Bull And Bear Certificates

Bull and bear certificates offer leveraged speculation on a range of popular global assets. Read on to discover the origins of bear and bull certificates, how traders can use them, and the pros and cons of these products vs other trading vehicles. We also rank the top brokers with bull and bear certificates trading.

Brokers With Bull & Bear Certificates

What Are Bull & Bear Certificates?

Bull and bear certificates, also referred to as leverage certificates, provide exposure to a range of underlying assets, including global indices, commodities and shares. They essentially allow traders to make a profit from steady price trends, leveraging the daily price movement of a particular asset.

Here is the lowdown on where they came from, and how they work:

Origins

Bull and bear contracts were first introduced to the European and Australian markets in 2001 and have developed a foothold in these markets, as well as in Asia.

Certificates are issued by large financial institutions and can be purchased on several leading exchanges, such as the Nasdaq Nordic and Euronext.

The bear and bull certificate name derives from popular stock market terms. So, what does a bear and bull market mean and what’s the difference between the two?

- A “bear market” is one of curtailed economic growth and negative investor sentiment, with many securities experiencing prolonged and substantial price declines. Accordingly, “bear” certificates are used to speculate that the price of an asset will decrease.

- A “bull market” describes a positive market outlook where equities are expected to rise in value. As a result, “bull” certificates are used to speculate that the price of an asset will increase.

How Bull & Bear Certificates Work

After purchasing a bull or bear certificate, subsequent price movements in an underlying asset are tracked in the value of the contract according to its intrinsic leverage. This mechanic will be familiar to traders that have invested in a leveraged or inverse ETF.

For example, if an investor purchases a bear certificate based on the FTSE with 1:5 (5x) leverage, a 3% decrease in the value of the index would see a 15% increase in the value of their contract.

This investor could either cash out and take their 15% profit, minus trading fees, or let the contract run for the chance at further, compounding gains.

Traders should also note that these certificates come with expiration dates and barrier levels, at which point the contracts are “called” by their issuers. If a bull/bear certificate reaches its lower barrier, it expires worthless to protect investors from a negative balance.

Details on the specific levels and expiry are available when viewing an individual certificate.

Markets

While bull and bear certificates are used primarily in Europe and Asia, these products cover a wide range of global assets.

Through bull and bear certificates, traders can speculate on:

- Global indices

- US, European and Asian shares

- Spot and futures commodities

- Government-issued and corporate bonds

Indeed, Euronext lists over 11,000 leverage certificates on its exchanges, while these instruments are also strongly represented on the Hong Kong Stock Exchange and Nasdaq Nordic.

It’s important to note that bull and bear certificates are only available to trade while their underlying asset is within its local exchange hours.

Leverage

Leverage trading is a big part of what makes bull and bear certificates popular. Investors can access certificates with up to 1:20 leverage, though more volatile markets will have lower leverage.

For example, popular bull and bear certificate issuer Nordea Markets offers up to 1:20 leverage on index futures certificates, but only 1:5 on single shares.

Certificates can expire worthless after sudden large price movements due to their lower boundaries. As a result, treat highly-leveraged products with caution.

Fees

Compared to other instruments such as CFDs

, the trading fees for bull and bear certificates are relatively complex.

Firstly, investors need to take into account the spreads and/or trading commission on the exchange they are using. Some exchanges will levy flat commissions while others may charge percentage rates. Traders should shop around between bull and bear certificate brokers to determine which rates are best for their financial interests.

Intrinsic costs of the certificate often include an admin fee, while all contracts with leverage are subject to an interest rate, or base rate fee. While admin fees are usually below 1%, interest fees depend on the leverage of a certificate. These fees are displayed on a yearly basis and can reach up to 1.5% per leverage multiplier point.

To stop high base rate fees from eating into profits, bull/bear certificates with high leverage are best traded on a short-term basis.

Pros Of Trading Bull & Bear Certificates

- Simple product – The intrinsic leverage and direction of bull and bear certificates make them straightforward to invest with

- Market choice – Traders can use bear and bull certificates to speculate on stocks, indices, commodities, futures and more

- Leverage trading – With leverage of up to 1:20 available, margin trading can be used to amplify gains

- Capped losses – Investors cannot lose more than they put into a bull/bear certificate

Cons Of Trading Bull & Bear Certificates

- High fees – Sometimes high and multiple fees can eat into profits from trading bull and bear certificates

- Not popular in the US – Despite solid support in Europe and Asia, the US market for leveraged certificates is limited

- Not suited to long-term – Stacking costs and high leverage make bull and bear certificates ill-suited to long-term investing

- Taxable – Unlike binary options, which are classed as gambling and not taxed in some regions like the UK, bull and bear certificates are subject to trading taxes

- Current income – Trading bull and bear certificates will not provide dividends or interest payments

How To Trade Bull & Bear Certificates

1) Find A Broker/Provider

When comparing the best bull and bear certificate trading firms, a good exchange will:

- Have a wide range of bull/bear trading products and underlying markets

- Practical training materials with certificate specifications explained

- Be regulated by a reputable body such as the FCA, CySEC or ASIC

- Support fast, low-cost payment options in your local currency

- Have a solid trading platform and/or mobile app

- Have competitive fees and commissions

Set up an account with a broker that meets all of these criteria.

2) Choose Your Asset

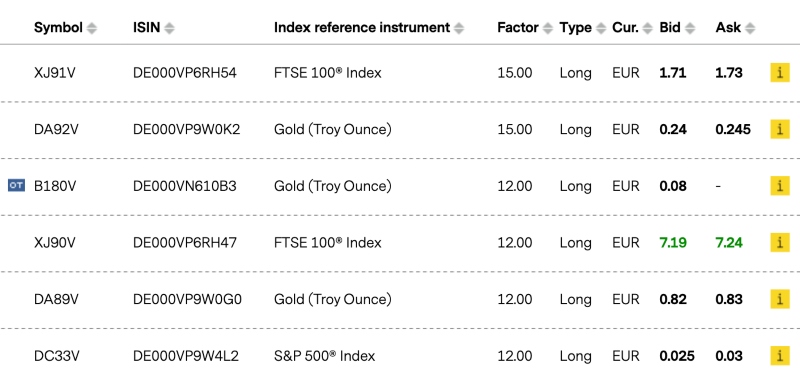

Which asset would you like to speculate on? Most exchanges will have a search function where you can quickly find a list of bull/bear certificates based on the underlying asset, including European stocks, commodities like gold, or indices such as the Dax.

Once you have this list, choose the direction of your prediction – a bull certificate if you believe the price will increase, and a bear certificate if your prediction is of a price decrease.

Leverage is also a crucial component of bull and bear certificates. Take care not to over-leverage your investment or your certificate could hit its lower boundary quickly and leave you with nothing.

3) Check The Details

Each certificate is unique, and has bounds and an expiry date at which the certificate will “call”. Ensure you are familiar with these values.

4) Buy The Certificate

Once the price of a certificate is at a level you are happy with, purchase your certificate(s).

You can now hold your position for as long as you wish until expiry or the price hits an upper or lower boundary.

Strategies & Tips

Here are four trading strategies that are well-suited to trading bull and bear certificates:

Trading The News

In the digital age, the markets react quickly to emerging global news. However, breaking news can still offer on-the-ball investors opportunities for profit.

Whether you’re zeroed in on a specific asset or looking at a market or sector more generally, staying on top of upcoming news events such as earnings reports, new technological advances and regional economic health can help eagle-eyed investors spot upcoming trends.

Some investors choose to speculate on the emergence of a rumour and then sell once official news is announced. Others try to time the “top” of a trend immediately following the news and bet on a correction.

However you choose to trade, using customized alerts to notify you of breaking news in specific sectors can aid a successful strategy.

Fundamental Investing

Fundamentals are what make an equity or asset valuable in the long run. Inversely, a lack of strong fundamental value can point to a long-term price decrease.

To find value, or lack of, some traders use mathematics to compare an asset’s price to sector benchmarks based on variables like recent earnings or debt balances. Others make informed predictions based on future supply and demand for a commodity or currency.

Fundamental trading rarely yields quick, significant price changes. Rather, an asset’s value is expected to change over an extended time period. For this reason, investors can choose low-leverage bull and bear certificates with far-out expiries when trading on fundamentals.

Technical Analysis

There are thousands of indicators, overlays and graphing tools that can be used to predict the future price of an asset. A favourite of forex and CFD traders, technical analysis can yield trading “signals” that suggest short, medium and long-term price changes.

The inherent leverage of bull/bear certificates can make trading on technical analysis signals, which can often suggest significant price movements, a potentially lucrative strategy. Furthermore, unlike with CFDs, the lower boundary of a certificate stops investors from losing more than they stake on a trade.

Automation

Using trading bots as a means to execute positions faster is becoming more common. In addition to speed, automated trading tools also allow investors to use a hands-off approach and remove their own emotions from the equation.

While automating bull/bear trades is less well supported than with other products such as forex and CFD, some exchanges may allow traders to run bot software on their platforms.

Check with your exchange or broker to see if this is possible.

Final Word On Trading Bull & Bear Certificates

Bull and bear certificates are an option for traders in Europe and Asia that want leveraged speculation with capped losses. There are thousands of products available to investors spanning markets like commodities, indices, stocks and bonds. However, the cons include high trading fees and inferior tax liabilities compared to alternative trading vehicles.

Use our table of the best brokers with bull and bear certificates to start trading.

FAQs

What Leverage Can I Use On Bull & Bear Certificates?

Bear and bull certificates have leverage built into their contracts. Maximum leverage is generally 1:20, which can amplify price movements in an underlying asset by 20x. For example, a $1000 capital outlay would mean purchasing power of $20,000.

Which Leverage Certificate Do I Use In A Bull Market?

A bull market refers to a significant upwards price trend – investors can use a bull certificate to predict that the price of an asset will increase.

Which Leverage Certificate Do I Use In A Bear Market?

A bear market is used to describe a negative economic outlook with assets decreasing in value. To bet on the price of an asset going down, traders can use a bear certificate.

Do Traders Have To Pay Tax On Bull & Bear Certificates?

Yes, capital gains from bull and bear certificates are subject to tax in most jurisdictions, such as the UK.

Is Trading Bull & Bear Certificates Safe?

Bear and bull certificates are provided by large financial institutions and can be traded on well-regulated global exchanges. As a result, they are a legitimate trading vehicle.

With that said, all trading is risky so investors should take a careful approach to money management.