Best Brokers For Bonds

Investors trade bonds for profit by capitalizing on changes in government or corporate bond values. Dig into our pick of the best bond trading brokers, selected after thorough review, comparison, and rating.

Best Brokers For Bonds 2026

Based on our latest assessment, these are the 6 best bond trading accounts:

Why Are These Brokers the Best for Trading Bonds?

Here is a quick rundown on why these bond brokers stand out from the rest following our tests:

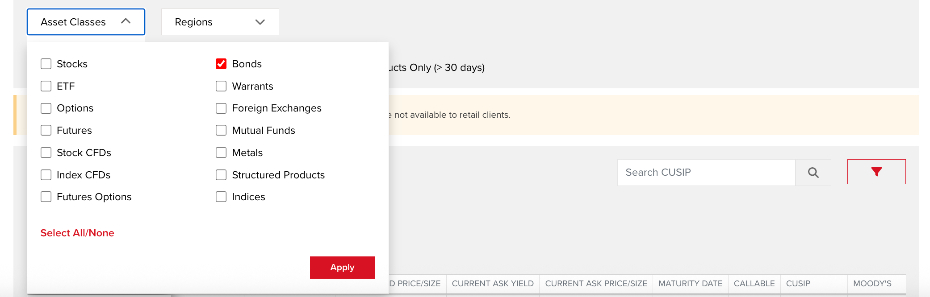

- Interactive Brokers is the best broker for trading bonds in 2026 - Interactive Brokers maintains its position as a top-ranking bond broker, with a whopping selection of over 1 million products. Helpfully, the firm provides a comprehensive Bond Search tool to narrow down the wealth of popular treasuries and notes, as well as the lesser-known municipal securities. Commissions are also competitive, starting at 0.2 basis points for the first $1 million of face value.

- Firstrade - Firstrade clients can access an excellent range of fixed-income investments such as treasury bills, municipal bonds and secondary market certificates of deposit (CDs). The broker charges zero commissions on online trades and there is no minimum deposit to get started, making Firstrade a good pick for novice bond investors.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

- Zacks Trade - Zacks Trade is a top pick for seasoned bond traders. With exclusive access to over 20 top-tier research providers, including Dow Jones and Morningstar, traders can stay ahead of the bond market easily. Commissions start from 0.025% of the face value plus $3 per government bond, and the broker’s proprietary terminal is packed with analysis features for active, high-volume traders.

- AvaTrade - AvaTrade offers European and Japanese bond trading through CFDs, allowing users to speculate on rising and falling prices. Spreads on treasuries are tight and leverage up to 1:5 is available, amplifying both returns and losses. AvaTrade excels by offering bonds on MT4 and MT5 – platforms that are great for short-term traders and algo traders.

- Trade Nation - Trade Nation offers a handful of popular bond futures on their proprietary TN Trader terminal. The 1:5 leverage, low fixed spreads and $0 minimum deposit make Trade Nation ideal for beginners looking to start trading bonds easily. There are also some decent analysis tools available, including a signal centre to help uncover bond market opportunities.

Compare the Best Brokers for Bonds on Key Attributes

Discover the ideal bonds broker for your needs with our feature comparison:

| Broker | Bonds | Minimum Investment | Regulators | Cost Rating |

|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | / 5 |

| Firstrade | ✔ | $0 | SEC, FINRA | / 5 |

| Optimus Futures | ✔ | $500 | NFA, CFTC | - |

| Zacks Trade | ✔ | $2500 | FINRA | / 5 |

| AvaTrade | ✔ | $100 | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM | / 5 |

| Trade Nation | ✔ | $0 | FCA, ASIC, FSCA, SCB, FSA | / 5 |

How Safe Are These Bond Trading Brokers?

Are the best bond brokers reliable, and do they protect your investments?

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| Firstrade | ✘ | ✘ | ✘ | |

| Optimus Futures | ✘ | ✘ | ✔ | |

| Zacks Trade | ✘ | ✘ | ✘ | |

| AvaTrade | ✘ | ✔ | ✔ | |

| Trade Nation | ✘ | ✔ | ✔ |

Compare Mobile Bond Trading

Do these brokers offer a seamless mobile bond trading experience?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| Firstrade | iOS & Android | ✘ | ||

| Optimus Futures | iOS & Android | ✘ | ||

| Zacks Trade | iOS & Android | ✘ | ||

| AvaTrade | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ |

Are the Top Bond Brokers Good for Beginners?

The top bond brokers for beginners offer demo accounts and essential learning tools:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| Firstrade | ✘ | $0 | $1 | ||

| Optimus Futures | ✔ | $500 | $50 | ||

| Zacks Trade | ✔ | $2500 | $3 | ||

| AvaTrade | ✔ | $100 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots |

Are the Top Bond Brokers Good for Advanced Traders?

Advanced traders need brokers with powerful tools for a better bond trading experience:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| Firstrade | - | ✘ | ✘ | ✘ | - | ✘ | ✔ |

| Optimus Futures | TradingView Pine Script, API Features | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| Zacks Trade | Yes (algos) | ✔ | ✘ | ✘ | - | ✘ | ✘ |

| AvaTrade | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✔ | 1:30 (Retail) 1:400 (Pro) | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 (entity dependent) | ✘ | ✘ |

Compare the Ratings of Top Brokers for Bonds

Our tests reveal how the leading brokers for trading bonds measure up in key areas.

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| Firstrade | |||||||||

| Optimus Futures | |||||||||

| Zacks Trade | |||||||||

| AvaTrade | |||||||||

| Trade Nation |

Compare Trading Fees

The cost of trading bonds with a broker will make a big difference over time:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| Firstrade | ✘ | $0 | |

| Optimus Futures | ✘ | $0 | |

| Zacks Trade | ✘ | $15 | |

| AvaTrade | ✔ | $50 | |

| Trade Nation | ✔ | $0 |

How Popular Are These Brokers With Bonds?

These bond brokers have the highest number of active traders:

| Broker | Popularity |

|---|---|

| Interactive Brokers | |

| AvaTrade |

Why Trade Bonds with Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Trade Bonds with Firstrade?

"Firstrade is perfect for beginners looking to trade US stocks with zero commissions. There is a wealth of free education plus premium-quality research, notably through its latest FirstradeGPT tool, plus trading ideas from Morningstar, Briefing.com, Zacks and Benzinga."

William Berg, Reviewer

Firstrade Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Regulator | SEC, FINRA |

| Platforms | Firstrade Invest 3.0, TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | $1 |

| Account Currencies | USD |

Pros

- One of the first brokers to add AI-powered analysis through FirstradeGPT

- Highly trusted US-regulated brokerage and SIPC member

- Enhanced stock trading environment with overnight trading and fractional shares added

Cons

- Visa credit/debit card deposits and withdrawals are not accepted

- Customer support still needs work following testing with no 24/7 assistance

- No demo/paper trading account found at over 90% of alternatives evaluated

Why Trade Bonds with Optimus Futures?

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

- Optimus Futures has expanded its suite of software, with a variety of futures trading platforms, including its own Optimus Flow, CQG, MetaTrader 5, and TradingView, making it easy to find the right fit for charting, order management, and execution.

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

Why Trade Bonds with Zacks Trade?

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Demo account

- Comprehensive research and data

- 20+ account denominations

Cons

- No MT4 or MT5 platform integration

- Shortcomings regarding platform loading times and technical glitches

- No forex, commodities or futures trading

Why Trade Bonds with AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

Why Trade Bonds with Trade Nation?

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Full range of investments via leveraged CFDs for long and short opportunities

- Trade Nation is a multi-regulated and respected broker that previously operated as Core Spreads

- Multiple account currencies are accepted for global traders

Cons

- Fewer legal protections with offshore entity

Comparing Bond Brokers

To find the best bond brokers, we evaluate firms across several categories:

The Number Of Bonds

Top brokers offer a range of bonds, sometimes thousands, helping investors build diverse portfolios.

Our analysis found that most bond brokers offer access to several types of bonds, including:

- Government Bonds – Generally deemed the safest, these are debt securities issued by governments to support public spending and obligations. Importantly, brokers may use different terms to describe government bonds. US bonds, for example, are often known as treasuries, while UK bonds are frequently called gilts, and debt instruments issued by the German government are known as bunds.

- Corporate Bonds – Riskier than government bonds, these debt instruments are used by companies to raise funds for various purposes, such as expansion. The quality and risk of corporate bonds vary depending on the creditworthiness of the firm. Investment-grade corporate bonds are usually safer but often come with lower yields, whilst junk bonds are riskier but tend to offer higher returns.

Also important is the vehicle you can use to speculate on bond values. For short-term speculation, contracts for difference (CFDs) and spread betting are popular, allowing users to speculate on prices without owning the underlying bond. For longer-term investing, you can buy bonds directly or deal in exchange-traded funds (ETFs).

- Interactive Brokers offers a huge selection of products with over 1,000,000 bonds and an easy to use search tool.

The Fees To Trade Bonds

The best bond brokers offer low fees with no hidden charges.

Our testing shows that many firms charge a transaction fee, known as a commission. Low-cost platforms charge commissions of <1% or <$10. Fees may also be shown as a spread, especially if you trade bond CFDs. Here, sub 1 point is competitive.

Importantly, we look for any volume discounts that can bring costs down. Our team also evaluate non-trading fees, which can take the form of account opening and maintenance fees, deposit and withdrawal charges, plus inactivity penalties.

- CMC Markets offers bonds with spreads as low as 1 point. We also rate that you can reduce spreads by up to 40% through the Alpha program.

The Minimum Investment

The top bond brokers offer an accessible minimum deposit, lowering the entry barrier.

Our research shows that many top bond brokers accept new traders with a minimum deposit of <$200. With that said, some firms have no minimum deposit, making them a good option for beginners.

Importantly, we balance a low minimum deposit with the quality of the investment tools and market research. We have found that sometimes it is worth investing more upfront to access higher-quality tools.

- OANDA has no minimum deposit and offers European, US and UK bonds with competitive conditions.

The Platforms And Tools

Our top-rated bond brokers offer easy-to-use platforms with excellent market research tools.

When we test bond brokers, we look for user-friendly platforms and apps that allow investors to analyze markets and manage trades. The best software will help you find bonds that align with your financial goals and risk appetite.

Our team also consider the availability of additional resources for bond traders, whether expert commentary on the maturity, yield, and quality of bonds, or tools to help investors calculate potential returns and fees.

- AvaTrade offers two sophisticated platforms for bonds with advanced charting software – MT4 and MT5.

The Broker’s Regulatory Status

We only recommend bond brokers that we trust.

Several factors impact the trust rating we assign brokers. The most important of which is whether the brokerage is regulated by a respected financial body. Investing through a tightly regulated bond broker will help protect you from scams and unfair practices.

Among the most respected regulators are the US National Futures Association (NFA), US Commodity Futures Trading Commission (CFTC), UK Financial Conduct Authority (FCA), and Australian Securities & Investments Commission (ASIC).

Our team also factor in the reputation of the bond broker and look for signs of credibility, such as being listed on a stock exchange or part of a banking institution.

- IG is a trustworthy bond broker regulated by reputable bodies, including the NFA, CFTC and FCA.

FAQ

What Is A Bond Broker?

A bond broker is an intermediary that provides a platform where you can buy, sell and speculate on bond values.

Our analysis shows that the best bond brokers offer a large number of bonds, a choice of investing vehicles, transparent fees with low commissions, and oversight from a trusted regulator.

Do I Need To Open An Investing Account To Buy Bonds?

To invest in bonds, you generally need to open an account with an online broker.

When you have completed the sign-up requirements and satisfied any minimum deposit requirements, you can purchase or trade bond instruments through the firm’s investing platform or mobile app.

Which Is The Best Bond Broker?

We have compiled a list of our best bond brokers. We considered several factors, including the number and type of bonds available, fees on bond instruments, the minimum investment, plus the quality of the platforms and tools.

Importantly, we also checked the broker’s regulatory credentials and reputation. Only bond brokers we trust make our rankings.

What Types Of Bonds Do Brokers Offer?

The types of bonds available to traders will vary between online brokers. However, top-rated brokers offer a selection of government, corporate, and fixed bonds, plus a choice of investment vehicles, such as CFDs, ETFs, and spread bets.

Article Sources

- AvaTrade - Bond Investing Conditions

- CMC Markets - Bond Investing Conditions

- IG - Bond Investing Conditions

- OANDA - Bond Investing Conditions

- How I Trade and Invest in Stocks and Bonds, Richard D. Wyckoff, 2006

- Fundamentals of The Bond Market, Esme Faerber, 2001

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com