CMTrading Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Performing Financial Broker Africa 2024 – Global Business Review Magazine

- Most Trusted Forex Broker Africa 2024 – Brand Review Magazine

- Most Innovative Trading App Africa 2024 – Brand Review Magazine

- Best Financial Broker Africa 2024 – Global Business & Finance Magazine Awards

- Best Performing Broker South Africa 2023 – Global Business & Finance Magazine

- Best Growing Broker Kenya 2023 – Global Business Review Magazine

- Best Performing Financial Broker Africa 2023 – Global Business Review Magazine

Pros

- CMTrading operates under the oversight of the FSCA in South Africa, providing degree of operational security and accountability, ensuring the platform follows industry standards.

- The CMTrading Academy has come a long way, offering a wealth of materials for traders at all levels. Video courses, webinars, and market analysis updates can help users deepen their knowledge.

- CMTrading have added an incredibly intuitive AI chart feature which we’ve not seen elsewhere and offers signals in three simple steps: find an asset, take a screenshot of the chart, then upload it to the scanner for technical analysis and signals in seconds.

Cons

- While CMTrading offers a variety of assets, the overall selection is still significantly narrower than that of category leading brokers like BlackBull. The focus is primarily on forex, commodities, a few indices, and crypto.

- CMTrading's customer support is unavailable around the clock, which proved inconvenient during testing for traders in different time zones or those who encounter issues during non-business hours.

- Spreads are higher than those offered by some competing brokers like IC Markets based on evaluations. This could increase trading costs, particularly for high-volume day traders.

CMTrading Review

Regulation & Trust

CMTrading is averagely trusted.

On a positive note, it’s been operating since 2012 and expanded its presence from South Africa to the Middle East over the years.

It has also received multiple awards, including ‘Best Broker Africa’ for seven consecutive years from 2017 to 2023.

Weighing the negatives, it’s authorized by ‘yellow tier‘ and ‘red tier‘ bodies in DayTrading.com’s Regulation & Trust Rating, with the selection based on your residency and trading preferences:

- GCMT South Africa Pty Ltd, trading as CMTrading, is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa, license number 38782.

- GCMT Limited, trading as CMTrading, is regulated by the Financial Services Authority (FSA) of Seychelles, license number SD070.

The FSCA of South Africa and the FSA of Seychelles do not typically offer the same level of consumer protection as top-tier regulators like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

The FSCA primarily focuses on financial market conduct within South Africa, and the Seychelles FSA operates more as a registration body for international firms.

While these regulators provide some protection, clients under ‘green-tier’ regulators generally benefit from more robust safeguards, including investor compensation schemes and stricter compliance standards.

CMTrading

Dukascopy

Interactive Brokers

Regulation & Trust Rating

Regulators

FSCA, FSA

FINMA, JFSA, FCMC

FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Accounts & Banking

Live Accounts

CMTrading offers four distinct account types to accommodate active traders with varying experience levels and investment capacities. All accounts offer relatively high leverage up to 1:200.

Key differences include:

- Basic Account: Designed for beginners, this account requires a relatively steep investment between $299 and $1,999. It provides regular spreads, daily market reviews, trading e-books, a beginner’s video education package, one risk-free trade, sessions with a market analyst, and access to live webinars.

- Trader Account: This account is suitable for intermediate traders and requires an investment of $2,000 to $9,999. In addition to the Basic Account, it offers slightly improved spreads, two risk-free trades, and Trading Central.

- Gold Account: Aimed at advanced traders and suitable for short-term traders, this ECN account requires an investment between $10,000 and $50,000. It includes all features of the Trader Account, with floating spreads from 0.1 pips, three risk-free trades, access to a dedicated market analyst, Trading Central analysis, and trading rebates. Commissions are added at $7 per round trip (per lot).

- Premium Account: This account is tailored for professional traders and is for investments exceeding $50,000. It encompasses all the features of the Gold Account, with the addition of customized trading conditions, access to a trading room, and further special offers.

The broker also provides swap-free accounts for traders who follow Islamic finance rules.

The choice of account types is excellent, but providing detailed information on spreads, commissions, and other trading costs for each type would enhance transparency and help traders like me choose the correct account based on trading needs.

It’s also disappointing that CMTrading doesn’t provide a choice between fixed or variable spread accounts.

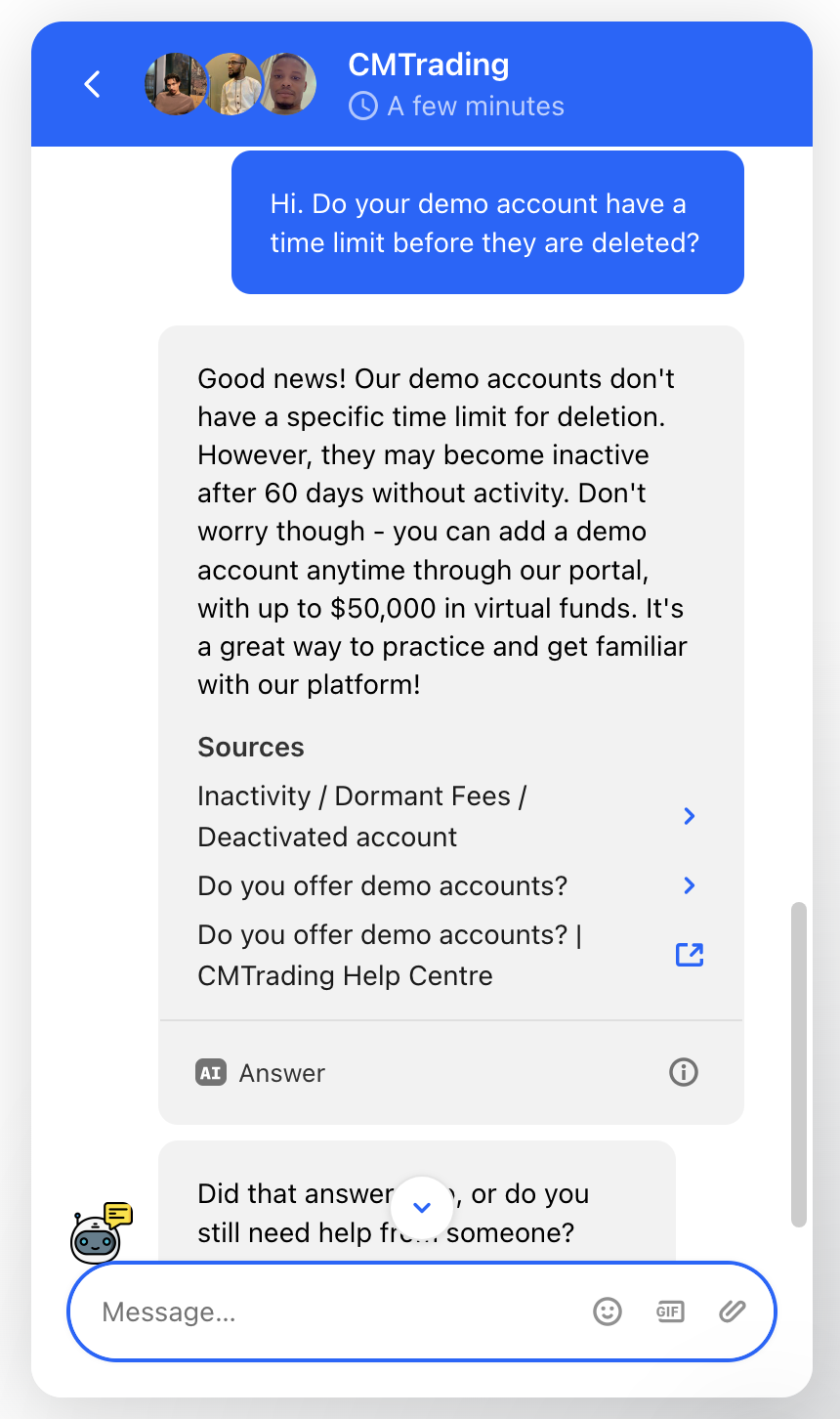

Demo Accounts

CMTrading provides a free demo account, which is essential for testing the broker’s trading platforms and client dashboard.

Annoyingly, accessing a demo account without registering for a live account is impossible. However, I found the process of opening an account seamless and user-friendly. Registration took only a few minutes, and I could then add demo accounts through my client portal.

My demo account was pre-loaded with $10,000 in virtual funds, enabling me to familiarize myself with CMTrading’s proprietary Webtrader platform or MT4 in a risk-free environment.

Still, I’ve been disappointed that I can’t manually change leverage or add virtual funds to my demo accounts.

While demo accounts don’t have a specific time limit for deletion, they may become inactive after 60 days without activity.

Deposits & Withdrawals

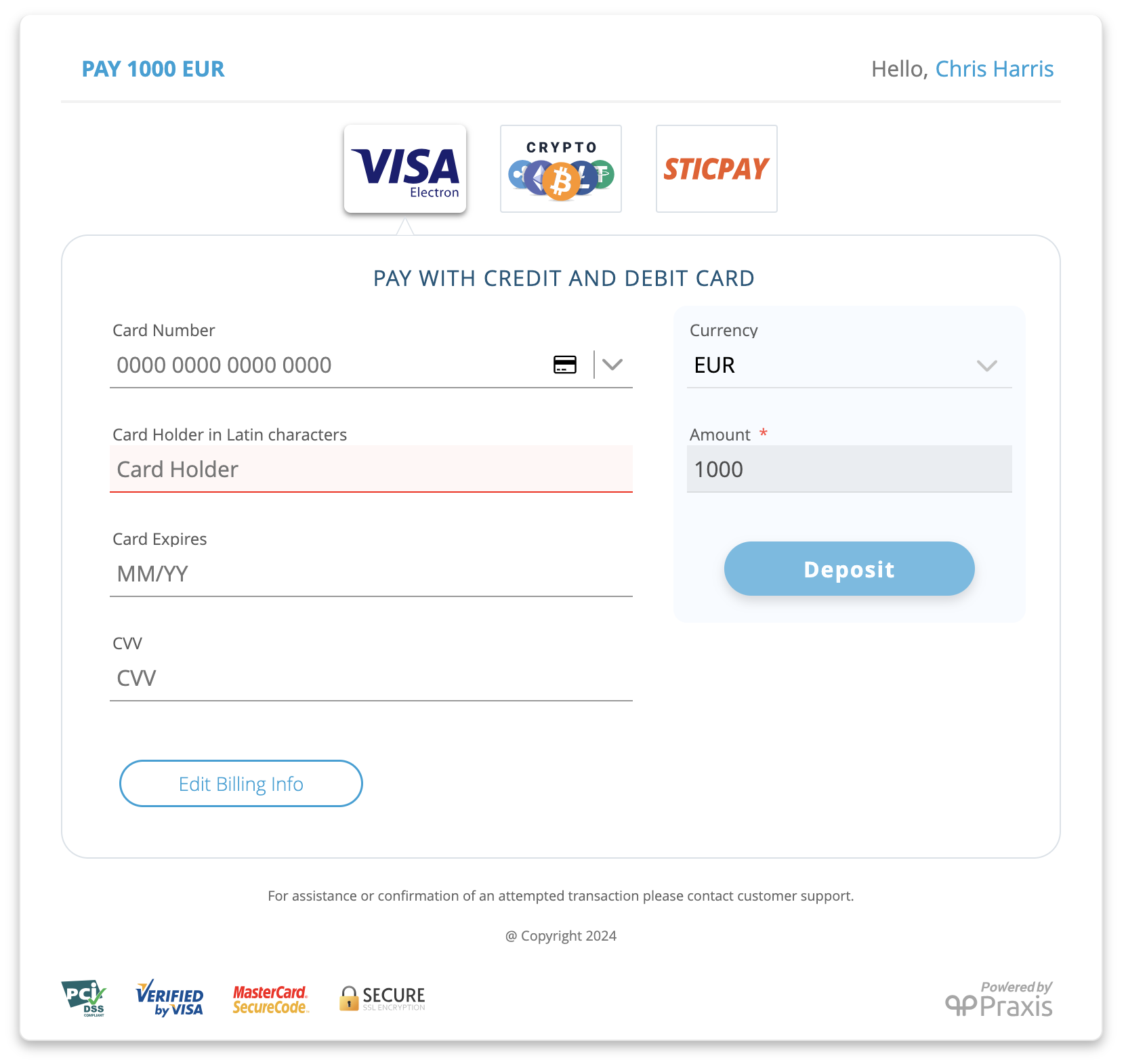

CMTrading provides a reasonable range of deposit and withdrawal options to accommodate its global client base. However, the selection available depends on your location.

For instance, being based in Europe I can fund my accounts using credit cards or debit cards, the Sticpay e-wallet, and cryptocurrencies (USDT, BTC, ETH, USDC, BEP, TRC20).

However, I’ve been surprised to see that bank wire transfers aren’t an option, given almost every broker we’ve evaluated provides this service.

The platform also supports mobile payment solutions like Skrill, Perfect Money, and Neteller in specific regions, offering an added convenience.

Deposits can be processed in multiple currencies, including USD, EUR, and ZAR, making it convenient for traders worldwide to access the platform.

When possible, withdrawals are processed using the same method as deposits. For example, when I deposit using a debit card, I must withdraw up to the deposited amount back to that card.

Any profits exceeding the initial deposit can be withdrawn using alternative methods, such as an e-wallet.

The minimum deposit is $100, and there are no fees for depositing funds into a live trading account. The minimum withdrawal is $20, and transfer fees apply if funds are withdrawn in a different currency than the one used to deposit.

CMTrading strives to process withdrawal requests within 24 hours, although I find the time almost instant.

It would be good to see greater transparency about potential fees, including currency conversion charges. Expanding payment options to include more localized solutions would also make the platform accessible to a broader audience.

CMTrading

Dukascopy

Interactive Brokers

Accounts & Banking Rating

Payment Methods

Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Finrax, Maestro, Mastercard, Neteller, Ozow, Perfect Money, Skrill, Sticpay, Visa

Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer

ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer

Minimum Deposit

$100

$100

$0

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Assets & Markets

CMTrading provides access to just 165+ tradable assets, a considerably small collection compared to most day trading brokers. There are no ETFs, options, bonds, or futures.

You can trade:

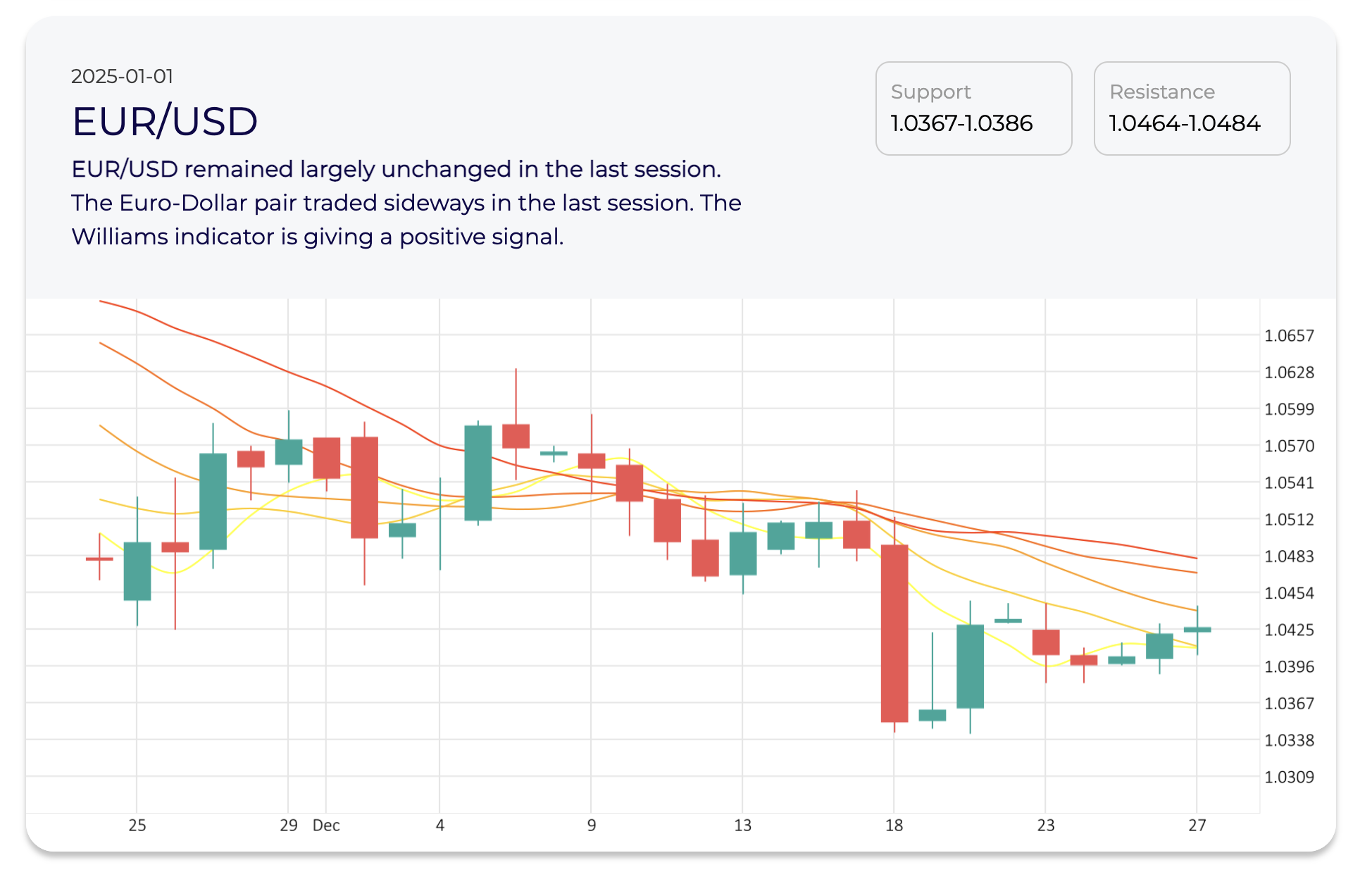

- Forex: 50+ pairs including majors (eg EUR/USD), minors (eg EUR/CAD) and exotics (eg USD/ZAR).

- Stocks: 75+ stocks from leading US and EU companies like Intel and BMW, providing exposure to various sectors and industries.

- Indices: 10+ major global indices like the Dow Jones, FTSE 100, DAX, and FTSE/JSE Top 40, allow you to speculate on the performance of some of the world’s largest financial markets.

- Commodities: 15+ commodities such as gold, silver, oil, and agricultural products like coffee and wheat, let you diversify into metals and energy markets.

- Cryptocurrencies: 15+ coins including Bitcoin, Ethereum and Ripple let you tap into the volatile and dynamic digital asset market.

Another key difference between CMTrading and its competitors (AvaTrade, eToro, and Pepperstone) is the lack of passive investment options (real stocks, real ETFs) and a copy trading service (Copykat is no longer available).

CMTrading

Dukascopy

Interactive Brokers

Assets & Markets Rating

Trading Instruments

CFDs, Forex, Stocks, Indices, Commodities, Crypto

CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options

Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies

Margin Trading

Yes

Yes

Yes

Leverage

1:200

1:200

1:50

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Fees & Costs

CMTrading earns revenue primarily through floating spreads on the instruments it offers.

For major forex pairs, such as EUR/USD and GBP/USD, floating spreads during testing came in at approximately 1.5 pips and 2.6 pips, respectively, on the Basic and Trader accounts.

Spreads are tighter on the Gold and Premium ECN accounts, starting from 0.1 pips on EUR/USD, but with a $7 per round trip (per lot) commission.

It’s worth noting that ECN conditions do not apply to Islamic accounts or when trading cryptocurrencies and stocks.

While these spreads are competitive within the industry, they may not be as tight as those offered by the cheapest brokers we’ve evaluated, such as IC Markets and Fusion Markets, who cater to high-frequency and advanced traders with near-zero spreads.

However, CMTrading’s advantage is that trades using a Basic or Trader account do not incur additional commission fees, which helps simplify cost calculations and reduce transaction-related expenses.

You should also be mindful of additional costs that may arise. For instance, CMTrading imposes a monthly inactivity fee of $15 on accounts that have remained dormant for three months or more.

This fee can add up over time for infrequent traders, so staying active or withdrawing funds from idle accounts is sensible.

Another cost to consider is the overnight rollover fee, which applies to positions kept open beyond the trading day. Furthermore, there are conversion fees if you use multiple currencies to deposit and withdraw.

| CMTrading | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.1 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 1.0 | 100 | 0.005% (£1 Min) |

| Oil Spread | 0.01 | 0.1 | 0.25-0.85 |

| Stock Spread | 0.1 | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

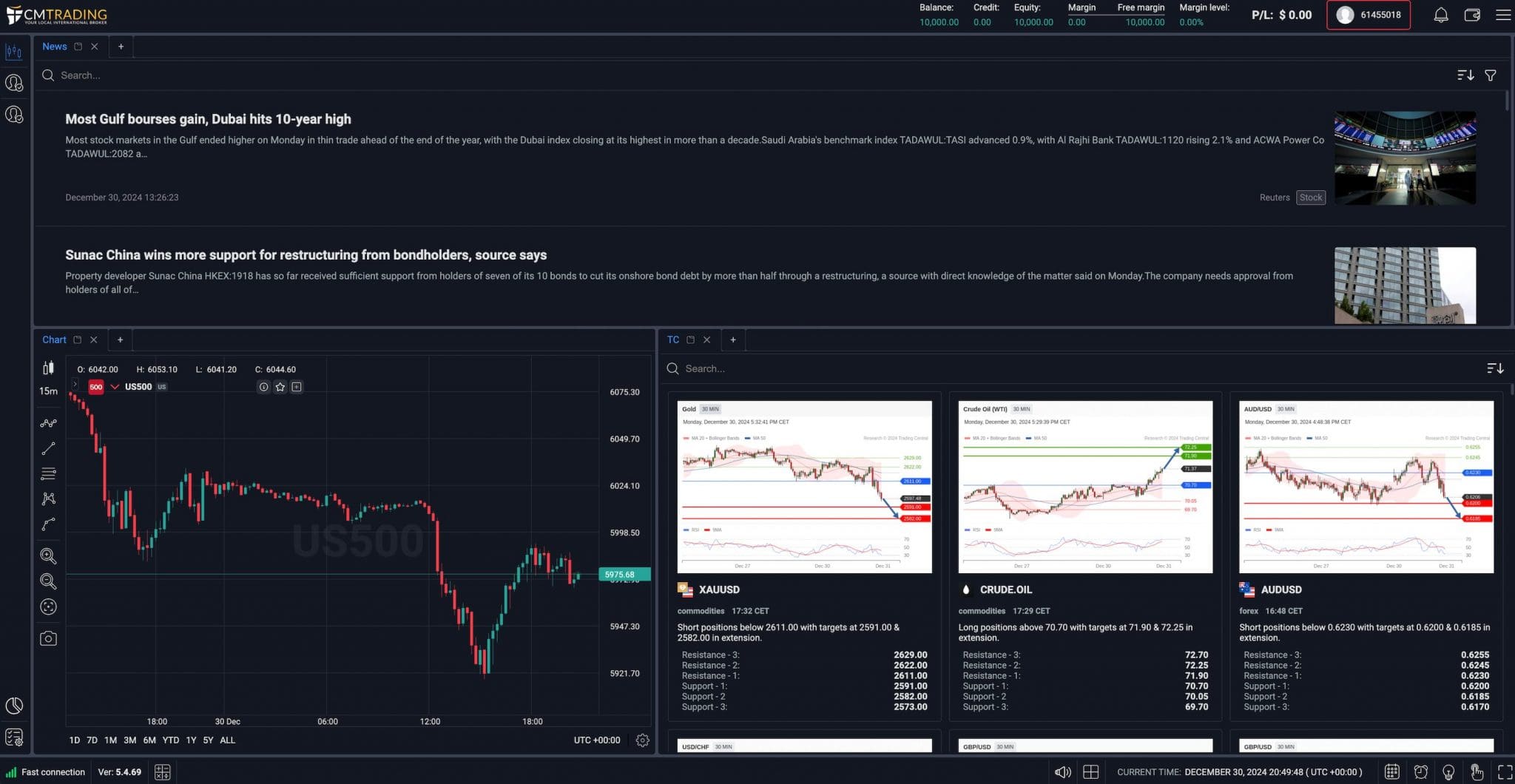

CMTrading offers just two trading platforms: MT4 and its proprietary Webtrader.

MetaTrader 4 (MT4)

MT4 is one of the most popular trading platforms in the industry and is highly regarded for its powerful features and reliability.

Available for desktop, web, and mobile devices, the platform offers advanced charting tools, offering multiple chart types, timeframes, and a variety of customizable technical indicators. These tools allow you to perform detailed technical analyses and execute strategies precisely.

Another standout feature of MT4 is its support for automated trading through Expert Advisors (EAs). You can purchase and use prebuilt EAs or program your own to automate trading strategies based on specific criteria, such as price levels, indicators, or patterns.

This feature is handy for managing trades in volatile markets or when you can’t monitor the markets in real-time.

MT4 also provides a secure trading environment with encrypted data transmission and a customizable interface, making it suitable for traders with varying levels of expertise.

While MT4 is a robust platform, CMTrading could improve the user experience by integrating more third-party plugins for advanced analytics and risk management. Enhanced tutorials or live support dedicated to navigating and customizing MT4 could help users maximize its potential.

Webtrader

CMTrading’s own browser-based trading platform eliminates the need for software installation, making it highly accessible if you prefer day trading directly from your web browsers.

Webtrader is also available for mobile devices if you like to trade on your phone or tablet.

Webtrader offers real-time market quotes, interactive charts, and an intuitive interface that even beginner traders should find easy to navigate.

However, Webtrader lacks some advanced functionalities in MT4, such as support for automated trading and extensive customization options.

Enhancing Webtrader with additional technical analysis tools, more charting features, and the ability to set detailed alerts could make it more appealing to experienced traders.

The lack of support for other popular trading platforms like MetaTrader 5 (MT5), cTrader, and TradingView is disappointing, considering many active traders like me widely favor them for their advanced features, enhanced analytical tools, and greater flexibility.

By incorporating these platforms, CMTrading could attract a broader range of traders, including those who prioritize cutting-edge tools and community-driven insights.

CMTrading

Dukascopy

Interactive Brokers

Platforms & Tools Rating

Platforms

Webtrader, MT4, TradingCentral

JForex, MT4, MT5

Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower

Mobile App

iOS & Android

iOS

iOS & Android

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Research

CMTrading’s blog provides a range of articles on topics like market analysis, trading strategies, and industry news. However, much of the platform’s market analysis is primarily shared through videos on its YouTube channel.

These videos offer timely insights into market trends and trading opportunities, making them a valuable resource for staying up-to-date.

While the blog complements this with written content, expanding the depth of blog posts or integrating more written market analysis could further enhance its utility.

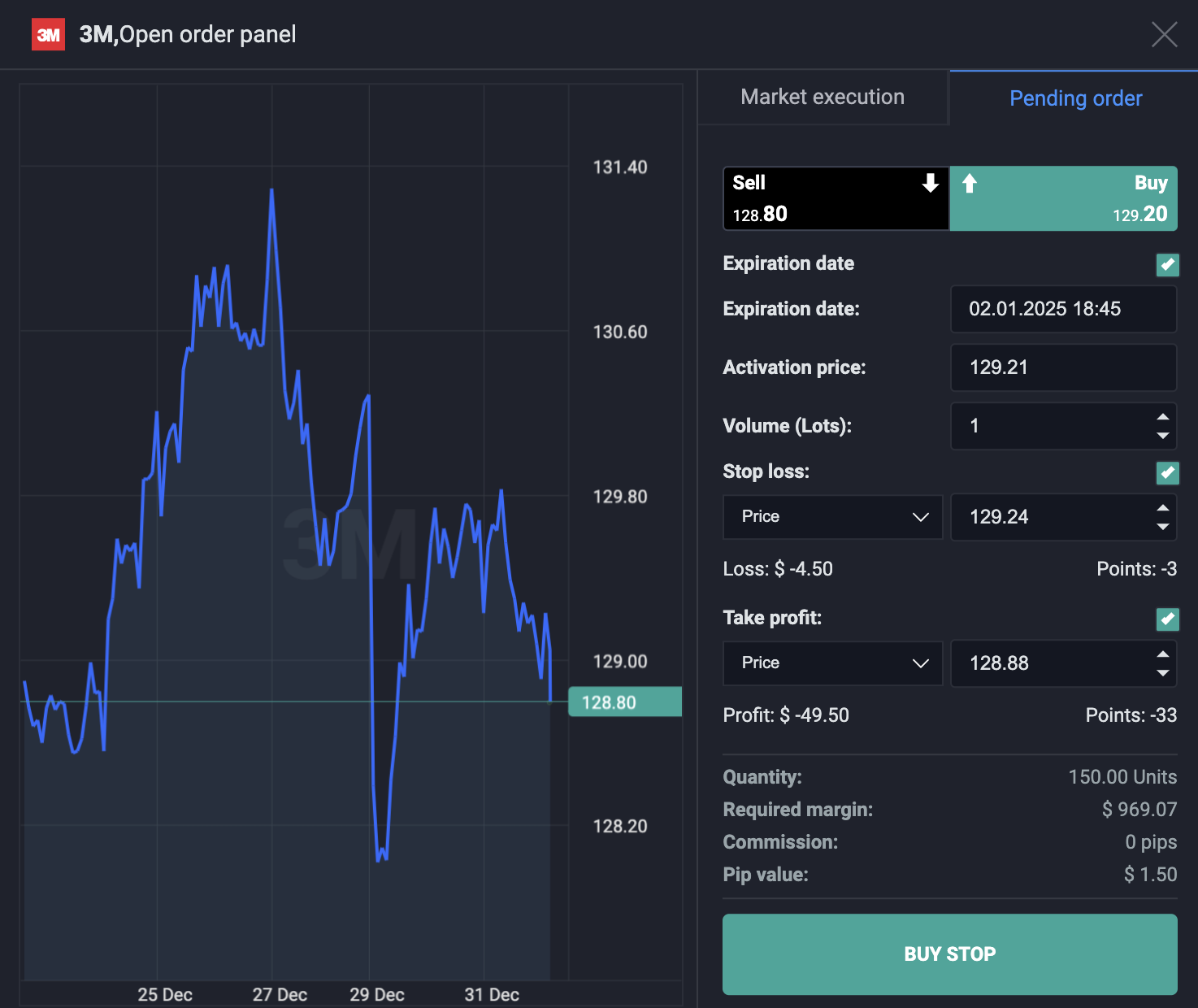

Another key research tool is Trading Central (unavailable to Basic Account holders), which provides technical analysis of specific assets. CMTrading’s trading app also makes it easy to trade Trading Central signals with just a few clicks – including stop loss and take profit levels.

In addition, CMTrading publishes a handful of daily signals from third-party News Factory on its website, but these trades have to be input manually.

An economic calendar is also available on the website, but I’ve been disappointed this isn’t integrated into the trading platform, as it’s crucial for anticipating market volatility and planning trades accordingly.

| CMTrading | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

CMTrading provides an outstanding suite of educational resources through its Academy, which supports traders of all experience levels.

The Academy includes videos, webinars, e-books, and structured video courses tailored to beginners, intermediate traders, and advanced professionals.

For newcomers, the ‘Intro to Trading’ course offers 42 videos covering fundamental concepts, while the ‘Intermediate Course’ provides 40 videos on trading strategies and technical analysis. Advanced traders can benefit from a comprehensive 48-video course on sophisticated strategy and optimization of market performance.

In addition, CMTrading offers regularly updated video series like ‘Motivational Mondays’ and ‘Technical Tuesdays,’ which provide timely insights into market trends and strategies.

I’ve found that subscribing to the broker’s YouTube channel helps me keep up to date with these frequently published videos.

E-books, including the ‘Basics of Trading’ guide, cover essential topics such as market analysis and risk management, serving as valuable resources for self-paced learning.

Live webinars also allow you to engage directly with in-house experts, ask questions, and stay updated on market developments.

| CMTrading | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

CMTrading offers a comprehensive customer support system across various phone, email, live chat, WhatsApp, and social channels.

Additionally, dedicated email addresses are available for specific inquiries: general support, onboarding, funding-related questions, and introducing business (IB).

For self-service options, I find CMTrading’s Help Centre provides a useful range of articles covering topics such as account registration, verification, deposits, withdrawals, and platform guidance.

The presentation and grammar of the Help Centre is a little rough around the edges, but it serves its purpose well.

While the current support framework is robust, there are areas for enhancement. Extending support hours from Monday to Friday, 08:00-21:00 GMT+2 to 24/5 availability would better accommodate clients in different time zones and those trading outside regular hours.

Being based in the UK, I struggled to connect with a live chat representative during the US trading session due to the time difference.

Regularly updating the Help Centre with new articles and tutorials based on common client inquiries and feedback would keep the resource relevant and comprehensive.

It would also be good to see a ticketing system to track the status and history of inquiries to enhance transparency and allow for more efficient follow-up communications.

CMTrading

Dukascopy

Interactive Brokers

Customer Support Rating

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Should You Day Trade With CMTrading?

CMTrading offers several attractive features, including a user-friendly proprietary platform and an emphasis on trader education through its Academy.

The accessible learning materials and no commission fees on entry-level accounts make it a solid starting point for beginners and intermediate traders.

However, CMTrading’s spreads are less competitive than those offered by some brokers, particularly for major forex pairs, which may affect profitability for cost-conscious day traders.

Its regulatory oversight, while sufficient, does not match the consumer protections provided by top-tier regulators like the FCA or ASIC.

Exploring alternatives might be worthwhile if you prioritize lower trading costs, 24/7 support, or stronger regulatory frameworks.

On the other hand, if you value a comprehensive educational approach and a user-friendly trading environment, CMTrading could be a good fit.

FAQ

Is CMTrading Legit Or A Scam?

CMTrading is a legitimate broker regulated by the Financial Sector Conduct Authority (FSCA) in South Africa and the Financial Services Authority (FSA) in Seychelles.

While it may not offer the same robust consumer protections as top-tier regulators like the FCA or ASIC, CMTrading’s regulation, diverse trading instruments, and established presence in the market indicate that it is not a scam.

Is CMTrading Suitable For Beginners?

CMTrading is suitable for beginners due to its comprehensive educational resources, including video courses and webinars designed to teach trading basics.

The platform’s proprietary platform makes it easy for new traders to navigate and execute trades. Additionally, the availability of free demo accounts allows beginners to practice and familiarize themselves with trading without risking real money.

However, the small asset library, slightly higher spreads, and inactivity fees should be considered.

Best Alternatives to CMTrading

Compare CMTrading with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

CMTrading Comparison Table

| CMTrading | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Rating | 3.5 | 3.6 | 4.3 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | $100 |

| Regulators | FSCA, FSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | – | 100% Anniversary Bonus | – |

| Platforms | Webtrader, MT4, TradingCentral | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:200 | 1:200 | 1:50 |

| Payment Methods | 13 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by CMTrading and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CMTrading | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | No | Yes | No |

| Silver | Yes | Yes | No |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | Yes |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | Yes | No |

CMTrading vs Other Brokers

Compare CMTrading with any other broker by selecting the other broker below.

The most popular CMTrading comparisons:

Customer Reviews

5 / 5This average customer rating is based on 1 CMTrading customer reviews submitted by our visitors.

If you have traded with CMTrading we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of CMTrading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’m a beginner day trader and heard about CMTrading through a mate. So far they’ve proven to be a dependable choice – the academy has loads of easy-to-follow guides on forex and strategies. Because I’m kinda new to online trading, the daily signals have been helpful and I’m loving the AI chart feature. All I have to do is upload a chart of say Tesla and then CMTrading analyze it and give me trading signals, including their confidence level!