Reinsurance – Its Role in a Financial Portfolio

Reinsurance is prized in portfolio construction because of the diversification it can provide in a portfolio.

While most asset classes move at least partially due to global credit cycles, reinsurance instruments often trade due to a totally separate set of factors (e.g., natural disasters and other weather-/insurance-related events).

For example, catastrophe bonds (CAT bonds) payout in the event of a catastrophe (such as a hurricane, tornado, earthquake, flood, and so on).

On the other hand, normal financial instruments payout based on shifts in growth, inflation, risk premiums, and discount rates.

In this article, we’ll cover the reinsurance industry, types of reinsurance, its role in financial portfolios, and how to get access to reinsurance.

Key Takeaways – Reinsurance

- Reinsurance can be a diversifier within a portfolio.

- Unlike stocks or bonds, returns in reinsurance are largely driven by weather events, not economic conditions.

- This low correlation can significantly reduce overall portfolio risk.

- Risk Reduction

- By adding assets that aren’t tied to the broader market, reinsurance can significantly reduce overall portfolio risk without sacrificing returns.

- Catastrophe Protection

- Reinsurance is especially valuable in protecting against large, unexpected losses (like those from the 2017 storms), making the entire portfolio more resilient to ‘black swan’ events.

- Pricing Dynamics

- Disasters lead to a reduction in reinsurance capital, driving up prices. Savvy investors understand these cycles and may seek to enter the market after major events to take advantage of higher expected returns.

What Is Reinsurance?

Reinsurance is, in simple terms, insurance for insurers.

When an insurance company experiences a large claim, it can reinsure its risk with another insurer in order to limit its exposure to the event.

Reinsurance can also be used by insurance companies to manage their risks.

By reinsuring parts of their portfolio that are exposed to certain types of risks, they can spread those risks out among many reinsurers.

This reduces the impact that any one event would have on their bottom line.

Ceding company

The ceding company is the insurance company that is transferring its risks to the reinsurer.

Cedant

A cedant is the person or company that cedes business to another person or company.

In the case of the insurance industry, an insurer is a cedant to a reinsurer.

Reinsurer

The reinsurer is the insurance company that is receiving the risks from the ceding company.

Why Use Reinsurance in a Financial Portfolio?

Reinsurance can play an important role in financial portfolios.

Reinsurance can be used in a financial portfolio for two main reasons:

- to reduce risks and

- to increase returns

Risk Reduction

- Core Impact – Reinsurance reduces portfolio risk by spreading exposure across multiple insurers. This lessens the impact of any single adverse event.

- Diversification – Reinsurance augments a portfolio’s diversification by introducing assets with returns uncorrelated to traditional markets (e.g., stocks, bonds).

- Protection Examples: Reinsurance can specifically mitigate several risks, including:

-

- Natural disasters

- Financial market volatility

- Terrorism

- Borrower default

Return Enhancement

Reinsurance can also be used to enhance returns in a portfolio. By reinsuring certain types of risks, the expected return on investment is increased.

- Downside Protection – Reinsurance limits losses during adverse events (like a stock market decline), allowing the investor to maintain their position and avoid selling at a low point.

- Increased Leverage – Reinsurance can free up capital, which can then be redeployed for potentially higher-return investments. This increases leverage in a calculated way.

- Derivative Strategies – Reinsurance, when paired with derivatives, can create structures with limited downside risk and potential for leveraged upside returns.

More balance and diversification

When used correctly, reinsurance can help to create a more balanced and diversified portfolio.

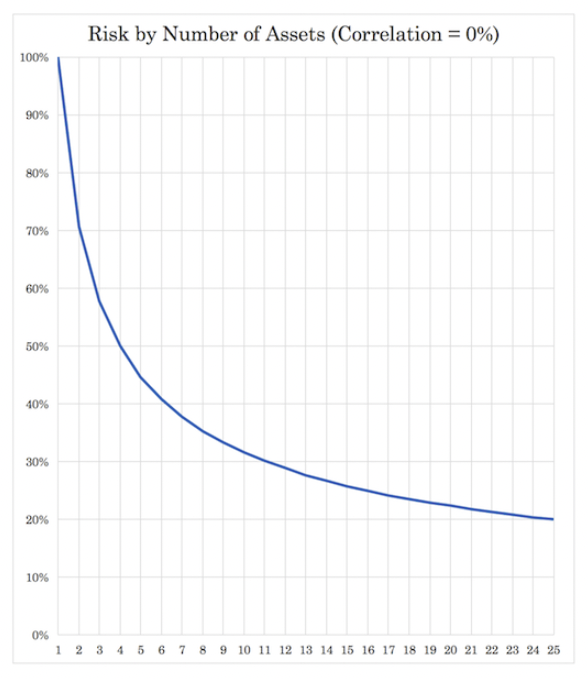

We explained in a separate article the math behind diversification. When you combine various uncorrelated returns streams you can decrease your risk without reducing your returns.

For example, if you were to have 10 equal-returning, equal-risk returns streams that are uncorrelated from each other you will improve your return-to-risk ratio by a factor of more than 3-to-1.

Reinsurance can be considered part of this, given its returns are not part of global credit cycles or economic environments like other asset classes.

They still involve risk like all investments, but it’s a different type of risk that’s uncorrelated with other returns streams.

For example, reinsurance companies have to account for catastrophic events, which are one-off occurrences that have a low probability of happening (but a large expected loss when they do).

This type of risk is not as easily diversifiable as other risks like interest rate risk or currency risk.

Reinsurance companies are able to take on more risk because they can spread this risk over a large number of policyholders.

This allows them to charge lower premiums than if they were to insure each policyholder individually.

How Individual Traders & Investors Can Get Access to Reinsurance

Let’s look at the methods of access to reinsurance for individual traders and investors.

Catastrophe Bonds (CAT Bonds)

- What they are – Securitized instruments specifically tied to predefined catastrophic events. If the event doesn’t occur, investors receive regular payments. If it does, investors may lose some or all of their principal.

- Accessibility – CAT bonds can be traded on some exchanges, making them the most accessible option for individual traders/investors.

- Considerations:

- CAT Bonds offer lower risk than other reinsurance investments, but also lower potential returns.

- Individual CAT bonds may require higher minimum investments.

Reinsurance-Focused Funds

- What they are – Investment funds (often hedge funds or ETFs) that specialize in various reinsurance strategies.

- Accessibility – Easier for individual investors to access, as they buy shares in the fund itself. Some reinsurance ETFs are also available.

- Considerations:

- Fund performance depends on manager skill in selecting and structuring reinsurance deals.

- Watch out for fees, which can be high in some funds. Transparency of holdings is important as well.

Insurance-Linked Securities (ILS)

- What they are – A broader category of securities related to insurance risks, including CAT bonds and other more complex structures. These tend to be less standardized than CAT bonds.

- Accessibility – ILS are typically traded over-the-counter (OTC), often requiring connections to specialized brokers.

- Considerations:

- Minimum investment sizes tend to be high, restricting access for individual investors.

- Requires a high degree of expertise to understand and evaluate risks.

Direct Investment in Reinsurance Companies

- What it is – Purchasing shares in publicly-traded reinsurance companies.

- Accessibility – Easy, as it’s just like buying any other stock on an exchange.

- Considerations:

- The company’s stock price will be influenced by broader market factors in addition to the reinsurance business.

- Many of these factors you’re trying to get away from (e.g., interest rates, credit cycles, supply/demand for equities).

- Can be difficult to assess the quality of a reinsurance company’s portfolio and risk management.

- The company’s stock price will be influenced by broader market factors in addition to the reinsurance business.

Additional Factors to Consider

- Risk Tolerance – Reinsurance investments carry significant risk, especially outside of CAT bonds. Assess your risk appetite before investing.

- Time Horizon – Reinsurance can be a longer-term investment. Be prepared to hold positions through market cycles, especially after large loss events.

Expertise

Understanding reinsurance requires a fair bit of specialized knowledge. Consider funds managed by experienced professionals if you’re less familiar with the industry.

Advantages of Reinsurance

There are many advantages of reinsurance for both insurance companies and policyholders.

For insurance companies

For insurance companies, reinsurance can help to:

- reduce the impact of a large loss on their balance sheet and overall financial performance

- spread out their risk among many reinsurers

- manage their assets and capital more effectively

- protect their bottom line in the event of a large loss

For policyholders

For policyholders, reinsurance can help to:

- provide peace of mind in the event of a large loss

- get a higher limit on their insurance policy for less money

- protect their assets from a catastrophic loss

Different Methods of Reinsurance

There are three main methods of reinsurance:

- treaty reinsurance

- facultative reinsurance, and

- retrocession reinsurance

Treaty Reinsurance

Treaty reinsurance is the most common type of reinsurance. Under a treaty reinsurance agreement, the reinsurer agrees to reinsure all or most of the risks that the ceding company writes.

The reinsurer and the ceding company will agree on a reinsurance treaty, which outlines the terms of the agreement.

Treaty reinsurance can be further divided into two types:

- quota share reinsurance and

- excess of loss reinsurance

Quota share reinsurance is a type of pro-rata reinsurance where the reinsurer agrees to share in a certain percentage of every risk that the ceding company writes.

For example, if a quota share agreement was for 50 percent, then the reinsurer would pay 50 percent of any claims that arise from the underlying policies.

Excess of loss reinsurance is a type of reinsurance where the reinsurer only pays claims that exceed a certain threshold, or attachment point.

For instance, if the reinsurer has an attachment point of $10 million and the ceding company experiences a loss of $15 million, then the reinsurer would pay $5 million.

What are reinsurance treaties?

A reinsurance treaty is a contract between an insurer and reinsurer that outlines the terms and conditions of the reinsurance agreement.

Under a reinsurance treaty, the reinsurer agrees to reimburse the insurer for any losses that are incurred as a result of writing insurance policies.

Reinsurance treaties can be either proportional or non-proportional.

Facultative Reinsurance

Facultative reinsurance is a type of reinsurance where the reinsurer agrees to reinsure a single risk or a small group of risks. It is reinsurance that is not part of a treaty.

This type of reinsurance is usually used for risks that are too large or too risky for the ceding company to insure on its own. That is, this type of reinsurance is usually used when the reinsurer wants to reinsure a specific risk that is not covered by a treaty.

One advantage of facultative reinsurance is that it gives the ceding company more flexibility in choosing which risks to insure.

Functions of Reinsurance

Most insurance companies have reinsurance programs. This is used to help reduce the risk of a potential loss from happening.

Income smoothing

Reinsurance can help to smooth out the income of an insurance company.

This is because reinsurance allows the insurance company to spread its risk among many reinsurers. This reduces the impact that any one event would have on their financial performance.

Asset and capital management

Reinsurance can also be used by insurance companies to manage their assets and capital.

By reinsuring parts of their portfolio that are exposed to certain types of risks, they can spread those risks out among many reinsurers.

This reduces the impact that any one event would have on their balance sheet.

Risk management and risk transfer

Reinsurance is also a key part of an insurance company’s risk management program. By reinsuring parts of their portfolio that are exposed to certain types of risks, they can reduce their exposure to those risks. This helps them to protect their bottom line in the event that a large loss occurs.

Arbitrage

Reinsurance can also be used as a tool for arbitrage. This is because reinsurance contracts are often traded on the secondary market.

So, if an insurance company believes that the reinsurance contract they have purchased is underpriced, they can sell it on the secondary market for a profit.

But in general, arbitrage can mean different things:

- A reinsurer may have a more favorable tax arrangement than their clients. This means any pre-tax profits translate to higher post-tax profits. It’s not any different from individuals changing their location for tax purposes to increases their overall take-home pay.

- The regulatory environment may be different relative to their clients. This might entail needing less capital to cover risks or having to make less risk-adverse assumptions when valuing risk. This already naturally exists in markets, such as how institutional investors use synthetic products instead of operating in cash equity and other markets to obtain lower margin requirements.

- The reinsurer has a cost-efficiency advantage relative to clients.

- A reinsurer may be more efficient at pricing risk due to an underwriting advantage or due to access to certain data.

- There may be differences in actuarial reserves between the reinsurer and its clients.

- The reinsurer may be more willing to take on risk than the insurer (i.e., more risk, more expected return).

- The reinsurer may be more diversified with respect to its assets and liabilities. Or they have a different regulatory framework to abide by and can hold fewer assets to cover risk. The reinsurer may view an insurer’s liability as a potential for hedging based on their unique portfolio.

Surplus relief

Reinsurance can also be used by insurance companies to reduce their surplus. This is because reinsurance allows the insurance company to reinsure a part of their portfolio that is not profitable.

By reinsuring these risks, the insurance company can reduce their losses and improve their bottom line.

Reinsurer’s expertise

In addition, reinsurers often have expertise in specific types of risks.

So, by reinsuring a risk with a reinsurer that has expertise in that type of risk, the ceding company can reduce its chances of experiencing a loss.

Creating a manageable and profitable portfolio of insured risks

Reinsurance allows insurance companies to create a portfolio of insured risks that is both manageable and profitable.

By reinsuring their risks, they can reduce their exposure to loss and improve their financial performance.

Types of reinsurance

Proportional reinsurance

Proportional reinsurance is a type of reinsurance where the reinsurer agrees to pay a portion of each claim that is made by the insured.

The reinsurer’s share of each claim is determined by the reinsurance contract.

Non-proportional reinsurance

Non-proportional reinsurance is a type of reinsurance where the reinsurer agrees to pay a fixed amount for each claim that is made by the insured.

The reinsurer’s share of each claim is determined by the reinsurance contract.

Quota share reinsurance

Quota share reinsurance is a type of proportional reinsurance where the insurer and reinsurer agree to share the risk on an agreed percentage basis.

Excess of loss reinsurance

Excess of loss reinsurance is a type of reinsurance where the reinsurer agrees to pay all claims that exceed a certain amount. The threshold is known as the attachment point.

Stop-loss reinsurance

Stop-loss insurance is a type of reinsurance that is used by insurance companies to protect themselves from large losses.

It is also known as excess-of-loss reinsurance.

Stop-loss insurance is generally purchased in conjunction with workers’ compensation or property and casualty insurance policies.

When a claim is made under one of these policies, the stop-loss insurer will reimburse the insurance company for the amount that exceeds a certain limit.

This limit is usually specified in the stop-loss policy.

The goal of stop-loss insurance is to protect the insurance company from having to pay out large sums of money in claims.

Retrocession Reinsurance

Retrocession reinsurance is reinsurance that is purchased by a reinsurer from another reinsurer.

This type of reinsurance is used to spread the risk among many reinsurers.

So, the main advantage of retrocession reinsurance is that it allows reinsurers to limit their exposure to any one risk.

For example, if a reinsurer writes a $10 million treaty with another reinsurer, it may take out retrocession reinsurance for $5 million to protect itself from any losses that may arise from the treaty.

Risks attaching basis

The reinsurance contract will also specify the risks that will be covered under the reinsurance agreement.

Generally, reinsurance contracts will cover all risks that are associated with the original insured risk.

However, there may be some risks that are not covered by the reinsurance agreement. This is known as the risks attaching basis.

Losses occurring basis

The reinsurance contract will also specify the losses that will be covered under the reinsurance agreement.

Generally, reinsurance contracts will cover all losses that are associated with the original insured risk.

However, there may be some losses that are not covered by the reinsurance agreement. This is known as the losses occurring basis.

Claims-made basis

The reinsurance contract will also specify the basis on which claims will be paid.

There are three main types of basis that reinsurance contracts can use: Claims-made, occurrence, and reported.

The most common type of basis is the claims-made basis. Under this basis, the reinsurer will only pay claims if they are made during the policy period.

This is different from the occurrence basis, which pays claims for losses that occurred during the policy period, even if the claim is made after the policy has expired.

The reported basis is a combination of both the claims-made and occurrence basis. Under this basis, the reinsurer will only pay claims if they are made during or after the policy period.

Fronting

Fronting is a type of reinsurance where the reinsurer agrees to reinsure all of the risk that is written by the insurer.

The reinsurer will usually charge a fee for this service.

This type of reinsurance is used by insurers to reduce their exposure to risk.

So, the main advantage of fronting is that it allows the insurer to reinsure all of its risks with one reinsurer.

Reinsurance Contracts

Reinsurance contracts are generally written for one year. However, some contracts may be written for shorter or longer periods of time.

The reinsurance contract will specify the terms and conditions of the reinsurance agreement.

The reinsurer’s liability will usually cover the whole lifetime of the original insurance, once it is written.

However, some reinsurance contracts may have a limited liability. This means that the reinsurer will only be liable for claims that occur during the policy period.

The reinsurance contract will also specify the premium that the insurer will pay to the reinsurer.

The premium is generally calculated as a percentage of the original premium charged by the insurer.

The reinsurance contract will also specify any commissions or fees that the reinsurer will charge.

Commissions are generally paid as a percentage of the premiums paid by the insurer.

Fees are generally charged on a per-policy basis.

Catastrophe Bond (CAT Bond)

A catastrophe bond is a type of reinsurance that is used to transfer the risk of catastrophic events to investors.

Catastrophe bonds are generally issued by reinsurers and sold to investors.

The reinsurer will use the proceeds from the sale of the bonds to pay for claims that arise from the catastrophic event.

If there is no claim, then the investor will get their money back, plus interest.

Catastrophe bonds are generally used to transfer the risk of natural disasters, such as hurricanes and earthquakes.

They were created and first used in the mid-1990s in the aftermath of Hurricane Andrew (1992, which hit Florida) and the Northridge earthquake (1994 in California).

They can also be used to transfer the risk of man-made disasters, such as terrorist attacks.

Who participates in the CAT bond market?

Investors who participate in this market include hedge funds, specialized catastrophe-oriented investment funds, and different types of asset managers.

Life insurers, reinsurers, banks, pension funds, and other types of financial participants also participate in CAT bond offerings.

For individual traders, they are sometimes available through one’s broker.

What are the benefits and risks of investing in CAT bonds?

Benefits include the potential to earn a higher return than other types of investments, as well as the possibility of diversifying one’s portfolio.

Risks include the possibility of a loss of principal, as well as the risk that the reinsurer may not be able to pay claims if there is a catastrophic event.

How are CAT bonds traded?

CAT bonds are generally traded through broker-dealers who specialize in reinsurance.

They can also be traded on some reinsurance exchanges.

The trading process is similar to other types of securities trading.

Investors can buy and sell CAT bonds through these broker-dealers and exchanges.

Catastrophe Modeling

Catastrophe modeling involves taking into account all the salient factors to understand the various facets of risk involved in a disaster.

This type of modeling is used by reinsurers to help them price reinsurance contracts.

It is also used by insurance companies to help them assess their own risks and to design policies that will minimize losses.

Catastrophe modeling is a complex process that involves the use of sophisticated analytical models.

The models take into account a wide range of factors, including weather patterns, geographic data, building construction data, and historical data.

The goal of catastrophe modeling is to provide a comprehensive understanding of the risk involved in a disaster.

This understanding can then be used to develop strategies for managing the risk.

Reinsurance Sidecar

A reinsurance sidecar is a type of reinsurance vehicle that is used to transfer risk from one insurer to another.

It is generally used in conjunction with property and casualty (P&C) insurance policies.

The reinsurance sidecar is usually established as a separate legal entity.

It is typically structured as a limited liability company or a partnership.

The reinsurance sidecar will enter into reinsurance contracts with the insurer.

Under these contracts, the reinsurance sidecar will agree to pay claims that exceed a certain limit.

The goal of the reinsurance sidecar is to protect the insurer from having to pay out large sums of money in claims.

Loss portfolio transfer

A loss portfolio transfer (LPT) is a type of reinsurance that is used to transfer the risk of a portfolio of policies from one insurer to another.

An LPT can be used to transfer the risk of a single type of policy, such as automobile insurance, or it can be used to transfer the risk of a group of policies, such as all the policies in a particular state.

LPTs are generally used to transfer the risk of portfolios that are no longer profitable for the insurer.

The goal of an LPT is to enable the insurer to reduce its exposure to loss and to free up capital that can be used for other purposes.

Conclusion

Reinsurance is a type of insurance that is purchased by an insurance company from a reinsurer.

The main purpose of reinsurance is to spread the risk among many reinsurers, which reduces the impact that any one event would have on the insurance company.

Reinsurance can also be used by an insurance company to manage their assets and capital, as well as to reduce their exposure to certain types of risks.

Reinsurance is important because it helps ensure that insurers remain profitable. By reinsuring their risks, insurers can reduce their exposure to loss and improve their bottom line.

When you reinsure your risks with a reinsurer, you’re essentially transferring some of the risk to them in exchange for a premium.

The reinsurer then becomes responsible for any claims that exceed the amount of the premium you paid.

This allows you to free up capital that would otherwise be tied up in reserves to cover these types of claims.

Reinsurance can help traders and investors create a more balanced and diversified portfolio by reinsuring certain types of risks.

This can help to reduce the impact of any one event on your portfolio, and can also help to enhance returns by increasing leverage in a prudent, risk-limited way.