Can You Trade Binary Options With No KYC Verification?

When trading binary options, some investors want to start trading on a new platform immediately or to do so without turning over their personal data to unregulated brokers. A binary broker with no know-your-customer (KYC) and verification requirements can be appealing to these traders, though these are high-risk options and should be treated with caution.

We explain the ways it can be possible to trade binary options with no KYC checks. We also unpack the identity checking process and run through why, for good reason, it is normally compulsory.

Binary Options Brokers With No KYC

Note these brokers may not be authorized in your country. Opening an account could see you forego local regulatory protections.

Are KYC Checks Needed For Binary Trading?

KYC checks are standard when trading binary options. KYC stands for know-your-customer or know-your-client, and is often a regulatory requirement for a broker to verify their customers’ identities.

Companies typically require copies of documents such as driving licences, passports or ID cards to ensure that a registered trader is who they say they are.

Some firms also ask for proof of funds, using information such as bank statements or tax returns to ensure traders can prove where their funds are coming from.

Why Are KYC Checks Needed?

Brokers are normally required by local compliance laws to verify the identity of their traders. This form of customer due diligence is to prevent fraud and to exclude wanted or financially sanctioned persons. These checks are usually more stringent for regulated firms, with more documents needed for KYC approval.

Binary options brokers are also encouraged to comply with international AML (anti-money laundering) rules. This is to prevent the proceeds of crime or terrorism from being laundered into “clean” funds.

Is It Possible To Trade Binary Options With No KYC?

Many modern mainstream binary options brokers require customer verification with an application for a live account. This is to meet approval standards for AML regulations to run a legitimate business.

However, there are several ways investors can technically trade binary options with no KYC checks:

Brokers With No KYC

Brokers that do not require KYC checks to trade real funds can be considered high-risk, and some may not be legitimate. In addition, these services are few and far between due to crackdowns on firms that did not comply with AML regulations.

However, there are a few platforms that allow investors to trade binaries free from KYC constraints. These platforms tend to be crypto-based, using decentralized finance rather than traditional funding methods and using tokens like Bitcoin or Ethereum as account base currencies.

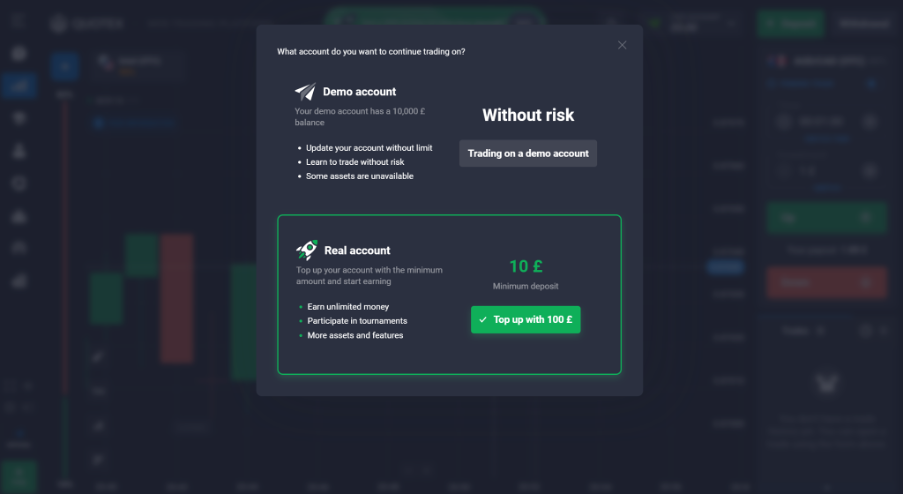

Demo Trading

There are also several brokers, including Quotex and Pocket Option, that allow traders to create binary demo accounts and login to platforms with very little information. This gives investors access to a practice account, with upwards of $10,000 in paper funds.

However, to convert this account to a real profile where traders can stake real funds, they may have to complete an identity verification process.

Should You Trade Binary Options With No KYC?

Many traders who look for no-KYC firms are looking for a firm they can quickly drop into for a test trade without waiting for days for identity checks. In some cases, it’s enough to be able to test a strategy on a demo account, but some may prefer to get a feeling for live trading.

There are also traders who seek out no-KYC binary brokers because they want to protect their privacy and avoid giving out personal data. There’s legitimate reason to be careful about this – as the SEC, FCA, ESMA and other regulators have warned, the binary options sector has had a high incidence of fraud and unscrupulous practices, and identity theft is a very real concern.

In either case, traders should be aware that a broker without KYC is likely to be poorly regulated or altogether unregulated, and is therefore high risk. Only stake small amounts of your capital if any.

Key Considerations

While giving over less of your personal data and information to binary options brokers may seem like a no-brainer, here are a few things to consider before signing up:

Regulation

Regulated entities are scarce in the binary options space as it is. Opting for a brokerage that allows real-money trading without KYC verification eliminates the possibility of oversight from an external body.

While regulation is no guarantee of authenticity or protection from fraud, licensed firms tend to be more reliable than their unregulated counterparts.

Payment Options

Legitimate platforms that deal in fiat currencies will almost always require KYC checks to pass international anti-money laundering (AML) regulations and bank their profits.

As a result, no KYC binary options will rarely deal with traditional funding options such as card payments, bank wire transfers or e-wallets. Instead, they are sometimes blockchain-based, with investors needing to deposit, trade and withdraw in crypto tokens.

As well as potentially increased fees for deposits and withdrawals in tokens like Bitcoin and Ethereum, traders may need to have a crypto wallet or exchange account to transfer funds in and out of a binary options account.

Pros And Cons Of No KYC Binary Trading

Pros

- Privacy – It can help investors keep their identity concealed from platforms, though websites may still collect personal data like IP address.

- Less risk of leaked data – Whether from a hack, rogue employee or fraudulent platform, personal information can be leaked and used for identity theft. Not having to submit identity verification documents helps reduce this risk, though doesn’t eliminate it entirely.

- Faster sign-up – Binary traders do not need to wait for verification to complete before getting started, a process that can sometimes take days.

- Crypto integration – Binary firms are often crypto-based, allowing investors to speculate with fewer ties to banks or transitional finance.

- Hassle-free practice – Many more mainstream binary options brokers offer well-funded demo accounts to traders who sign up with just an email address.

Cons

- Unregulated brokers – Choosing a binary broker with no KYC requirements often eliminates the potential to trade on a regulated platform.

- Demo only – Most brokers that allow investors to sign up without identity checks and documents offer demo trading only before verifying at the real money stage.

- Crypto-only – Being able to use fiat funds on a binary options platform with no KYC checks is unlikely. Instead, blockchain-based tokens such as Bitcoin (BTC) and Ethereum (ETH) are more likely funding options.

- Limited broker options – Very few brokers support funds binary trading without personal documents.

How To Trade Binary Options With No KYC

Here are examples of creating a demo profile and real-money account:

Demo Trading

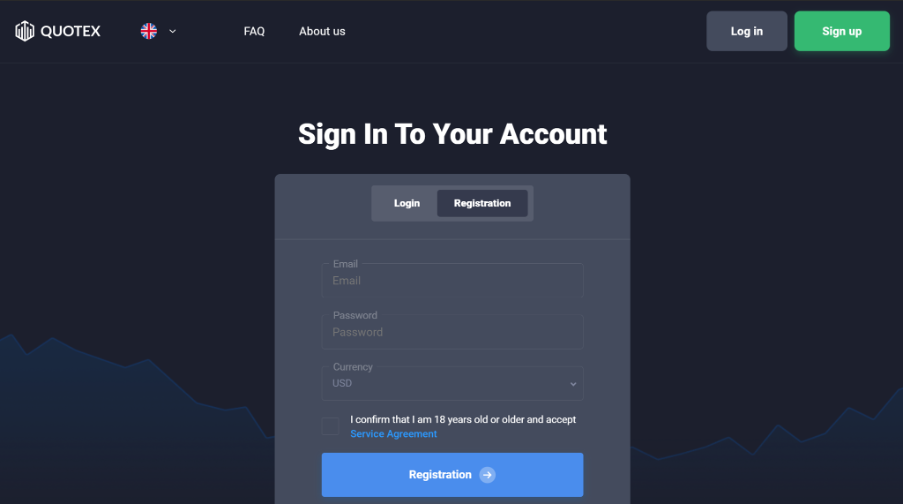

First, select your broker. We are using Quotex for our example. Navigate to their website and find the sign-up or registration section.

With a binary options broker without KYC checks, all you will need to put in is an email address and password.

Next, select the demo account option. You may need to verify your email address using a message sent to you by the broker, but there is no need to submit identity documents.

After this stage, you can start practising in the markets immediately.

Bottom Line

Binary options trading using a broker with no KYC is appealing to some traders. This is due to reduced risk of document leaks and identity theft, enhanced privacy, and a quicker sign-up process.

However, brokers that allow real funds trading with no KYC measures are high-risk due to their lack of regulation. Furthermore, these platforms will often use crypto instead of fiat funds for deposits, trading, and withdrawals.

FAQs

Are Binary Options With No KYC Legal?

While it may not always be illegal for consumers themselves to trade binary options through a broker with no KYC measures, users should be wary that any broker offering this service is likely unregulated and in many jurisdictions could be breaking the law by doing so; as a result regulators may shut down their platform and software for breaking anti-money laundering (AML) laws and regulations.

We recommend checking the rules and regulations on binary trading in your country before opening an account.

Is There A Binary Options No KYC Hack?

Unfortunately, there is no way around KYC verification on binary options platforms that require it. With that said, binary options traders can often open demo profiles with fewer sign-up requirements.

Are Binary Options With No KYC Safe?

No. Due to the unregulated nature of platforms, traders should consider binary options brokers with no KYC verification measures high-risk. Extra due diligence is required to sign up with a reliable and trustworthy broker.

Do Binary Options Brokers With No KYC Accept Bank Transfers?

Binary options platforms with no KYC primarily use crypto for funding and trading. As a result, traders may need to invest using Bitcoin, Ethereum or other blockchain-based tokens.