Spread Option Betting: Alternative Variations to Improve Risk/Reward

Spread option betting can be an attractive strategy for traders who want to limit their risk relative to having positions in the underlying but also don’t want to pay the often large premiums associated with pure options bets.

Owning or shorting the underlying is a linear bet – it doesn’t protect you from the large adverse movements that can occur. It also limits how much leverage a trader can use because the potential downside can be so large.

Options can enable a trader to obtain leveraged returns in a safer way by simply buying put or call options. Your downside is limited to the net outlay of premium. If you own or short the underlying security your potential downside is going to be a lot steeper.

But due to the volatility risk premium, options are expensive, on average.

Spread betting means a trader can, e.g., express a long position in a security by buying call options and shorting call options further out-of-the-money (OTM).

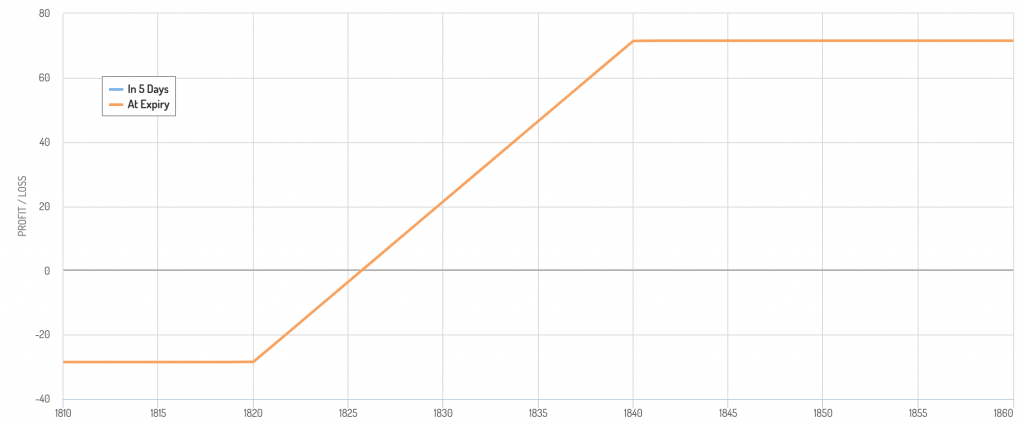

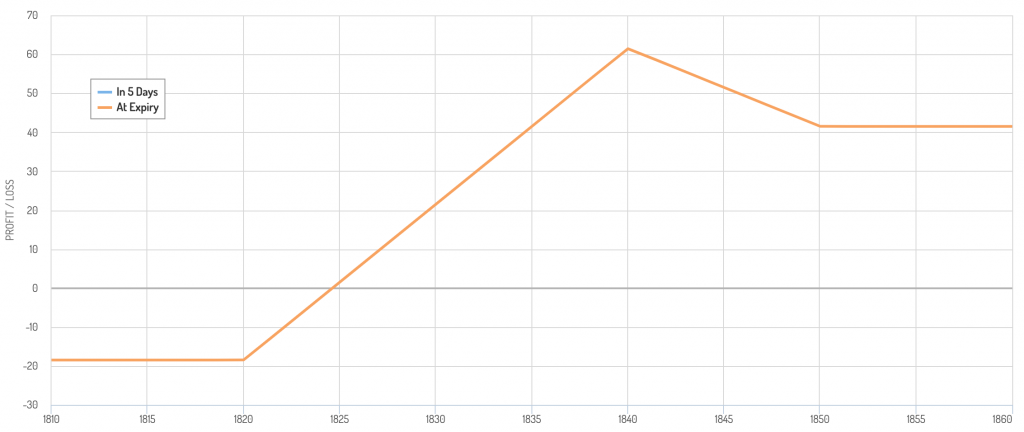

A spread bet – in this case a bull spread (aka a call spread) basically looks like the following in terms of an options payoff diagram:

Your downside is shown by the lower line while your upside is capped by the upper line. This is commonly called a collar.

Shorting options helps you collect premium. In exchange for that premium, you cap your upside.

This can help a trader lower risk by preventing a large outlay of premium just to express a point of view on the markets.

An example call spread would be buying ATM call options on gold and shorting OTM call options on the commodity.

Let’s say gold is trading at $1,820 per ounce.

A trader could buy an 1820 strike call option and sell an 1840 strike call. That gives a spread of up to 20 ticks to capture.

If trading GC futures, that gives $2,000 of upside given 100 ounces of gold per contract (100 * ($1,840 – $1,820)).

If the 1820 call costs $950 each and the 1840 call costs $380 each, that means in exchange for that $2,000 of upside, there is an associated net cost (net premium outlay) of $950 minus $380, or $570.

The potential reward to risk is therefore $2,000 minus your premium (premium is your maximum loss) of $570 divided by the premium, or $1,430 divided by $570. This comes to 2.5x.

If you did five contracts, you’d have to lay out $2,850 to make up to $10,000 ($7,150 net).

2.5x is a quality risk/reward. But can that be reasonably improved?

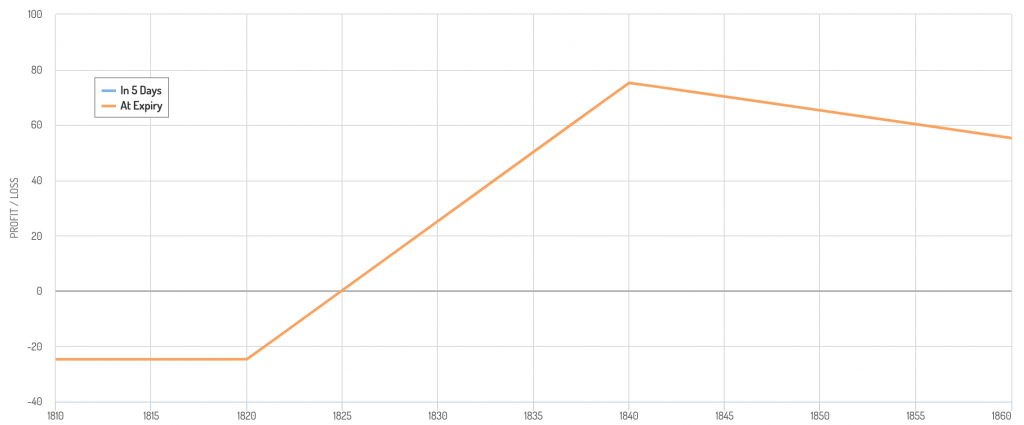

Overweighted spread betting

Overweighted spread betting enables you to better your reward to risk by selling additional options to obtain more premium and lower your net outlay.

Your trade-off is that profitability wanes if price goes past the short OTM calls.

Taking the gold example again from above, let’s say you wanted to do the same trade but improve your risk/reward. To do so, you could sell an extra 1840 (OTM) call.

This gives you a lower net outlay. If you wanted to buy five calls, you could sell six calls.

The net outlay is then: 5*$950 – 6*$380 = $2,470 (instead of $2,850 as in the previous example)

Your potential reward is still $10,000 ($7,530 net). Your reward to risk improves from 2.5x to $7,530/$2,470 = 3.0x

But if we zoom out more on the graph, we can see the type of profitability decline of the trade if we’re overweighting (“overstacking”) the short side of it.

In other words, if you get above the upper band of the channel (the trade is going “too well”) your profitability starts falling. That’s the trade-off.

But it may be worth it because if price gets to that point you’ve already captured a fair amount of profit.

And if the trade goes against you, you won’t lose as much as you would have otherwise.

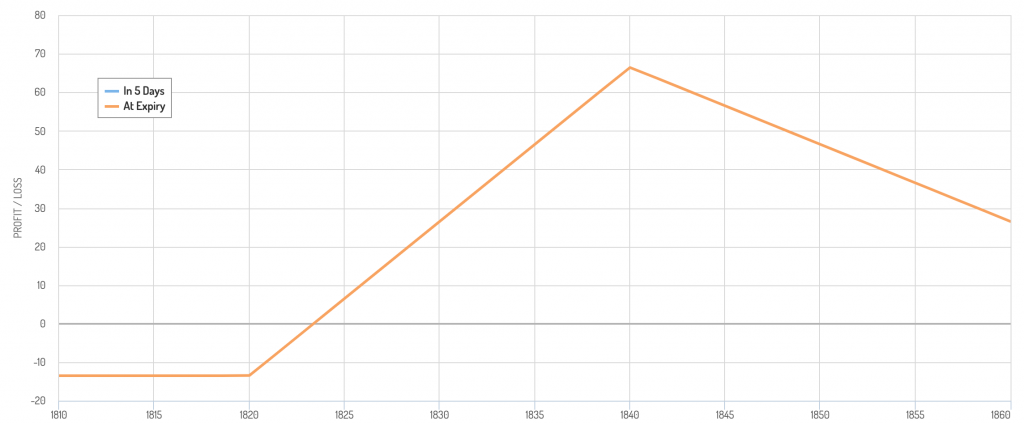

Overweighted spread betting + offsetting position in the underlying

We covered this strategy more in a different article.

What it basically boils down to is the same spread betting strategy, but using a position in the underlying with a covered put structure (or call, depending on the base trade). This helps increase reward relative to risk further.

For example, if you have on a call spread (bull spread) on gold (e.g., 5 call option contracts long and 6 OTM calls short), short 1 contract of the underlying, and cover the short with a put, this can increase your reward/risk by a decent fraction.

You still have a bullish trade setup, but the offsetting position – i.e., short of the underlying plus a short put to form a covered put – can help the risk/reward math.

If gold (GC futures) is shorted at $1,820, with a short put providing a premium of $1,100, your new payoff diagram looks like this:

You can see that your maximum loss ($1,350) is constrained while your maximum profitability ($6,640) is about 5x higher.

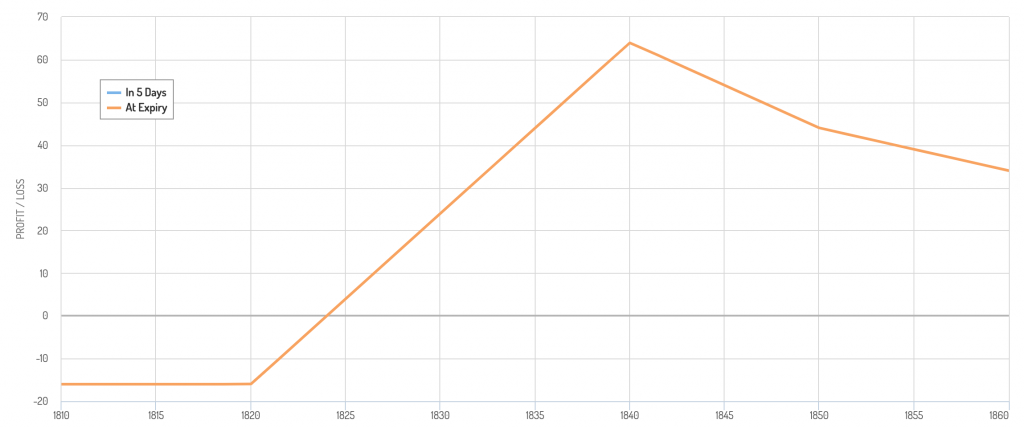

Adding in dynamic hedging

You could also include a dynamic hedging element to the trade.

For instance, if the price of gold gets to the top part of your profitability zone (1840 in these examples), you can cover the short put with the 1820 strike and set up a new short put with an 1840 strike.

This would help boost the overall potential profitability of the trade.

But, at the same time, if the trade were to reverse course and “roll back down the hill”, you’d no longer have the advantage of the short position helping offset some of the lost profitability.

Moreover, at the outset, you can buy a cheap call to arrest the potential for “trade going too well” scenario to harm your net profitability.

Buying 1-2 cheap OTM calls (e.g., 1850 strike in this example) could work if you choose to overweight the short side of the trade and/or take the opposite position in the underlying.

This reduces your potential reward/risk, but will prevent you from potentially losing too much of the profit you’ve earned.

1 OTM call

2 OTM calls

Dynamic hedging is more of an active management day trading strategy. It’s not a recommended element for those who prefer more passive trading strategies.

Conclusion

Options are attractive because they limit your risk. This enables you to trade more aggressively than you might otherwise be able to.

At the same time, options can be expensive. Options sellers want to be compensated for the convex structure that options provide and the non-linear risk that entails.

For this reason, many traders use spread option betting to improve their return relative to their risk. This includes the use of:

- Collar trade structures

- Overweighting the short side of the collar to improve potential return relative to risk

- Employing long/short strategies

- Adding in dynamic hedging