FXGT Review 2025

Awards

- Best Trading Conditions APAC 2024 – UF Awards

- Most Innovative Broker 2024 – UF Awards

- Best Hybrid Broker 2024 – UF Awards

Pros

- FXGT supports multiple platforms, including MT4, MT5, and its proprietary FXGT Trader, added in 2024, catering to different trading styles, such as MetaTrader's automated trading with Expert Advisors (EAs).

- Five account types are available to suit different trading needs, including accounts for beginner and advanced traders, plus the Optimus account, which was built for day traders and now offers the highest leverage we've seen up to 1:5000 (amplifying profit and loss).

- FXGT stands out after introducing access to over 30 popular cryptocurrencies such as Bitcoin, Ethereum, etc. This is advantageous for traders interested in diversifying into digital assets and provides an additional market to explore beyond traditional forex and stocks.

Cons

- FXGT is regulated by regional authorities like the Seychelles FSA and South Africa’s FSCA, but still does not hold licenses from ‘green tier’ regulators such as the UK’s FCA or Australia’s ASIC. This means that traders may not benefit from the higher investor protections, stringent oversight, and dispute resolution mechanisms.

- FXGT offers a subpar selection of around 185 assets, which is limited compared to category-leading brokers like Saxo with its 72,000+ instruments. In particular, FXGT does not provide access to a wide range of stocks from international markets.

- While FXGT offers some research, such as its market analysis section and an economic calendar, they are not as extensive as those provided by brokers like IG. Traders looking for detailed analysis, in-depth reports, or third-party research will find FXGT's resources woeful.

FXGT Review

Regulation & Trust

2.8 / 5FXGT is averagely trusted.

It’s a relatively new broker established in 2019 with a baseline level of oversight from one ‘yellow tier’ and one ‘red tier’ body in DayTrading.com’s Regulation & Trust Rating:

- South Africa: GT IO Markets (Pty) Ltd is registered in South Africa (company registration number 2015/059344/07) and is authorized by the Financial Sector Conduct Authority (FSCA) under license number 48896. ‘Yellow tier’.

- Seychelles: GT Global Ltd is registered in Seychelles (company registration number 8421720-1) and is regulated by the Seychelles Financial Services Authority (FSA) under license number SD019. ‘Red tier’.

The brokerage is also registered with other financial bodies, though these do not serve retail traders:

- Cyprus: GT Investment Services Ltd is registered in Cyprus (company registration number HE 389575) and is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 382/20.

- Vanuatu: GT Global Markets Ltd is registered in Vanuatu and is licensed by the Vanuatu Financial Services Commission (VFSC) under license number 700601.

- Cyprus: GT Payment Agent Ltd is a registered company in Cyprus (company registration number HE 440349). GT Payment Agent Ltd facilitates payment services to GT Global Ltd.

FXGT may offer legitimate trading services but lacks regulation from ‘green tier’ regulators like the UK’s FCA or Australia’s ASIC, which are known for their stricter compliance and investor protections.

Still, our investigations reveal that the broker implements robust risk mitigation measures, including negative balance protection, segregated client funds, and liability insurance of €1 million for all account holders.

| FXGT | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FSCA, FSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.8 / 5Live Accounts

FXGT offers five trading accounts designed to cater to traders of varying experience levels and strategies. Although this is flexible, beginner traders might find the choice confusing:

- Mini: Designed for beginners or those wanting to trade with minimal risk. It requires a minimum deposit of $5 and offers leverage of up to 1:1000. Spreads start from 1 pip, and there are no commission fees. This account is eligible for promotions, but contract sizes are limited to 10,000.

- Standard+: A versatile option for a broad range of active traders, this account requires a $10 minimum deposit and offers the same high leverage of up to 1:1000. Spreads start from 1 pip, with no commissions, and it offers bigger contract sizes up to 100,000. This account is also promotion-eligible.

- ECN Zero: Targeted at short-term and algorithmic traders, this account has a $100 minimum deposit and spreads starting from 0 pips. While it charges commissions of $3 per side on forex and up to $5 round turn for precious metals, it does not qualify for promotions. Interestingly, gold has a three-day swap-free allowance. Up to 1:1000 leverage is available.

- PRO: Suitable for short-term swing traders, this account combines no commissions with spreads starting from 0.5 pips. It requires a $50 minimum deposit, offers up to 1:1000 leverage, and does not qualify for promotions. Forex pairs (major, minor), metals, and energy commodities have up to six days of swap-free allowance.

- Optimus: Tailored for day traders, this account boasts exceptionally high leverage of up to 1:5000, starting with a $10 minimum deposit. Spreads start from 0.8 pips, and no commissions are applied. However, the account is only accessible on MT5 (not MT4) and does not qualify for promotions. All assets except indices have up to two days of swap-free allowance.

Demo Accounts

Opening an FXGT demo account is simple, but you can only do it once you register for a full account.

During testing, I was also limited to just two demo accounts, which is restrictive as I wanted to test different strategies on all three supported trading platforms.

From my client area, I was able to quickly set up a demo account using any of the five trading account types, select my leverage, and select the account’s base currency.

Things got a little less straightforward when it came to adding funds to my demo account.

Unlike many brokers that automatically credit demo accounts with virtual funds, I had to manually add virtual funds from the client area of $1,000 at a time. I could not manually input the amount I wanted (such as $50,000). While it’s not a massive hurdle, it unnecessarily adds extra steps.

Deposits & Withdrawals

FXGT provides an expanding array of deposit and withdrawal options depending on your location, including:

- Credit/debit cards: Visa, Mastercard, Apple Pay, Google Pay, supporting USD, EUR, and JPY currencies. The minimum deposit is $50, with instant processing and no fees.

- E-wallets: Bitwallet and Sticpay accept USD, EUR, and JPY currencies, while Neteller supports USD and EUR. Minimum deposits are $10 for Bitwallet and $5 for Sticpay and Neteller. All offer instant processing without fees.

- Bank transfers: Near-instant local bank transfers in JPY are supported, with a minimum deposit of $100.

FXGT provides an unlimited Loyalty Bonus promotion tailored for Mini and Standard+ accounts. This incentive lets you earn a 25% bonus on every deposit up to $10,000. For example, if you deposit $3,000, you will receive $750 on top, reflected as $3,750 in your account.

It’s an appealing offer to enhance your account balance and trading capacity, but it’s important to note that bonus funds are not withdrawable. Instead, they function as a tool to increase your trading capacity, acting as an additional leverage.

While this can amplify your trading opportunities, it also carries the risk of magnified losses, similar to traditional leveraged trading.

Unfortunately, cryptocurrency transactions are not supported, so you cannot open accounts, deposit funds, or withdraw funds using cryptocurrencies. This is a feature we increasingly see at alternatives, such as Eightcap and BlackBull.

| FXGT | Dukascopy | Plexytrade | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Apple Pay, Bitwallet, Credit Card, Debit Card, Google Pay, Mastercard, Neteller, Sticpay, Visa, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | Bitcoin Payments, Ethereum Payments |

| Minimum Deposit | $5 | $100 | $50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

2.5 / 5Although growing, FXGT offers just 185+ CFDs across a range of asset classes. This core section caters to various trading styles.

Still, the library is considerably smaller than brokers like CMC Markets, which offers over 12,000 instruments, or IBKR which offers over 10,000 US stocks and ETFs.

- Forex: Trade on 50+ currency pairs, including majors (USD/EUR, GBP/USD), minors (AUD/JPY, EUR/CHF), and exotics (USD/TRY, ZAR/USD).

- Stocks: Access 50+ popular US stocks like Amazon, Microsoft, and Tesla for potential exposure to established companies.

- Indices: Speculate on market movements with 10+ global indices including the S&P 500, Dow Jones and FTSE 100.

- Commodities: Diversify your portfolio with 5+ energy commodities (US oil, UK oil, natural gas) and precious metals (gold, silver).

- Cryptocurrencies: Capitalize on the volatility and growth potential of 30+ cryptos including Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

To enhance its appeal and attract a wider clientele, FXGT could consider diversifying its product range to include ETFs, options, bonds, and interest rate derivatives.

Broadening its stock selection to encompass a broader range of global exchanges would also potentially attract traders interested in international markets and smaller-cap companies.

| FXGT | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:5000 | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.5 / 5FXGT offers a competitive and transparent fee structure designed to accommodate traders at all levels. Its range of account types offers cost-effective conditions for short-term traders.

Most account types, for example, are commission-free, relying instead on variable spreads that can vary significantly depending on the asset.

The ECN Zero account stands out for the tightest spreads, making it particularly attractive to scalpers and intraday traders. However, it comes with a trade-off of commissions of up to $6 per round-turn trade. Despite these charges, the overall trading costs can be lower due to the minimal spreads.

In contrast, the Mini account offers wider spreads, making it a suitable option for beginners.

Swap fees generally apply if you intend to hold positions overnight. However, somewhat unusually, FXGT provides flexibility with swap-free trading options. PRO account users can enjoy swap-free trading on forex pairs (major, minor), metals, and energy commodities for up to six days. Other account types may allow three days of swap-free trading on select instruments.

Deposits and withdrawals are generally free for most payment methods, including debit/credit cards and e-wallets. However, bank wire transfers can incur fees based on the transaction amount.

Additionally, FXGT charges no fees for opening, maintaining, or closing accounts, further enhancing its cost-efficiency.

FXGT has successfully created a balanced fee model that caters to diverse trading styles and levels of expertise.While there is room for refinement, its current structure offers significant advantages, particularly for those seeking cost-effective and flexible trading solutions.

| FXGT | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 2.2 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 110 | 100 | 0.005% (£1 Min) |

| Oil Spread | 1.1 | 0.1 | 0.25-0.85 |

| Stock Spread | 31.9 (Apple Inc) | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

3.5 / 5FXGT has expanded its platform offerings to include its proprietary platform, FXGT Trader.

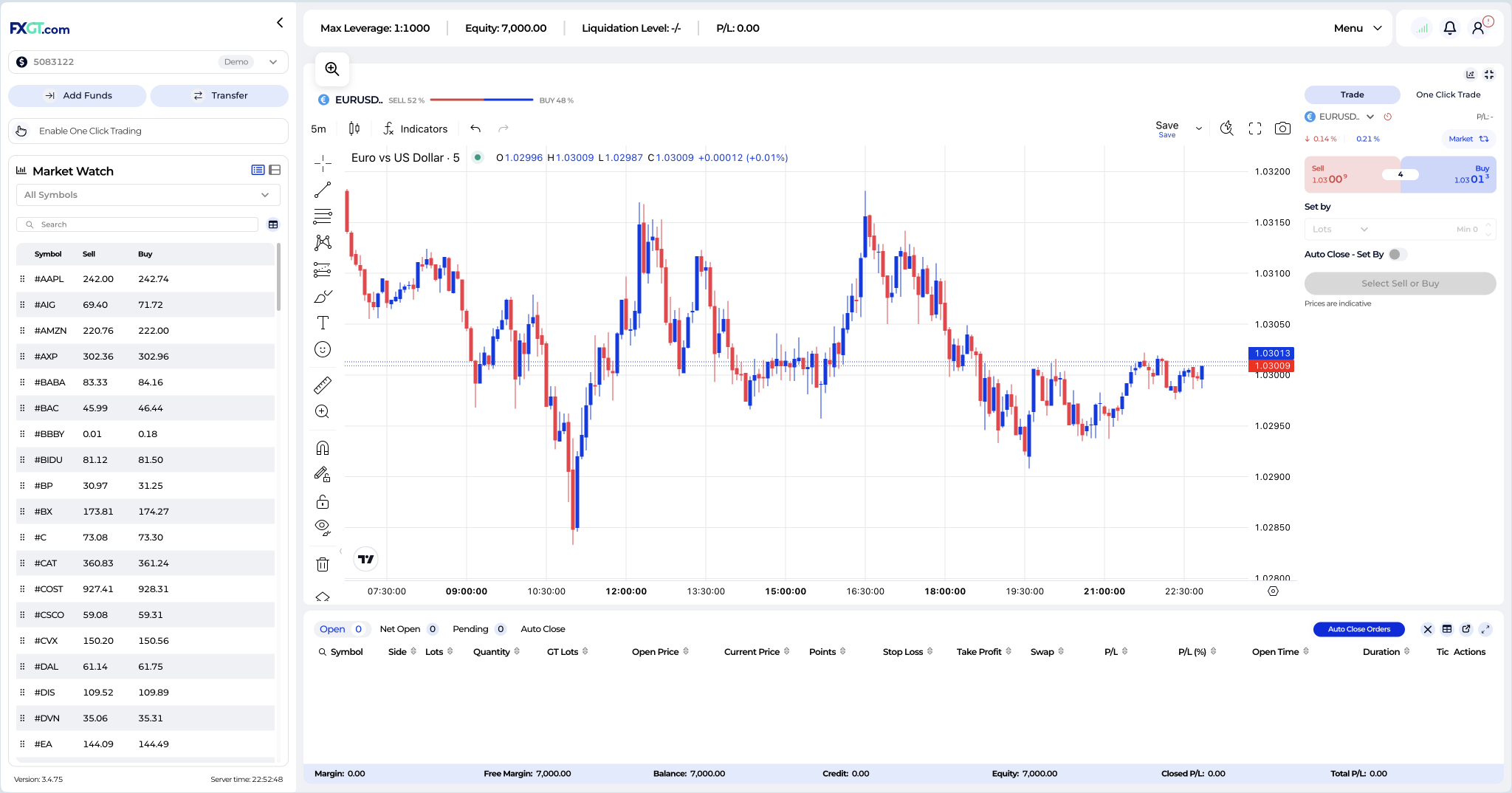

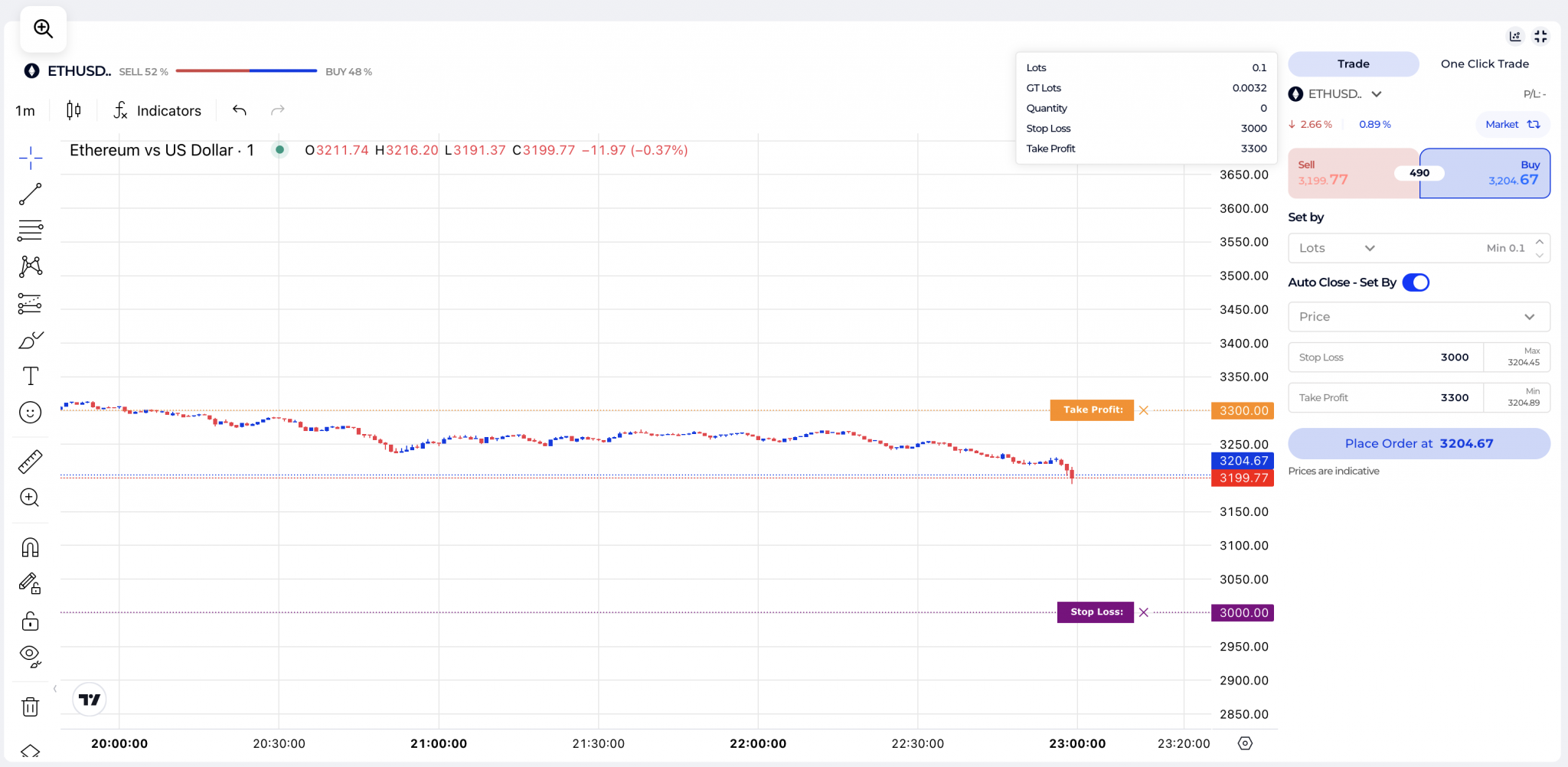

FXGT Trader

This latest addition is a web-based platform and mobile app that integrates the powerful TradingView charting system, known for its advanced features and user-friendly design.

FXGT Trader is a good choice for new and aspiring traders due to its modern, intuitive interface that remains robust in functionality. One of its most notable features includes 90 drawing tools, which facilitate detailed technical analysis.

Another practical feature is the ability to save chart settings, which allows me to retain my configurations across sessions – a valuable timesaver compared to platforms that require reconfiguration each time I log in.

MT4/MT5

For traders preferring more established platforms, MT4 and MT5 remain solid options.

These platforms are celebrated for their powerful trading capabilities and are available across various devices, including Windows and Mac desktops, iOS and Android mobile devices, and web browsers.

They provide a comprehensive suite of tools, including automated trading through Expert Advisors (EAs) and a wide range of technical indicators.

If you’re willing to invest time in learning these platforms, perhaps by starting with a demo account, you will find all the tools necessary to plan and execute effective trading strategies.

However, a common critique of MT4 and MT5 is their somewhat outdated interface design, which can feel uninspired compared to modern trading platforms.

While their functionality remains top-notch, upgrading their look and feel would enhance the user experience and align them more closely with contemporary trader expectations.

If you meet the eligibility criteria, which include an initial deposit of $3,000 and a monthly trading volume, you can qualify for the VPS Sponsorship program.

This program allows you to establish your own Virtual Private Server (VPS) to ensure your trading terminal maintains a persistent connection to the market and executes trades even when you are not logged into your platform.

| FXGT | Dukascopy | Plexytrade | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | FXGT Trader, FXGT App, MT4, MT5 | JForex, MT4, MT5 | MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

2.8 / 5FXGT provides a few research tools that I appreciate to help me make more informed trading decisions:

- Blog: The blog offers educational articles, trading strategies, and insights into various financial instruments, catering to beginners and experienced traders.

- Market Analysis: The Market Analysis section of the blog provides in-depth technical and fundamental analyses, weekly recaps, and forecasts, helping me stay updated on market trends.

- Economic Calendar: The MetaTrader-powered Economic Calendar lists upcoming economic events and data releases that may impact financial markets, enabling me to anticipate market movements.

The research tools are useful, but to compete with the leading brokers like IG and eToro, FXGT could consider implementing a real-time news feed and publishing analyst webinars and tutorials to offer deeper insights into market analysis and trading strategies.

| FXGT | Dukascopy | Plexytrade | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

1 / 5FXGT’s educational offerings are lacking. The company’s blog is the only resource available for those seeking educational content.

The blog covers market updates, company news, and basic trading tips. Still, it lacks in-depth educational resources such as structured courses, video tutorials, webinars, and e-books.

This could be a significant drawback for novice traders just starting their journey in the financial markets.

To improve this area, FXGT could introduce various educational materials catering to different learning styles. By comparison, Axi and IBKR offer beginner-friendly video tutorials that break down basic concepts like market analysis, risk management, and trading strategies.

Additionally, in-depth articles covering advanced topics, such as technical analysis, chart reading, and economic indicators, could help short-term traders better understand the markets.

Live webinars could be another valuable addition to FXGT’s educational offerings. They would allow traders to interact with experts in real-time, ask questions, and deepen their understanding of complex trading concepts.

| FXGT | Dukascopy | Plexytrade | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

2.5 / 5FXGT offers 24/7 multilingual customer support through the following channels:

- Live Chat: Accessible directly on the website, providing real-time assistance.

- Email: Clients can reach the broker at ‘support@fxgt.com’.

- Online Contact Form: Available for submitting inquiries on its ‘Contact Us’

- Social Media: Platforms like Instagram, Facebook, YouTube, LinkedIn, and X respond to client inquiries and share company updates in real-time.

FXGT should be commended for its round-the-clock support. Still, I experienced problems during testing with the live chat widget not displaying during my visits, which was inconvenient when I needed immediate support.I would also like the chat widget integrated directly into the FXGT Trader platform, so I don’t have to keep going to the website for support.

FXGT could further enhance the customer support experience by introducing a dedicated phone support line for immediate assistance and a detailed FAQ section so you can find quick answers to common queries without needing to contact support.

Regardless of my account tier, a dedicated account manager would also be ideal for personalized support.

| FXGT | Dukascopy | Plexytrade | |

|---|---|---|---|

| Customer Support | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With FXGT?

Whether to day trade with FXGT depends on your individual trading needs and priorities.

FXGT offers a range of platforms catering to various short-term trading styles and levels of expertise, with tools for both beginners and advanced traders.

Its accounts also meet the needs of short-term traders, particularly Optimus, which offers some of the highest leverage we’ve seen (1:5000), amplifying both gains and losses.

Two regional authorities also regulate FXGT, although they provide a basic level of security compared to ‘green tier’ regulators like the FCA or ASIC, which may be a concern if you prioritize the highest levels of regulatory oversight.

Alternative brokers might be worth exploring for those prioritizing top-tier regulation and more comprehensive research and educational tools.

FAQ

Is FXGT Legit Or A Scam?

FXGT is a legitimate broker, but its regulatory oversight is minimal compared to larger, more well-known brokers like IG or IC Markets.

While it offers a variety of trading instruments, such as forex and CFDs, traders should exercise caution and perform thorough research before depositing money.

If you’re considering opening an account, assess the potential risks and always start with smaller deposits, especially if you’re a beginner.

Is FXGT Suitable For Beginners?

FXGT can be suitable for beginners, but there are a few factors to consider before diving in.

The platform offers a demo account, which is a great feature for new traders to practice without risking real money. However, the lack of comprehensive research and educational resources makes it harder for beginners to grasp trading concepts fully.

Additionally, while the platform is quite user-friendly, there are far better platforms from other brokers, notably eToro and XTB, that can make trading much more intuitive.

Top 3 Alternatives to FXGT

Compare FXGT with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Plexytrade – Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

FXGT Comparison Table

| FXGT | Interactive Brokers | Dukascopy | Plexytrade | |

|---|---|---|---|---|

| Rating | 3.5 | 4.3 | 3.6 | 2.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5 | $0 | $100 | $50 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 |

| Regulators | FSCA, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | – |

| Bonus | Up To 25% Loyalty Bonus | – | 10% Equity Bonus | 120% Cash Welcome Bonus |

| Education | No | Yes | Yes | No |

| Platforms | FXGT Trader, FXGT App, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:5000 | 1:50 | 1:200 | 1:2000 |

| Payment Methods | 10 | 6 | 11 | 2 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Plexytrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXGT and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXGT | Interactive Brokers | Dukascopy | Plexytrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

FXGT vs Other Brokers

Compare FXGT with any other broker by selecting the other broker below.

Customer Reviews

3 / 5This average customer rating is based on 1 FXGT customer reviews submitted by our visitors.

If you have traded with FXGT we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of FXGT

Article Sources

- FXGT

- GT IO Markets (Pty) Ltd - FSCA License

- GT Global Ltd - FSA License

- GT Investment Services Ltd - CySEC License

- GT Global Ltd - Liability Insurance

- FXGT Loyalty Bonus

- FXGT Blog

- FXGT Market Analysis

- FXGT Economic Calendar

- FXGT Instagram

- FXGT Facebook

- FXGT YouTube

- FXGT LinkedIn,

- FXGT X

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Ive mostly enjoyed my time day trading at FXGT. Their ECN Zero account is ideal (tight spreads and high leverage) and I like that there’s no limit on charts in the platform and that it’s easy to use. That’;s the good bit. What’s bad is that I’ve had times where stuff in the client portal takes agessss to load, even opening the platform. Getting through to live chat can also be like playing roulette, red or black, there or not, who knows.