Capital Structure

Capital structure refers to the composition of a firm’s funding sources.

It is a blend of debt, equity, and hybrid securities used to finance a company’s operations and growth initiatives.

Understanding capital structure is important for investors, traders, and business managers.

It provides insights into a company’s risk profile, operational flexibility, and potential for future profitability.

While the optimal capital structure may differ across companies and industries, a careful analysis of debt, equity, and hybrid securities can help make informed decisions about trading, investing, and managing a business.

Key Takeaways – Capital Structure

- Capital Structure Essentials:

- Capital structure refers to a company’s funding sources, including debt, equity, and hybrid securities.

- It impacts a company’s financial health and ability to finance operations and growth.

- Components and Implications:

- Capital structure consists of debt, equity, and hybrid securities.

- Debt is borrowed capital with repayment obligations, while equity represents ownership.

- Hybrid securities combine debt and equity features, offering flexibility.

- Importance and Decision Factors:

- Capital structure affects risk, profitability, and cost of capital.

- Optimal structure minimizes cost while considering industry, risk, taxes, and market conditions.

- Businesses must choose between debt’s tax benefits and equity’s dilution effects.

Understanding Capital Structure

The capital structure of a company is integral to its financial well-being.

It’s the combination of various types of debt and equity that a company utilizes to finance its business operations.

Components of Capital Structure

There are three key components to a company’s capital structure:

- debt (e.g., loans, issuing bonds)

- equity, and

- hybrid securities (e.g., preferred stock)

Debt typically includes both long-term obligations like bonds and short-term obligations like loans.

Equity includes common and preferred shares.

Hybrid securities combine elements of debt and equity, examples include convertible bonds and preferred shares.

Debt in Capital Structure

In the capital structure, debt can be seen as a borrowed capital that a company uses for its operation.

This is an obligation that the company must repay in the future, typically with interest.

Equity in Capital Structure

Equity, on the other hand, represents ownership in the company.

When a company issues equity, it is essentially selling a piece of itself in exchange for capital.

Hybrid Securities in Capital Structure

Hybrid securities are a mix of debt and equity characteristics.

Convertible bonds, for instance, start as debt and can be converted into equity at certain trigger points, giving a company flexibility in its capital structure.

Importance of Capital Structure

The importance of a firm’s capital structure lies in its potential to impact the firm’s risk profile and profitability.

It can influence the cost of capital and, consequently, the company’s potential to generate returns for its stakeholders.

Trading and Capital Structure

Traders need to understand a company’s capital structure as it can influence a stock’s price.

Higher levels of debt can increase a firm’s risk, possibly leading to higher required rates of return and lower stock prices.

Conversely, lower levels of debt can reduce risk and potentially boost a stock’s price.

Investing and Capital Structure

For long-term investors, the capital structure is critical because it may influence the company’s ability to weather financial downturns.

Companies with too much debt may be at risk during economic downturns (or any time their revenue falls or their costs increase), while firms with healthy balances of debt and equity can be more resilient.

Business Perspective on Capital Structure

From a business perspective, the decision to finance operations with debt or equity can have significant implications.

Debt must be repaid and can constrain a firm’s flexibility, but it offers tax benefits.

Equity does not have to be repaid but dilutes ownership and future earnings.

Optimal Capital Structure

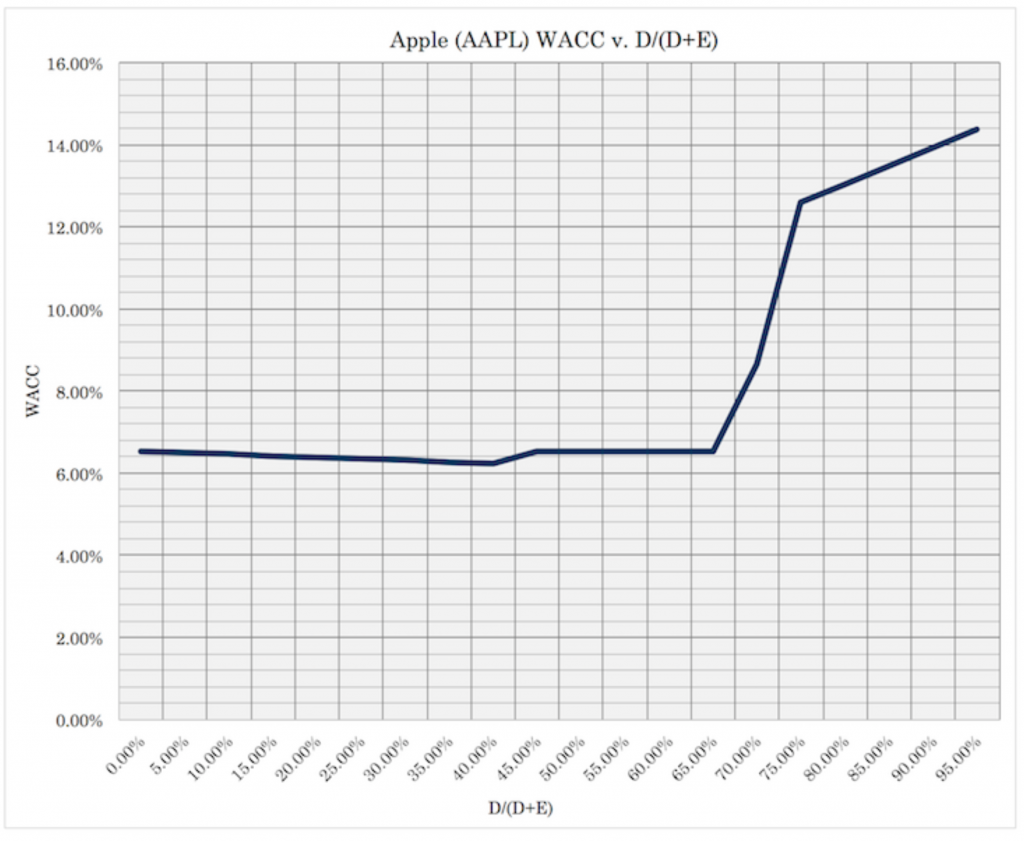

The optimal capital structure is the mix of debt and equity that minimizes the firm’s cost of capital, thereby maximizing its value.

This mix is dependent on various factors, including the nature of the industry, the company’s operational risk, its tax situation, and market conditions.

Some debt – in terms of minimizing cost – can be good because debt is cheaper than equity (it’s senior in the capital structure).

However, past a point it can be dangerous as principal and interest costs can be too onerous.

The chart below shows this concept graphically using Apple (AAPL) stock.

Modigliani-Miller Theorem

According to the Modigliani-Miller theorem, in a world without taxes, bankruptcy costs, and asymmetric information, the capital structure is irrelevant.

The value of a firm is determined by its cash flows and not by how it is financed.

However, the Modigliani-Miller theorem is more of an academic concept rather than something with a lot of real-world value.

FAQs – Capital Structure

What is capital structure in corporate finance?

Capital structure refers to the way a corporation finances its assets through a combination of equity, debt, or hybrid securities.

The structure is a specific mix of long-term debt, short-term debt, common equity, and preferred equity.

The capital structure decision has important implications for the risk and return of the shareholders and corporate sustainability.

Can you explain the capital structure substitution theory?

The Capital Structure Substitution theory (CSS) argues that firms seek to maintain an optimal value range rather than an optimal debt ratio.

When the firm’s value is below the optimal range, it issues debt, and when it’s above, the firm issues equity.

This model assumes that at any given point, a firm’s management decides between issuing debt or equity based on a trade-off between the expected risk of default versus the dilution costs.

What is the Pecking Order Theory?

The pecking order theory, proposed by Myers and Majluf in 1984, suggests that companies prioritize their sources of financing based on the least resistance.

First, they prefer internal financing (retained earnings); if that is not enough, they will use debt; if a safe debt level has been reached, only then will they use external equity.

According to this theory, equity is a less preferred means to raise capital because of the asymmetric information problem between managers and investors.

Can you elaborate on the Market Timing Hypothesis?

The Market Timing Hypothesis suggests that firms time their issuance of new equity or debt based on market conditions.

That is, they will issue equity when the market is booming (i.e., the cost of equity is low), and they will issue debt when the market is down.

This theory challenges the static trade-off theory, which asserts that firms have an optimal debt-to-equity ratio and thus, they adjust their current capital structure to this target.

What is the Trade-off Theory of Capital Structure?

The trade-off theory of capital structure posits that firms balance the costs and benefits of debt and equity financing to determine their optimal capital structure.

The costs of debt include financial distress, bankruptcy risk, and agency costs.

The benefits include tax advantages due to interest deductibility (tax shield) and reduced agency costs of equity.

This theory suggests that firms have an optimal debt-to-equity ratio where the marginal benefit of additional debt equals the marginal cost.

What is the Merton Model?

The Merton Model is an analytical model used to assess the credit risk of a company’s debt.

Robert C. Merton proposed this model, and it extends the Black-Scholes option pricing model to incorporate the company’s debt and equity.

According to the Merton model, the company’s equity can be seen as a call option on the firm’s assets, and the default risk arises when the value of the assets falls below the debt level.

What is a Tax Shield?

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest, medical expenses, charitable donations, amortization, and depreciation.

In the context of capital structure, the interest expense that comes from debt financing can be used to reduce a company’s taxable income, thus creating a “shield” against taxes.

This tax benefit of debt is an integral part of the trade-off theory of capital structure.

Conclusion

- Capital Structure Basics: Capital structure refers to a company’s funding mix of debt, equity, and hybrid securities, shaping its financial health and growth opportunities.

- Debt vs. Equity Dynamics: Capital structure involves balancing debt’s repayment obligations and equity’s ownership impact, with hybrid securities providing flexibility.

- Optimal Balance for Success: Selecting an optimal capital structure minimizes costs and considers industry, risk, taxes, and market conditions, important for maximizing a company’s value and resilience.