Markets

Which markets and assets best suit day trading? We explore the importance of volume, volatility and liquidity when choosing the right underlying markets to day trade. From forex to stocks or cryptocurrency, we help you find the right trading market for you.

Before you start day trading in the financial markets, you will have to decide where to focus your energy. Fortunately, advancements in technology have resulted in a diverse range of trading instruments now being available. This page will break down the main day trading markets, including forex, futures, options, and the stock market. It will cover their benefits and drawbacks, as well as look at which is the best day trading market for beginners. The information will help you decide which market best suits your individual circumstances, from lifestyle constraints to financial goals.

Top Brokers For Day Trading All Markets

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Brokers with the most trading assets

Stock Markets

The stock market remains one of the most popular types of online markets for day traders. Quite simply, you buy and sell shares of a company.

The allure is obvious: a straightforward trading vehicle and the chance to profit from some of the world’s most famous companies, from Amazon and Google to Shell and BP.

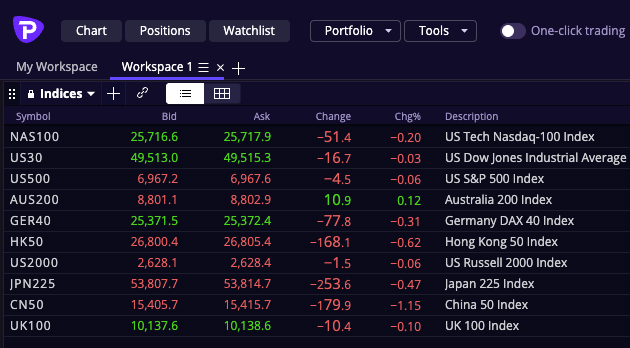

Plus, if you do opt for day trading the stock market, you have several huge indices to choose from, including:

- FTSE 100 – This contains one hundred of the largest companies listed on the London Stock Exchange.

- Dax 40 – Germany’s flagship blue-chip index, made up of 40 leading listed companies in Germany (per the index rules).

- Hang-Seng Index (HSI) – A free-float-adjusted, market-cap-weighted index tracking leading companies listed on the Hong Kong Stock Exchange; the number of constituents can change over time.

- NASDAQ Composite – Here you will find some of the world’s technology titans.

- S&P 500 – An index of 500 leading large-cap US companies, often used as a barometer for the US equity market.

- Dow Jones Industrial Average – This index contains thirty of the largest and most influential companies in the US.

Due to its popularity, you can also now find a wealth of stock market trading courses and other resources online, from books and PDFs to stock market forums, blogs, and live screeners.

Key Considerations

Despite plenty of opportunities and trading with market statistics on your side, there is fierce competition in the major stock markets. In the US, some broker-dealers must apply pattern day trader rules: if your margin account is flagged as a pattern day trader, you generally need to maintain at least $25,000 in equity to continue day trading.

So, trading the stock market may not be the right choice for beginners with limited capital. Instead, you may be better off turning your attention to one of the different markets below.

However, if you want further guidance on day trading the stock market, see our stocks page.

Futures Markets

Futures are another popular market for day trading from home. A futures contract is a standardized agreement to buy or sell a specified asset (or cash-settled reference) at a set price, for delivery/settlement in a specified future month.

As a day trader, you look to profit from price fluctuations between when the buy/sell contract is made and when the position is closed.

Futures contracts often reference commodities and financial markets such as precious metals (eg, gold), industrial/base or ferrous metals (eg, aluminum or steel), energy products, and agricultural goods.

The purpose of futures contracts is to mitigate unpredictability and risk. For example, if you knew you were going to produce one thousand litres of milk in a year, you could sell it at the then market price. However, dairy-free milk may continue to surge in popularity over the next year, leading to a decline in market prices. The solution – agree to sell the milk now at a pre-determined price so you can guarantee a certain degree of profit.

Financial futures (such as equity index futures) are standardized, legally binding contracts to buy or sell the referenced asset at a future date/month; traders often use them to hedge risk or speculate, and many positions are closed before expiry.

Key Considerations

However, before you decide that day trading the futures market is for you, there are some important factors to take into account:

- Capital – Futures are leveraged products and require margin. Margin requirements vary by contract specifications, broker/FCM policies, and market conditions; smaller ‘micro’ contracts can reduce the capital needed per position.

- Flexibility – Trading hours vary by exchange and contract. Many major futures trade nearly 24 hours on electronic venues, typically with a short daily maintenance break. Always check the contract’s trading schedule and plan exits around liquidity, maintenance windows, and expiry.

- Narrow – Trading the stock market game promises a vast array of trading opportunities on numerous stocks. However, whilst some day traders follow volume and volatility, many traders in the futures market focus on one particular futures contract. Therefore, if you desire a diverse day trading experience, consider trading on various markets.

Overall, if you want to start trading in oil, energy and commodity markets, then futures may well appeal. Having said that, you will still need a reasonable amount of capital and be prepared to possibly narrow your focus to just one or two particular futures contracts.

For further guidance, including strategy and top tips, see our futures page.

Forex Markets

The popularity of trading the currency markets has grown significantly in recent years. It is now the largest market in the world. Decide to delve into the forex space, and you will attempt to turn a profit from price fluctuations in exchange rates. You will buy and sell currencies when you believe they will move either higher or lower in relation to other currencies.

Currencies are always traded in pairs. But despite several options, only some possess the liquidity and other characteristics you need to generate intraday profits.

Key Considerations

There are several attractive features to day trading in the forex market:

- Time – FX trading is typically available 24 hours a day during the trading week (commonly from late Sunday to late Friday). It’s generally closed on weekends, though some brokers like IG offer limited weekend pricing/products.

- Minimal investment – Some FX brokers allow small initial deposits, but the amount you should fund depends on position sizing, margin requirements, and how much you can afford to lose, especially when leverage is involved.

- Costs – Many retail FX accounts bundle costs into the spread, while some brokers offer commission-based pricing with tighter spreads. The fee structure depends on the broker and account type.

However, currency markets do come with certain drawbacks:

- Trading on market volatility – Plenty are lured in by the flexibility of forex trading. The problem is, to generate substantial profits, you are often still restricted to periods of high volatility and volume. For major pairs like GBP/USD and EUR/USD, liquidity and volatility often increase when major sessions overlap, especially the London–New York overlap.

- Difficulty – It is a crowded marketplace with plenty of false market trading signals. Beginners are often recommended to stick to the GBP/USD or EUR/USD currency pairs. Both promise sufficient daily volume and price action.

- Leverage – Due to price fluctuations in the forex market being small, many traders turn to leverage to maximise profits. Whilst this can indeed bolster takings, it can also amplify losses.

Forex is among the most accessible markets for many retail traders, partly due to broad broker availability and around-the-clock weekday trading. It promises low barriers to entry, trading outside of US market hours, plus minimal initial investment. You can also benefit from free strategies, technicals, blogs, forums, videos and reviews, by simply heading online.

For further guidance on day trading in the currency markets, see our forex page.

Cryptocurrency Markets

Crypto markets have expanded significantly over the past decade. Regulation and consumer protections vary widely by jurisdiction and continue to evolve, so traders should check local rules and only use reputable, appropriately regulated venues where available.

Many cryptoassets can be highly volatile, which may create short-term trading opportunities but also increases the risk of rapid losses. Crypto prices can move sharply on news, liquidity changes, and market structure events.

It isn’t just the Bitcoin market that offers day traders opportunities for profit. You can also day trade in the following popular digital currencies:

- Ethereum

- Litecoin

- Ripple

- Cardano

- Stellar

- Dash

Key Considerations

But with well-established markets, such as stocks, why should you start day trading in the cryptocurrency market?

- Low cost – Many crypto venues let you trade small amounts because you can buy and sell fractional units. However, fees vary by platform (trading fees, spreads, and withdrawal costs), so compare total costs before trading.

- Volatility – Cryptocurrency markets are developing a reputation for huge price swings. There are ample opportunities to generate profits. However, these fluctuations also mean an increased risk of large losses.

- Accessibility – As market breadth increases, so does the software and equipment available for crypto day traders. Head online and you will find tutorial videos and a range of other educational resources to assist you. Spot crypto markets on many exchanges trade 24/7, though trading hours and liquidity can differ for certain derivatives or broker-offered products.

- Exchange/custody risk – If an exchange or custodian fails, is hacked, or restricts withdrawals, you may lose access to some or all of your assets. Consumer protections can be limited, and many crypto holdings are not covered by deposit insurance or investor compensation schemes. Regulators such as Hong Kong’s SFC frequently warn about the risks of using unregulated virtual asset trading platforms.

- Regulation – Whilst the world scrambles to regulate these emerging markets, there is a risk of falling victim to scam brokers. Not to mention, unregulated markets can be manipulated with pumps and dumps, wash trading, plus spoofs.

For guidance on charts, patterns, strategy, and brokers, see our cryptocurrency page.

Options Markets

Many platforms now offer trading in options markets. An option is a derivative contract that gives the buyer (holder) the right, but not the obligation, to buy (call) or sell (put) the underlying asset at a specified strike price on or before a set expiration date (depending on the option style). The seller (writer) has an obligation if the option is exercised/assigned.

The advantage of options trading is that you do not have to own the underlying asset, which can often be far more expensive than a stock, for example.

Types

Despite having a reputation for being a risky instrument, there exist just two main classes of options:

- Put – This sell option enables you to sell at a certain price.

- Call – The buy option allows you to purchase at a particular price.

On top of that, there exists a long list of different capital, global, and emerging markets you can trade options in, although not all are appropriate for day trading. These include:

- Stock options

- Index option

- Mini options

- Mini Index options

- Options on futures

- Weekly SPY options

- OEX options

- ETF options

- S&P 500 options

- Crude oil options

For further guidance on how to start day trading in the options market, see our options page.

Binary Options

Another interesting market comes in the form of binary options. Your job is to decide whether the underlying asset will finish above or below a particular price at a certain time.

Binary options are fixed-outcome contracts offered by some venues (where permitted), but availability varies widely by broker and jurisdiction. For example, you can trade binary options on commodity values, such as crude oil and aluminum. Alternatively, if you want to take a position on world-famous stocks, you can get binary options on Google, Tesla, and BP. Even forex markets and cryptocurrencies are on the binary options menu.

They appeal because they are an all-or-nothing trade. You know how much you will win or lose before you place the trade. So, if you want a straightforward market and instrument, plus access to global stocks with minimal capital, then binary options could be worth exploring.

For further information, including strategy, brokers, and top tips, see our binary options page.

Important: In some jurisdictions (including the UK), regulators have banned the sale of binary options to retail consumers, and authorities have issued warnings about widespread fraud on unregistered platforms.

CFD Markets

A contract for difference (CFD) is an agreement with a broker to exchange the difference between an asset’s opening price and closing price. You don’t own the underlying asset; your profit or loss is based on how the price moves while your position is open.

CFD availability and retail protections differ by region. Many jurisdictions impose leverage limits, margin close-out rules, and negative balance protections for retail clients.

But with so many domestic and foreign trading markets and financial instruments available, why do CFDs warrant your attention?

- Diversity – There are thousands of instruments to choose from with CFD investing, including currencies and commodities. Plus, it’s a growing industry, meaning market diversity will increase.

- Leverage – This could help you capitalise on opportunities, bolstering profits. However, there is also the risk of increased losses, so caution must be taken when using leverage.

- Costs & structure – Many CFDs are open-ended, but trading costs can include the spread, potential commissions, and overnight financing/holding charges for positions kept open. Terms and total costs vary by broker and underlying market.

For more information on how investing in the markets with CFDs works, see our CFD page.

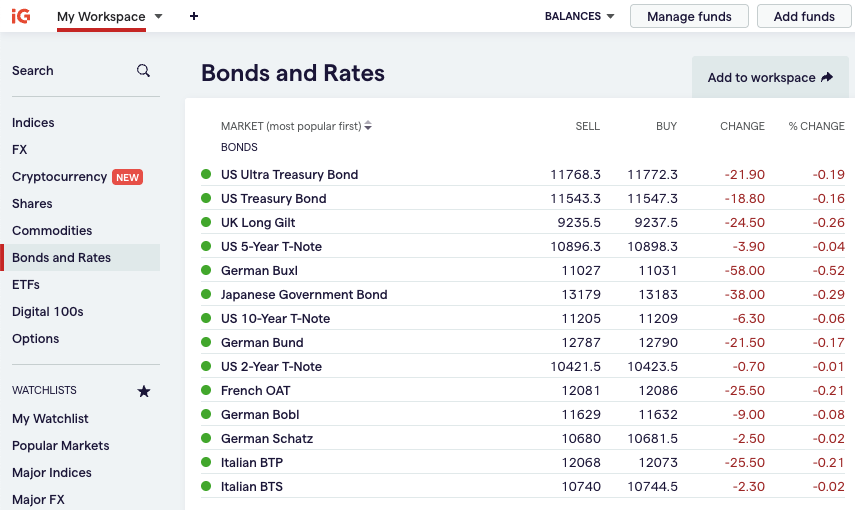

Bonds Markets

Bonds are debt instruments issued by governments (sovereign bonds) and companies (corporate bonds). When you trade bonds, you’re effectively trading expectations about interest rates, inflation, credit risk, and economic growth.

While many people think of bonds as long-term, income-focused investments, they can also be traded short-term, often via highly liquid products like government bond futures (eg, US Treasuries) or bond ETFs that track major bond indices.

Key Considerations

- Lower volatility (often) – High-quality government bonds may move less than equities day-to-day, so short-term traders often rely on leverage (eg, futures) or focus on high-impact macro events.

- Rate sensitivity – Bond prices typically move inversely to interest rates. Central bank decisions, inflation data and employment reports can drive sharp intraday moves.

- Liquidity varies – Major government bond futures and large bond ETFs can be very liquid, but individual corporate bonds may trade less frequently with wider spreads.

- Product choice matters – ‘Bond day trading’ is often done via bond futures, ETFs, or CFDs rather than trading individual bonds directly, which can affect fees, leverage, and trading hours.

For further guidance on how to trade bonds, see our bonds page.

Prediction Markets

Prediction markets let traders buy and sell contracts tied to the outcome of a future event, such as an election result, an economic release, or a sports or entertainment outcome (depending on what the platform offers and what’s legal locally). Prices typically reflect the market’s implied probability of an outcome.

These markets can appeal to short-term traders because prices may move quickly around news, polling, breaking events, and new information.

Key Considerations

- Regulation and legality – Rules differ widely by country and by product structure. Use platforms that are properly licensed for your jurisdiction and understand whether the product is regulated as a financial derivative, a betting product, or something else.

- Risk warning – Many prediction market contracts can feel similar to pure betting: outcomes may be binary, timing is fixed, and losses can be total. Treat them as high-risk instruments, not a guaranteed ‘information edge.’

- Settlement and disputes – Read how outcomes are defined and resolved (data source, deadlines, dispute processes). Poorly defined contracts can create unexpected settlement results.

- Liquidity and slippage – Some events are liquid; many are not. Thin order books can mean large spreads and price gaps, especially near resolution.

- Platform and counterparty risk – As with crypto and offshore brokers, platform failure, withdrawal issues, or poor governance can be a major risk. Prioritise trusted oversight and transparent operating practices.

For further information and trading guidance, see our Prediction Markets page.

Choosing A Day Trading Market

Day trading the markets for a living is no easy feat, despite direct access to many markets with just an internet connection. The problem is, market structure, quality and characteristics vary hugely. So, the market you choose must depend on your individual circumstances, from financial resources and appetite for risk to availability and market knowledge.

There are also a few important factors to consider when you’re deciding on a trading market. These are:

Volatility

Day trading in a volatile market is essential. Volatility is a measure of how much the price will vary over a given time. The more the price fluctuates, the more opportunity there is for you to profit from intraday movements.

Liquidity

Liquidity is concerned with your ability to buy and sell an instrument without affecting price levels. Markets with high liquidity mean you can trade numerous times a day with ease.

Market Resources

If you don’t have an in-depth understanding of your market, then you need to consider the availability of resources. Where will you be able to go for market updates and to gauge day trading market sentiment?

Is trading data easily accessible online? If not, it is worth exploring what your broker can offer; trading volume charts, for example, can often prove useful.

Also, does the market you’re interested in have an array of day trading market news sources you can turn to? Let’s say you’re interested in commodities. Does your broker have a gold trading market newsfeed where important daily moves will be explained?

Narrow Your Focus

Another common mistake some individuals make is to try their hand at a number of different markets at the same time. Each market has its own nuances and complexities that require significant attention. So, you should focus on one market and master it. Then, if you can generate consistent profits and you want to explore other markets, you can do.

So, don’t just start trading random overseas markets. A careful and calculated decision will often benefit you in the long run.

Demo Account

Whichever market you opt for, start day trading with a demo account first. This will enable you to get some invaluable practice before you put real capital on the line. You can get to grips with analytics, practice trading in bearish markets, choppy markets, and learn all the basics. It’s also an effective way to test drive a broker.

Algorithm Capabilities

You may also want to consider whether you will be able to employ automated algorithmic trading to increase market efficiency and capitalise on volatility. Some strategies can be automated, but performance can change as market conditions shift, so any system should be tested, monitored, and risk-managed rather than assumed to remain profitable.

These algorithms can be used for trading ranging markets, with market internals and capitalising on market cycles. You simply enter your parameters and then let your trading bot do the heavy lifting.

Final Word

Above, some of the best day trading markets have been broken down. As you can see, today you have a wide range to choose from.

However, before you decide, consider your financial circumstances, market knowledge, availability, and your risk tolerance. This will help you decide which of the above markets you would be best suited to. Also, utilise the array of online market trading guides, resources and websites available. All may enhance your overall performance.