17+ Types of Investors to Know in the Market

Financial markets are a mix of different participants, who have different sizes and different motivations.

This is important to get at because the prices of all assets are just the total amount spent on them (with either money or credit) divided by their quantity.

All markets and their pricing are just mixes of these participants.

If you can get a good idea of who’s in what markets, how big they are, what their motivations are, and what they’re likely to do, you can start to get a good feel for where a market might go.

It can also be helpful to understand within the context of your individual trades.

Whenever you make a trade there’s some entity on the other side of it and there’s a reason why they’re doing it.

Who might your counterparty be and why might they be doing it?

Let’s take a look at the main players in global financial markets.

Individual traders (retail investors)

The vast majority of market participants (by number and sometimes overall amount of money, depending on the market) are what’s collectively known as retail investors.

These are individuals who trade on their own behalf. They might trade through an online broker, or they might even just use the platforms provided by their bank.

What motivates retail traders?

For most, it’s a mix of trying to grow their savings, generate some extra income, or both.

How big are individual traders?

There are estimated to be over 55 million active retail investors in the US alone.

They are not as big as institutions in markets like the United States.

However, in markets like China, retail traders have traditionally been the majority of the money as well.

More retail-driven markets tend to be heavily characterized by momentum moves.

Many individual traders believe that something that has gone up a lot is a good investment rather than a more expensive one, and something that’s gone down a lot is a worse investment.

This leads to buying when things are good and selling when things are bad and exacerbates trending moves.

The popular example of the Gamestop and AMC trading frenzies in 2021 are examples of these extreme momentum moves when retail becomes a key driver of a market.

Institutional investors

At the other end of the spectrum from retail investors are institutional investors.

These are a group of private companies and other private and public entities that include, most notably, pension funds, insurance companies, hedge funds, and sovereign wealth funds.

What motivates them?

For pension funds and insurance companies, it’s about meeting long-term liabilities.

They need to generate a certain return over the long term to be able to pay out pensions or policyholders.

Hedge funds are generally about generating alpha (excess return) for their clients or improving return per unit of risk (while not necessarily beating markets).

And sovereign wealth funds are usually trying to achieve a similar goal to pension funds, but on behalf of a government.

How big are they?

Institutional investors hold an estimated $100 trillion in assets globally. That’s over three times the size of the entire retail market.

Banks and other financial intermediaries

Banks play two main roles in financial markets. The first is as a provider of credit. The second is as a market maker.

As a provider of credit, banks take deposits from savers and lend that money to borrowers, capturing an interest rate differential to produce net interest income. This is how most get access to credit, whether it’s for a mortgage, a car loan, or just a personal loan.

As market makers, banks provide liquidity to the markets by buying and selling assets themselves.

They make money from the spread between the prices they buy and sell at.

What motivates them?

For banks, it’s all about making money. That might be through lending money out at higher rates than they pay on deposits, by trading in financial markets, or through services.

How big are they?

The total amount of money in global financial institutions is now approximately $500 trillion.

However, since the financial crisis in 2008, investment banks play less of a role in trading the markets. Prop trading is now largely engulfed within hedge funds.

Vulture funds (distressed asset funds)

So-called vulture funds are a type of hedge fund or alternative investment manager that focuses on distressed assets.

These are assets that are in financial difficulty, such as loans that are about to go into default.

The term “vulture fund” is sometimes considered a pejorative term, suggesting they swoop in to pick up the scraps of what’s left, so distressed asset investing is often a more common reference.

What motivates them?

Vulture funds are all about making money from poorly performing assets by turning them around, through restructurings, recapitalizations, mergers, breakups, litigation, and other miscellaneous special situations.

They often include more “old economy” sectors, such as malls and department stores or in commodity sectors that have fallen on hard times, but it can broadly apply anywhere.

They buy assets at a discount, fix them up, and then try to sell them later at a higher price.

How big are they?

It’s difficult to say exactly how big the vulture fund industry is because many of these funds are privately owned and aren’t purely dedicated to one strategy.

But there are at least hundreds of billions of dollars dedicated to distressed asset investing.

The most popular distressed hedge funds or distressed equity and credit investors include Baupost Group, Fortress, Silver Point Capital, Apollo, Oaktree Capital, Aurelius Capital, Davidson Kepner, and Anchorage Capital.

High-frequency traders

High-frequency trading (HFT) is a type of trading that uses algorithms to execute trades at very high speeds.

HFT firms make money from the spread between the prices they buy and sell at, and from the rebates they receive from exchanges for providing liquidity.

What motivates them?

Like banks, HFT firms are in it to make money and it largely depends on their volume.

They use their speed and technology to give themselves an edge over other market participants.

How big are they?

HFT firms now account for more than 50 percent of all US equity trading volume.

Family offices

A family office is a private wealth management firm that provides services to (usually) a single family.

These services can include investment management, tax planning, estate planning, and nonprofit work, such as philanthropy and private foundations.

Moreover, family offices also may handle tasks such as managing household staff, family management and governance, creating travel arrangements, accounting and payroll activities, property management, management of legal affairs, financial and investor education, and other activities.

Many hedge funds have been converted into family offices, meaning they no longer take outside capital. One example is Stanley Druckenmiller’s Duquesne Capital, now Duquesne Family Office.

Family offices are also less regulated than most other types of investment vehicles given they don’t take outside investor capital.

Hedge fund to family office conversions

Some investors may convert their operations to family offices for a lower-stress lifestyle than hedge fund management or because they’ve earned enough wealth to the point where taking on outside capital is no longer in their interests.

All traders and investors looking to generate excess market returns will cap their size at a certain point and may not need outside capital.

Some strategies also have limited capacity because of the limited size of their markets.

Family office minimum net worth

A family office with two investment professionals and four full-time support staff can cost $1-$2 million per year to operate. Of course, more complex operations can take a larger staff and will incur more costs.

The incentives are usually based on the profits or capital gains generated by the office.

Accordingly, those who set up family offices often have net worths and investable assets in excess of $100 million.

What do family offices invest in?

Family offices might invest in public and private equity, venture capital (startups, growth equity), hedge funds, commercial real estate, commodities, and other alternatives, such as reinsurance, litigation finance, and other less popular asset classes.

What motivates them?

For family offices, it’s all about preserving and growing the wealth of the family they represent.

How big are they?

It’s estimated that there are around 3,000 family offices in the US alone.

They are estimated to represent a total of around $7 trillion.

The largest family offices include those of Bill Gates (Cascade Investment), the Walton family (Walton Enterprises LLC), and Jeff Bezos (Bezos Expeditions).

Financial endowments

A financial endowment is a fund that is used to invest a nonprofit’s investable assets to support a specific purpose.

The most common type of financial endowment is an educational endowment, which is used to fund scholarships, research, or other educational expenses.

What motivates them?

Endowments are usually set up with the aim of preserving the capital and generating a return to fund initiatives over the long term.

How big are they?

US university endowments have a combined value of about $700 billion.

The endowments of Harvard, Yale, and Stanford are the largest university endowments in the US.

Fund of hedge funds

A fund of hedge funds is a type of investment fund that invests in a number of different hedge funds.

Fund of funds is often referred to as multi-manager investment.

Most fund of funds limit themselves to one type of “collective investment scheme”. For example, a hedge fund FOF, a mutual fund FOF, a private equity FOF, a venture capital FOF, an investment trust FOF, and so on.

What motivates them?

For fund of hedge funds, it’s all about diversification.

By investing in a number of different hedge funds, they aim to reduce the overall risk of the portfolio.

By and large, they are looking for returns streams that are uncorrelated.

How big are they?

The global fund of funds industry collectively manages more than $1 trillion.

Pension funds

A pension fund is a type of investment fund that is used to provide retirement benefits for employees.

Pension funds are usually set up by employers and are managed by trustees.

Retirees’ pensions don’t typically rise much year to year because the immunization strategies pension funds use assume relatively fixed future liabilities, which are accordingly matched by a lot of fixed-rate (rather than floating-rate) assets.

What motivates them?

The main goal of pension funds is to generate a return that can support the payments of pensions.

Most pensions funds have asset ratios that they target. That means that if stocks fall and other assets in their portfolio (like bonds) go up, they’ll sell the stuff that went up to buy the assets that fell to maintain their desired allocations.

How big are they?

Pension funds in the US had a combined value of more than $30 trillion.

Sovereign wealth funds

A sovereign wealth fund (SWF) is a type of investment fund that is owned by a government.

These funds are usually used to invest in foreign assets, such as stocks, bonds, and real estate.

Does the US have a sovereign wealth fund?

The United States does not have a federal sovereign wealth fund.

But there are a number of state funds, which are commonly called permanent funds, throughout the country that derive their wealth from a wide range of sources including fossil fuels.

Does China have a sovereign wealth fund?

Yes, China has multiple.

The country’s four biggest sovereign wealth funds, including those that are managed by CIC, SAFE Investment Company, NSSF, and HKMA, are within the world’s top-10 largest SWFs.

Moreover, China continues to be the world’s largest country in terms of SWF-managed capital, which is more than 30 percent of the world’s total.

What motivates them?

The goals of sovereign wealth funds vary from country to country.

Some countries use these funds to save for future generations, while others use them to finance infrastructure projects or stabilize their economy.

Many countries that are highly dependent on selling their resources (like oil or commodities) have sovereign wealth funds to prudently diversify.

How big are they?

Sovereign wealth funds are estimated to have $11 trillion in assets under management.

Commodity Trading Advisors (CTAs)

A CTA, or commodity trading advisor, is a type of investment manager who specializes in trading futures and other derivatives.

CTAs typically use quantitative trading strategies to capture short-term market trends, and they often trade in large volumes due to their lower capital requirements.

Because of this, CTA managed futures are an attractive option for investors looking for exposure to commodities markets with lower volatility and more reliable returns than traditional investment strategies.

However, it is important to carefully assess the CTA’s performance and risk management practices before investing in CTA managed futures.

What motivates them??

There is no single answer to this question, as CTA managed futures are motivated by a number of different factors.

Some CTA managers may be driven by the potential for high returns and large profits, while others may be motivated by the desire to accurately predict market trends or manage risk more effectively.

Other common motivators include the challenge of trading markets successfully with new strategies, the desire to experiment with a wide range of trading strategies, and an interest in technical analysis and quantitative strategies.

Ultimately, the motivations of CTA managers can vary widely depending on their individual goals and preferences, making it important to carefully research any CTA that you are considering investing with.

How big are they?

They have an AUM of around $500 billion combined.

Systematic CTA strategies are about 4x as popular as discretionary CTA strategies.

Because of their low capital requirements, they can be a bigger influence on markets than their AUM suggests.

They also have an influence on enhancing sell-offs and gains because of their emphasis on momentum.

High net-worth individuals (HNWI)

A high-net-worth individual is someone who has a net worth of $1 million or more.

“Very-HNWI” (VHNWI) can refer to someone with a net worth of at least $5 million.

An additional tier of “ultra-high-net-worth individuals” (UHNWIs) are those with $30 million in assets.

These individuals are often courted by private wealth management firms for money management, tax planning, and estate planning services.

What motivates them?

HNWIs are usually motivated by the same things as other investors: they want to grow their wealth and preserve their capital.

How big are they?

It’s estimated that there are around 20 million HNWIs worldwide.

The breakdown by region, number, and wealth is below (totaling more than $160 trillion):

| HNWI wealth distribution (by region) | ||

|---|---|---|

| Region | HNWI population | HNWI wealth |

| Global | 20.8 million | $80 trillion |

| Asia-Pacific | 6.9 million | $24 trillion |

| North America | 7 million | $24.3 trillion |

| Europe | 5.4 million | $17.5 trillion |

| Middle East | 0.8 million | $3.2 trillion |

| Latin America | 0.6 million | $9 trillion |

| Africa | 0.2 million | $1.8 trillion |

Insurance companies

Insurance companies are businesses that sell insurance policies.

These policies provide protection against the risks of everyday life, such as car accidents, fires, and theft.

What motivates them?

Insurance companies are in business to make money. They do this by charging premiums for their policies and investing the money they collect (called “float”).

How big are they?

The global insurance industry has combined assets of around $45 trillion.

Mutual funds

A mutual fund is a type of investment fund that is owned by a group of investors.

These funds pool together the money of many different investors and use it to buy a variety of assets, such as stocks, bonds, and other assets.

What motivates them?

Mutual funds are usually motivated by the same things as other investors: they want to grow their wealth and preserve their capital.

How big are they?

Mutual funds in the US had a combined value of about $22 trillion.

Private equity firms

A private equity firm is a type of investment firm that specializes in investing in privately held companies.

These firms typically invest in companies that are not listed on public stock exchanges.

What motivates them?

Private equity firms want to invest in companies that have earnings and relatively clean balance sheets so they can take them private through a leveraged buyout (LBO) transaction.

The goal is to make these companies more efficient, use the cash flows to pay off the debt, and exit them by selling to another investor or through an IPO.

How big are they?

Private equity firms globally have a combined value of around $9 trillion.

Hedge funds

A hedge fund is a type of investment fund that uses a variety of strategies to earn returns.

Hedge funds are typically only available to accredited investors.

Their clients often include pension funds, endowments and foundations, sovereign wealth funds, and families.

What motivates them?

Hedge funds use a variety of strategies to grow and preserve the capital of their clients.

How big are they?

Hedge funds worldwide have a combined value of $5 trillion. For comparison, in 2000, hedge funds managed around $260 billion.

Venture capital

Venture capitalists (VCs) are investors who provide capital to startups in exchange for equity.

They typically invest in early-stage companies that have high growth potential.

Angel investors often fall into this category, though they are often individuals looking to make investments in startups.

What motivates them?

Venture capitalists are looking to make a profit from their investments.

They typically invest in companies that they believe have high growth potential.

Venture capital is more about finding emerging trends and technologies and venture firms are rarely interested in things like profits like equity and credit investors.

It is more of a “home run” type of investment style where many investments may not pan out (most startups fail) and total returns are largely driven by investments that deliver large money-on-money multiples (e.g., a $1 million investment turning into $200 million).

How big are they?

Venture capital firms in the US have an AUM of around $700 billion.

The top two firms are Andreessen Horowitz and Sequoia Capital and have close to $70 billion in AUM.

Central banks

A central bank is a type of financial institution that regulates the money supply and interest rates in an economy.

Central banks also typically manage a country’s foreign exchange reserves.

The US has few foreign exchange reserves relative to other economies relative to its size. For example, China typically has around 25x to 30x the amount of FX reserves as the US, meaning the US has little of the “world’s money”.

What motivates them?

Central banks are motivated by their statutory mandate.

This typically means controlling inflation or maximizing unemployment within the context of price stability (both in the real economy and financial stability).

Other central banks have other mandates, such as maintaining a stable exchange rate.

To achieve these goals, central banks will control interest rates and transact in financial assets (mostly their own government’s bonds and government-backed securities (e.g., mortgage-backed securities)).

How big are they?

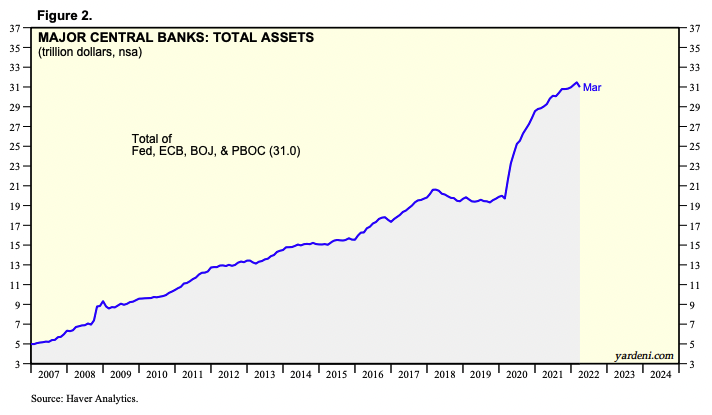

The world’s top four central banks – the US Federal Reserve, ECB, BOJ, and PBOC – had a balance sheet of $31 trillion as 2022.

Major Central Banks: Total Assets

Conclusion

There are many different types of market participants, each with their own set of incentives and overall sizes.

It’s important to understand who these players are and what they’re likely to do in order to make better-informed trading decisions.