Portfolio Simulation Among Top Traders & Hedge Funds: Methods, Tools & Best Practices

Hedge funds and professional traders rely on top-notch portfolio simulation techniques to manage trades and investments across asset classes.

This involves modeling how complex portfolios would perform under various conditions – from historical backtests to real-time market moves – in order to refine strategies and control risk.

Here, we look at how leading firms simulate their portfolios, covering the full lifecycle from data ingestion to performance reporting.

We discuss common methods like backtesting historical performance, real-time simulation (paper trading and live risk tracking), stress testing for extreme scenarios, and integrated risk management.

We also look at whether top hedge funds build proprietary systems or use off-the-shelf platforms, and which tools are favored.

Finally, we provide detailed steps and recommended tools/software for smaller or independent traders to emulate professional processes on a budget.

Key Takeaways – Professional Portfolio Simulation

- Define trading/investment objectives.

- Ingest and clean data from market, fundamental, and alternative sources.

- Backtest strategies across historical data, accounting for execution costs and constraints.

- Run real-time simulations to monitor intraday P&L, exposures, and order behavior.

- Stress test scenarios (e.g., 2008 crash, rate shock) to assess tail risks.

- Measure risk using VaR, factor exposure, drawdowns, and liquidity metrics.

- Generate analytics reports for performance attribution and compliance.

- Iterate continuously, adjusting parameters as markets and goals evolve.

First, What Are Your Goals?

Before anything else, portfolio simulation starts with one foundational question: What is the goal or goals?

Everything flows from that central question and that’s personalized to you.

Beating Equity Benchmarks Isn’t the Only Goal

A common misconception among the general public is that all traders and investors are trying to beat the S&P 500. That’s just one possible objective among countless others.

Hedge funds and institutional managers operate under diverse mandates, and each shapes how portfolios are constructed, simulated, and evaluated. Single products can have multiple objectives (return goals, volatility caps, drawdown caps, Sharpe ratio benchmarks, etc.).

For example, some hedge funds aren’t seeking alpha at all but are purely hedging risk exposures for pension plans or insurance clients.

In these cases, “return” is irrelevant as a metric entirely; what matters is offsetting specific liabilities or exposures.

Others aim to beat inflation by a margin, say CPI + 300bps (i.e., 3%), so there’s growing real purchasing power over time. If inflation was 3% each year for 3 years, the manager needs to hit or exceed 19.1% gains (i.e., 6% compounded).

If the S&P 500 was flat in nominal terms over those three years, getting 5% gains (“beating the market”) wouldn’t be acceptable.

And if the S&P 500 was up 50% in nominal terms over that time, then a 20% return wouldn’t be a failure. It would be the manager doing exactly what they were supposed to (assuming they kept the portfolio within reasonable risk thresholds).

Some target a steady fixed nominal return, like 7% per year, to meet contractual obligations or actuarial assumptions (e.g., pensions, insurance).

Many institutional investors, such as pensions, foundations, family offices, endowments, and sovereign wealth funds, place higher priority on capital preservation and risk control than on beating equity benchmarks.

For these clients, too-high volatility and tail risk are dealbreakers. A hedge fund (or one of their products) that lags the S&P 500 by 3% annually but does so with one-third the volatility and no 15%+ drawdowns may be delivering far better risk-adjusted returns, which is what these allocators actually care about.

Related: Hedge Funds Not Beating the Market – Problem or Not?

Correlations

Another thing is correlations.

Are you delivering positive returns streams (or hedging to offset them if normal assets fall)?

Anyone can replicate a benchmark for free. Being able to provide quality return streams with zero or negative correlation to traditional beta exposure (stocks, bonds, interest rates, oil) is a valuable thing.

If what you provide simply correlates with everything else, there’s not the unique value-add.

In the End, What Are the Objectives?

Simulation, therefore, isn’t about proving a strategy outperforms the market. It’s about confirming it meets the specific risk-return objectives of the end user.

Without clearly defined goals, no simulation (no matter how sophisticated) can deliver meaningful insights.

Data Ingestion and Preparation

Any simulation process begins with high-quality data ingestion.

Hedge funds ingest vast amounts of market and alternative data daily, often across all major asset classes (equities, bonds, commodities, FX, derivatives, etc.).

They pull data from sources like Bloomberg, Reuters, exchanges, and specialized data providers into centralized storage.

Many funds maintain an internal “golden source” database or data lake that consolidates cleaned historical price data, corporate actions, economic indicators, and even alternative datasets (satellite images, social media sentiment, etc.).

Data engineers make sure the data is scrubbed for errors, adjusted for splits/dividends, and normalized for use in models.

Some quantitative funds use custom time-series databases (for example, Man AHL open-sourced its Arctic database built on MongoDB to handle high-frequency data efficiently). The goal is to provide portfolio simulation engines with accurate, consistent data.

Large multi-strategy funds often invest in cloud-based data infrastructure for scalability.

For example, many firms leverage cloud storage and computing to handle surging data volumes without bottlenecks.

They integrate new data sources quickly as strategies demand, using flexible pipelines that can ingest everything from live market feeds (for intraday simulation) to historical time series (for backtesting).

This data foundation is critical: flawed data can invalidate simulations, so firms devote significant resources to getting data management right.

Data Extremes in Modern Trading Environments

Data ingestion is also extreme in modern trading. It can literally be petabytes per day.

To put it into perspective, a petabyte of data, assuming it’s all text and can be printed at 6,000 characters per page, would require approximately 166.7 billion (1.667 x 10^11) 8.5”x11” sheets of paper.

Backtesting Strategies on Historical Data

Historical backtesting is a core simulation method used by quantitative and systematic hedge funds.

Backtesting means applying a trading strategy or portfolio approach to past market data to evaluate how it would have performed.

Hedge funds build highly customized backtesting engines to simulate their complex strategies with realism.

These engines account for nuances like transaction costs, bid-ask spreads, taxes, market impact, and execution delays, especially for high-frequency or large-scale strategies. By modeling such frictions, the simulation results better mirror real-world performance.

In fact, one leading platform emphasizes using tick-by-tick data and realistic execution modeling (including market depth and variable commissions) so that backtests closely replicate live trading conditions.

Many professional tools also allow paper trading mode after backtest – moving to real-time data in simulation without risking capital – to validate that a strategy works in live conditions.

Quantitative hedge funds often run massive numbers of backtests. Literally as many as they can.

For example, if they run 1 million simulations across a 10-year horizon, are there any failures or drawdowns beyond what’s acceptable? The failure/unacceptable drawdown rate should be nil.

They test variations of algorithms, different parameter sets, and even Monte Carlo simulations (randomized scenarios) to gauge strategy strength and what its prospective variance looks like.

It’s common for top quant funds to use HPC clusters or cloud computing to run many simulations in parallel.

For example, cloud scaling lets researchers backtest strategies on decades of data or do multi-asset simulations that require heavy computation. Backtesting also isn’t limited to quant funds; even discretionary managers use it to pressure-test investment theses.

A long/short equity fund manager might backtest how a portfolio rebalancing approach would have fared historically, or a global macro fund might simulate a rules-based asset allocation over prior business cycles. They might run it through other countries and other currencies to make sure that it’s timeless and universal, and not just off the past few decades of US (or domestic) data.

However, purely fundamental strategies rely less on automated backtests and more on scenario analysis.

To perform backtests, in-house systems are prevalent at top firms. Hedge funds often consider their backtesting platforms a source of competitive advantage, thus building them internally.

These proprietary systems are tailored to the fund’s strategies and often integrated with their data stores and risk models.

They also allow full control – developers can incorporate custom risk metrics or signals unique to the firm. The investment is high, but the payoff is a system that exactly fits the fund’s needs.

On the other hand, some funds (especially smaller ones) use or adapt off-the-shelf backtesting software.

There are professional-grade platforms that offer strategy research, development, and simulation.

For instance, Deltix (QuantOffice), SmartQuant, or QuantConnect provide environments to code strategies and test on historical data.

Many order management systems (OMS) also now include backtesting modules. The decision often comes down to resources and required flexibility: building in-house grants more customization, whereas buying a platform can be faster but might impose limitations.

(Industry surveys note that while custom systems promise a perfect fit, they incur key-man risk and high maintenance costs, whereas vendor solutions can leverage widely known standards and reduce onboarding time.)

Real-Time Simulation and Live Monitoring

Beyond historical tests, top traders perform real-time simulations to see how strategies or portfolios behave in current markets.

This can take the form of paper trading (executing trades in a simulated environment or shadow portfolio) or real-time risk monitoring of actual positions.

Hedge funds often maintain “dummy” portfolios that mirror the real portfolio, using live data feeds to compute hypothetical P&L as if trades were executed.

This allows them to observe strategy behavior day-to-day without financial risk or to forward-test modifications before using for real.

For example, a fund might run a new algorithm in parallel to the main portfolio for several months, comparing its simulated returns to actual results, to build confidence before allocating capital.

Real-time portfolio simulation also ties into intraday risk management. Professional risk systems ingest live market data and continuously price positions and calculate risk metrics as markets move.

Many hedge funds have custom risk dashboards that show up-to-the-minute P&L, Greeks (for options), sensitivities, and Value-at-Risk based on current portfolio holdings.

They might run thousands of calls in their cloud platform to produce intraday real-time risk measures for complex equity strategies.

This emphasizes how real-time simulation has to be efficient and scalable.

By simulating the portfolio’s response to live market tick data, risk managers make sure the fund isn’t exceeding limits or drifting into unintended exposures during the day.

If the simulation shows, for example, that an interest rate move is causing outsized losses, the fund can take proactive action.

Strategy drift or inadvertent exposures are a thing that traders are constantly monitoring.

Another aspect is pre-trade simulation: before executing large trades, portfolio managers often simulate how the trades would affect the overall portfolio’s risk and return profile.

They use tools (sometimes integrated in execution management systems) to preview the outcome of proposed trades.

According to FactSet’s trading technology team, buy-side traders increasingly want to “effectively simulate their portfolios to generate their target investment outcomes” by connecting research and portfolio tools to trading systems.

Modern multi-asset EMS (Execution Management Systems) allow traders to model changes across FX, equities, derivatives, etc., and see the projected impact on metrics like sector exposure or VaR (i.e., how much is at risk within the context of certain timescales at certain confidence intervals) before they trade.

This real-time feedback loop helps professionals adjust sizing or hedges on the fly.

Stress Testing and Scenario Analysis

Stress testing is key for hedge funds to simulate performance under extreme or hypothetical conditions.

Rather than relying on standard day-to-day variability, stress tests ask “What if?” for unlikely but impactful scenarios.

Hedge funds typically define a set of stress scenarios that span various risks: equity market crashes, bond yield spikes, credit spread widening, volatility surges, currency devaluations, etc.

They then shock the portfolio by applying these scenario moves to all positions and revaluing the portfolio.

For example, a stress test might impose a 30% drop in global equities, a 300bps rise in interest rates, and a specific widening of credit spreads to mimic a 2008-style crisis.

Simulating such a scenario, the fund can estimate potential losses and identify vulnerabilities (e.g., a strategy that performs well in normal times might show a catastrophic drawdown under these conditions).

Hedge funds use both historical scenarios (replaying events like Black Monday 1987, the 2008 Lehman collapse, March 2020 pandemic shock) and hypothetical scenarios (tailored to current risks, like “what if inflation rises 10% and oil hits $200?”).

Risk teams use dedicated software or in-house tools for this. Large multi-asset funds might integrate scenario analysis into their risk platform so that at any time, they can run ad hoc stresses on today’s portfolio.

Many vendor risk systems also support this: for instance, Bloomberg’s PORT and MSCI RiskManager allow users to define custom shocks on various risk factors and see portfolio impacts.

Scenario analysis can stress multiple factors simultaneously – e.g., a downturn accompanied by a volatility spike and credit crunch – to reflect how correlations behave in crises.

Importantly, stress testing is often done firm-wide as well as at the strategy level. A multi-strategy hedge fund that’s run with pods of independent teams will aggregate exposures from all trading teams to see if there’s a concentration (like many desks all betting on low rates) that could hurt in a particular scenario.

Regulators and investors increasingly expect funds to demonstrate strong stress testing.

In practice, funds that used formal stress tests and VaR models were found to have more accurate expectations of their losses in the 2008 crisis, and they fared better during that drawdown. This is evidence that integrating stress simulations into the investment process leads to improved resilience.

Thus, top hedge funds make scenario analysis a routine part of risk meetings – reviewing how the portfolio would weather shocks and ensuring risk limits (like maximum tolerable loss in a given scenario) are respected.

Some hedge funds even perform reverse stress testing: they ask “what scenario would produce a loss of X%?” and then evaluate how plausible that scenario is, to find hidden risks.

All these practices require flexible simulation software (and the hardware to match it demands), whether built internally or via third-party risk software that the fund customizes.

Risk Management Integration

Strong risk management is woven through all stages of portfolio simulation at professional firms. Rather than treating risk as a separate silo, top hedge funds integrate risk metrics into their backtesting, live simulation, and stress testing results.

For instance, when backtesting a strategy, quants will calculate not just returns but also volatility, Sharpe ratio, drawdowns, and factor exposures during the simulated period.

They may also compute Value-at-Risk (VaR) on the strategy’s returns or run historical scenario tests on the simulated portfolio to understand tail risks.

This helps in strategy selection – a strategy with great returns but unacceptable risk (e.g., huge crash losses or high correlation to equity markets) might be discarded or adjusted.

In real-time operations, hedge funds typically have a central risk system or team overseeing risk across all portfolios. These risk systems provide daily (often intraday) reports on key measures: VaR, exposure by asset class/country/sector, leverage, liquidity of holdings, and compliance with limits.

Modern risk platforms can generate P&L and risk reports across multiple portfolios, asset classes, and risk factors on demand.

For example, a risk report might show that a global macro fund’s overall VaR is, say, $20 million with top contributions coming from equity delta and credit spreads.

If that VaR is above the fund’s threshold, the portfolio managers would be prompted to cut positions. The ability to slice and aggregate risk in different ways (by strategy, by desk, by instrument) is key, especially for multi-strategy funds. This also helps make sure the firm doesn’t become over-concentrated unknowingly.

Risk management systems: In-House vs Vendor

Large hedge funds often build bespoke risk systems because their strategies can be very complex (exotic derivatives, high-frequency trades, etc.) and they want full transparency into the models.

These systems ingest positions and market data, then calculate metrics using the fund’s proprietary models for pricing and risk sensitivities.

However, building such systems is costly and requires constant maintenance as markets evolve. Many funds therefore use a hybrid approach: they might use vendor components or frameworks for certain standard risk analytics and build custom code on top for their special needs.

There are well-known off-the-shelf risk platforms widely used in the industry: for example, BlackRock’s Aladdin (originally a risk management system, now a full investment platform) is used by many asset managers and some hedge funds for its integrated risk analytics and portfolio management capabilities.

Others use Bloomberg for risk – Bloomberg’s PORT/MARS analytics can handle multi-asset risk and stress tests within the Bloomberg terminal environment, useful for funds that want quick setup.

Another example is MSCI RiskMetrics (successor of JPMorgan’s famous risk system), which provides VaR and scenario analytics and is accessible as a service.

Imagine Software is a cloud-based risk/P&L platform that some hedge funds (especially mid-sized) use to avoid building from scratch – it provides an extensive library of pricing models and stress testing tools, accessible via web portal (either installed in-house or via SaaS) as noted by industry commentary.

Regardless of tool/software, the outputs of these risk systems feed directly into decision-making. Risk managers work closely with portfolio managers to impose risk limits (like max leverage, concentration limits, stop-loss levels) and use simulation results to enforce them and better understand why they’re needed.

For example, if simulations show a portfolio’s 10-day 99% VaR exceeds, say, 5% of fund capital, they might mandate reducing positions.

In short, professional firms treat simulation and risk management as two sides of the same coin – every simulation yields risk insights, and every risk metric is based on simulating how the portfolio could behave.

Portfolio Reporting and Performance Analytics

The final step in the simulation lifecycle is reporting – turning the backtest or simulation results into insights for portfolio managers, risk committees, and investors. Hedge funds have automated reporting pipelines.

After each backtest, quant teams will generate summary reports showing key performance statistics (annualized return, volatility, Sharpe, max drawdown, alpha vs. benchmarks) and often attribution analysis (e.g., which factors or trades drove returns).

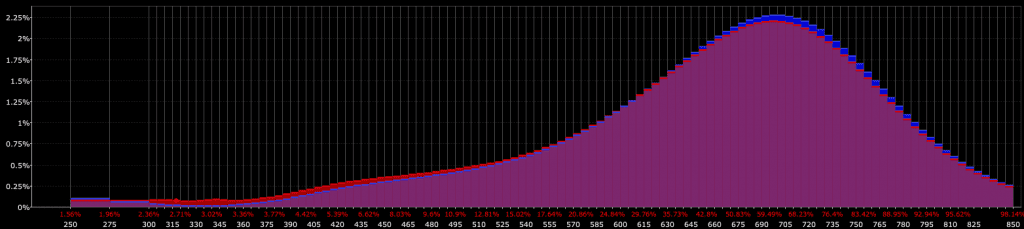

Visualizations like equity curves, drawdown charts, and distribution of returns are included to quickly convey strategy characteristics.

For example, traders don’t view things in the form of specific point forecasts, but a distribution – i.e., a range of possibilities with different probabilities associated with them.

These reports help portfolio managers compare strategies or identify if a strategy’s performance comes with unacceptable risk.

In live trading, daily risk and P&L reports are standard. Each day, the risk system produces a report for each portfolio and the overall fund.

This includes starting and ending positions, daily profit/loss, and updated risk measures (Greeks, VaR, scenario results). Many hedge funds use dashboards (either custom web dashboards or BI tools like Tableau) to allow interactive exploration of this data.

For example, a PM can log in and see their portfolio’s exposure breakdown by sector or how today’s P&L would change if the S&P 500 moved by ±2%.

Automation is important: rather than manual Excel work, modern systems automatically compile data from trading, risk, and accounting systems to generate these reports.

The largest funds even do intraday reporting – risk is recalculated multiple times per day and flash reports are sent if something significant changes (for instance, a big market move triggers a loss beyond a threshold).

External reporting is another consideration. Many hedge funds report performance and risk to their investors (usually monthly or quarterly). These reports often highlight how the fund is positioned and what stress test results look like (to assure investors that risk is under control). There’s also regulatory reporting in some jurisdictions requiring disclosure of risk metrics or stress tests.

For these purposes, simulation outputs must be archived and auditable.

This has led some firms to adopt standardized reporting frameworks like the Open Protocol (formerly Risk Metrics’ OPERA report) for hedge funds, which standardizes the exposure and risk reporting so that investors can compare across funds.

Whether for internal use or external transparency, reporting closes the loop: it translates the technical simulation results into actionable information and documentation. In trading firms and hedge funds, reporting is an integral part of the system design, so that every stakeholder sees a coherent picture of performance and risk.

Technology Choices: In-House Systems vs. Off-the-Shelf Tools

A critical strategic decision for hedge funds is whether to build technology in-house or buy off-the-shelf solutions for portfolio simulation and management.

There’s no one-size-fits-all answer; it often depends on the fund’s size, strategy complexity, and resources.

Let’s compare the approaches and the tools commonly used:

Building In-House

Many hedge funds (especially large quantitative firms) develop proprietary systems for backtesting, risk, and portfolio management. The advantage is a custom fit – the system can be tailored exactly to the fund’s strategies and can be modified at any time as needs evolve.

Firms like Renaissance Technologies or Two Sigma, for example, are known to have vast internal platforms maintained by teams of developers. In-house systems also keep intellectual property and data completely within the firm, which is a plus for secretive strategies (and virtually all genuine alpha strategies are).

However, building in-house requires significant investment in technology and talent. Firms need to hire skilled quant developers, maintain hardware or cloud infrastructure, and continuously update the software to support new markets or products.

New funds often underestimate the time and cost – projects frequently run over budget and take longer than planned, and there’s ongoing cost to prevent “technology lag” as data volumes grow.

Generally speaking, plan for things to cost 1.5x as much and take 1.5x as long to complete.

There’s also key-person risk: if a lead architect leaves, the system’s upkeep might suffer.

Despite these challenges, top funds often justify in-house builds because competitive edge in simulation and execution can directly translate to higher profits, outweighing the costs.

Using Vendor Platforms

Smaller and mid-size hedge funds, and even some larger ones, frequently use off-the-shelf platforms for parts of their workflow.

Modern vendor systems are quite comprehensive – many offer integrated solutions covering order management, portfolio management, and risk analytics in one.

For example, Charles River IMS and BlackRock Aladdin are often cited as “frontrunners” that “integrate trading, risk analytics, and operations” in a single platform.

Such systems can handle multi-asset portfolios, provide built-in backtesting or scenario analysis tools, and come with support and updates (reducing the burden on the hedge fund’s internal team).

Other popular solutions include Bloomberg AIM, SimCorp Dimension, and SS&C Eze OMS, which provide various combinations of trading, compliance, and risk modules.

For pure risk management, funds might license platforms like MSCI Barra/RiskMetrics, Imagine Software, or FactSet’s risk analytics, rather than reinvent the wheel.

The benefit of buying is speed and reliability. A new fund can get up and running quickly on a proven system and hire staff already familiar with it.

The trade-off is less flexibility; the fund may have to adapt its processes to the software’s way of doing things, or pay the vendor for custom features.

Hybrid Approach

Increasingly, hedge funds are taking a hybrid “best-of-breed” approach: using multiple specialized tools and integrating them.

Many hedge funds believe hedge funds that seamless integration of systems is a top competitive advantage.

For instance, a fund might use a high-performance execution management system (EMS) for trade simulation and execution, connect it to a different OMS for position keeping, and plug in a separate risk analytics service – stitching together the components via APIs. The trend is toward an open ecosystem where in-house and external systems share data fluidly.

This way, funds leverage the strengths of vendors (e.g., a high-quality accounting module or data warehouse) while still customizing key pieces (e.g., their secret sauce strategy models and custom IP).

Cloud technology and API-driven design have made this easier, which enables funds to mix and match solutions without the old issues of siloed data.

The bottom line: top-level hedge funds will build or buy whatever gives them an edge, often ending up with a blend of both.

A fully monolithic system that does everything is rare; instead, integration of several tools (plus in-house glue code) is the norm to achieve flexibility and scale.

Application to Coding Languages and Developer Environments

This build-vs-buy decision often extends to coding languages and development environments as well.

Some hedge funds go so far as to design their own programming languages or heavily customize existing ones to better suit their internal workflows.

Jane Street, for instance, famously uses OCaml, a functional programming language that supports extremely rigorous type safety, which they value for minimizing errors in complex systems.

Other firms, like Bridgewater, have developed proprietary languages that are close derivatives of Scala, tailored to specific simulation or data pipeline needs.

These custom languages allow for highly optimized internal tooling, improved performance in certain domains, and tightly integrated system components.

Nonetheless, this customization comes at a cost. It narrows the pool of developers who are already proficient, and even experienced engineers (who can pick up languages faster than the average dev) often face a steep learning curve.

This slows onboarding and increases reliance on a small group of experts, compounding key-person risk.

In contrast, firms that stick to widely-used languages like C++, Python, or Java benefit from a larger hiring market, broader open-source support, and easier interoperability with third-party systems.

There might be a smaller group of specialists who can code in the firm’s internal language, while a larger group of employees focuses on quickly prototyping models in Python or other widely-used languages. It just depends.

Ultimately, just as hedge funds choose whether to build or buy platforms, they also weigh the trade-offs between specialized software and developer accessibility when selecting programming languages for simulation and risk systems.

Example Tools, Software, and Systems

The table below provides examples of tools in different categories, highlighting those often built in-house versus off-the-shelf solutions used in the industry:

Data Ingestion

Hedge Fund Approach:

- In-house data pipelines feed into a central warehouse.

- Integrates live and historical data from Bloomberg, Reuters, and exchanges.

- Emphasizes custom cleaning and a unified “golden source” database (fully cleaned, etc., like discussed earlier).

Off-the-Shelf Tools:

- Bloomberg Terminal/Data Feed, Refinitiv Eikon (live market data).

- Quandl, FactSet (market and alternative datasets).

- S&P Global Market Intelligence (provides structured financials, fundamental data, and ESG datasets across global companies and asset classes, often integrated into portfolio analytics platforms).

- Man AHL’s Arctic (open-source time-series DB used as custom store example).

- TickData (high-quality historical tick-level data across equities, futures, options, and FX, widely used for backtesting and quantitative research).

Strategy Backtesting

Hedge Fund Approach:

- Proprietary simulation engines built in Python, C++, R, or Matlab.

- Cloud or cluster-based to scale tests across asset classes and timeframes.

- Incorporates execution costs, market impact, and firm-specific trading rules.

Off-the-Shelf Tools:

- Deltix/EPAM QuantOffice, QuantConnect, AlgoTrader.

- Open-source: Backtrader, Zipline (Python), quantstrat (R).

- OMS/PMS platforms like Charles River offer integrated backtesting modules.

Real-Time Simulation & Execution

Hedge Fund Approach:

- Live risk systems with market data feeds for real-time P&L and exposure monitoring.

- Sandbox environments to test strategies without deploying real capital.

- Joint development by risk and engineering teams for intraday oversight.

Off-the-Shelf Tools:

- Interactive Brokers TWS (with Risk Navigator), Thinkorswim PaperMoney.

- TradingView for Pine script simulation.

- Institutional EMS: Bloomberg EMSX, FactSet Portware for trade execution modeling.

Stress Testing & Scenario Analysis

Hedge Fund Approach:

- Internal scenario frameworks that allow multi-factor shocks and custom stress models.

- Integrated into firm-wide risk systems for daily or on-demand use.

Off-the-Shelf Tools:

- Bloomberg PORT/MARS, MSCI RiskManager (RiskMetrics).

- Imagine Software for pre-built and custom stress scenarios.

- PortfolioVisualizer for basic Monte Carlo and crisis simulations.

Risk Management

Hedge Fund Approach:

- Centralized, in-house risk engines that compute VaR, Greeks, exposures, and liquidity metrics.

- Real-time dashboards with firm-specific models and limits.

Off-the-Shelf Tools:

- BlackRock Aladdin, SimCorp Dimension, Barra factor models.

- Prime broker risk reports offer an external supplement for smaller funds.

Reporting & Analytics

Hedge Fund Approach:

- Automated in-house dashboards for daily P&L, drawdowns, and strategy attribution.

- Built using Python, SQL, and BI tools like Tableau for visualization.

Off-the-Shelf Tools:

- Microsoft Excel (especially for smaller operations).

- Tableau, Power BI for dynamic dashboards.

- Vendor solutions: Eze Eclipse, Advent APX, and PMS platforms with reporting suites.

This comparison shows that hedge funds usually combine both approaches:

- using in-house systems where differentiation matters (strategy simulation, proprietary risk models) and

- leveraging external tools for commoditized functions (market data, basic analytics, trade processing)

Even for independent traders (as discussed next), a scaled-down version of this mix of tools is often most effective.

Emulating Professional Processes as an Independent Trader

Independent traders or small fund managers can follow a miniaturized version of the professional portfolio simulation process.

While they won’t have the massive resources of a hedge fund, many of the core principles and even tools are accessible on a smaller scale today.

Here are detailed steps and recommendations for a smaller trader to emulate the professional workflow:

1. Data Acquisition and Management

Start by securing reliable data for the assets you trade.

For end-of-day historical data, sources like Yahoo Finance or Alpha Vantage (free) can suffice, whereas paid data providers (Tiingo, Quandl, Bloomberg subscriptions) offer more depth.

Be sure to gather data for all relevant asset classes in your portfolio (e.g., stocks, ETFs, commodities, crypto) and store it in an organized manner (spreadsheets or a database).

Clean the data for any errors or missing values.

Just as a hedge fund centralizes data, you should aim to maintain your own “database” (even if it’s simple CSV files or an SQLite database) as a so-called golden source.

This makes backtests and analysis consistent.

Over time, incorporate additional data like fundamental metrics or economic indicators if your strategy uses them.

2. Choose a Backtesting Platform

Select a platform for developing and backtesting your trading strategies on historical data.

If you prefer no-code or low-code solutions, consider platforms like TradingView or TrendSpider which allow strategy creation with simple scripting and provide built-in historical data.

TradingView, for instance, lets you write strategies in Pine Script and quickly backtest on many instruments with a user-friendly interface. These are great for technical strategy testing and have the benefit of community scripts and ideas.

Alternatively, if you are comfortable coding (which unlocks more flexibility), you can use Python or R with open-source libraries.

Python’s backtrader, Zipline (used in Quantopian), or Pyfolio can be used to simulate strategy logic on historical price series. R offers packages like quantstrat for strategy backtesting.

Coding your own backtest gives you fine control to replicate professional realism – e.g., you can program in slippage models or schedule trades at realistic intervals. The downside is more effort to code and debug.

As an intermediate option, software like MetaTrader (for forex/CFD trading) or MultiCharts offer a balance: they have GUI and easy script languages and can backtest portfolios of instruments (MultiCharts’ Portfolio Trader can test a strategy across multiple symbols with realistic execution).

Whichever route, start simple: test your strategy on historical data over multiple market conditions (bull, bear, sideways markets) and note performance and risk metrics.

Try to avoid biases (like look-ahead bias or overfitting) – professionals invest a lot of effort to make sure their backtests are valid, and so should you.

3. Real-Time Simulation (Paper Trading)

Before risking real money, run your strategy in a real-time simulated environment.

Most retail brokers offer paper trading accounts – for example, Interactive Brokers has a paper trading mode in Trader Workstation, and TD Ameritrade’s thinkorswim offers “PaperMoney.”

Use these to execute your strategy with live market data but using virtual funds.

This step is akin to the hedge fund practice of forward-testing strategies. It will reveal practical issues that backtests might not capture (such as execution delays, or how it feels to manage the strategy in live conditions). Or just simply not having enough data to test, which is where synthetic data steps in.

Some specialized platforms like ProRealTime make this seamless – you can backtest a strategy and then switch it to paper trade live through an integrated broker connection.

During this phase, set up real-time monitoring of performance: e.g., track daily P&L, max drawdown so far, win/loss rates, etc.

Treat it like it’s real – many independent traders keep a journal or daily report of their paper trading results to analyze later.

Only after a period of successful paper trading (say a few months) should you consider going live with actual capital – this mirrors how a professional trading firm would incubate a strategy before allocating significant funds.

4. Risk Management and Metrics

Implement basic risk management similar to hedge funds.

Define your risk limits: for instance, what’s the maximum percentage of your account you’re willing to lose on a single trade (stop-loss), or in a single day/week (drawdown limit)?

Use your backtest results to inform these limits (if the strategy historically had a max drawdown of 15%, you might set a hard stop at 20% drawdown to shut down and reevaluate).

Calculate risk metrics on your portfolio periodically: e.g., track volatility of returns, Sharpe ratio, and maximum drawdown.

Even though you won’t have a dedicated risk department, you can use tools to help.

Many broker platforms have built-in risk analytics – Interactive Brokers’ Risk Navigator can simulate what your portfolio’s value would do under various market moves (like a 2% market drop, or an interest rate change) and gives a rudimentary VaR.

You can also do simple VaR or scenario calculations in Excel or Python.

For example, you could compute the one-day 95% VaR of your portfolio by looking at the distribution of daily returns from your backtest.

If you trade options or other derivatives, pay attention to Greeks (delta, gamma, etc.) which measure sensitivity – some platforms will display these for your positions.

The key is to be aware of where your biggest risks are coming from.

Professional risk managers often ask, “What’s the worst that could happen to our portfolio?” – as an independent trader you should ask the same and quantify it, even if roughly.

Then they hedge against that (e.g., OTM options).

5. Stress Testing Scenarios

Just as hedge funds simulate extreme scenarios, you can perform your own stress tests on your portfolio.

Think of a few nightmare scenarios relevant to your strategy – e.g., if you’re long tech stocks, what if a 2000-style dot-com crash happened, or what would happen with small upward shifts in interest rates?

If you trade currencies, what if a sudden 5% devaluation occurs overnight? Take historical data from those periods (if available) or manually shock your current positions by a certain percentage and see the effect.

For instance, you can simulate a 10% market drop by reducing all your stock prices in your portfolio by 10% in a spreadsheet and checking the new portfolio value (this gives a sense of loss in that scenario).

There are also free tools online: the website Portfolio Visualizer (we’ve used their charts in other articles) offers a “Monte Carlo Simulation” and “Portfolio Stress Test” tool where you can input a portfolio and apply historical crises like 2008 or 1987 to it.

These analyses will show you the hypothetical loss. If you find a single scenario could wipe 50% of your account, you might adjust your positions or add hedges (like put options) to mitigate that risk.

Small traders should particularly examine correlation risks – often a portfolio that seems diversified (say stocks in different industries) can all tumble together in a crisis.

Understanding this through scenario analysis is key to avoid catastrophic surprises.

6. Tools for Multi-Asset Simulation

If you trade multiple asset classes (say stocks and crypto, or stocks and options), look for platforms that support all of them so you can simulate the combined portfolio.

Some retail platforms are limited (for example, MetaTrader is mainly for forex/CFDs, and won’t handle actual stock portfolios well).

In such cases, you might use a combination: perhaps use Python to backtest an overall portfolio allocation strategy across asset classes – Python libraries can ingest different asset data easily.

There are also specialized multi-asset retail platforms: QuantConnect (online) allows backtesting strategies that include equities, forex, futures, crypto in one Python-based framework (or C#).

MultiCharts as mentioned has a portfolio backtester that can include different instruments together.

Even a well-structured Excel spreadsheet model can be used for simulating an asset allocation strategy over time (by applying returns of each asset class to your holdings row by row).

The goal is to treat your whole portfolio holistically, not just individual trades in isolation, mirroring how a hedge fund looks at aggregate risk.

7. Reporting and Review

Finally, institute a habit of regular reporting and review of your performance – basically treating yourself like a one-person hedge fund.

Maintain a trading log and produce monthly summaries of how your strategy performed. Include key stats (return %, volatility, Sharpe, drawdown) and write commentary on what went well or poorly.

This is analogous to a hedge fund’s monthly report to investors or an internal review meeting. By writing it down, you impose discipline and can identify if the strategy is deviating from expectations.

Use visualization to your advantage: plot your equity curve (cumulative returns over time) and compare it to a benchmark (maybe the S&P 500 if you trade US equities, for example). If you have multiple strategies, analyze each one’s contribution to overall P&L.

Many tools can help automate parts of this: for instance, Python’s Pyfolio library can generate an entire tear-sheet report of performance metrics and graphs from your returns data.

Even if done manually, this process will make you more objective, much like a risk team provides a check on a portfolio manager in a professional setting.

Adjust your strategy as needed based on these reviews – if simulations and live results show new risk or declining performance, take it as a cue to refine your approach.

8. Continual Learning and Tool Improvement

The professional process is iterative. Hedge funds continually upgrade their systems and methods – as an independent trader, you should also refine your box over tools over time.

This could mean learning to code (which is easier these days) if you initially used drag-and-drop tools, so you can unlock more advanced simulations, or subscribing to better data feeds when you can afford them to improve accuracy.

Stay updated on new platforms or libraries; for example, new backtesting software or trading simulators often come out (recent reviews suggest ProRealTime, TradingView, and TrendSpider as top choices due to their balance of data, realism, and ease of use).

Choose what fits your style and budget, but don’t shy away from investing in good tools – professionals know that robust infrastructure pays for itself by preventing mistakes and uncovering opportunities.

Even using free trials or community editions can be a way to test if a tool adds value to your process before fully committing.

Following these steps, an independent trader can approximate the rigor that top hedge funds apply to portfolio simulation.

The scale is smaller, but the mindset is the same: use data-driven testing, control your risk through simulations of many scenarios, and use technology to enhance decision-making.

Modern platforms have “bridged the gap” by making powerful analytics available to retail users, so with dedication, a solo trader today can implement processes that were once the domain of institutional players.

Conclusion

Hedge funds simulate their portfolios across asset classes using a thorough, technology-driven process.

From ingesting quality data, to backtesting strategies on historical markets, to simulating trades and stress scenarios in real-time, these firms leave little to guesswork.

Backtesting provides confidence in strategies (and avoids costly failures), real-time simulation and monitoring ensure agility in live markets, and stress tests plus strong risk management guard against tail risks and unforeseen correlations.

The entire pipeline – culminating in transparent reporting – is often supported by a mix of in-house systems and cutting-edge vendor platforms, tailored to the fund’s strategy type (be it quantitative, global macro, long/short equity, etc.).

Quantitative funds tend to invest most heavily in custom simulation infrastructure, while fundamental strategies might lean more on vendor risk models and scenario tools, but all recognize the value of rigorous portfolio simulation.

Having quants and developers close to the trading process has gone from a competitive advantage to “table stakes” – funds demand flexible, integrated tech stacks that can spin up new simulations or data analyses on demand.

For smaller and independent traders, the landscape of tools/software/platforms available today enables them to emulate these professional practices more than ever.

By systematically acquiring data, leveraging accessible platforms for backtesting and paper trading, and applying risk management discipline (with the help of both broker tools and custom analysis), independent traders can significantly improve their odds of success.

The key is to approach trading as a business: use simulations to inform every decision and treat risk as a quantity to be measured and managed, not just an afterthought.

Whether one is running a multi-billion-dollar hedge fund or a personal trading account, the principles of thorough testing, continuous simulation, and vigilant risk oversight form the bedrock of sustainable investment performance.

The mission is to identify your edge, focus on the risks you’re deliberately choosing to take, and manage the portfolio from end to end. Because without a clear understanding of your risks, you can’t make the right ones.