Credit Spreads – Everything to Know

Credit spreads are financial instruments that are used to speculatively trade credit risk.

To go long credit spreads, this involves the simultaneous purchase of a high-yield credit instrument, such as a corporate bond or credit default swap (CDS), and the sale of a lower-yield credit instrument, such as a US Treasury security or CDS.

Credit spreads are typically used by investors who believe that credit risks in one asset class will increase relative to another asset class.

Because credit spreads involve trading credit risk rather than interest rates, they can be an effective tool for managing portfolio volatility and diversifying investment portfolios that already contain significant exposure to interest rate risk.

The term “credit spread” can also refer more broadly to the difference between two different credit instruments or securities, regardless of whether or not they are traded simultaneously.

For example, the credit spread between a AAA-rated corporate bond and a BBB-rated corporate bond would be the difference in yield between the two bonds, as long as everything else is held equal.

Investors and traders who are considering credit spreads should be aware of the potential for loss if credit risks increase more than expected.

Credit spreads can also be volatile and may widen quickly if there is a sudden change in market conditions.

As with any investment, it is important to carefully consider one’s objectives, risk tolerance, and financial situation before entering into any credit spread transaction.

Minsky moments in the context of credit spreads

The main idea behind the Financial Instability Hypothesis developed by Hyman Minsky was that stability and low volatility generate complacency and eventually lead to suboptimal decisions.

In other words, good conditions sow the seeds of their own demise.

Once economic actors are confident that nothing will go wrong, borrowing happens on more and more relaxed terms.

This goes on until almost everyone qualifies for leverage even when there’s little evidence that cash flows will be available to service their liabilities.

For example, during the 2008 financial crisis, housing got into trouble partly because of so-called NINJA loans (no income, no job, no assets).

In stable parts of the cycle, traders might accept credit spreads of just two percent over government bonds, duration-matched.

If the environment is boring and seems safe, then you might as well get a couple extra percent, right?

However, that two percent might not fairly compensate for the extra risk taken on.

And at some point, something breaks.

Credit spreads as an indication of where we are in the cycle

Credit spreads are an important variable to watch if one wants to understand at which stage of the leverage and business cycle we’re in:

- very narrow credit spreads imply that borrowers have easy and abundant access to credit

- widening credit spreads are generally an indication that things will get worse for the private sector

Examples of credit spreads

Credit spreads usually compare risk-free government bonds to those containing credit risk, such as those of corporations and other entities that don’t have the backing of a government that can always pay its bills in nominal terms (because a government can create money, unlike an individual or corporation).

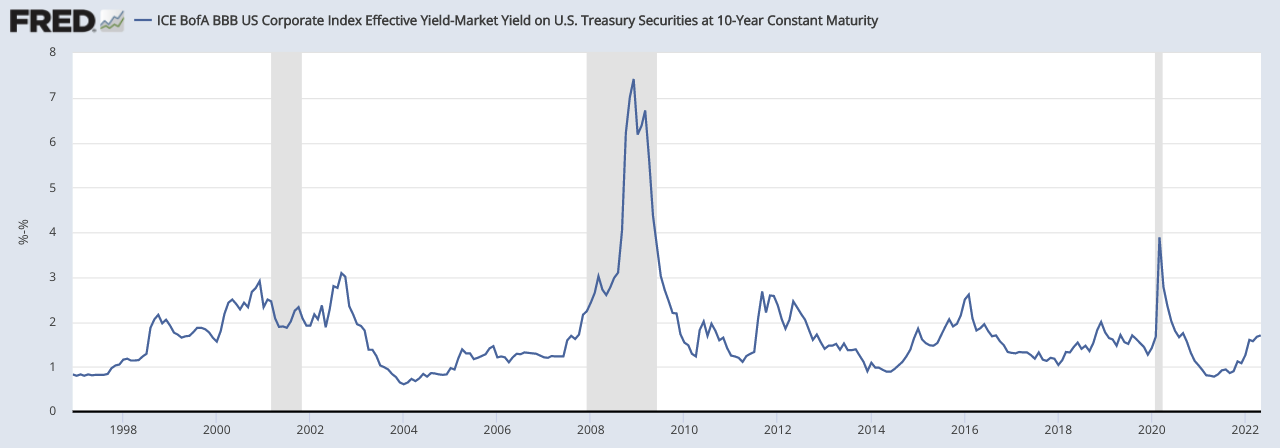

This is an example of the spread between BBB bonds and the US 10-year government bond.

ICE BofA BBB US Corporate Index Effective Yield (minus) Market Yield on US Treasury Securities at 10-Year Constant Maturity

(Sources: Board of Governors; Ice Data Indices, LLC)

Credit spreads reflect more than just credit risk

Credit spreads don’t necessarily reflect credit risk alone, but also regulatory and institutional constraints that larger bond buyers have to adhere to when transacting in bond and fixed income markets.

Who are the main players in the bond market?

Mostly bank treasuries, currency reserve managers (part of central banks), and pension funds.

After the 2008 financial crisis, regulators understood that commercial banks didn’t have enough liquid assets on their balance sheets.

So, they introduced what became known as the Liquidity Coverage Ratio (LCR).

It stipulated that banks must always have enough High Quality Liquid Assets (HQLA) to meet deposit outflows when a stressed scenario comes along.

This effectively means that 10 to 15 percent of commercial banks’ balance sheet has to be invested in HQLA assets.

What does this come to in terms of raw numbers?

With Europe and the US together, that’s about $10 trillion chasing HQLA assets.

And this HQLA is not only risk-free government bonds. HQLA also contain some credit risk-bearing fixed income instruments.

How the LCR calculation works

If you purchase a government bond or keep bank reserves at your domestic central bank, you will face no liquidity haircut: $100 million in US Treasuries is $100 million in HQLA in your LCR calculation.

If instead you wanted to purchase some AA to AAA rated corporate bonds for the extra yield, your liquidity haircut will be 15 percent: for every $100 million you purchase, you will get $85 million added for HQLA purposes.

If you move down the quality ladder, the liquidity haircut will grow all the way to 50 percent.

If you go to junk bonds, then they simply won’t count for the regulatory LCR ratio.

Credit trading tends to be highly rules based

One implication of this means that a lot of credit trading is rules based.

A simple downgrade from AA- to A+ would increase the liquidity haircut for banks from 15 percent to 50 percent, which is a huge gap.

So this impacts the decision making of this big group of marginal buyers of credit spreads well beyond only the credit risk considerations.

You will also find that government-backed instruments with equal credit risk (i.e., practically no credit risk) and equal duration will trade at different yields.

US Treasuries and mortgage-backed securities are an example.

Why are the credit spreads wider?

In these cases, the institutional constraint is not regulation but liquidity.

This brings us to the next big group of fixed income buyers.

When a commodity producer exports oil and other commodities to Europe or the US, they get paid in euros or US dollars.

As this process goes on, the country accumulates hard currency flows, which is typically invested in foreign reserve assets to generate returns.

These instruments that they invest in have to be very liquid so that the exporting nation can sell foreign exchange reserves to support the domestic currency or meet its obligations at any point in time.

The pool of global FX reserves is about $13 trillion.

Risk policies of FX reserves

Central banks usually set their investment risk policy for FX reserves fairly conservatively.

For example, the Bank of Israel and the Swiss National Bank do not allow any purchases of bonds whose credit rating is below BBB-.

More importantly, they will also set maximum investment thresholds for bonds that are considered less liquid than sovereign bonds.

This is commonly determined by looking at:

- bid/ask spreads

- the overall size of the bond market, and

- the liquidity of the underlying repo market

This helps explain why a government-backed security that has the same overall characteristics of a corresponding government bond can trade at a wider credit spread.

That is, the market is much smaller, with wider bid/ask spreads, and has less of a repo market.

This, in turn, means that the big buyers in the market will demand a premium (i.e., a credit spread) that doesn’t have anything to do with the inherent credit risk.

Credit spreads are clearly impacted by the degree of the borrower’s creditworthiness.

But, as you can see, there are regulatory and institutional constraints that affect the decision-making progress of big fixed income buyers and play an important role as well.

Main takeaway

The main takeaway is that credit spreads mostly reflect underlying credit risks in most cases, but regulatory and liquidity constraints influence what big buyers can do, thereby inflating spreads in cases where risk is otherwise the same.

This can be a good thing for smaller buyers who can nimbly take advantage and don’t have such constraints or strict rules to adhere to like the large institutions.

Even if there’s no extra credit risk, a smaller bond market with a less liquid repo market and wider bid/ask spreads can have a wider credit spread due to a big buyer’s inability to exploit this arbitrage.

A downgrade from investment grade to junk (BBB- to BB+) will exclude the bond issuer from a large pool of institutional capital that might otherwise buy the bond for HQLA purposes or as part of foreign exchange reserves (in the case of a central bank).

This disproportionately impacts credit spreads beyond just creditworthiness considerations.

The term fallen angel in the investment world means a bond that went from an investment-grade rating but has since been reduced to junk bond status.

The US BBB market is $3 trillion deep and represents a big portion of the Investment Grade market.

Credit spreads in the market

When it comes to markets, credit spreads are basically a short volatility trade.

They’re also a carry trade, which is most popular in currency markets but applies to any strategy attempting to capture a positive spread between two different things.

What it basically means is that you’re short the safe stuff and long the risky stuff to capture a spread.

If you’re short 5-year US Treasuries at two percent yield to fund 5-year BB debt at six percent, you’re capturing a four percent spread.

Your risk is the BB debt losing value faster than the Treasuries – which will happen during risk-off events – and losing more than your 4 percent yield.

You can also capture your 4 percent yield plus appreciation during cases when credit spreads tighten.

When things are getting better and monetary policy is supportive to risk assets, those lending money will be willing to take additional risks to generate returns and money and credit will flow toward riskier businesses.

Most everyone is long credit spreads

Everybody more or less wants to be long credit spreads.

It’s the type of risk-taking activity that most everyone does.

Being long stocks is also a type of “long credit spreads” trade.

Companies have money, debt, and other forms of capital and they use this capital to make money at a higher rate.

As credit spreads tighten, more traders and investors will want to participate in the opportunity to lend funds to riskier businesses – despite the progressively lower compensation for credit risk.

This leverage that builds causes implied volatility to fall because everything is going great, but eventually leads to instability when something happens.

Economic resources become misallocated until an event happens where cash flows economy-wide aren’t adequate to service the debt payments, defaults pick up and there’s a downturn.

How do you find data for credit spreads?

Credit spreads are a good data point to track to see if things are changing.

a) One way is through the FRED Database, which tracks corporate yields at various tiers (e.g., BBB, BB, B, C) and also US Treasury rates.

By subtracting the two, you can find the credit spread you’re after.

b) The HYGH ETF is another way.

The iShares Interest Rate Hedged High Yield Bond ETF tracks an index of US dollar-denominated, high yield corporate bonds, but hedged for interest rate risk.

It basically allows you to look at high yield credit spreads via the portfolio of the HYG ETF without being muddied by the interest rate component.

c) LQDH does the same thing but for US investment grade credit spreads.

Credit spreads and business cycle fluctuations

Credit spread widening is associated with increased recession risk.

Some traders perceive this as an indication of potentially being in a late cycle economy.

Widening credit spreads are a function of businesses taking on more risk and investors being compensated for that risk.

This happens as the business cycle matures because companies have used up all the easy ways to grow and they need to take on more debt and issue equity to continue to grow.

Investors will require a higher return for these riskier assets. This is why credit spread widening is associated with increased recession risk.

What are some credit spread trading strategies?

Some common credit spread trading strategies include:

- Buying credit default swaps on high yield bonds

- Shorting investment grade bonds

- Shorting BBB rated bonds (or lower)

- Buying CDS on investment grade bonds likely to become “fallen angels”

- Selling protection on single name credit default swaps

With credit spreads, you’re essentially betting on the risk of a company or country defaulting on their debt obligations.

If you think a company is going to struggle to make their debt payments, you would buy credit default swaps on their bonds.

This is effectively shorting the bond and betting that it will go down in value.

If the company does indeed struggle and defaults on its debt, you will make money.

However, if they are able to make their payments, you will lose money.

Another credit spread trading strategy is to short investment grade bonds.

These are bonds that are rated BBB or higher by rating agencies like Moody’s and S&P.

Credit spreads and equity returns

Widening credit spreads are typically associated with negative equity returns.

It means there is now more risk relative to what was priced in.

Investors will demand a higher return for these riskier assets, which can lead to lower stock prices.

However, credit spreads don’t always move in tandem with equity returns and it’s important to note that they are different asset classes with unique drivers.

To successfully trade credit spreads, you need to understand the underlying factors that drive credit spread movements and how they relate to broader economic trends.

Credit spreads and volatility

Credit spread widening is associated with more volatility.

When credit spreads widen, it means there is more risk in the market.

This can lead to increased volatility as investors sell off assets that are perceived to be riskier.

However, credit spread widening doesn’t always lead to increased volatility.

Sometimes, credit spread widening can be a sign of market participants becoming more risk-averse and selling off risky assets in an orderly way as traders move into safe-haven assets.

Credit spreads and default probabilities

When credit spreads start ballooning out, it means default probabilities are going up.

For credit traders, this is an important signal to monitor, as it can indicate which companies and countries are at greater risk of default.

However, credit spreads and default probabilities don’t always move in tandem, as some of it can reflect interest rates movements that have nothing to do with credit risk.

This includes factors like the risk-free rate, regulatory matters, and liquidity constraints.

Credit spreads and inflation

Lower credit spreads are commonly associated with lower inflation.

Higher inflation generally causes credit spreads to widen, as traders and investors anticipate a late cycle dynamic.

In other words, when inflation is rising, credit spreads usually widen in anticipation of the central bank tightening monetary policy.

This can lead to higher interest rates and lower stock prices.

However, credit spread widening doesn’t always mean that inflation is on the rise.

Sometimes credit spread widening can be a sign of market participants becoming more risk-averse and selling off assets perceived to be riskier, which can be deflationary.

Moreover, if inflation rises due to a rise in commodity prices, this can be good for commodity credits and lower credit spreads despite higher potential inflation.

Credit spreads and monetary policy

When credit spreads widen, it is usually when monetary policy is less supportive of risk assets.

Central banks are usually tightening monetary policy to rein in inflation, which can cause risk asset prices to decline when they move faster than what the market discounts.

However, credit spread widening doesn’t always mean that monetary policy is less supportive of risk assets.

Sometimes credit spreads can widen in anticipation of central banks tightening monetary policy.

In other words, market participants may be selling off risk assets because they expect the central bank to raise interest rates and reduce the amount of liquidity in the market.

Credit spreads and interest rates

When credit spreads tighten, it means that risky yields fall more than risk-free yields. Or risk-free yields rise while risky yields don’t rise as much (or stay the same or fall).

This happens when investors are chasing yield and taking on more risk.

However, credit spread tightening doesn’t always mean that traders and investors are becoming more risk-averse.

It can occur when risky yields rise but risk-free yields rise even more.

Credit spread FAQ

What is a credit spread?

A credit spread is the difference in yield between two bonds of different credit quality.

The credit spread is used as a measure of credit risk.

What causes credit spreads to widen?

There are many factors that can cause credit spreads to widen.

Some of the most common include:

- central banks tightening monetary policy

- inflation rising faster than what the market discounts, and

- market participants becoming more risk-averse (which can be tied to the above two reasons or a different event entirely, such as geopolitical conflict)

How do credit spreads affect interest rates?

Credit spreads can affect interest rates in two ways.

First, when credit spreads widen, it means that risky yields rise more than risk-free yields.

Second, credit spread tightening can be caused when central banks lower interest rates and help inject more liquidity into the market, therefore helping risk assets relative to less risky assets.

What is the difference between a credit spread and a yield curve?

A credit spread is the difference in yield between two bonds of different credit quality.

A yield curve is a plot of yields across a range of maturities for a single credit quality.

Do credit spreads widen due to lower liquidity?

It can be part of it.

Sometimes credit spreads can widen in anticipation of central banks raising interest rates.

In other words, market participants may be selling off risk assets because they expect the central bank to raise interest rates and reduce the amount of liquidity in the market.

What skills are needed to trade credit spreads successfully?

There are many skills to develop so you can successfully trade credit spreads.

Some of the most common include understanding how credit spreads interact with other market factors like liquidity, investor sentiment (e.g., bullish, bearish), and default probabilities.

Additionally, it is important to have a strong understanding of monetary policy and interest rates when trading credit spreads, as these factors often have a major impact on their performance and price dynamics.

What are some of the risks of credit spread trading?

There are a few risks to credit spread trading that you should be aware of.

First, credit spreads can be very volatile and price movements can be difficult to predict.

Second, credit spreads are often influenced by factors that are hard to predict in advance, such as central bank policy, geopolitics, or global economic conditions.

Credit spreads can also be impacted by event risk, which is the risk of a sudden and unexpected event happening that causes prices to move sharply in one direction or the other.

When are yield spreads highest?

They are typically highest during the early stages of a recession.

This is when volatility ramps higher causing credit spreads to “blow out”.

This is also when traders have the fattest spreads to capture.

The issue, of course, is the timing. When volatility is high and markets are churning rapidly, it is not fun to buy, fearing further losses.

Moreover, during the early stages of a recession, this is usually when traders’ portfolios are having issues with drawdowns and lack the ability to buy more despite the new opportunities available.

What are the different types of credit spreads?

There are a variety of credit spread strategies that traders can use to take advantage of different market conditions.

Some of the most common include credit spread arbitrage, credit curve trading, credit option strategies, credit index trading, and credit spread volatility trades.

Many traders choose to specialize in one particular type of credit spread depending on their individual trading goals and risk preferences.

Conclusion

Credit spreads can provide valuable information about market conditions and credit risk.

Understanding how credit spreads interact with other market factors can help you to successfully trade them. However, it is important to be aware of the risks involved before you begin trading credit spreads.