Inflation and CPI Swaps – How Do They Work?

An inflation swap is an agreement between two parties to exchange periodic payments based on inflation.

The payments are usually based on changes in the Consumer Price Index (CPI). CPI swaps are used to hedge against inflation or to speculate on inflation.

Inflation swaps can be used to hedge against inflation by fixing the payments that will be made in the future.

This can protect a company from rising prices, which can eat into profits. CPI swaps can also be used to speculate on inflation.

If a trader thinks that inflation will rise relative to what’s already discounted into the market, they can buy a CPI swap and profit from the increase in prices.

CPI swaps are traded over-the-counter (OTC) and are not standardized like futures contracts.

This means that there is more flexibility in terms of the contract, but it also means that there is more risk.

OTC contracts are also less liquid than futures contracts, so it can be harder to find a counterparty to trade with.

When entering into an inflation swap, both parties must agree on the following:

The notional amount

This is the amount of money that will be used to calculate the payments.

It is usually denoted in US dollars, though inflation swaps can be denominated in any currency.

The inflation index

This is the index that will be used to track inflation.

The most common inflation indices are the consumer price index (CPI) and the producer price index (PPI).

The fixed rate

This is the interest rate that will be paid on the notional amount. It is usually denoted in percentage points or basis points.

The floating rate

This is the interest rate that will be paid that is linked to the inflation rate. It is usually denoted in percentage points or basis points.

The term

This is the length of time over which the swap will last. It is usually denoted in years.

The payments in an inflation swap are calculated using the following formula:

Fixed payment = Notional amount x Fixed rate

Floating payment = Notional amount x (Inflation index – Floating rate)

A CPI swap will lose value if inflation comes in lower than expected and gain value if it comes in higher than expected.

Market value of an inflation swap or CPI swap

The market value of an inflation swap or CPI swap may be marked to market in response to changing market forces.

The mark to market value is the fair value of the inflation swap or CPI swap, based on the current inflation rate and interest rates.

The mark to market value will fluctuate over time as inflation and interest rates change.

If inflation increases more than priced in, the market value of the inflation swap or CPI swap will increase.

This is because the floating payments will be worth more in terms of purchasing power, as they are linked to the inflation rate.

If inflation decreases more than what’s priced in, the market value of the inflation swap or CPI swap will decrease.

This is because the floating payments will be worth less in terms of purchasing power.

Inflation-linked bonds and their correlation to inflation swaps

Inflation swaps are often used as an alternative to inflation-linked bonds. Inflation-linked bonds are bonds whose payments are linked to inflation.

They are also known as inflation-protected securities or index-linked securities, as well as their abbreviation ILBs.

The most common type of inflation-linked bond is a Treasury Inflation-Protected Security (TIPS).

TIPS are issued by the US government and their payments are linked to the CPI.

In general, inflation swaps and inflation-linked bonds will have a positive correlation.

This means that when inflation increases relative to discounted expectations, the market value of both will increase.

When inflation decreases relative to discounted expectations, the market value of both will generally decrease.

However, for ILBs, there is still the interest rate component, so an inflation surprise can actually still decrease their value.

Differences between inflation swaps and inflation-linked bonds

There are some important differences between inflation swaps and inflation-linked bonds.

Inflation swaps are derivative instruments, while inflation-linked bonds are debt instruments.

This means that inflation swaps are more complex than inflation-linked bonds.

They are also riskier. Inflation swaps are not backed by any asset or the full faith of a government, so they are subject to counterparty risk.

This is the risk that one of the parties will default on their obligations. Inflation-linked bonds are backed by the issuer, so they are not subject to counterparty risk.

Finally, inflation swaps can be used to hedge against inflation or to speculate on inflation.

Inflation-linked bonds can only be used to hedge against inflation to an extent, but they do not hedge out interest rate risk.

For a trader to recreate an inflation swap via the bond market, they would have to go long an inflation-linked bond and short the corresponding tenor nominal rate bond.

This would entail setting up two trades, which is more complicated than just buying an inflation swap.

An inflation swap may also have lower collateral requirements relative to buying inflation-linked bonds.

Inflation expectations

Changes in inflation expectations are what drive the prices of inflation-linked securities and derivatives, such as ILBs and inflation and CPI swaps.

Inflation expectations are backed out by comparing same-tenor nominal rate bonds and inflation-linked bonds.

This dataset can be found on economic databases like FRED, including 1-year, 2-year, 5-year, 10-year, and 30-year expected inflation rates.

These are also called breakeven inflation rates.

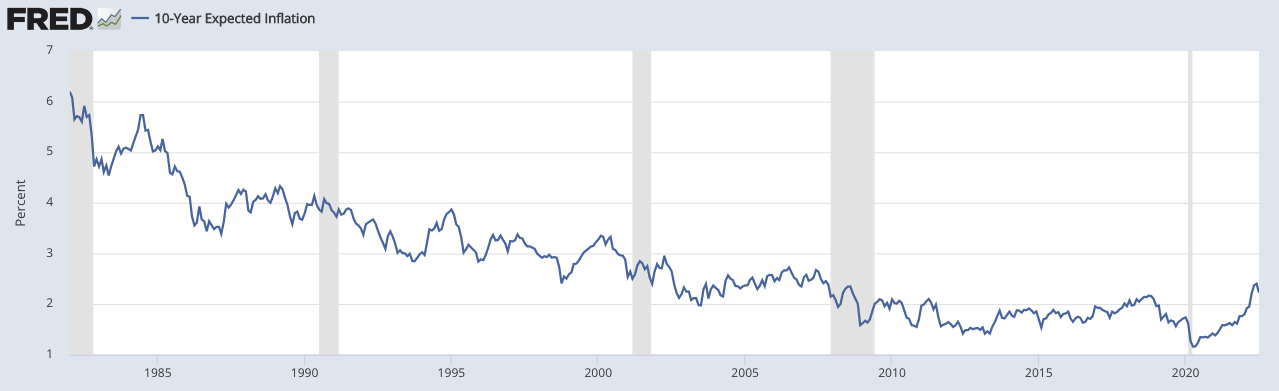

10-Year Expected Inflation (10-Year “Breakeven Inflation”)

(Source: Federal Reserve Bank of Cleveland)

The inflation expectations curve is a graphical representation of these inflation expectations at different maturities.

The shape of the inflation expectations curve can give you insights into inflationary pressures in the economy.

A steeper inflation expectations curve indicates that inflation is expected to rise in the future, while a flatter inflation expectations curve indicates that inflation is expected to fall in the future.

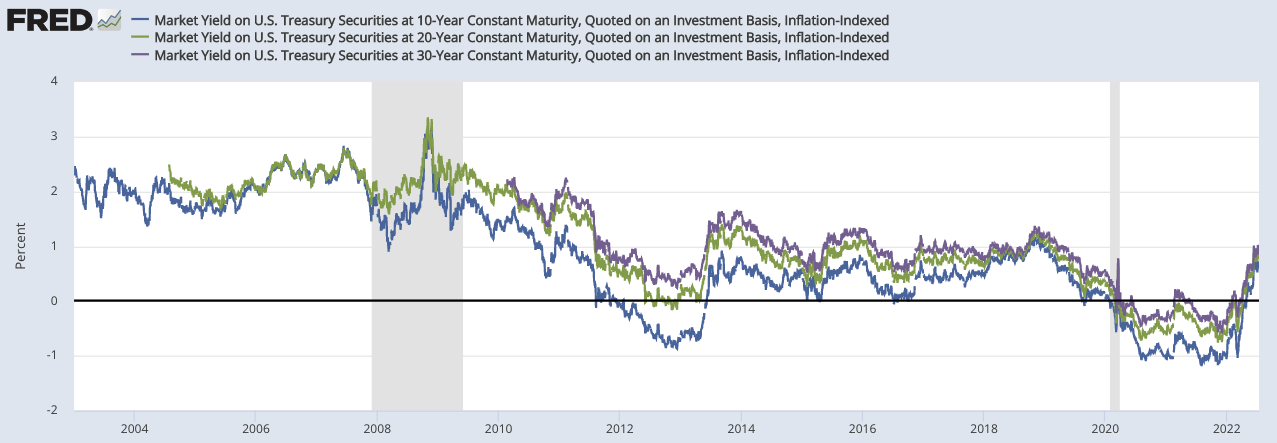

It can also be shown as a real yield curve, meaning the shape of the curve after subtracting various nominal bond yields from their corresponding breakeven inflation rates.

US Treasury Real Yield Curve

(Source: Board of Governors of the Federal Reserve System (US))

Speculation via inflation swaps

Inflation swaps can be used to speculate on inflation.

If a trader believes that inflation will increase relative to expectations, they can buy an inflation swap.

If inflation does increase, the market value of the inflation swap will increase. The trader can then sell the inflation swap at a higher price and make a profit.

Conversely, if a trader believes that inflation will decrease relative to discounted expectations, they can sell an inflation swap.

If inflation does decrease, the market value of the inflation swap will decrease. The trader can then buy the inflation swap back at a lower price and make a profit.

How do I trade inflation swaps or inflation-linked bonds?

In order to trade inflation swaps or inflation-linked bonds, you will need to find a broker that offers these products.

Some brokers may only offer inflation-linked bonds, as ILBs are a standard security, while an OTC derivative like an inflation swap is typically only available to institutional investors.

It is also important to keep in mind that inflation swaps and inflation-linked bonds are not suitable for all investors.

They are complex instruments and involve a sophisticated understanding of what drives them and the role they might play in a portfolio. You should make sure that you understand how these instruments work before trading them.

If you are interested in trading inflation swaps or inflation-linked bonds, contact a broker today.

Inflation and CPI Swaps – FAQs

What is an inflation swap?

An inflation swap is a derivative instrument that allows two parties to exchange payments based on changes in the inflation rate.

Inflation swaps are more complex than inflation-linked bonds, and they are subject to counterparty risk.

What is a CPI swap?

A CPI swap is a type of inflation swap where the payments are linked to the Consumer Price Index (CPI).

CPI swaps are used to speculate on inflation or to hedge against inflation.

What is the difference between an inflation swap and an inflation-linked bond?

Inflation swaps are derivative instruments, while inflation-linked bonds are fixed income instruments.

This means that inflation swaps are more complex than inflation-linked bonds and they are subject to counterparty risk. Inflation-linked bonds are backed by the issuer, such as a sovereign government or the assets of a corporation, so they are not subject to counterparty risk in the same way.

Inflation-linked bonds can only be used to hedge against inflation to some extent, as they don’t hedge out interest rate risk.

How can I trade inflation swaps or inflation-linked bonds?

In order to trade inflation swaps or inflation-linked bonds, you will need to find a broker that offers these products.

Some brokers may only offer inflation-linked bonds, but not OTC derivatives like an inflation swap.

It is also important to keep in mind that inflation swaps and inflation-linked bonds are not suitable for all traders and investors.

They are complex instruments and involve risk. You should make sure that you understand how these instruments work before trading them.

If you are interested in trading inflation swaps or inflation-linked bonds, you’ll need to check with your broker or another broker to see if they carry the products you’re looking for.

Summary – Inflation and CPI Swaps

Inflation and CPI swaps are derivative instruments that allow two parties to exchange payments based on changes in the inflation rate.

Inflation swaps are more complex than inflation-linked bonds, and they are subject to counterparty risk.

A CPI swap is a type of inflation swap where the payments are linked to the Consumer Price Index (CPI).

CPI swaps are used to speculate on inflation or to hedge against inflation. In order to trade inflation swaps or inflation-linked bonds, you will need to find a broker that offers these products.

Inflation-linked bonds are more commonly available on brokerages, while an OTC derivative like an inflation swap is typically only available to institutional clients.

Related

- High Inflation Investing – How to Profit From High Inflation

- How to Build a Stagflation Portfolio

- Inflation Protection – How to Protect Wealth from Inflation