Binary Options Day Trading

Binary options trading hinges on a simple question: will an asset’s price be above or below a certain level at a specific time? Binaries are one of the simplest instruments to trade, but how exactly do they work, and what are their pros and cons? This guide to binary options day trading for beginners covers all the basics.

Quick Introduction

- Binary options are derivatives where you make a bet on the price movement of an underlying asset without taking ownership of it.

- A correct prediction will see you win a fixed payout, typically a percentage of your investment. An incorrect prediction will see you lose your stake.

- Binary options brokers offer trading on a range of underlying assets, from stocks and forex to commodities and cryptocurrencies.

- Binaries are particularly popular with short-term traders, with contract timeframes starting from just a few seconds through to minutes, hours, days and even weeks.

- A robust trading strategy and a sensible approach to risk management are essential to have a successful binary options trading experience.

Top 4 Binary Options Brokers

These are the top 4 binary options brokers according to our latest tests:

Download DayTrading.com’s Binary Options Trading For Beginners PDF.

What Are Binary Options?

Binary options are derivatives that can be traded on almost any market. They are popular because they are straightforward – you know precisely how much you could win, or lose, before you make the trade. This is why they are also known as ‘all or nothing’ trades.

Binary or ‘digital’ options have existed for decades as institutional products. In 2008, the US SEC approved exchange-traded binary options on US options exchanges such as NYSE American and CBOE. Separately, in 2009, Nadex, a US exchange regulated by the CFTC, launched its own range of exchange-traded binary options.

How Do Binary Options Work?

To understand how a binary options trade works in practice, let’s look at an example:

Will Tesla’s stock price, currently valued at $200, increase or decrease in the next two hours?

You stake $200 that it will, and your broker offers a payout of 75%.

Two hours pass, and Tesla’s share price is now valued at $205.

As a result, your trade finishes ‘in the money’ and the broker pays you $350 ($200 stake + $150 payout ($200 * 0.75)).

If Tesla’s stock price had fallen by the two-hour mark, your bet would have finished ‘out of the money’, and you would have lost your $200 stake.

Contract Components

It’s important to understand the key variables within a binary contract:

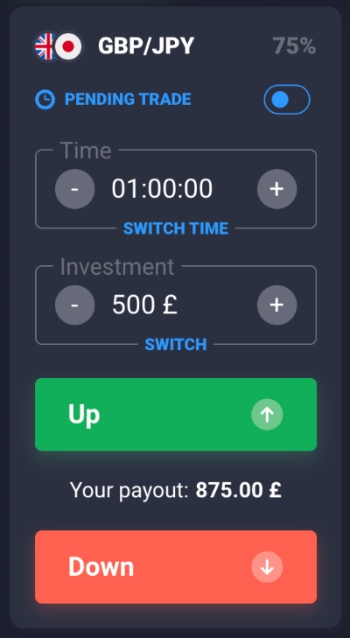

- Asset – This is the market you will be speculating on. The best binary options brokers offer opportunities on stocks and shares, major, minor and exotic currency pairs, metals like gold and silver, energies such as oil and gas, plus cryptocurrencies including Bitcoin. In the example below, GBP/JPY is the underlying asset.

- Expiry time – This is the length of time the contract will be open. The top platforms offer a range of expiries, from turbos that span a matter of seconds, to 1-minute, 2-minute, 5-minute, and 30-minute contracts, plus longer binaries of 1-hour, 4-hour, several hours, days, weeks, and even months. In the example below, the expiry time is set to 5 minutes.

- Stake – This is the amount you wish to bet on the trade. In the example below, £500 is the investment amount. Remember, if the trade moves against you, you will lose the entire amount.

- Payout – This is how much you stand to win or lose depending on the outcome. This is normally a percentage of the staked amount. In the example below, the platform is offering a 75% return on this trade, so the potential payout is £875 (£500 + £375).

- Strike price – This is the price the asset must be above or below to finish ‘in the money’ and win the pre-agreed payout. Note, instead of a strike price, some beginner-friendly binary options platforms simply ask you to decide whether the value of an asset will increase or decrease beyond the existing price, as shown in the example below via the ‘up’ and ‘down’ buttons.

Option Types

There are several different option types to choose from. These are the most popular:

- Up/Down (High/Low) – The simplest binary option. Will the price be higher or lower than the current price when the expiry time comes? High/low trades are the most common type of binary contract available from our platform evaluations.

- In/Out (Range or Boundary) – A ‘high’ and ‘low’ figure will be set. You are then making a determination as to whether the price will finish within or outside of these boundaries. These types of binaries are no longer widely available on platforms from our tests.

- Touch/No Touch – Levels will be set that are either higher or lower than the current price. You then enter a position as to whether the price will ‘touch’ these levels between the time of trade and expiry. Payout will come as soon as the touch takes place.

- Ladder – These are similar to up/down trades. However, instead of using the current price, the ladder will have pre-determined levels that are staggered up or down. These normally demand a substantial price move. The flip side of this is returns will frequently exceed 100%. Although it is worth noting, both sides of a trade are not always available.

How Much Can You Win?

There are two key binary options pricing structures to get your head around:

Fixed Payout

The percentage payout for a digital options contract will depend on three key factors: the asset (and its volatility), the length of the contract, and the broker in question.

Payouts usually vary between 75% and 95% of the initial capital staked. The moment you open the contract, the payout will be fixed.

For example, imagine that a contract has a payout of 88% and you decide to invest $1000. If you win, you will receive your initial investment back, plus the 88% payout. Therefore, your net profit is: $1000 * 0.88 = $880.

However if your prediction is incorrect, you will lose your initial investment, so you will be down -$1000.

This is the straightforward binary options pricing model found at most top brokers.

$0 To $100

Binary options trades on certain US-regulated exchanges, plus some other platforms, often expire with a worth of $0 or $100. This means that your potential profit will always be $100 minus your initial investment, while your potential loss will be your original investment.

The initial price of your investment is dependent on the volatility of the underlying asset and the length of the contract.

Some platforms also gives users the option to exit a contract early. You can do this by closing your position at the current market price. Essentially, the price of the contract will vary over time. This is because the closer you are to the expiry time, the more information you will have, and thus you will be more likely to predict the outcome of the contract.

If the contract looks likely to win, then the price of the contract will rise (compared to the initial investment). If the opposite were to occur, a losing contract’s price would fall. Your profit or loss from exiting early would be the difference between the current market price and your original investment (minus any fees).

Is Trading Binary Options Legal?

The legal status of binary options is highly jurisdiction-specific, so always check the current rules from your local regulator before trading.

For example, in Australia, ASIC has banned the issue and distribution of binary options to retail clients until at least 1 October 2031, while in the UK, there has been a permanent ban to retail consumers since 2019. ESMA also introduced an EU-wide ban to retail clients from July 2018.

Despite this, many traders opt for offshore binary options brokers, though this comes with the added risk of little to no regulatory protection, dishonest marketing and fraudulent schemes, as highlighted in the CFTC and SEC’s investor alert of binary options fraud.

Banc de Binary is a prime example of a scam brokerage. The firm did not gain the relevant licensing needed to trade in the US, meaning many aspiring binary traders were left with no financial protection. In 2016, the company agreed to pay $11 million to settle charges brought against it by the SEC and CFTC.

Pros & Cons Of Trading Binary Options

Pros

- Simplicity – Because you are determining only one factor, direction, your bet is straightforward. The price can only go up or down. You also don’t need to concern yourself with when the trade will end; the expiry time takes care of that. Whereas in other markets, you may need a system to limit your losses, such as a stop-loss.

- Fixed risk – Trade stocks, gold, and crude oil, and you’ve got a vast number of factors to contend with, from slippage and margin to news events and price re-quotes. With binaries, your maximum loss per trade is known in advance. Regulators have reported similar outcomes in real-world data; for example, ASIC found that around 80% of retail clients lost money trading binary options.

- Trade control – Because you know what you may make or lose before you enter the trade, you have greater control from the start. Trade in stocks, for example, and you have no guarantee that your trade will make the entry price.

- Profit potential – Compared to other trading, the returns in binaries are attractive. Some brokerages promise payouts of over 90% on a single trade.

- Choice – Rather than being constrained to a specific market, such as cryptocurrencies or stocks, binary options allow traders to trade across virtually all markets.

Cons

- Reduced trading odds – Whilst you can benefit from trades that offer in excess of 80% payouts, these are often when the expiry date is some time away from the trade date. If the odds of your binary trade succeeding are very high, you may have to make do with reduced payout odds.

- Limited trading tools – Whilst most brokerages offer advanced charting and analysis capabilities, trading tools for binary traders often fall short of the mark. Fortunately, there are other online sources for these graphs and tools, plus brokers are working to increase their offerings.

- Price of losing – Your odds are tilted in favor of losing trades. Approximately, for every 70% profit, the corresponding loss of the same trade would result in an 85% loss. This means you need a win percentage of at least 55% to break even.

- Position sizing – Unlike some stock brokers that let you trade very small position sizes via micro-lots, many binary options traders choose relatively large stakes per trade compared to their account size. For example, if you have $250 and keep risking $50–$100 per trade (20–40% of your balance), just a handful of losing trades can wipe you out. Sensible position sizing (for example, risking only a small percentage of your capital per trade) is critical.

Getting Started

Starting to trade binary options is fairly straightforward:

Step 1 – Find a broker

This is one of the most important decisions you will make. You need a top binary options platform that meets all your requirements and that will enhance your trade performance.

Importantly, there is no universal best broker; it depends on your individual needs. Some firms offer minimum trades of just $10, whilst others require hundreds or even thousands. The solution is to do your homework first.

Step 2 – Choose A Market

You can trade binaries in pretty much everything, including stocks, forex, indices, and commodities. You can bet on anything from the price of natural gas to the stock price of Google.

Opt for an asset you have a good understanding of that offers promising returns.

Step 3 – Decide On An Expiry Time

As a short-term trader, you’ll probably be more interested in 30-second, 1-minute and end-of-day expiry times. You need to balance binary options trading volume with price movement.

Whilst the more trades you make means greater profit potential, it’s better to make fewer and more accurate trades. Also, find a time that complements your trading style.

Step 4 – Decide On Size

In the binary options game, size does matter. The greater your investment, the greater the possible profit.

On the flip side, remember the entirety of your investment is on the line. You need an effective money management system that will enable you to make sufficient trades whilst still protecting you from blowing all your capital.

Step 5 – Choose An Option

You will have any number of the options outlined above to choose from. Think carefully about how confident you are in your determination.

Consider factors that will jeopardise your investment, and select an option that gives you the best chance of succeeding. Don’t automatically select a ladder trade because you want huge returns, consider which options are the safer bets.

Once you’ve made that decision, check and confirm your trade. Then you can sit back and wait for the trade payout.

Demo Video

Below is a video explaining how to trade binary options on the platform of a leading provider:

Strategies

There are two reasons you must have a binary options trading strategy:

- A strategy prevents emotions from interfering with trade decisions. Fear, greed, and ambition can all lead to errors. A strategy allows you to focus on the maths and data.

- A strategy allows you to repeat profitable trade decisions. Once you’ve found out how and why that trade worked, you can replicate it to try and create consistent profits.

There are two crucial elements to your trading method: creating a signal and deciding how much to trade. The second is essentially money management.

Many binary option strategies also fail to sufficiently consider time variables. Certain strategies will perform better with specific time options.

You may want to look specifically for a 60-second binary strategy. Alternatively, trading 15-minute binary options may better suit your needs. So, whichever strategy above you opt for, ensure you take time into account.

Once you have honed a strategy that turns you profits, you may want to consider using an automated system to apply it. These robots usually rely on signals and algorithms that can be pre-programmed.

Education

Binary options trading 101 – immerse yourself in educational resources. As Benjamin Franklin asserted, ‘an investment in knowledge pays the best interest’. The top traders never stop learning. The markets change, and you need to change along with them.

To do that, utilize some of the resources detailed below.

- Books & eBooks – There is a whole host of books and ebooks out there that can impart invaluable information on day trading binary options. You can benefit from the knowledge of experts with decades of experience. The good thing about a book is that it allows you to learn at a pace that suits you.

- Video tutorials & seminars – Engaging and easy to follow. There are numerous online video tutorials out there that can walk you through making a trade. With seminars, you’ll also be able to have questions answered, and the binary options trading basics explained, plus some brokers offer weekly seminars to keep you up to date with market developments.

- Courses – There are also binary options courses available without an investment. Alternatively, paid services are available.

- PDFs & instruction guides – These will give you a clear breakdown of steps that you can follow and apply. The best part is that you can find plenty online that are totally free and easy to download, whether you’re using Android, Windows, or iOS.

- Forums & chat rooms – This is the perfect place to brainstorm ideas with gurus. You can benefit from recommendations and learn in real-time whilst investing in your binary options. You can also swap live chart screen grabs to get a feel for other methods and tactics.

- Newsletters & blogs – These are brilliant for keeping up to date with upcoming developments that may affect your markets. Plus, you could hear about binary options competitions (yes, they really do exist).

Tips

Journal

A trading journal with a detailed record of each trade, date, and price will help you hone your strategy and potentially increase future profits.

Whether you keep it as an Excel document or use tailor-made software, it could help you avoid future dangers. As a bonus, it can make filing tax returns easier at the end of the year.

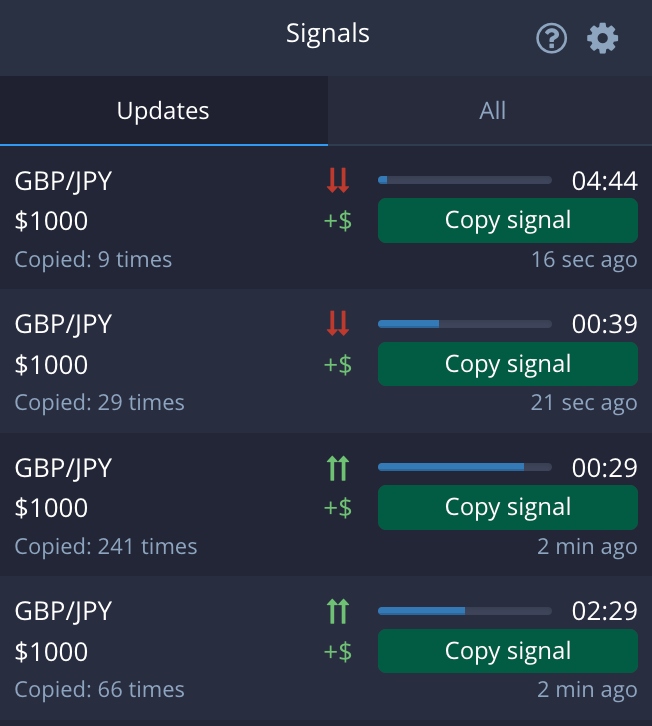

Copy Trading

Copy trading tools may be useful for beginners, with brands such as ZuluTrade establishing a name for themselves in the auto-trading market. Pocket Option, IQCent, and RaceOption all offer their own binary options copy trading tools.

Copy trading platforms essentially let you automatically mirror the trades of other traders. They can be an effective way to learn from others, as long as you keep in mind that it may not be professional traders that you are copying.

The top platforms offer performance stats and metrics so novice investors can find the right master trader for their goals and risk tolerance.

Taxes

Tax treatment of binary options is nuanced and has evolved depending on jurisdiction.

For example, in the US, the IRS sets out the tax treatment of investment income, including options, in Publication 550 on investment income and expenses.

Historically in the UK, some binary products were treated like gambling and profits were often not taxed for casual punters. Since 2018, many binary options have been brought under the financial-instrument regime, and taxes can depend on the product structure and whether HMRC sees your activity as investment, speculation or a trade.

There is no guaranteed tax-free treatment; you should get advice from a qualified tax professional in your jurisdiction.

Alternatives To Binary Options

Binary options aren’t for everyone. Other online trading products may be a better fit depending on your preferences, risk appetite and approach.

Below we’ve compared some alternatives to binaries. You’ll see some of these are markets that can be traded with binary contracts, such as stocks and crypto, but they can also be traded directly or via other vehicles.

| Instrument | How it differs from binary options | Why traders may use it instead |

|---|---|---|

| CFDs | Trade price movement with leverage; profit/loss varies by how far price moves (not fixed win/lose). Losses can exceed deposit. | More markets + position control (stop-loss/take profit/trailing); can scale risk/reward instead of fixed payouts. |

| Vanilla Options | Contract gives a right (buy/sell) at a strike; outcomes aren’t fixed – value depends on price, time and volatility. | Many strategies (hedging, spreads, covered calls); buyers have defined max loss (premium) with uncapped upside. |

| Futures | Standardised contracts to buy/sell later; P/L moves tick-by-tick and positions are margined. | Deep liquidity in key markets; useful for short-term speculation and hedging exposures. |

| Stock Trading | You own shares/ETFs (spot investing), rather than a fixed-time bet. | Long-term investing, dividends, and holding without expiry; generally simpler and often more regulated/protected. |

| Cryptocurrency (spot) | You own tokens; no expiry and no fixed payout – returns depend on market move. | Access to a newer/volatile asset class; additional uses like staking/participation (with platform/coin risks). |

| Spread Betting | Bet per “point” of movement; P/L depends on movement size (not fixed). Often CFD-like but region-specific. | Simple execution with leverage; in some places can have favorable tax treatment (jurisdiction-dependent). |

Can You Hedge With Binary Options?

Yes, binary options can be used as a hedge, but it’s a pretty blunt tool rather than a precise one. Because binaries often have a fixed payout and are all-or-nothing at expiry, they don’t offset losses smoothly the way vanilla options or futures often can. They can reduce worst-case outcomes in specific scenarios, but the insurance is easy to mis-price and can drag on returns.

How it can be done:

- Two-binary overlap hedge (range/boundary-style): open a call and a put on the same market/expiry with different strikes so there’s a middle zone where both can finish in-the-money, and outside that zone only one side pays – reducing (not eliminating) the chance of a full loss.

- Mix contract types (e.g., touch + low/high): combine binaries so one leg pays if a level is hit while the other pays if price ends on a side of a strike – again aiming to soften losses.

- Binary + underlying position: use a put-style binary around your entry/stop zone so a sharp adverse move triggers a fixed payout that partially offsets the spot loss.

Why it often doesn’t work well:

- Step-function payoff: the hedge only pays if the specific condition is met by expiry, so small timing/price differences can make it fail.

- Pricing and payout challenges: buying both sides typically sacrifices upside; fees and payout asymmetry can turn the hedge into a guaranteed drag.

- Platform risk matters: in the US, binaries should be traded on regulated exchanges – unregistered/offshore venues add fraud/withdrawal risk that can negate any hedging benefit.

Can Trading Binary Options Make You Rich?

In theory, yes, it can, like any type of trading, but in reality, it takes a lot of skill and luck.

Trading binary options can be profitable, but to get there, you’ll need the right broker, an effective strategy, and solid trading education, for example, by reading the resources we offer here. Starting small and making sure you can be profitable at all is a good first step and test of your abilities.

Make sure not to trust any broker or person who guarantees quick profits if you only deposit more money. There is no such thing as guaranteed profits in any financial market. There are many examples of scam brokers that exploit people who mistakenly think there is such a thing as “easy money”. Make sure you’re not their next victim.

FAQ

Are Binary Options Safe For Beginners?

As with all forms of online trading, you may lose money with binary options, especially if you are a beginner who doesn’t yet have a proven strategy. As such, never risk more than you can afford to lose.

How Long Does It Take To Get Good At Binary Options Trading?

There is no set time limit to master the fundamentals of binaries. For beginners, it’s all about research, practice, and patience. Spend time trading binaries in a demo profile until you feel comfortable risking real funds.

Is Trading Binary Options A Good Idea?

As binary options trading involves answering a straightforward yes/no question, some believe it is a simple trading product for beginners. And as traders never own the underlying asset, such as gold or bitcoin, binaries can be an attractive opportunity for new investors.

However, it’s important to have a robust strategy and take a sensible approach to risk management to prevent excessive losses.

Is It Possible To Become A Millionaire Trading Binary Options?

Possible, yes. Likely, no. There’s no guarantee you’ll ever become a millionaire through binary options regardless of how long you spend trading – most people don’t, and a review by the Australian Securities and Investments Commission found that as many as 80% of binary traders lost money. To become profitable, you need to be disciplined, focused on risk and wallet management, and have a strategy that gives you an edge.

Are Binary Options Banned In Europe?

In the EU/EEA, the marketing, distribution and sale of binary options to retail clients has been effectively banned by ESMA’s intervention and subsequent national measures. Brokers not regulated in Europe may still offer binaries to EU clients, though these are typically not authorized and will leave you without regulatory protections.

It is also possible for EU traders to be re-classified as professional traders under strict MiFID II criteria, which takes them outside of retail-focused bans. However, reclassification requires objective tests, and many firms may not offer binaries even to professional clients.

Does Binary Options Arbitrage Work?

Binary options arbitrage is the idea that you can lock in a risk-free profit by exploiting pricing or payout differences on the same binary outcome. For example, one broker might offer a higher payout on a “call” outcome, while another offers a comparatively generous payout on the opposite “put.” In theory, a trader splits their stake across both sides so that one trade must finish in the money, and the combined payouts exceed the total amount risked.

Another variation focuses on price discrepancies rather than payouts. If one platform implies a higher probability for an outcome than another, the trader attempts to buy low on one and hedge on the other. Because binaries settle at either full value or zero, the maths looks neat on paper.

The problem is that this idea borrows heavily from traditional arbitrage in stocks, futures, or foreign exchange. Markets where pricing is transparent, execution is fast, and rules are consistent across venues. But binary options don’t behave like that in practice. Binary trades are often confirmed sequentially, not simultaneously. Even small delays between clicking two opposing trades can leave you exposed on one side, especially on very short expiries. By the time the second trade is placed, pricing or payouts may have already changed.

Finally, some platforms actively monitor behavior. Repeated opposing trades on the same asset, especially across short expiries, may trigger restrictions, re-quotes, or outright blocks.

Can You Short Assets With Binary Options?

Yes, shorting with binary options involves taking out a contract where you turn a profit if the price of a particular asset, such as Bitcoin, falls. This can be done by pressing the down/put or similar buttons on most platforms we’ve used. However, the risks remain the same as going long – you could lose your stake if the price of the asset doesn’t fall at expiry.

Additional Reading

If you want to learn much more about binary options, head over to our favorite site on the subject – BinaryOptions.net – one of the more established education sites dedicated to binary options.