The Complete Guide to the Inverted Yield Curve

An inverted yield curve is an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality.

This is considered a negative yield curve, because it is “inverted” from the typical yield curve relationship, in which longer-term rates are higher than shorter-term rates.

What Happens in an Inverted Yield Curve Environment

In an inverted yield curve environment, it costs more to borrow money for a shorter period of time than it does to borrow money for a longer period of time.

This may seem counterintuitive, but it can be explained by the fact that lenders are generally willing to accept a lower return on their investment when they lend money for a longer period of time.

In other words, they are willing to take on more risk in exchange for a higher return.

When the yield curve is inverted, it is often seen as a sign that lenders are concerned about the future direction of interest rates and the economy.

Inverted yield curves have preceded some of the most severe economic downturns in history, including the Great Depression and the 2008 financial crisis.

Short-Term vs. Long-Term Interest Rates

The difference between short-term and long-term interest rates is called the yield spread.

In a normal yield curve environment, the yield spread is positive, which means that long-term rates are higher than short-term rates.

In an inverted yield curve environment, the yield spread is negative, which means that short-term rates are higher than long-term rates.

The yield curve is said to be “inverted” when the yield spread is negative. In other words, when short-term rates are higher than long-term rates. An inverted yield curve is often seen as a sign of economic trouble.

Inverted Yield Curve and Recession

While an inverted yield curve is not a guarantee that a recession will occur, it is generally seen as a strong indicator that one may be on the horizon.

For this reason, investors and economists closely watch changes in the shape of the yield curve as a potential leading indicator of economic activity.

An inverted yield curve occurs when the yields on long-term debt instruments are lower than the yields on short-term debt instruments.

This is the opposite of the typical yield curve relationship, in which longer-term rates are higher than shorter-term rates.

What Causes an Inverted Yield Curve?

There are a few different factors that can cause an inverted yield curve.

One is that investors may believe that the Federal Reserve will raise interest rates in the future, which would cause short-term rates to increase relative to long-term rates.

Another possibility is that investors may be concerned about the direction of the economy and the potential for a recession.

In this case, they may be willing to accept a lower return on their investment in exchange for the safety of a longer-term investment.

Finally, it is also possible that there is simply more demand for long-term debt instruments than there is for short-term instruments.

This could be due to a variety of factors, including changes in tax policy or regulations.

What Are the Effects of an Inverted Yield Curve?

An inverted yield curve can have a number of different effects on the economy.

One is that it can make it more difficult for businesses to borrow money for expansion or investment.

This is because businesses typically borrow money for shorter periods of time than individuals, so an inverted yield curve means that they will have to pay a higher interest rate on their loans.

Another effect is that it can make it more difficult for consumers to finance large purchases, such as homes or cars.

This is because consumer loans are typically issued for longer periods of time than business loans, so an inverted yield curve means that consumers will also have to pay a higher interest rate on their loans.

Finally, an inverted yield curve can put downward pressure on stock prices.

This is because it is generally seen as a sign that the economy may be heading for a recession.

When investors are concerned about the future of the economy, they are typically less likely to invest in stocks, which can cause prices to fall.

What Should You Do If There Is an Inverted Yield Curve?

If you are concerned about the potential effects of an inverted yield curve, there are a few things you can do.

Diversification

First, you can make sure that you have a diversified portfolio that includes investments such as bonds and cash.

These investments may perform well when stock prices are falling, depending on things like inflation and other matters.

Savings rate

Second, you can consider increasing your savings rate.

This will give you a cushion to fall back on if the economy does enter a recession and your investment portfolio loses value.

Speak with financial professionals

Finally, you can speak with a financial advisor to get more information about how an inverted yield curve may impact your specific situation.

Types of Yield Curves

There are several different types of yield curves, in general:

- Normal

- Steep

- Flat

- Inverted

- Humped

The most important thing to remember about yield curves is that they can change over time.

In other words, a yield curve that is normal today could become inverted shortly.

For this reason, it’s important to stay up-to-date on economic news and developments so that you can adjust your investment portfolio as needed.

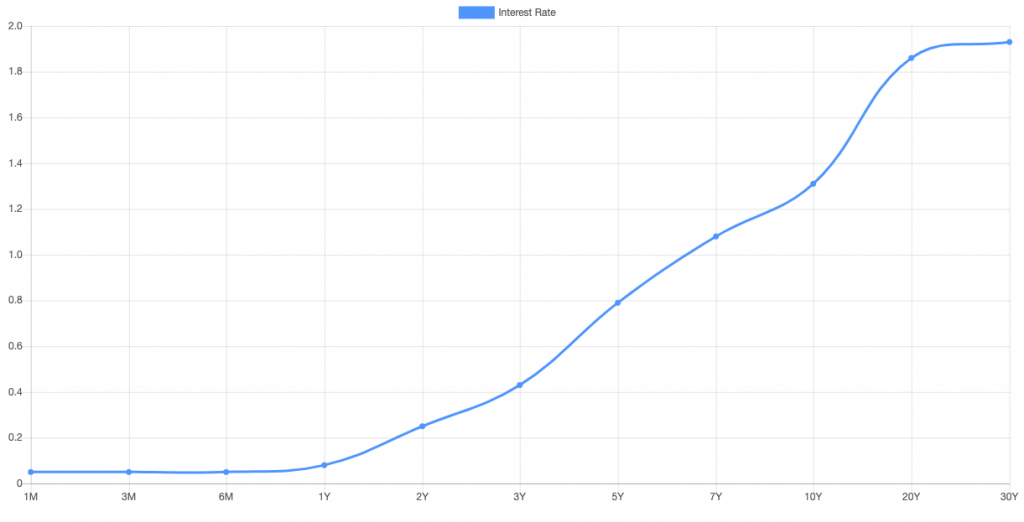

Normal Yield Curve

A normal yield curve is the most common type of yield curve.

In a normal yield curve, long-term interest rates are higher than short-term interest rates. This is because investors typically demand a higher return for investing their money for a longer period of time.

Steep Yield Curve

A steep yield curve is one in which the difference between long-term and short-term interest rates is larger than usual.

This can happen when investors are expecting the economy to grow rapidly in the future.

It is a variation of a normal yield curve.

Yield curves can also look steep in some portions and flat in others.

For example, if traders expect interest rates to remain the same for the next three years but rise after that, the yield curve would be flat at first, then steepen after that.

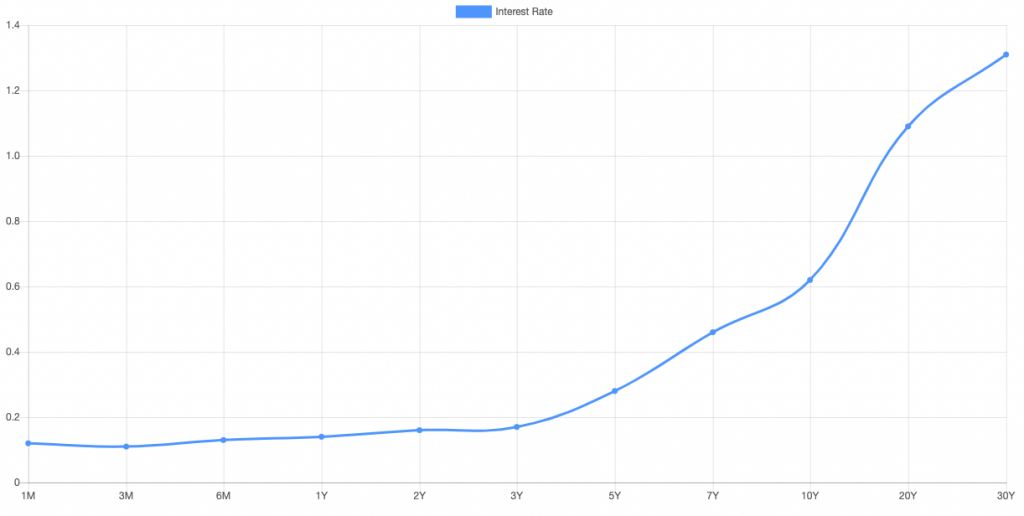

Flat Yield Curve

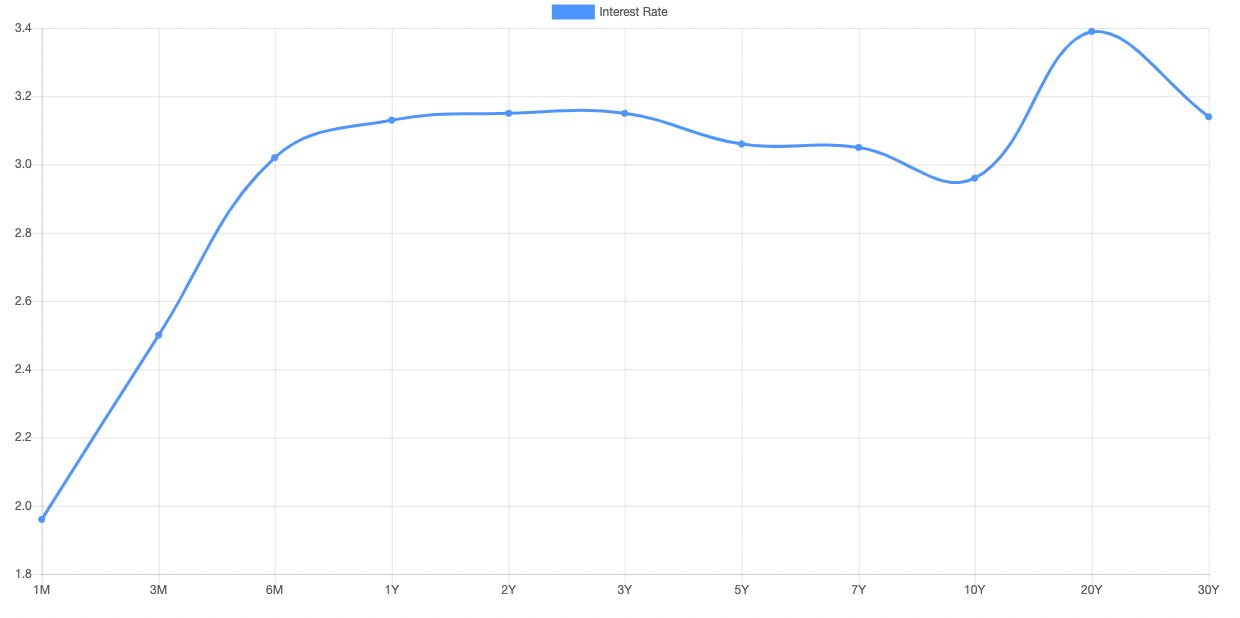

A flat yield curve is one in which long-term and short-term interest rates are similar.

This can happen when investors are unsure about the future direction of the economy.

Yield curves can look flat in certain portions of them and steeper in others.

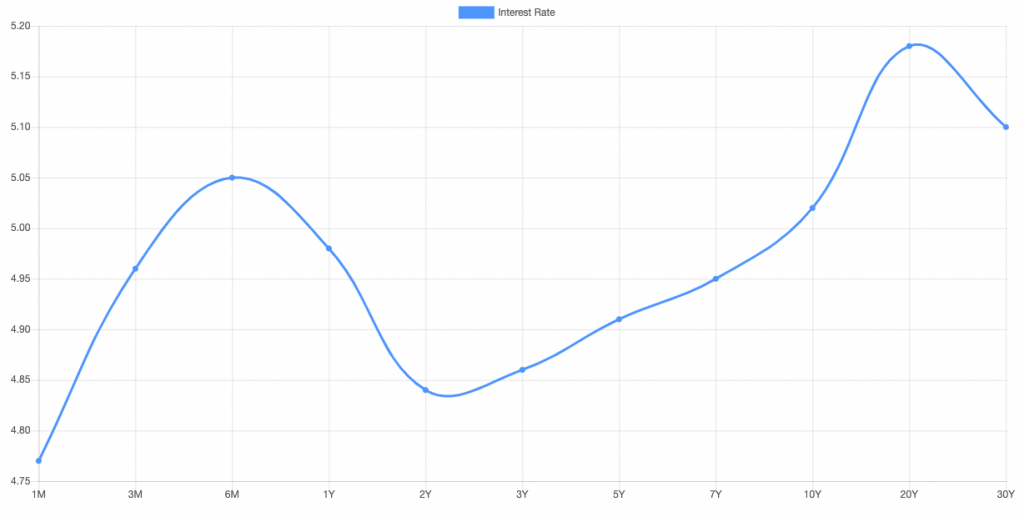

For example, the yield curve below has a spread of only 20bps between short-term interest rates and 10-year interest rates.

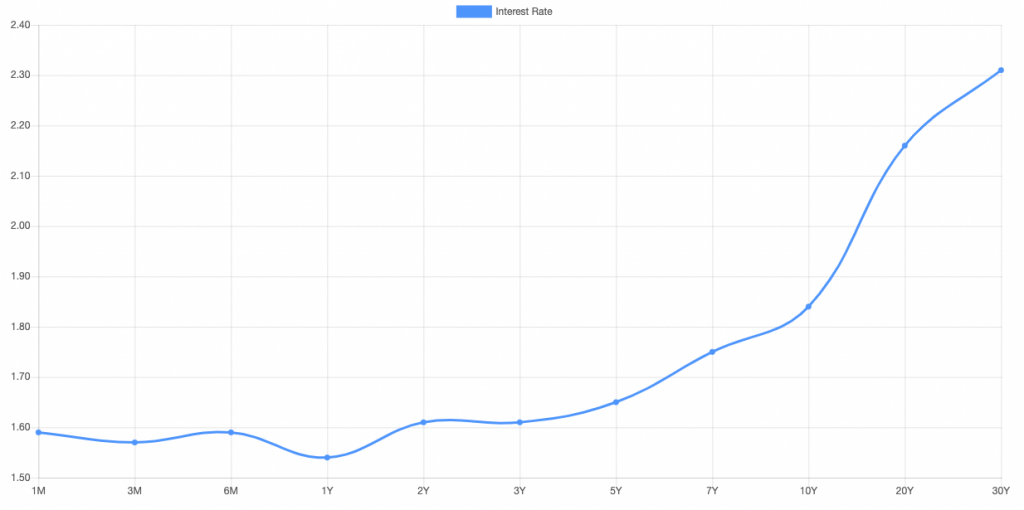

Inverted Yield Curve

An inverted yield curve is one in which short-term interest rates are higher than long-term interest rates. This happens when investors are worried about the future of the economy and believe that a recession may be coming.

Below is an example of what the yield curve looked like in July 2007, shortly before the 2008 financial crisis. Yields from six months’ maturity were above those from 1Y to 10Y maturities.

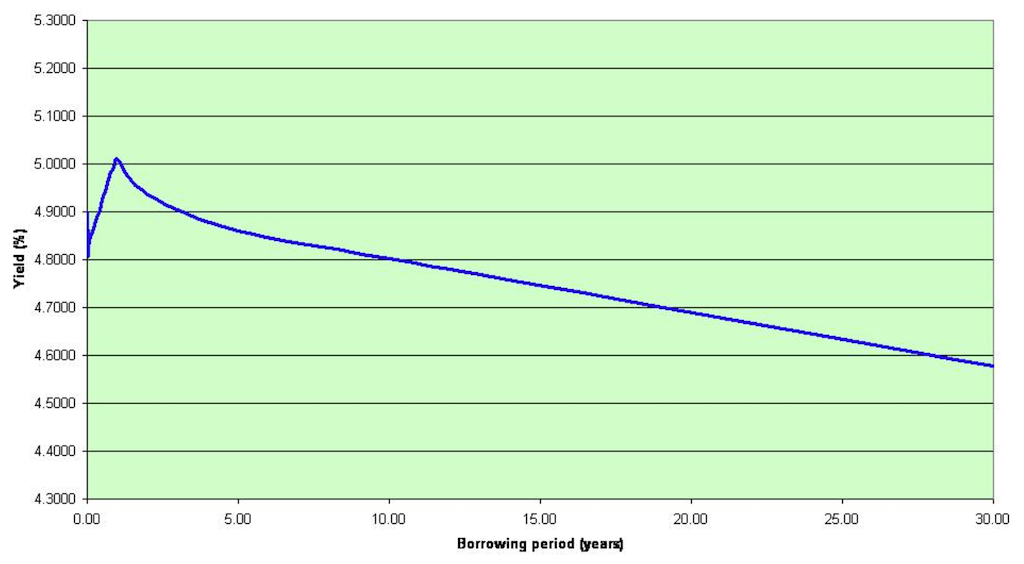

Humped yield curve

A humped yield curve is one in which long-term interest rates are higher than short-term interest rates for a period of time, but then short-term interest rates rise and exceed long-term interest rates.

This type of yield curve is rarely talked about but humped yield curves do occur with some regularity.

Humped yield curve are also sometimes called “kinked” yield curves.

Kinks describe any pattern that disrupts a yield curve from its normal upward shape.

Inverted Yield Curve Impact on Consumers

An inverted yield curve may signal that the flow of credit may be slowing, which may lower consumer sentiment and spending patterns.

In addition, an inverted yield curve may increase borrowing costs for consumers.

This is because when short-term interest rates are higher than long-term interest rates, it becomes more expensive to borrow money for a long period of time.

As a result, consumers may cut back on their spending in order to save money.

Inverted Yield Curve Impact on Businesses

An inverted yield curve may also signal that businesses will start to cut back on their investment and expansion plans.

This is because businesses rely on borrowing to finance their expansion plans. When borrowing costs increase, it becomes more expensive for businesses to expand. As a result, businesses may start to see a slowdown in their growth.

In addition, an inverted yield curve may also lead to layoffs and job cuts as businesses try to save money.

This can further reduce consumer spending, which can have a negative impact on the economy.

Inverted Yield Curve and the Labor Market

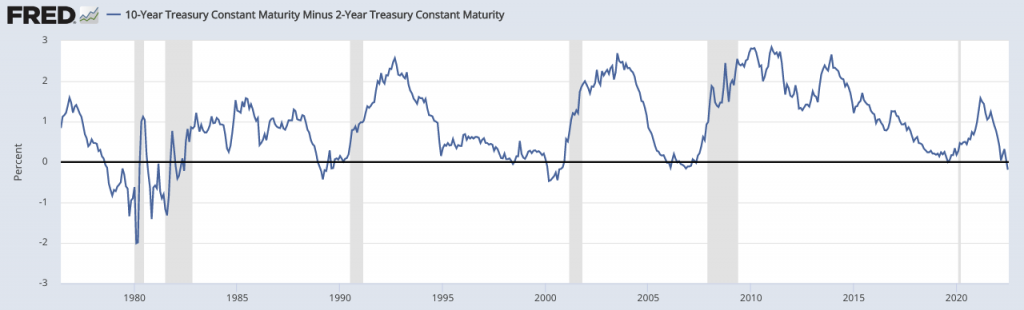

The labor market is a lagging indicator of a recession while an inverted yield curve is taken as a leading indicator.

This is because an inverted yield curve is a financial economy signal while the labor market is a real economy factor.

The financial economy leads the real economy. This is why an inverted yield curve is considered a leading indicator of a recession while the labor market is only a lagging indicator.

The inversion of the yield curve has been a reliable predictor of past recessions, indicating that traders and investors believe that the economy will deteriorate in the future and are therefore demanding a higher return on their investment, causing prices to often fall and dim the outlook for the real economy.

An inverted yield curve signals that the market expects economic growth to slow in the future, which leads to lower corporate profits and fewer job opportunities. This ultimately results in higher unemployment.

The relationship between an inverted yield curve and the labor market can be seen in the following diagram:

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

(Source: Federal Reserve Bank of St. Louis)

We can see unemployment typically peaking early in the next expansion while the yield curve inversion happens before the recession itself.

Inverted Yield Curve Impact on Fixed-Income Investors

An inverted yield curve can have a negative impact on fixed-income investors.

This is because when interest rates decline, the value of bonds increases.

However, when interest rates rise, the value of bonds declines. As a result, an inverted yield curve may lead to losses for investors who are holding bonds, but it also depends on the type and the strategy.

An inverted yield curve simply entails a relative shift in interest rates, which impacts different tenors in various ways.

In addition, an inverted yield curve may also lead to higher borrowing costs for fixed-income investors.

This is because when short-term interest rates are higher than long-term interest rates, it becomes more expensive to borrow money. As a result, fixed-income investors may start to see their investment returns decline.

The “borrow short to lend long” strategy no longer works in this case.

For example, if one can borrow cash at two percent and invest it in a four percent returning bond, this represents a two percent spread. But this goes away when the yield curve inverts and there is no spread left to capture.

It increases the appeal of cash as an investment relative to other assets.

Inverted Yield Curve Impact on Equity Investors

An inverted yield curve may also have a negative impact on equity investors.

This is because when the economy starts to slow down, businesses may start to see a decline in their profits.

As a result, the value of stocks may start to decline. In addition, an inverted yield curve may lead to higher borrowing costs for businesses, which can further reduce profits and cause the value of stocks to decline.

The carry trade becomes less attractive.

What Economic Theories Are Used to Describe the Yield Curve?

Two economic theories have been used to explain the shape of the yield curve:

- the pure expectations theory and

- the liquidity preference theory

Pure expectations theory

The pure expectations theory states that the shape of the yield curve is determined by market participants’ expectations about future interest rates.

If market participants expect interest rates to rise in the future, they will demand a higher return on their investment today.

As a result, long-term interest rates will be higher than short-term interest rates.

Conversely, if market participants expect interest rates to fall in the future, they will be willing to accept a lower return on their investment today.

As a result, short-term interest rates will be higher than long-term interest rates.

Liquidity preference theory

The liquidity preference theory states that the shape of the yield curve is determined by the demand for money.

The demand for money is related to the interest rates that people are willing to accept when they lend or borrow money.

The theory states that people have a preference for holding their wealth in the form of cash, and that this preference increases as the interest rate increases.

The liquidity preference theory was first proposed by John Maynard Keynes in his book The General Theory of Employment, Interest and Money in February 1936.

Keynes argued that the demand for money is not just a function of the interest rate, but also of the level of economic activity.

When economic activity is high, people are more likely to spend their money rather than hold it as cash. This means that they are willing to accept lower interest rates when they lend money, and that the demand for money is higher at high levels of economic activity.

The liquidity preference theory has been used to explain the shape of the yield curve, and it has also been used to predict changes in interest rates.

It remains an important part of macroeconomic theory.

What’s the Difference Between Interest Rates and Bond Yields?

When it comes to bonds, there are a lot of different terms that get thrown around.

Two of the most important (and often confused) terms are interest rates and bond yields. Here’s a quick rundown of the difference between the two:

Interest Rates

Interest rates refer to the cost of borrowing money.

When you take out a loan, the interest rate is the percentage of the loan that you will have to pay back in addition to the principal.

For example, if you take out a $100 loan with an interest rate of 5 percent, you will owe $105 ($100 + $5 interest) when the loan is due.

Bond Yields

Bond yields, on the other hand, refer to the return that investors earn on their bonds.

When you buy a bond, you are lending money to the issuer (usually a government or corporation) and they agree to pay you back the principal plus interest at a later date.

The interest payments are known as the bond’s coupon rate.

The yield of a bond is determined by its coupon rate and the current market conditions.

If market interest rates rise, the price of existing bonds will fall and the yield will increase. Conversely, if market rates fall, bond prices will rise and yields will decrease.

So, to sum it up: Interest rates refer to the cost of borrowing money, while bond yields refer to the return that investors earn on their bonds.

Inverted Yield Curve – FAQs

What Is a Yield Curve?

A yield curve is a graphical representation of the relationship between interest rates and maturity dates.

The x-axis represents maturity dates, while the y-axis represents interest rates.

What Is an Inverted Yield Curve?

An inverted yield curve is a type of yield curve in which short-term interest rates are higher than long-term interest rates.

This happens when investors are worried about the future of the economy and believe that a recession may be coming.

What Does an Inverted Yield Curve Mean for the Economy?

An inverted yield curve is often seen as a sign that the economy may be heading for a recession.

This is because when investors are worried about the future of the economy, they tend to invest more in short-term investments.

This drives up the demand for short-term investments and causes interest rates to increase.

How Does an Inverted Yield Curve Impact Consumers?

An inverted yield curve may signal that the flow of credit may be slowing, which may lower consumer sentiment and hamper spending in the economy.

In addition, an inverted yield curve may increase borrowing costs for consumers.

This is because when short-term interest rates are higher than long-term interest rates, it becomes more expensive to borrow money for a long period of time.

As a result, consumers may cut back on their spending, especially discretionary spending, in order to save money.

How Does an Inverted Yield Curve Impact Businesses?

An inverted yield curve may also signal that businesses are about to become less profitable.

That’s because when short-term rates exceed long-term rates, it becomes more expensive for businesses to borrow money for expansion.

As a result, they may cut back on hiring and investment. This can lead to weaker economic growth and even an economic recession.

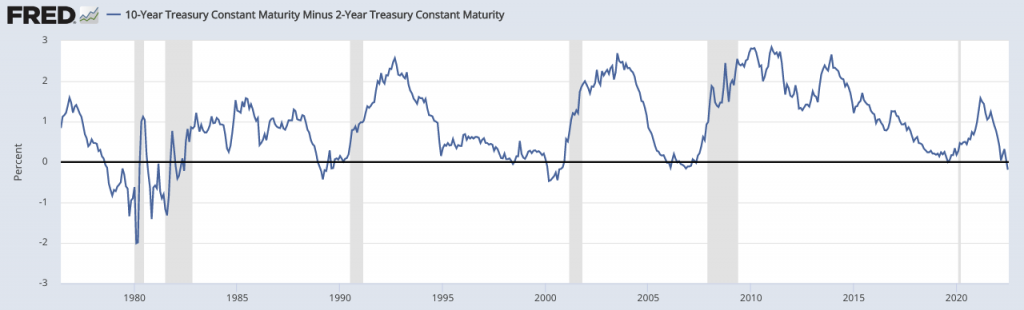

Why Is the 10-Year to 2-Year Spread Important?

The 10-year to 2-year spread is important because it is one of the most closely watched indicators of economic activity.

Inverted yield curves have preceded some of the most severe economic downturns in history, including the Great Depression and the 2008 financial crisis.

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

(Source: Federal Reserve Bank of St. Louis)

What Can an Inverted Yield Curve Tell an Investor?

An inverted yield curve can signal that the economy may be heading for a recession.

In addition, an inverted yield curve may impact the financial markets in a number of ways.

For example, it may cause stock prices to fall and bond prices to rise (or fall, depending on the type).

In addition, an inverted yield curve may cause the value of the dollar to rise relative to other currencies as global economic activity slows, creating a shortfall of dollars and a supply-driven rise in the dollar’s value.

What Should Investors Do When There Is an Inverted Yield Curve?

When there is an inverted yield curve, investors should closely monitor their investments and be prepared to make changes if necessary.

In addition, investors should keep a close eye on economic indicators such as employment data and retail sales.

If these indicators start to weaken, it could be a sign that the economy is heading for a recession.

What Are the Risks of an Inverted Yield Curve?

An inverted yield curve can signal that the economy may be headed for a recession.

In addition, an inverted yield curve may impact the financial markets in a number of ways.

For example, it may cause stock prices to fall and investors might want bonds and cash instead.

The dollar might rise and emerging market currencies might struggle.

As a result, many traders and investors may experience losses on their investments.

Does an Inverted Yield Curve Predict Recession?

An inverted yield curve is often seen as a leading indicator of a recession.

This is because an inverted yield curve typically occurs when investors are worried about the future of the economy. Inverted yield curves have preceded every recession since 1950 in the US.

However, it’s important to note that an inverted yield curve is not a guarantee that a recession will occur.

There have been times when an inverted yield curve has not been followed by a recession.

What to Do If There Is an Inverted Yield Curve?

If you’re worried about an inverted yield curve, there are a few things you can do to prepare.

First, make sure you have an emergency fund in place. This will help you cover unexpected expenses if the economy slows down and you lose your job.

Second, consider paying off any high-interest debt that you have. This will help reduce your monthly expenses if the economy weakens and your income decreases.

Finally, consider investing in assets that may perform well during economic downturns and having a more balanced portfolio. This will help protect your portfolio from losses if the stock market falls.

Should Long-Term Investors Care About an Inverted Yield Curve?

Many would argue that long-term investors shouldn’t care about the yield curve as they aren’t trying to actively trade the markets and make tactical decisions about stages of the business cycle.

It is important, however, to have a basic understanding of the yield curve and what an inverted yield curve may signal about the future.

An inverted yield curve has been a reliable predictor of past recessions, so it’s definitely something that long-term investors should be aware of.

Summary – Inverted Yield Curve

The yield curve is simply a graphical representation of yields across different maturities for fixed-income securities.

The most commonly used measure is the difference between the yields on 10-year and 2-year US Treasury bonds, which is referred to as the “2s10s spread.”

When this spread is positive, it is considered “normal” and indicates that investors expect economic growth and higher inflation in the future.

An inverted yield curve occurs when the 2s10s spread turns negative, meaning that investors believe that economic growth will slow in the future and inflation will fall.

Others may also check indicators such as the 3-month/3-year spread as a closer indication of what the market expects in the short term.

An inverted yield curve is often a sign that the Federal Reserve is worried about inflation and is trying to keep it under control by raising interest rates.

When the Fed raises rates, it makes borrowing more expensive for businesses and consumers. This can slow down the economy and eventually lead to job losses.

Inverted yield curves have preceded each of the last seven recessions, so they are taken very seriously by economists and investors. Sometimes yield curves will invert more than once during each business cycle.

However, it’s important to remember that an inverted yield curve is not a surefire predictor of a recession. There have been times when an inverted yield curve has not been followed by a recession.

If you are concerned about the potential effects of an inverted yield curve, there are a few things you can do to protect yourself.

First, make sure that you have a diversified portfolio that includes investments such as some bonds and cash. Second, consider increasing your savings rate, if possible.

If you’re worried about how an inverted yield curve may impact your business, it’s important to stay up-to-date on economic news and talk to your financial advisor.

They can help you develop a plan to weather any potential economic downturn.

Related

- What Determines Bond Yields?

- What To Do About Zero Percent Bond Yields?

- How Interest Rates Impact Banks

- Where Are the ‘Bond Vigilantes’?

- Business Cycle & Its Impact on Financial Markets

- Yield Curve Control (YCC) & Its Implications

- QE and the Impact on Yields