15+ Best Python Packages & Libraries for Finance

Python is a cornerstone in finance, offering a various of packages and libraries that cater to various financial analysis needs.

This article outlines the most effective Python packages for finance, focusing on their unique features and applications.

Pandas: Data Manipulation and Analysis

Pandas are NumPy (covered below) are your bread-and-butter libraries for financial data analysis.

Pandas excels in handling and transforming financial datasets, especially time-series data common in finance.

Key features include efficient DataFrame objects for data manipulation with integrated indexing and tools for reading and writing data between in-memory data structures and different file formats.

NumPy: Numerical Computing

NumPy is fundamental for numerical computations in Python.

It provides support for large, multi-dimensional arrays and matrices, along with a collection of mathematical functions to operate on these arrays.

Financial analysts often use NumPy for complex mathematical calculations like options pricing and risk management models.

Pandas and NumPy are the two foundational libraries for financial-related Python tasks (and are at the core of a lot of data and math-related tasks, in general).

In our various articles where we do Python modeling, we almost always have NumPy installed, followed by Pandas.

Related: How to Install Python in R Studio

Matplotlib: Data Visualization

Matplotlib is a comprehensive library for creating static, animated, and interactive visualizations in Python.

In finance, it’s widely used for plotting data points, lines, bars, and histograms to analyze financial trends and patterns.

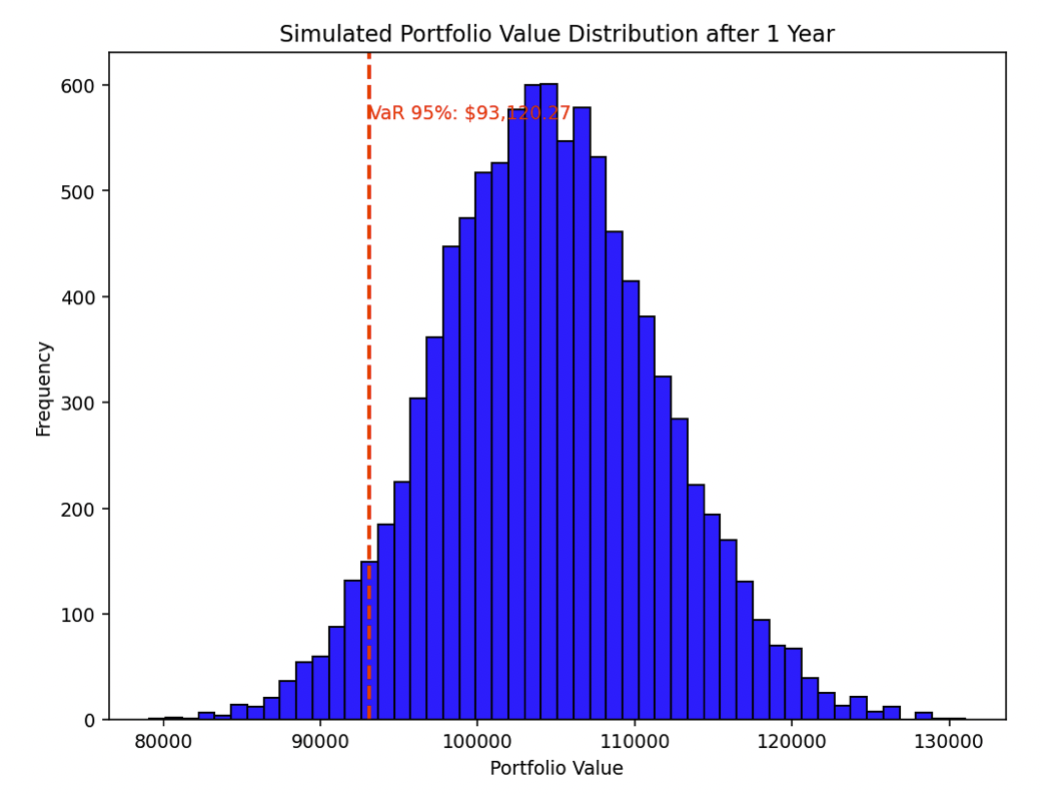

An example plot generated from Matplotlib, showing a Monte Carlo portfolio simulation with VaR plotted directly on the histogram:

SciPy: Advanced Scientific Computing

SciPy builds on NumPy and provides additional functionality for scientific and technical computing.

It includes modules for optimization, linear algebra, integration, interpolation, special functions, FFT, signal and image processing, and other tasks relevant to financial modeling.

Statsmodels: Statistical Modeling

Statsmodels is great for statistical modeling and econometrics in Python.

It provides classes and functions for estimating different statistical models and conducting statistical tests.

This package is particularly useful in finance for time series analysis and risk assessment.

Scikit-learn: Machine Learning

Scikit-learn is a simple and efficient tool for data mining and data analysis built on NumPy, SciPy, and Matplotlib.

In finance, it’s used for predictive modeling and algorithmic trading, leveraging its extensive range of supervised and unsupervised learning algorithms.

QuantLib: Quantitative Finance

QuantLib, written primarily in C++ and exported to Python, is a software framework for quantitative finance.

This library is specifically designed for modeling, trading, and risk management in real-life.

QuantLib supports various aspects of quantitative finance such as derivatives pricing, interest rate modeling, and date and time calculations.

Pyfolio: Portfolio and Risk Analytics

Pyfolio offers detailed risk and performance analytics for portfolios.

It provides a straightforward way to create tear sheets for analyzing returns, positions, and transactions.

Pyfolio is particularly valuable for backtesting strategies and analyzing the risk-return profile of investments.

Zipline: Algorithmic Trading

Zipline is an open-source algorithmic trading simulator written in Python.

It is known for its performance and ease of use in backtesting trading algorithms.

Zipline is used by finance professionals to develop, test, and deploy trading strategies.

FBProphet: Forecasting Time Series Data

Developed by Facebook, FBProphet excels in time series forecasting.

It is designed for forecasting with daily observations that display patterns on different time scales.

It is particularly useful for stock market trend analysis and economic forecasting.

Seaborn: Enhanced Data Visualization

Seaborn extends Matplotlib’s functionality.

It provides a higher-level interface for drawing attractive and informative statistical graphics.

It integrates well with Pandas data structures.

This makes it an ideal tool for visualizing complex financial data.

Seaborn is particularly effective for creating heatmaps, time series visualizations, and distributions that can highlight financial trends and relationships.

Keras: Deep Learning in Finance

Keras is a high-level neural networks API, capable of running on top of TensorFlow, CNTK, or Theano.

It enables fast experimentation with deep learning.

This is a valuable feature in finance for tasks such as fraud detection, algorithmic trading, and risk management.

Keras simplifies the creation and training of neural networks.

It makes deep learning more accessible and efficient.

Plotly: Interactive Graphs

Plotly is a graphing library that makes interactive, publication-quality graphs online.

Plotly can create intricate plots like candlestick charts and 3D plots, which are used in analyzing financial instruments and market movements.

ECOS: Convex Optimization

ECOS (Embedded Conic Solver) is a numerical software for solving convex optimization problems.

It’s useful in finance for portfolio optimization and asset allocation where the optimization of a convex objective function is required under convex constraints.

SCS: Large-scale Convex Optimization

SCS (Splitting Conic Solver) is a numerical optimization algorithm for solving large-scale convex cone problems – useful in financial contexts where robust optimization is required.

This includes scenarios like derivative pricing and risk management, where optimization problems can be complex and large in scale.

Additional Tools in Financial Analysis

- TensorFlow: Often used alongside Keras, TensorFlow is a tool for machine learning and deep learning, offering extensive capabilities in modeling complex financial systems and predictive analytics.

- PyMC3: Ideal for Bayesian modeling and probabilistic machine learning, PyMC3 is useful in finance for risk management and econometric analysis.

- Dash: A Python framework for building analytical web applications. Dash can be used to create interactive, web-based dashboards for data visualization and financial analysis without requiring complex web development skills.

Conclusion

Each of these packages contributes uniquely to financial analysis and modeling.

By leveraging these libraries, finance professionals can perform a wide range of tasks more efficiently – from data manipulation and statistical modeling to complex financial simulations and algorithmic trading.