Modern Portfolio Theory [Assumptions, Diversification, Advantages, Limitations]

What Is Modern Portfolio Theory?

Modern portfolio theory (MPT) is a framework for analyzing and making decisions about investment portfolios.

It was first developed by Harry Markowitz in the early 1950s and has since become one of the most important ideas in finance.

MPT is built on the idea of diversification, which is the concept that spreading your investments across different asset classes can reduce risk while still providing a good return.

For example, rather than investing all of your money in stocks (public equities), you might invest in a combination of stocks, bonds, commodities, cash, and so on.

This diversification can help to protect you from losses if any one asset class declines in value, as each has different environmental biases.

MPT goes one step further by taking into account not just the expected return of each asset, but also the volatility (a form of risk) of each asset.

This is important because some assets may have high returns but also high volatility, while others may have lower returns but low volatility.

By taking both of these factors into account, MPT gives investors a more complete picture of how an investment portfolio might perform.

MPT has been criticized by some in recent years, as it relies on several key assumptions that may not hold true in all market conditions.

However, it remains one of the most widely used tools for portfolio analysis and decision-making.

Key Takeaways – Modern Portfolio Theory

- Modern portfolio theory is a popular investment framework that is used by many investors and financial professionals.

- MPT attempts to optimize portfolios by taking into account the trade-off between risk and return.

- By diversifying across asset classes and carefully selecting investments, MPT can help investors create portfolios that have the potential to generate strong returns while minimizing risk.

- While MPT has come under criticism in recent years, it remains a popular tool among investors and continues to be a useful conceptual framework by many people in the financial industry.

The Four Key Assumptions of Modern Portfolio Theory

In order to understand MPT, it is first necessary to understand the four key assumptions that it is based on.

Modern Portfolio Theory assumes that most investors are:

1. Investors are rational and risk-averse

2. Markets are efficient

3. Assets are priced correctly

4. Investors have access to all information

Investors Are Rational and Risk-Averse

The first assumption of MPT is that investors are rational and risk-averse.

This means that they have a clear understanding of the risks and rewards associated with each investment, and they make decisions based on maximizing their expected return while minimizing their risk.

Of course, in reality, not all investors are completely rational or risk-averse.

However, this assumption is important for the purposes of MPT.

Without it, the theory would not be able to accurately predict how investors will react to different market conditions.

Markets Are Efficient

The second assumption of MPT is that markets are efficient.

This means that all relevant information about an investment is reflected in its price.

In other words, prices always reflect the true value of an asset.

This may not always be the case in reality, but it is assumed for the purposes of MPT.

If markets were not efficient, then it would be difficult to determine whether an investment was fairly priced or not.

Assets Are Priced Correctly

The third assumption of MPT is that assets are priced correctly.

This means that the prices of assets reflect all of the relevant information about them.

In other words, prices are assumed to always reflect the true value of an asset.

This may not always be the case in reality, but it is assumed for the purposes of MPT.

If assets were not priced correctly, then it would be difficult to determine whether an investment was a good deal or not.

Investors Have Access to All Information

The fourth and final assumption of MPT is that investors have access to all information.

This means that investors have a complete understanding of the risks and rewards associated with each investment.

Of course, in reality, this is not always the case.

However, this assumption is important for the purposes of MPT.

Without it, the theory would not be able to accurately predict how investors will react to different market conditions.

Modern Portfolio Theory and Risk

Modern Portfolio Theory defines risk as the volatility of an investment’s return.

In other words, risk is the amount of fluctuation that an investment experiences over time.

The higher the risk of an investment, the more volatile its returns will be.

MPT assumes that all investors are risk-averse, which means that they seek to minimize their risk while still maximizing their expected return.

This is why MPT takes into account not just the expected return of each asset, but also the volatility of each asset.

By taking both of these factors into account, MPT gives investors a more complete picture of how an investment portfolio might perform.

Of course, volatility is a type of risk; it is not the entirety of risk itself.

Modern Portfolio Theory Diversification

Modern Portfolio Theory is based on the idea of diversification.

Diversification is the process of spreading your investment across a variety of different assets.

The goal of diversification is to minimize risk while still maximizing return.

MPT suggests that the best way to achieve this goal is to invest in a portfolio of various assets that have low (or no) correlation to each other, rather than investing in just one asset.

A portfolio is a collection of different investments, such as stocks, bonds, commodities, and other assets.

By investing in a portfolio of assets, you can minimize your overall risk while still potentially achieving a high return.

Of course, it is important to remember that no investment strategy is guaranteed to succeed, and there is always some risk involved.

However, diversification is one of the best ways to minimize your risk while still giving yourself the chance to achieve a high return on your investments.

Modern Portfolio Theory – Efficient Frontier

The efficient frontier is a concept in modern portfolio theory that refers to the collection of portfolios that offer the highest expected return for a given level of risk.

The efficient frontier is derived from the Markowitz portfolio optimization model, which uses a quadratic programming algorithm to find the optimal portfolio weights for a given set of assets.

The efficient frontier is often graphed as a curve, with each point on the curve representing a different portfolio.

The Efficient Frontier – Explained in 3 Minutes

The portfolios on the efficient frontier are said to be “efficient” because they offer the highest possible return for their level of risk.

Portfolios that fall below the efficient frontier are considered to be “inefficient” because they do not offer as high of a return for their level of risk.

The efficient frontier has been used by investors for decades to help them choose the optimal portfolio for their needs.

The efficient frontier has come under fire from critics who say that it does not accurately reflect the true risk-return characteristics of investments.

Despite its criticism, the efficient frontier remains a popular conceptual tool among investors and portfolio managers.

Influence of Modern Portfolio Theory on Today’s Markets and Portfolio Construction

Modern portfolio theory has had a profound impact on the way that investors construct portfolios today.

The concept of diversification, as well as the efficient frontier, are both widely used by investors in order to choose the optimal mix of assets for their portfolios.

MPT has also influenced the development of numerous financial products, such as index funds and exchange-traded funds (ETFs).

These products are designed to track specific market indexes, which gives investors exposure to a wide variety of assets without having to choose and purchase each asset individually.

Index funds and ETFs have become extremely popular in recent years, and they are now used by millions of investors around the world.

Overall, modern portfolio theory has had a major impact on the world of investing.

Advantages of Modern Portfolio Theory

Modern portfolio theory has a number of advantages that make it appealing to investors.

One key benefit is that it provides a mathematical framework for analyzing and understanding investment risk.

This helps investors to make more informed decisions about how to allocate their assets.

Another advantage of modern portfolio theory is that it takes into account the fact that different assets have different levels of risk.

This means that investors can construct portfolios that are better diversified and less risky than if they had simply invested in a single asset.

Lastly, modern portfolio theory can help investors to maximize their returns while minimizing their risk.

By using this approach, investors can create portfolios that have the potential to generate quality returns without incurring too much risk.

Modern Portfolio Theory Criticism & Limitations of Modern Portfolio Theory

While MPT has been widely accepted by the investment community, it has come under criticism over the years.

Risk aversion assumptions

One common criticism is that MPT assumes that investors are rational and risk-averse.

However, many experts have argued that this assumption is unrealistic and does not reflect the true nature of human behavior.

Equating risk as volatility

Another limitation of MPT is that it only considers risks like volatility.

Volatility is just one form of volatility. And it is a risk that is not directly applicable to illiquid investments that are marked to market infrequently.

It does not account for other types of risks, such as political risk or regulatory risk.

It also treats upside and downside volatility as the same. (Upside portfolio helps a portfolio grow in value. Downside volatility causes a portfolio to decline in value.)

Historical data

Lastly, MPT tends to rely on historical data to make predictions about the future.

For example, when traders and investors look at what’s likely to transpire based on what’s happened in the past (i.e., return and volatility of various investments and asset classes).

However, past performance is no guarantee of future results, which means that there is always the potential for MPT models to be inaccurate.

Despite its limitations, modern portfolio theory remains a popular conceptual tool among investors and financial professionals.

While it is not perfect, MPT can still provide insights that can help investors make better decisions about how to allocate their assets.

Modern Portfolio Theory and Correlation

Correlation is a statistical measure that shows how two variables move in relation to each other.

A positive correlation means that the two variables move in the same direction, while a negative correlation means that they move in opposite directions.

Modern portfolio theory takes into account the correlation between assets when constructing an optimal portfolio.

By diversifying across asset classes with low correlations, investors can minimize the overall risk of their portfolios.

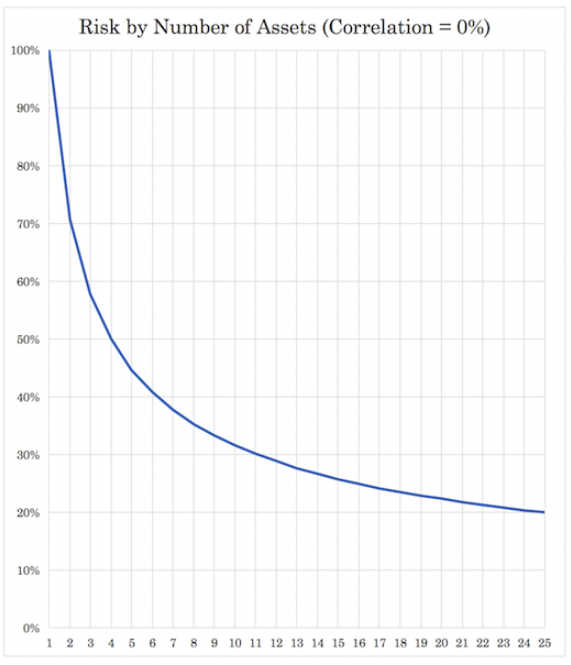

For example, if investors can find 4 investments or returns streams that are uncorrelated and have equal return and equal risk, they will keep the same return but lower their risk by a factor of 2x.

If they have 9 uncorrelated investments or returns streams that have equal return and equal risk, they will keep the same return but lower their risk by a factor of 3x.

If this goes up to 16, then they keep the same return but lower risk by a factor of 4x.

This relationship is shown in the graph below.

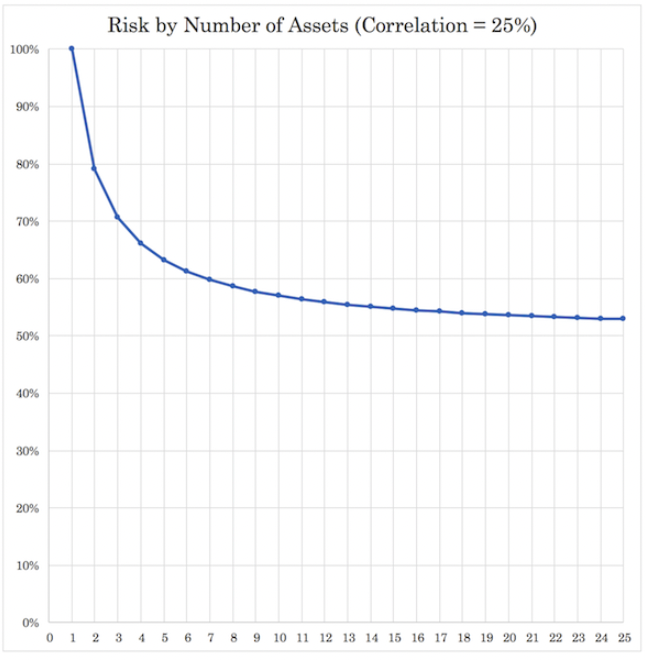

However, there is an important emphasis on non-correlation.

When the correlation goes up to 25 percent, for example, you can see a material drop-off in the benefits of diversification based on a certain point.

There are marginal benefits the more you go. And this curve flattens out faster the higher the correlation.

This is because if one asset class experiences a decline in value, the other asset classes are likely to provide some offsetting gains or at least not decline as much.

Diversification is one of the most important aspects of modern portfolio theory, and it is something that all investors should keep in mind when constructing their portfolios.

Modern Portfolio Theory and Asset Allocation

Asset allocation is the process of deciding how to allocate your assets among different asset classes.

The goal of asset allocation is to create a portfolio that has the potential to generate strong returns while minimizing risk.

Modern portfolio theory can be used to help investors determine the optimal asset allocation for their portfolios.

By using MPT, investors can help understand how to design a portfolio that can perform well in different market conditions and choose an allocation that is appropriate for their goals and risk tolerance.

While there is no single “right” answer when it comes to asset allocation, MPT can still be a helpful tool in making decisions about how to allocate your assets.

Modern Portfolio Theory: Terms & Concepts

Below are some common terms and concepts in MPT:

Portfolio Optimization

Portfolio optimization is a concept in MPT, whereby traders/investors seek to maximize the expected return of their portfolio for a given level of risk.

The critical factors driving portfolio optimization are the risk-return ratio and the risk-return spectrum.

The risk-return ratio is a measure that compares the expected returns of an investment to the amount of risk undertaken to capture these returns.

A higher ratio is usually desirable, as it indicates a higher return for a given level of risk.

The risk-return spectrum, on the other hand, is a theoretical concept that posits higher potential returns are associated with increased levels of risk.

This idea embodies the inherent trade-off in investing: higher potential returns could mean higher potential losses.

MPT’s notions of economic efficiency are drawn from the efficient-market hypothesis and the random walk hypothesis.

The efficient-market hypothesis proposes that financial markets are “informationally efficient” with current prices accurately reflecting all available information.

The random walk hypothesis suggests that stock price changes are random and unpredictable – and hard to “beat” in practice given the competition – making the case for diversified portfolios in the pursuit of financial gains.

Utility Maximization Problem

The utility maximization problem is an economic theory suggesting investors make decisions to maximize their satisfaction or utility.

This is aligned with MPT, which encourages diversification to achieve optimal results (i.e., highest return for a given risk).

Markowitz Model

The Markowitz model, or the mean-variance model, is at the heart of MPT.

It provides a formal framework for creating a portfolio of assets, considering their expected returns and standard deviations (risk).

The goal is to find a portfolio that minimizes risk for a given expected return, or equivalently, maximizes expected return for a given risk level.

Merton’s Portfolio Problem

Merton’s portfolio problem extends Markowitz’s model to a continuous-time setting.

It provides a dynamic strategy for portfolio selection, considering not just the distribution of returns, but also an investor’s consumption and investment horizon.

Kelly Criterion

The Kelly Criterion is a mathematical formula used to determine the proportion of wealth to invest in a single bet or investment to maximize long-term growth.

This formula helps investors manage risk and optimize returns over time.

Roy’s Safety-First Criterion

Roy’s safety-first criterion is a risk-management approach that prioritizes preventing financial disasters over maximizing expected returns.

The aim is to choose a portfolio with the smallest probability of falling below a certain threshold level of wealth or return.

In other words, the focus is on reducing left-tail risk as much as possible or eliminating it entirely.

Theory and Results (Derivation of the CAPM)

The Capital Asset Pricing Model (CAPM) is a key outcome of MPT.

It determines a theoretically appropriate expected return of an asset, given that asset’s non-diversifiable, or systematic, risk.

The equilibrium price of an asset, according to the CAPM, is determined by the risk-free rate, the expected market return, and the asset’s beta.

The beta of an asset is a measure of its systematic risk in relation to the market.

A beta greater than 1 indicates the asset is more volatile than the market, while a beta less than 1 suggests the asset is less volatile.

Various models such as the Fama–MacBeth regression, Hamada’s equation, and capital structure substitution theory can help estimate the beta of a specific asset.

CAPM also differentiates between systematic and idiosyncratic (specific) risks.

Systematic risk refers to the risk inherent to the entire market or an entire market segment, while idiosyncratic risk is the risk associated with a particular asset, independent of the overall market.

Under MPT, an investor can achieve an optimal portfolio by selecting a point along the efficient frontier, the set of portfolios that maximize expected return for a given level of risk.

This portfolio selection is subject to the investor’s risk tolerance and expected return.

Mutual Fund Separation Theorem

A key theorem of MPT is the mutual fund separation theorem.

It states that, given certain assumptions, any investor’s optimal portfolio can be constructed from a combination of one risk-free asset and a particular portfolio of risky assets.

This specific portfolio of risky assets is called the “market portfolio.”

Tangent Portfolio

The tangent portfolio is the portfolio on the efficient frontier with the highest Sharpe ratio, i.e., it offers the best risk-return trade-off.

It is the point at which the capital market line, a line drawn from the risk-free rate tangent to the efficient frontier, touches the efficient frontier.

Market Portfolio

The market portfolio is a theoretical bundle of investments that includes every type of asset available in the world financial market, with each asset held in proportion to its market value.

According to MPT, this portfolio lies on the efficient frontier and is the optimal portfolio for any investor who assumes the market is efficient and risk is represented by volatility.

Capital Allocation Line and Capital Market Line

The Capital Allocation Line (CAL) is a line drawn on a graph of all possible combinations of risk-free and risky assets.

The slope of the CAL represents the reward-to-variability ratio. The steeper the CAL (i.e., the greater the slope), the better the risk-return trade-off of the portfolio.

The Capital Market Line (CML) is a specific CAL drawn from the risk-free asset to the tangent portfolio on the efficient frontier.

The CML is the best attainable CAL given the risk-free rate and the risky assets in the market.

Security Characteristic Line and Security Market Line

The Security Characteristic Line (SCL) is a plot of a security’s expected excess return over the risk-free rate as a function of the excess return of the market portfolio.

The slope of the SCL is the security’s beta, and the intercept is the alpha, a measure of the expected return of the asset independent of the market return.

The Security Market Line (SML) is a line on a graph showing the relationship between the expected return of a security and its beta.

The SML is important in determining whether an asset being considered for a portfolio offers a reasonable expected return for risk.

CAPM Critiques

Despite its theoretical elegance, CAPM has been subjected to numerous critiques.

One of the most prominent is Roll’s critique, which states that CAPM is not testable because the true market portfolio can never be observed.

Related Measures

Several performance measures complement MPT, such as Alpha, the Sharpe ratio, the Treynor ratio, and Jensen’s alpha.

These measures provide insights into the risk-adjusted performance of an investment or portfolio.

Alpha is a measure of the excess return of an investment relative to the return of a benchmark index.

The Sharpe ratio is a measure of risk-adjusted performance, which is calculated by subtracting the risk-free rate from the portfolio’s return and dividing the result by the standard deviation of the portfolio’s return.

The Treynor ratio, similar to the Sharpe ratio, uses beta instead of standard deviation as the risk measure.

Jensen’s alpha measures the return of a portfolio over its expected return as predicted by CAPM.

Optimization Models

MPT uses various optimization models like the Markowitz model and the Treynor-Black model.

These models aim to optimize portfolio selection based on the investor’s risk tolerance and expected return.

The Treynor-Black model is a hybrid of active and passive management.

It proposes an optimized portfolio combining a diversified market index and a few select mispriced securities identified by active management.

Equilibrium Pricing Models (CAPM and Extensions)

MPT forms the basis of equilibrium pricing models, including the classic CAPM and its various extensions:

Consumption-based CAPM (CCAPM), Intertemporal CAPM (ICAPM), and the Single-index model.

These models provide a more nuanced understanding of asset pricing, factoring in intertemporal decisions, consumption preferences, and other factors.

In addition to these models, multiple factor models, such as the Fama-French three-factor model, Carhart four-factor model, and Arbitrage Pricing Theory (APT), have emerged.

These models extend CAPM by including other systematic risk factors that may affect a security’s return.

Post-Modern Portfolio Theory (PMPT)

Post-modern portfolio theory (PMPT) is a new approach to portfolio management that was developed in response to the limitations of modern portfolio theory.

PMPT’s most popular contribution is the idea that not all volatility is bad.

For example, if volatility helps your portfolio increase in value, that’s an example of good volatility.

Volatility that makes a portfolio fall in value is bad volatility.

For this reason, PMPT focuses on the Sortino ratio as its measure of risk rather than the Sharpe ratio.

What is the difference between the Sortino ratio and Sharpe ratio?

The Sortino ratio is a risk-adjusted performance measure that only looks at downside volatility.

The Sharpe ratio, on the other hand, considers both upside and downside volatility when calculating risk-adjusted performance.

PMPT also takes into account the idea of fat tails, which is the concept that asset returns are not distributed evenly.

Instead, they tend to cluster around the mean while also having a long tail of outliers in both directions.

This means that there is a greater chance of extreme events occurring than what would be predicted by a normal distribution.

By taking into account fat tails, PMPT provides investors with a more accurate picture of the risks and potential rewards associated with investing in different asset classes.

What Is (Fat) Tail Risk?

FAQs – Modern Portfolio Theory

What is Modern Portfolio Theory?

Modern portfolio theory is an investment strategy that was developed by Harry Markowitz in the 1950s.

The basic idea behind MPT is that investors should diversify their portfolios across a variety of different assets in order to minimize risk while still maximizing return.

MPT is based on the concept of the efficient frontier, which is the collection of portfolios that offer the highest expected return for a given level of risk.

Despite its critics, MPT remains a popular investment strategy.

Is Modern Portfolio Theory Still Relevant?

Modern portfolio theory is a powerful tool that can be used to help investors make better decisions about how to allocate their assets.

However, it is not perfect and has some limitations.

Post-modern portfolio theory was developed in response to these limitations and provides a more accurate picture of the risks and rewards associated with investing.

MPT and PMPT both have their merits and there is a huge variety of investment strategies and styles that fall under the umbrella of “portfolio management.”

The best strategy for you will depend on your individual goals and risk tolerance.

What is the Efficient Frontier?

The efficient frontier is the collection of portfolios that offer the highest expected return for a given level of risk.

In order to be on the efficient frontier, a portfolio must have a higher expected return than any other portfolio with the same level of risk or a lower level of risk than any other portfolio with the same expected return.

The efficient frontier is often graphed as a curve, with risk on the x-axis and return on the y-axis.

Portfolios that lie on or below the efficient frontier are considered to be efficient, while those that lie above it are considered to be inefficient.

The efficient frontier is important because it can help investors identify the optimal balance between risk and return for their portfolios.

What is Risk?

There is no single definition of risk. But in general, it can be thought of as the chance of losing money on an investment.

Risk can be measured in a number of ways, but the most common measures are standard deviation and beta.

Standard deviation measures the volatility of a security’s returns, while beta measures the relationship between a security’s returns and the market’s returns.

Both standard deviation and beta are useful measures of risk, but they have different implications for investors.

What is the Sharpe Ratio?

The Sharpe ratio is a measure of risk-adjusted return that considers both upside and downside volatility when calculating performance.

It was developed by economist William Sharpe in the 1960s and is still widely used today.

The Sharpe ratio is calculated by subtracting the risk-free rate from the expected return of an investment, and then dividing that number by the standard deviation of the investment’s returns.

The higher the Sharpe ratio, the better the risk-adjusted performance of an investment.

What are Fat Tails?

Fat tails are a concept in statistics that refers to the fact that asset returns are likely to experience larger deviations than what might be predicted by the normal distribution.

In other words, there are likely to be more outliers (or “fat tails”) at the extremes.

Fat tails are important because they can have a significant impact on an investor’s portfolio.

For example, if an investor is holding a portfolio of stocks with fat tails, then a small number of extreme events could have a large impact on the portfolio’s performance.

What is Diversification?

Diversification is the process of spreading your investment across a variety of different assets in order to lower risk and maximize return per each unit of return.

The idea behind diversification is that it is better to own a little bit of each asset than it is to own all of one asset.

Diversification can be achieved by investing in a variety of different asset classes with low correlations to each other.

It can also be achieved by investing in a variety of different sectors, industries, and geographical regions.

The key to successful diversification is to make sure that your investments are not too similar to each other.

If they are too similar, then they will tend to move in the same direction and you will not achieve the desired level of risk reduction.

What is Asset Allocation?

Asset allocation is the process of deciding how to allocate your assets among different asset classes.

The most common asset classes are stocks, bonds, and cash.

Asset allocation is a key part of investment planning because it can have a major impact on your overall risk and return profile.

The right asset allocation for you will depend on your investment goals, time horizon, and risk tolerance.

What is Portfolio Rebalancing?

Portfolio rebalancing is the process of periodically adjusting the mix of assets in your portfolio back to your target allocation.

Rebalancing is important because it helps you maintain your desired level of risk and return.

Over time, the performance of different assets will vary, which will cause your asset mix to drift away from your target allocation.

Rebalancing forces you to sell the asset that has increased in value and buy more of the asset that has decreased in value, which brings your portfolio back to its original allocation.

What is Risk Tolerance?

Risk tolerance is the degree of variability in investment returns that an investor is willing to tolerate.

Investors with a high risk tolerance are willing to accept a higher degree of volatility in their returns, while investors with a low risk tolerance are not.

Risk tolerance is an important concept because it helps investors determine how much risk they are willing to take on.

It is also helpful in setting investment goals and creating an investment plan.

What is the Capital Asset Pricing Model (CAPM)?

The CAPM is a model that is used to determine the expected return of an asset.

The model takes into account the risk of the asset and the market risk premium.

The CAPM is a helpful tool for investors because it allows them to compare the expected return of different assets.

It is also helpful in setting investment goals and creating an investment plan.

Conclusion – Modern Portfolio Theory

Modern Portfolio Theory (MPT), introduced by Harry Markowitz in 1952, introduced a new paradigm in financial investment management.

It revolves around the notion that an investment’s risk and return characteristics should not be viewed in isolation, but evaluated by how the investment affects the overall portfolio risk and return.

Modern Portfolio Theory is a tool that can help investors to build a diversified portfolio that maximizes return while minimizing risk.

While MPT has some limitations, it is still one of the most popular and widely used investment theories today.

If you are interested in learning more about MPT and how to use it to build a diversified portfolio, there are many resources that we have available:

- How to Build a Balanced Portfolio

- Balanced Beta – Balancing Risk, Not Dollars

- Balanced Portfolio with VRP Overlay

- Building a Balanced Portfolio with Options

Modern Portfolio Theory (MPT) is a theory that was developed by Harry Markowitz in the 1950s. It is a tool that investors can use to help them build a diversified portfolio that minimizes risk while maximizing return.

MPT has some limitations, but it is still one of the most popular and widely used investment theories today.