Knock-Out Options

Knock-out options offer short-term trading opportunities with easy to understand risk management. Beginners benefit from a straightforward entry point with a pre-determined exit plan. This guide explains how knock-out options trading works, plus the pros and cons. We also list the best brokers for trading knock-out options in 2026.

Knock-Out Options Brokers

Knock-Out Options Explained

Knock-out options are financial contracts with pre-defined profit targets. Each contract has a floor price and a ceiling price to lock in profits and limit potential losses. Positions are automatically closed out when the price hits one of these thresholds.

On the top platforms, like IG, knock-out options are offered on popular markets, including major forex pairs, commodities and large US stock indices. When traders open an order ticket, they can choose the price and size. This will then display the maximum risk and potential returns.

Example

A Dow Jones contract’s underlying price is 34,420, with a floor of 34,410 and a ceiling of 34,460. The value of the contract is the ceiling minus the floor: 34,460 – 34,410 = 50 points, worth $500.

Now, to determine the maximum risk and cost of entering the trade, you need to understand the difference between the buy price and floor price, which in this case, is 34,420 – 34,410 = 10. This is equivalent to $10 per point, so the total needed to open the position is $100.

The maximum potential return is the difference between the buy price and the ceiling price: 34,460 – 34,420 = 40 points, or $400.

Contract Types

There are several popular types of knock-out options available to retail investors:

Up & Out

Up and out knock-out options void the contract if the underlying asset’s value is greater than the barrier before the expiration time. This makes it popular with traders who have entered a put contract, helping to reduce potential losses.

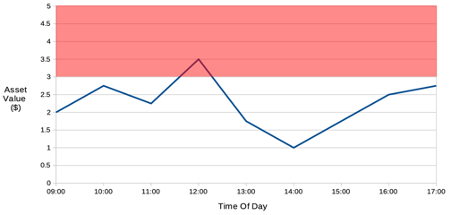

In the chart below, the contract starts at 9 a.m. with a 5 p.m. expiration. The asset is trading at $2 and the barrier level is $3 at the time of entry. The asset’s value surpasses $3 just after 11:30 a.m., therefore, the position is automatically closed.

Down & Out

With a down and out option, the position is closed once the asset’s value drops below a certain level at any time between the opening of the contract and the expiry. This type of knock-out is attractive to investors entering a call contract.

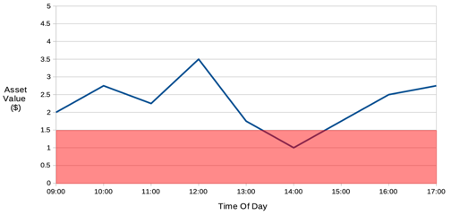

Let’s look at an example below. You will see the asset is trading at $2 with the price barrier set at $1.5. The contract would end as soon as it reaches the barrier just before 1:30 p.m.

Reverse

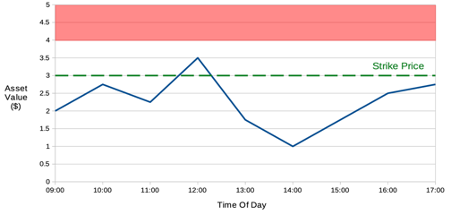

A reverse knock-out option (RKO) involves a barrier level that is in-the-money when it hits the strike price. So, for a call option, this would be when the asset’s value is greater than the strike price. An example of how this would work is shown in the graph below.

Here, the strike price is $3, and the entry price is $2. With a barrier of $4, this reverse knock-out option would not come into effect as the price hasn’t been reached. If the barrier were $0.50 less, then the contract would be void at midday.

Double

You can also combine knock-out options. A double knock-out option creates two barrier levels with one on either side of the strike price. If the asset’s value stays within the two boundaries, the contract essentially operates like a vanilla option. But while this can reduce potential losses, it can also reduce potential profits.

European

European options are contracts where the trader can only purchase or sell the asset at expiry. The introduction of the knock-out mechanism means that the trader determines the payout requirements when they enter their position.

For example, a trader could say the contract will pay out if the underlying asset’s value is greater than or less than the barrier price. They enter a call option and say that the asset will only be bought if it is trading at $5 greater than the strike price. If it is less, then the contract is voided, and the asset is not purchased.

Knock-Out vs. Knock-In Options

Both financial contracts are forms of barrier options. The main difference between knock-in options and knock-out options is how the option changes once the asset’s price reaches the barrier level. With knock-outs, the contract is nullified. With knock-in options, the contract is activated. This means that the contract is essentially inactive until the barrier level price is reached.

Pros of Knock-Out Options

Benefits of trading knock-out options include:

- Fixed exit plan

- Lower premiums

- Beginner-friendly

- Offered by top brands like IG

- Can be used as part of hedging strategies

- Agreed limits mean you don’t have to monitor positions

- Available on popular markets like forex, stocks and commodities

Cons of Knock-Out Options

Downsides of signing up with a broker that offers knock-out options include:

- Contracts can reduce profit potential

- Practising on demo accounts doesn’t always prepare you for real-time trading

Final Word on Knock-Out Options

Knock-out options are popular with beginners, offering dynamic short-term trading opportunities on forex and stocks, among other major markets. Contracts have built-in risk management meaning investors know how much they stand to win or lose before entering a position. Knock-out options are also offered by some of the best online brokers in 2026. Use our guide to start trading today.

FAQs

What Are Knock-Out Options?

Knock-out options are a type of financial contract with fixed profit and loss targets, also known as ceiling and floor prices. Once one of these barriers is hit, the contract is automatically closed out and the trader either receives their winnings or loses their deposit.

Are Knock-Out Options Legal?

Knock-out options are available in most major trading jurisdictions, including the US, UK, Australia, Europe and Asia. With that said, it is always worth opening an account with a regulated brand.

Where Can I Trade Knock-Out Options?

Knock-out options are available on several leading trading platforms, including IG. Check for market access, pricing and payouts, trading tools and customer support before registering for an account. We also recommend testing firms through their free demo accounts before risking real funds.

What Are the Different Types of Options Contracts Available?

Among the most popular types of retail trading options are binary options, vanilla options, American options and European options. Knock-out options are a type of barrier option that falls under the broader umbrella of binary options.