Axi Review 2025

See the Top 3 Alternatives in your location.

Awards

- Best Forex Provider 2023 – Online Money Awards

- Best MT4 Provider UK 2022 – International Business Magazine Awards

- Best CFD Provider 2022 – Shares Awards

- Best CFD Provider 2021 – Shares Awards

- Most Transparent Forex Broker (Middle East) 2021 - Global Forex Awards

- Best EMEA Region Broker 2020 - ADVFN International Financial Awards

Pros

- Advanced traders can now sign up for the Axi Select funded trader program through the broker’s offshore entity, providing funding up to $1 million with a 90% profit share.

- Axi's latest copy trading app is really intuitive based on our tests with useful filtering options to match strategies with individual risk preferences.

- The growing educational resources in the Axi Academy, including free eBooks, video tutorials and notably interactive quizzes, are excellent for supporting beginner traders.

Cons

- Despite bolstering its stock CFDs in US, UK and EU markets, it’s still nowhere near as extensive as firms like BlackBull which offer thousands of equities for diverse opportunities.

- Despite performing well whenever we use it, Axi's support is unavailable 24/7, which can be inconvenient for traders in different time zones or those needing assistance outside standard trading hours.

- Axi still has our confidence but issues with the ASIC and FMA in recent years mean it needs to continue providing a secure environment while adhering to licensing conditions.

Axi Review

Regulation & Trust

Trust is a key part of Axi’s appeal. However, we’ve had to lower its Regulation & Trust Score following infractions.

- Axi Financial Services (UK) Limited is regulated by the UK Financial Conduct Authority (FCA), a ‘green tier’ body in DayTrading.com’s Regulation & Trust Rating. This ensures that Axi adheres to stringent compliance requirements. UK clients are protected up to £85,000 in the event of broker insolvency.

- AxiCorp Financial Services Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC), a ‘green tier’ body. But its license was suspended for four months in 2020 for several failures, notably for not complying with client money reporting rules.

- AxiCorp Financial Services Pty Ltd is regulated by the Financial Markets Authority (FMA) in New Zealand, a ‘green tier’ body. However, its derivatives issuer license was suspended for a period in 2019. It’s since demonstrated that it has taken suitable steps to remedy the issues.

- AxiCorp Financial Services Pty Ltd is regulated by the Dubai Financial Services Authority (DFSA), a ‘yellow tier’ body. It holds a Category 4 license with a ‘Retail’ endorsement, but is not authorized to hold client assets or money.

- AxiTrader Limited is registered with the St Vincent and the Grenadines Financial Services Authority (SVGFSA), a ‘red tier’ body. This allows the broker to onboard global clients, however you may not get strong regulatory protection, including zero investor compensation.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, ASIC, FMA, DFSA, SVGFSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

Axi offers a strong range of account types tailored to meet the needs of various active traders, from beginners to experienced professionals:

- Standard Account: Suits traders seeking a straightforward pricing structure. It has slightly higher spreads starting from 0.9 pips but charges no commission, making it a cost-effective choice for those who prioritize simplicity over ultra-tight spreads.

- Pro Account: Designed for more advanced traders who prefer lower trading costs on larger volumes. This account features spreads starting at 0.0 pips and charges a commission of $7 per round trip (ie $3.50 to open and $3.50 to close a trade).

- Spread Betting: Exclusive to the UK and Ireland, this account allows tax-efficient trading on price movements without owning underlying assets. Spread betting has proven popular with short-term traders.

- Swap-Free: A swap-free account that eliminates overnight swap fees for traders requiring compliance with Islamic finance principles, making it suitable for those adhering to Sharia law.

Axi’s account offerings are strengthened by the flexibility to select a preferred base currency (USD, EUR, GBP, CHF, PLN), a maximum leverage up to 1:500 (depending on location), and minimum trade size of just 0.01 lots.

Demo Accounts

Based on my direct experience, Axi’s demo account offers a realistic trading simulation on the MetaTrader 4 (MT4) platform with up to $100,000 in virtual funds.

It mimics live trading conditions, including real-time spreads and execution speeds, allowing you to practice risk-free for 30 days.

However, while a demo account ensures an easy transition to a live account and includes 24/5 dedicated support, unlike other brokers, such as BlackBull, Axi lacks indefinite access for testing your trading strategies.

Deposits & Withdrawals

Axi provides multiple depositing options, including the popular e-wallet PayPal and traditional methods like bank wire transfers and credit/debit cards (Visa and Mastercard).

Deposits and withdrawals are generally fee-free and can be made in a wide range of currencies, including AED, CAD, CHF, EUR, GBP, HKD, PLN, SGD, USD and ZAR.

The flexibility in currency options caters to a global clientele, although annoyingly, there’s no support for the increasingly popular crypto. You can deposit and withdraw in crypto at brokers like Exness.

Axi imposes a minimum deposit requirement of $10 for transfers, making it accessible for all traders. Credit/debit card deposits are lower, at $5.

Axi doesn’t charge for withdrawals exceeding $50 or for full account withdrawals – otherwise, a $25 administration fee may apply. Also, the provider may incur a transfer fee for e-wallet transactions.

I’ve found that credit/debit card and e-wallet transactions are typically processed instantly, but bank transfers typically take 1-3 business days to complete – including international withdrawals.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Airtel, Alipay, Boleto, BPAY, Credit Card, Debit Card, FasaPay, Giropay, iDeal, JCB Card, Maestro, Mastercard, Neteller, PIX Payment, POLi, Skrill, Sofort, Visa, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $0 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

Axi offers a well-rounded range of tradable assets, particularly in forex.

It has also expanded its suite of US, UK and EU stocks over the years, with 50 new additions in 2021, then again in 2023 with big names like Spotify and PayPal, as well as in 2024 with fresh shares in technology, electric cars and other popular industries.

Still, a further broadening of equities and commodities would further enhance its appeal, especially for advanced traders seeking diverse opportunities.

Similar to many brokers we’ve evaluated, Axi primarily offers CFD trading. This means you can speculate on the price movements of various assets, such as stocks, indices, and commodities, without actually owning them.

- Forex: 70+ major, minor, and exotics (eg EUR/USD, GBP/JPY). Good but fewer than Pepperstone‘s 100+.

- Commodities: 15+ metals, oil and naturals (eg gold, coffee). Reasonable but fewer than IC Markets‘ 25+.

- Indices: 15+ from US, Europe, Asia and Australia (eg US 30, AUS 200). Reasonable but fewer than IG‘s 80+.

- Stocks: 100+ covering the US and Europe (eg Microsoft, HSBC). Poor compared to BlackBull‘s 26,000+.

- Crypto: 35+ depending on your location (eg BTC, ETH). Reasonable but fewer than Eightcap‘s 120+.

Axi could also strengthen its competitive position by broadening its asset range to include ETFs, options, bonds, and interest rates, available at brokers like IG.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:500 | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

Axi strikes a balance between affordability and flexibility, offering competitive spreads on both Standard and Pro accounts that align with industry standards:

- For traders using a Standard account, testing shows the average spread for popular currency pairs like EUR/USD is around 1.3 pips, while GBP/USD averages 1.5 pips, and AUD/USD is typically 1.4 pips. Standard account holders also enjoy commission-free trading.

- Those opting for the Pro account benefit from significantly tighter spreads, such as 0.2 pips for EUR/USD, 0.5 for GBP/USD, and 0.5 for AUD/USD, albeit with an added $7 USD commission per round trip.

The cost-effectiveness of these accounts largely depends on your trading volume and asset preference. For low-frequency traders or those new to the market, the simplicity and zero commissions of the Standard account might be appealing.

However, high-frequency day traders or professional traders may find the Pro account’s tighter spreads more advantageous in the long run.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.2 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 1.0 | 100 | 0.005% (£1 Min) |

| Oil Spread | 0.03 | 0.1 | 0.25-0.85 |

| Stock Spread | 0.07 | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

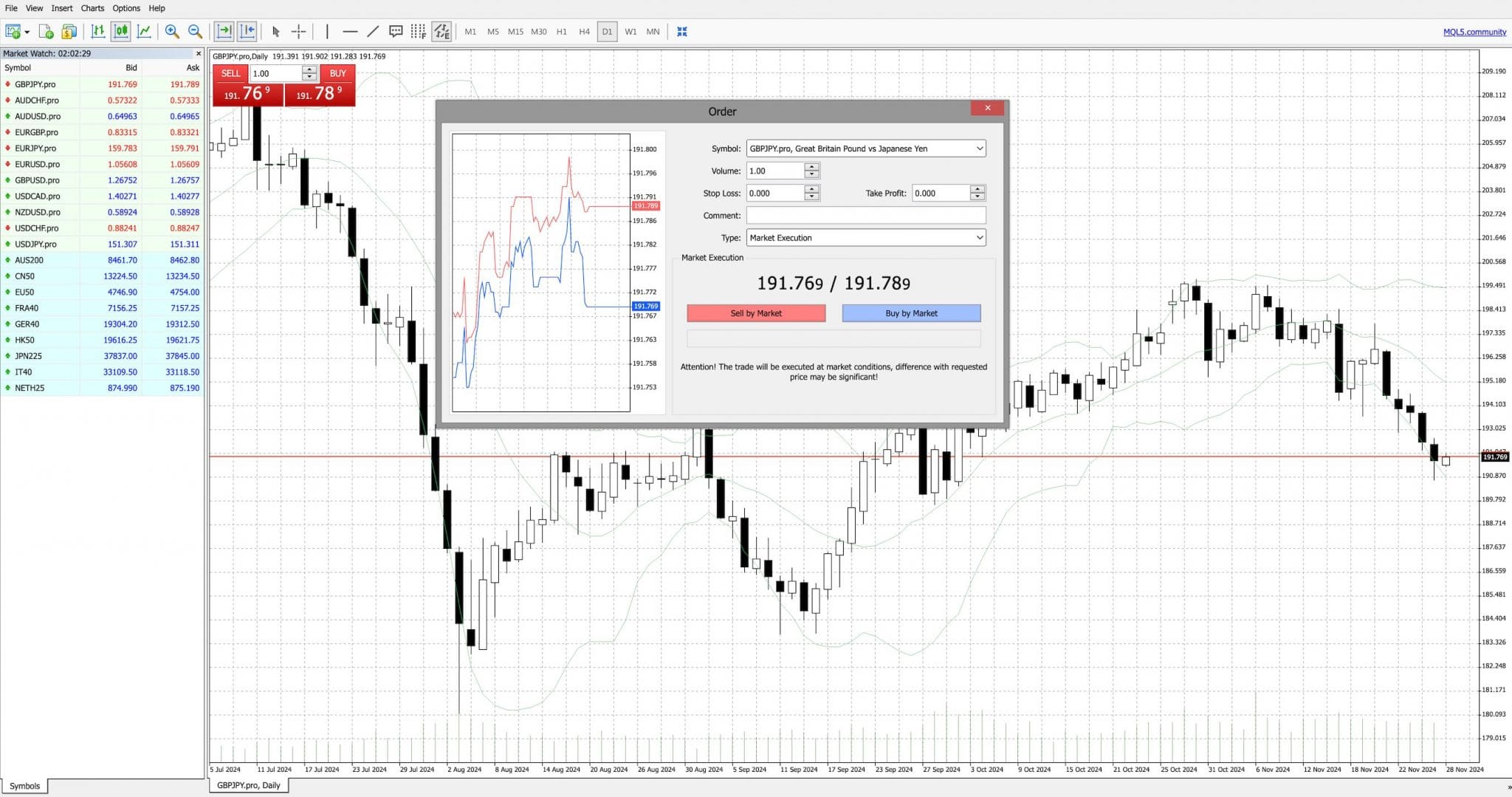

MetaTrader 4

Axi primarily offers the MetaTrader 4 (MT4) platform, a popular choice with active traders due to its flexibility and robust features.

The platform is compatible with Android and iOS devices and Mac and Windows systems (web or desktop), ensuring accessibility across various devices, with frequent updates to improve the trading environment.

I personally tested the MT4 platform and what I really like is that the intuitive interface makes it relatively easy to execute trades efficiently.Also, Axi’s comprehensive educational resources (which I dive into later), will clearly support beginners in navigating the platform’s features.

MT4 provides access to over 150 assets, real-time pricing, and advanced charting tools. Features like custom indicators, automated trading strategies via the MQL4 programming language, and integration with third-party applications such as Myfxbook enhance its utility.

Axi also includes MT4 NextGen plugins for live account holders, offering advanced order management, sentiment trading tools, and additional analytics to complement the core platform.

This is a noteworthy addition that isn’t available at most MT4 brokers I’ve assessed, making Axi a compelling choice for the serious trader.

Yet while MT4 is a strong offering, the absence of MT5 might be a drawback for traders seeking a more modern platform with additional features.I’m also really disappointed that there’s no support for the excellent cTrader and TradingView platforms – I prefer using both to MetaTrader and increasingly see brokers providing all four, including BlackBull.

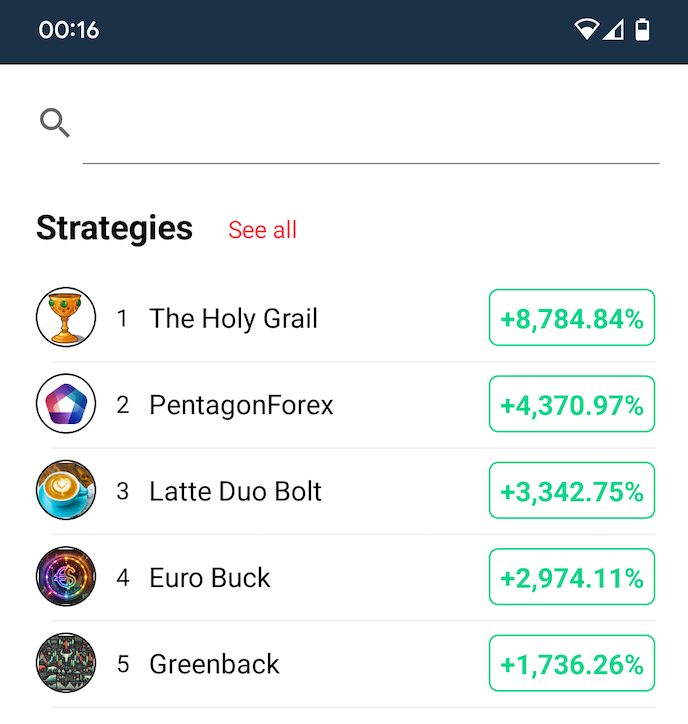

Copy Trading

Axi brought in copy trading in 2021 through an app available for Android and iOS, enabling you to replicate successful strategies from other investors.

I spent a long time exploring it and this social trading feature is impressively user-friendly, with filters for risk management and trader performance to match individual preferences.

VPS hosting also enhances Axi’s trading environment for day traders seeking low latency and uninterrupted connections.

Additionally, there is MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) account management for professionals.

Axi Select

Axi is also one of the few brokers to offer funded trading accounts, which it introduced in 2023.

Axi Select has six stages with funding available to traders that can demonstrate they can achieve consistent returns while managing risk.

Up to $1,000,000 is available in funding with a profit split up to 90% in favor of the trader. There is no fee to join the programme – it is open to all traders that can show they have the skills.

However, what you can’t get away from is that you have to sign up with the offshore entity – AxiTrader Limited, which isn’t authorized by a strong regulator. This makes it a risky endevour – you could have limited recourse options in case of issues.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Axi Copy Trading, MT4, AutoChartist | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

I meticulously combed through Axi’s research tools and what I found is a reasonable range of features.

However, expanding interactive features such as live webinars and real-time expert commentary, which you can find at providers like IG, would greatly benefit traders, especially beginners.

Axi provides informative daily market updates, an average blog with trading insights, and an integrated economic calendar for tracking key global events.

There are also helpful calculator tools to aid aspiring traders in planning their trades. These tools include a Required Margin Calculator to determine the necessary funds, a Pip Calculator to gauge price movement value, and a Profit/Loss Calculator to estimate potential outcomes.

But its the tools from third parties Autochartist and Trading Central, available in MT4, that really add value by automatically identifying chart patterns and trading opportunities, making technical analysis more accessible for new traders.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

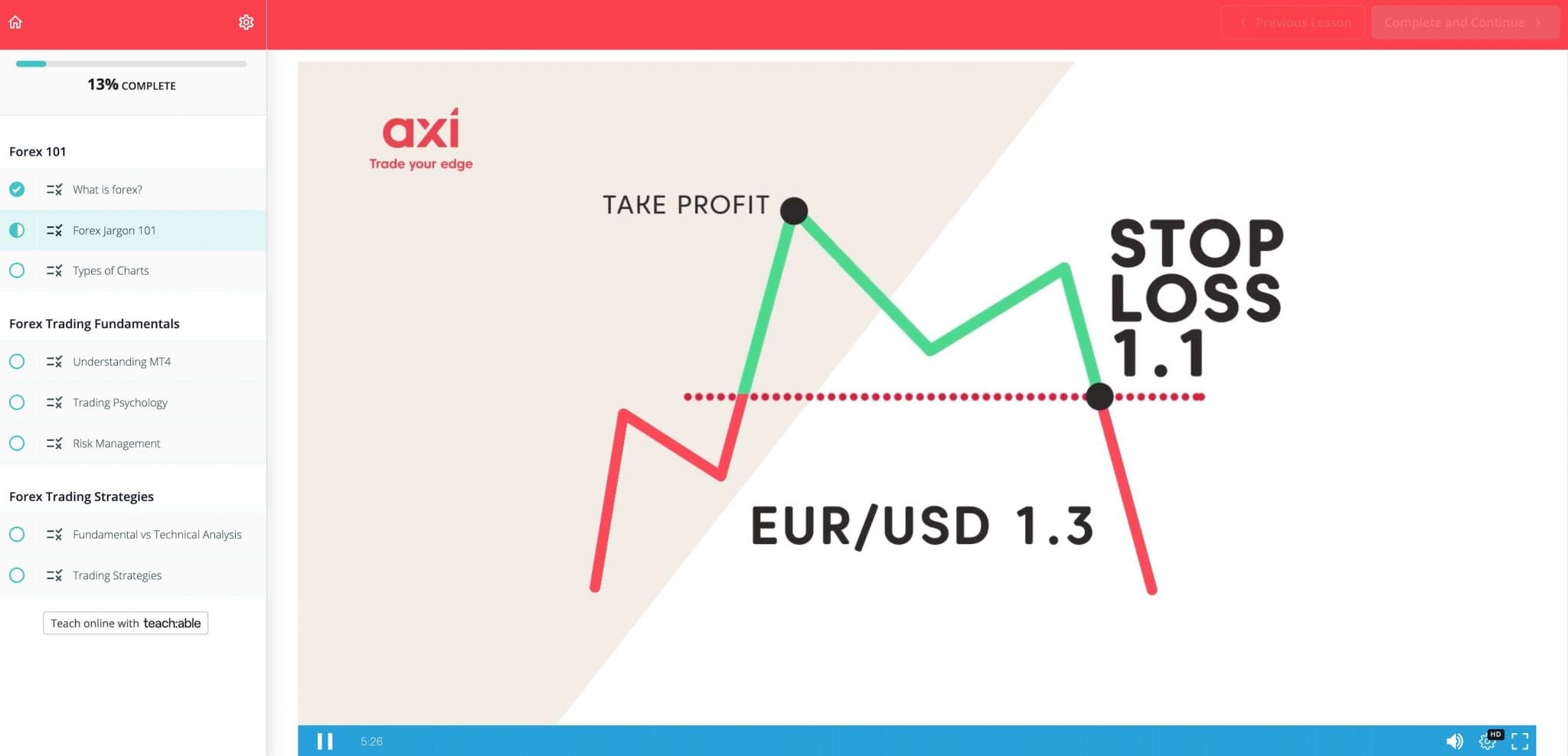

Education

From my investigations, Axi offers excellent educational resources to help beginner traders build their skills and confidence in the financial markets.

These resources include Axi Academy, which provides free courses (some of which I’ve completed myself) tailored to specific trading topics like gold trading and risk management strategies.

The academy is clearly designed to be accessible and incorporates videos, written content, and quizzes to make learning interactive and engaging.

Additionally, Axi offers a small library of free downloadable eBooks covering essentials such as forex trading fundamentals, market analysis, and trade management. These materials help simplify complex trading concepts, making them suitable for beginners.

Video tutorials on the MetaTrader 4 platform are also a welcome addition. They provide step-by-step guidance on how to install and use the platform effectively.

The Trading Glossary is another helpful resource for new traders. It offers clear definitions of key trading terms and concepts, which can often seem overwhelming.

Additionally, Axi’s well-written blog regularly updates market insights, trading tips, and industry trends. The blog covers a mix of educational and market-related content, which helps bridge the gap between theory and practice.

Axi’s educational offerings are comprehensive, but they could be further improved with live webinars or mentorship programs to provide beginners with more hands-on learning opportunities and personalized support.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Axi offers a range of customer support options to help ensure you have access to assistance when needed. Its team is available via live chat, email, and phone, providing 24/5 support.

I’ve discovered the live chat feature, accessed directly from the website, allows for quick responses, while toll-free phone support is available in 10 regions, including Australia, Germany, Singapore and the UK.

Axi also has an extensive Help Center and client portal where you can submit email requests and track the status of your inquiries.

I find the Axi Help Center to be a valuable resource. It’s a one-stop shop for most questions, from account details to trading platform specifics. It saves me a lot of time and trouble.

But although Axi’s support options are robust, there is still room for improvement. Offering 24/7 support, especially for international traders in different time zones, could enhance the customer experience. Around-the-clock support is a quality I’ve come to appreciate at alternatives like Exness.

Additionally, expanding the video tutorials could help streamline the support process.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Axi?

Axi is a solid choice, mainly for those interested in forex and CFD markets, thanks to its competitive spreads and dependable MT4 platform.

While beginners may find their need for a proprietary app limiting, Axi’s educational resources and responsive customer support can still provide valuable assistance.

Overall, Axi is a reliable and trustworthy broker for a wide range of active traders, but advanced traders looking for a broader range of assets with the lowest spreads will be better served elsewhere.

FAQ

Is Axi Legit Or A Scam?

Axi, formerly AxiTrader, is a legitimate broker with strong regulatory credentials. It is authorized by reputable financial authorities, including the FCA and ASIC – ‘green tier’ bodies in our regulator classification system. This ensures compliance with strict industry standards for transparency and customer protection.

While it is a trustworthy broker, as with any financial services provider, you should ensure you understand the risks of trading leveraged products and confirm Axi’s offerings suit your needs.

Is Axi Suitable For Beginners?

Axi can be suitable for beginners due to its competitive and straightforward pricing, especially on the Standard Account with no commission, but there are definitely more intuitive trading platforms than MT4. Personally, I really like eToro’s platform.

There is also no proprietary app to guide new traders, which may make the learning process more challenging.

Best Alternatives to Axi

Compare Axi with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Axi Comparison Table

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Rating | 3.7 | 3.6 | 4.3 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | $100 |

| Regulators | FCA, ASIC, FMA, DFSA, SVGFSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | – | 100% Anniversary Bonus | – |

| Platforms | Axi Copy Trading, MT4, AutoChartist | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:500 | 1:200 | 1:50 |

| Payment Methods | 19 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by Axi and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Axi | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | Yes | Yes | No |

| Silver | Yes | Yes | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | Yes |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | Yes | No | No |

| Volatility Index | Yes | Yes | No |

Axi vs Other Brokers

Compare Axi with any other broker by selecting the other broker below.

The most popular Axi comparisons:

Customer Reviews

4.8 / 5This average customer rating is based on 13 Axi customer reviews submitted by our visitors.

If you have traded with Axi we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Axi

Article Sources

- Axi

- Axi Financial Services (UK) Limited - FCA License

- AxiCorp Financial Services Pty Ltd - DFSA License

- AxiCorp Financial Services Pty Ltd - ASIC License

- AxiCorp Financial Services Pty Ltd - FMA License

- AxiTrader Limited - SVGFSA License

- Axi - FMA License Suspension

- Axi - ASIC License Suspension

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Axi is one of the few brokers I truly trust. Fast execution, tight spreads, and professional service — everything just works smoothly.

I started trading with Axi recently, and I’m impressed with how user-friendly everything is. The registration process was smooth, and the support team helped me with every step. I like the intuitive interface and fast trade execution. It’s clear that Axi prioritizes traders’ needs. I’m definitely staying with them long-term.

After trying several brokers, I settled on Axi because of their transparency and reliability. The platform is easy to use and performs well even during volatile markets. I appreciate how clearly they explain trading costs and how quickly they process payments. Support is available when you need it and always polite. It’s a broker I feel comfortable recommending to others.

Axi gives me confidence with their consistent service. Spreads are fair, the platform is secure, and withdrawals always arrive on time.

I find Axi very convenient for both part-time and full-time trading. The platform is accessible, fast, and works well on all devices.

Axi offers exactly what a trader needs: great spreads, quick execution, and solid customer support. I had a small question about account verification, and the support team responded within minutes. Very professional service.

Axi might not have all the bells and whistles of larger brokers, but it does a great job where it counts—execution, transparency, and support. I use it primarily for forex, and I’ve had very few issues. The mobile app is fine, though a refresh in design would be nice.

Axi is a trustworthy broker. I’ve had a live account for 6 months, and everything works smoothly. Good leverage options and helpful tools like Autochartist.

I actually came across Axi becaue I was looking for a decent P/L calculator that i could punch in my trade configurations in. After coming back to the site regularly for that I eventually decided to open an account, and glad I did. MT4 runs smoothly with Axi (I prefer the desktop client than the sometimes slower web trader). They also have a good selection of IPO CFDs with 0 commission and 5x leverage. Good broker overall that I recommend.

I’ve tried a few brokers in the past, but Axi stands out for its transparency and professionalism. The fee structure is clear, and I’ve never had any issues with withdrawals. I also like that they’re regulated and have a good reputation in the industry. It gives me peace of mind knowing my funds are in safe hands.