Barbell Investing Strategy – How to Use A Barbell Portfolio Strategy

What is a barbell investing strategy? In this article, we look at some related posts and explain asset allocation when using a barbell strategy (as coined by Nassim Taleb in the book Antifragile).

A barbell investment strategy aims to minimise risk with the largest part of the portfolio, but embrace exposure to black swan events with small, low-cost but high risk positions in the remainder.

Top Brokers For Barbell Portfolio Strategies

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Key Takeaways – Barbell Investing Strategy

- Diversification and Balance

- Barbell investing strategy emphasizes balancing the portfolio between high-risk and low-risk assets.

- Instead of trying to predict market directions or bothering with medium-risk assets that have only moderate returns with risks that are difficult to estimate.

- Risk Management

- By combining assets with contrasting risk profiles, such as high-risk equities and low-risk bonds, the strategy manages overall portfolio risk.

- This configuration allows for capital appreciation during market upswings and risk mitigation during downturns, to help with the risk-return trade-off.

- Adaptability and Long-Term Focus

- This approach tries to protect against market volatility and economic fluctuations, with the safe part of the portfolio staying stable and the risky part may or may not paying off (e.g., deep OTM put options vs. high-risk startups).

- Backtesting the Barbell Approach

- We backtest the barbell and compare it to the S&P 500 and a traditional balanced portfolio.

Real-World Barbell Strategy

In a previous article, we covered Universa Investment’s performance through its tail risk hedging strategy. It pursues what’s commonly known as a barbell portfolio.

Universa’s capital risk in the “high risk” part of its portfolio is only 2 to 3 percent of its overall capital – i.e., the part it dedicates to put options to benefit off the occasional market routs.

It earned at least $3 billion from the market decline with about only $100 million in total derivatives exposure.

The other part of its portfolio is in a mix of safe assets like cash, government bonds, and high-grade corporate bonds that pay out safely.

The payoff from the safe assets essentially fund the derivatives exposure.

Universa makes it straightforward to its clients that it doesn’t expect to generate anything in sub-average to great market environments for equities. But it expects to make a lot when the market crashes because of its highly convex exposure to big market drops.

Given most investment funds have equity beta (i.e., are long a lot of equities) and have other types of equity risk in addition (e.g., real estate, private equity, early-stage companies), adding a portion of their portfolio to a tail-risk hedging strategy could be a judicious use of capital.

It’s something unique and can provide an offset when the bulk of its portfolio doesn’t do well.

Barbell Portfolios

Barbell portfolios – and portfolios that use barbell strategy concepts – are out there in one form or another.

But they’re not popular because their risk allocation is so low.

For institutional funds in particular, without a consistent low-double digit percentage return each year – or at least something that beats passive index tracking within acceptable risk parameters – it’s hard for them to scale.

Structure Of A Barbell Portfolio

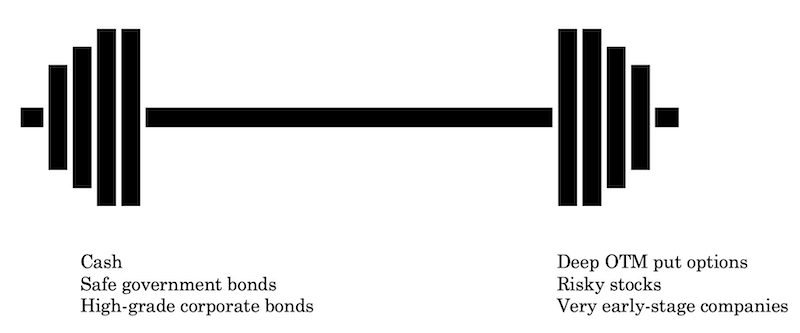

Traders who take the barbell portfolio approach structure the portfolio in a way where there’s a dichotomy between “high risk” and “low risk” and little, if anything, in between:

You see some combination of:

- i) a small allocation toward nonlinear, high convexity bets on one end that don’t lose much if they don’t pan out but can make a lot if they do, and

- ii) a larger allocation toward assets that have less volatility and lower yields that provide low, stable returns

Safe Barbell Assets

- Treasury bills

- Government bonds

- Cash or cash equivalents

- High-grade corporate bonds

- Fixed deposits

Risky, Convex Barbell Assets

- Out-of-the-money (OTM) put options

- Venture capital investments

- High-risk personal projects (starting a new business with no previous experience)

- High-risk stocks

- Tactical day trading

- Commodities with speculative potential

- Cryptocurrencies

Because the types of bets are so different from each other from a risk and potential return perspective – virtually on opposite ends of a spectrum – this gives rise to the name barbell portfolio.

You have allocations on each side of the risk/return spectrum, giving it a dichotomous weighting.

As an example of what could be considered on each end of the barbell:

While Universa uses put options as part of its “high risk” basket, it doesn’t have to be puts.

It can be virtually anything that gives high return potential but a high likelihood of either not panning out or simply having a lot of risk or price volatility.

This can mean things like:

- Highly speculative stocks, businesses, and commercial projects

- Very early-stage ventures, perhaps even pre-revenue companies

- Cryptocurrencies

- Any type of derivative structure with a low likelihood of winning

If traders risk a few percent of their portfolios per year on the highly convex, asymmetric payout bets and return that 2 to 4 percent on the “safe bets” then in an otherwise normal year the portfolio will remain steady.

The returns on the safe bets effectively pay for the losses on the long-shot bets.

It’s not going to be the most exciting portfolio most of the time and you won’t see much growth.

But every now and then, maybe every 10 years, this type of portfolio can see great returns of three-digit or even four-digit percentage gains in one year – if put into highly convex, speculative investments.

Many institutional investors that look for something different from what they have can benefit if they deem that it helps them manage risk or enhance returns more effectively.

Nassim Taleb’s Barbell Philosophy

Nassim Taleb’s advocacy for the barbell approach to risk management is a reflection of his broader philosophy on uncertainty, risk, and decision-making under conditions of opacity.

Here are the key elements of this approach:

Concept of the Barbell Strategy

- Avoiding the Middle – Taleb’s barbell strategy advocates for avoiding medium-risk investments. He posits that risk is inherently difficult to calculate accurately. Instead, it promotes a binary investment strategy.

- Combination of Extremes – The strategy involves a linear combination of extremes – being hyper-conservative on one end and hyper-aggressive on the other.

- Robustness to Estimation Errors – By focusing on the extremes and avoiding the middle, the barbell strategy is seen as more robust to errors in risk estimation.

Application in Investment

- Asset Allocation – Typically, a large portion of the portfolio (80-90%) is allocated to extremely safe investments, such as treasury bills, to preserve capital.

- Speculative Component – The remaining portion is invested in high-risk, diversified speculative bets aiming for high returns.

- Limited Downside Speculation – An alternative form of the barbell strategy involves engaging in speculative investments where the potential downside is limited, allowing for aggressive risk-taking with controlled loss potential.

Philosophical Underpinnings

- Skepticism of Risk Measurement – Taleb’s approach stems from a skepticism towards the accuracy and reliability of risk measurement tools and models. He emphasizes the unpredictable nature of the real world.

- Preference for Extremes – His endorsement of the barbell strategy reflects a belief that in environments of uncertainty. He argues that concentrating investments in the extremes can lead to a more predictable and controlled range of outcomes.

Impact on Decision-Making

- Influences on Financial and Personal Decisions – The barbell strategy is not only a financial investment approach but also a life philosophy. Taleb suggests applying this principle across various domains, including politics, economics, and personal life choices like exercising (e.g., resting/walking moderating vs. short bursts of intense exercise).

Overall

Nassim Taleb’s barbell strategy is a manifestation of his broader philosophical stance on uncertainty.

He advocates for a risk management approach that eschews moderate risks in favor of a mix of extreme conservatism and aggressive speculation.

Barbell Backtesting

How does the barbell perform in a backtest?

We tested the following portfolios:

Portfolio 1 – All Stocks

| Asset Class | Allocation |

|---|---|

| US Stock Market | 100.00% |

Portfolio 2 – More Traditional Balanced Portfolio

| Asset Class | Allocation |

|---|---|

| US Stock Market | 30.00% |

| 10-year Treasury | 50.00% |

| Gold | 20.00% |

Portfolio 3 – Barbell

| Asset Class | Allocation |

|---|---|

| 10-year Treasury | 70.00% |

| Gold | 10.00% |

| US Micro Cap | 20.00% |

Here, we follow the traditional barbell approach, with 80% in safer assets (70% US Treasuries and 10% in gold), and the other 20% of the portfolio going into higher-risk micro caps.

Results

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| Stocks | $10,000 | $1,925,614 | 10.61% | 15.75% | 37.82% | -37.04% | -50.89% | 0.44 | 0.64 | 1.00 |

| Balanced | $10,000 | $793,062 | 8.74% | 7.91% | 33.50% | -13.63% | -17.23% | 0.54 | 0.85 | 0.64 |

| Barbell | $10,000 | $670,207 | 8.39% | 7.33% | 34.78% | -15.39% | -21.61% | 0.53 | 0.84 | 0.53 |

The barbell approach, overall, did quite well on a risk-adjusted basis.

Its Sharpe and Sortino ratios were on par with the more traditionally balanced portfolio (S&P 500 or equivalent, moderate bonds, moderate gold).

It had a little bit of a higher drawdown.

The approach (barbell) may also not work as well when real interest rates are negative due to the heavy safe-asset exposure.

While the 100% stocks approach “wins” at face value, it’s important to realize that the balanced and barbell approaches are getting these types of returns with half the volatility or less as the all-stocks approach.

A good financial engineer could run this portfolio at the same volatility as the S&P 500 and get returns that are roughly 7% better per year.

The barbell has a lower correlation to the broader stock market than the more traditional balanced portfolio and has a slightly better skew (though higher kurtosis, which is displayed in its higher maximum drawdown).

We have some more advanced metrics describing these portfolios in the Appendix at the end of this article.

Barbell Concepts For Non-Barbell Traders

Hedging tail risk prudently is important for every trader.

Ideally hedging should be done in a way where the benefits outweigh the costs.

Because of the volatility risk premium where options are structurally expensive (similar to standard insurance policies issued by private insurance businesses so they have a profit and a sustainable business), perpetual hedging is a long-run drag on performance.

When hedging tail risk with a focus on value, preparing for an economic and market bruising makes sense when justified. Namely, when volatility is cheap such that it makes sense when making the bet.

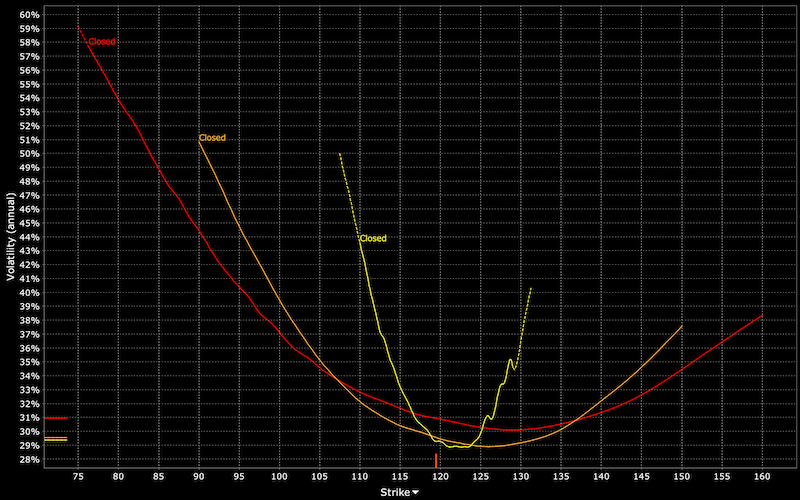

How do we know when volatility is cheap?

An easy way is to look at the historic realized volatility of whatever you’re trading and compare that to the implied volatility going forward.

Almost all brokers have an implied volatility calculator within an options chain, often shown as ‘IV’ followed by an annual percentage.

For example, the historical volatility of the S&P 500 is about 15 to 16 percent annualized. In the example below, implied volatility is about 22 percent, making it more expensive than normal.

(Source: Interactive Brokers)

Some top trading brokers even show implied volatility across all strike prices of a certain maturity.

Implied volatility is not static across all strikes.

With respect to stocks, traders have more demand for downside protection to protect against losses, making puts generally more expensive than calls. This reflects in a volatility skew, where put option IVs tend to be higher than call option IVs.

(Source: Interactive Brokers ‘Implied Volatility Viewer’)

At the same time, while historic volatility can be a good guide of how an asset is likely to act, the future is not always like the past.

For example, government bond volatility is lower than in past history given central banks anchor them down at zero to keep today’s highly indebted economies going.

Because of this lower volatility in interest rates of both the short- and long-term variety, this also cuts down on currency volatility as well.

Price Dynamics For Barbell Investing

Barbell portfolios are designed to help get ahead during downturns and mostly tread water during good periods.

Many traders and institutions believe that a portfolio should be fully invested all the time. Universa’s approach is that only a slight part of the portfolio is invested in the convex bets with the remainder in the safer lower-yield assets.

For most investors that type of approach doesn’t work as they’re likely to face years or a decade or more of no capital appreciation.

But barbell portfolios fulfill a niche in the market. Every investment manager looking to take on outside clients has to differentiate in some way.

Being fully invested is generally good for investment firms in order to generate fees, but it isn’t necessarily the best for clients.

With the barbell portfolio, the main consideration isn’t necessarily between earning very little to nothing in cash or cash-like securities and earning something a bit better in standard bond and stock investments.

This is the standard trade-off made in conventional portfolios.

Instead of “opposing extremes” asset allocation is viewed on a continuum in terms of how much to allocate to cash, bonds, and stocks, examining the reward and risk of each in both absolute terms and relative to each other.

Instead, for a barbell portfolio strategy, it’s about the optionality of the cash.

In other words, how much it can earn you if assets become cheap enough versus the potential cost of holding them at more expensive levels.

But having a lot of cash and cash-like assets is not popular among investment managers because it’s not good for business.

People don’t want to pay management fees just to have their cash lay around not being used.

People are naturally impatient. While most sophisticated clients – e.g., pension funds, sovereign wealth funds, endowments – have healthy expectations, they still want to see results to stay onboard.

It’s not an easy argument to make that they should sit out present gains for the prospect of future gains that may not transpire. It’s the standard conundrum of the value investor who prefers to mostly sit out expensive markets only to see them zoom higher most of the time.

Most investment managers can’t have a barbell portfolio strategy – in the sense of a heavy concentration in very safe assets – and expect their business to thrive.

Universa is unique, but it also doesn’t have a lot of money allocated to it – at least pre-2020 – for a reason. Few clients are willing to see no gains year after year.

One’s fiduciary duty is to nonetheless do what’s best for clients, even if that does lead to a smaller client base.

Those that are willing to allocate to a tail risk hedging fund will likely only do so in a small quantity to help balance out their equity risk.

Other Types Of Barbell Strategy

Barbell strategies often refer to fixed income portfolios.

Part of the portfolio might be in longer duration securities (e.g., longer than 10 years) that give higher yields while the other part might be in shorter duration securities (e.g., less than five years) that are more stable in price.

But the barbell can mean many different approaches.

It could be as basic as a stocks and bonds dichotomy, such as a 60/40 or 50/50 portfolio.

The weightings can also move around as necessary to help accomplish certain objectives.

The barbell portfolio attempts to provide diversification in such a way to get access to both safe yields and riskier assets (that can provide higher yields) at the same time.

Many portfolios do this, but don’t have a distinct dichotomy between the two.

In a fixed income context, the short-term yields can take advantage of current interest rates while also holding longer duration securities that pay higher yields.

If interest rates were to rise, the shorter duration bonds won’t have as much price risk and can be rolled into new bonds that offer the higher yields.

The barbell strategy is a more active form of trading, whether it be due to the shorter duration nature of some securities and the rolling over process, monitoring the riskier part of a portfolio, or otherwise.

As in Universa’s case, the barbell strategy enables a portfolio to earn returns safely to help effectively fund a riskier part of the portfolio.

It uses cash and bonds to fund the put option part of the portfolio. The liquidity associated with cash and bonds also provide flexibility if one wants to more actively manage a portfolio.

A barbell manager might have the goal to at least return the rate of inflation to avoid losing purchasing power over time.

To do this, the portfolio might invest in inflation-protected bonds and a mix of other securities to get to the inflation rate plus any additional return required to fund the higher risk portion of a portfolio (e.g., OTM options).

Risks To Consider

Interest rate risk

The traditional barbell portfolio of long duration bonds and short duration bonds has interest rate risk.

When interest rates rise, bond prices fall, and more so for long duration bonds. A trader may end up getting stuck with 10+ year duration securities that yield less than safer shorter term instruments had they been purchased when yields were lower.

Either the trader might sell the bond and realize a loss or bank on the bonds performing better going forward.

Inflation risk

Portfolios with a lot of nominal rate bonds face risks of inflation.

Most bonds are fixed-rate in nature. If a bond yields one percent and inflation is three percent, the trader has a real yield of minus-two percent.

Missing out on ‘stuff in the middle’

A barbell portfolio will invest in a mix of low-risk and high-risk assets with little to no allocation toward middle-of-the-road assets like safe stocks, moderate-quality bonds, and so on.

There is a time when these types of assets will outperform in absolute and relative terms. Diversifying broadly and not just on each end of the spectrum can help improve risk-adjusted returns.

A portfolio that invests heavily or exclusively in mid-duration or moderate risk assets is called a bullet portfolio.

Reinvestment risk

Reinvestment risk occurs when bonds are maturing and the yields of new debt are lower than the ones that just returned their principal.

In a low interest rate world, this is a reality for many investors. Before the financial crisis, they may have gotten 5 percent yields in safe government debt. Now they look across the yield curve and see yields of one percent or even negative nominal yields.

That leaves a lack of viable replacement securities to choose from. That means traders must look into riskier securities that have more credit risk or longer duration, or pursue riskier strategies to generate they yield they’d like.

The Barbell In A Low Interest Rate World

The Black-Scholes model predicts that put options are less expensive when interest rates are high.

This makes sense given any drop in earnings that can cause stocks to fall can normally be “caught” by cutting interest rates.

In a low interest rate world, that process no longer normally works as designed. Put options become more expensive with less ability to offset drops in earnings with lower interest rates. That puts a premium on put protection.

Moreover, when interest rates are high, this enables barbell strategies to function well for those who rely on investing in cash and bonds to bankroll the riskier part of the portfolio.

When interest rates fall, this squeezes the barbell portfolio strategy’s potential margins on both sides.

The safe part of the portfolio returns less and the risky part of the portfolio either becomes more expensive (e.g., put options) and/or riskier.

Speculative stocks are even more expensive than normal because they’re discounted at lower interest rates and more people pile into them without much yield in other securities.

Accordingly, one might expect the barbell strategy practitioners to adapt during these periods.

The safe part of the portfolio might have to become riskier. Or else accept mild losses most years.

It may have to include bonds and other securities of lower creditworthiness or longer duration. These have more price risk and volatility. The investment manager might also have a lower allocation to the riskier side of the portfolio.

Barbell Portfolio Convexity

The barbell portfolio strategy is considered convex as it’s a trading or investing technique that seeks to exploit the benefits of both high-risk, high-return investments and low-risk, low-return investments.

The strategy involves constructing a portfolio that is heavily weighted towards either end of the risk-return spectrum.

For example, a typical barbell portfolio might be composed of 80 percent high-risk, high-return assets and 20 percent low-risk, low-return assets.

How this percentage varies will depend on what part of the cycle we’re in.

During periods where stocks and risk assets are more expensive, traders following a barbell strategy will typically put more of the portfolio into cash or short-term bonds.

How does a trader determine if stocks are expensive?

Determining whether stocks and other risk assets are expensive will typically entail the following:

- Are forward earnings multiples (i.e., P/E ratios) high relative to average?

- Are lots of new buyers in the market (e.g., retail participation in the market up, higher options activity)?

- Is inflation high relative to the central bank’s target?

- Is unemployment low? Are there very tight labor markets?

- Is the central bank tightening policy?

Advantages

The main advantage of the barbell portfolio strategy is that it allows investors to capture the upside potential of high-risk, high-return investments while still providing some downside protection from low-risk, low-return investments.

This type of portfolio construction can be especially beneficial in volatile market conditions when the direction of the market is in flux.

Another advantage of the barbell portfolio strategy is that it can help investors to diversify their portfolios and reduce overall portfolio risk.

By including both high-risk and low-risk assets in the portfolio, investors can offset the risk of any one investment with the stability of another.

This can lead to a more efficient portfolio that is better able to weather market volatility.

Disadvantages

For many traders, the barbell strategy might mean taking on too much risk for comfort.

Additionally, the barbell portfolio strategy can be difficult to rebalance on a regular basis, which can lead to sub-optimal results over time.

Despite these disadvantages, the barbell portfolio strategy can be a useful tool for traders who are looking to capture the upside potential of high-risk, high-return investments while still providing some downside protection.

When used correctly, the barbell portfolio strategy can lead to superior risk-adjusted returns and a more efficient overall portfolio.

Pension Funds & Bonds

Pension funds follow a similar concept to the barbell portfolio strategy.

When risk assets go up, they often look to sell in order to buy assets of less risk.

Conversely, when risk assets fall, they often look to buy them by selling off safer assets.

As a result, the strategy of pensions is quite analogous to the central idea behind the barbell portfolio strategy.

Barbell Investing Strategy FAQ

Why is a barbell structure best with a flattening yield curve?

When a yield curve is flat, it incentivizes traders and investors to put more of their capital into shorter-duration bonds that have equivalent yields as longer-duration bonds with the benefit of lower price risk.

A flat yield curve also signals economic slowdown may be likely, which makes risk assets less attractive to own.

Having more of a barbell structure, in that case, can make more sense.

How can the barbell portfolio strategy help investors diversify their portfolios and reduce overall risk?

By including both high-risk and low-risk assets in the portfolio, traders can offset the risk of any one investment with the stability and capital preservation of another.

This can lead to a more efficient portfolio that is better able to tolerate the large ups and downs associated with risk assets.

What are some of the main disadvantages of the barbell portfolio strategy?

The main disadvantage of the barbell portfolio strategy is that the trader must purchase enough high-risk, high-return assets to achieve the desired weighting in the portfolio.

For many traders, this might mean taking on too much risk for comfort.

Additionally, the barbell portfolio strategy can be difficult to rebalance on a regular basis, which can lead to sub-optimal results over time.

For example, if a trader is 90 percent stocks and 10 percent bonds because they perceive that risk assets are weak, and stocks fall in price some more, they might not be able to pick up bargains because they’re already “fully invested”, or essentially maxed out on their allocation.

Moreover, a barbell portfolio is not the same thing as a balanced portfolio.

A balanced portfolio will try to avoid environmental biases.

A barbell portfolio is still heavily skewed toward risk. Even if a portfolio is 60/40 stocks/bonds, stocks are more volatile than bonds, so the risk weighting is more like 90/10.

An 80/20 stocks/bonds portfolio has almost all of its risk in the stocks portion.

Holding cash against risky assets can help lower a portfolio’s overall risk, but not balance it very well.

Despite these disadvantages, the barbell portfolio strategy can be a useful tool for traders who are looking to capture the upside potential of high-risk, high-return investments while still providing some downside protection.

When used correctly, the barbell portfolio strategy can lead to superior risk-adjusted returns and a more efficient overall portfolio.

Do institutional traders use the barbell portfolio strategy?

Yes, institutional traders often use the barbell portfolio strategy or strategies analogous to it to achieve their desired risk and return profile.

However, because they have access to a wider range of assets, more capital, and a wider range of products (e.g., swaps), they are often able to take on more risk than individual traders.

This can lead to higher returns, but it also means that their losses can be amplified during periods of market volatility.

How can traders implement the barbell portfolio strategy?

There are a few different ways that investors can implement the barbell portfolio strategy.

One way is to invest in two separate portfolios, one that consists of high-risk, high-return investments and another that consists of low-risk, low-return investments.

The investor would then allocate a portion of their total capital to each portfolio based on their desired risk/return profile.

Another way to implement the barbell portfolio strategy is to invest in a single portfolio that consists of both high-risk, high-return investments and low-risk, low-return investments.

The investor would then allocate a portion of their total capital to each investment based on their desired risk/return profile.

Does the barbell portfolio strategy have any rules associated with it?

A trader may be “fully invested” when 90 percent of assets are in stocks or other risk assets and 10 percent is in cash or short-term bonds.

In other words, a trader might have a rule of always having 10 percent of assets in cash as a prudent buffer zone.

This cash can help to lower the overall risk of the portfolio and make it easier to rebalance during periods of market volatility.

Conclusion

The barbell portfolio strategy is a popular investment strategy that allows investors to capture the upside potential of high-risk, high-return investments while still providing some downside protection from low-risk, low-return investments.

There are a few different ways that investors can implement the barbell portfolio strategy.

One way is to invest in two separate portfolios, one that consists of high-risk, high-return investments and another that consists of low-risk, low-return investments.

Another way to implement the barbell portfolio strategy is to invest in a single portfolio that consists of both high-risk, high-return investments and low-risk, low-return investments. The investor would then allocate a portion of their total capital to each investment based on their desired risk/return profile.

The barbell portfolio strategy is not straightforward as to how to rebalance on a regular basis, which can lead to sub-optimal results over time.

This type of portfolio construction can be especially beneficial in volatile market conditions when the direction of the market is uncertain. While there are some risks associated with this strategy, it can be a useful tool for investors who are looking to achieve better risk-adjusted returns.

Appendix

Risk and Return Metrics

| Metric | S&P 500 | Balanced | Barbell |

|---|---|---|---|

| Arithmetic Mean (monthly) | 0.95% | 0.73% | 0.70% |

| Arithmetic Mean (annualized) | 11.99% | 9.08% | 8.68% |

| Geometric Mean (monthly) | 0.84% | 0.70% | 0.67% |

| Geometric Mean (annualized) | 10.61% | 8.74% | 8.39% |

| Standard Deviation (monthly) | 4.55% | 2.28% | 2.12% |

| Standard Deviation (annualized) | 15.75% | 7.91% | 7.33% |

| Downside Deviation (monthly) | 2.95% | 1.23% | 1.13% |

| Maximum Drawdown | -50.89% | -17.23% | -21.61% |

| Stock Market Correlation | 1.00 | 0.64 | 0.53 |

| Beta(*) | 1.00 | 0.32 | 0.25 |

| Alpha (annualized) | 0.00% | 5.08% | 5.55% |

| R2 | 100.00% | 40.65% | 28.10% |

| Sharpe Ratio | 0.44 | 0.54 | 0.53 |

| Sortino Ratio | 0.64 | 0.85 | 0.84 |

| Treynor Ratio (%) | 6.93 | 13.35 | 15.83 |

| Calmar Ratio | 0.39 | 0.10 | -0.18 |

| Active Return | 0.00% | -1.87% | -2.22% |

| Tracking Error | 0.00% | 12.32% | 13.40% |

| Information Ratio | N/A | -0.15 | -0.17 |

| Skewness | -0.51 | 0.09 | 0.13 |

| Excess Kurtosis | 1.88 | 1.37 | 1.59 |

| Historical Value-at-Risk (5%) | 7.12% | 2.87% | 2.51% |

| Analytical Value-at-Risk (5%) | 6.53% | 3.03% | 2.78% |

| Conditional Value-at-Risk (5%) | 10.01% | 4.08% | 3.85% |

| Upside Capture Ratio (%) | 100.00 | 41.17 | 35.06 |

| Downside Capture Ratio (%) | 100.00 | 21.95 | 13.34 |

| Safe Withdrawal Rate | 4.30% | 5.20% | 4.92% |

| Perpetual Withdrawal Rate | 6.05% | 4.43% | 4.12% |

| Positive Periods | 391 out of 626 (62.46%) | 397 out of 626 (63.42%) | 399 out of 626 (63.74%) |

| Gain/Loss Ratio | 1.03 | 1.32 | 1.37 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are monthly values. | |||