BlackBull Review 2026

See the Top 3 Alternatives in your location.

Awards

- Fast 50 Index (multiple years) - Deloitte

- Best Global FX Broker 2022 - Forex Expo Dubai

- Fastest Growing Exporter for Auckland 2018 - Westpac Auckland Business Awards

Pros

- BlackBulls’s research is superb, especially the daily ‘Trading Opportunities’ articles that break down complex market movements into easy-to-understand insights, making it simpler to capitalize on emerging trends.

- After partnering with ZuluTrade and Myfxbook, alongside improvements to its own CopyTrader, and finally enabling cTrader Copy, BlackBull offers one of the most comprehensive copy trading experiences we've seen.

- BlackBull offers every ingredient for day traders; fast execution speeds of <100ms, leverage up to 1:500, and tight spreads from 0.0 pips.

Cons

- Despite a growing selection of 26,000+ assets, including additions to its Asia Pacific indices, they are mainly stocks with an average selection of currency pairs and indices.

- Although the Education Hub now features improvements like webinars and tutorials, the courses we’ve explored need more focus on explaining the wider economic factors influencing prices.

- BlackBull lacks a proprietary platform, relying on MetaTrader, cTrader and TradingView. While these are excellent, other brokers' exclusive platforms, notably eToro’s, often have unique features for beginner traders.

BlackBull Review

Regulation & Trust

Founded in 2014, BlackBull is a long-standing and trusted broker based in New Zealand.

- The company’s flagship entity, Black Bull Group Limited is regulated by the Financial Markets Authority (FMA) in New Zealand, a ‘green tier’ body as per DayTrading.com’s Regulation & Trust Rating.

- Its international arm, BBG Limited, is regulated by the Financial Services Authority (FSA) of Seychelles, a ‘red tier’ body, offering only basic regulatory oversight despite helping it extend its global reach.

To improve its trustworthiness, BlackBull could expand its regulatory oversight to include other ‘green tier’ financial regulators such as the FCA (UK) or ASIC (Australia).

Implementing clearer communication regarding the differences in protections between its New Zealand and Seychelles entities would also help users make informed decisions about the jurisdiction under which they choose to trade.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FMA, FSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

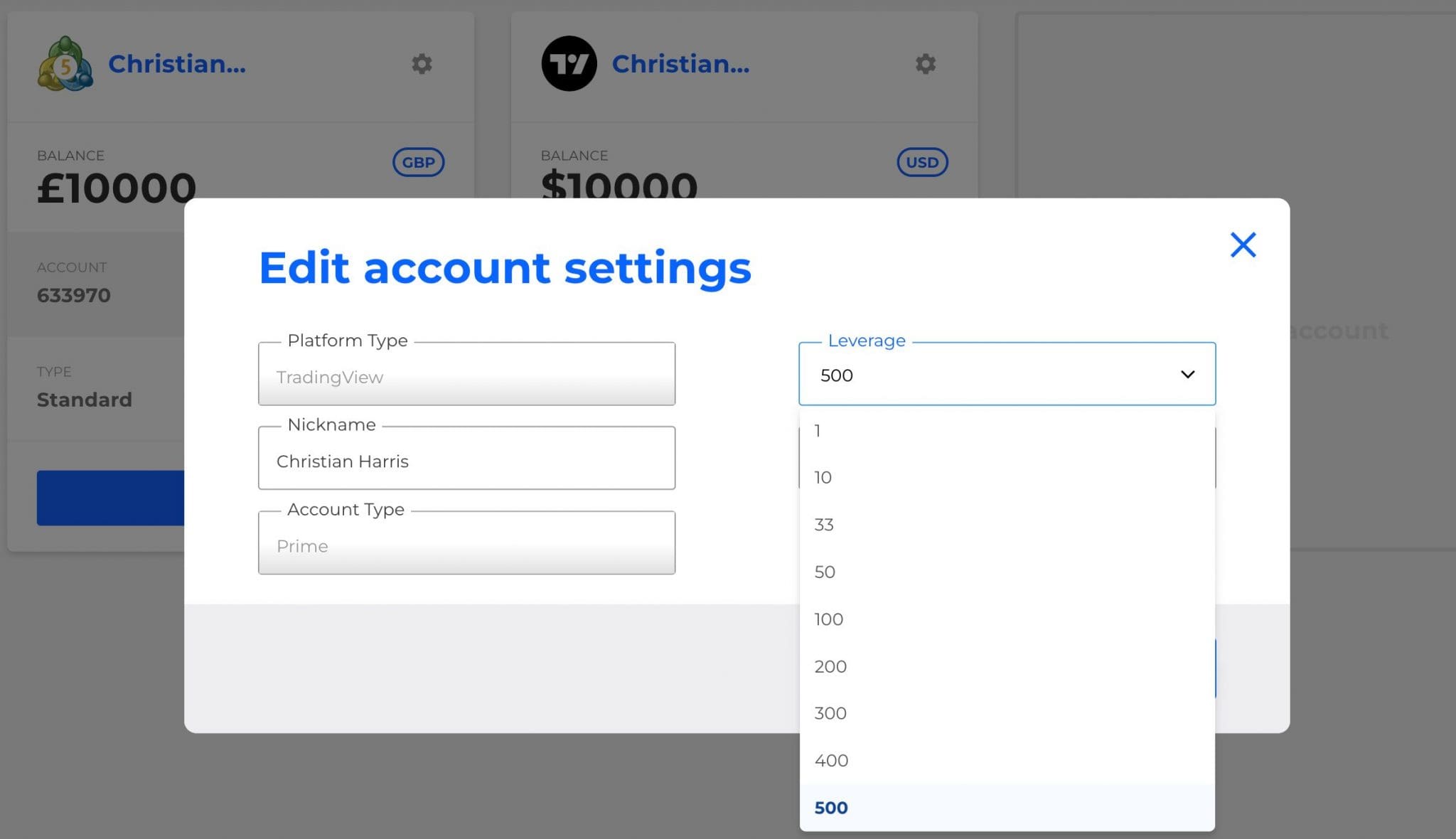

BlackBull Markets offers three primary trading account types, all suiting active traders but tailored to different experience levels and capital.

All three offer leverage up to 1:500 and a minimum trade size of 0.01 lots.

Key differences include:

- ECNStandard – Requires no minimum deposit, making it accessible for new traders, but spreads are the widest from 0.8 pips. Trades are commission-free, however.

- ECNPrime – Designed for experienced traders, with a minimum deposit of $0 (it used to be $2,000) and spreads reduced from 0.0 pips (down from 0.1 pips). The commission structure has been revamped, coming in at $6.00 per lot per trade.

- ECNInstitutional – Tailored for high-volume or professional traders with a minimum deposit of $20,000, offering custom features, premium tools and the lowest spreads from 0.0 pips. The commission is $4.00 per lot per trade.

Swap-free accounts are available on all accounts for clients adhering to Sharia law.

Setting up my account with BlackBull was impressively straightforward. I started by filling out a simple online form with basic personal details, which only took a few minutes.After uploading my identification documents for verification, the process moved smoothly, and my account was approved within a few hours.

The platform’s clear instructions and responsive support team made the experience hassle-free.

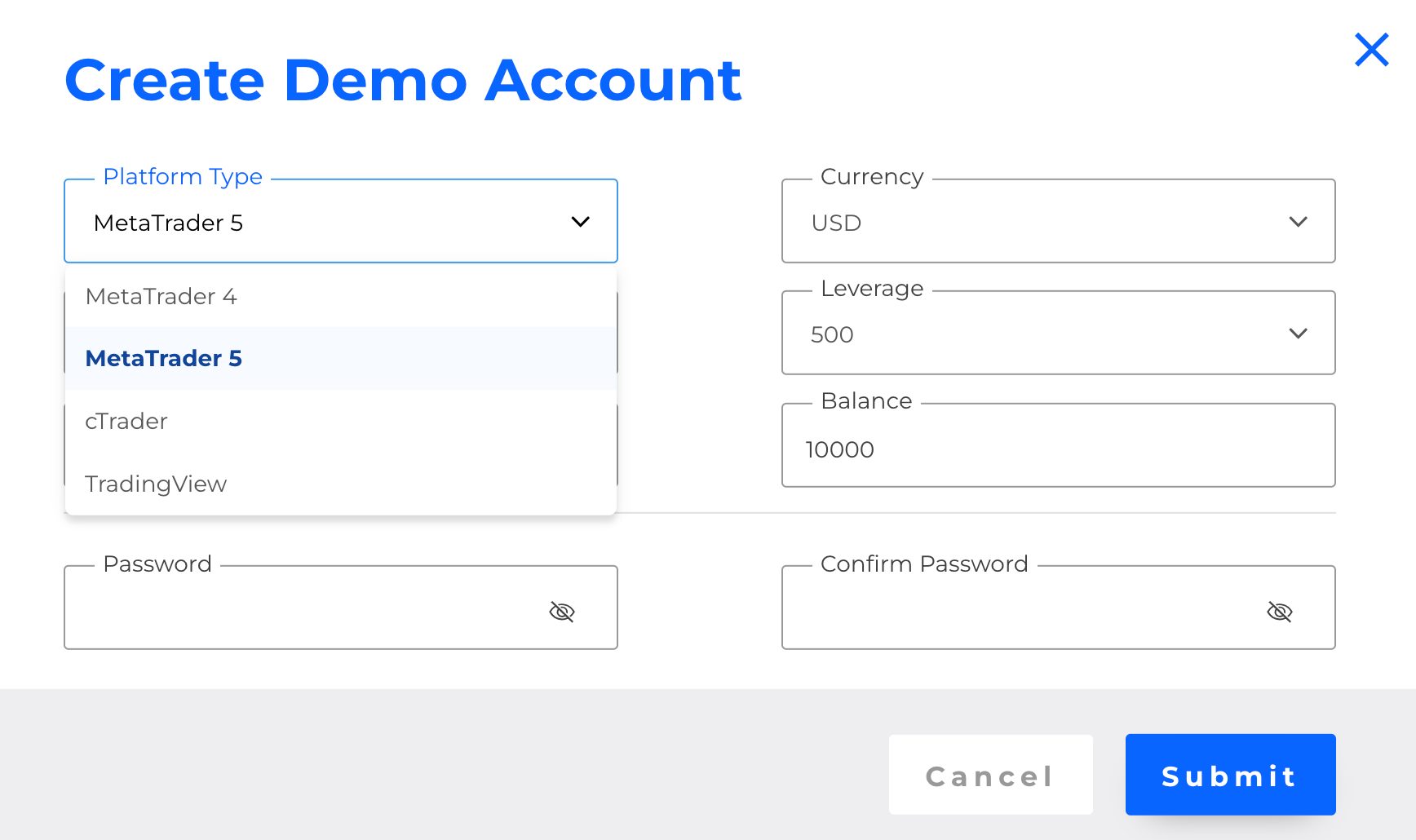

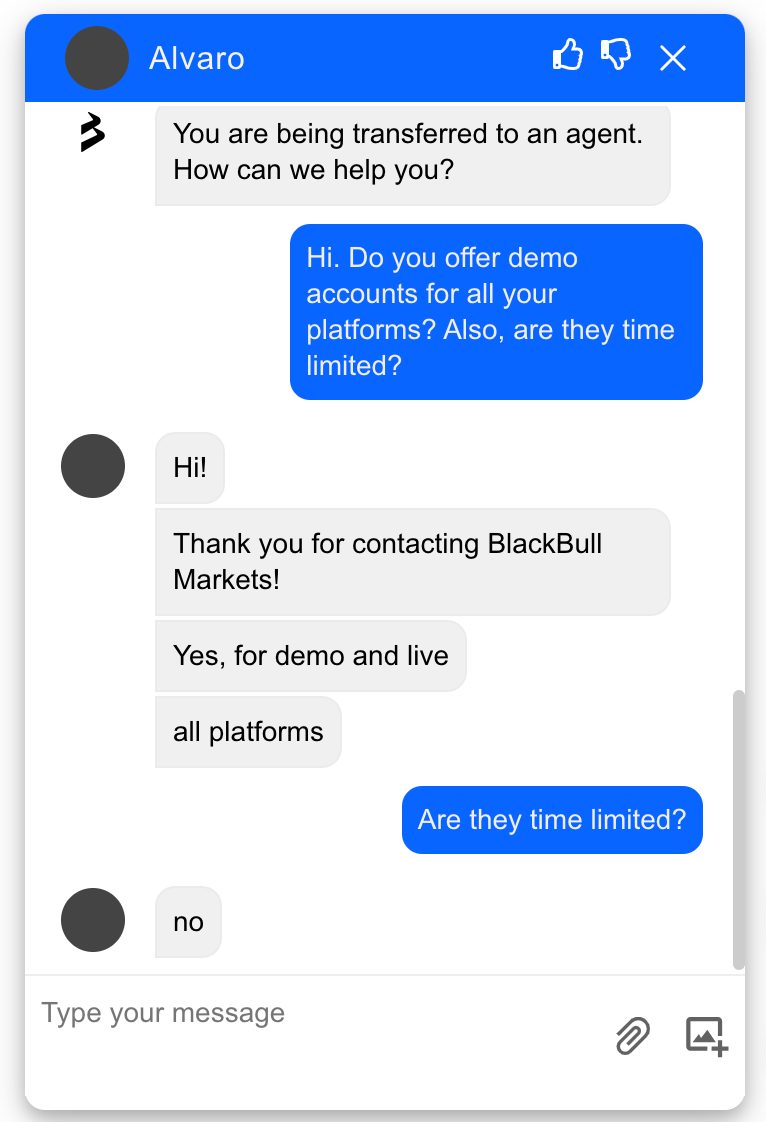

Demo Accounts

BlackBull should be praised for offering up to five demo accounts across all its supported platforms, unlike most brokers that offer a single demo solution.

These demo accounts are invaluable tools for accessing real-time market conditions using unlimited simulated funds for testing short-term trading strategies and familiarizing oneself with the broker’s extensive platform options.

The only downside is that BlackBull may close your demo account(s) if it has been inactive for 30 days. For live accounts, the inactivity period is one year.

Deposits & Withdrawals

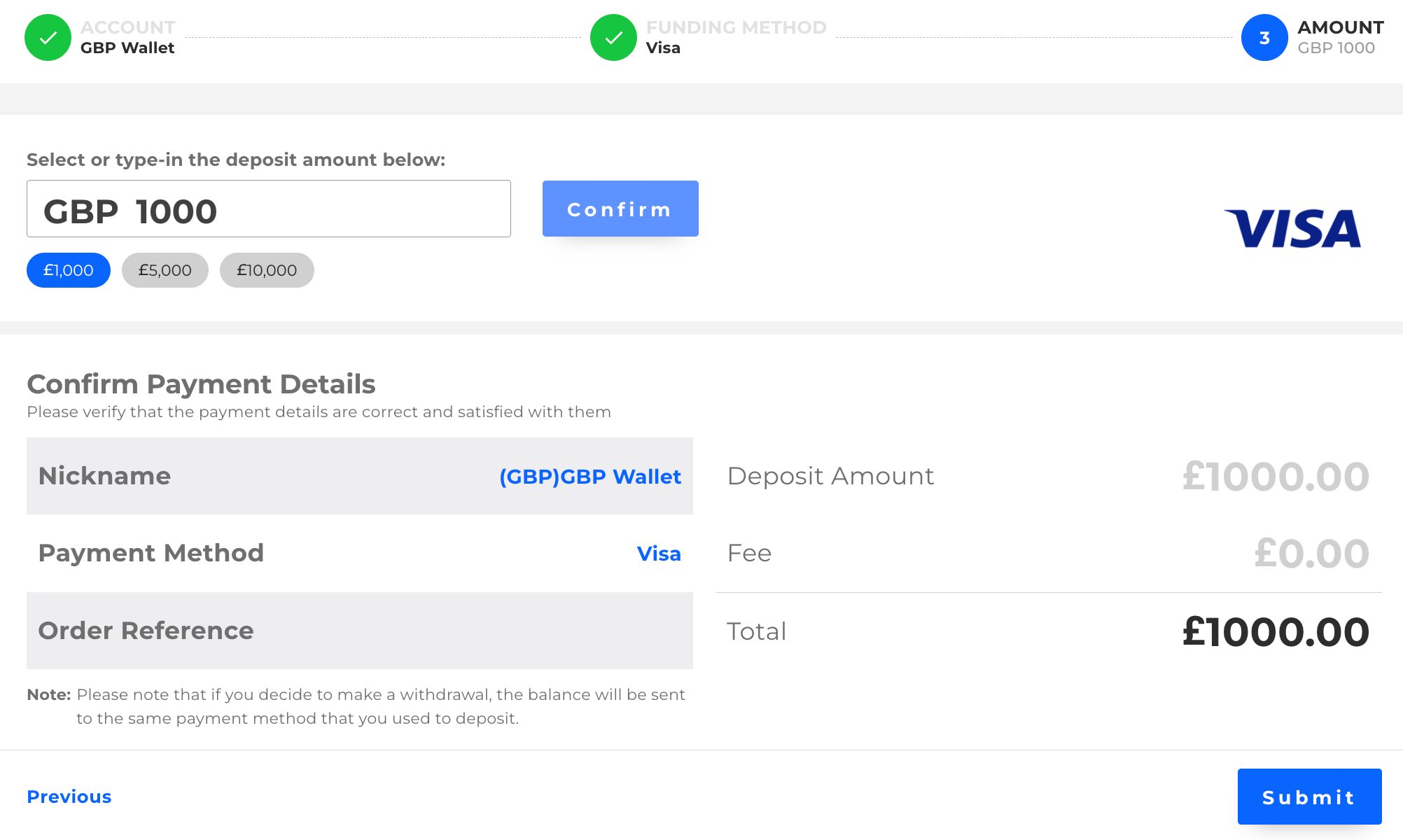

BlackBull offers a flexible range of deposit and withdrawal options in an impressive choice of nine base currencies (USD, EUR, GBP, JPY, AUD, NZD, SGD, CAD, ZAR), catering to traders globally.

Deposit methods include the usual credit and debit cards, bank transfers, local e-wallets like Skrill and Neteller, and cryptocurrency support.

However, it’s worth noting that the range of options will depend on your location.

In my experience, most deposits are processed instantly, ensuring quick access to funds for trading.

While generally efficient, withdrawals can take longer depending on the payment method, typically ranging from one to three business days.

There are no fees for deposits imposed by BlackBull Markets. However, withdrawal carries a $5 price tag, and you might get further hit by additional third-party fees from payment processors – specifically e-wallets and crypto exchanges.

When managing my funds, BlackBull’s deposit and withdrawal options have been excellent. The ease of depositing funds is commendable, but I’d prefer no withdrawal fees.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Airtm, Bitcoin Payments, Boleto, Credit Card, Debit Card, Ethereum Payments, FasaPay, Mastercard, Neteller, Skrill, UnionPay, Visa, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $0 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

BlackBull’s asset range that has grown over years, now totaling over 26,000 CFDs, initially appears almost unparalleled.

However, dig a little and it largely comprises stock CFDs. The range of other assets, like forex and commodities, are average.

- Stocks: 26,000+ covering the US, Europe and Asia (eg Apple, Tesla). Industry-leading selection – Saxo just trails with 23,000+.

- Indices: 11+ covering the US, Europe and Asia (eg US 30, Japan 225). Average but not great – IG offers 80+.

- Forex: 60+ major, minor, and exotic pairs (eg EUR/USD, GBP/JPY). Average but not great – CMC Markets offers 330+.

- Commodities: 11+ limited to metals and energy (eg gold, oil). Average but not great – IC Markets offers 25+.

- Cryptocurrencies: 17+ including majors and altcoins (eg Bitcoin, Dogecoin). Average but not great – Eightcap offers 120+.

- Futures: 31+ including indices and commodities (eg UK 100, wheat). Average but not great – Interactive Brokers offers 12,000+ futures and options.

To enhance its market offering, BlackBull could add ETFs, options, bonds and interest rates, catering to traders seeking diverse trading opportunities.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Stocks, Indices, Commodities, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:500 | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

BlackBull’s fee structure aligns well with industry standards from our analysis, with the Prime account’s improved commission structure and tighter raw spreads now even outperforming competitors like CMC Markets – a consideration for day traders making frequent transactions.

- If you opt for the ECN Standard account, there are no commission fees. Spreads start from 0.8 pips, making it suitable for beginners or those trading lower volumes.

- The ECN Prime account, built for seasoned traders, provides tighter spreads beginning at 0.0 pips but charges a commission of $6 per standard lot. Following a reduction in spreads in 2025, it now averages around 0.16 on EUR/USD and 0.12 gold, making it a great fit for active traders.

- Advanced traders opting for the ECN Institutional account benefit from negotiable commissions and spreads starting from 0.0 pips, tailored to high-volume trading needs.

Introducing more flexible commission tiers or discounts based on trading volume could further enhance its appeal to cost-conscious traders.

Notably, BlackBull does not charge account opening or inactivity fees, offering flexibility for active and occasional traders.

There are no fees for opening or funding a BlackBull account, which is a big plus for new traders, but the $5 withdrawal charge is a letdown—accessing my funds shouldn’t come at a cost.Exploring alternatives like IC Markets or TopFX might be worthwhile if you want zero spreads and fee-free withdrawals.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.16 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 1.5 | 100 | 0.005% (£1 Min) |

| Oil Spread | 1.5 | 0.1 | 0.25-0.85 |

| Stock Spread | Variable | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

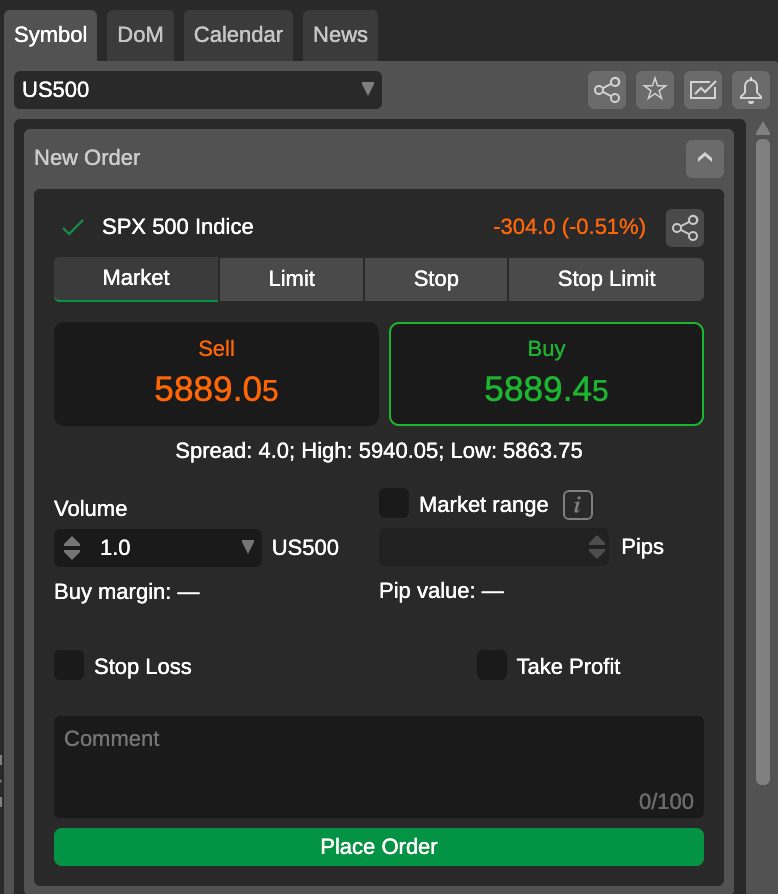

BlackBull offers an excellent selection of trading platforms that will meet the diverse needs of active traders.

My only gripe is that it lacks a single, all-encompassing platform that integrates all the essential features. A platform like this, which you can find at alternatives like eToro, would offer a more streamlined and efficient trading experience, especially for beginner traders.

BlackBull’s primary platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), with cTrader and TradingView added in 2023. Each platform is feature-rich and has both desktop and mobile apps (iOS and Android).

I’ve tried them all over the years and they all offer advanced charting tools, algorithmic trading options, and multi-asset capabilities. Here’s what you need to know:

- MT4 is a favorite among forex traders for its robust features, including fast execution speeds, support for automated trading with Expert Advisors (EAs), and customizable strategies. It has over 30 technical indicators, multiple timeframes, one-click trading, and customizable chart setups for detailed analysis. The WebTrader version offers the same functionality online, eliminating the need for software downloads. It’s just the interface I increasingly find bland and outdated.

- MT5 builds on MT4’s strengths with more advanced trading functions, including 21 timeframes, 38 indicators, and enhanced order types like hedging and complex pending orders. These tools provide greater flexibility and deeper market insights, making it ideal if you want advanced capabilities.

- TradingView is an incredible charting and social trading platform. It provides a comprehensive set of features for technical analysis, including 12 chart types, 100+ pre-built indicators, and 50+ drawing tools. Its modern and intuitive interface allows for easy navigation and customization, making it an excellent choice for day traders of all skill levels. Blackbull also integrated with the iOS and Android app directly in 2024 for a comprehensive mobile trading experience.

- cTrader is another sophisticated platform designed for serious traders, and an excellent addition from BlackBull. It offers advanced charting, diverse order types, level II pricing, and seamless execution across devices. Its additional module, cTrader Automate, enables automated strategies, making it a robust alternative to MetaTrader. With its sleek design and user-friendly interface that I really enjoy using, cTrader has gained popularity for its comprehensive versatility.

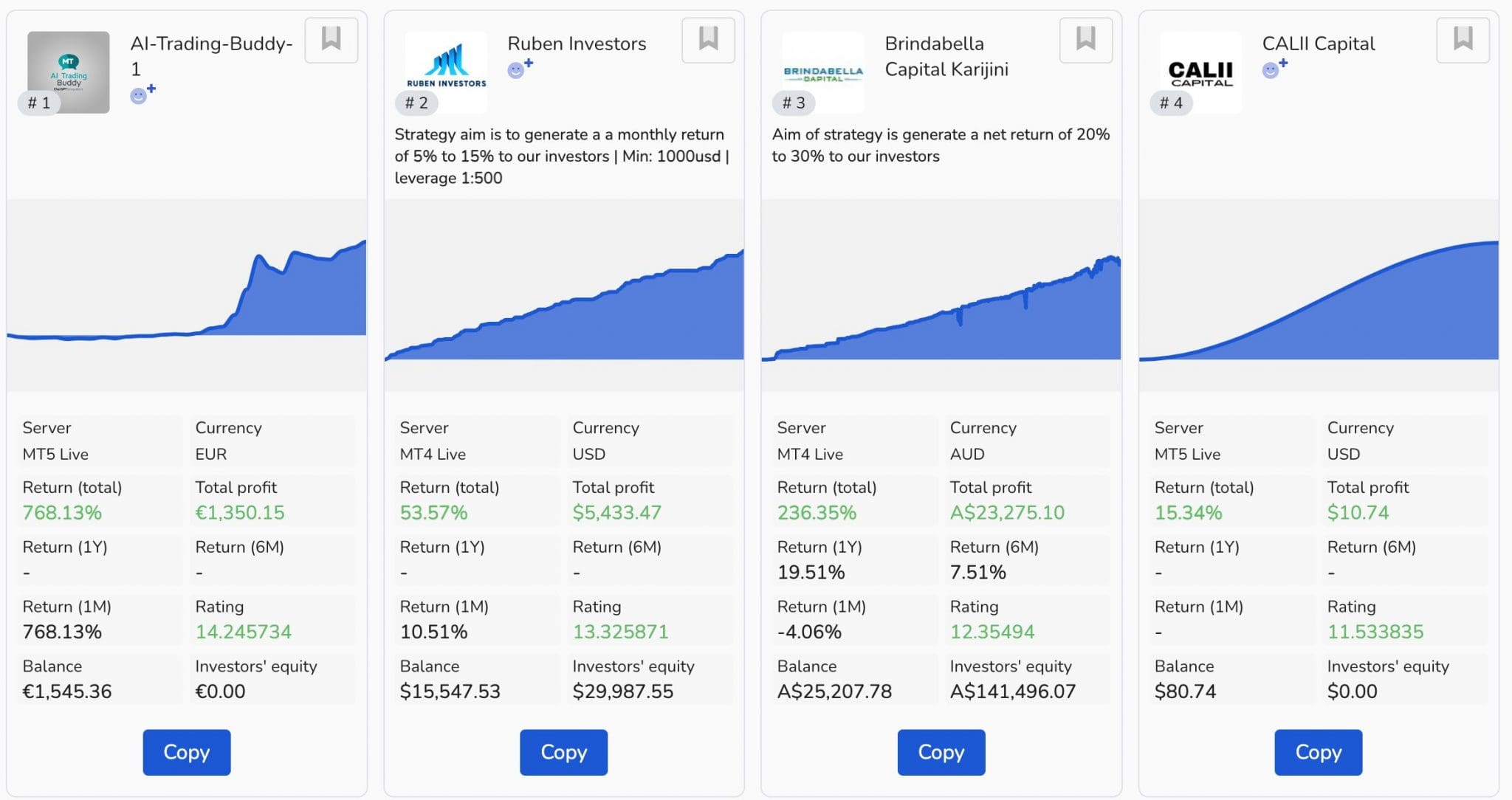

Additionally, BlackBull supports two proprietary platforms. BlackBull Invest focuses on actual stock trading and portfolio management, and BlackBull CopyTrader lets you automatically copy the trades of MT4/5 strategy providers.

Check out my video walk-through of BlackBull CopyTrader below, to get a sense of the design and features:

Furthermore, BlackBull added support for third-party Myfxbook and ZuluTrade copy trading platforms in 2021, and in 2025, it finally enabled cTrader Copy, joining the likes of IC Markets.

BlackBull Markets offers additional tools for advanced traders, including FIX API and Virtual Private Server (VPS) hosting.

These features enable low-latency trading, reducing the risk of negative slippage. In particular, they may appeal to veteran day traders dealing in high volumes.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

BlackBull Markets offers several helpful research tools to assist traders of all experience levels.

One useful feature is the economic calendar, which lets me receive high-importance alerts (filterable by country) in my iCloud, Google, or Outlook calendars.

It’s also worth noting that supported platforms cTrader, MetaTrader, and TradingView also have excellent integrated economic calendars.

BlackBull’s trading calculators are handy. The margin calculator is a fantastic tool for managing risk. It lets me determine the funds required to open and maintain positions by selecting my account base currency, an asset pair, the size of my position in lots, and my level of leverage.

There’s also a profit/loss calculator that helps me determine where to place my take profit and stop loss, a swaps calculator to determine the interest rate differential between two assets, and a currency calculator to determine the value of one currency against another based on current exchange rates.

For active traders, BlackBull’s ‘Trading Opportunities’ blog provides one or two daily updates on key economic events, market trends, and geopolitical developments, helping identify potential trading opportunities. It covers central bank decisions, inflation data, and currency movements.

For $45 per month (a one-month free trial is included), BlackBull Research provides an ‘institutional-grade’ stock recommendation service. However, much better value signal providers offer a more comprehensive package, especially for short-term traders.

We were pleased when Blackbull partnered with Autochartist in 2022 to bring powerful market analytics and automated opportunity identification directly into MetaTrader accounts. This was a step in the right direction.

However, fast forward to December 2026, and I’d still like to see the incorporation of more market analysis tools from third-party providers such as Trading Central and Signal Centre. These platforms offer in-depth, actionable analyses across various markets.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

I was delighted to discover that BlackBull offers a wide range of educational resources, including market analysis, trading guides, and tutorials, to help traders improve their knowledge and skills.

These tools are helpful for both beginners and experienced traders looking to refine their strategies, and have been improved over the years.

There are now webinars, live trading sessions, and well-written courses tailored to different skill levels in subjects including forex, crypto, commodities, and stocks.

Yet while new traders will find BlackBull’s educational materials helpful in developing technical analysis skills, the courses could have more emphasis on explaining the broader economic factors influencing asset prices.

To enhance its offerings and remain competitive, BlackBull could benefit from increasing the number of video tutorials and trading guides on essentials like technical analysis, risk management, and fundamental analysis.

I’d also like to see practice quizzes and tests and a library of downloadable e-books on various trading subjects.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

BlackBull offers a comprehensive selection of customer support options through live chat, WhatsApp, email, and phone, which are available 24/7.

There’s also a wide range of communication options through social media platforms, including Facebook, X, and Instagram.

Having experienced BlackBull’s around-the-clock support firsthand, I can confidently say that customer service is top-notch. Agents are always professional, efficient, and patient when assisting with my inquiries.

However, although I can access support in different time zones, the absence of localized support in multiple languages may limit accessibility for non-English speakers.

A highlight for me is the detailed FAQ portal for common queries. Not only does the portal include answers to most of the questions a trader might ask of the broker (platform and account support), but there are often video walkthroughs.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Customer Support | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With BlackBull?

If you want to day trade stock CFDs through an ECN account with competitive fees and a superb choice of platform options, then BlackBull is an excellent choice.

However, BlackBull lacks a comprehensive proprietary platform, which some competitors like eToro provide for enhanced usability for newer traders.

Additionally, while deposit fees are waived, withdrawal charges are an irritation and may detract from its cost-effectiveness compared to brokers offering free withdrawals.

FAQ

Is BlackBull Legit Or A Scam?

BlackBull is a legitimate broker regulated by the FMA in New Zealand and the FSA in Seychelles.

Since 2014, it has offered ECN trading conditions and access to over 26,000 assets, earning the trust of traders in 180+ countries.

While additional oversight from top-tier regulators like the FCA or ASIC would enhance its credibility, BlackBull’s partnerships with reputable institutions like Milford Asset Management and strong reputation confirm it is not a scam.

Is BlackBull Suitable For Beginners?

BlackBull Markets can be suitable for beginners, but it has limitations. It provides educational resources, low minimum deposits, and demo accounts, which are helpful for new traders.

Additionally, it supports widely used platforms like MT4/5, cTrader, and TradingView, making it accessible to those familiar with these tools.

However, BlackBull lacks its own proprietary platform tailored to entry-level traders, which might make the experience less intuitive for complete beginners.

Best Alternatives to BlackBull

Compare BlackBull with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

BlackBull Comparison Table

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Rating | 3.7 | 3.6 | 4.3 |

| Markets | CFDs, Stocks, Indices, Commodities, Futures, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | $100 |

| Regulators | FMA, FSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | Limited-time offer: 50% spread reduction on Bitcoin (from $12) and Ethereum (from $1.5) | 100% Anniversary Bonus | – |

| Platforms | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:500 | 1:200 | 1:50 |

| Payment Methods | 13 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by BlackBull and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| BlackBull | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | Yes | Yes | No |

| Silver | Yes | Yes | No |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | No | Yes |

| Options | No | No | Yes |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | No | Yes | No |

BlackBull vs Other Brokers

Compare BlackBull with any other broker by selecting the other broker below.

The most popular BlackBull comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 BlackBull customer reviews submitted by our visitors.

If you have traded with BlackBull we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of BlackBull

Article Sources

- BlackBull

- Black Bull Group Limited - FMA License

- BBG Limited - FSA License

- BlackBull Trading Opportunities

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

If you want to be a proper day trader then you need a broker like BlackBull in my not so humble opinion. Forget about shiny platforms and client portals, or the ‘latest big crypto’ – what I ask is “will my intraday trades go through when and at the price I want?” The answer is that they do at BlackBull and they definitely didn’t at other firms I’ve traded with (ahemm eToro). I don’t love everything but they deliver where it matters most for active traders – speed.