FXOpen Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best ECN Broker 2012 - Masterforex-V

- Best Forex Broker in Australasia 2011 - World Finance Magazine

- Best Islamic Forex Broker 2011 - IB Times Trading Awards

- Best South-East Asia Forex Broker and Best ECN Forex Broker 2011 - IB Times Trading Awards

- Best Trading Platform 2010 - Falcon Awards

Pros

- FXOpen introduced TradingView in 2022 and upgraded its TickTrader platform in 2024, offering Level 2 pricing, 1,200+ trading tools, and advanced order types, catering to both experienced and high-frequency traders.

- FXOpen reduced FX spreads by 40%+ in 2022 and introduced commission-free index trading in 2023, making it cost-effective for day traders.

- FXOpen streamlined its account offerings in 2024, ensuring a user-friendly setup with ECN accounts providing raw spreads from 0.0 pips, fast execution speeds, and discounted commissions for high-volume traders.

Cons

- FXOpen has a threadbare educational offering, lacking the courses and webinars you can find at brokers like IG, limiting its appeal to beginners seeking to build their knowledge.

- Despite bolstering its asset range, FXOpen still offers fewer global stocks, commodities, and cryptocurrencies than category leader BlackBull, reducing access to diverse trading opportunities.

- While still a trusted broker with authorization from the FCA and CySEC, FXOpen lost its ASIC license in 2024 following ‘serious concerns’ and no longer onboards Australian traders.

FXOpen Review

Regulation & Trust

Established in 2005, FXOpen has become a trusted broker, regulated by two ‘green tier’ and one ‘red tier’ financial authorities in DayTrading.com’s Regulation & Trust Rating:

- FXOpen UK is a trading name of FXOpen Ltd, authorized by the Financial Conduct Authority (FCA) (license number 579202). ‘Green tier’.

- FXOpen EU is a trading name of FXOpen EU Ltd, authorized by the Cyprus Securities and Exchange Commission (CySEC) (license number 194/13). ‘Green tier’.

- FXOpen INT is a trading name of FXOpen Markets Limited, registered in Nevis under the company No. C 42235 and is a member of The Financial Commission. ‘Red tier’.

- FXOpen AU is the trading name of FXOpen AU Pty Ltd. However, the Australian Securities & Investments Commission (ASIC) canceled FXOpen AU’s AFS license 412871 in September 2024 after an investigation revealed ‘serious concerns‘ regarding the broker’s capacity to effectively supervise its financial services and fullfil its licensing obligations. Following this, we’ve lowered FXOpen’s trust score.

For added security, FXOpen Ltd (UK) clients, regardless of nationality, have their funds fully protected up to £85,000 by the Financial Services Compensation Scheme (FSCS) in the event of FXOpen UK’s insolvency.

The Investors Compensation Scheme (ICS) fully protects the funds of FXOpen EU Ltd (Europe) clients up to €20,000.

Clients using FXOpen AU and FXOpen INT don’t have the same investor protection schemes so dispute resolution could be problematic in those regions.

However, negative balance protection is present in all jurisdictions, so you can’t lose more than your balance.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, CySEC, FC | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

FXOpen discontinued several of its account options in 2024, now offering a simplified user experience.

Its ECN (Electronic Communication Network) trading system offers direct market access, allowing you to trade at raw prices provided by banks and liquidity providers.

This type of account, particularly popular with day traders and high-volume traders, is suitable for accessing diverse trading instruments.

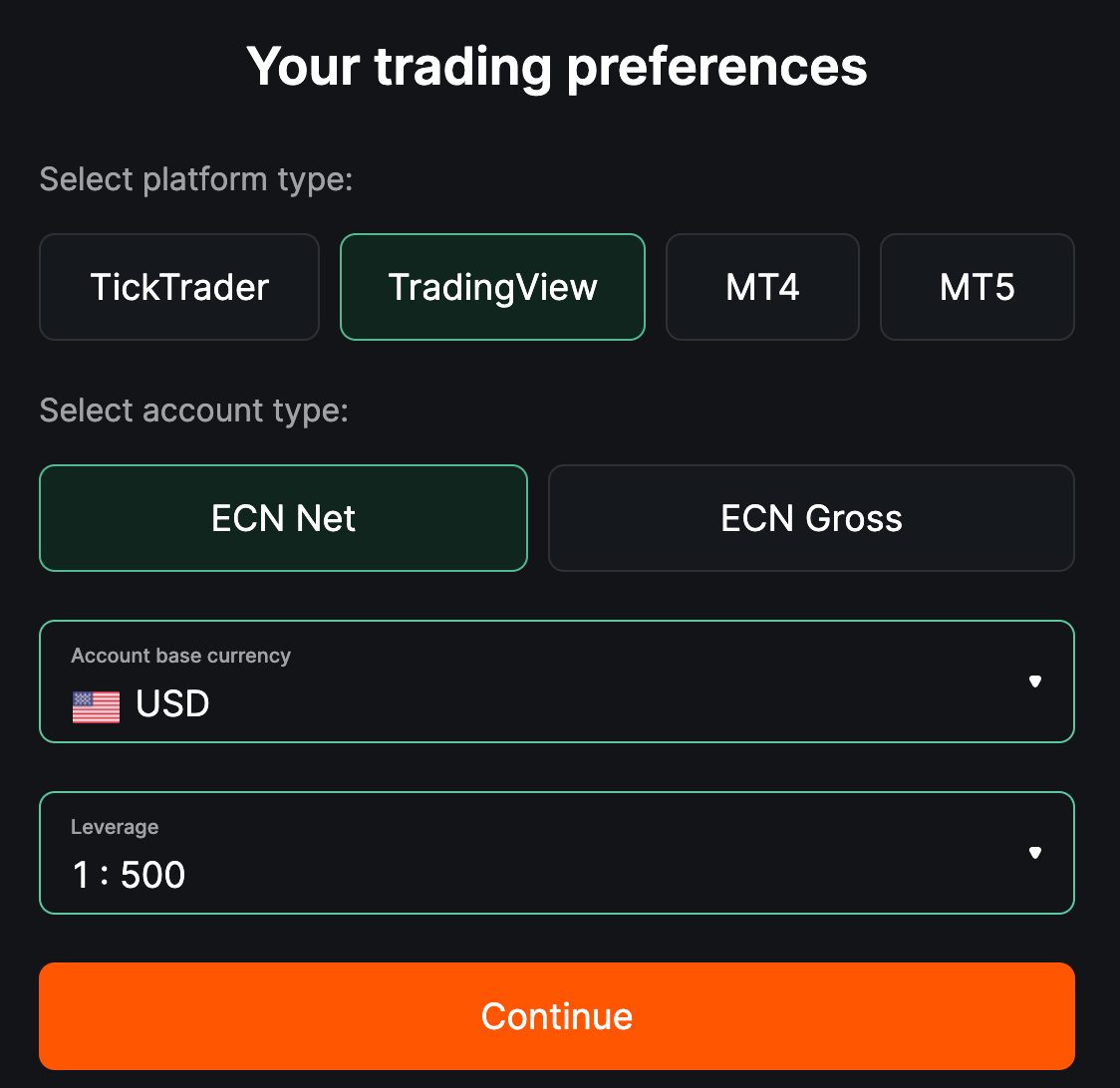

Setting up a live account only took me a few minutes, but it wasn’t without some confusion…

Setting up an MT4 account was straightforward. I had to choose between a regular ECN or PAMM investment, my preferred base currency (AUD, CHF, EUR, GBP, JPY, SGD, USD), and leverage level (1:1000 maximum introduced in 2023, up from 1:500).

However, opting for a TickTrader, TradingView, or MT5 account required me to choose between a ‘Gross’ or ‘Net’ account type. I didn’t know the difference between Gross and Net account types then, and because FXOpen needed to clarify it, I had to contact live chat.

It turns out, the key difference lies in how positions are tracked. On a Gross account, each position opened on a financial instrument is treated as an individual transaction. This means you can simultaneously hold multiple, even opposing (hedging), positions on the same instrument.

I was then able to create additional accounts within my user profile. To complete the process, I was asked to answer questions about CFD trading, create a secure password, and verify my phone number and email address.

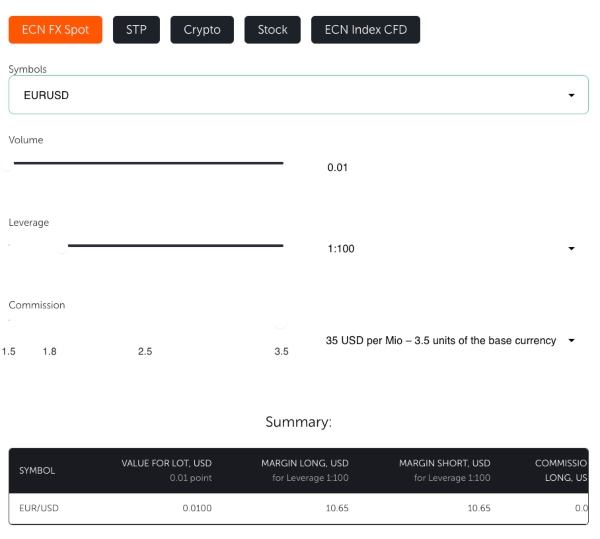

Key features of the ECN account:

- 0.01 minimum position size (micro lot).

- Up to 1:100 leverage (depending on client status, country and asset).

- Floating spreads starting from 0 pips (ideal for active traders).

- $100 minimum deposit (or the equivalent in another currency).

- Discounted commissions (per 1 lot) from $1.50 for account balances over $250,000, rising to a maximum of $3.50 for account balances below $1,000.

- 100/50% margin call/stop out.

FXOpen also offers swap-free Islamic accounts for Muslim traders, adhering to Sharia law. These accounts incur a commission on overnight positions, similar to swap charges.

Demo Accounts

I was able to open a demo account with FXOpen on platforms like MetaTrader 4, MetaTrader 5, and TickTrader, but TradingView demo accounts are not available. The process was quick and easy because no verification was required.

A demo account allows you to trade with up to $5,000,000 in virtual funds and leverage up to 1:500, but I was disappointed that it is limited to USD as the base currency.

Thankfully, demo accounts don’t have a time limit, either, so I can test other strategies like swing and position trading. However, they do become inactive after 90 days of no use.

Deposits & Withdrawals

FXOpen’s funding and withdrawing options are versatile and user-friendly, but the options available depend on your location.

For instance, bank transfers, credit/debit cards (Visa, Mastercard), and e-wallets like Skrill and Neteller are available for European entities, but the offshore entity limits choice to FasaPay, Volet, and cryptocurrencies (eg BTC, ETH), which is an inconvenience.

Deposits and withdrawals are usually processed within a few minutes, but funds credited to bank accounts can take up to three business days. You’ll also need to verify your account with some ID documents before depositing or withdrawing funds.

It’s also worth noting that some payment options, like crypto and Volet, incur fees.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, FasaPay, Mastercard, Neteller, Skrill, Visa, Volet, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $100 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

FXOpen offers a growing suite of tradable assets, providing flexibility for various short-term trading strategies. The full range depends on your jurisdiction, however. For instance, cryptocurrencies aren’t available in the UK.

You can trade:

- Forex: 50+ pairs including majors (eg EUR/USD), minors (eg AUD/NZD) and exotics (eg USD/MXN).

- Commodities: 5+ commodities including Gold (XAU/USD), silver (XAG/USD) and crude oil (XTI/USD).

- Stocks: 600+ stocks across major US, UK and Hong Kong stock exchanges (eg Tesla, Diageo, BYD).

- ETFs: 12+ including ARK Innovation (ARKK) and Autonomous Technology & Robotics ETF (ARKQ).

- Indices: 10+ covering the US, Europe, Asia and Australia (eg Nasdaq-100 and Nikkei 225).

- Crypto: 25+ cryptocurrency pairs (eg BTC/USD, ETH/USD).

Despite new additions over the years, notably 19 new ETF CFDs in 2023, expanding the offering to include global stocks, agricultural commodities, bonds, options, and futures could further enhance FXOpen’s competitiveness and appeal to a broader range of traders seeking diverse market exposure.

Unlike eToro, FXTM, and Pepperstone, FXOpen doesn’t offer passive investment options like real stocks or an in-house copy trading service outside MetaTrader.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (EU, UK), 1:1000 (Global) | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

FXOpen’s ECN accounts provide direct market access, allowing you to execute trades at raw prices from banks and liquidity providers for a small commission fee.

FXOpen has also made strides to lower its spreads over the years, notably in 2022 when it slashed forex spreads by more than 40%, making it a premier destination for day traders and scalpers.

Still, account fees vary based on account balance. High-volume traders benefit from discounted commissions, while those with lower balances may incur higher costs.

For instance, forex commissions can range from $3.50 to $1.50 per lot traded, depending on the account balance. Commodity CFD commissions are also tiered, with lower rates for more significant account balances. Cryptocurrency CFD commissions are fixed at 0.5% per side.

In 2023, FXOpen introduced commission-free trading on index CFDs, further enhancing its competitive edge.

Additional fees to consider include overnight swap charges and inactivity fees. A $10 monthly fee is charged for accounts inactive for as little as three months (FXOpen AU), and a $50 fee applies for account reactivation.

Currency conversion fees may also apply if your base account and funding currency differ.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.2 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 0.7 | 100 | 0.005% (£1 Min) |

| Oil Spread | 0.04 | 0.1 | 0.25-0.85 |

| Stock Spread | 0.40 (Apple) | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

FXOpen provides a wide range of trading platforms tailored to various trader needs, such as asset choice and support for automated trading (EAs).

MetaTrader 4 (MT4)

MT4 is an industry standard, and I find it solid for forex trading on Windows and Mac desktops, from a web browser, or on a mobile device.

It’s not my first-choice platform because I do not like its dated and clunky interface. Still, it offers advanced charting tools and over 30 technical indicators.

Limitations include the lack of support for ‘Net’ accounts, the lack of a built-in economic calendar, and API support for automated trading.

MetaTrader 5 (MT5)

MT5 builds on MT4’s strengths with additional features like more timeframes, support for ‘Net’ accounts and APIs, and an integrated economic calendar.

I appreciate the multi-asset support, but it needs the advanced interface customization seen in brokers like CMC Markets and IG platforms.

TradingView

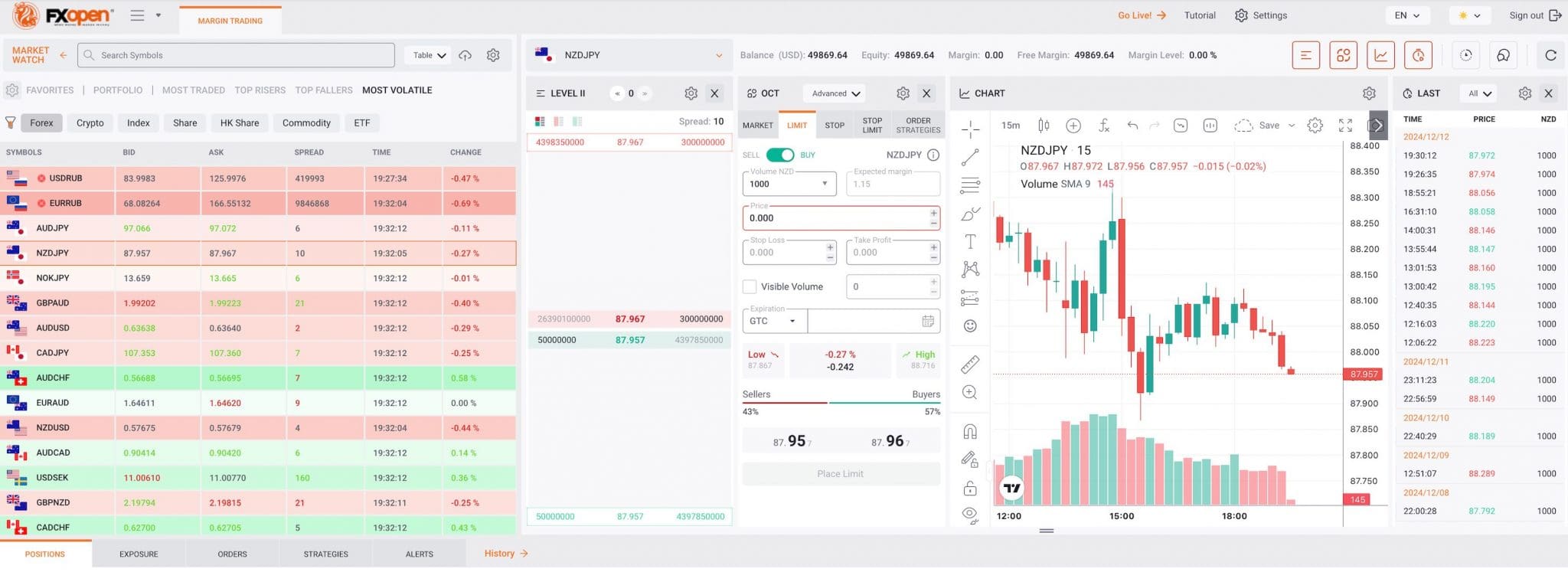

I have been impressed with FXOpen’s option for TradingView, which was added in 2022, because few brokers support it, though this number is gradually rising.

I rate TradingView because it’s the most intuitive trading platform and runs on most platforms: Windows, Mac, and Linux desktops, web browsers, and mobile devices.

It also boasts incredible charting tools, screeners, sentiment analysis, economic calendars, social insights, and fantastic community-created indicators. It also runs effortlessly on mobile devices.

The most significant limitations compared to MT5 and TickTrader are the lack of crypto and automated trading.

TickTrader

Once I’d spent a little time navigating this proprietary platform, I found it versatile and powerful. However, compared to TradingView, it could be more visually intuitive.

The customizable interface offers clear price analysis charts, over 1,200 advanced trading tools, Level 2 pricing, advanced risk management tools, and one-click trading, which I’ve found highly efficient when scalping.

Despite feature improvements in 2024, it still doesn’t have a native macOS app and only supports Windows and mobile devices.

In addition to the four common types of orders – Market Order, Limit Order, Stop Order, and Stop-Limit Order – it has advanced order strategies, including One Triggers Another (OTA), Ladder of the Orders, and Order by Date (OBD).

The only order type I would like to see added is a Trailing Stop Order, which is similar to a Stop Order but based on a percentage change in the market price rather than a fixed target price.

Overall, TickTrader is an advanced trading platform best suited to experienced traders.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | TickTrader, MT4, MT5, TradingView | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

FXOpen’s research tools are minimal compared to brokers like Saxo Bank and XM. Although the brokerage maintains a daily blog with market news, analysis, and trading tips, I’ve found the lack of in-house webinars or podcasts disappointing.

Furthermore, the lack of actionable trading signals from third-party tools like Autochartist, Trading Central, or Signal Centre makes the platform less competitive overall for beginner traders.

FXOpen could also improve by integrating tools like its economic calendar, divided calendar, and pip value calculator into its TickTrader platform. These additions would significantly enhance the trading experience, especially for data-driven day traders.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

FXOpen’s educational resources, besides a few introductory pages explaining key concepts of forex and CFD trading, are virtually non-existent.

Unlike IG and Interactive Brokers, which offer detailed courses and interactive tools, FXOpen must start publishing webinars, strategy guides, and market analysis tutorials for all skill levels to remain competitive and attract beginner traders.

At the very least, FXOpen should publish some third-party e-books on trading and forex basics, which could benefit new traders.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

FXOpen’s customer support is reliable but has room for improvement based on testing. It offers a 24/7 live chat, email, phone, and ticket system, which is helpful for all account and trading queries.

However, response times can be slower than those of top-tier brokers like Exness and IC Markets, which also offer multilingual 24/7 support.

Better self-help resources, such as more comprehensive FAQs and video tutorials, could help bridge gaps, although I appreciate the option to engage via popular social media platforms such as Facebook, X, LinkedIn, Instagram, and YouTube for less urgent queries.

Extending support hours, offering a callback option, and assigning dedicated account managers to all clients would significantly improve customer service.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With FXOpen?

Whether you should day trade with FXOpen depends on your needs and experience level.

FXOpen is a regulated broker offering competitive pricing, multiple account types, and solid platforms like MT4, MT5, TradingView and TickTrader, catering to experienced traders.

The range of CFDs on offer is acceptable, and the reduced spreads and commissions make it an attractive option. However, compared to brokers like IG or XM, the broker falls short in educational and research resources for beginners.

Before setting up a live account and depositing funds, carefully consider the regulatory branch and your trading goals.

FAQ

Is FXOpen Legit Or A Scam?

Based on our assessment, FXOpen is a respectable trading firm. It’s authorized by trusted regulators, notably the FCA in the UK. It’s also well-established with over 18 years in the industry and more than 1 million clients.

However, its Australian ASIC license was withdrawn due to ‘serious concerns’, and its offshore branch operates under lower oversight, raising concerns about its regulatory status in some regions.

Traders who prioritize safety should consider registering with FXOpen Ltd (UK) or FXOpen EU Ltd (Europe). These entities are backed by investor protection schemes that help protect client funds in the event of the broker’s insolvency.

Is FXOpen Suitable For Beginners?

FXOpen can be suitable for beginners, depending on your specific needs. The availability of industry-standard platforms like TradingView and MetaTrader and demo accounts also makes it accessible for new traders to practice.

However, FXOpen’s learning resources are limited compared to brokers like eToro, which specializes in beginner education. Additionally, some account types are more complex and might not be beginner-friendly due to commission structures.

Beginners should also be cautious about trading through its offshore branch, which has less regulatory oversight.

Best Alternatives to FXOpen

Compare FXOpen with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

FXOpen Comparison Table

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Rating | 3.7 | 3.6 | 4.3 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | $100 |

| Regulators | FCA, CySEC, FC | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | $10 No Deposit Bonus | 100% Anniversary Bonus | – |

| Platforms | TickTrader, MT4, MT5, TradingView | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:30 (EU, UK), 1:1000 (Global) | 1:200 | 1:50 |

| Payment Methods | 11 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXOpen and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXOpen | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | No | Yes | No |

| Silver | Yes | Yes | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | No | Yes | No |

FXOpen vs Other Brokers

Compare FXOpen with any other broker by selecting the other broker below.

The most popular FXOpen comparisons:

Customer Reviews

4.9 / 5This average customer rating is based on 11 FXOpen customer reviews submitted by our visitors.

If you have traded with FXOpen we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of FXOpen

Article Sources

- FXOpen

- FXOpen Ltd - FCA License

- FXOpen EU Ltd - CySEC License

- FXOpen INT - Financial Commission License

- ASIC Cancels FXOpen AU License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I have been trading with this broker for several years. Trading is carried out on two popular platforms – MT4 and MT5, but you can trade through platform tradingview, the browser offers a standard set of tools, as well as cfd. The connection to the server is quite good, quite adequate spreads and fast execution of orders. Narrow spreads. EUR / USD from 0.0. I often see 0.1. No slippage has been noticed yet.

FXOpen is a very good and reliable Forex broker for Professional Forex trading and my trading experience with them has been very positive.

The best thing about this broker is the Low spreads and the Deep market liquidity that is available to all the traders.

They are the Best.

I have been trading with FXOpen for several years now. I am satisfied with the conditions because the spread on many pairs is very narrow, slippage is minimal, and withdrawals are fast. Spread for trading pairs EUR/USD, USD/CHF, USD/JPY from 0.00 pips, average spread 0.02. You can open an account with a broker and connect it to the Tradingview platform. This is a good offer because the platform has many trading tools for professional traders.

This broker is reliable because I have tested their ECN trading account and, on many conditions, when the market was moving in a high volatile manner still, I was able to close my trades at the rates which were being displayed in my Meta Trader. I will continue using them.

Since I trade scalping, I was looking for a broker with tight spreads and instant execution. I chose FXOpen. What did I like? Spread 0.0-0.2 for the EUR/USD pair, excellent execution of orders, the terminal works without freezing. Profits are withdrawn quite quickly. I recommend

Overall, my experience with FXOpen has been positive. They’ve got the essentials covered. reliable platforms, competitive pricing, regulatory compliance, and responsive support. Of course, trading always carries risks, but with FXOpen, I feel like I’m in good hands.

The experience of forex trading with FXOpen using Metatrader 4 is satisfactory, I only started using the platform in early 2024. In terms of trading platforms, I like Metatrader 4 perhaps because I am familiar with this platform which is also used by the broker I used before.

I have very good experience with this broker because of the ECN account and also trade ETF so i am highly satisified with withdrawl as well. Sometimes i think Website needs to be updated

Good broker. Works for me. There are probably better ones out there than him, but I don’t see the point in looking for an alternative. I am satisfied with the basic parameters.

I usually trade forex on several major pairs with tight spreads such as EURUSD, GBPUSD, USDJPY with scalping techniques, withdrawals have been smooth so far, the trading platform now has Ticktrader which is quite impressive because it can access multi-market CFDs