9+ Strategies to Lower Your Delta to the Market

We trade because we expect that it’ll earn us money. Except when you have a poor day, week, or month in the markets it seems like the markets are maybe the easiest way to lose money.

Losing money in the markets teaches us expensive lessons on how to improve by doing things differently.

One of the most common reasons for losing money is having too much concentrated exposure to a certain asset or asset class.

In trading parlance, the sensitivity of your portfolio to movements in the underlying asset is called delta.

So when traders talk about “lowering their delta” they mean they’re lowering their sensitivity to price movements in the asset(s) they’re trading.

There are a few main ways how you can lower your delta to the market.

Let’s take a look.

Key Takeaways – Strategies to Lower Your Delta to the Market

We look at the following strategies to lower your delta to the market.

- Sell calls against your long position

- Buy puts to hedge your position

- Buying calls

- The collar

- Overweight calls

- Protect against losses within a range

- Selling puts to fund calls

- Lower your position size

- Hedge with non-correlated assets

- Use stop-loss orders

How to lower your delta to the markets

For purposes of this article, we’ll assume this pertains to being long assets in your portfolio.

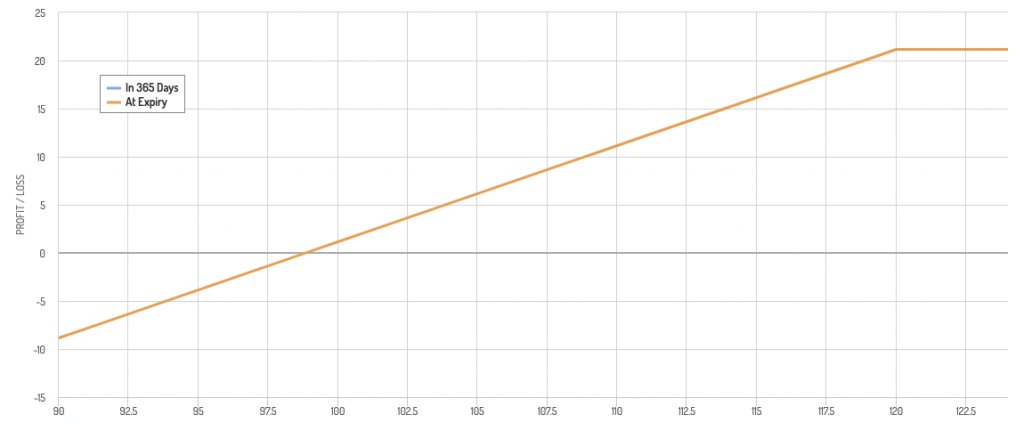

#1 Sell calls against your long position

Selling calls against a long position is a way to lower your delta because you’re no longer as sensitive to price movements of the asset.

This is also called writing covered calls.

It’s a good way to generate extra income from a position you already have and it lowers your risk.

The downside is that you give up some upside potential if the price of the underlying asset goes up.

For example, if you own a stock trading at $100 per share and you sell a call option with a strike price of $120, you can get another $20 per share in upside. However, if it goes beyond that, you’ll be capped out.

However, if the stock falls, you’ll capture the premium associated with the call option. This might be enough to offset the losses. But it’s often not enough to offset steep losses.

At the same time, if the stock rises but doesn’t rise to the strike price, you’ll also receive the full premium without any foregone gains.

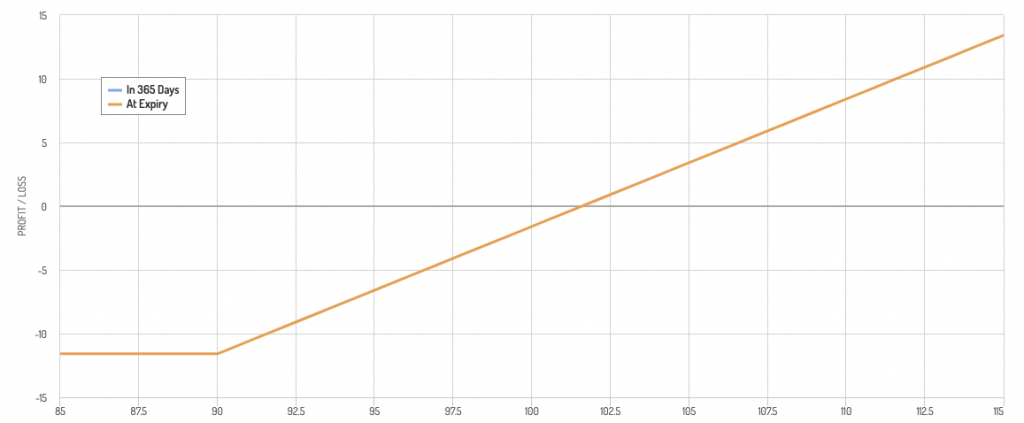

#2 Buy puts to hedge your position

If you’re really worried about a sharp move lower in the markets, another way to lower your delta is to buy put options.

Purchasing put options gives you the right, but not the obligation, to sell the underlying asset at a certain price.

It’s a way to hedge your position and protect yourself against a sharp move lower.

The downside is that it costs money to buy the put option. And in equity markets, due to the volatility skew, there is more demand for puts than calls, so puts are more expensive on average than calls.

Of particular concern for those who use puts as a trading strategy on a standalone basis, if the markets don’t fall, you’ll be out the premium you paid for the put option.

For example, you could buy a stock at $100 per share and not be comfortable with losing more than 10% in terms of capital losses.

So you could buy a 90 put to cap your downside but still enjoy the upside.

#3 Buying calls

Instead of having a position in the underlying asset, you can swap those out for calls options.

This limits your losses to the premium you pay for the options.

Of course, in this case you aren’t lowering your delta in terms of what direction you need to make money.

But options allow you to cut off your left-tail risk.

Take advantage of some more advanced options structures

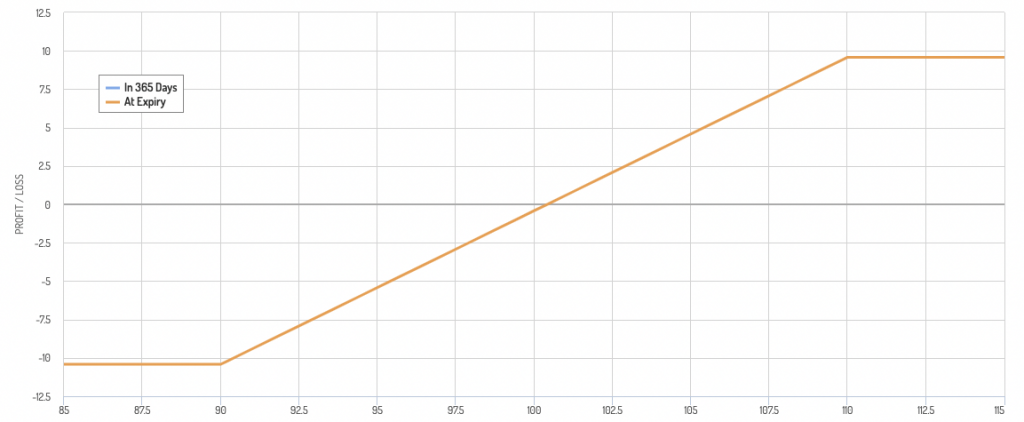

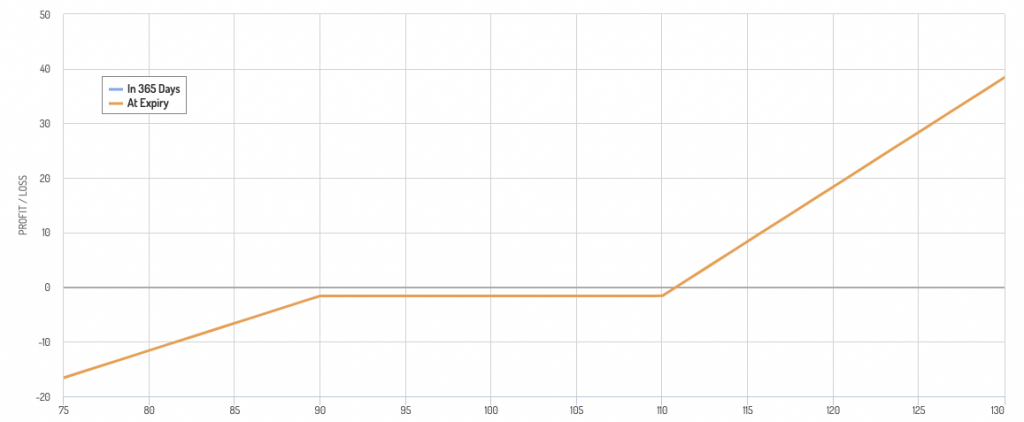

#4 The collar

Given the pros and cons of covered calls and being long puts and long calls, you can combine various options to better engineer what you’re going for and to help offset the less-than-ideal parts of each of those strategies.

A simple structure one can use is a covered call combined with a long put.

The idea is that the covered call can fund the long put, at least partially (given puts are more expensive than calls for stocks, all else equal).

You then have what’s called a collar.

You can only lose so much with the collar. But the trade-off is that you can only gain so much as well.

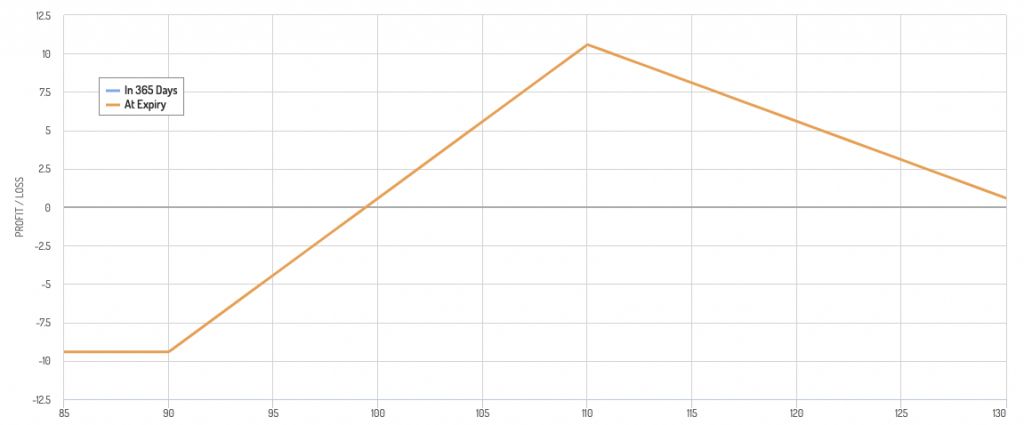

#5 Overweight calls

You can take the collar structure above and generate more premium by overweighting the call portion of the structure.

The downside to this is that if the stock goes up by too much you can start losing money.

For example, this options structure was created through:

- Long 2 units of the underlying stock

- Long 2 put options 10% OTM

- Short 3 call options 10% OTM

If the stock were to go up by more than 30 percent, then you could lose money outright.

For a steadier, mature stock (perhaps a dividend stock with limited capital growth) it could make more sense.

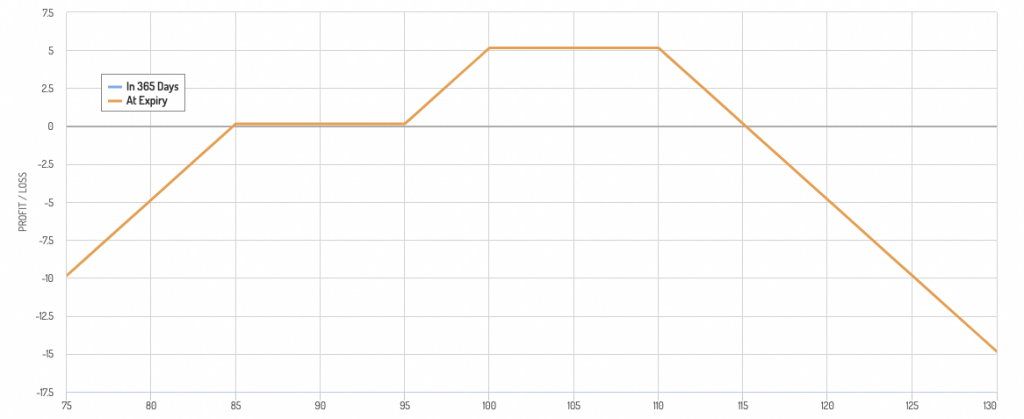

#6 Protect against losses within a range and don’t expect a lot of upside

Some traders might want to protect against losses within a certain range, but be okay with accepting the possibility of “resuming” these losses should the stock fall below a certain price point.

This is because:

a) it protects against the losses that are the most likely to occur instead of losses that are less likely to occur, and

b) if a stock becomes cheap enough, they may want to buy it at that price anyway.

At the same time, they might consider the covered call or overweight covered call approach depending on the asset in question to generate more premium.

The following options structure is created from the combination of:

- Long 1 unit of the underlying asset

- Long 1 put option 5% OTM

- Short 1 put option 15% OTM

- Short 1 call option ATM

- Short 1 call option 10% OTM

If the 10% OTM call (short) were to be eliminated:

In this case, your upside would be more than your downside UNLESS the stock falls more than 15 percent, then losses would be just like having the standard exposure to the stock (e.g., a delta of 1).

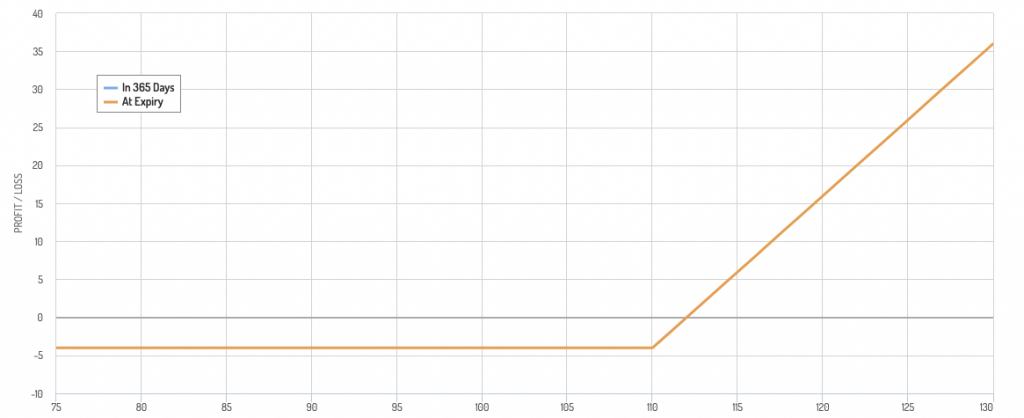

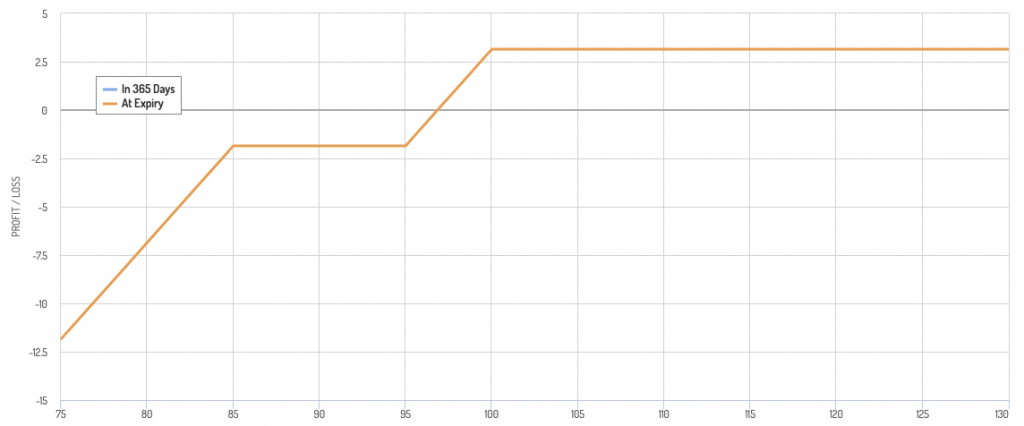

#7 Selling puts to fund calls

Options can be expensive. One way to defray the cost is to fund your long options by selling something else.

For example, you could sell a 10% OTM put to fund two long 10% OTM calls.

This would look something like this:

So, for the first 10 percent you lose on the stock, you’d lose only a small amount. If you lose more than that, you lose the equivalent of a “delta-1” position.

However, if the stock goes up, you can potentially make outsized gains.

Puts have quality funding potential because, as mentioned earlier, they tend to be more expensive than calls.

#8 Lower your position size

Being overly concentrated in a position is a classic portfolio killer.

If you have too much exposure to one thing, lowering your position size is a way to mitigate the effects of a move against you.

It’s not always the most exciting thing to do, but sometimes the most practical thing you can do is just cut back on your position size.

For example, if you own a stock that makes up 20 percent of your portfolio, would it be acceptable if it fell by 50 percent and that wiped out 10 percent of your overall portfolio?

However, if you cut your position size down to 5 percent of your portfolio, that loss would then only be 2.5 percent, which is a bit more manageable.

If you want the big upside without the unacceptable downside, then you’ll likely need to go to options (e.g., OTM calls) rather than holding a delta-1 position where you can lose a lot.

Lowering your position size would obviously lower your potential upside (if the stock went up) but it would also protect you against further losses should the stock continue to fall.

#9 Hedge with non-correlated assets

If you’re worried about downside risk in the markets, one way to offset that risk is by buying assets that aren’t correlated with stocks.

So, even if stocks go fall, you could potentially make money in other assets.

For example, if you’re worried about a stock market crash, you could buy put options on the SPY ETF – or another equity index ETF – to help hedge equity risk, while also buying gold (among other types of assets – e.g., bonds, commodities).

For an especially volatile portfolio, you can even hold more cash to help make it less risky and provide more of a buffer room.

Diversifying your portfolio across different asset classes, in general, can help offset downside risk.

This way, if stocks go down, those other assets could potentially go up and offset your losses.

Of course, this isn’t a perfect hedge as nothing is ever guaranteed, but it can help to lower your overall risk.

Related

- How to Build A Balanced Portfolio

- How to Build A Balanced Portfolio with Options

- Balanced Portfolio with VRP Overlay

#10 Use stop-loss orders

Stop-loss orders are another way to limit your losses and they’re built into most trading platforms.

A stop-loss order is an order to sell an asset when it reaches a certain price.

For example, let’s say you own a stock trading at $100 per share and you put in a stop-loss order at $95.

If the stock falls to $95, the stop-loss order will be triggered and your stock will be sold at $95.

The advantage of a stop-loss order is that it’s automatic.

You don’t have to keep track of the stock price all the time and you don’t have to make a decision about whether or not to sell.

The disadvantage is that if the stock price falls sharply, your stock might be sold at a price lower than $95 (this is called slippage).

In general, you should use a stop-loss order if you’re not comfortable with the idea of losing more than a certain amount of money on a trade.

If you’re willing to stomach more volatility, you can forego the stop-loss order.

FAQs – Delta options trading strategies

Is a higher or lower delta better?

Traders use delta to measure the directional risk of a given option or options strategy.

Higher deltas may work better for higher-risk and higher-reward strategies that are more speculative.

On the other hand, lower deltas may be ideally suited for lower-risk strategies with higher win rates.

What does it mean when an option is at the money?

An option is at the money (ATM) if the strike price of the option is equal to the current stock price.

Options with ATM strikes will have deltas around 0.50.

This means that they will gain or lose approximately $0.50 in value for every $1 move in the underlying stock.

What is the best delta for a covered call?

A covered call is a strategy that involves buying stock and selling call options against it.

Since the goal of a covered call is to generate income from the option premium while minimizing downside risk, a delta around 0.50 is generally optimal (e.g., an ATM option).

Is there such thing as a negative delta?

Yes, there are some types of options strategies that can have negative deltas.

For example, short straddles and short strangles typically have negative deltas.

This means that they will gain value if the underlying stock moves higher or lower, but will lose value if the stock doesn’t move at all.

What is the difference between gamma and delta?

Gamma measures the rate of change in an option’s delta.

In other words, it tells you how much the delta will change if the underlying stock price changes by $1.

Delta, on the other hand, is a static measure of an option’s risk.

It tells you how much the option will gain or lose in value if the underlying stock price changes by $1.

Conclusion

There are a number of different ways you can protect yourself from downside risk.

We covered the following strategies to lower your delta to the market.

- Sell calls against your long position

- Buy puts to hedge your position

- Buying calls

- The collar

- Overweight calls

- Protect against losses within a range

- Selling puts to fund calls

- Lower your position size

- Hedge with non-correlated assets

- Use stop-loss orders

Each of these strategies has its own pros and cons.

It’s up to you to decide which strategy – or combination of strategies – makes the most sense for your portfolio.