How to Trade Emerging Markets (Part III)

This is Part III of an ongoing series on how to trade emerging markets. Emerging markets are of increasing interest to many traders and investors as interest rates in developed markets are at zero (or in some cases below zero) with the yield on longer-duration, riskier assets heading down toward those yields as well.

In Part I, we covered the early part of the cycle in emerging market economies.

In Part II, we covered the up-cycle leading to the “bubble” phase, and the lead-up to the consequent top in the market.

In Part III, we will cover the top, beginning of the reversal, and defense of the currency.

The top

During the bubble phase, what started out as an attractive, under-invested place becomes increasingly crowded. More capital chases fewer opportunities, leading to lower forward returns.

These inflows increase the price of the currency, boost asset prices, and result in higher rates of debt growth. Eventually, this becomes unsustainable.

When forward returns decline, capital inflows weaken as well. This weakens asset prices, which causes a feed-through into the economy.

This causes asset prices and capital flows to weaken further. When capital begins leaving the country in excess of the capital coming in, this can lead to a balance of payments crisis.

When market prices are high, people extrapolate the optimistic assumptions that are baked into the price.

Because of the optimism reflected in asset prices, it doesn’t take much of a trigger to slow down the inflow of foreign capital and increase domestic capital outflows.

The role of trade balances

Shifts in capital flows are most important, though deteriorating trade balances can also play a role.

The currency runs higher, which makes its goods more expensive on the international market and causes higher levels of domestic consumption (from the high-priced currency being able to buy more goods and an increasingly rich population with the ability to afford them).

But in such circumstances, the imbalance in capital flows are usually the predominant factor leading the decline in asset prices.

What sets off the crisis?

To understand the mechanics, it is really no different than what would set off financial difficulties for a household or individual.

This is usually set in motion due to a loss of income, an increase in costs, a tightening in credit, or from large borrowing that becomes difficult to repay.

Any of these events could lead to a deficit where the amount of money coming in is less than the amount of money being spent. This deficit has to be closed and often isn’t easy to rectify.

Developed markets are in a privileged position where they typically have enough savings in their currencies such that they can “print” money to make up for the gap. Namely, they can issue credit to fill the gap. They can also have their central bank buy the debt if there isn’t sufficient demand for it in the private sector or among foreign entities (e.g., reserve managers, sovereign wealth funds, foreign investors).

This is one of the privileges of having a reserve currency.

The US has the world’s top reserve currency, followed by the EU under the euro. A typical marker of a reserve currency is how much of global savings are in a currency. Other measures include the relative proportion of a currency as it pertains to import invoicing, international debt, and its use in global payments. The JPY, GBP, CAD, AUD, NZD, CNY, and CHF can also be considered reserve currencies in some form, but are far behind the USD and EUR.

In emerging markets, they have limited savings in their currencies and therefore limited demand for their debt, which makes the situation more difficult to deal with. The set of trade-offs is more acute due to limited “printing” power.

They can fill the gap by printing money and risking a balance of payments crisis if there isn’t enough demand for their credit. This can lead to a large depreciation in the currency, which can lead to inflation. (In certain cases where gaps in income, spending, and printing are not closed, it can lead to hyperinflation.)

They can also raise interest rates to defend their currency.

To keep the currency steady, policymakers need to offer an interest rate on the currency that offsets both the inflation rate plus the depreciatory pressures related to the underlying capital flow.

But this isn’t always feasible as we’ll get into more below.

The shock

A country becomes prone to a reversal in its currency and markets due to an unsustainable inflow of capital relative to investable opportunities.

But usually there is a shock that sets off a reversal rather than a “slow realization” that prices reflect unsustainable conditions (though that sometimes happens as well).

For example, if an emerging market derives a lot of its revenue from the export of a certain commodity (like oil), a decline in its price could set off the income imbalance and cause a reversal.

Generally, it’s one of the following:

a) The cost of borrowing increases.

b) The cost of purchasing foreign goods increases.

c) Capital flows coming into a country decline due to foreign investors reducing their net investment or lending in the country.

– There are worries about the economic, political, or social conditions of the country.

– There is a tightening in monetary policy in the local currency and/or in the currency the country’s debts are denominated in. (Emerging markets are often highly dependent on foreign capital.)

– Tightening in monetary policy causes pressure for foreign capital to leave the country.

– The pace of capital flows in unsustainable and naturally attenuates.

d) The revenue generated from selling goods and services to foreign buyers falls.

– This is commonly due to commodity prices falling in countries that export them.

– The rise in a country’s currency can also make their goods and services more expensive and less competitive relative to other countries.

e) People and companies in the country want to get their own money out fearing that it may lose its value.

Lower capital flows

Capital flows are usually the first domino to fall in a balance of payments crisis.

Capital flows are what finance investment opportunities and consumption. Accordingly, the deterioration in flows causes this growth to weaken.

Domestic borrowers become less creditworthy. As a result, foreign investors are less willing to put their money in the country. This makes things worse and tightens credit further in a self-perpetuating way.

As capital flows drop, growth slows relative to potential. Revenue from exports falls, due to a drop in quantities sold (e.g., the currency is expensive) or due to a drop in prices (e.g., falling commodity prices).

Falling capital flows and income causes asset prices to go down. Because credit risk increases from worsening income to debt ratios, interest rates go up as lenders and investors require higher returns on their investment.

With higher interest rates, this slows the rate of economic growth due to a tighter spread between nominal growth rates and nominal interest rates. The quantity of profitable investments dry up as this spread closes.

The fundamentals of companies get worse as a result. Capital outflows pick up.

At a point, once nominal interest rates rise above nominal growth rates and debt servicing requirement exceeds available income, the economy suffers a debt bust.

Companies and individuals need cash to service these debts, so they liquidate assets. This causes asset prices to fall further. Banks also end up in trouble as companies default on their loans.

Policymakers vs. Traders / Lenders / Investors

At this stage, past the top, investors in the market anticipate what policymakers will do in response to the crisis (or brewing crisis).

Those holding assets or currency in the country wonder whether policymakers will implement restrictions on their ability to get their money out of the country. To pre-empt this, they will typically try to get their money out while they can. This worsens the balance of payments issue.

Policymakers are concerned about capital flowing out and the possibility of a steep drop in their currency, which underpins the value of financial wealth in the country.

A worsening balance of payments situation makes the trade-off more acute.

It is well-known among traders, investors, economists, and other market participants that central banks face a trade-off between output and inflation when they change interest rates and liquidity in the financial system.

Less well-known is that this trade-off is more difficult to manage when money is leaving the country (and conversely, easier to manage when money is coming into the country).

Capital flows coming into a country allow it to increase its foreign exchange reserves, lower interest rates, and/or appreciate its domestic currency depending on how the central bank wishes to use the advantage of positive capital flows.

When capital moves out, the central bank’s job is more difficult. Less growth is achieved per each unit of inflation. The flows cause the currency to depreciate, FX reserves to decline, and/or interest rates to rise.

The central bank needs to think through how to handle it.

Central banks will usually do one of two things at this stage:

i) Expend foreign currency reserves to fill in the balance of payments gap, or

ii) Raise interest rates to defend the currency.

The former is akin to a managed currency decline. This is rarely effective because the drop in the currency is a self-correcting mechanism in light of economic conditions. Selling pressure on the currency picks up as policymakers artificially prop it up, as many in the trading community expect the support for the currency to be temporary.

The latter, a currency defense, is rarely effective because it reduces credit creation and brings on economic pain.

Neither the currency nor the interest rates are at the levels required to bring on sustainable economic conditions.

The spot FX rate vs. the forward FX rate

Markets price in how much a currency is likely to appreciate or decline in the future.

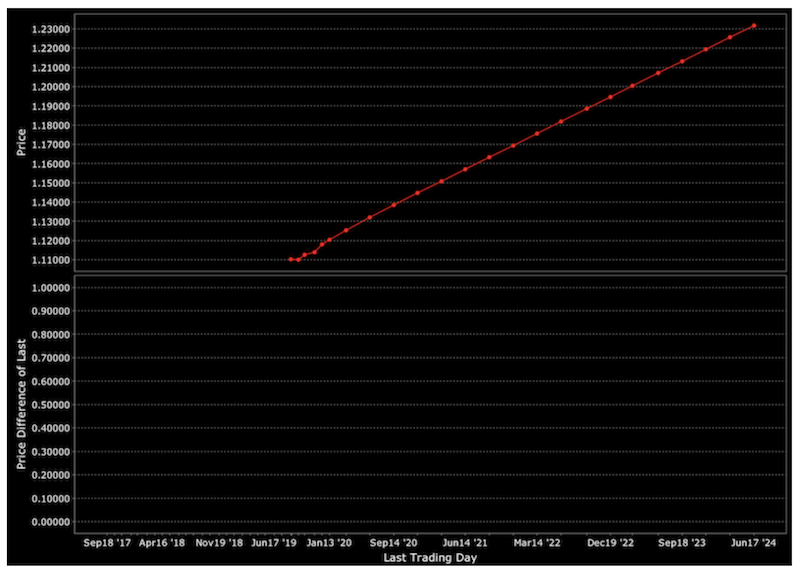

It can be up-sloping, like this chart of the EUR/USD.

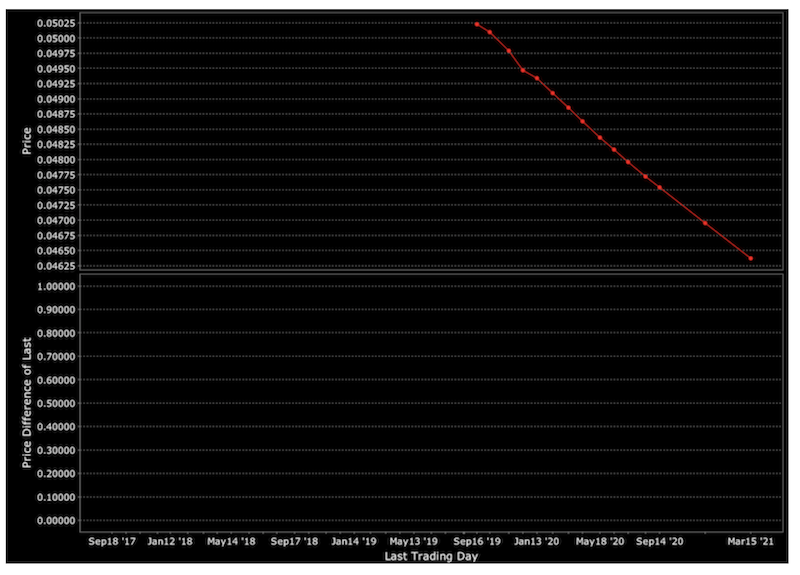

It can be down-sloping, like in this case of the Mexican peso relative to the US dollar.

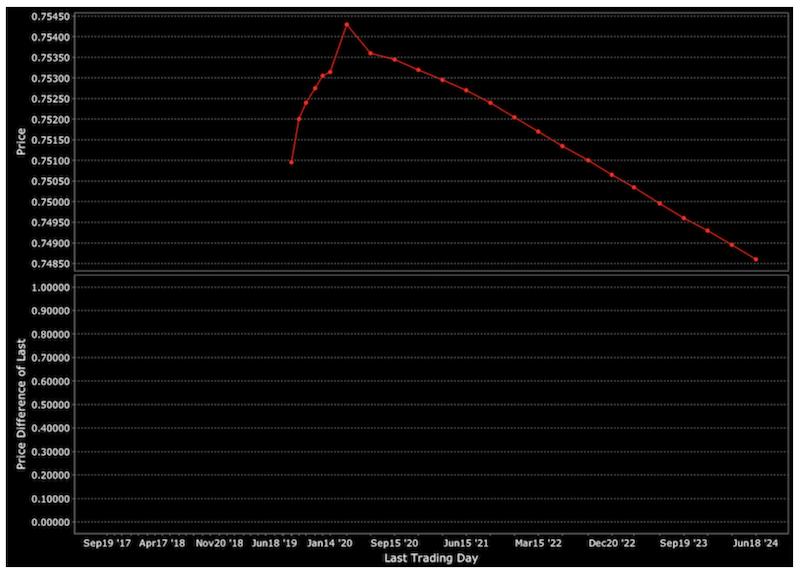

Or it can be kinked, or a combination or up-sloping and down-sloping based on some fundamental expectation in the future (e.g., such as monetary policies diverging). This is an example of the forward curve or the Canadian dollar relative to the US dollar.

The interest rate differential between one currency versus another plays into the nature of this spot/forward currency relationship. This is called the interest rate parity formula.

The interest rate parity formula is as follows:

F = S * (1 + domestic interest rate) / (1 + foreign interest rate)

F = forward exchange rate

S = spot exchange rate

Any expected currency decline is priced into the forward price relative to the spot price.

For example, if the market (i.e., a weighted-average sum of the opinions of all market participants) expects a currency to fall by 4 percent per year, then that currency will need to yield a 4 percent higher interest rate for the exchange rate to remain in equilibrium.

If depreciatory pressures are more acute over short periods of time, then the math is even more harsh.

For example, if there is a 4 percent depreciation expected over just one month (e.g., take balance of payments crises of Turkey and/or Argentina for similar real-world occurrences), then the math becomes that 4 percent raised to the power of 12 to annualize the interest rate (i.e., 1.04^12). That’s 60 percent (not 48 percent because of compounding).

Defending the currency with a 60 percent interest rate is likely to result in a severe drop in economic activity. Very few capital investments are viable at a 60 percent hurdle rate.

Plus, the economy is already weakening, if not already quite weak in terms of the overall level relative to the recent or semi-recent past. This makes such a large interest rate intolerable, as it would cause a huge contraction in the economy.

Even a relatively small expected annual currency depreciation, in the 5 to 8 percent range would require a large interest rate to be paid on the currency that would be above the hurdle rate of many investment projects.

Going to extreme double-digit interest rates, or even triple-digit (depending on how the math works out), would be an unacceptable path to take.

The issue with managed currency declines

When central banks try to manage currency decline alongside falling reserves, the market will pick up on this and expect continued depreciation in the currency.

Per the interest rate parity formula, further expected decline in the currency will push up domestic interest rates.

This acts as a form of tightening when the economy is weak and would benefit from easing.

Moreover, because traders, investors, and lenders expect additional currency depreciation, this will encourage further outflows of capital.

The balance of payments deficit will widen and the central bank will be forced to expend more reserves to defend the currency. Or else they will let the currency fall on its own, which is sometimes not perceived to be an acceptable policy choice. But it is often inevitable in the end when selecting from a menu of unpalatable options.

On top of that, expending reserves has a finite limitation to it. Just as a household or company has a limited amount of savings, so do countries. No levelheaded policymaker wants to risk running out of reserves.

Policymakers will often make public statements about their willingness to defend the currency to “scare off” speculators and relieve pressure on the currency. This type of bluffing behavior from policymakers is especially common for those who need to defend a pegged currency regime.

Promises to defend the currency is also most common right before the cycle moves into its next stage, which is when they allow the currency to go and move on to a new equilibrium.

Letting the currency go

If policymakers increase interest rates, it will prop up the spot currency level.

However, the forward level will continue to decline relative to the spot level. This is normal due to the relationship between the interest rate differential and the pricing between the spot and forward currency pricing.

This tends to cause the forward exchange rate to lead the spot rate downward as the interest rate differential increases.

When policymakers stop expending reserves or give up holding interest rates artificially high, the currency is let go.

The fall in the spot rate causes the interest rate differential to tighten. In turn, the forward exchange rate rallies relative to the spot rate.

Other defense mechanisms

Capital controls are an alternative way of defending a currency. It restricts the movement of capital in and out of the country to avoid having such flows impact the exchange rate.

Policymakers may sometimes make use of this tool, deeming it attractive relative to alternatives.

Tying up the capital account could ostensibly seem like a reasonable tactic relative to the pain involved in increasing interest rates or letting a currency depreciate.

This can also include measures such as banning gold ownership to prevent capital from going into alternative or inflation-hedge stores of wealth.

The US example

For example, in the United States, Executive Order 6102 banished gold ownership. Holding the precious metal was forbidden from 1933 to 1975 with some exceptions (e.g., some collector coins, jewelry). Some relaxations were put into place in 1964.

President Roosevelt, at the depth of the Great Depression (in 1933), broke the link with gold to relieve debtors and get more currency in the economy. At the time, money creation was impeded due to the gold standard.

Executive Order 6102 forced gold to be exchanged for paper currency at $20.67 per ounce (about $420 per ounce in today’s money).

This permitted more currency to flow into the economy. Nearly one year later, gold was devalued by the Gold Reserve Act to $35 per ounce (about $700 per ounce in today’s money). Increasing the dollar to gold conversion provided more incentive for people to exchange their gold reserves for paper currency.

Price and wage controls

Sometimes policymakers will try to place controls on wages and certain goods.

These policies, however, rarely solve problems. They usually undermine economic efficiency by creating shortages in supply relative to demand. Some goods and activity still occur and go “underground” in the form of black markets.

Why capital controls usually fail

In some cases, capital controls can work when capital flows are relatively small and don’t have much influence on a currency. The Bretton Woods currency system that was in place from 1944 to 1971 is an example.

When capital flows are a bigger part of the picture, they typically fail because:

a) People will find ways around them, and

b) Trying to trap people gives them a signal that something might be amiss or unavailable to them in the future, and they become more motivated to escape.

Capital controls are akin to banks shutting down. The fear itself of banks shutting down makes people want to go take their money out. Naturally, this is how “bank runs” manifest.

Capital controls can work temporarily, but they are not sustainable long-term when they are out of whack with the underlying fundamentals.

Normally, policymakers are willing to tap into up to 20 percent of their foreign currency reserves before letting the currency fall. This phase of the cycle typically spans from 3 to 9 months.

In Part IV of the series (of five total parts), we will cover the depression phase of the cycle in trading emerging markets.