Sticpay Brokers 2026

Sticpay is a global money transfer service with a focus on Asian markets. The e-wallet provider partners with many merchants, along with top forex brokers to provide efficient and secure international payments.

Our review explores the benefits of trading with Sticpay, including its key features, such as the prepaid ATM bank card, account set-up and login, plus deposit and cashback options. We also list the best brokers that accept Sticpay deposits in 2026.

Best Sticpay Brokers

These are the best 6 brokers with Sticpay, based on our analysis:

This is why we think these brokers are the best in this category in 2026:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- FBS - Founded in 2009, FBS is an award-winning CFD broker operating in over 150 countries with a client base exceeding 27 million traders. Traders are supported at every stage of their journey with 24/7 assistance, market analytics, trading calculators, and competitive pricing with zero commissions.

- Vantage - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- CMTrading - Established in 2012, CMTrading has emerged into a popular broker with active traders, particularly in South Africa. Sporting four account options (Basic, Trader, Gold, Premium) and the popular MT4 platform alongside the broker’s own Webtrader, it provides a compelling trading environment for short-term traders.

- LiteFinance - LiteFinance is an offshore-regulated broker with 55 forex pairs and a range of international stocks as well as a smaller list of indices, commodities and cryptocurrencies. With support for the MetaTrader 4 and MetaTrader 5 platforms as well as a proprietary mobile app, there is a good selection of tools available. The broker offers a Classic commission-free account as well as an ECN account with spreads starting from zero and a commission per lot.

Compare The Best Sticpay Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| Exness | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| Fusion Markets | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 |

| FBS | $5 | CFDs, Forex, Indices, Shares, Commodities | FBS App, MT4, MT5 | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Vantage | $50 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | ProTrader, MT4, MT5, TradingView, DupliTrade | 1:500 |

| CMTrading | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Webtrader, MT4, TradingCentral | 1:200 |

| LiteFinance | $50 | Forex, CFDs, indices, shares, commodities, cryptocurrencies | MT4, MT5 | 1:500 (Crypto 1:50) |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

Cons

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

FBS

"FBS is an excellent choice for day traders at every level and budget, with just a $5 minimum deposit and intensive academy for aspiring traders alongside access to MT4, MT5 and highly leveraged trading opportunities up to 1:3000 for experienced traders."

Christian Harris, Reviewer

FBS Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Shares, Commodities |

| Regulator | ASIC, CySEC, FSC |

| Platforms | FBS App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Account Currencies | USD, EUR |

Pros

- The trading firm has picked up over 90 awards and amassed more than 27 million clients, making it one of the largest and most established brokers globally.

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

- 24/7 customer support that performed excellently during testing is available, alongside a $5 minimum deposit, high leverage options, and a huge variety of 200+ funding options, making it ideal for traders with small accounts.

Cons

- There are only two base currencies available - EUR and USD - which isn't practical for minimizing currency conversion fees for many global traders, and is especially striking given the broker’s user base spans over 150 nations.

- Although the FBS app offers a terrific mobile trading experience for aspiring traders and MT4/MT5 cater to advanced traders, the absence of cTrader and TradingView, which are increasingly offered by alternatives like Pepperstone, will deter day traders familiar with these platforms.

- Investor protection is only available for clients within the EU, meaning global traders may not be protected if their account goes negative, significantly increasing the risk to your funds.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

- Vantage caters to hands-off investors with beginner-friendly social trading via ZuluTrade & Myfxbook

- There are no short-term strategy restrictions with hedging and scalping permitted

Cons

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

CMTrading

"CMTrading is well suited to traders in South Africa looking for highly leveraged trading opportunities on global financial markets through a user-friendly, web-accessible platform, with signals from reputable providers to help inform short-term trading decisions."

Christian Harris, Reviewer

CMTrading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FSCA, FSA |

| Platforms | Webtrader, MT4, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, ZAR |

Pros

- The CMTrading Academy has come a long way, offering a wealth of materials for traders at all levels. Video courses, webinars, and market analysis updates can help users deepen their knowledge.

- CMTrading operates under the oversight of the FSCA in South Africa, providing degree of operational security and accountability, ensuring the platform follows industry standards.

- CMTrading have added an incredibly intuitive AI chart feature which we’ve not seen elsewhere and offers signals in three simple steps: find an asset, take a screenshot of the chart, then upload it to the scanner for technical analysis and signals in seconds.

Cons

- Spreads are higher than those offered by some competing brokers like IC Markets based on evaluations. This could increase trading costs, particularly for high-volume day traders.

- While CMTrading offers a variety of assets, the overall selection is still significantly narrower than that of category leading brokers like BlackBull. The focus is primarily on forex, commodities, a few indices, and crypto.

- CMTrading's customer support is unavailable around the clock, which proved inconvenient during testing for traders in different time zones or those who encounter issues during non-business hours.

LiteFinance

"LiteFinance will suit traders seeking high leverage on forex, stocks, commodities, indices and cryptocurrencies. The social trading system will also suit newer investors looking to learn from seasoned traders."

Tobias Robinson, Reviewer

LiteFinance Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies |

| Regulator | CySEC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 (Crypto 1:50) |

| Account Currencies | USD, EUR |

Pros

- Automated trading via APIs

- Decent suite of extra tools and features including a VPS

- Good range of forex pairs

Cons

- Some complaints online about difficulties withdrawing funds

- Wide spreads on the Classic account

- Does not accept US traders

Note: Sticpay has no affiliation with STC Pay.

How Did We Choose The Best Sticpay Brokers?

To identify the top Sticpay brokers, we:

- Searched our database of 500 online brokers to find all those that accept Sticpay payments

- Confirmed that they support Sticpay deposits and withdrawals for day trading

- Ranked them by their rating, based on 100+ data points and our in-depth observations

What Is Sticpay?

Sticpay is a global e-wallet service used for peer-to-peer transfers, online purchases and trading activities. The company has a presence in over 200 countries, including Canada, Sweden, and France and supports payments in 30+ currencies including USD.

Sticpay is particularly popular with financial institutions in APAC countries, such as Malaysia, China, South Korea, the Philippines, and Indonesia. The company is also legitimately authorized to operate within the EEA under the regulation of the FCA.

Benefits Of Trading With Sticpay

Easy Registration

To sign up for an iwallet account, clients need to submit proof of identity and their residential address. The process is quick and easy with applications usually processed within one business day. The platform negates the need for a lengthy application, helping individuals to start trading quickly.

Multiple Deposit Options

Sticpay accepts deposits via credit/debit cards, bank wire transfers, cryptocurrencies, and UnionPay. These can be accessed via the ‘money in’ section of a client’s account. The payment gateway’s base currency is USD, however, this default can be changed, unlike Skrill or Neteller e-wallet solutions.

Mobile App

Sticpay offers a convenient and safe mobile app. The mobile interface is user-friendly and offers all of the platform’s key features.

The app can be downloaded to iOS and Android (APK) devices which means traders can view transactions while on the move. This is a useful feature for individuals who already trade the financial markets from their mobiles.

Availability

You can find the Sticpay logo on numerous global brands and trading brokerages. It is a safe forex payment gateway bridging trading platforms to individual users via an integrated API. The transaction system supports many forex brokers in 2026, including XM, Tickmill, FBS, and Axiory.

Multi-Currency

Sticpay caters to its global user base by offering multi-currency settlement for customers as well as instant international transfers. 30+ fiat currencies are supported as well as four cryptocurrencies. For reference, Neteller supports 22 and Skrill, 40.

Account Tiers

Whilst some e-wallet providers charge users to access more premium services such as increased transaction limits and prepaid card access, Sticpay adopts a single tier system. This means all users can enjoy equal access to functionalities.

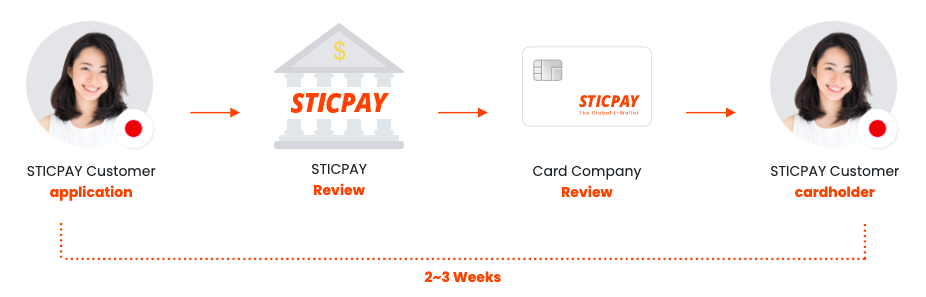

STIC CARD

A free-of-charge prepaid virtual card can be used globally. Clients can transfer funds from a Sticpay account, spend offline or withdraw from international ATMs. Visit the Stic Card section of the company’s website for more information including minimum fees and daily withdrawal limits.

Additional Features

The company is good at keeping its clients up to date with the latest news. Regular posts are published on the payment gateway’s website, along with posts via the @STICPAY Twitter account, where a comment utiliser is enabled.

Cons Of Trading With Sticpay

Fees

Traders may be charged for both deposits and withdrawals. Prices vary from broker to broker but take note, these charges can quickly cut into profits. The platform faces competition from cheaper alternatives. See below for further details on payment fees.

Excluded Countries

Some countries do not allow clients to use the Sticpay system. Traders from the USA, Côte d’Ivoire and Zimbabwe, for example, will not be able to register for a payment account and make deposits.

No Transfer Cancellations

Sticpay does not offer refunds or payment cancellation of any funds deposited into client accounts. All payments are final and irreversible.

Speed Reviews

Deposits and withdrawals are processed within 1 minute regardless of location. Note that your broker may have their own processing times which may cause a slight delay in funds reaching your trading account. In general, though, top forex brokers process deposits instantly and pay out profits within a few business days.

Security

Security features are robust with safe account login via password inscription. Traders that register should be reassured by the anti-fraud features and security verification measures, including segregating client funds with KYC checks on both merchants and individuals.

Sticpay also follows strict anti-money laundering policies, verifying client transactions with advanced technology solutions. The firm only acts as a payment solution to those merchants that comply with the regulatory laws of the countries in which they operate.

Note, funds and activities of clients in the EEA are covered under the Financial Ombudsman Service.

How To Deposit Using Sticpay

To make a deposit at your broker using Sticpay, you’ll first need to add money to your Sticpay account.

The minimum deposit is $100 or equivalent. Clients must access the ‘money in’ section of their account to select relevant deposit methods.

The process to deposit to your trading account is then fairly straightforward at most brokers. For example:

- Log in to the client area and navigate to the deposit section

- Select Sticpay from the list of available methods

- Enter the deposit amount and follow the instructions to complete to transaction

Sticpay also offers a domestic bank wire feature. This can help save the time and fees associated with using an intermediary bank partner. The service is established in 10 countries including the Philippines.

Charges

Fees vary by deposit and withdrawal method:

Deposits

- Credit and debit cards, including Visa and MasterCard – up to 3.85%

- International bank wire – 1%

- Local bank wire – Up to 4%

- UnionPay – 5%

Withdrawals

- International bank wire – up to 5%

- Local bank wire – varies by country

Internal transfer fees may also be charged by your FX broker. Sticpay does not apply inactivity fees vs ecoPayz’s $1.79 charge after 12 months. The firm does, however, charge a 1% transaction fee for member-to-member transfers. Member-to-merchant fees are charged at 2.5% + a $0.3 transaction fee.

Sticpay’s fee structure is not the most competitive. For example, Skrill users are charged just 1% for Visa and Mastercard payments, compared to 3.85% on Sticpay. With that said, the company does offer greater flexibility than other e-wallets via multi-currency accounts.

Rewards

Sticpay offers cashback services to clients using the platform to fund active trading accounts. Rewards are based on trading volume. Brokers affiliated with Sticpay’s cashback services include XM and JustForex. Check the cashback terms for your broker as they may vary.

Customer Care

To get in touch with the customer team at Sticpay visit Support on the website. The team generally responds quickly and can assist with a range of queries. Users can submit a ticket or alternatively, send an email to the relevant team:

- account@sticpay.com

- merchant@sticpay.com

- funds@sticpay.com

- affiliate@sticpay.com

Is Sticpay Good For Day Trading?

Sticpay offers a fast and secure payment solution operating across global merchants with simple account creation, 24-hour customer service support, a mobile app, and a pre-paid card option. On the downside, the platform does charge deposit and withdrawal fees which can erode profits.

It is worth noting that the platform’s fee structure is not the most competitive in the market but it does outstrip its competitors when it comes to flexibility and accessibility. Sticpay services are also limited in some countries so ensure your desired funding methods are available where you are based and check that your broker accepts the platform as a viable funding option.

FAQ

Is Sticpay Safe To Use In My Trading Account?

Sticpay implements advanced KYC and AML checks to enhance platform security. The company is legitimate, registered under Coopertoby Ltd, and, regulated by the Financial Conduct Authority in the UK. Sticpay is a trusted money transfer operator used by many global merchants including well-known trading brokers.

Can Traders Use Sticpay In India?

Yes, traders based in India can transfer funds locally and internationally. ISticpay accepts customers from most global locations, including the UK, Zambia, India, Nigeria, Argentina, Bahrain, Ecuador, Vietnam, Bangladesh, Kenya, Gabon, Guatemala, Nepal, Senegal, Tanzania, Costa Rica, South Africa, UAE, and many more. Note, some countries including USA do not permit the use of Sticpay.

Is Sticpay Available For Traders In South Africa?

Yes, Sticpay global e-wallet services are available to traders based in South Africa.

Which Brokers Offer Sticpay?

Several top-rated brokers support Sticpay deposits and withdrawals, though this can vary depending on your location. Notable firms include Deriv and Fusion Markets. You can refer to our list of top Sticpay brokers to find out if the payment method is available in your jurisdiction.