Portfolio Tilt

Portfolio tilt involves adjusting the asset allocation within a portfolio to reflect the trader’s expectations about future market conditions.

This shift, often toward specific asset classes or sectors, allows the trader to position their portfolio to potentially benefit from anticipated market trends.

Portfolio tilt is commonly done in the context of “base” portfolio that’s well-structured and strategically put together.

That way, if the tilts are wrong, it doesn’t produce outsized effects compared to a pure tactical asset allocation approach.

Key Takeaways – Portfolio Tilt

- Adaptive Asset Allocation

- Portfolio tilt involves adjusting asset allocation based on market forecasts.

- This enables traders to position their portfolios to benefit from anticipated trends.

- It’s a mix between strategic and tactical asset allocation.

- Defensive Shifts in Weak Markets

- In weaker markets, traders might favor high-quality stocks and less cyclical sectors like consumer staples and utilities to reduce risk.

- Inflation Hedging

- During periods of expected higher inflation, increasing allocations to commodities and inflation-linked bonds can help protect purchasing power.

Portfolio Tilt vs. Pure Strategic Asset Allocation: Comparative Chart

The following chart compares the characteristics of portfolio tilt and pure strategic asset allocation across various factors:

| Factor/Criteria | Portfolio Tilt | Pure Strategic Asset Allocation |

| Objective | Short-term adjustments to capitalize on expected market trends | Long-term, consistent approach to achieve broad goals |

| Flexibility | High, frequently adjusted based on market outlooks | Low, changes infrequently unless there is a shift in goals |

| Decision Basis | Market forecasts, economic indicators, short-term trends | Historical performance, risk tolerance, long-term projections |

| Time Horizon | Short-term to medium-term | Long-term |

| Risk Management | Active, based on anticipated risks and opportunities | Passive, with occasional rebalancing |

| Typical Asset Mix | Dynamic, changing allocation to sectors/asset classes | Static, predefined allocation percentages |

| Example Adjustments | Increasing commodities in inflationary periods, shifting to quality stocks in downturns | Regular rebalancing to maintain 40/40/20 equity/bond/commodity split |

| Performance Drivers | Tactical, dependent on correct market timing and selection | Strategic, dependent on broad market trends and diversification |

| Cost | Potentially higher due to more frequent trading | Lower, with minimal trading and transaction costs |

| Complexity | High, requires ongoing market analysis and adjustments | Low, straightforward and easier to manage |

| Investor Type | Active investors, traders, those with market expertise | Passive investors, those with a long-term focus |

| Advantages | Potential for higher returns, better risk management during volatility | Stability, predictability, easier to maintain |

| Disadvantages | Higher risk of timing errors, increased costs | Potentially lower returns, less responsive to market changes |

Comparisons – Portfolio Tilt vs. Strategic Asset Allocation

Here’s a comparison of the two strategies across various factors:

Portfolio Tilt

- Flexibility: High

- Decision Basis: Market forecasts

- Time Horizon: Short-term to medium-term

- Risk Management: Active

- Typical Asset Mix: Dynamic

- Performance Drivers: Tactical

- Cost: Higher

- Complexity: High

- Trader Type: Active

- Advantages: Higher returns potential, responsive to market changes

- Disadvantages: Higher risk, increased costs

Pure Strategic Asset Allocation

- Flexibility: Low

- Decision Basis: Historical performance

- Time Horizon: Long-term

- Risk Management: Passive

- Typical Asset Mix: Static

- Performance Drivers: Strategic

- Cost: Lower

- Complexity: Low

- Trader Type: Passive

- Advantages: Stability, predictability

- Disadvantages: Lower returns potential, less responsive to market changes

Let’s look at some examples or the portfolio tilt approach:

Weaker Market Environment

Shift Toward Quality

In a weakening market, traders might favor high-quality stocks.

These are often characterized by:

- strong balance sheets (quality assets, low debt)

- consistent earnings, and

- stable cash flows

These companies are typically less sensitive to economic cycles.

If there is a problem with the economy, they can more easily get to the other side of a crisis compared to companies that struggle with cash flow and have lots of debt.

Less Cyclical Sectors

Traders might tilt their portfolios towards less cyclical sectors, such as:

Consumer Staples

These companies produce essential products that consumers need regardless of economic conditions (e.g., food, beverages, household items).

Utilities

Companies that provide essential services such as electricity, water, and gas are generally less affected by economic downturns.

Example

Reducing exposure to consumer discretionary stocks, which include companies that produce non-essential goods and services that consumers might cut back on during economic downturns.

Expecting Higher Inflation

Increase Allocation to Commodities

Commodities often act as a hedge against inflation.

As prices rise, the value of commodities tends to increase.

Inflation-Linked Bonds (ILBs)

These bonds adjust their interest payments based on inflation rates, protecting the holder’s purchasing power.

(They still have interest rate risk and are not pure inflation hedges like an inflation swap would be.)

They’re also an option for rising interest rate environments since ILBs have lower duration and rate risk, all else equal, compared to their nominal bond counterparts.

Example

Allocating a larger portion of the portfolio to precious metals like gold or industrial metals like copper.

Other Examples of Tactical Allocation Tilt

Other scenarios:

Rising Interest Rates

Decrease Long-Term Bonds

Long-term bonds tend to lose value as interest rates rise.

Traders might reduce their exposure to long-duration bonds.

This allocation might go toward:

- shorter-duration bonds

- cash as interest rates improve

- commodities

- stocks that hold their value as interest rates rise

Expecting Economic Growth

Increase Cyclical Sectors

Sectors such as consumer discretionary and industrials tend to perform well during periods of economic expansion.

Equities Over Bonds

Equities generally provide higher returns than bonds during periods of strong economic growth.

Strategic vs. Tactical Allocation

Many traders – especially those with longer-term styles – focus heavily on their strategic asset allocation mix.

Strategic Allocation

Long-Term Focus

Involves setting a target asset mix based on long-term goals and risk tolerance.

It remains relatively constant over time.

Most passive, long-term investors have what could be considered a strategic asset allocation mix.

This is a mix that’s relatively well backtested and stress-tested, so deviating from it generally isn’t recommended.

Example

A traditional 60/40 portfolio with 60% equities and 40% bonds is the most common.

Balanced beta is another strategic allocation concept.

Tactical Allocation

Short-Term Adjustments

Involves making adjustments to the portfolio based on short-term market forecasts or economic conditions.

Turning the Knobs Slowly

Instead of drastic shifts, tactical allocation involving “tilt” involves gradual adjustments.

For instance, increasing exposure to a particular sector by a few percentage points based on expected trends.

Example

Shifting 5-10% of the portfolio from bonds to equities if expecting a strong economic recovery.

Q&A – Portfolio Tilt

What is portfolio tilt, and how does it differ from standard asset allocation?

Portfolio tilt involves adjusting the asset allocation within a portfolio to reflect the trader’s expectations about future market conditions.

Unlike standard strategic asset allocation – which typically sets a fixed distribution of assets based on long-term goals and risk tolerance – portfolio tilt is a more dynamic strategy.

It allows traders to shift their focus towards or away from specific asset classes or sectors to take advantage of anticipated market trends or economic changes.

How can traders use portfolio tilt to exploit expected market conditions?

Traders can use portfolio tilt by reallocating their investments/trades based on their forecasts of market conditions.

For example, if a trader expects economic growth, they might increase their exposure to cyclical sectors like consumer discretionary and industrials, which tend to perform well in such environments.

Conversely, if they anticipate a downturn, they might shift towards more stable sectors like consumer staples and utilities, which are less sensitive to economic cycles.

What factors should traders consider when deciding to tilt their portfolios?

When deciding to tilt their portfolios, traders can consider:

- Economic Indicators – Data on GDP growth, employment rates, inflation, and interest rates.

- Market Trends – Trends in stock prices, bond yields, and commodity prices.

- Sector Performance – Historical and current performance of different sectors.

- Geopolitical Events – Events that could impact markets, such as elections, wars, and trade policies.

- Company Fundamentals – Financial health, earnings stability, and balance sheet strength of companies within targeted sectors.

How does tilting a portfolio towards high-quality stocks help in a weakening market environment?

Tilting a portfolio towards high-quality stocks in a weakening market environment can provide stability and reduce risk.

High-quality stocks are typically characterized by:

- Strong Balance Sheets – Companies with low debt, good assets, and ample cash reserves are better positioned to weather economic downturns.

- Steady Earnings – Firms with stable and predictable earnings are less likely to experience significant volatility.

- Stable Cash Flows – Reliable cash flows ensure that companies can maintain operations and meet financial obligations even in tough times.

Why might traders shift their portfolios towards less cyclical sectors during economic downturns?

Less cyclical sectors, such as consumer staples and utilities, provide essential goods and services that remain in demand regardless of economic conditions.

During economic downturns, these sectors are less affected by reduced consumer spending and can offer more stable returns.

By shifting their portfolios towards these sectors, traders can reduce the impact of economic volatility on their investments.

How can traders adjust their portfolios in anticipation of higher inflation? Lower inflation? Higher growth? Lower growth?

Higher Inflation:

- Increase Allocation to Commodities – Commodities often act as a hedge against inflation as their prices rise with inflation.

- Inflation-Linked Bonds – These bonds adjust their interest payments based on inflation rates, protecting purchasing power.

Lower Inflation:

- Increase Long-Term Bonds – Lower inflation generally leads to lower interest rates, which benefits long-term bonds.

- Growth Stocks – Companies that can grow their earnings independently of the inflation rate may perform better.

Higher Growth:

- Increase Cyclical Sectors – Sectors like consumer discretionary and industrials tend to do well during periods of strong economic growth.

- Equities Over Bonds – Equities generally provide higher returns than bonds during periods of economic expansion.

Lower Growth:

- Shift to Defensive Sectors – Sectors such as consumer staples and healthcare, which provide essential products, can offer more stability.

- High-Quality Bonds – Bonds from stable issuers can provide steady returns when growth prospects are weak.

What role do commodities play in a portfolio tilt strategy?

Commodities can act as an inflation hedge and provide diversification benefits.

They tend to have low long-run correlation with other asset classes like stocks and bonds, which helps reduce overall portfolio risk.

In a portfolio tilt strategy, increasing the allocation to commodities can protect against inflation and economic unknowns.

Commodities such as gold are valuable during periods of market stress or currency devaluation.

How do rising interest rates influence portfolio tilting decisions?

Rising interest rates typically lead to a decline in the value of long-term bonds, as their fixed interest payments become less attractive compared to new issues with higher yields.

In response, traders might:

- Decrease Exposure to Long-Term Bonds – To avoid losses due to declining bond prices.

- Increase Exposure to Short-Term Bonds – Short-term bonds are less sensitive to interest rate changes and can be reinvested at higher rates more frequently.

- Consider Financial Sector Stocks – Banks and other financial institutions often benefit from higher interest rates, as they can charge more for loans.

What is the significance of short-term bonds in a rising interest rate environment?

Short-term bonds are significant in a rising interest rate environment because they are less sensitive to interest rate changes.

As interest rates rise, the value of long-term bonds declines more significantly due to their longer duration and fixed interest payments.

Short-term bonds, on the other hand, mature quickly and can be reinvested at higher rates. This makes them a more stable and flexible option during periods of increasing rates.

What are the main differences between strategic and tactical allocation in the context of portfolio tilt?

Strategic Allocation:

- Long-Term Focus – Establishes a target asset mix based on long-term goals and risk tolerance.

- Stable Over Time – The allocation remains relatively constant, with adjustments made infrequently.

- Example – A traditional 60/40 portfolio with 60% equities and 40% bonds.

Tactical Allocation:

- Short-Term Adjustments – Involves making short-term changes based on market forecasts or economic conditions.

- Dynamic – The allocation can change frequently to exploit expected market trends.

- Example – Shifting 5-10% of the portfolio from bonds to equities if anticipating a robust economic recovery.

How do traders implement gradual adjustments in tactical allocation without drastic shifts?

Traders implement gradual adjustments in tactical allocation by making small, incremental changes rather than large, sweeping moves.

For example, instead of completely reallocating from bonds to equities, a trader might turn the dials slowly and increase equity exposure by a few percentage points at a time based on ongoing assessments of economic/market conditions.

This method reduces the risk of overreacting to short-term market fluctuations and allows for more measured responses to economic indicators.

What are some real-world examples of portfolio tilting strategies based on economic conditions?

Expecting a Weak Market:

- Shift to High-Quality Stocks – Favor companies with high net incomes, cash flow, lots of assets, and low debt.

- Move to Defensive Sectors – Increase exposure to consumer staples and utilities.

Anticipating Higher Inflation:

- Increase Allocation to Commodities – Put more in precious metals like gold and industrial metals like copper, nickel, etc.

- Invest in Inflation-Linked Bonds – Protect purchasing power through bonds that adjust interest payments based on inflation rates.

Rising Interest Rates:

- Decrease Long-Term Bonds – Reduce exposure to long-duration bonds that are sensitive to rate changes.

- Increase Short-Term Bonds – Favor short-term bonds that can be reinvested at higher rates more frequently.

Why is it important for traders to balance risk and return when tilting their portfolios?

Balancing risk and return is important because the potential for higher returns needs to be aligned with an acceptable level of risk.

Too much risk will inevitably blow out a portfolio at some point, so risk control is #1.

Over-tilting towards high-risk assets in pursuit of higher returns can expose the portfolio to significant losses if market conditions change the other way.

Conversely, overly conservative tilts may limit potential gains.

Effective portfolio tilt strategies carefully weigh the risk-reward trade-off to optimize performance while maintaining risk at a manageable level.

How do traders determine the appropriate level of exposure to different asset classes in a portfolio tilt strategy?

Traders determine the appropriate level of exposure by analyzing several factors:

- Market Conditions – Current and forecasted economic indicators such as GDP growth, inflation, and interest rates.

- Risk Tolerance – The trader’s capacity and willingness to endure market volatility and potential losses.

- Time Horizon – The length of time the trader plans to hold the investments/trades.

- Sector Analysis – Performance trends and prospects of different sectors and asset classes.

- Historical Data – Past performance and correlation of various asset classes under similar economic conditions. The past, of course, isn’t necessarily the future.

What are the potential risks of incorrect portfolio tilting based on market forecasts?

- Market Volatility – Incorrect tilting can expose the portfolio to unexpected market fluctuations.

- Economic Shifts – Changes in economic conditions can invalidate initial forecasts, leading to losses.

- Sector Underperformance – Overweighting underperforming sectors can drag down portfolio returns.

- Interest Rate Risk – Misjudging the direction of interest rates can lead to losses, particularly in bond-heavy portfolios or in rate-sensitive equity categories (e.g., tech and other longer-duration cash flows).

- Inflation Risk – Failure to correctly anticipate inflation trends can erode purchasing power and real returns.

How can historical market trends inform current portfolio tilt decisions?

Historical market trends show how different asset classes and sectors have performed under various economic conditions.

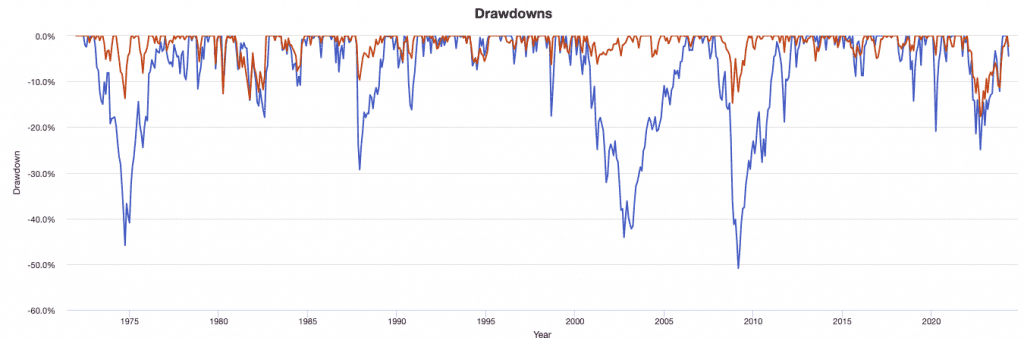

For example, the following chart shows how a 100% Stocks portfolio (blue line) did in terms of drawdowns versus an allocation of 40% Stocks, 40% Bonds, and 20% Gold/Commodities (red line).

By studying past data, traders can identify patterns and correlations that may repeat under similar circumstances.

This historical perspective helps traders make informed decisions about which tilts might be effective in the current market environment, improving the chances of achieving desired outcomes.

What tools and data sources do traders use to analyze market conditions for portfolio tilting?

- Economic Indicators – Data from government agencies (e.g., Bureau of Economic Analysis, Federal Reserve) on GDP, inflation, and employment.

- Market Reports – Analysis from financial institutions, research firms, and market analysts. Sell-side reports from equity research groups at i-banks are common for equity managers.

- Technical Analysis – Charting tools and software to identify market trends and price movements.

- Fundamental Analysis – Company financial statements, sector performance reports, and macroeconomic studies.

- Financial News – Real-time updates from reputable news sources.

- Proprietary Models – Custom-built quantitative models to forecast market trends and evaluate risk-return profiles.

How does portfolio tilt align with long-term trading strategies?

Portfolio tilt aligns with long-term investment strategies by allowing traders to make tactical adjustments without deviating from their overall strategic goals.

While strategic allocation sets the long-term framework based on risk tolerance and objectives, tactical tilting provides flexibility to adapt to short-term market conditions.

This dual approach helps traders improve returns and reduce risks, maintaining a balanced and well-diversified portfolio over time.

This type of approach can be applicable across timeframes – from day traders to long-term investors.

Conclusion

Portfolio tilt is a dynamic trading strategy that aligns with current market expectations.

By adjusting the asset allocation based on anticipated market conditions, traders can potentially enhance returns and reduce risks and better customize the portfolio.

This approach requires a blend of strategic long-term planning and tactical short-term adjustments.