Best Day Trading Brokers & Platforms in Indonesia 2026

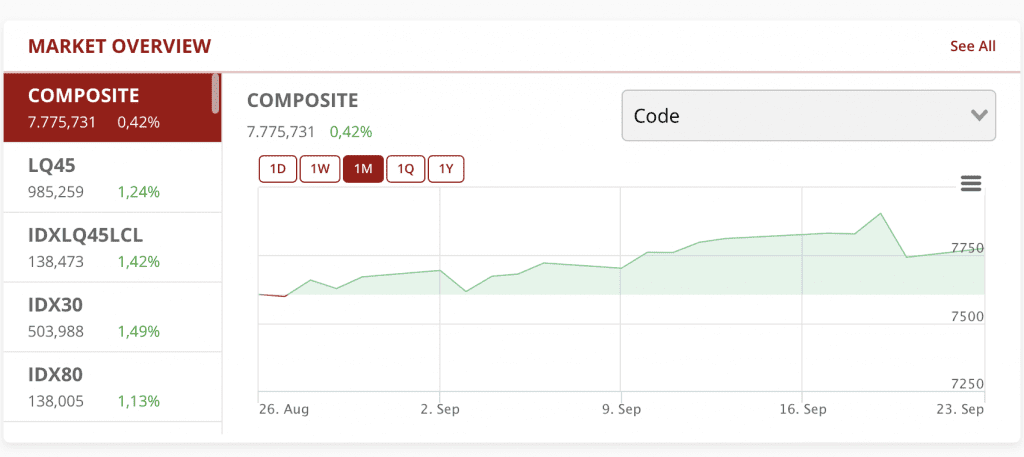

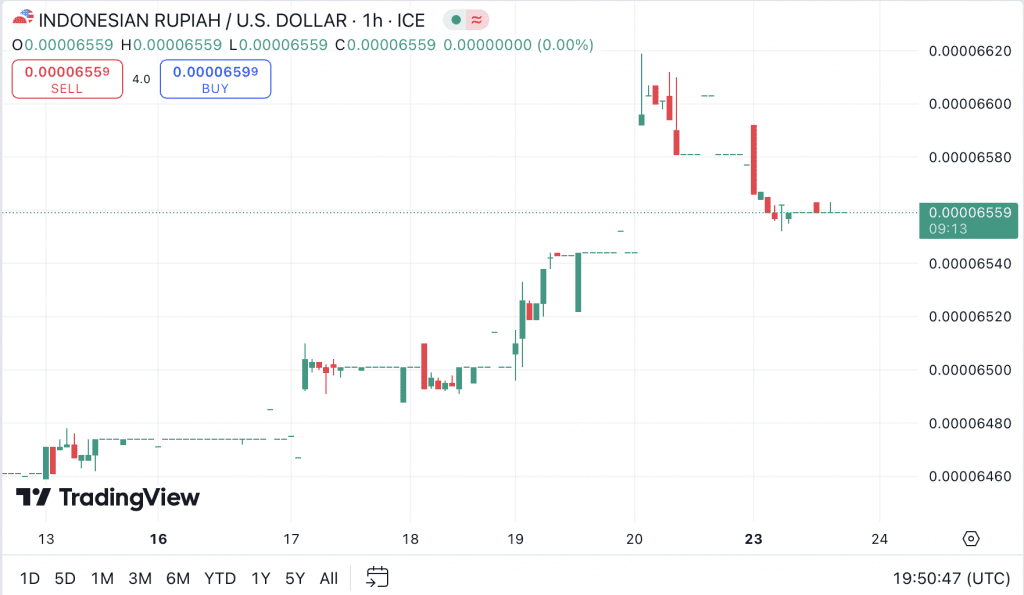

Day traders in Indonesia aim to profit from short-term price movements in currencies like the Indonesia rupiah (IDR), stocks on the Indonesian Stock Exchange (IDX), and global financial markets, through an online broker.

Indonesia’s Financial Services Body (OJK) and Commodity Futures Trading Regulatory Agency (Bappebti) regulate financial services in the country. However, many Indonesians use regulated, international brokers, though it’s essential you still follow Indonesia’s laws.

Jump into DayTrading.com’s pick of the top day trading brokers in Indonesia. Our experts rated them for their terrific short-term trading experience, with some excelling for Indonesians with IDR accounts and Halal accounts.

Top 6 Platforms For Day Trading In Indonesia

These 6 brokers won in our extensive tests to discover the best destination for short-term traders in Indonesia:

-

1

IC Markets

IC Markets -

2

Exness

Exness -

3

XM

XM -

4

AvaTrade

AvaTrade -

5

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

6

Trade Nation

Trade Nation

This is why we think these brokers are the best in this category in 2026:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

Best Day Trading Brokers & Platforms in Indonesia 2026 Comparison

| Broker | Minimum Deposit | Islamic Account | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|---|

| IC Markets | $200 | ✔ | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:1000 | ASIC, CySEC, CMA, FSA |

| Exness | Varies based on the payment system | ✔ | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| XM | $5 | ✔ | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| AvaTrade | $100 | ✔ | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Pepperstone | $0 | ✔ | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Trade Nation | $0 | ✔ | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | MT4 | 1:500 (entity dependent) | FCA, ASIC, FSCA, SCB, FSA |

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Full range of investments via leveraged CFDs for long and short opportunities

- Multiple account currencies are accepted for global traders

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

Cons

- Fewer legal protections with offshore entity

Methodology

To compile our list of the top day trading platforms for Indonesians, we searched our database comprising hundreds of brokerages to find every one that accepts clients in Indonesia.

Then we ranked firms using their overall rating which is derived from live tests, 100+ data points, and broker comparisons.

- We confirmed that all our recommended brokers accept day traders from Indonesia.

- We checked brokers have regulatory oversight from the OJK, Bappebti or another organization we trust.

- We selected brokers with access to a diverse range of financial markets.

- We verified that each broker provides competitive fees for day traders.

- We prioritized brokers with robust and reliable charting tools.

- We ensured that brokers have clear margin and leverage policies.

- We examined order speeds and execution quality where data is available.

- We verified that brokers offer convenient options for account funding in Indonesia.

- We noted whether a halal trading account is available given that Indonesia is a Muslim country.

How To Choose A Day Trading Broker In Indonesia

Based on our years of evaluating hundreds of day trading platforms, here are the key factors to consider:

Choose A Broker You Can Trust

Scam brokers and fraudsters have become common as the number of online traders in Indonesia rises.

The scale of the problem was evident after the arrest of Indonesian fraudster Wahyu Kenzo for a trading robot scam involving the Auto Trade Gold app that cost traders $585 million.

That’s why we thoroughly check that brokers are above board:

- We investigate whether each broker’s licenses are up to date by checking the relevant authority’s listings. We’ve found that Indonesian traders are often directed to the weakly regulated branches of established brokers.

- We check press reports and our own user reviews to understand the broker’s track record and uncover any history of unfair practices.

- We look for other hallmarks of a reliable broker, such as listings on a stock exchange and high user figures.

- We’ve awarded AvaTrade a near-perfect 4.8 score for Regulation & Trust because it has maintained the highest standards over 15+ years. AvaTrade offers full transparency on trading terms, boasts a clean record, 400,000+ users, and has licenses from seven regulators, including trusted bodies like ASIC and CySEC.

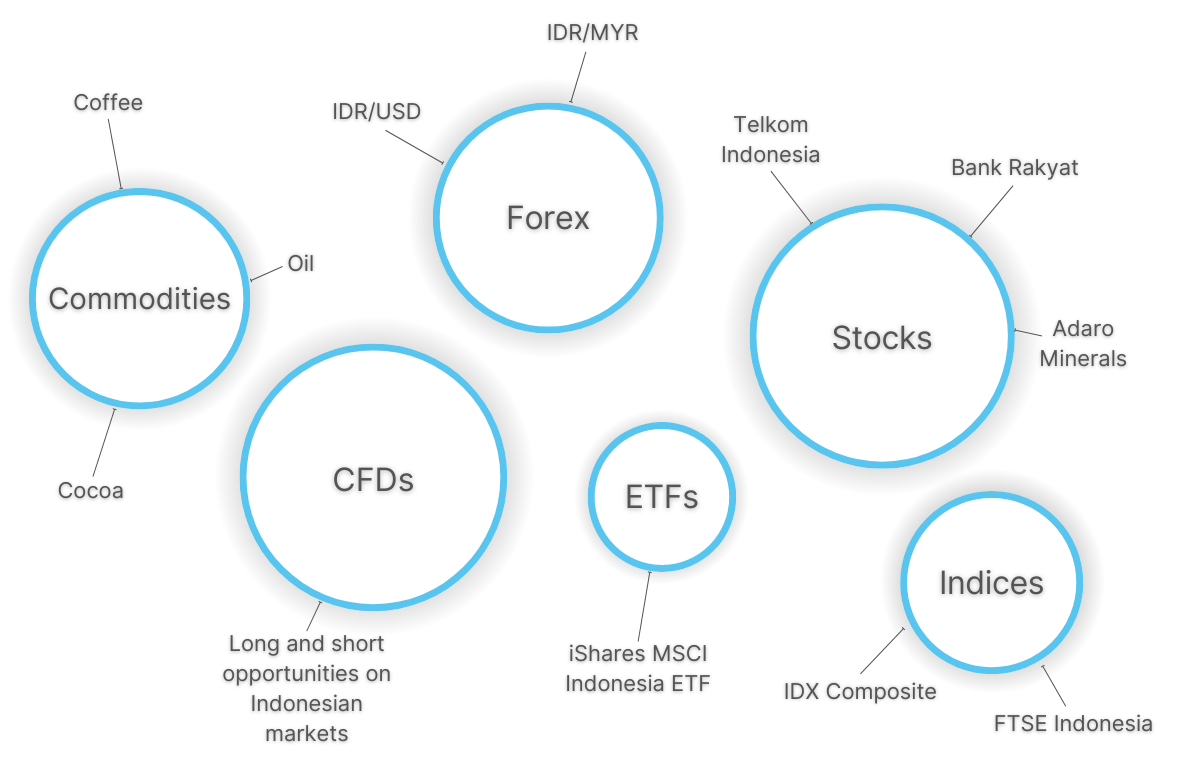

Choose A Broker With Access To Diverse Markets

Most traders will check that a broker has a few specific instruments they want to trade before signing up, but you shouldn’t neglect the advantages of having a broad instrument list.

Some of our top brokers have thousands of diverse assets on their platforms, allowing traders to learn about different markets and find new opportunities as they develop their skills.

Traders in Indonesia may want to start with regional forex pairs and stocks like Telkom Indonesia that are traded on the IDX.

They may also look for important Indonesian commodities like oil, palm oil and cocoa, as well as cryptocurrencies, which are officially recognized as commodities in the country.

- Deriv.com maintains its leading position for market access in Indonesia with a 4.5 Assets & Markets score. Its instrument list blends traditional CFD trading with novel instruments like multipliers, accumulators and simulated indices, and traders benefit from tight spreads and a suite of extras including VPS hosting.

Choose A Broker With Competitive Fees

We’ve found that the spread – the difference between an asset’s bid and ask price – is usually the most important trading fee to consider when choosing a broker for day trading.

Most of the time, you’ll need to pay a commission to access the tightest spreads, and this can be another decisive fee to consider.

You should also make sure that there are no unreasonable non-trading fees, such as expensive deposits and withdrawals via your preferred payment method. A good way to reduce these costs is to trade with a broker that has an IDR account.

- Exness continues to dominate our list of budget brokers with its 4.8 rating on Fees & Costs, which it earned with its low commissions of $3.50 per lot, razor-thin spreads (and zero-spread account options), and exceptional list of account currencies including IDR.

Choose A Broker With A Reliable Charting Platform

You’ll need a reliable charting platform with a suite of indicators and tools to fulfil your day trading potential.

Many brokers support one or more of the top third-party trading platforms – the biggest players include MetaTrader 4, MetaTrader 5, cTrader and the slicker and more contemporary TradingView.

I’ve also been impressed by some brokers’ bespoke, in-house platforms lately. These are custom-made for the broker’s instrument list, and often feature streamlined, integrated research and analysis tools that are ideal for beginners.Some, like eToro, actually integrate the charts from TradingView or another third-party platform, so you get the best of both worlds.

- Pepperstone’s platform options remain among the best in the game, with access to the four most popular third-party platforms (MT4, MT5, cTrader and TradingView) plus useful tools like Autochartist and DupliTrade for automated analysis and copy trading.

Choose A Broker With Transparent Leverage Requirements

Leverage is a key tool that allows day traders to augment their trading power using borrowed funds. A trader with $100 of capital to place on a trade can increase the size of their position to $1000 by using leverage of 1:10.

You need to know the precise terms and conditions when trading with borrowed funds, so choose a broker that is transparent and makes it clear how much leverage is available on every instrument.

They should also disclose whether or not they offer negative balance protection to prevent you from losing more than your account balance in a bad trade.

- FXTM provides a flexible leverage allowance up to 1:2000, so day traders can choose the level that suits their style. We recommend new traders stick to rates below 1:20 on major FX pairs and avoid margin trading for volatile instruments, but if you’re more experienced you are sure to find enough leverage to meet your needs.

Choose A Broker With High-Quality Execution

Day trading centres on short-term price movements, so you’ll need fast and reliable execution to achieve your trading goals.

We investigate every broker’s execution speed and give priority to those that maintain an average below 100 milliseconds. We also assess the extent of ‘slippage’ – the difference between the price when the order is placed and it is filled.

- IC Markets remains at the head of the pack for execution quality, with speeds well ahead of our 100ms benchmark for fast brokers and averaging 35ms on many instruments. This excellent quality is provided by servers close to Wall Street in New York’s Equinix Data Center.

Choose A Broker With Convenient Account Funding

We look for brokers that have a reasonable barrier of entry for Indonesian traders, with a low minimum initial deposit and convenient ways to deposit rupiahs.

Almost all of the hundreds of brokers we have reviewed accept new traders for a first deposit of 250 USD (around 3.8 million IDR) or lower.

Also look for a broker with a fast, reliable payment method, whether that’s a traditional debit card or bank transfer or a more novel method like Doku Wallet or Gopay, two of Indonesia’s top digital payment solutions.

- XM leads our rankings for accounts because of its flexible funding, including e-wallets like Skrill that accept IDR payments. It’s also one of the most affordable brokers with a deposit of just 5 USD (around 76,0000 IDR), and it’s been recognized with a slew of prizes that include DayTrading.com’s Best MT4/MT5 Broker.

FAQ

Who Regulates Day Trading Brokers In Indonesia?

Indonesia’s financial regulators that oversee retail trading markets are the Financial Services Body (OJK) and the Commodity Futures Trading Regulatory Agency (Bappebti).

However, these bodies are not the most active when it comes to licensing brokers that provide day trading products, so many residents look for a reliable international firm with a license from another trusted organization. Going down this route is allowed, but you must still adhere to Indonesia’s trading regulations and tax obligations.

Which Is The Best Broker That Accepts Traders In Indonesia?

There isn’t any single top day trading broker; the best for you will depend on your specific requirements and preferences.

Each of the brokers on our list meets specific traders’ needs. IC Markets and FXTM are great choices for experienced day traders due to their fast execution and high leverage allowance; eToro‘s in-house platform is great for beginners and Pepperstone offers flexible charting options. All offer Islamic accounts catering to Indonesia’s muslim-majority population.

Recommended Reading

Article Sources

- Indonesian Stock Exchange (IDX)

- Financial Services Body (OJK)

- Commodity Futures Trading Regulatory Agency (Bappebti)

- Report: Cryptocurrencies officially recognized as commodities in Indonesia

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com