XM Review 2025

Awards

- Outstanding Customer Service Global 2024 - Capital Finance International Magazine

- Best FX Service Provider 2024 - City of London Wealth Management Awards

- Best FX Broker, Europe 2023 - World Finance Forex Awards

- Best CFD Provider 2023 - City of London Wealth Management Awards

- The Best Crypto CFDs 2022 - Financial Expo Egypt

- Best FX Service Provider 2022 - City of London Wealth Management Awards

- Best MT4/MT5 Broker 2021 - DayTrading.com

- Best FX Educational Broker in the MENA region 2021 - Dubai Expo Awards

Pros

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

XM Review

Regulation & Trust

4.1 / 5We’ve been evaluating XM since 2019 and it’s earned the trust of our experts.

It has authorization from two ‘green tier’ (CySEC, ASIC), one ‘yellow tier’ (DFSA) and one ‘red tier’ (IFSC) regulator in DayTrading.com’s Regulation & Trust Rating.

XM also provides negative balance protection and segregates client funds for EU and non-EU customers, helping to safeguard your funds from excessive losses and misuse.

However, unlike publicly traded counterparts including Plus500 and IG, XM’s private status limits the availability of financial disclosures. This could impact transparency for traders seeking detailed financial information.

Pros

- Excellent regulatory oversight for traders in Australia, Europe and the Middle East.

- A long-standing broker, established in 2009 that has attracted 10+ million traders.

- Negative balance protection ensures you cannot lose more than your initial deposit.

Cons

- Trading Point Holdings Ltd, the company behind XM, is not listed on a stock exchange.

- XM is no longer regulated by the FCA, though UK traders can use its sister entity, Trading.com.

- Regulatory compliance varies by location, with the IFSC-registered entity offering fewer protections.

Accounts & Banking

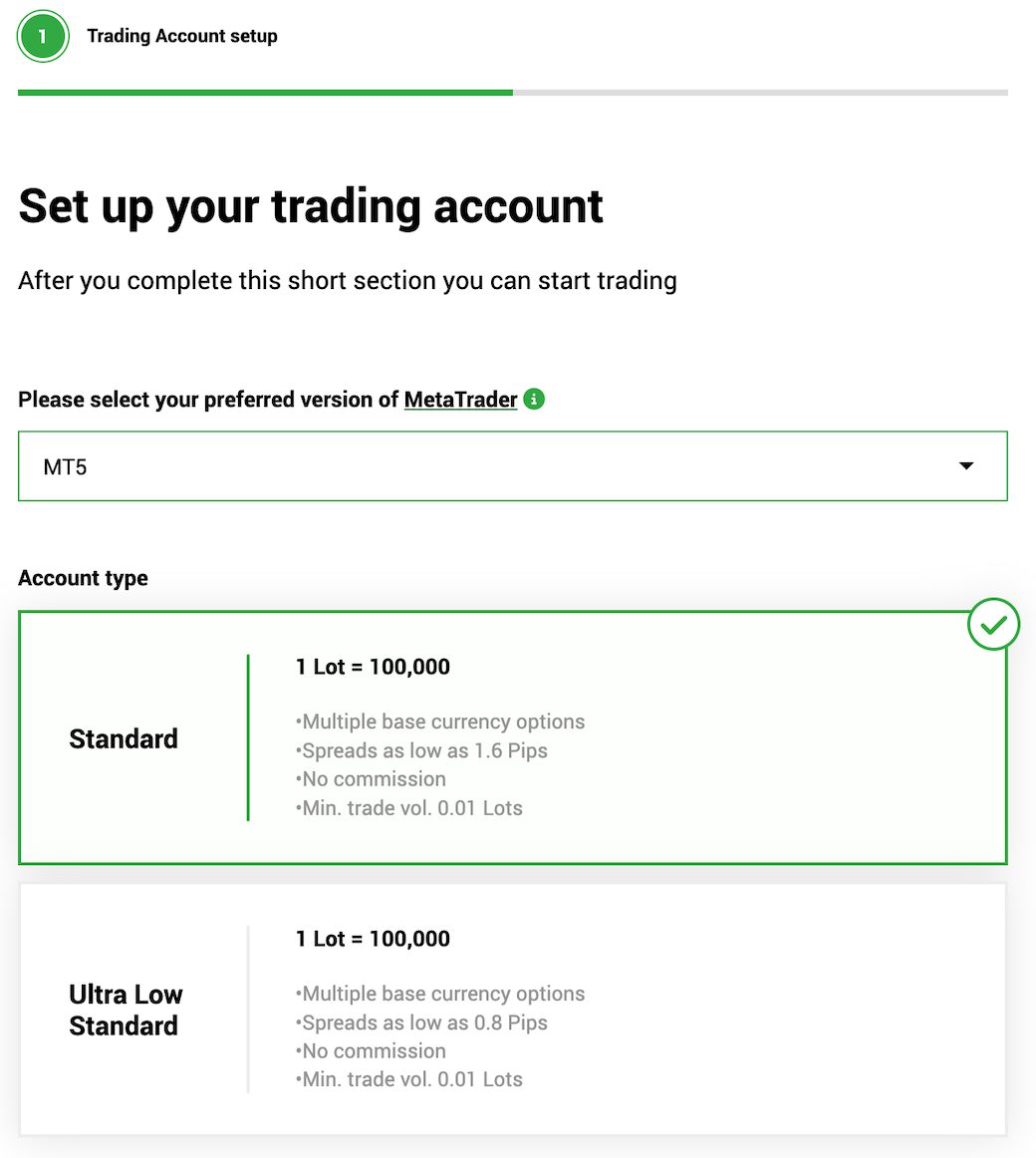

4.5 / 5Live Accounts

To accommodate a range of trading experiences and budgets, XM lets you open up to eight live trading accounts from a choice of three main account types:

- Ultra Low Micro: Allows trading with a minimum contract size of 0.1 lots (mini lot). The minimum deposit is just $5, and leverage can be up to 1:1000, depending on the region. No commissions are charged on trades, and spreads start from 0.8 pips.

- XM Ultra Low: Designed for beginners or those trading smaller volumes, it allows trading with a smaller contract size of 0.01 lots (micro lots). The minimum deposit is also just $5, with leverage up to 1:1000 depending on the region, and no commissions are charged on trades. Spreads start from 0.8 pips.

- XM Zero: Best for serious day traders and scalpers, the XM Zero Account provides spreads starting from as low as 0 pips. However, unlike other XM accounts, it charges a commission per trade, which varies depending on the asset being traded. While there are no hidden fees, the overall trading cost will depend on the spread and commission structure.

I found the account registration process at XM straightforward. I only had to provide my name and email address to enter the client dashboard.To deposit funds and start trading, I had to complete the standard KYC procedure by submitting Proof of Identity (POI) and Proof of Residence (POR). Once submitted, my account was approved in under 24 hours.

Deposits & Withdrawals

XM’s deposit and withdrawal options are competitive compared to multi-regulated brokers such as IC Markets, Pepperstone, and FP Markets.

In particular, XM offers just a $5 minimum deposit. Minimal withdrawal amounts, however, will depend on the transfer type and are typically a little higher.

The availability of base accounts in EUR, GBP, USD and JPY can help minimize conversion fees, unlike eToro, which only supports GBP and USD for deposits, holdings, and trades.

The deposit and withdrawal process is generally straightforward and convenient. While international bank wire transfers can take several days depending on the bank, Visa and Mastercard transactions are typically processed instantly.

Skrill and Neteller e-wallets offer nearly instantaneous deposits and withdrawals for even faster options. XM also provides region-specific local payment methods, such as PayTrust88, that depend on your location.

While deposits are free, some withdrawal methods, such as certain bank transfers, may incur small fees. To keep costs low, I prefer using debit cards.

Pros

- Low $5 minimum deposit requirement for beginners.

- Flexible withdrawal options including bank transfers, credit cards, and e-wallets.

- Deposits and withdrawals are processed quickly, with near-instant transfer solutions.

Cons

- Base account currencies are limited to EUR, GBP, USD and JPY.

- No social login or two-factor authentication for smoother sign-ins.

- Although common, there is limited access to certain payment methods in specific regions.

Assets & Markets

4.5 / 5XM offers a strong range of over 1,000 instruments, particularly in forex, stocks, and indices, which are key markets for active traders.

While it may offer fewer commodities and cryptocurrencies than some market leaders, its overall offering remains competitive, particularly with its extensive stock CFDs and currency pairs.

However, brokers like IG or CMC Markets provide more options for those seeking a broader variety, particularly in stocks and cryptos. BlackBull also offers a superior range of overall trading opportunities, with over 26,000 instruments available to suit various trader preferences.

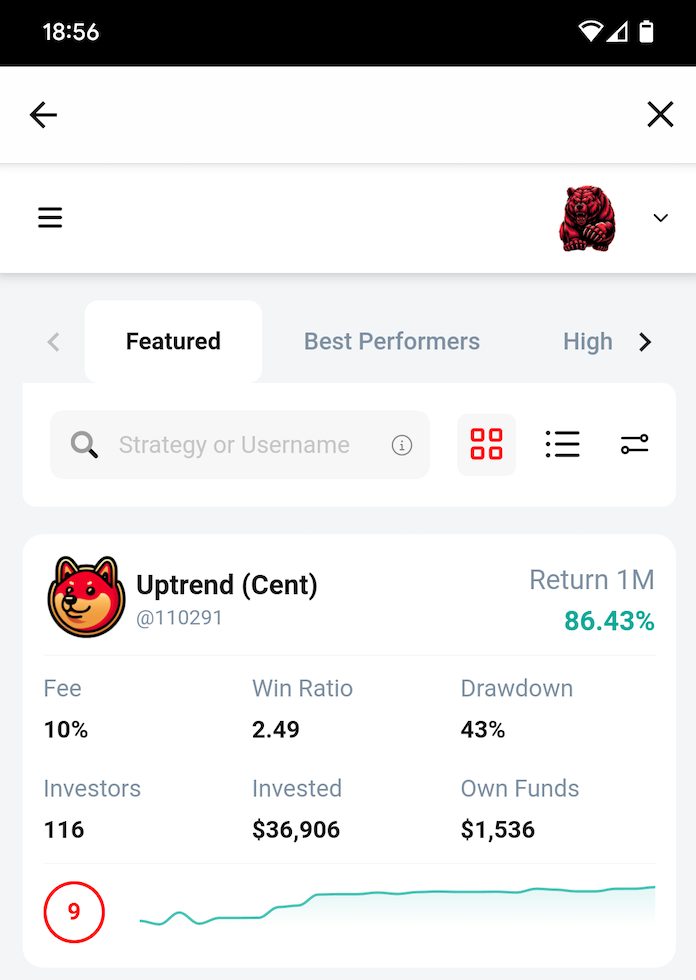

I’m disappointed that XM still does not offer bonds or exchange-traded funds (ETFs). It also lacks passive trading opportunities, such as interest on uninvested cash.However, a copy trading feature is exclusive to the XM mobile app. Popular crypto pairs are available exclusively on the mobile app, including BTC/USD and ETH/USD.

Pros

- A growing suite of 1000+ markets provides diverse short-term trading opportunities across various economies.

- Thematic indices have been added, allowing you to speculate on specific market trends or sectors.

- XM offers unique ‘turbo stocks’ for highly leveraged trading on a handful of popular shares.

Cons

- The selection of markets trails category leaders like Blackbull with its 26,000+ instruments.

- The range of cryptos is narrow compared to alternatives like Eightcap with its 120+ crypto derivatives.

- Bonds and ETFs aren’t available and interest isn’t paid on unused cash balances.

Fees & Costs

4 / 5XM’s trading fees are reasonable having come down in recent years, but they can still be bettered by some day trading brokers, notably IC Markets and Fusion Markets.

Trading costs vary based on asset class and account type. The Ultra Low Micro and XM Ultra Low accounts offer commission-free trading with floating spreads starting from 0.8 pips, typical of many other brokers we’ve analyzed.

For day traders seeking even lower spreads, the Zero account provides raw spreads from 0.0 pips with a commission of $3.50 per lot per trade.

Pros

- Low spreads on the XM Zero account minimize trading costs for short-term traders.

- Spreads are particularly competitive on major currency pairs appealing to forex traders.

- There are no deposit or withdrawal fees for most payment methods keeping non-trading costs down.

Cons

- Spreads can widen significantly during trading sessions based on tests.

- Deposits in unsupported currencies (except USD, EUR, GBP, JPY) may incur conversion fees.

- A $15 inactivity fee is applied after a period of account dormancy, penalizing casual traders.

Platforms & Tools

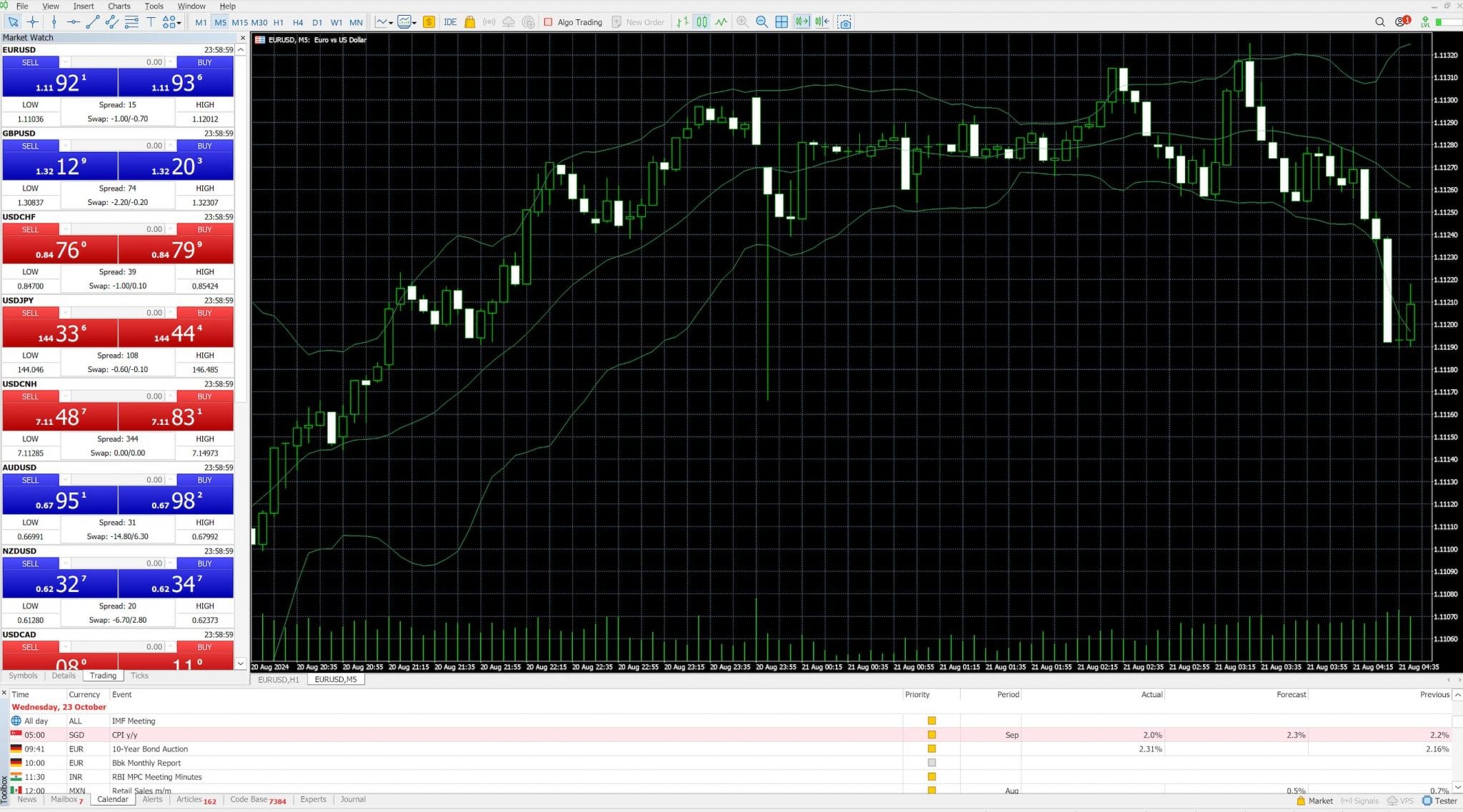

4.8 / 5XM offers two of the industry’s most popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Disappointingly, there’s no support for cTrader or TradingView, the latter of which we’re increasingly seeing being integrated by brokers, including IG and FP Markets.

However, the broker does provide a proprietary mobile app, which is available for Android and iOS devices.

Watch my video walk through of the XM app below to see how it looks and feels, as well as how to place a trade.

MT4 is well-known for its simplicity and reliability, making it best suited to forex trading. It has robust features such as 60+ technical analysis tools, customizable charts, and support for automated trading via Expert Advisors (EAs).

The upgraded version of MT5 provides a more advanced suite of 80+ technical tools, such as additional indicators, extra order types, and access to a broader range of asset classes, including stocks, bonds, and cryptocurrencies. It includes Depth of Market (DOM) features and a built-in economic calendar.

Both platforms are available in desktop, mobile (iOS and Android), and WebTrader versions, allowing trades to be executed from anywhere.

Pros

- Dependable desktop and mobile versions of MT4/5 are supported with MultiTerminal.

- A free VPS is available if you meet deposit and volume requirements.

- XM’s proprietary mobile app is really easy to use and supports copy trading.

Cons

- The lack of an in-house desktop or web platform, available at firms like IG and AvaTrade, may deter novices.

- TradingView and cTrader platforms still aren’t supported despite their growing popularity with active traders.

- XM’s mobile app is intuitive but it’s basic and needs more technical analysis tools for advanced day traders.

Research

4.3 / 5XM offers a range of research tools specifically designed to assist beginner traders in enhancing their trading skills and market understanding.

One of the primary resources is the daily market analysis, which includes interesting insights into major financial markets, updates on significant economic events, and analysis of key market trends.

Additionally, XM provides excellent in-house technical and fundamental analysis reports that break down market movements, enabling beginners to understand the factors influencing price changes and potential trading opportunities and trade ideas from third-party Trading Central.

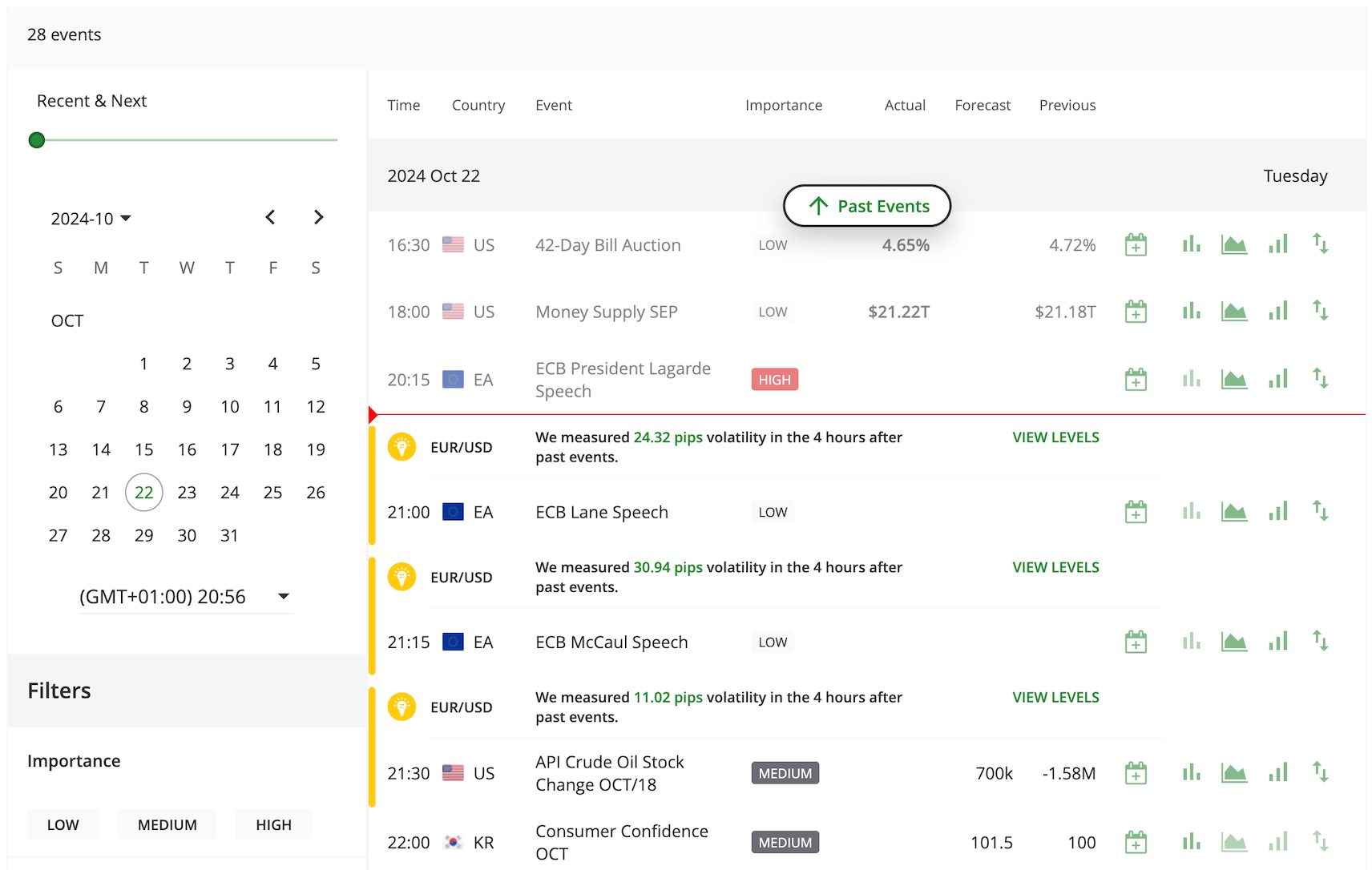

An economic calendar also helps to keep you informed about upcoming events that can cause market volatility. This is great for fast-paced strategies like day trading.

Pros

- Daily market analysis and news updates are great for helping to identify potential trading opportunities.

- The in-depth asset reports and research articles have particularly good coverage of the forex market.

- The well-presented technical analysis from third-party Trading Central will appeal to short-term traders.

Cons

- Despite the addition of the ‘Discover’ feature, the research tools could be a lot more intuitive.

- The economic calendar lacks advanced filtering options beyond ‘countries’, ‘event type’ and ‘importance’.

- Trading Central isn’t integrated into the app which would ensure a comprehensive trading experience.

Education

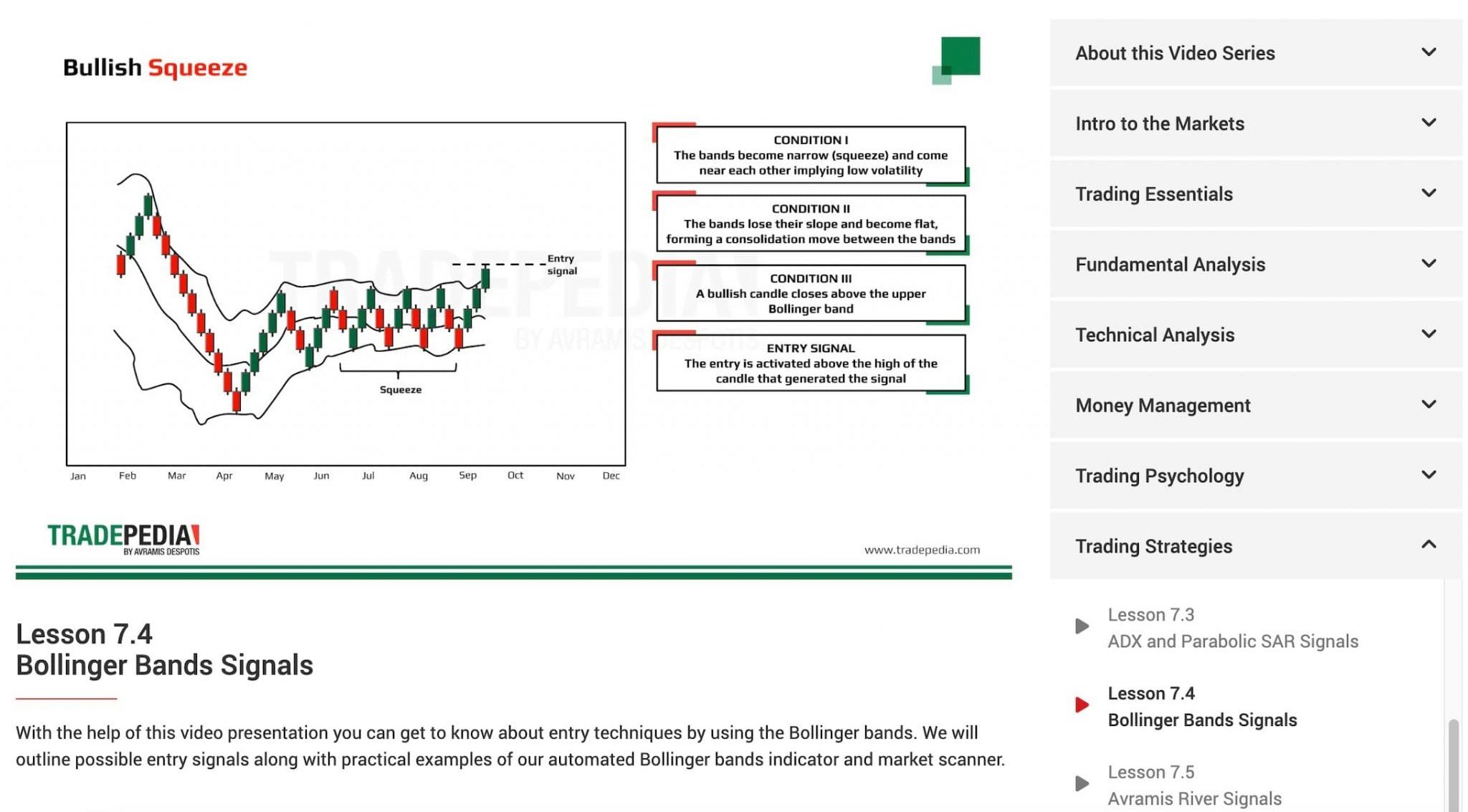

4.8 / 5XM provides various high-quality and enjoyable educational content aimed at beginner traders to help them build their trading knowledge and skills.

These include comprehensive tutorials, articles, and videos covering fundamental trading concepts, technical analysis, risk management strategies, and platform tutorials.

XM also hosts live webinars and seminars seven days a week in 23 languages, led by 77 instructors. These sessions allow beginners to interact and learn directly from experts and cover a range of topics, from basic trading principles to advanced strategies, providing insights into market dynamics and trading techniques.

New traders will further appreciate the client-exclusive webinars and podcasts led by experienced professionals, covering various trading topics, strategies, and tools, allowing beginners to learn directly from experts.

I’ve found XM’s educational content excellent overall, but it could be done with structured learning materials tailored to different skill levels.This commitment to education would ensure novice traders have the tools and knowledge to navigate the financial markets confidently.

A glossary of terms would also get newbies up to speed on trading jargon.

Pros

- Excellent range of education including videos and now podcasts for more modern learning channels.

- Regularly updated content and a ‘Live Education Schedule’ make for a continuous learning experience.

- Frequent live webinars hosted by experienced traders are great for detailed market analysis and trade setups.

Cons

- Topics are less extensive than other brokers, notably category leader IG with its dedicated academy.

- Tutorials are helpful but need more interactive elements, with limited progress tracking and quiz elements.

- There are no structured learning courses which would provide a more comprehensive trading journey.

Customer Support

4.9 / 5XM offers excellent customer support with multiple options, including live chat, email, and phone (Cyprus or Australia numbers).

They’re available 24/5, so I’ve always been able to reach out during market hours, no matter my time zone. What’s great is that the support team offers multilingual support in 25 languages, which is helpful for traders from different parts of the world.

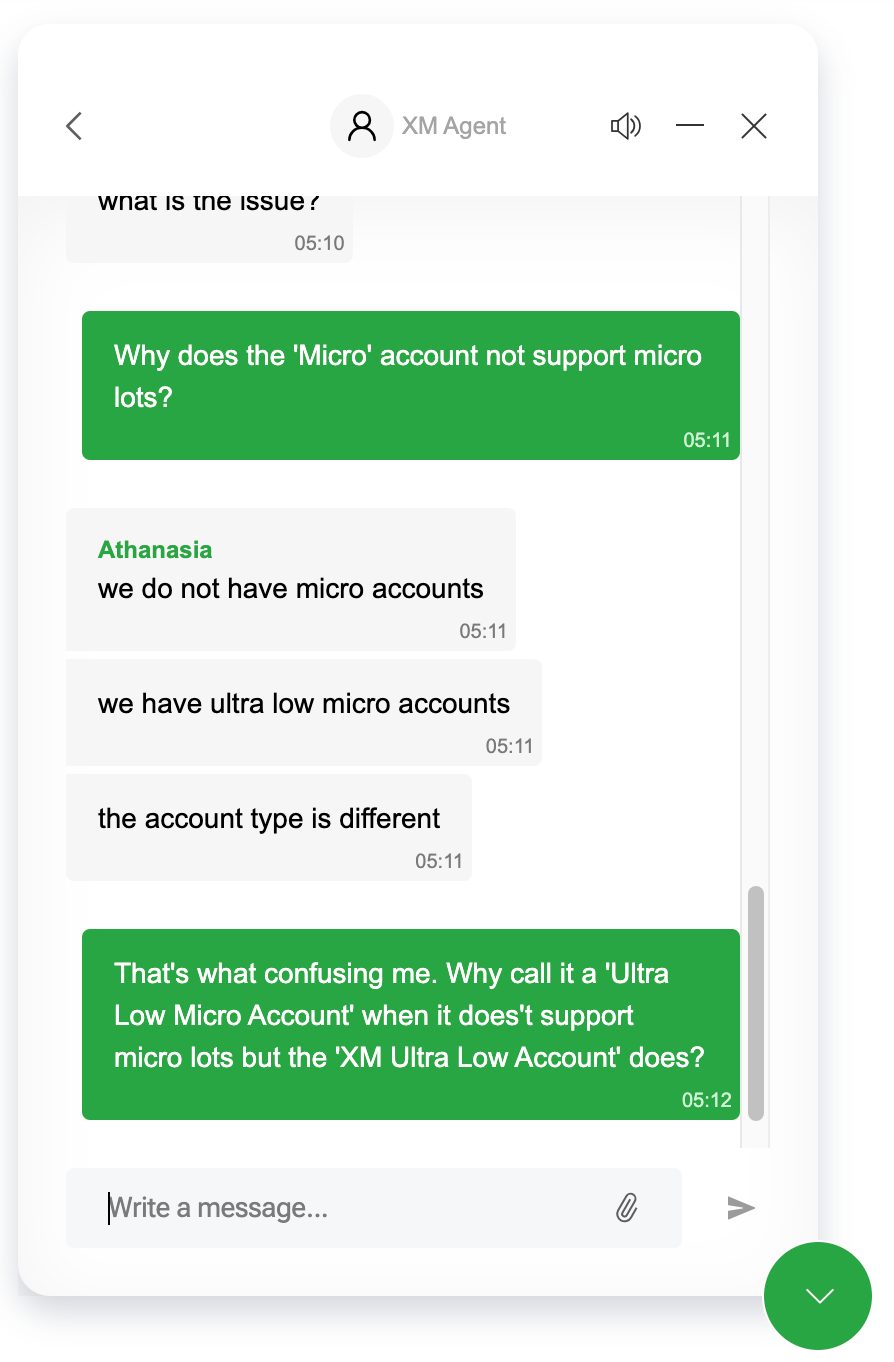

I’ve used their live chat a few times when I needed quick assistance. Once, I was having trouble understanding the differences between accounts, so I jumped on live chat. Within a few minutes, the representative answered my questions.

I’ve also used their email support for more complex questions. When I wanted to swap leverage, I sent them an email. Although it took a few hours to get a response, the reply I received was detailed, with step-by-step instructions that made the process easy to follow.

I’ve found XM’s customer support responsive, helpful, and professional. No matter the issue, they’ve always ensured I get the assistance I need, making trading with them a smoother experience.

My only criticism is that there needs to be a localized direct telephone line or a call-back feature, a service offered by ActivTrades.

Pros

- 24/5 worldwide customer support makes XM ideal for global traders with fast response times during testing.

- Multilingual support in 25 languages beats out almost every competitor.

- There is a helpful FAQ section on its website for basic enquiries.

Cons

- While reliable during market hours, live chat is unavailable during non-peak hours.

- A glossary of terms could save beginners from having to contact and wait for a customer support agent.

- Not all representatives may be fluent language speakers potentially resulting in a frustrating user experience.

Should You Day Trade With XM?

XM broker offers a suitable trading environment for both novice and experienced day traders. Its support for MT4/5 platforms, competitive fees, comprehensive educational resources, and reliable customer support cater to a wide range of trading needs.

XM’s commitment to transparency and security, coupled with its diverse instruments and flexible account options, makes it an attractive choice for active traders, with the Zero account and its spreads from 0.0 pips the stand-out option.

Yet while XM provides a strong foundation for trading, it’s worth noting that it currently lacks features like investing in real assets, especially cryptocurrencies, and the lack of an in-house desktop or web platform marks it out against competitors like IG and AvaTrade.

FAQ

Is XM Legit Or A Scam?

Established in 2009, Australia-based XM has a proven track record as a reliable broker. Known for its efficient trading services, quick execution speeds, and secure trading environment, XM has garnered a positive reputation among our traders and industry experts.

The broker’s professional approach to addressing client concerns and facilitating smooth deposit and withdrawal processes further solidifies its credibility.

Is XM A Regulated Broker?

XM is a reputable broker regulated by leading financial authorities, including two ‘green tier’ regulators (CySEC and ASIC).

By safeguarding client funds and offering negative balance protection in specific jurisdictions, XM prioritizes a secure trading environment, establishing itself as a trustworthy and reliable choice for traders.

Is XM Suitable For Beginners?

XM caters to new traders with features like low minimum deposits (starting at $5 for certain accounts) and demo accounts for risk-free practice.

XM also offers a comprehensive suite of educational resources, including tutorials, webinars, and seminars, to guide beginners through the fundamentals of trading, market analysis, and risk management.

Yet while XM provides a range of features for beginners, it’s worth noting that it lacks a proprietary trading platform explicitly designed for novice traders.

Does XM Offer Low Fees?

XM’s fees are reasonable but can be bettered at brokers like IC Markets and Fusion Markets. Most account types offer commission-free trading, with generally tight spreads, particularly on popular instruments like major forex pairs.

For day traders seeking even lower spreads, the XM Zero account provides spreads starting from 0.0 pips with a small commission per trade.

Top 3 Alternatives to XM

Compare XM with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

XM Comparison Table

| XM | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 4.8 | 4.3 | 3.6 | 4 |

| Markets | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | ASIC, CySEC, DFSA, IFSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | $30 No Deposit Bonus When You Register A Real Account | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | Yes | Yes | Yes | No |

| Platforms | MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 11 | 6 | 11 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by XM and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| XM | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

XM vs Other Brokers

Compare XM with any other broker by selecting the other broker below.

The most popular XM comparisons:

- XM vs FXPro

- XM vs IronFX

- XM vs JustForex

- Interactive Brokers vs XM

- OctaFX vs XM

- ThinkMarkets vs XM

- XM vs AvaTrade

- XM vs Vault Markets

- XM vs Olymp Trade

- Exness vs XM

- Deriv.com vs XM

- XM vs Pepperstone

- Vantage vs XM

- XM vs IC Markets

- XM vs Expert Option

Customer Reviews

4.6 / 5This average customer rating is based on 27 XM customer reviews submitted by our visitors.

If you have traded with XM we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of XM

Article Sources

- XM

- Trading Point of Financial Instruments Ltd - CySEC License

- Trading Point of Financial Instruments Pty Ltd - ASIC License

- Trading Point MENA Limited - DFSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Initially, I thought that the absence of overnight fees would compensate with wider spreads on the Ultra low standard account, but it happened to be a wrong assumption. I was paying attention to the spreads on my instruments, and surprisingly they are still tight (:

On gold, the spread is almost always below $1, on EURUSD it never reaches more than 1 pip…

I guess XM is one of those brokers with an absolutely spotless reputation on the market.

In addition the broker has a lot of social initiatives to help the community or those in need.

Maybe it’s just ot put on a show idk, but it doesn’t look like this.

I’ve joined this company recently and it is my first time working with a broker company. My registration was unimpeded and without serious problems. The verification process was also very fast. It was kind of hard to choose the right trading account and then I contacted the support team. They explained all the nuances and differences between accounts and I chose a standard account. Thank you guys!

Spreads are where XM excels the most. So to give you the context I used to tarde major currencies, namely GBP/JPY pair of any GBP pair except GBP/USD with spreads more than 2 pip and sometimes 3 pips when the market is volatile.

At Xm I have average spreads for GBP pairs around 1.5 pips. Which means many times it’s even lower than that.

And it’s without commissions and swaps on my Ultra low account. Very nice.

The educational resources have made my landing a soft one. I wonder if it is the same for everyone… once I started trading here, I was actually excited to tell people about the broker. I guess that for some people at least it is like that because there is quite the number of reviews here.

The spreads are very tight starting from 0.6 pips, although you might see a little bit higher in rl. It is very easy to convince interested to give this broker a look.

My immersion into trading with this platform is smooth so far. I had no troubles with registering, choosing preferred leverage, verifying the account and depositing it.

As for deposits, then there was a slight delay but only because my bank couldn’t process the transaction faster and I found out about it due to the customer support specialist who I had a small talk with.

Availability of the MT5 on all devices is notable, I tried trading on the tablet and it was fine. I still make mistakes and sometimes don’t always understand where to click to close the order or adjust position size…

In all my time being a trader, this is the one broker that I can vouch for that doesn’t manipulate its charts and is honest with its operations. Not saying that there are no other honest brokers; I am only saying this is one of the honest ones. The broker has about 10M traders using their platform, which says a lot about their honesty. The support too is very active and replies almost immediately.

XM just stands out with its brand in the industry. When I chose them as the main broker to trade with, they had been already in the business for around a decade. One of the factors that bolstered my decison is the fact that XM is strictly regulated by several respected regulatory entities, including CySEC.

As for the range of assets here, it is really huge here. I trade forex pairs and stocks, and frankly the costs stemming from my trades are minimal thanks to the low spreads from the broker.

Regarding the customer support, they are trully attentive and fast to reply.

Decided not to miss a chance on the cocoa’s upsurge. I had all the neccessary tools and conditions here at XM platform. Right leverage, friednly UI of the platform and low fees.

I was opening short trading positions at multiple leves , at 6190 and 7200 price levels (seemed to me a validation of the breakout).

The trades went ok, but if the spreads were even lower, it d be amazing

XM is good if you want to open an account and start trading quickly. I think the platform is pretty dated though and you can’t trade ETFs.