Brokers With IDR Accounts

The Indonesian rupiah (IDR) is the official currency of Indonesia. It is abbreviated as ‘Rp’ and issued by Bank Indonesia. IDR accounts are an obvious choice for Indonesian traders looking for convenient deposits.

Having a trading account in IDR could also be helpful if you are looking to capitalize on Indonesia’s emerging market potential, especially oil and palm oil, and opportunities for gains in currency trading.

Discover DayTrading.com’s selection of the top brokers with Indonesian rupiah accounts.

Best Brokers With IDR Accounts

Following our extensive evaluations, these are the 2 top brokers supporting IDR accounts:

This is why we think these brokers are the best in this category in 2026:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

Brokers With IDR Accounts Comparison

| Broker | IDR Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| JustMarkets | ✔ | $1 | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures | CySEC, FSA |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

JustMarkets

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- MetaTrader 4 integration

- Trustworthy and regulated by CySEC

- Welcome bonus for new traders

Cons

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

How Did We Choose The Best Brokers?

To pinpoint the top IDR trading platforms, we followed a meticulous selection process:

- We utilized our directory spanning hundreds of brokers, ensuring we provide you with up-to-date information.

- We eliminated any firms that didn’t meet our stringent requirements for offering IDR-denominated accounts.

- We used a scoring system that evaluates platforms on 100+ quantitative metrics and qualitative assessments.

What Is An IDR Account?

An IDR trading account is based in the Indonesian rupiah. This means deposits, withdrawals and trading transactions are processed in IDR.

They can be a valuable tool for diversifying your portfolio and capitalizing on the growth of the Indonesian economy, potentially reducing transaction costs, hedging currency risk, and providing the potential for capital appreciation.

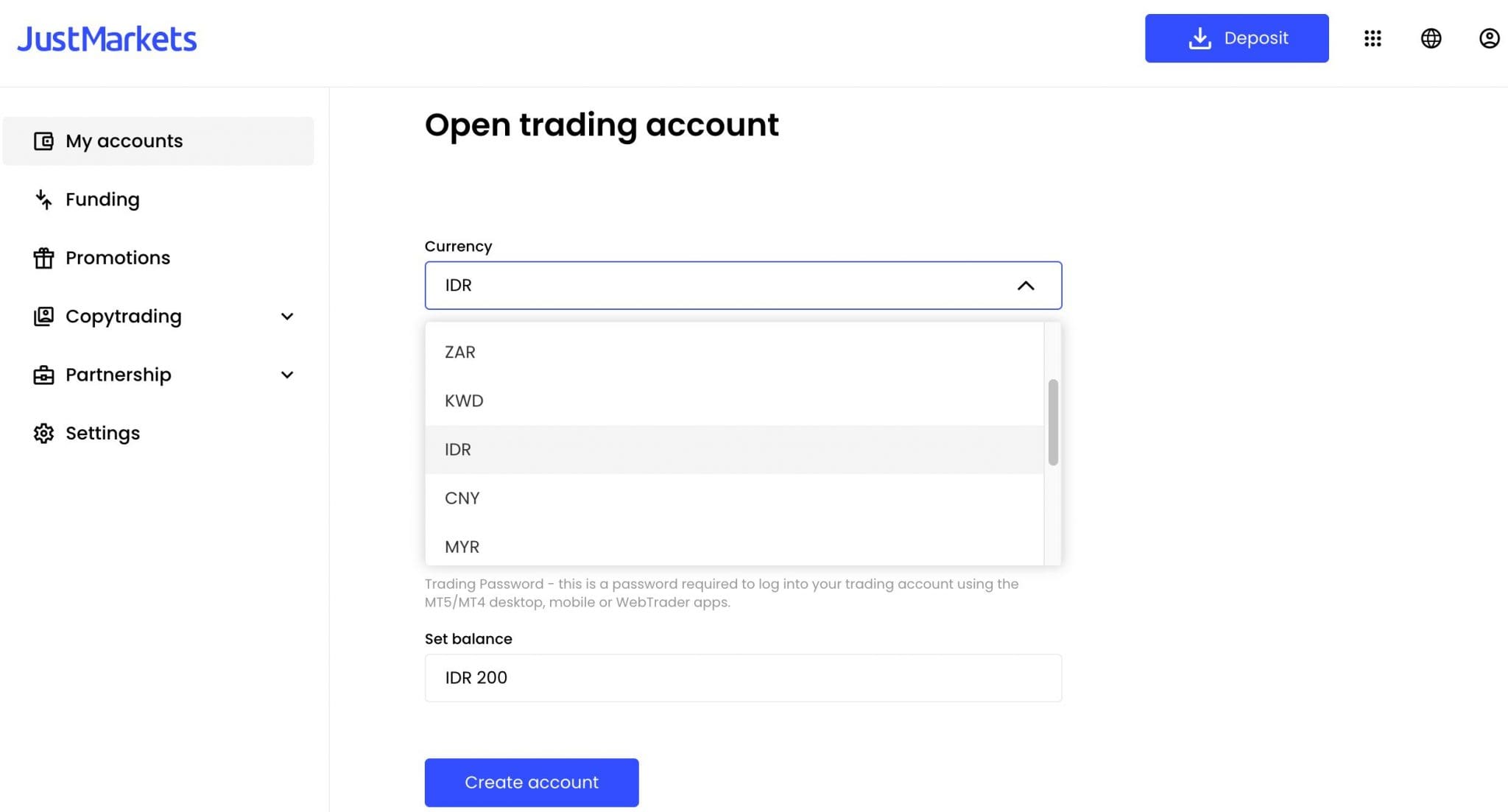

Setting up an IDR trading account is a straightforward process. Once you’ve completed the necessary identity and address verification, you’re ready to start trading.To illustrate, here’s a snapshot of my account at JustMarkets, where I selected ‘IDR’ from the ‘Currency’ menu.

Do I Need An IDR Trading Account?

IDR trading accounts may be suitable for certain types of traders:

- For traders based in Indonesia, an IDR account can offer a substantial advantage regarding tax reporting. They streamline the accounting process and simplify tax obligations by eliminating the need to track and report foreign exchange gains or losses.

- An IDR account may provide access to the vibrant Indonesian stock market, though this is rare based on our assessments. You may be able to more easily trade various Indonesian financial instruments, such as stocks, commodities, and derivatives on the Indonesia Stock Exchange (IDX).

- For some traders, concentrating on domestic Indonesian assets may mitigate the potential adverse effects of currency fluctuations on trading profits. This is particularly beneficial during times of economic uncertainty or market instability.

How Can I Check If A Broker Offers An Account In Indonesian Rupiah?

Follow this three-step process to confirm whether a broker supports an Indonesian rupiah trading account:

- Navigate to the ‘Account Options’ section of a trading provider’s website or app. Here, you’ll often find a list of supported currencies for various account types. If not, reach out to the customer support team.

- Ensure that your trading account supports ‘IDR’ as the base currency, allowing you to execute trades smoothly in IDR.

- Create a trading account and select ‘IDR’ as your base currency. Fail to select IDR at the setup stage and you may not be able to change the account’s base currency further down the line.

Pros & Cons Of IDR Trading Accounts

Pros

- Trading directly in IDR can eliminate the need for constant currency conversions. This not only helps you save on exchange fees but also minimizes the risk of fluctuating exchange rates, potentially providing a more cost-effective trading experience for Indonesians.

- IDR accounts may give you access to the Indonesian economy, offering geographic and currency diversification within your portfolio. This can enhance your risk management strategy and potentially boost returns by spreading exposure across different markets and currencies.

- An IDR account may allow quicker payment and trade settlements with Indonesian entities, enhancing transaction efficiency and minimizing delays.

Cons

- IDR accounts are extremely rare – supported by less than 5% of the brokers we’ve evaluated. Opting for a trading platform with a USD account will give you more options that may better align with your trading goals.

- The IDR tends to be more volatile than major currencies like USD and EUR due to its sensitivity to global commodity prices and economic shifts in emerging markets. Significant currency fluctuations, especially during economic instability, can affect the value of your trading account.

- An IDR-based account is ideal for managing transactions and assets priced in IDR. However, it may limit access to international stocks, bonds, or financial products traded in other currencies.

- If you intend to trade assets not denominated in IDR, you may have to convert IDR to other currencies. This can expose you to the risks of foreign exchange volatility and conversion costs, especially when the IDR is experiencing fluctuations.

FAQ

Which Is The Best Broker With An IDR Account?

Our team of experts has thoroughly analyzed the top trading platforms that offer IDR accounts.

Leverage our list to find the perfect platform that aligns with your day trading requirements.

How Much Does It Cost To Open A Trading Account Based In Indonesian Rupiah?

Based on our investigations, the standard minimum deposit for IDR trading is typically up to USD 250, which is approximately IDR 3,837,215. However, certain brokers provide more affordable options.

One notable example is JustMarkets, which offers a significantly lower minimum deposit of just USD 10 (roughly IDR 153,525). This makes it an appealing option, especially for beginners or traders with limited funds.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com