The Danger of Selling Volatility

Selling volatility is among the highest-risk trading strategies.

Also known as being “short gamma”, selling volatility typically means selling options naked or on an uncovered basis. When you sell an option you have a fixed amount of upside – i.e., the premium of the option – and potentially unlimited downside.

If you are short a call option, your losses are unlimited on the upside. Once it blows through a strike price, there’s really no ceiling. For example, those who sold Gamestop (GME) call options on an uncovered basis could have lost hundreds or thousands in terms of the multiple on their premium.

For example, if you sell a 100 strike call option for $50, and the stock goes up to $400, that’s a $300 per share loss. With 100 shares per contract, that’s a $30,000 loss, or 600x your premium.

If you are short a put option, your losses are limited to whatever downside there might be on the price of the security or instrument.

If this is a stock or a bond, your downside is limited to zero. The same is also true as it pertains to a currency. It’s less common for national currencies to be wiped out, but it does happen (e.g., Zimbabwe, Venezuela; others throughout history often due to hyperinflationary events).

As we learned with oil prices going negative, selling a put option on oil does not leave you with a downside only based on the spread of your strike price from zero.

At one point, front-month WTI crude oil was trading at minus-$40 per barrel. Commodity prices can go negative because there can come a point where producers would be willing to pay buyers to take it off their hands.

Electricity prices going negative due to limited grid capacity is a well-known phenomenon. Natural gas prices in Texas went negative in 2019. When there is a fixed cost associated with shutting in production or disposing of something, there is the risk of negative prices.

Many traders and computer programs effectively assumed a zero lower bound on oil. That ended up being a major miscalculation based on what happened on the May contract going into the close.

Those who sell volatility for income may also underestimate the losses from selling call options.

For example, interest rates and bond yields can go negative. At one point, many investors assumed that negative interest rates shouldn’t occur because it flips around the borrower/lender relationship. Why would a lender pay somebody to take their money?

But when people have an ample need for safety and liquidity and price-insensitive central banks buy bond securities to help financial markets and economic activity, it’s entirely feasible that bond yields go negative.

When central banks are out of room in terms of their traditional tools, it’s entirely possible they push the cash rate negative. Yield curves out 10-plus years are negative in many of the developed world’s bond markets.

Moreover, if there’s deflation in an economy, it’s possible that such bonds can produce positive real returns (i.e., inflation-adjusted returns). However, one should expect central banks to target an inflation rate of at least zero. So any negative inflation is likely transitory.

When one’s alternative is highly volatile risk asset markets, the thinking is that earning minus-50bps in cash or safe government bonds beats the possibility of being exposed to losses of a much higher magnitude elsewhere.

Anyone wanting to sell call options on interest rates or bonds at an expected upper bound in price (i.e., lower bound in yield) is underestimating their tail risk.

And underestimation of tail risk, which options are often used to protect against, is one of the most common ways people wipe out in trading.

Extrapolation of the past

In a bull market, the bad times of the past fade away and people feel more comfortable taking on risks.

When volatility is low, the yield of a security becomes the most important thing. This encourages most everything with a low interest rate to be shorted against securities with a higher interest rate or yield as people scour markets for a better return.

This builds leverage in the financial system and traders become more confident in bets they believe are worth the risk because they rarely happen – i.e., selling far out-of-the-money options.

When these events do occur, the losses are many multiples of the premium they expected to get. Some dynamically hedge these trades.

For example, shorting a stock they had sold put options against to protect against further losses, which further intensifies the downward market action.

Current volatility informs current risk-taking behaviors

Risk managers will reference current volatility when they measure how much risk their portfolio managers are taking.

When volatility increases, it forces selling at the same time to de-risk portfolios, which amplifies sell-offs, causing the risk they worry about to manifest.

Products that have limited loss characteristics built into their structure (e.g., options, volatility ETFs) means that the issuer/market maker has to sell on the way down and buy on the way up (e.g., delta hedging, gamma hedging), which amplifies volatility and tail risk. XIV’s infamous implosion in 2018 was a classic example.

Volatility Trading: The Market Tactic That’s Driving Stocks Haywire

The case of CalPERS

CalPERS is the California pension system for public employees of the state. Pension funds typically have most of their portfolios in equities and equity-like products, such as hedge funds, private equity, and other alternative investments.

Big institutional funds are essentially short volatility, even if many of the more conservative ones don’t short options uncovered due to risk management concerns.

This is because they own lots of investment assets that do well in an environment where volatility is mild. As volatility increases, so do risk premiums, which bids down their prices.

As the market rose in late-2019 and into-2020, CalPERS disposed of some of its hedges as they got further out-of-the-money. It may seem like a no-brainer to hedge to limit your potential losses, but they also incur a cost.

And if they’re so far OTM, then it could seem to make sense to sell them and save on future losses.

However, on an expected value basis, it about evens out. Even though the probability favors OTM options expiring worthless (good for the seller, bad for the buyer), there’s also the small probability of reaping large rewards.

For institutions who trade in large quantities, whatever they do is going to have an impact on the markets. The hedges they put on are typically complex and it becomes harder to find counterparties at the size required. This leads to even higher transaction costs, which tend to increase in a non-linear way.

From 2009 to early 2020, those who assiduously hedged their risk probably underperformed the market.

When this occurs, limited partners (LPs, i.e., outside investors) often lose patience and pull their money even if the tail risk hedging strategy employed is likely to systematically provide better risk-adjusted returns over time.

Day traders selling volatility

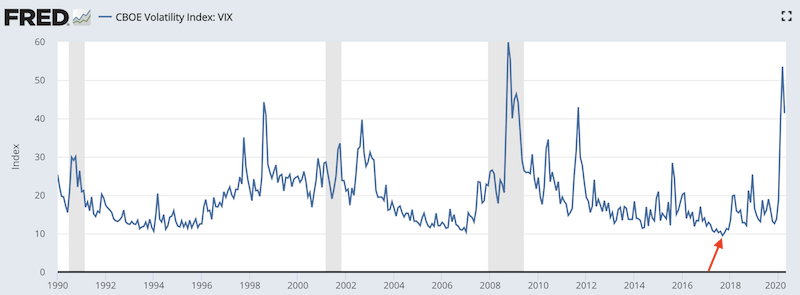

In 2017, as the US stock market generated new highs from optimism over corporate and individual tax cuts, deregulation, a generally positive and improving view of US business, favorable monetary policy, and few tail risks, equity volatility fell to its lowest level since the index came into use in January 1990.

(Source: St. Louis Fed, Chicago Board of Exchange)

Shorting volatility became a highly profitable trade and, along with bitcoin, became among the most profitable trades of the year.

It inspired some notable cases, such as Seth Golden of Ocala, Florida, whose success with the trade made it into the New York Times in August 2017, approximately five months before the “short vol” bubble burst.

Golden had been a Logistics Manager at his local Target department store, but made millions of dollars day trading volatility from his home office:

Each morning, at the market’s open, Seth M. Golden, a former logistics manager at a Target store, fires up the computer in his home office in northern Florida and does what he has done for years: Put on bets that Wall Street’s index of volatility, the VIX, will keep falling.

It has been a lucrative strategy as the so-called fear gauge has been, outside of the occasional spike, largely fearless — confounding experts by sloping persistently downward and in the process making Mr. Golden a multimillionaire.

“There has been a lot of white noise,” said Mr. Golden last Tuesday on a day that the VIX plummeted more than 10 percent, allowing him to lock in profits from short trades. “You had North Korea, Afghanistan, Trump people resigning. But I was never nervous — so today I just sat back, ate some popcorn and cashed in my profits.

But after every spike of fear must follow a longer period of calm, Mr. Golden contends, which, he argues, is a perfect scenario if your bias is to always bet against fear.

“The nature of volatility is that it desensitizes over time,” he said. “Which is why the index has been tracking down for so long.”

Mr. Golden, who is 40, lives in a suburb of Ocala, Fla. Since he has been shorting VIX, he says his net worth has gone to $12 million from $500,000 in about five years.”

When a lot of new investors are entering the market, certain investments are talked about “everywhere” (e.g., Tesla, Gamestop), and crowding into the same stuff, it’s usually an indication that caution should be heeded.

The bolded portion in the above quote is an assumption that as the world moves forward and people learn, financial markets may be less volatile over time as a secular trend.

Do central bankers become better at managing the market cycles?

Do traders learn lessons from the past and not repeat them?

In reality, we know that such tranquil periods tend to sow the seeds of their own demise as risk builds (e.g., more leverage, more crowded trades not based on good fundamentals), leading to magnified reactions the other way.

Golden even managed to raise $100 million to short volatility due to his success pressing the pedal on this trade.

But eventually, the luck ran out on this trade. It’s a trade that makes a little bit of money consistently most of the time, followed by abbreviated periods where years or decades of gains can be wiped out in a very short period.

The trade became extremely crowded (as evidenced by Golden, with no previous money management experience, raising an ample amount of money). Trade crowdedness is apt to happen when something works for a long time and investors extrapolate the past.

It seems to make very high Sharpe ratios for long periods of time, punctuated by events that even out its performance.

In February 2018, when short volatility positioning was very high, wage growth numbers were higher than anticipated when non-farm payrolls were released, the well-known data point released on the first Friday of each month.

This was a good thing for the economy. But such numbers are not necessarily a good thing for the markets.

This was interpreted by the market that the Fed would hike interest rates faster than was discounted into the curve. This term structure of interest rates is always baked into the prices of all financial assets.

This is true for bonds, stocks, real estate, private equity, and so on. When this goes higher, holding all else equal, the prices of financial assets fall due to the present value effect.

Accordingly, we saw a little bit of a correction in asset prices and the short volatility trade was whiplashed.

(Source: Trading View)

The spike in volatility in February 2018 doesn’t seem like much.

But it’s enough to blow up the trade, particularly with the amount of systemic risk that had been embedded in. Whether shorting the VIX through options, the index itself, ETFs and ETPs, or from shorting put options, it’s not hard to lose money with a limited upside/unlimited downside trade structure.

The XIV ETP (a VIX ETP betting on volatility going down in a leveraged way) famously blew up entirely. Liquidity in many of these markets isn’t sufficient to absorb momentous events.

One of the problem with VIX ETPs is that with a low starting point for volatility, a spike ends up being large on a percentage basis. These leveraged instruments force the buying of VIX contracts as a matter of rebalancing.

Some of these “exchange traded products” have liquidation, or early termination, clauses built into them.

That means in a scenario where any price move is particularly strong, they are effectively redeemed and that’s the end of the product. On February 5, 2018, XIV collapsed. Beyond the VIX ETP rebalancing risk, concentrations of short volatility strategies can unwind systematic strategies and cause amplified market sell-offs.

Those involved in short volatility strategies often have an inadequate grasp of the risk/reward of the trade, particularly when the last event that wiped out such trades was long ago.

The danger of extrapolating the past

Traders tend to underestimate how much they can lose typically based on the assumption that current conditions are likely to continue.

For example, when oil went negative, this was a product of market structure. Oil storage filling up had something to do with the circumstances leading up to that (i.e., the fundamental reason why oil prices can go negative), but the massive drop was a technical breakdown.

Going into the May expiry, some traders thought they could make a quick profit. They bought crude oil likely to see if they could force a “short squeeze” higher as prices approached zero – or forcing other traders to capitulate and sell going into expiry.

However, there’s one major problem with buying a contract going into expiration: buying the contract into expiration forces them to take physical, formal delivery of the oil once the contract expires.

The traders trying to test sellers’ resolve going into the expiration appeared to make the serious amateur error of not realizing that buying NYMEX WTI into the close required taking the oil to begin with.

Accordingly, they had no choice but to unwind and take the losses. Like selling volatility, this caused much greater losses than anticipated when the “impossible” happened.

Conclusion

Being “short gamma”, or selling options, is the most common way that people short volatility. In normal times, you earn a little bit of money consistently, followed by brief periods punctuated by large losses.

Selling volatility on an uncovered basis is one of the most common ways that people blow up in trading (the other being the uneducated use of leverage).

In the case of CalPERS, growing accustomed to a stable bull market led it to underestimate its risk. Having hedges in place is prudent. But it can be expensive and complicated.

In the case of AIMCo, losing $3 billion – or any massive sum of money – selling volatility isn’t hard given the minus-infinity loss potential of the trade structure.

Investor psychology and bias is dominated by what’s happened in market in the very recent past. Wild swings exacerbate moves in those directions, leading to wilder swings.