Asset allocation vs. Diversification – Exploring the Difference

Asset allocation and diversification might be related concepts in finance, trading, and investing, but there are slightly different.

Asset allocation refers to the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. The asset allocation process takes into account the investor’s goals, risk tolerance, and investment horizon.

Diversification is an investment technique that seeks to reduce risk by investing in a variety of assets. Diversification attempts to smooth out unsystematic risk events in a portfolio so that the positive performance of some investments can offset the negative performance of others.

You can think of diversification as a sub-component of asset allocation and at the intersection of asset allocation and portfolio strategy.

When determining asset allocation and diversification you should first consider your investment goals and risk tolerance, which relates to what kind of returns you need, time until retirement, how much volatility you can withstand, and so on.

Asset allocation may change over time as your goals or risk tolerance changes.

Benefits of asset allocation and diversification

Diversification is important because it helps to manage risk and can improve overall returns by allowing you to obtain the returns stream(s) of more than one asset class.

The best way to diversify your portfolio is to invest in a variety of asset classes, including stocks, bonds, cash, commodities, currencies, and illiquid assets. You can also diversify by investing in different sectors, industries, and geographic regions.

We talk about how to build a balanced portfolio in this article.

We also go through the math behind asset allocation here.

What are the different methods of diversification?

Diversification as it pertains to trading and investing means diversification by:

- assets

- asset classes

- countries

- currencies, and

- different financial and non-financial stores of value

Most market participants are biased toward their own domestic stock markets.

They’re usually:

- entirely long

- entirely in stocks (maybe with some bonds sprinkled in), and

- entirely in dollars or their domestic currency

For Americans, we tend to forget that 96 percent of the world’s population lives outside of the United States and generates around 80 percent of the world’s GDP.

There are also different asset classes, such as fixed income (the largest asset class globally), commodities, illiquid assets (real estate, venture capital, private equity, alternatives), and there are different currencies rather than having everything in dollars.

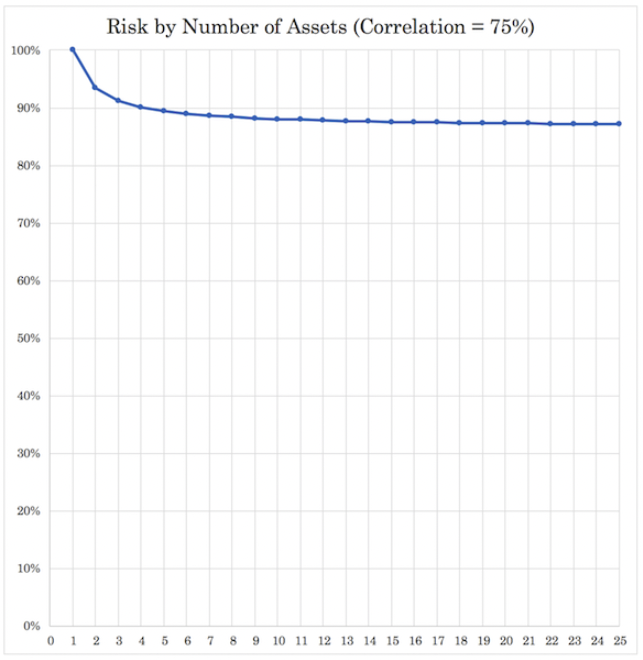

Even if you own 1,000 different stocks, they tend to be highly correlated to each other, so there’s not a lot of diversification potential once you get beyond a solid handful.

For example, if stocks have a 75 percent correlation to each other, then there’s not much marginal benefits once you get up to a fairly low number.

Correlation

There are two basic ways of measuring correlation:

- by looking at the past (e.g., bonds and stocks have been X percent correlated over the past Y years)

- by looking at intrinsic differences

The second way is fundamentally better than the first.

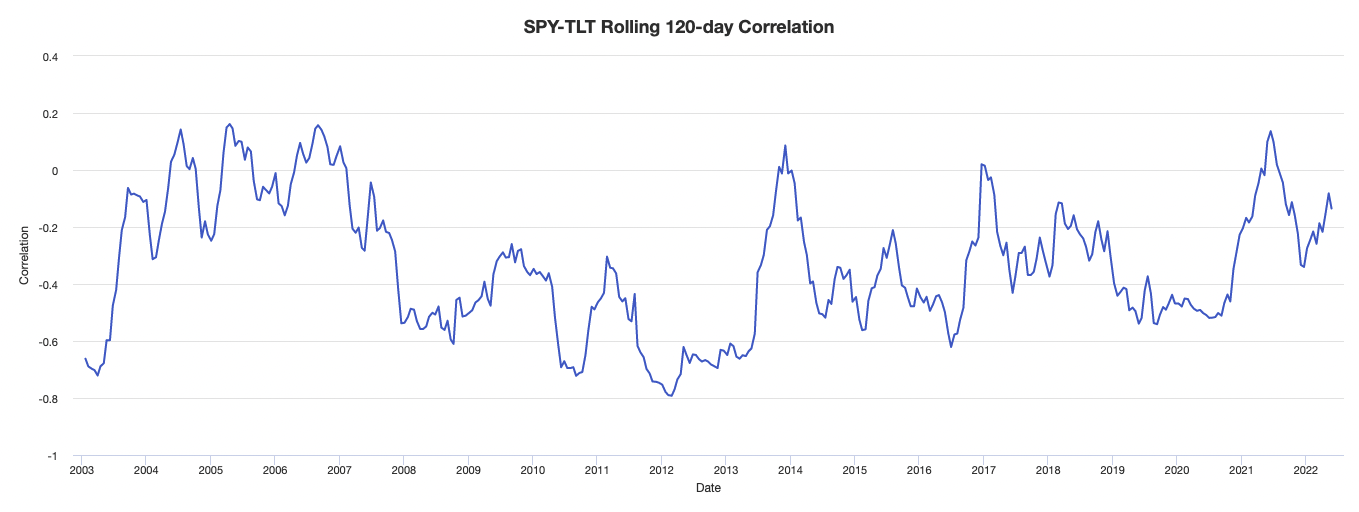

Correlations change over time. They are fleeting byproducts of the environmental biases that each asset class has.

For example, equities tend to do well when growth is above expectation and inflation is low to moderate.

Reserve-currency government bonds tend to do well when growth and inflation are low.

When inflation is under control, then stocks and bonds tend to have an inverse correlation because they diversify each other well when growth is the main driver of changes in discounted expectations.

When inflation is the main driver of changes, then stocks and bonds tend to diversify each other poorly.

This means the stock-bond correlation can be all over the place.

Most market participants are conditioned to think of it as being negative, but it can be positive for periods when inflation is the major variable.

So, correlation is important, but it is not the whole story. We need to look at other things as well.

This includes what assets are intrinsically like.

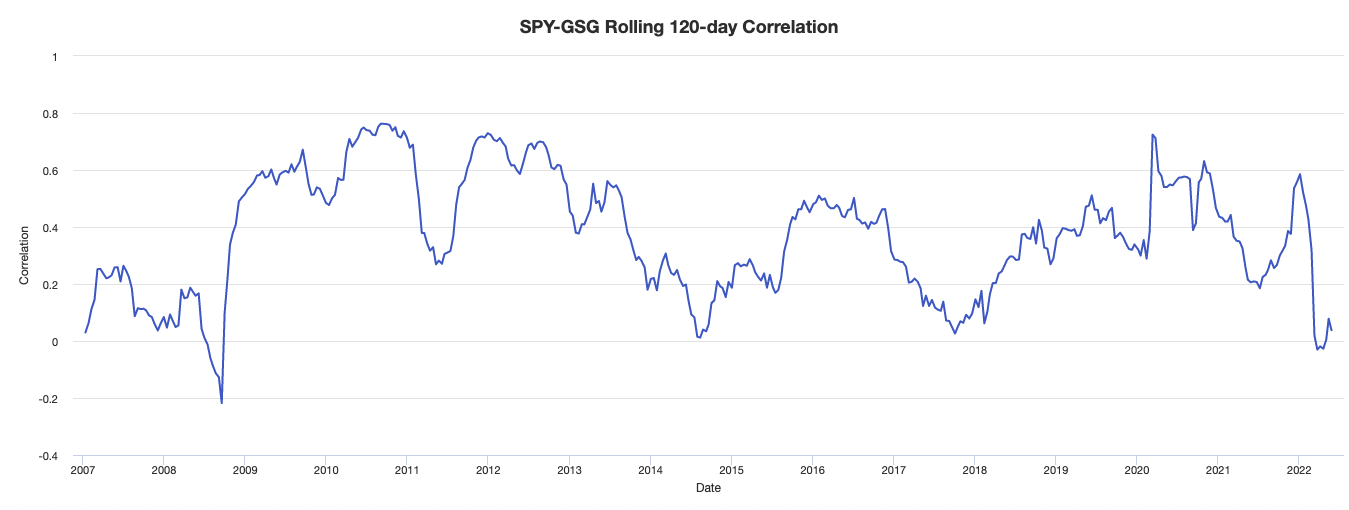

Most have experienced stocks and commodities as being positively correlated, which is often the case when growth is a bigger variable than inflation.

However, when inflation is above expectations commodities often outperform stocks while stocks might actually decline.

So the stocks-commodities correlation can turn negative.

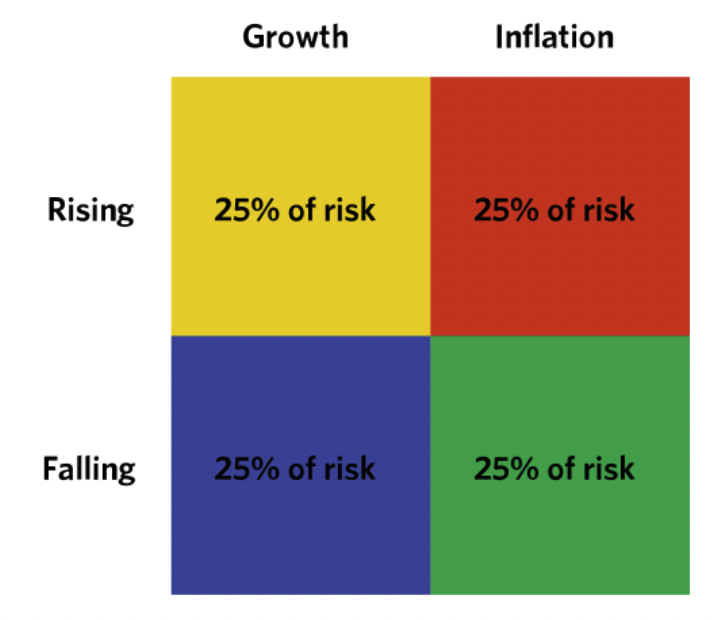

If you believe that growth and inflation are the main two overarching macro variables that determine the changes in discounted expectations that drive asset prices, then you can think of things in terms of a 2×2 square:

Where your goal is to put 25 percent of your risk into each of the four sub-portfolios or buckets:

- rising growth assets

- rising inflation assets

- falling growth assets

- falling inflation assets

What are diversifying strategies?

By understanding how different asset classes have behaved in the past, we can get a sense of how they might behave in the future.

For example, if we think inflation is going to be a bigger driver than growth, then commodities might be a good diversifier.

If we think growth will be the more important variable over inflation (and growth will be above expectations), then stocks might make more sense.

But you also don’t know how things will necessarily transpire relative to discounted expectations – which is baked into the price – which is the idea behind having a balanced, well-diversified portfolio in the first place.

So it can be a good idea to have a piece of your portfolio in lots of different asset classes to help increase your risk-adjusted returns over time.

The balanced beta approach covered here is a basic framework for thinking about diversification, which includes by sector or by country.

You can also think about it from a risk management perspective.

For example, if you’re long stocks and the market declines, then having some bonds, cash, and commodities might help reduce the drawdown.

Stocks tend to do poorly in a recession, so adding in some cash, nominal bonds, inflation-linked bonds, and commodities might help as well since they may do well during periods of economic decline to help offset losses in risk assets.

It’s important to understand that diversification is not a panacea. It will not protect you from all risk.

But it can help reduce the overall volatility of your portfolio and help smooth out returns over time.

Asset allocation and diversification examples

An all-stocks portfolio is common but it’s poorly diversified (even if you’re spread out among lots of stocks or indexed) because equities have a certain environmental bias.

This also goes for bonds, commodities, gold, and other assets.

They all have an environment where they do well and an environment where they do terribly.

If you mix them well you have less to worry about. Your drawdowns will be much more shallow and easier and faster to get out of.

For example, here’s a portfolio of the following makeup:

| Asset Class | Allocation |

|---|---|

| US Stock Market | 20.00% |

| 10-year Treasury | 20.00% |

| TIPS | 20.00% |

| Short-Term Tax-Exempt | 10.00% |

| Gold | 12.00% |

| Short-Term Investment Grade | 8.00% |

| Cash | 10.00% |

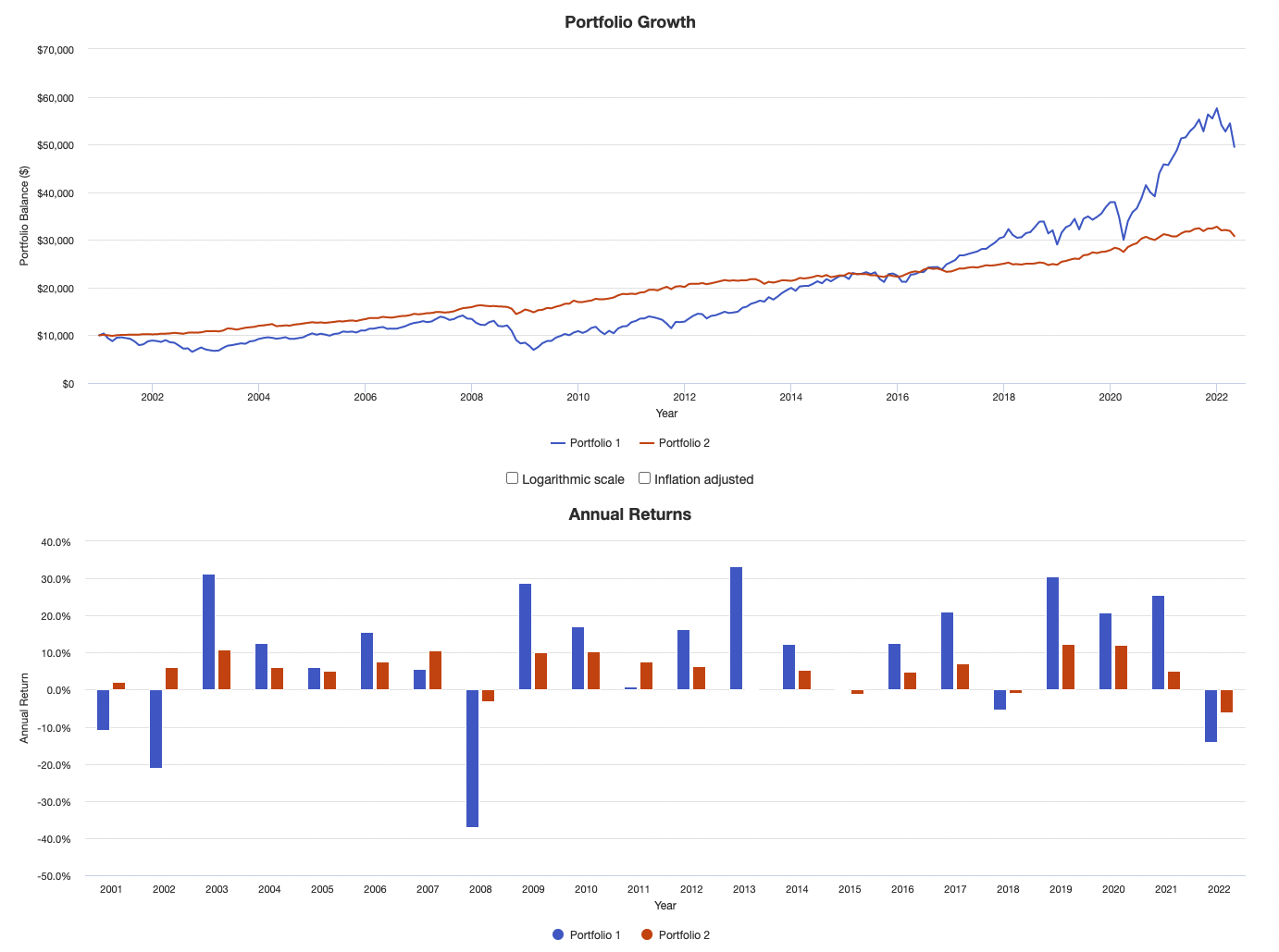

When compared alongside a stocks portfolio, the return of this example diversified portfolio is lower, but the volatility is less than a third of the stocks portfolio.

Portfolio Returns

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| 100% Stocks | $10,000 | $49,501 | 7.79% | 15.49% | 33.35% | -37.04% | -50.89% | 0.48 | 0.69 | 1.00 |

| Diversified | $10,000 | $30,800 | 5.41% | 4.68% | 12.40% | -6.01% | -11.32% | 0.87 | 1.41 | 0.57 |

In the graph below, Portfolio 1 is the all-stocks portfolio and Portfolio 2 is the diversified portfolio.

If a bit of leverage was applied to the portfolio, it would produce the same return but at just two-thirds of the volatility.

Diversification in some form or another is about getting the same returns for less risk, higher returns for the same risk, or some permutation thereof.

We have an Appendix of more descriptive statistics of this comparative approach at the end of this article.

Asset Allocation vs. Diversification – FAQs

What’s the difference between asset allocation and diversification?

Asset allocation is the process of deciding how much of your portfolio to allocate to each asset class.

Diversification is the process of selecting a mix of assets that have low correlation with each other.

The goal of both asset allocation and diversification is to reduce risk and volatility in your portfolio and to have better risk-adjusted returns.

Why is asset allocation important?

Asset allocation is important because it helps you manage risk and steer your portfolio toward achieving your goals.

By allocating a certain percentage of your portfolio to each asset class, you can help ensure that your portfolio doesn’t become too risky or overly dependent on one or just a handful of assets or a single asset class.

Why is diversification important?

Diversification is important because it helps you manage risk by investing in a mix of assets that have low correlation with each other.

By diversifying your portfolio, you can help lower your risk and volatility.

What are some common asset allocation models?

There are many different asset allocation models, but some of the most common are the following:

–60/40 Portfolio: This portfolio allocates 60 percent of its assets to stocks and 40 percent to bonds.

–80/20 Portfolio: This portfolio allocates 80 percent of its assets to stocks and 20 percent to bonds.

–90/10 Portfolio: This portfolio allocates 90 percent of its assets to stocks and 10 percent to bonds.

Read more: Is the 60/40 Portfolio Dead?

What are some common diversification strategies?

Some common diversification strategies include investing in a mix of asset classes, investing in a mix of different sectors, and investing in a mix of countries and currencies.

One may also diversify between financial and non-financial sources of wealth.

For example, financial wealth is made up of stocks, bonds, cash, digital currencies, and traditional fiat currencies.

Non-financial wealth is made up of things like gold, commodities, collectibles, land, real estate, and other hard assets.

What are some common risks associated with diversification?

There are many risks associated with diversification, but some of the most common are:

–Concentration risk: This is the risk that you will have too much of your portfolio invested in one asset class or one sector.

–Country risk: This is the risk that you will have too much of your portfolio invested in one country.

–Sector risk: This is the risk that you will have too much of your portfolio invested in one sector.

An example of all three at the same time would be a portfolio where 50 percent of its allocation is in ExxonMobil stock (XOM).

This would be an example of too much concentration (one company and one investment), country risk (mostly US-based risk), and sector risk (oil and gas).

What are some common benefits of diversification?

Some common benefits of diversification include:

–Reduced risk: By diversifying your portfolio, you can help reduce the overall risk of your portfolio.

–Smoothed returns: By diversifying your portfolio, you can help smooth out your returns over time.

–Increased return potential: By diversifying your portfolio, you can help increase your return potential.

–Lower drawdowns: You can have lower drawdowns and get out of them faster.

Conclusion – Asset Allocation vs. Diversification

The terms “asset allocation” and “diversification” are often used interchangeably. They are two similar but distinct concepts.

Asset allocation is the process of deciding how to distribute your assets among different asset classes.

Diversification is a technique that can be used to reduce the risk in your portfolio by investing in a variety of asset classes.

The goal of asset allocation is to match the risk-return profile of your portfolio to your investment goals.

The goal of diversification is to reduce the overall risk of your portfolio by investing in many different asset classes that have low correlations with each other. In other words, they should be intrinsically different.

Diversification does not guarantee a profit or protect against loss.

Asset allocation and diversification are both important parts of creating a well-rounded investment portfolio to help you achieve your trading and investment objectives within acceptable risk parameters.

In sum, asset allocation and diversification are both important concepts that should be considered when constructing a portfolio. By knowing the difference between the two, you can make sure that you are using both asset allocation and diversification to your advantage.

Appendix

An appendix showing the comparative statistics between the two portfolio approaches as discussed earlier in this article.

| Arithmetic Mean (monthly) | 0.73% | 0.45% |

|---|---|---|

| Arithmetic Mean (annualized) | 9.09% | 5.53% |

| Geometric Mean (monthly) | 0.63% | 0.44% |

| Geometric Mean (annualized) | 7.79% | 5.41% |

| Standard Deviation (monthly) | 4.47% | 1.35% |

| Standard Deviation (annualized) | 15.49% | 4.68% |

| Downside Deviation (monthly) | 3.07% | 0.80% |

| Maximum Drawdown | -50.89% | -11.32% |

| Stock Market Correlation | 1.00 | 0.57 |

| Beta(*) | 1.00 | 0.17 |

| Alpha (annualized) | -0.00% | 3.89% |

| R2 | 100.00% | 32.67% |

| Sharpe Ratio | 0.48 | 0.87 |

| Sortino Ratio | 0.69 | 1.41 |

| Treynor Ratio (%) | 7.43 | 23.71 |

| Calmar Ratio | 0.62 | 0.95 |

| Active Return | 0.00% | -2.37% |

| Tracking Error | 0.00% | 13.38% |

| Information Ratio | N/A | -0.18 |

| Skewness | -0.61 | -0.74 |

| Excess Kurtosis | 1.32 | 3.89 |

| Historical Value-at-Risk (5%) | -8.01% | -1.71% |

| Analytical Value-at-Risk (5%) | -6.63% | -1.77% |

| Conditional Value-at-Risk (5%) | -10.04% | -2.77% |

| Upside Capture Ratio (%) | 100.00 | 23.76 |

| Downside Capture Ratio (%) | 100.00 | 7.39 |

| Safe Withdrawal Rate | 5.72% | 6.84% |

| Perpetual Withdrawal Rate | 5.06% | 2.90% |

| Positive Periods | 167 out of 256 (65.23%) | 168 out of 256 (65.63%) |

| Gain/Loss Ratio | 0.80 | 1.26 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are based on monthly values. | ||

We see such advantages as:

- higher potential returns (if leverage applied, keeping volatility of the two portfolios the same)

- lower volatility

- lower downside deviation

- less beta

- more alpha

- higher risk versus reward metrics (Sharpe, Sortino, Treynor, Calmar)

- lower R-squared (i.e., less market correlation)

- low value-at-risk (VaR)

- lower downside capture ratio

- higher safe withdrawal rate

- higher upside to downside capture ratio (i.e., gain to loss ratio)

- a (slightly) greater number of months in which the allocation makes a positive return