Successful Trading: 8 Principles to Enhance Returns & Reduce Risk

What makes for successful trading? There are many different theories, strategies, tactics, opinions, and ideas on what successful trading looks like.

The goal of this article is to boil it down to a handful of basic principles to help both enhance returns and reduce risk.

What’s to be learned (or reasserted) from recent events?

2020 was an eventful year for global markets and economies.

#1: Extrapolation is dangerous

People tend to extrapolate what they’ve grown accustomed to.

As a result, after a period of a certain type of behavior and results observed in markets and economies, it’s likely to be extrapolated forward and discounted in (i.e., priced in) to the markets.

For instance, most will think that investment assets that have produced good results in the recent past are good investments rather than more expensive ones. So they tend to buy more near the tops and sell near the bottoms.

It’s one of the most common mistakes and perhaps the most hazardous.

On the other end, rebalancing assets well – selling off those that have done well and buying enough that have done worse to blend assets closer to the targeted mix – is likely to both increase returns and lower risk.

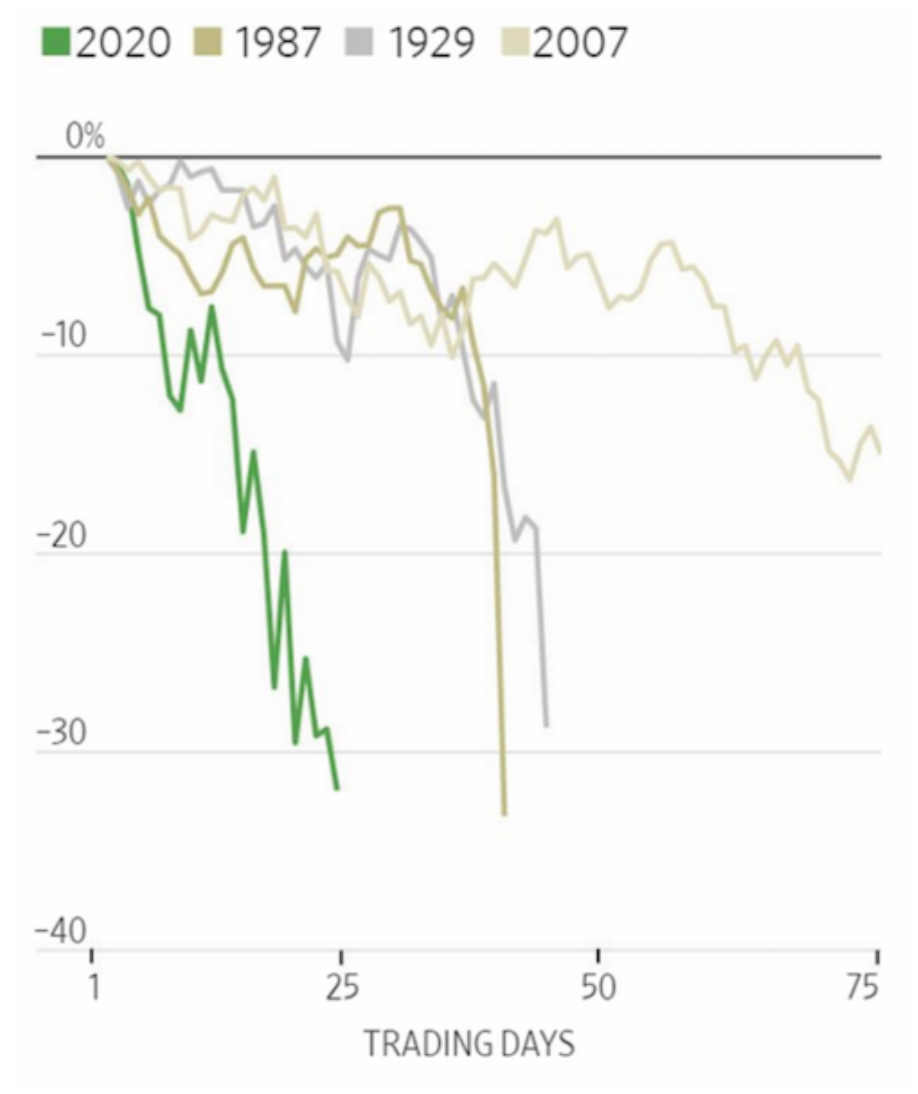

The big shift in expectations when large swaths of the economy would be shut down and many people losing their incomes drove a sell-off that was more violent than the one seen in 2008 and 1929.

(Source: Wall Street Journal)

#2: Distinguishing possibilities from probabilities

Certain events are rare but they happen.

Trading is heavily about probabilities, expected values, and distributions.

Just about anything is possible. It’s the probabilities that matter.

Certain events – e.g., natural disasters, unexpected armed conflicts, major supply chain disruptions in strategically important goods (e.g., oil), bubbles (and bubbles popping) – are always in the tails of your distributions.

#3: Reduce tail risk

Tail or black swan risks are relatively unlikely events that happen infrequently but can cause massive losses when they do.

Reducing tail risk in your portfolio is incredibly important. What took a very long time to build can be wiped out very quickly if you’re not careful.

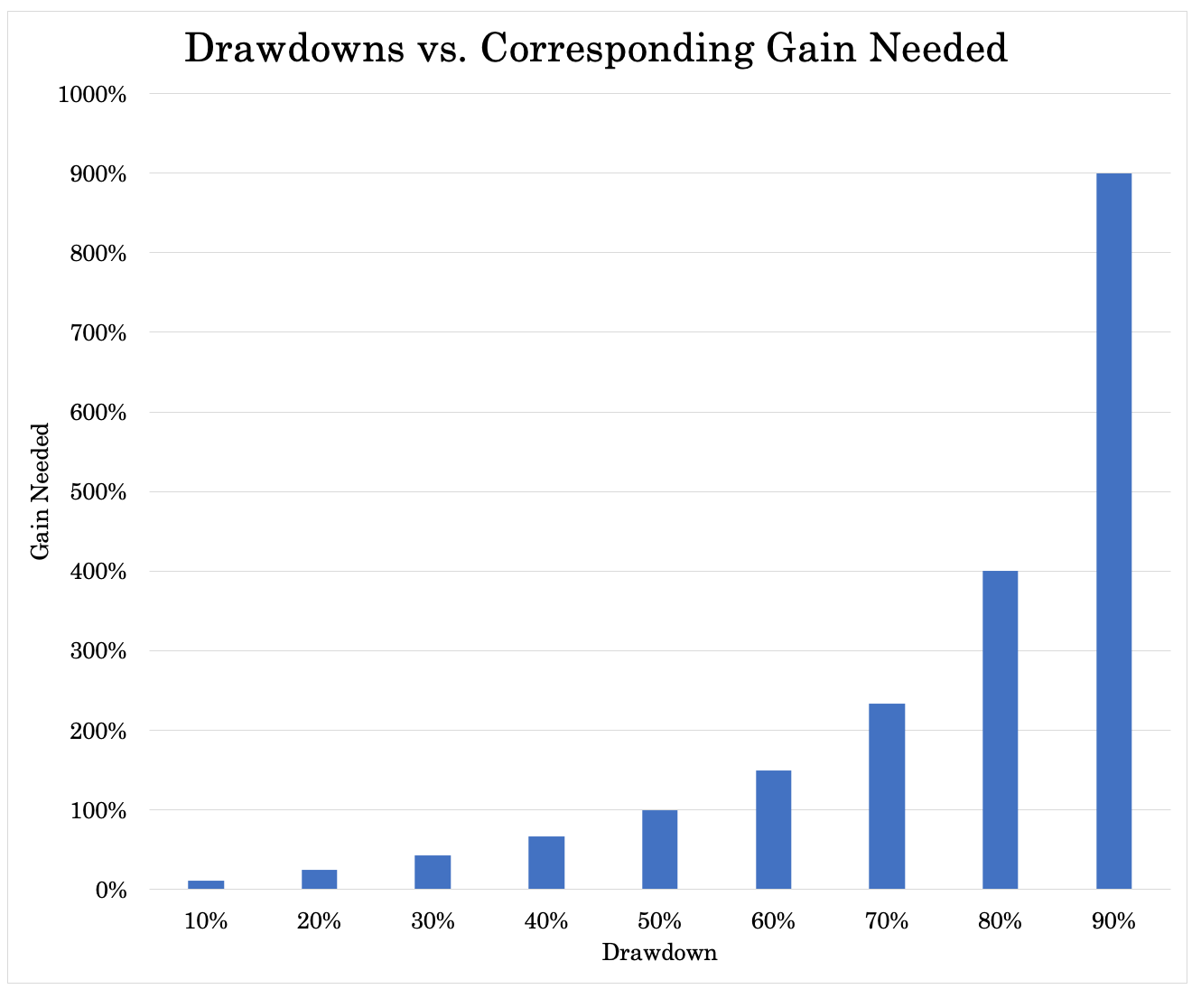

If you have a 50 percent drawdown, you need a 100 percent gain to get back to where you were. If you have an 80 percent drawdown, you need a 5x return just to get back.

Big losses are not compensated by big gains.

As shown, the larger the drawdown the bigger the gain needed.

Example

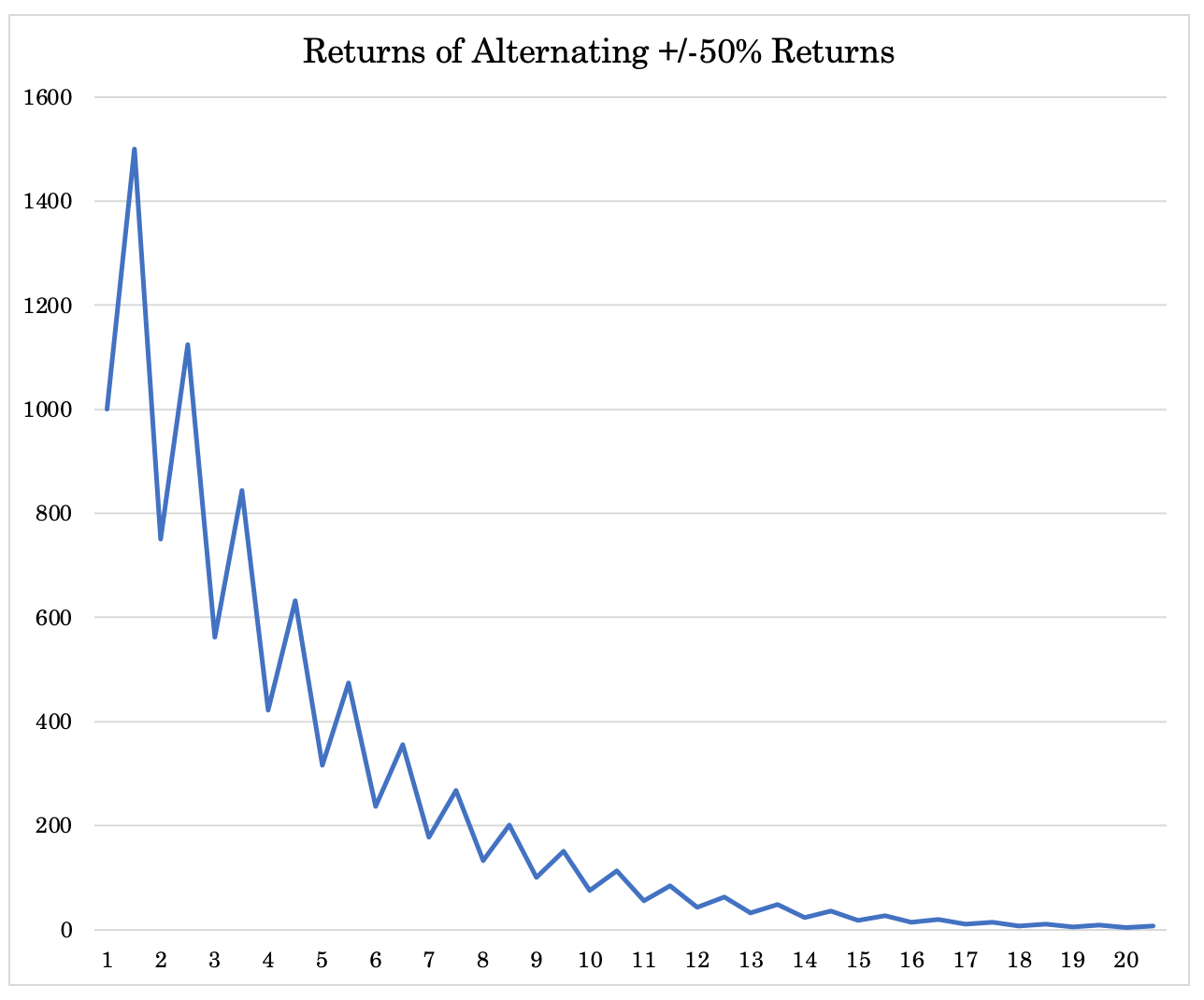

For instance, let’s say you have alternating gains and losses of 50 percent each.

Say you start out with $1,000 and gain 50 percent in the first period (you’re now at $1,500), lose 50 percent (down to $750), gain 50 percent (up to $1,125), and so on.

Each round of this game that you go through, you’ll have progressively less money. To pay off that 50 percent loss, you need a 100 percent gain, not just the corresponding loss.

At the start of the fourth round – three wins and three losses – you’ll already be down more than 50 percent of your original investment

After just ten rounds of this game, you’ll have lost about 90 percent of your original investment.

After 15 rounds, you’ll be down more than 97 percent.

After 20 rounds, you’ll be down more than 99 percent – to just $6 left of your original $1,000.

Graphically the results look as follows:

Tail risk investment strategies

There are also standalone tail risk investment strategies.

These attempt to make money in financial markets by buying options or buying tail-risk hedges in some form. This type of trading aims to make a profit when the market moves enough to create significant losses (or sometimes gains) for holders of normal investments, but is a benefit for the tail risk trader or investor buying insurance on the market.

Read more: Tail Risk Hedging: Strategies and Comparisons

#4: Having balance is critical

More broadly, what’s the best way to protect yourself?

Policymakers also tend to more reactive than proactive and move to reverse extremes in economies and markets.

So we tend to have big reversals and shifts in economies and markets as a result. This is why having a portfolio that’s diversified well and rebalanced to maintain an excellent strategic mix has a much better expected return to risk ratio than any single investment.

Protecting against these outcomes can be done in a variety of ways.

You can learn how to balance your bets better so that you’re not too dependent on any given outcome while retaining the big upside.

You can tilt your asset allocation in certain ways (even within asset classes) that reduces your risk relative to your return. For example, if you want exposure to stocks but in a way that can improve return to risk, you can add more defensive stocks and balance the allocation better.

You can decide for your own circumstances what types of losses would be unacceptable and prudently hedge against these outcomes.

This is heavily what options markets are for. They represent a type of insurance analogous to the types of insurance we buy to protect against other adverse outcomes.

Because of the volatility risk premium, options are more expensive than they technically “should” be. The underwriter needs to make a profit in order to underwrite it.

Balance is also critical in business.

One example of balance would be an insurance company’s portfolio on its liability side (policies written on individuals and businesses). Such a portfolio will generally have decent balance since generally insurance policyholders will rarely simultaneously suffer major catastrophes with respect to fire, theft, and the like while making claims under their healthcare plans at the same.

#5: There are no easy good or bad investments

Traders should be careful about coming to easy conclusions that there are obvious good or bad investments or trades.

It’s important to remember that all investments compete with each other. And there are many intelligent people who are trying to pick the winners relative to the losers.

When money is placed on them, the changes in pricing that accompany this determine future payoffs and outcomes. Moreover, what’s not known is high relative to what is known relative to what’s baked into the price.

Accordingly, your starting point is that all investments are roughly equally good in terms of the return in relation to the risk. In other words, their expected risk-adjusted returns are about comparable to each other.

What you do know is that various types of assets will act differently from each other.

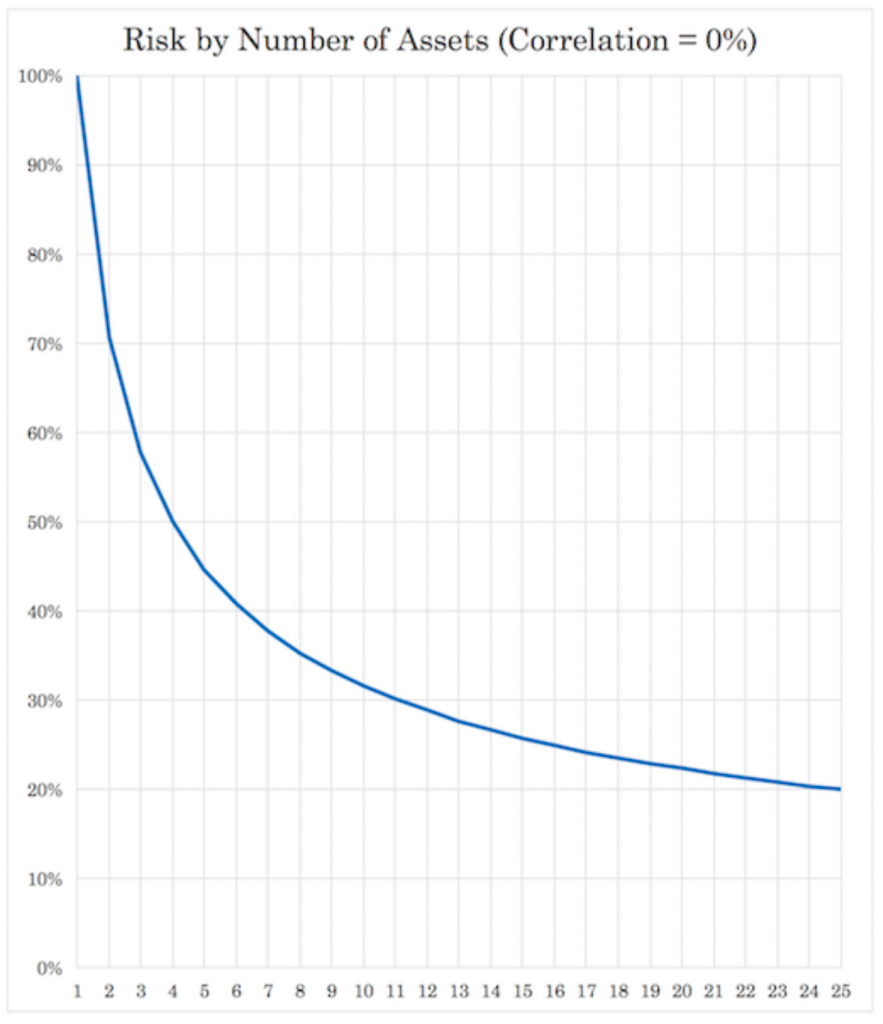

As a result, you know that if you can mix them well you can increase your return to risk ratio. Put another way, you can reduce your expected risk by more than you reduce your expected return.

For example, if you have 10 equal-returning, equal-risk investments that have no correlation to each other, you’re boosting your return-to-risk ratio by a factor of more than 3x. Or about just 30 percent of the risk of having just a single concentrated position.

Especially in a low-return environment

When you’re in an environment where the amount of liquidity is high in relation to the supply of assets, it bids up their prices and bids down the yields of just about everything.

In such cases, it doesn’t make sense to have a lot of money in cash or in bonds yielding such low returns.

When cash and bonds are at minus-1 percent to plus-2 percent nominal yields – depending on where you go – those are effectively destroying wealth in real terms.

But you don’t necessarily want a heavy allocation to stocks either. Their forward returns aren’t likely to be very high. US Stocks have traditionally returned slightly more than about three-and-a-half percent per year over the 10-year Treasury.

| Name | CAGR | Stdev | Best Year | Worst Year | Max Drawdown | Sharpe | Sortino | Mkt Correl |

|---|---|---|---|---|---|---|---|---|

| US Stock Market | 10.62% | 15.64% | 37.82% | -37.04% | -50.89% | 0.43 | 0.63 | 1.00 |

| 10-year Treasury | 7.11% | 8.02% | 39.57% | -10.17% | -15.76% | 0.33 | 0.52 | 0.03 |

| Cash | 4.66% | 1.01% | 15.29% | 0.01% | 0.00% |

Stocks are also vulnerable to a rise in interest rates, which can come from higher inflation expectations and/or higher real yields, as people want to be compensated in a way that’s in line with the risk they assume.

Accordingly, you don’t want to just be in a single asset class, a single country, or a single currency with the monetary shift that’s going on globally.

Wealth is always moving around, not necessarily being destroyed on net.

It may be shifting into different assets (e.g., different stocks), different asset classes, different countries, and/or different currencies.

When there’s a flood of liquidity, yields are pressed down to the point where nothing is that attractive, it favors a well-diversified set of assets.

#6: Learn how to deal well with what can’t be known

Trading and investing is a game where what you know and what you have in your head is small relative to what you don’t know and what you can’t be aware of.

Put a different way, in the markets, what can be known is small relative to that which is unknown.

Making winning bets in the market is difficult for the same reason winning in the sports betting markets is difficult.

The range of unknowns is higher in comparison to the range of knowns relative to what’s already priced into the market.

We know each year that a certain set of NFL teams are better than others.

We know that the same few half dozen or so Premier League teams are genuinely in the running to win the league or place high enough to get a spot in the Champions or Europa League. Everyone else is mostly looking for a respectable finish or trying to avoid relegation.

You can bet on a Liverpool or Manchester City to win the Premier League, but there’s already a lot of other people betting the same way. This raises the price of the bet and reflects the relatively high probabilities of getting the outcome this particular subset of bettors want.

Likewise, you can bet on a mid-pack team or one of the likely relegation candidates to win the league and make a lot if you’re right being it’s not a “crowded” bet. But the probability of such a bet working out is low and reflected in the reality of the long odds.

Accordingly, everything is more or less an equally good bet – namely, the size of the reward multiplied by the odds of winning.

Similarly, good companies and bad companies are well known in the markets. But the payoffs reflect what is already known.

Investors expect more compensation (i.e., higher future returns) for an unprofitable, highly indebted company versus one that has low debt and stable cash flow.

On top of that, if you do bet, this process will change the expected payoffs.

This is especially an issue for managers trying to deploy a lot of capital relative to the size of their markets. It’s why alpha-chasing managers cap their size. Getting to a certain size means getting in and out will move markets in an adverse way.

#7: Understand expected value

Understanding expected value is critical. What is the size of the reward and what is the probability of being correct against the size of the loss and the probability of being wrong?

When you know expected value, you will see that it’s not always the best idea to simply bet on what’s most probable.

Many sports bettors make the mistake of simply betting on who or what is most likely to win – “the chalk”.

They might overrate the favorites and overrate their probability of beating the spread.

For example, if the Kansas City Chiefs are +7.5-point favorites against the New York Giants, most bettors will still take the Chiefs because they know (at least as of the time this is being written) that the Chiefs are a better team than the Giants.

However, that 7.5-point spread already reflects this information.

That means they need to win by more than a touchdown (seven points) for that bet to work out.

That 7.5-point spread implies that the favorite has a 78.1 percent chance to win the game and of course a little bit under 50 percent odds of covering the spread. The bookmaker expects to keep about 4-5 percent of that as part of their profit for “brokering” the deal, so that’s also built in.

As a bettor, you have to assess whether these odds are appropriate. A beginning bettor may be more inclined to bet on what’s good rather than more assiduously assess probabilities in a systematic way.

Similarly, beginning investors and traders tend to pick companies they’ve have heard of and are perhaps good by conventional standards (e.g., market cap). But this doesn’t mean they are better investments.

Likewise, a beginning bettor might be attracted to the idea of a 5-team parlay where each team they bet on is a big moneyline favorite.

Say each have an 80 percent chance of winning their game or match (-400 American odds). And let’s say you agree with those odds, that they’re neither too high nor too low.

A bettor would put down $100 to win $205 back, more than double their initial bet.

However, what are the real odds of winning this bet? It’s a simple calculation – 80 percent odds for all five, all independent from each other. That’s 0.8 to the power of 5.

Probability of winning = 0.8^5 = .328

So, you have just under a 33 percent chance of winning.

What’s your expected value for the bet?

Expected value = .328*$205 – (1-0.328)*$0 = $67.24

$67.24 is lower than what you have to put up (your initial $100). So you would expect to lose money on this bet thinking in terms of expected value.

In reality, for this bet to pay off you’d need each to have around 87 percent odds of winning their match-up (in terms of the flat equilibrium breakeven).

Expected value in options

Expected value comes up a lot in options trading.

Many options bets involve betting on low probability events.

This means the option seller can enjoy a relatively high winning percentage, but will face the prospect of large losses that could wipe out all the profit from a high number of winning trades.

For example, if you sell OTM options on an uncovered basis (generally never a good idea) and win 90 percent of the trades, but suffer an average loss of 15x your premium on the 10 percent you lose, you’re losing money, not making money.

Once again the general idea is that the focus should not be on how often you’re right or wrong. Instead, it should be about maximizing your expected value – assuming any loss you may incur in the process is acceptable.

To use a baseball analogy, it’s not the batting average that matters; slugging percentage is more important (how much you make when are successful).

Expected value in everyday decision-making

We make lots of expected value decisions daily whether we consciously realize it or not.

When we make sure the door is locked on our home before we head out, that’s an expected value calculation.

When we look at the GPS map before going somewhere even when we’re pretty sure we know where we’re going, it’s another type of expected value calculation.

If you take a rain jacket because of a 50 percent chance of rain while we’re out, that’s another.

Expected value in other professions

Virtually all businesses will involve expected value calculations in some way. And it changes the way some types of games are being played.

For example, in basketball the traditional wisdom was that it was better to take a shot as close to the rim as possible as it provided the highest probability outcome. (The three-point line was instituted in the NBA in 1979.)

Now more players are backing up to take a shot to try to score three points instead of two. Depending on the shooting skill of the player, this can make perfect sense from an expected value standpoint.

If a player’s chance of making a 20-foot shot (worth two points) is 45 percent, and his chance of backing up and taking a 25-foot shot (worth three points) is 35 percent, what should he choose to do?

(Assume no unique circumstances, such as being down 0-1 points in the game with a few seconds remaining, in which case taking the two-point shot would of course be advisable.)

We would do an expected value calculation:

Expected value of two-point shot = 0.45 * 2 = 0.90 points

Expected value of three-point shot = 0.35 * 3 = 1.05 points

Taking the three-point shot would expect to yield an additional 0.15 points per iteration. Do it 100 times, it would expect to yield an extra 15 points.

Making these process improvements doesn’t mean every decision is going to work out perfectly.

You will get a lot of ‘-2’ results simply because your probability of hitting the two-point shot is higher than making the three-point shot. It’s about the net results over time.

You should have enough offsetting ‘+3’ results (though fewer because the probability is lower) such that you have about a +0.15 improvement per round.

In trading, it’s the same way in terms of generating efficiency improvements. Many of these will come from ideas that you then implement in practice and test out.

A good result is, however, not always a function of a good process. Likewise, a bad result is not always a consequence of a bad process.

It’s all about probabilities, expected values, and distributions.

That leads us to our next one.

#8: Don’t overvalue a data point any more than logical

What matters over time is whether your process and judgment is sound or not, and not whether the last trade or last X amount of time has been good for your returns.

Any single trade or snippet of time can have various explanations as to why it played out the way it did.

It wouldn’t be prudent to evaluate baseball hitters on the basis of one at-bat. Even the best hitters will strike out many times. That’s why statistics like batting average, on-base percentage, and slugging percentage exist to capture track records over time.

Data points will add up to a pattern of behavior. How many trades or how much time needs to elapse before you have a clear understanding whether something works or not will depend on what exactly is being done.

For most strategies, it can literally take years before it can be understood whether it’s value-additive or not.

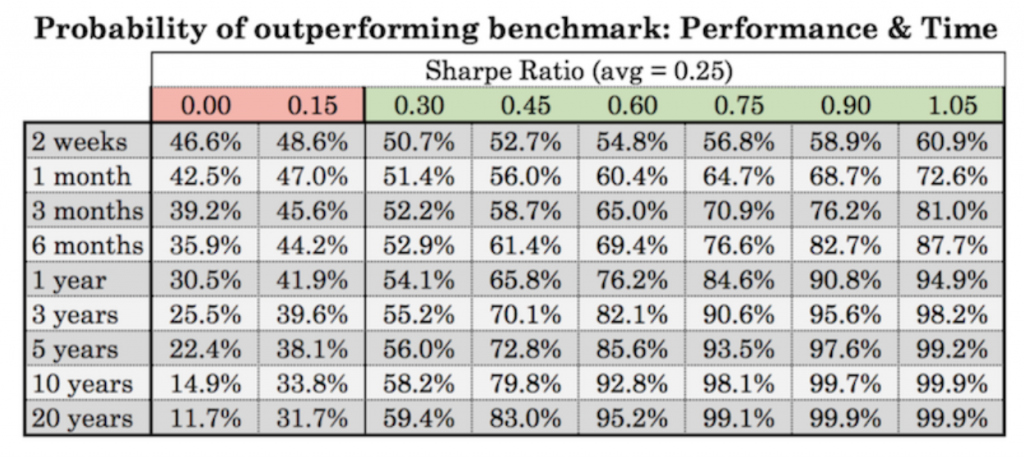

If we assess the approximate talent level of a trader via Sharpe ratio and want to understand the probability of beating a benchmark, it depends on the level of under- or overperformance.

If the Sharpe ratio of a benchmark is 0.25, a trader or investment manager that operates at around a 0.45 level could go ten years and still have about a 1-in-5 chance of underperforming.

At the same time, some things take little data to determine their quality (e.g., if a strategy is very bad).

Conclusion

There are many ways to make money in the markets just as there are many ways to make money in business. Successful trading can include many different approaches.

In this article, we decided to boil it down to eight basic principles:

i) Extrapolation is dangerous

Because something has done well in the recent past doesn’t mean it’s a better investment. It could simply be more expensive.

ii) Distinguishing possibilities from probabilities

Most everything is possible. Putting more attention on the probabilities of such outcomes is more important.

iii) Reduce tail risk

Trading is another business where the ultimate goal is sustainability. Revenue must exceed costs. Market history shows that most losses come in punctuated periods and punish those who have a lot of left-tail risk. Finding ways to reduce it is very important.

iv) Having balance is critical

Pushing your bets and putting a lot on any given outcome is not a good way to do it. You can make a lot but you can lose a lot or even put yourself out of the game entirely.

There’s nothing wrong with hitting singles for a living and having the occasional big hit from trade structure where you have a lot to gain but little to lose.

v) There are no easy good or bad investments

All that is known, which is small relative to the range of unknowns, is discounted in. Take caution against any confidence that something is an obviously good or obviously bad bet. You should always be afraid of what you’re missing.

vi) Learn how to deal well with what can’t be known

Confidence and betting in a concentrated way is something that traders will feel inclined to do, but learn that it’s generally not a prudent idea.

If you understand that you don’t know a lot, you’re probably going to do something about it. You’re probably going to hedge or limit your position size, and look for ways to achieve better balance.

vii) Understand expected value

When you understand expected value, you’ll see that the bets in which you have the highest probability of being right are not necessarily the best ones to make.

Think of each bet as a probability of being right and a reward from being right along with a probability of being wrong and a penalty for being wrong. Positive expected value bets are the best so long as you can cover any loss associated with being wrong.

viii) Don’t overvalue a data point any more than logical

Any bad trade or bad week or month is not necessarily indicative of a bad process, just as any good trade or good stretch is indicative of a good process.

Over time a body of evidence will build up from various data points to determine a track record.