Markets.com Review 2026

See the best Markets.com alternatives in your location.

Pros

- Markets.com provides commission-free trading on most assets with spreads starting from around 0.6 pips on major forex pairs, making it cost-effective for casual traders.

- Switching between the proprietary web platform (great for alerts and quick analysis) and MT5 (strong for algorithmic EAs) was smooth in our tests; positions synced across desktop, web, and mobile without gaps or re-quotes.

- Within the 2,200+ CFDs, Markets.com offers thematic baskets like the Warren Buffett Blend and Cannabis Blend, which behaved like ready-made mini-ETFs during testing, saving the work of balancing weights manually.

Cons

- Inactivity charges kick in after just 3 months, while variable spreads are wider than top ECN brokers during testing, which may deter day traders and high-frequency traders.

- The proprietary web platform felt a bit basic once we pushed into advanced charting with fewer drawing/indicator options than full TradingView or MetaTrader.

- During sign-up, we hit unclear account type explanations and got stuck in an email verification loop that locked us out for an hour - way less streamlined than other brokers we’ve tested.

Markets.com Review

Our review of Markets.com gives an impartial look at the broker’s strengths and weaknesses, drawn from our own experience using the platform and focused on the features active traders value most.

Regulation & Trust

Markets.com, owned by Safecap Investments Limited, is a long-established brokerage that has been in operation since 2008.

The Cyprus-based brand has evolved, previously operating under different legal entities and names. It is now part of a broader group known for its presence in both retail and institutional trading circles. This legacy positions Markets.com as a seasoned player in the industry, attracting a global client base with its comprehensive multi-asset CFD offerings.

The company is regulated primarily by the CySEC in the EU a – ‘green tier’ body in DayTrading.com’s regulator classification, the FSCA in South Africa – a ‘yellow tier’ body, and the SVGFSA (St. Vincent & Grenadines) – a ‘red tier’ body.

While these regulators provide a certain level of oversight, you need to recognize that not all regulatory frameworks are equally stringent.

For example, the offshore SVGFSA allows for high leverage of 1:500 and more, as well as features such as 0.0 pip spreads – conditions that might appeal to more risk-tolerant traders but signal a lighter regulatory touch compared to ‘green-tier’ bodies like the UK’s FCA or Australia’s ASIC, which enforce stricter client asset safeguards, lower leverage caps, compensation schemes, and rigorous conduct standards.

Having said that, features such as segregated accounts, two-factor authentication, and strong encryption help to reassure us about the security of funds.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | CySEC, FSCA, SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

Markets.com offers several live account types tailored to different trader profiles, with the Classic Account being the primary choice for most individuals.

The Classic Account requires a relatively low minimum deposit (approximately $200), offers spreads starting from 0.6 pips on forex, provides leverage of up to 1:500, and grants access to over 2,200 assets, including forex, indices, commodities, stocks, bonds, ETFs, and cryptocurrencies.

For professionals, the Professional Account offers additional features catering to more active or high-volume traders.

There are also specialized options, such as Islamic (swap-free) accounts. However, regional restrictions and regulatory compliance may affect their availability.

Unfortunately, I found the registration process less intuitive compared to other brokers we’ve tested because Markets.com doesn’t clearly explain the different account types during sign-up. It wasn’t immediately apparent which account would best suit my trading needs.This lack of clarity made the initial setup more confusing than I expected, especially when I was trying to make an informed choice quickly. I also got stuck in an email verification loop that required me to enter and confirm my email and password details multiple times – I even got locked out for an hour due to too many ‘failed’ attempts.

Demo Accounts

Markets.com offers a straightforward demo account that’s easy to set up and completely free, allowing you to practice trading with $10,000 in virtual funds across a wide range of assets.

The demo environment mirrors real market conditions and gives access to the same web platform used for live trading, which helps for testing strategies and getting comfortable with the interface without any financial risk.

Compared to leading CFD brokers, Markets.com’s demo account holds up well for beginners seeking a risk-free introduction. However, some top-tier brokers, such as Pepperstone offer more advanced features and educational resources that are integrated with their demo accounts.

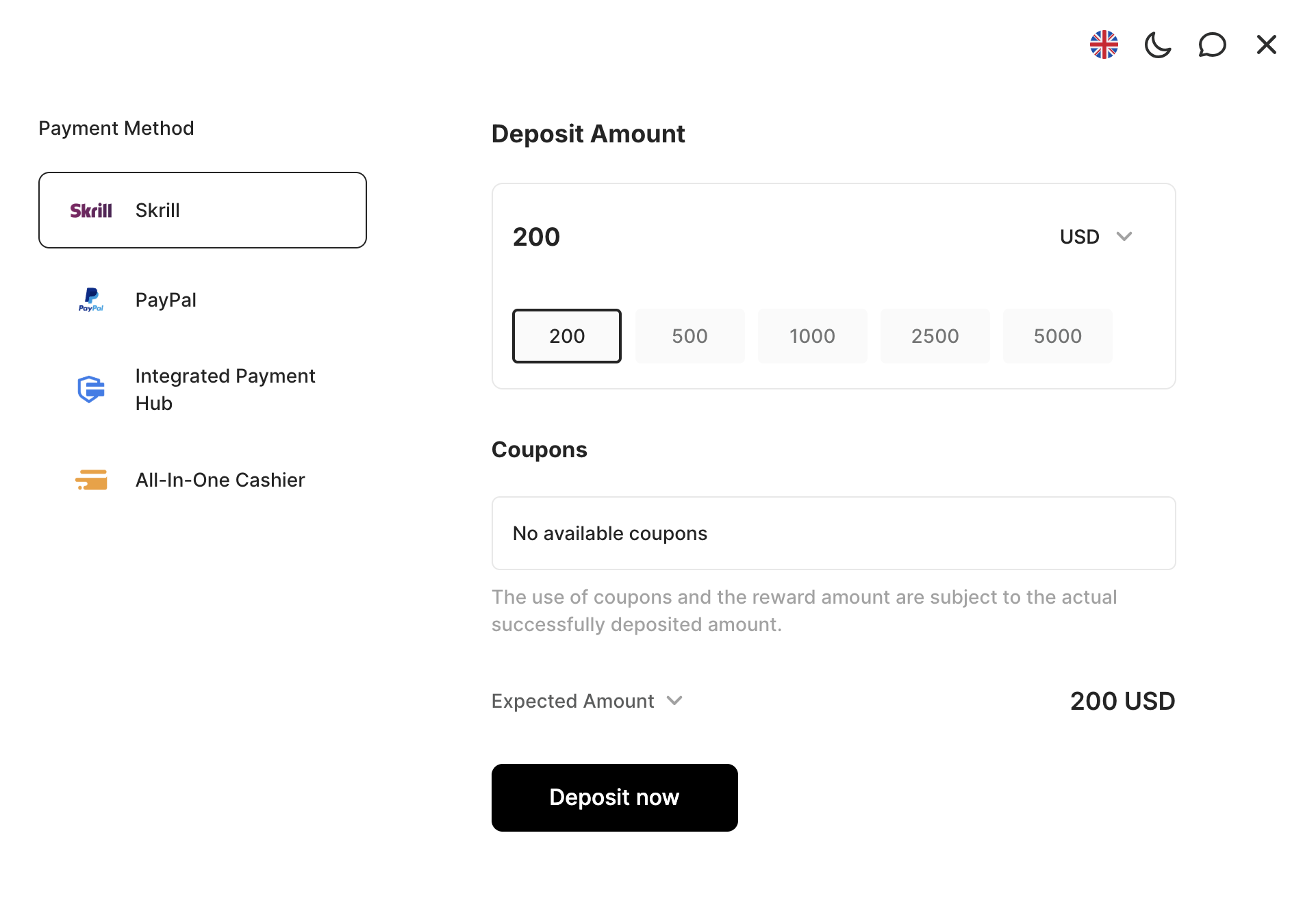

Deposits & Withdrawals

Based on my experience with Markets.com, the deposit and withdrawal options are generally convenient, with several popular funding methods available, including debit cards, credit cards, bank wire transfers, and electronic wallets such as PayPal, Skrill, and Neteller.

The minimum deposit is $200 ($10 minimum withdrawal) across 11 base currencies (PLN, EUR, DKK, USD, AUD, CHF, GBP, NOK, SEK, CZK, and ZAR), which is welcoming for global traders – and beginner traders starting with limited capital.

Withdrawals are processed through the original funding method to comply with anti-money laundering rules, with no fees charged by the broker. However, external fees from banks or payment providers may still apply. This is the same at most brokers I’ve used.

Also, withdrawal times vary depending on the method, ranging from up to 24 hours for e-wallets to 2-5 business days for bank transfers, which is pretty standard but can feel slow if quick access to funds is critical.

One positive I noticed at Markets.com is the straightforward interface for making deposits and withdrawals directly through the platform or mobile app, which feels user-friendly and efficient.However, I was again disappointed by Markets.com’s lack of upfront information about funding types and limits. It wasn’t immediately clear what deposit and withdrawal options were available or if any limits or fees applied. This lack of transparency contrasts with other brokers that provide clear, detailed funding guidelines right from the start.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Apple Pay, Credit Card, Debit Card, Mastercard, Neteller, PayPal, Skrill, Visa, Wire Transfer, WorldPay | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $200 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

Markets.com offers an excellent range of over 2,200 CFDs across multiple markets, including 70+ forex pairs, 300+ global stocks, 30+ major indices such as the S&P 500 and FTSE 100, 20+ commodities like gold, silver, oil, and natural gas, 30+ cryptocurrencies like Bitcoin, Ethereum, and Litecoin, as well as 68+ ETFs and 4+ bonds including SPDR S&P 500 (SPY) and 10-Year US Treasury Note.

There are also 15+ thematic blends, like the ‘Buffett Blend’ (mimics the investment strategies of the legendary investor) and ‘Cannabis Blend’ (focusses on companies in the cannabis sector), tailored for innovative and thematic trading strategies.

This variety suits my desire to diversify trading strategies without needing multiple brokers. The leverage varies by asset class and client type, ranging from modest limits on cryptos to higher leverage on forex and commodities, which is standard practice given regulatory restrictions.

However, compared to some top brokers, Markets.com’s asset range, while extensive, is somewhat more limited in terms of sheer market depth and advanced instruments.

For instance, IG offers access to over 17,000 markets and includes futures and options trading, which are absent at Markets.com.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:500 | 1:50 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

Markets.com’s fee structure is relatively straightforward, with zero commission on trades and no fees for deposits or withdrawals.

The primary trading cost is derived from spreads, which are variable and typically start at 0.7 pips on major forex pairs, such as EUR/USD.

While this spread is competitive for casual traders, it can be higher than the ultra-tight spreads offered by specialized brokers, such as IC Markets, which may be more significant for scalping or high-frequency trading.

There are also additional costs to be aware of, such as a flat-rate currency conversion fee of 0.6% and an inactivity fee of $10 per month (deducted monthly from the account balance) after just three months of dormancy.

The inactivity fee seems a bit aggressive compared to some competitors, who offer more extended grace periods or have no inactivity fees.

On the plus side, Markets.com refunds bank charges for deposits over $2,500, which is a nice touch for larger traders.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 1.3 | 0.08-0.20 bps x trade value | 1.2 |

| FTSE Spread | 2.5 | 0.005% (£1 Min) | 1.0 |

| Oil Spread | 0.05 | 0.25-0.85 | 2.5 |

| Stock Spread | 1.53 (Apple) | 0.003 | 0.14 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

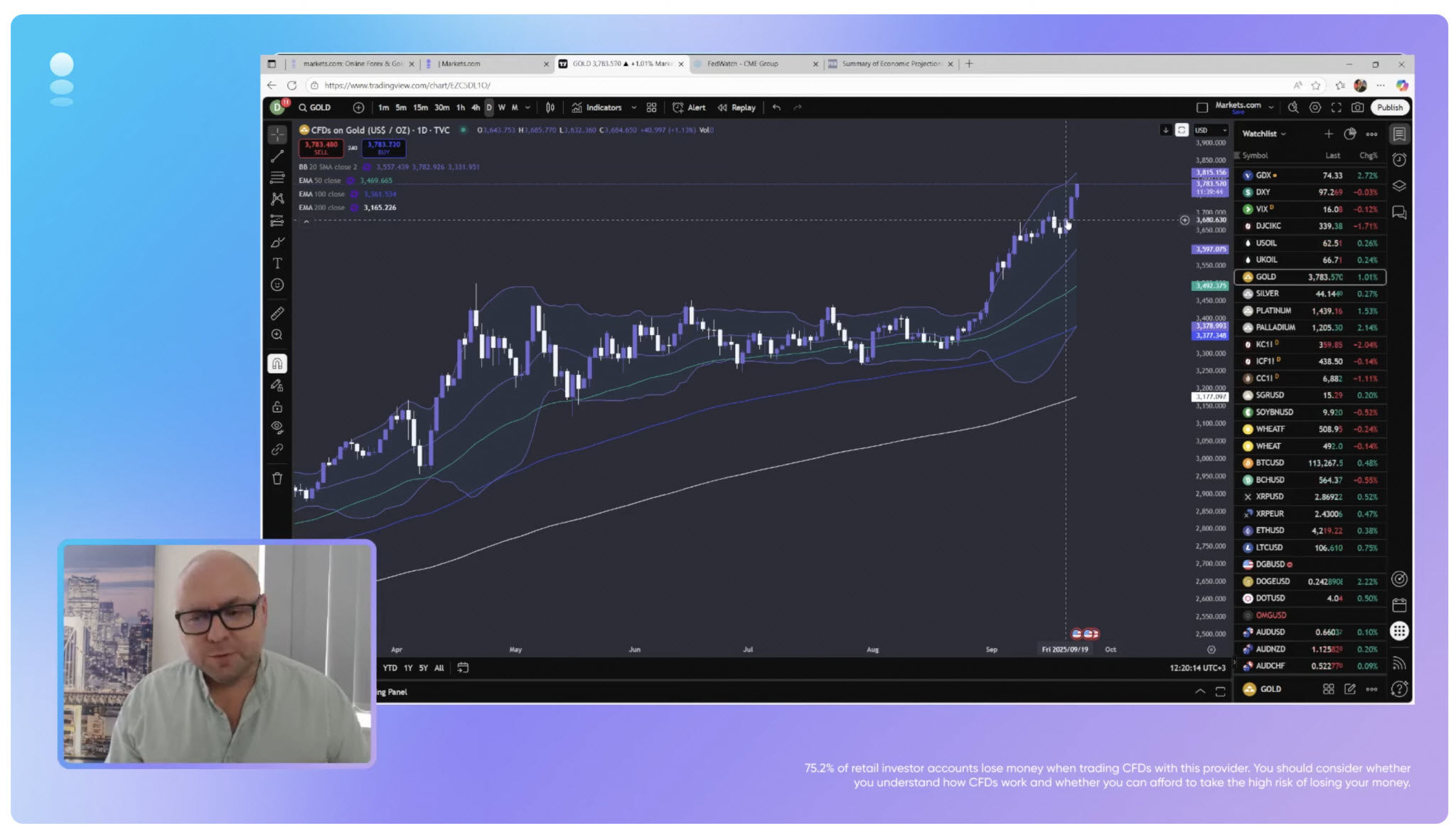

Markets.com supports the popular platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as a proprietary, user-friendly platform based on TradingView, which can be accessed without downloads. Mobile versions of these platforms maintain most desktop features, allowing you to trade effectively on the go.

From my hands-on experience with Markets.com’s proprietary trading platform, I found it clean and intuitive, with a straightforward layout that makes order placement and understanding trading costs easy.

The TradingView-based platform offers useful features, such as customizable watchlists and a large selection of indicators, but the new design gets rid of the integrated news feeds, which helped me stay on top of the markets without feeling overwhelmed.

Furthermore, the charting tools, while decent for basic technical analysis, lack some of the advanced indicators and drawing tools I’m accustomed to on MT5 or TradingView.

The execution speed was generally reliable during my trading sessions, but I noticed occasional slight delays in fast-moving markets compared to specialized platforms like cTrader.

Overall, it’s a solid platform for beginners and those who prefer simplicity, but advanced traders may find it somewhat basic.

What’s also missing is support for cTrader, a platform I prefer for its advanced order types, customizable interface, and integrated economic calendar and news feed.

Additionally, Markets.com does not offer copy trading features, which are popular among brokers such as Vantage, where you can automatically follow established trading strategies.

Markets.com’s platform offerings cater well to beginners and intermediate traders who want reliable options, along with some additional proprietary tools. However, more advanced or social traders might find the platform selection somewhat limited compared to brokers with broader technology suites.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Web Platform, MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Mobile App | iOS, Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

Markets.com offers solid research tools, such as Trading Central (not available in all jurisdictions), which provides automated technical analysis, market signals, and trading ideas that I find really helpful for spotting opportunities.

They also offer regular, albeit poorly presented, in-house news and analysis articles on their website, as well as really informative YouTube-hosted market updates, providing valuable insights for traders seeking to stay informed through video content.

A TradingView-powered economic calendar and forex heatmap are also on their website, which I’ve found particularly useful for staying informed about key economic events and visualizing currency strength at a glance.

The economic calendar is integrated into the web trading platform and provides real-time updates on critical market-moving announcements, complete with filters for country and importance, helping to plan trades around potential volatility.

Other bonuses that we don’t see at most firms include a Hedge Funds Confidence tool that uses SEC data, plus an Insiders Trades feature that flags increases and decreases in the shareholdings of popular companies.

However, one notable downside is the absence of popular research alternatives, such as Autochartist or Signal Centre (formerly PIA First Limited), which some leading CFD brokers include for more diversified trading signals and pattern recognition.

Markets.com meets the basic research needs of traders well and is suitable for both beginners and intermediate traders. However, traders seeking more advanced or multiple-source research tools may find the options somewhat limited compared to brokers such as IG or IC Markets.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Markets.com offers a solid range of educational resources through its Education Centre, including a comprehensive trading glossary, detailed articles, and instructional videos that can help new traders build foundational knowledge and understand key trading concepts.

The materials cover basics such as how CFDs work, risk management, trading psychology, and market analysis, making them well-suited for beginners or those looking to brush up on the essentials.

However, compared to brokerges such as Interactive Brokers or FxPro, Markets.com’s educational content appears somewhat less extensive and interactive. Top-tier brokers often supplement written resources with live webinars and structured courses based on skill level, which I don’t see as fully developed here.

There’s also less focus on advanced strategies or in-depth market analysis, which more experienced traders may find limiting.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Markets.com’s customer support is slow but easily accessible across multiple channels, including live chat, phone, WhatsApp, and email support.

Whenever I reached out for help during testing – especially by live chat – responses usually took over 10 minutes, although support staff were efficient at resolving queries and providing relevant information.

The website also offers an online query form and a comprehensive Help Centre with guides and FAQs, which is helpful for simple questions outside business hours.

Support is available 24 hours a day, Monday to Friday, which matches the industry standard but means help isn’t available on weekends. This could be a limitation for traders handling issues outside regular market hours, particularly with products like crypto, which trade around the clock.

The absence of dedicated account managers is also a drawback, which makes it feel less comprehensive than the very best brokers in the sector.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Markets.com?

Markets.com is a legitimate, regulated broker that offers a user-friendly platform, a broad range of assets, and solid research and educational resources, making it accessible to both beginners and intermediate traders.

While fees are competitive, advanced traders may find tighter spreads and deeper market access with brokers like Pepperstone or IC Markets.

It also lacks support for cTrader and TradingView platforms, and offers no copy trading facility – features we see at most leading competitors these days.

However, if you value accessibility, security, and straightforward support, Markets.com is a safe, balanced choice for most retail CFD and forex traders.

FAQ

Is Markets.com Legit Or A Scam?

Markets.com is a fully regulated broker, licensed by authorities such as CySEC, the FSCA, and the SVGFSA, and has been operating since 2008, making it a legitimate trading platform.

However, accounts under the FSCA (South Africa) generally come with fewer investor protections compared to CySEC, meaning the level of security may vary depending on your jurisdiction.

Is Markets.com Suitable For Beginners?

Markets.com is beginner-friendly, with a $200 minimum deposit, a user-friendly platform, and an Education Centre that offers glossaries, articles, and videos. A free demo account also lets new traders practice risk-free.

However, the registration process can feel confusing, and while the educational materials cover basics well, they lack interactive or more advanced courses for deeper learning.

Best Alternatives to Markets.com

Compare Markets.com with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Markets.com Comparison Table

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 4.4 | 4.3 | 4.5 |

| Markets | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, FSCA, SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | – | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | Web Platform, MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:500 | 1:50 | 1:50 |

| Payment Methods | 10 | 6 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Markets.com and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Markets.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | No |

| Futures | Yes | Yes | Yes |

| Options | No | Yes | Yes |

| ETFs | Yes | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | Yes | No | No |

| Volatility Index | Yes | No | No |

Markets.com vs Other Brokers

Compare Markets.com with any other broker by selecting the other broker below.

The most popular Markets.com comparisons:

Customer Reviews

1 / 5This average customer rating is based on 1 Markets.com customer reviews submitted by our visitors.

If you have traded with Markets.com we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Markets.com

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I am writing this to warn other traders.

I traded with Markets.com (under Finalto South Africa) and built up my account over time. Everything seemed smooth—until I attempted to withdraw my $340,000 balance. Instead of processing the withdrawal, they rejected it without a clear explanation.

After requesting clarification, they referred to vague “liquidity abuse” and started coordinating with a third-party compliance firm. This raised red flags for me.

I was never told my strategy was unacceptable during trading. I provided full documentation and had no violations or margin issues. I used normal trading patterns, and their system accepted my trades and spreads. When I asked for detailed clarification, I received generic replies and delays.

I’ve submitted a complaint to the FSCA and escalated my case to the FAIS Ombud. It’s under assessment now, and I hope justice is served. Until then, I cannot recommend Markets.com.

If you’re a serious trader or scalper, be very cautious. A broker that rejects withdrawals after profits is a major red flag.

🚨 Final Thought:

I lost trust in Markets.com. I advise other traders to document everything, avoid large balances without regulatory protection, and think twice before using this broker for serious day.