Business Cycle & Its Impact on Financial Markets

In this article, we explore the concept of the business cycle and all of its implications on financial markets.

What are business cycles?

Business cycles are periods of time during which the economy grows or contracts.

The four main phases of a business cycle are expansion, peak, contraction, and trough.

What are the best economic indicators to know where we are in the business cycle?

Inflation, GDP growth, and labor (employment and unemployment) are the three most important indicators to watch when trying to gauge where we are in the business cycle.

Inflation

Inflationary pressures typically increase as an economy nears full capacity, and so rising inflation can be a sign that the economy is late-cycle.

GDP growth

GDP growth is another important indicator to watch, as it can provide clues about the sustainability of economic expansion.

Indicators like PMI help denote when manufacturing is in expansion or contraction. When PMI is below 50, manufacturing is in a contractionary state. When PMI is above 50, manufacturing is in an expansionary state.

Labor

Unemployment levels tend to fall during late-cycle economies as businesses find it increasingly difficult to find workers.

All of these indicators should be closely monitored in order to get a sense of where we are in the business cycle.

Yield curve

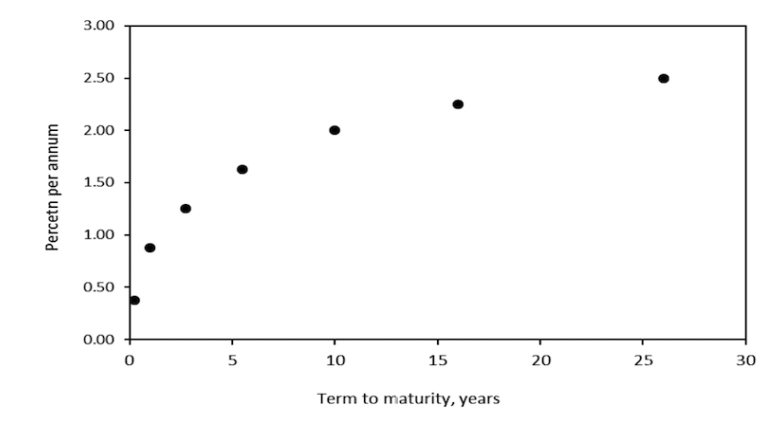

Another business cycle indicator is the yield curve.

The yield curve is a graphical representation of how yields on government bonds change as the maturity date of the bond lengthens.

It tends to be upward-sloping and flatter once you get to the longer-duration maturities.

(Source: New York Federal Reserve)

The yield curve sloping upwards signals more compensation as the duration of your investment increases. So usually longer-dated bonds have higher yields than shorter-dated bonds.

However, when the economy is late-cycle, the yield curve can invert, with shorter-dated bonds having higher yields than longer-dated bonds.

This is because investors are anticipating that inflation will rise in the future, and so they demand a higher yield on shorter-dated bonds.

There are a number of indicators that can signal that an economy is late-cycle.

How are the business cycle and stock market related?

The business cycle is often used as a predictor of the stock market.

When the economy is in an expansion phase, it is typically thought that the stock market will also be expanding. However, there are times when the stock market will peak before the business cycle does, which can signal an impending recession.

The financial economy (the market for money and credit) leads the real economy (the market for goods and services).

What are some causes of business cycles?

There are many possible causes of business cycles, but one of the most common is changes in government policy.

Changes in tax rates, interest rates, and government spending can all lead to changes in the business cycle.

Other potential causes include natural disasters, technological innovation, and changes in consumer behavior.

What is meant by a late-cycle economy?

In general, the late-cycle economy refers to the period of time near the end of an economic expansion when growth is slowing and asset prices are peaking.

This is typically a time when the Federal Reserve is tightening monetary policy in order to avoid inflationary pressures.

How does a late-cycle impact the stock market and other financial markets?

The late cycle economy impacts the stock market and other financial markets in a few key ways.

First, late cycle economies tend to be characterized by higher interest rates. This makes it more expensive for companies to borrow money and can lead to slower economic growth.

Second, late cycle economies are often associated with inflationary pressures. This can lead to higher prices for goods and services, which can erode profits for companies.

Third, late cycle economies can also be marked by increased uncertainty. This means that the markets’ distribution of discounted expectations widens, which can lead to more market volatility.

This can make traders and investors sell risk assets if they believe a recession is likely, leading to declines in the stock market.

Related: How to Trade a Late-Cycle Economy

How can businesses prepare for late-cycle economies?

There are a number of things businesses can do to prepare for late-cycle economies:

– Review their debt levels and make sure they are manageable

– Build up cash reserves to weather any potential downturns

– Invest in more efficient processes and technology to improve margins

– Review their customer mix and diversify their revenue sources

– Prepare contingency plans for a potential economic slowdown or recession

What are some indicators that we may be in a late-cycle economy?

There are a number of indicators that can signal that an economy is late-cycle. These include:

- Rising interest rates

- Increasing corporate debt levels

- Slowing economic growth

- Tightening labor market conditions

- Inflationary pressures

- Inverted yield curve

It’s important to monitor all of these indicators closely in order to make informed investment decisions.

Or else one can have a balanced portfolio in order to be largely immune from the swings.

What are some of the risks associated with late-cycle economies?

There are a number of risks associated with late-cycle economies, including:

– Rising interest rates can lead to higher borrowing costs and decreased lending activity.

– Increasing corporate debt levels can lead to increased default risk.

– Slowing economic growth can lead to increased unemployment.

– Tightening labor market conditions can lead to wage inflation and increased cost pressures for businesses.

– Inflationary pressures can lead to higher prices for goods and services.

What are some strategies that investors can use to navigate late-cycle economies?

There are a number of strategies that investors can use to navigate late-cycle economies, including:

a) Traders and investors should consider diversifying their portfolios. This means investing in a variety of assets, including stocks, bonds, and cash. Diversify portfolios across asset classes, currencies, and geographies.

Related: Asset Allocation vs. Diversification – Exploring the Difference

b) Market participants should rebalance their portfolios periodically.

This ensures that your portfolio is properly aligned with your investment goals and risk tolerance.

c) Third, traders and investors should stay disciplined with their investing strategy. This means sticking to your plan and not selling your investments when the stock market declines. It may be painful to hold assets that are falling, but it’s often the worst thing you can do during periods of liquidity dislocation.

d) Increase cash reserves and focus on defensive investments.

e) Monitor indicators closely for signs of deteriorating conditions. This includes things like manufacturing data (e.g., PMI) in producer hubs, such as China and Germany.

f) Consider strategies such as putting your money in consumer staples and utilities over consumer discretionary.

g) Consider alternative investments such as hedge funds and private equity if you have those opportunities available to you.

In general, returns streams that are uncorrelated to your other investments. This can include things like liquid alternatives.

h) Actively manage portfolios to protect against downside risk.

How do a mid-cycle economy differ from a late-cycle economy?

A late-cycle economy is typically characterized by slowing economic growth, rising interest rates, and increasing corporate debt levels.

A mid-cycle economy is typically characterized by stable economic growth and interest rates.

How can you tell when a mid-cycle economy is going into a late-cycle economy?

You can tell a mid-cycle economy is going into a late-cycle economy when inflation picks up and/or central banks start raising interest rates to contend with inflation or potential inflation.

What are the 5 stages of economic cycle?

First, you have the expansion. This is when unemployment is low, and businesses are growing.

Then you have the late-cycle economy, which is when growth is slowing but asset prices are peaking.

The next stage is the recession, which is when unemployment is rising and economic activity is contracting.

After the recession comes the trough, where interest rates have been cut enough to get enough money and credit into the system to get the economy to bottom and into what’s then called the recovery.

The recovery is when economic activity starts to pick back up but unemployment remains high.

Finally, you have the expansion again. This completes the economic cycle.

Some will argue there are really 4 stages of an economic cycle…

What are the 4 phases of the business cycle?

The four phases of the business cycle are expansion, peak, contraction, and trough.

What is meant by business cycle specifically in macroeconomics?

The business cycle, also known as the economic cycle or the trade cycle, is the downward and upward movement of gross domestic product (GDP) around its long-term growth trend.

The length of a business cycle is the period of time between a peak and a trough.

What is an expansionary phase?

An expansionary phase is characterized by increasing GDP and falling unemployment.

This is typically a time when businesses are growing and hiring.

What is a peak?

A peak is characterized by slowing GDP growth and rising inflationary pressures.

This is commonly when the Federal Reserve (or domestic central bank) is raising interest rates to cool off the economy.

What is a contractionary phase?

A contractionary phase is characterized by falling GDP and rising unemployment.

This is typically a time when businesses are cutting back on spending and hiring.

What is a trough?

A trough is characterized by bottoming GDP growth and falling inflationary pressures.

This is typically a time when the Federal Reserve is lowering interest rates to stimulate the economy to get it going.

Traditionally this is the best time to buy risk assets – i.e., when the economy is weak and the central bank is pumping lots of stimulus in to get it going again.

How do business cycles affect the economy?

The business cycle affects the economy in a number of ways. The most obvious way is through employment.

When GDP is growing, businesses are typically hiring. This leads to lower unemployment and higher wages.

As GDP slows and enters into a contractionary phase, businesses typically begin laying off workers. This leads to higher unemployment and lower wages.

The business cycle also affects inflation.

When the economy is growing rapidly, businesses often have difficulty keeping up with demand. They may raise prices to compensate for this. This can lead to inflationary pressures.

As the economy slows and enters into a contractionary phase, businesses often have excess capacity and may cut prices in order to increase demand. This can lead to deflationary pressures.

The business cycle also affects interest rates. When the economy is growing rapidly, the Federal Reserve often raises interest rates to cool off the economy and prevent inflationary pressures.

As the economy slows and enters into a contractionary phase, the Federal Reserve often lowers interest rates to stimulate economic activity.

The business cycle also affects stock prices. When the economy is growing rapidly, businesses are typically doing well and their stock prices will rise.

As the economy slows and enters into a contractionary phase, businesses may begin to struggle and their stock prices will fall as traders realize that earnings are likely to fall.

How long does each phase of the business cycle last?

There is no set timeframe for each phase of the business cycle. They can last for years or even decades, or only months.

The length of each phase depends on a number of factors, so there’s no exact timeframe.

The average business cycle is about 7-8 years.

But by and large, the faster and more extreme the stimulus, the more likely an economy is to get overheated more quickly and produce a downturn.

What causes the business cycle?

There is no one single cause of the business cycle, but the act of producing credit and the need to eventually pay that debt back makes economic behavior start to quickly resemble a cycle.

When individuals, companies, and governments borrow they are not just borrowing from a lender, they are borrowing from their future selves. That means they have to spend less in the future.

In the end, it is a result of a number of different factors. These include changes in consumer spending, changes in government spending, changes in business investment, and changes in the money and credit supply.

How does a business cycle end?

Business cycles end when earnings are less than what is owed collectively. When cash flows are swamped by debt service payments, then the economy will turn down.

This often happens when the Fed (or domestic central bank) tightens monetary policy too much and tips the economy into a recession.

The end of a business cycle can happen for purely monetary reasons, but it can also end for other reasons, such as drought, flood, or natural disaster.

What are some common indicators of each phase of the business cycle?

There are a number of different indicators that can be used to identify each phase of the business cycle.

Some common indicators include GDP growth, unemployment, inflation, interest rates, and stock prices.

What are the different methods to control business cycles?

There are a number of different methods to control business cycles.

Monetary policy

The most common method is through monetary policy.

The Federal Reserve and other central banks can use interest rates to try and slow down an economy that is growing too rapidly and inflationary pressures are starting to build.

They can also use interest rates to try and stimulate an economy that is slowing down and enter into a recessionary phase.

Fiscal policy

Another method of controlling business cycles is through fiscal policy.

The government can use spending and taxation to try and stimulate an economy that is slowing down. They can also use spending and taxation to try and cool off an economy that is growing too rapidly.

Regulation and financial stability

A third method of controlling business cycles is through regulation and financial stability considerations.

The government can enact regulations that attempt to stabilize the economy by limiting the amount of risk that businesses can take on.

They can also put in place regulations that try to prevent financial bubbles from forming.

What are the different types of business cycles?

Debt-deflationary cycle

The most common type of business cycle is the debt-deflationary cycle.

This is where an economy grows rapidly and creates a lot of debt.

As the economy starts to slow down, businesses may have difficulty paying back their debts and this can lead to a sharp contraction in economic activity.

Recessions in developed markets that have most of their debt denominated in domestic currency, which makes their recessions deflationary.

This means they work through it by changing the interest rates, changing the maturities (spreading it out), writing down part of it, and changing whose balance sheet it’s on.

Inflationary cycle

Another type of business cycle is the inflationary cycle.

This is where an economy grows rapidly and inflationary pressures start to build up.

As the economy slows down, businesses may cut prices in order to increase demand and this can lead to deflationary pressures.

Stagflationary cycle

A third type of business cycle is the stagflationary cycle.

This is where an economy experiences both inflation and unemployment or low growth (even negative growth) at the same time.

This can be a difficult economic environment to manage as it can be difficult to find the right policies that will help to boost growth while also keeping inflation in check.

The fundamental problem in a stagflationary environment is the interest rate needed to corral inflation is too high relative to what the markets and economy can tolerate.

Related:

How does the business cycle impact the commodity market?

When the business cycle is in the stage where nominal demand peaks, this is often best for commodities.

This is why it’s commonly stated that the best environment for commodities is a hot, booming economy where real growth and inflation are high.

In this environment, prices for commodities tend to increase as demand outpaces supply.

However, when the business cycle turns and enters into a recessionary phase, this is often negative for commodities.

During a recession, demand for commodities falls as businesses and consumers cut back on their spending. This can lead to lower prices for commodities.

How does the business cycle impact the stock market?

The business cycle can have a big impact on the stock market.

When the economy is growing rapidly, this is often seen as positive for stocks as businesses tend to do well in this environment.

The early stages of a business cycle tend to be good for stocks as central bankers try to get things going again. A lot of the money and credit being created goes into financial assets.

However, when the economy slows down and enters into a recessionary phase, this is often seen as negative for stocks as businesses may start to experience difficulties.

How does the business cycle impact the government bond market?

Government bonds of reserve currency countries are often some of the best assets to hold when the economy turns down.

They are a source of safety and may provide a reliable place to store savings. Stocks often do worse.

How does the business cycle impact the currency markets?

The business cycle can have an impact on currency markets.

When the economy is growing rapidly, this often leads to an appreciation in the value of the currency as businesses and investors seek to invest in the country.

However, when the economy slows down and enters into a recessionary phase, this often leads to a depreciation in the value of the currency as businesses and investors pull their money out of the country.

Related: How are Exchange Rates Determined? Currency Valuation Models

What are some of the risks associated with business cycles?

Inflation and deflation

Inflation is a risk because business cycles can lead to inflationary or deflationary spirals.

Spirals happen when the business cycle exacerbates pre-existing trends, leading to an increase or decrease in prices that then further reinforces the business cycle.

Inflationary spirals happen when business cycles lead to increases in prices, which then leads to more business activity and higher prices.

This can cause the economy to overheat and can lead to a recession.

Deflationary spirals happen when business cycles lead to decreases in prices, which then leads to less business activity and lower prices.

This can cause the economy to contract and can lead to a recession.

Policymakers will always try to target an inflation rate of at least zero.

When inflation is below zero it means output and employment aren’t being maximized entirely.

They will nonetheless try to keep inflation low, generally somewhere between zero and four percent. A two percent inflation target is common.

Asset bubbles

There are a number of risks associated with business cycles. One risk is that business cycles can lead to asset bubbles.

This is where prices for assets such as housing or stocks increase sharply due to excessive demand.

These bubbles can eventually burst, leading to a sharp decrease in prices and a contraction in economic activity.

This is most likely when purchases are made on credit.

Financial crises

Another risk is that business cycles can lead to financial crises.

This is where a sharp contraction in economic activity leads to a wave of defaults and bankruptcies among businesses and households.

This can cause a severe disruption in the financial system and the economy as a whole.

It’s especially true when key intermediaries, such as commercial banks are overleveraged and/or overexposed to what’s crashing.

It can threaten their solvency, which in turn means things that people take for granted could be in trouble, such as their savings accounts, investment accounts, and so on.

Currency risk

Overstimulation of an economy can lead to too much inflation and currency debasement.

This is another business cycle risk.

Drop in output and higher unemployment

Finally, business cycles can also lead to unemployment.

This is because as business cycle contractions occur, businesses often lay off workers in order to save money to help them survive and because work disappears when output falls.

This can lead to a rise in unemployment, which can have a negative impact on people’s spending.

In developed economies like the US, consumer spending is typically around 70 percent of the economy.

What are some of the challenges associated with business cycle management?

One challenge with business cycle management is that it can be difficult to identify when a business cycle is about to start or end.

This is because business cycles can be caused by a variety of factors, and there is often a lag between when these factors start to change and when the business cycle actually starts or ends.

Another challenge with business cycle management is that business cycles can have different impacts on different sectors of the economy.

For example, some sectors may do well during an economic expansion while others may do poorly. This can make it difficult to come up with policies that are effective for the whole economy.

Finally, business cycles can be difficult to manage because they often involve trade-offs between different objectives, with the most common being the balance between growth and inflation, which is a fundamental market equilibrium.

For example, policies that boost economic growth may lead to higher inflation, while policies that keep inflation in check may slow down economic growth. Policymakers need to carefully weigh these trade-offs in order to make the best decisions for the economy.

When are business cycles harder to manage?

Business cycles are more difficult to manage when policymakers are more constrained.

When policymakers are faced with a declining economy and interest rates are at or close to zero (i.e., not enough to get a bottom in the economy), high existing deficits, a weak currency, high inflation, or business confidence is low, business cycles are more difficult to manage.

Conclusion

The business cycle is a result of a number of different factors and can end for a variety of reasons. There are a number of indicators that can be used to identify each phase of the business cycle.

Chief among them are PMI, growth, inflation, and unemployment.

And there are a number of methods that can be used to control business cycles.

The most common method is through monetary policy. Another method is through fiscal policy. A third method is through regulation and financial stability considerations.

The different types of business cycles include the debt-deflationary cycle, the inflationary cycle, and the stagflationary cycle.

Fiscal and monetary policies will be used to help smooth out business cycles and reduce their impacts on the economy. However, business cycles can be difficult to manage and there are often trade-offs between different objectives.

It is important to understand where we are in the business cycle in order to make the best decisions for the economy from a policy perspective and capital allocation from a trader or investor’s point of view.