Complex Analysis & Complex Numbers in Finance, Trading & Investing

Complex analysis is a branch of mathematics focusing on functions of complex numbers.

Complex numbers, blending real and imaginary parts, are important because they allow us to solve equations (x^2 = -1) that can’t be solved with just real numbers, which expands our understanding and capabilities in various fields (e.g., finance, machine learning, quant trading).

Key Takeaways – Complex Analysis in Finance, Trading & Investing

- Complex Numbers

- A complex number combines a real number and an imaginary number.

- It’s usually written in the form a + bi, where a and b are real numbers, and i is the imaginary unit.

- Complex numbers let us explore and solve equations and problems that regular numbers can’t (the square of an unknown being a negative number) – by adding an extra dimension that opens up new ways to understand the world around us.

- Modeling Price Behavior

- Complex analysis, especially through Fourier transforms, helps in decomposing asset price movements.

- Enables better prediction of future prices.

- Option Pricing

- Used in advanced models to more accurately price complex derivatives and options.

- Risk Management

- Enhances the assessment of portfolio risk by capturing the multidimensional aspects of financial instruments and market conditions.

Below are some key concepts and applications in these areas:

Fundamental Concepts of Complex Analysis

Complex numbers are a type of number that extend the traditional idea of numbers.

In simple terms, a complex number is a combination of a real number and an imaginary number.

To understand this, let’s break it down:

Real Numbers

These are the numbers we use in everyday life, like 1, -3, 0.5, and so on.

They can be positive, negative, or zero.

Imaginary Numbers

An imaginary number is defined by the square root of -1, which is not a real number (since squaring any real number always gives a positive result).

This square root of -1 is represented by the symbol i.

Complex Numbers

Numbers of the form:

a + bi

Where:

- a and b are real numbers, and

- i is the imaginary unit (x^2 = -1)

For example, 3 + 4i is a complex number, where 3 is the real part and 4i is the imaginary part.

Complex numbers expand our understanding of numbers and allow us to solve equations that can’t be solved using only real numbers, like the square root of a negative number.

This is useful in advanced mathematics, physics, engineering, and certain areas of finance.

Analytic Functions

Functions that are complex differentiable in a neighborhood of every point in their domain.

This differentiability leads to powerful properties like conformality and the ability to expand in power series.

- Conformality refers to the property of complex differentiable functions to locally preserve angles and shapes (though not necessarily sizes) of geometric figures.

- The ability to expand in power series means these functions can be represented as a sum of powers of complex numbers.

Contour Integration

Integral of a complex function along a path in the complex plane.

It’s important for evaluating integrals in real analysis through techniques like the residue theorem.

Why Are Imaginary Numbers Important in Finance?

The square root of -1, represented as i, is important because it allows us to solve mathematical problems that would be impossible to solve using only real numbers.

This concept achieves several key things:

- Solves Otherwise Impossible Equations – Without i, we can’t find solutions to simple equations like x^2 = -1, because no real number squared gives a negative result. The introduction of i allows us to solve such equations.

In quantitative finance, complex numbers can be important in solving certain differential equations that arise in stochastic modeling, for example.

Complex Analysis & Complex Numbers’ Applications in Finance and Trading

Complex numbers are used in finance for several advanced applications, primarily due to their unique mathematical properties and the analytical techniques they enable.

Here are some key reasons and contexts where imaginary numbers are applied in finance:

Option Pricing Models

In the Black-Scholes framework and other option pricing models, the use of complex numbers (mostly in the form of complex logarithms and exponentials) facilitates the analysis of options pricing.

For example, the Fourier transform (which involves complex numbers) is used in some advanced option pricing techniques to handle models where the underlying asset’s price dynamics have jumps or other non-standard characteristics.

The pricing models often involve solving differential equations where complex number techniques are useful.

Risk Management and Stochastic Processes

In financial mathematics, stochastic processes (like Brownian motion, which underpins many financial models) often employ complex analysis for solutions (particularly when dealing with path integrals or Ito’s calculus).

In certain risk management techniques, complex numbers are used to model the behavior of financial instruments in extreme conditions or to simulate various scenarios for stress testing.

Signal Processing in Algorithmic Trading

Techniques from complex analysis are used in signal processing, which is used in algorithmic trading.

For instance, the Fast Fourier Transform (FFT), an analysis form in signal processing, is grounded in complex analysis.

FFT is used to analyze the frequency components of financial time series data.

This analysis helps in identifying trends, cycles, and periodic patterns in asset prices.

Time Series Analysis (Analyzing Cyclic or Seasonal Patterns)

Complex numbers are used in econometrics and time series analysis to understand cyclical and seasonal patterns in economic data.

The decomposition of time series into trend and seasonal components, often requires techniques like Discrete Fourier Transform (DFT) that use complex numbers.

Quantitative Analysis of Interest Rates

In some interest rate models, particularly those involving no-arbitrage conditions in a continuous-time finance framework, complex analysis can provide solutions to otherwise intractable problems.

Electrical Engineering Analogues

In fields like electrical engineering, complex numbers are routinely used to analyze circuits.

These techniques have analogs in financial engineering for modeling cash flows and returns, especially in derivative structuring and risk management.

Portfolio Optimization and Asset Allocation

Complex numbers can also be used in some advanced portfolio optimization models.

These models often require solving complex optimization problems where the mathematics involved can extend into complex numbers (a negative number is used in the solution to a variable to the power of an even number).

Complex Analysis in Economic Theory

Conformal Mapping

Used in certain economic models to simplify complex economic systems or regions for analysis.

Dynamic Systems

Complex dynamics, a field using methods of complex analysis, can be applied to study chaotic behavior in economic models.

Complex Geometry in Finance

As we looked at in other articles, financial data can often be studied geometrically and topologically.

Complex geometry comes in, using tools like differential equations and manifolds, to navigate these curves.

Pricing Exotic Options

For complex financial instruments like rainbow or barrier options, geometric models provide sophisticated pricing mechanisms.

Related: Exotic Options

Modeling Volatility Smiles

When implied volatility isn’t constant, employing geometric methods can better reflect market realities.

Optimizing Portfolios

Similar to finding the most efficient route in a contorted space, complex geometry can help guide strategic asset allocation.

While it’s a specialized area, complex geometry in finance opens up new perspectives.

Related

- Differential Geometry

- Symplectic Geometry

- Riemannian Manifolds

- Manifold Learning

- Differential Topology

- Geometric Mechanics

Complex Numbers in Machine Learning Applications in Finance

In machine learning applications within finance, complex numbers offer a way to enhance algorithms, such as in data representation and signal processing tasks.

They’re used in neural networks to process and analyze time series data (e.g., stock prices) where their ability to encode information in both magnitude and phase is valuable.

This is useful in tasks like anomaly detection, trend analysis, and predictive modeling.

Complex-valued neural networks (which leverage complex numbers) can offer better performance in certain financial applications by effectively handling data with inherent periodicity and phase relationships (a common characteristic in financial markets).

This comes with the nuance that their effectiveness depends on the specific problem, data characteristics, and computational complexity.

Coding Example – Complex Analysis & Complex Numbers in Finance

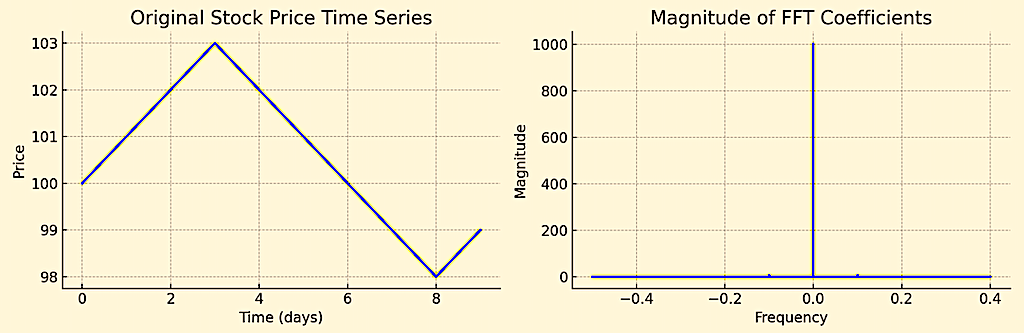

Let’s consider an example where we use Python to calculate the Fourier Transform of a simple financial time series.

The Fourier Transform, useful in signal processing, can be applied to financial data to identify periodic components or trends.

This example will demonstrate the use of complex numbers in such a context.

Let’s say we have a simple time series representing the closing prices of a stock over a certain number of days.

We will use the Fast Fourier Transform (FFT), a computationally efficient version of the discrete Fourier Transform, to analyze this time series.

First, you need to have Python installed with the NumPy library, which provides support for large, multi-dimensional arrays and matrices, along with a collection of mathematical functions to operate on these arrays.

- We’ll start by creating a simple list stock_prices to represent the stock prices over a period (for simplicity, 10 days).

- We’ll use the np.fft.fft function to compute the Fast Fourier Transform of this time series.

- This operation involves complex numbers, as the output fft_result is an array of complex numbers.

- The frequencies corresponding to these components are calculated using np.fft.fftfreq.

- We then plot the original time series and the magnitudes of the FFT results. The magnitude plot gives an idea of the significant frequencies in the data.

import numpy as np

import matplotlib.pyplot as plt

# Example stock prices over 10 days

stock_prices = [100, 101, 102, 103, 102, 101, 100, 99, 98, 99]

# Compute the Fast Fourier Transform (FFT)

fft_result = np.fft.fft(stock_prices)

# Compute frequencies associated with FFT components

freq = np.fft.fftfreq(len(stock_prices))

# Plotting the original time series

plt.figure(figsize=(12, 4))

plt.subplot(1, 2, 1)

plt.plot(stock_prices, color='blue')

plt.title('Original Stock Price Time Series')

plt.xlabel('Time (days)')

plt.ylabel('Price')

# Plotting the magnitudes of the FFT results

plt.subplot(1, 2, 2)

plt.stem(freq, np.abs(fft_result), 'b', markerfmt=" ", basefmt="-b")

plt.title('Magnitude of FFT Coefficients')

plt.xlabel('Frequency')

plt.ylabel('Magnitude')

plt.tight_layout()

plt.show()

Challenges & Limitations

Complexity

The methods of complex analysis can be mathematically intensive and may not always be intuitive for practitioners in finance without a strong mathematical background.

Naturally, it’s mostly limited to specialized forms of financial engineering and quant trading or theoretical research.

Model Risk

In finance, models using complex analysis must be used with caution.

It depends on the problem being solved and knowing the applicable technique(s) to be used.

Conclusion

Complex analysis has applications in finance, markets, and trading – in areas like derivative pricing, risk management, and algorithmic trading.

Nonetheless, the applicability and effectiveness of these methods depend heavily on the assumptions of the underlying models and the skill of the practitioners in applying these mathematical tools to real-world scenarios.

Article Sources

- https://www.worldscientific.com/doi/abs/10.1142/S2810939222500010

- https://www.worldscientific.com/doi/abs/10.1142/9781800613706_0001

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com