. It’s closer to staples than a lot of other things.

Staples like food, basic medicines, and personal care products are a lot less.

Food producers and beverages are best off, which makes sense because it’s the most basic need.

Personal care, healthcare, and pharmaceuticals aren’t far behind.

Utilities as a form of consumer staples

Utilities are up there as well, just ahead of tobacco.

Utilities are considered their own sector outside of consumer staples, though they have staples-like properties.

Everybody needs electricity, running water, gas to heat their homes, and so on.

So even in a terrible recession people are still largely going to pay their utility bills.

Utility companies do, however, tend to be more leveraged. So this makes them more rate-sensitive than the average company.

So from a cash flow perspective, they tend to be pretty reliable. But their valuations can nonetheless be hit by a rise in interest rates.

Consumer staples as a way to replace bond income

For decades, people could rely on bonds as a stable source of income.

But with cash and bond yields at close to zero and real yields on quality bonds negative in most of the developed world, it doesn’t make a lot of sense to own these.

In fact, some even look to short bonds.

They still have some diversification value. But for income generation purposes, they’re of little value and they still come with a lot of downside. (There’s no limit to high how yields can rise.)

More and more, traders and investors looking to still own bonds are going to have to go to other countries, which means taking on some level of currency risk.

There are certain ETFs that make it easier than buying individual foreign bonds (e.g., EMLC) but for many traders there’s an availability issue.

Alternative bond sources

Even an asset class like commodities can be a piece of replacing a bond portfolio.

Commodities on their own don’t yield anything, but this doesn’t matter as much when the yields on everything else have collapsed.

When interest rates are held low, especially in real terms, this makes commodities more attractive to own.

If there’s a lot of spending and economic activity, then the need for commodities increases. If supply doesn’t keep up, which is often the case, their prices go up.

The liquidity created from low interest rates has to go somewhere. And a lot of that is going to spill out of terrible-returning cash and bonds into other things.

Those other things are assets like:

- some forms of stocks

- private businesses

- commodities

- currency-like commodities (e.g., gold)

- real estate

- real assets (e.g., art, collectibles), and

- alternatives stores of value (e.g., bitcoin and other forms of cryptocurrency)

As we mentioned earlier in the article, if interest rates are low and nominal GDP is high then you probably want to own nominal GDP in a diversified way.

This also means that investment vehicles with an income generation focus – typically individual investors approaching retirement as well as pensions, endowments, foundations, and similar types of investors – are going to look for safer types of stocks and businesses to own.

Fixed income yields are so low in nominal terms and mostly negative in real terms that they want to be in equity markets but in a safer way.

Consumer staples can act as a type of bond replacement. It might not be the most exciting portfolio, but owning various types of assets whose cash flows closely mirror nominal GDP and spending patterns can be a good strategy.

As a whole, they’ll probably be more reliable than the average stock.

Do consumer staples outperform a regular stock portfolio?

All sectors outperform in one environment or another. So being well-diversified is a good thing, even if having a certain sectoral tilt can make sense to achieve certain goals.

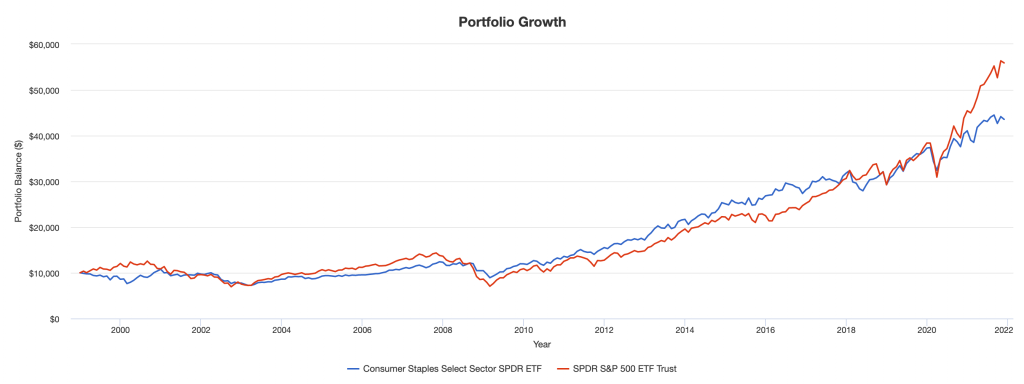

In this case, we’ll do a comparison of consumer staples versus the aggregate stock market over time, using the two most popular ETFs of each.

- XLP = Consumer Staples Select Sector SPDR ETF

- SPY = SPDR S&P 500 ETF Trust

SPY came about in 1993. XLP has been around since December 1998, with 1999 being its first full year.

So, we can go from 1999 forward for comparison’s sake.

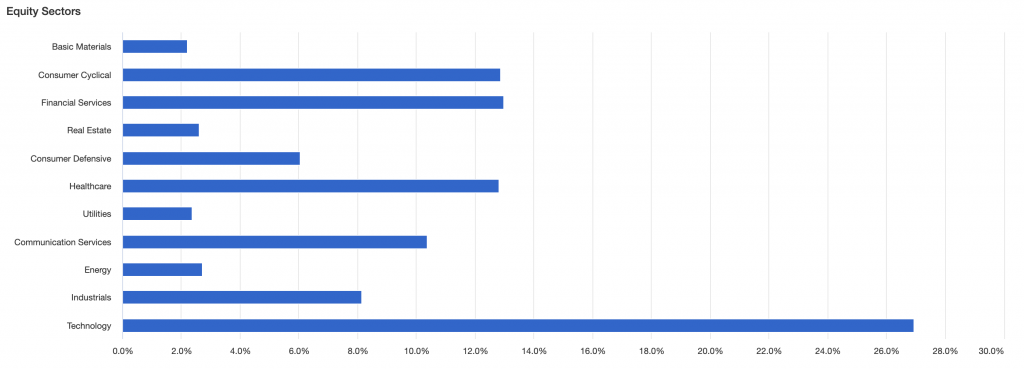

First, here’s the S&P 500’s sectoral breakdown:

S&P 500 Sector Weights

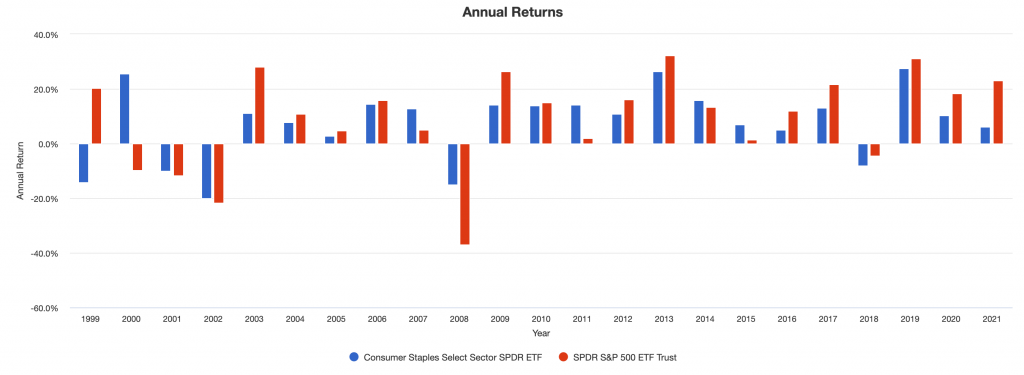

Relative performance over time:

Consumer Staples (blue line) vs. S&P 500 (red line)

Here we can see year-by-year returns of each.

Portfolio Returns

| Ticker | Initial Bal | Final Bal | CAGR | Stdev | Best Yr | Worst Yr | Max Draw | Sharpe | Sortino | Correl |

|---|---|---|---|---|---|---|---|---|---|---|

| XLP | $10K | $43,561 | 6.6% | 12.2% | 27.4% | -20.1% | -32.6% | 0.45 | 0.64 | 0.59 |

| SPY | $10K | $55,908 | 7.8% | 14.9% | 32.3% | -36.8% | -50.8% | 0.47 | 0.68 | 0.99 |

- Initial Bal = initial balance

- Final Bal = final balance

- CAGR = annualized return

- Stdev = standard deviation in returns (annual)

- Max Draw = maximum drawdown

- Sharpe = Sharpe ratio

- Sortino = Sortino ratio

- Correl = correlation to US stock market

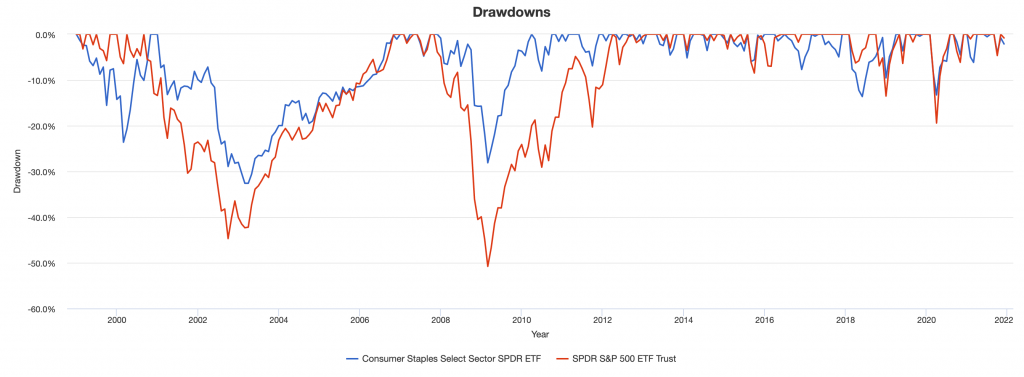

Drawdowns

Here we’ll look at drawdowns.

Consumer staples have the shallower drops during bear markets.

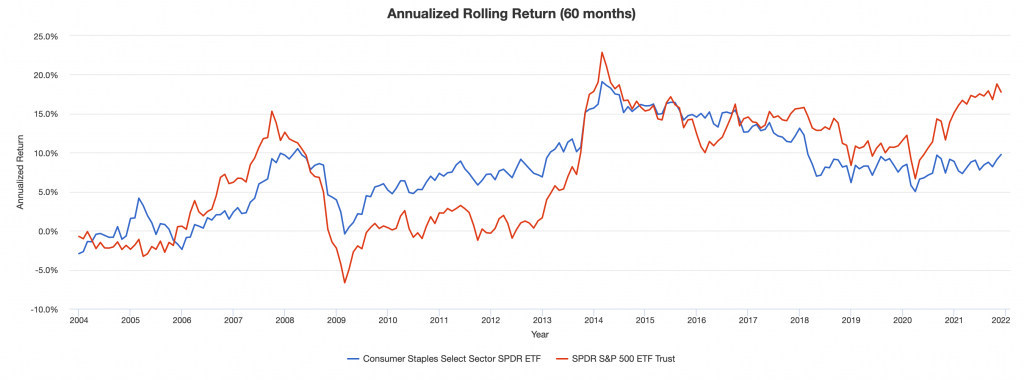

Rolling returns

Rolling returns also give an idea of their relative performance.

Consumer staples don’t have the big ups and downs, as shown in the graph.

Drawdowns for Historical Market Stress Periods

Here we can look at how each did during key market stress periods, such as the dotcom crash and 2008 financial crisis.

| Stress Period | Start | End | Consumer Staples | S&P 500 |

|---|---|---|---|---|

| Dotcom Crash | Mar 2000 | Oct 2002 | -28.94% | -44.71% |

| Subprime Crisis | Nov 2007 | Mar 2009 | -28.12% | -50.80% |

Drawdowns for Consumer Staples Select Sector SPDR ETF

The top-10 drawdowns for each, when they occurred, their length, recovery period, and total underwater time.

| 1 | Jan 2001 | Feb 2003 | 2 years 2 months | Dec 2006 | 3 years 10 months | 6 years | -32.61% |

| 2 | Dec 2007 | Feb 2009 | 1 year 3 months | Mar 2010 | 1 year 1 month | 2 years 4 months | -28.12% |

| 3 | Jan 1999 | Feb 2000 | 1 year 2 months | Oct 2000 | 8 months | 1 year 10 months | -23.62% |

| 4 | Feb 2018 | May 2018 | 4 months | Mar 2019 | 10 months | 1 year 2 months | -13.63% |

| 5 | Feb 2020 | Mar 2020 | 2 months | Jul 2020 | 4 months | 6 months | -13.28% |

| 6 | Apr 2010 | Jun 2010 | 3 months | Sep 2010 | 3 months | 6 months | -8.04% |

| 7 | Jul 2016 | Nov 2016 | 5 months | Feb 2017 | 3 months | 8 months | -7.72% |

| 8 | Jun 2011 | Sep 2011 | 4 months | Nov 2011 | 2 months | 6 months | -6.91% |

| 9 | Jan 2021 | Feb 2021 | 2 months | Mar 2021 | 1 month | 3 months | -6.15% |

| 10 | Aug 2015 | Aug 2015 | 1 month | Dec 2015 | 4 months | 5 months | -5.96% |

Drawdowns for SPDR S&P 500 ETF Trust

| 1 | Nov 2007 | Feb 2009 | 1 year 4 months | Mar 2012 | 3 years 1 month | 4 years 5 months | -50.80% |

| 2 | Sep 2000 | Sep 2002 | 2 years 1 month | Nov 2006 | 4 years 2 months | 6 years 3 months | -44.71% |

| 3 | Jan 2020 | Mar 2020 | 3 months | Jul 2020 | 4 months | 7 months | -19.43% |

| 4 | Oct 2018 | Dec 2018 | 3 months | Apr 2019 | 4 months | 7 months | -13.52% |

| 5 | Aug 2015 | Sep 2015 | 2 months | May 2016 | 8 months | 10 months | -8.48% |

| 6 | Apr 2012 | May 2012 | 2 months | Aug 2012 | 3 months | 5 months | -6.63% |

| 7 | Jan 2000 | Feb 2000 | 2 months | Mar 2000 | 1 month | 3 months | -6.43% |

| 8 | May 2019 | May 2019 | 1 month | Jun 2019 | 1 month | 2 months | -6.38% |

| 9 | Feb 2018 | Mar 2018 | 2 months | Jul 2018 | 4 months | 6 months | -6.28% |

| 10 | Sep 2020 | Oct 2020 | 2 months | Nov 2020 | 1 month | 3 months | -6.14% |

Summary statistics

| Arithmetic Mean (monthly) | 0.60% | 0.72% |

|---|---|---|

| Arithmetic Mean (annualized) | 7.43% | 9.01% |

| Geometric Mean (monthly) | 0.54% | 0.63% |

| Geometric Mean (annualized) | 6.63% | 7.80% |

| Standard Deviation (monthly) | 3.52% | 4.31% |

| Standard Deviation (annualized) | 12.20% | 14.92% |

| Downside Deviation (monthly) | 2.41% | 2.89% |

| Max. Drawdown | -32.61% | -50.80% |

| US Market Correlation | 0.59 | 0.99 |

| Beta(*) | 0.47 | 0.96 |

| Alpha (annualized) | 2.92% | -0.09% |

| R2 | 34.88% | 97.86% |

| Sharpe Ratio | 0.45 | 0.47 |

| Sortino Ratio | 0.64 | 0.68 |

| Treynor Ratio (%) | 11.84 | 7.31 |

| Calmar Ratio | 0.81 | 1.05 |

| Active Return | -1.61% | -0.44% |

| Tracking Error | 12.83% | 2.29% |

| Information Ratio | -0.13 | -0.19 |

| Skewness | -0.71 | -0.50 |

| Excess Kurtosis | 1.14 | 1.04 |

| Historical Value-at-Risk (5%) | -5.78% | -7.40% |

| Analytical Value-at-Risk (5%) | -5.19% | -6.37% |

| Conditional Value-at-Risk (5%) | -8.44% | -9.57% |

| Upside Capture Ratio (%) | 49.93 | 94.22 |

| Downside Capture Ratio (%) | 42.45 | 95.40 |

| Safe Withdrawal Rate | 5.04% | 5.05% |

| Perpetual Withdrawal Rate | 4.20% | 5.28% |

| Positive Periods | 164 out of 275 (59.64%) | 173 out of 275 (62.91%) |

| Gain/Loss Ratio | 1.04 | 0.90 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are based on monthly values. | ||

Conclusion

The consumer staples sector is a good place to potentially find investments that sell quality consumer products that are always valued and in demand by virtually all consumers because their necessity does not change throughout economic cycles.

Accordingly, consumer staples are potentially an area to find a quality combination of yield and relative safety.

It’s especially a concern when interest rates are low and traders and investors want to look for assets that can help replace bonds in their portfolios.

With that said, consumer staples will not outperform the overall stock market.

They have done so over periods. But when liquidity is looser than normal, the overall stock market will tend to outperform because safety doesn’t traditionally do as well in these environments.

So you still want to be diversified across a number of stocks within the consumer staples sector and other types of stocks as well.

But consumer staples might be a quality to tilt toward in a stock portfolio, especially later in business cycles when liquidity starts tightening.

It can also be an alternative bond replacement strategy in certain environments where interest rates are low to help enhance yield in a portfolio in a relatively safe way relative to taking on extra exposure to riskier equities.

As a whole, consumer staples might not be the most exciting sector, but owning various types of assets whose cash flows closely mirror consumer spending patterns can be a good strategy to bring more stability to a stock portfolio.

As a whole, they’ll probably be more reliable than the average stock overall, even if they don’t necessarily outperform on net.

Frequently Asked Questions (FAQ)

Is it better to put money in a select few consumer staples stocks or buy an ETF?

Generally speaking, the more diversified you are, the less likely you are to have big ups and downs.

Even if you buy an ETF, that will move around quite a bit given the nature of stocks. That volatility will be enhanced by buying a smaller selection of individual stocks.

Individual security selection also assumes that you can do better than a representative index. Most traders and investors won’t be able to do this over time and active management is a more hands-on type of trading or investing style.

What’s in an ETF of consumer staples stocks?

It depends on the ETF, but the most popular two are XLP and VDC.

They’re very similar to each other in terms of their holdings.

Here are XLP’s top-15 holdings and approximate weights (which shift around over time based on performance and changes in what’s held in what amount):

| PG | Procter & Gamble Company | 16.79% |

| COST | Costco Wholesale Corporation | 10.60% |

| PEP | PepsiCo, Inc. | 10.11% |

| KO | Coca-Cola Company | 9.68% |

| PM | Philip Morris International Inc. | 4.53% |

| MDLZ | Mondelez International, Inc. Class A | 4.53% |

| WMT | Walmart Inc. | 4.37% |

| MO | Altria Group Inc | 4.26% |

| EL | Estee Lauder Companies Inc. Class A | 4.20% |

| CL | Colgate-Palmolive Company | 3.50% |

| KMB | Kimberly-Clark Corporation | 2.33% |

| STZ | Constellation Brands, Inc. Class A | 2.01% |

| GIS | General Mills, Inc. | 1.99% |

| SYY | Sysco Corporation | 1.96% |

| ADM | Archer-Daniels-Midland Company | 1.84% |

Here are VDC’s top-15 holdings:

| PG | Procter & Gamble Company | 13.38% |

| COST | Costco Wholesale Corporation | 8.60% |

| PEP | PepsiCo, Inc. | 7.96% |

| WMT | Walmart Inc. | 7.78% |

| KO | Coca-Cola Company | 7.77% |

| PM | Philip Morris International Inc. | 4.35% |

| MDLZ | Mondelez International, Inc. Class A | 3.63% |

| MO | Altria Group Inc | 3.34% |

| EL | Estee Lauder Companies Inc. Class A | 3.27% |

| CL | Colgate-Palmolive Company | 2.67% |

| KMB | Kimberly-Clark Corporation | 1.99% |

| STZ | Constellation Brands, Inc. Class A | 1.66% |

| GIS | General Mills, Inc. | 1.64% |

| ADM | Archer-Daniels-Midland Company | 1.59% |

| SYY | Sysco Corporation | 1.57% |

As you can see in each case, the top-5 holdings make up around 50 percent of the ETF’s total weight and the top-10 holdings make up around 70 percent of the total allocation.

What is the best consumer staples ETF?

The main two candidates are XLP and VDC.

VDC generally has a slightly lower expense ratio. This is generally true for most of Vanguard’s ETFs relative to SPDR’s.

But XLP has been around longer and is more liquid, with a higher AUM. XLP’s options markets tend to be more liquid as well for those interested in trading options.