Long-Short Strategy: Improving Risk-Reward with Options Trading

Options are more advanced instruments that can help you improve your portfolio’s risk/reward when employed well. In this article, we’ll cover a specific long-short strategy for options trading to help improve your reward relative to your risk.

It uses a combination of both options spreads and a covered call or put position in the underlying.

Securities trading vs. Options trading

When you invest in securities, your returns are essentially modeled with distributions. You don’t have a defined upside and you may or may not have a defined downside.

Some instruments can go to zero while others can have values less than zero in some circumstances.

But you can be sure that certain outcomes are more probable than others. The distribution will be the fattest where price currently resides and thinner at prices far from where the security currently trades.

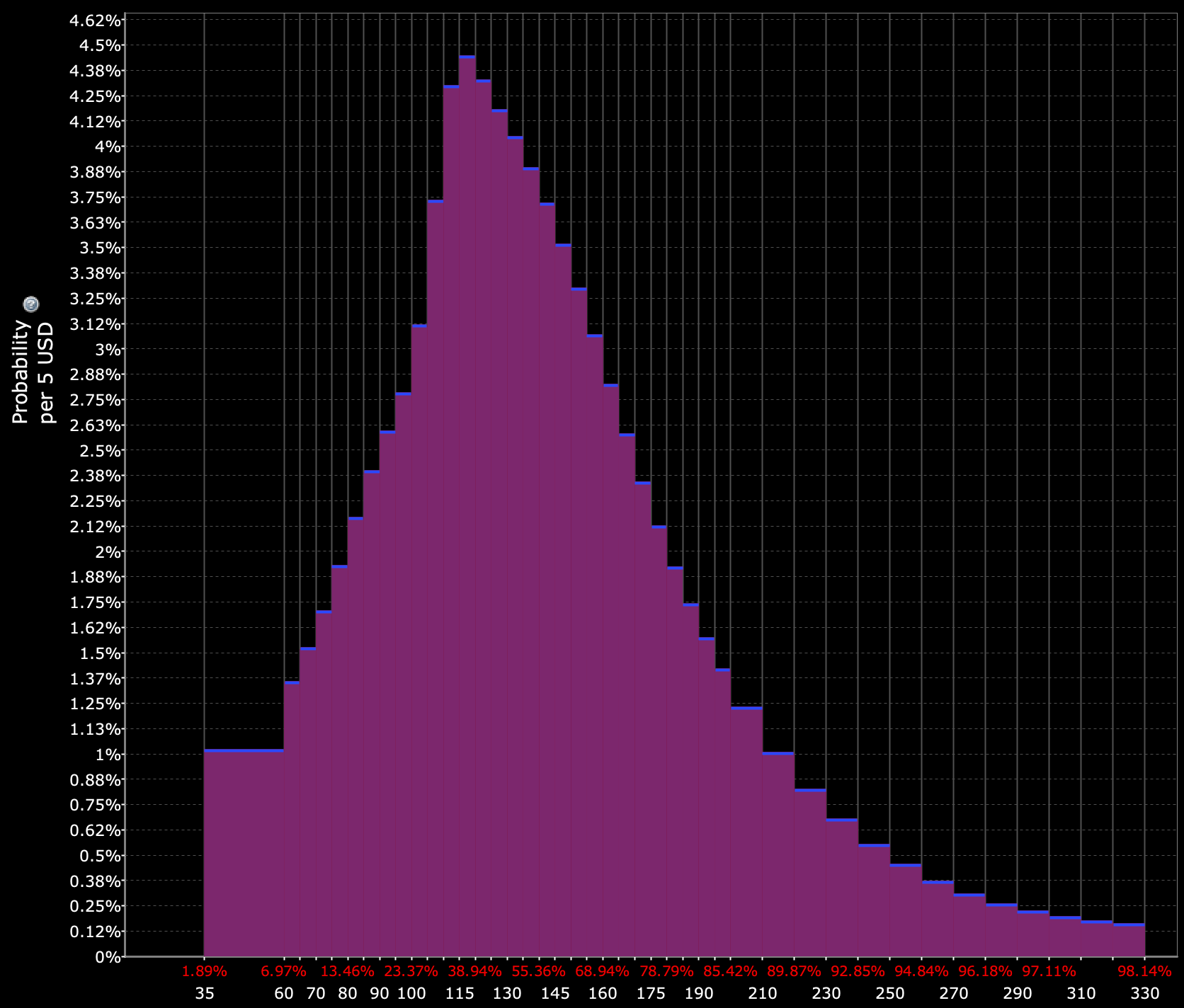

Take this example of Apple (AAPL) stock.

If price is trading in the $100 to $200 range, you might expect the distribution to be the most prominent in that area and prices in the “extremes” to be thin. And there’s a probability associated with each slice of the distribution.

Example of an outcomes distribution when trading the underlying security using probabilities implied from options pricing

(Source: Interactive Brokers)

However, when you trade options, you have the ability to specifically define how much upside potential you have and how much downside you can have.

You still have a distribution of outcomes that are possible, but you can more tightly manage that range with a hard lower- and upper-bound.

Options also have the capacity to be used in a way that can cause great harm to a portfolio – especially when shorting them in an imprudent way.

Long-short strategy: Using both the underlying securities and options to maximize risk/reward

The following long-short strategy involves going long or short a certain asset through a bull or bear spread and taking the opposite position with the underlying.

Example

Let’s look at an example. Let’s say we want to buy shorter-term SPY options.

Call spread

If we buy, for example, a 431-433 bull spread (long 431 strike calls, short 433 strike calls) and have a position of 20 of each (20 431’s, 20 433’s), that gives $4,000 worth of upside on the spread.

(20 options contracts x 100 shares per contract x $2 of upside spread from the 431-433 spread).

To calculate simple reward/risk, we need to know much the bull spread costs.

In this case, to use an example of real-life pricing, it’s $3.18 per share for the 431 calls and $2.09 per share for the 433 calls.

Taking the difference it’s a net outlay of $1.09 per share. So we’re risking $1.09 to make $2 per share.

That isn’t too bad if the call spread starts around at-the-money (ATM) (or close to it), there is adequate time left to make a move to profit, and there’s a certain amount of volatility to the instrument.

All would increase the probability of profit.

But there’s an additional leg to this trade.

Shorting some amount of the underlying

For the call spread, the 20 contracts long and 20 short means 2,000 shares with 100 shares per contract.

To improve the risk/reward of the trade, we can go short a smaller amount of the underlying security but structure it as a covered put.

Let’s say the 431-433 call spread (bull spread) was set up ATM.

That means we could short 500 shares of SPY and cover it by shorting 5 put contracts. This is 25 percent of the hypothetical long position, so it remains a net bullish bet. We could also do a higher or lower number, but we’ll use 25 percent in this example.

Let’s say the put option premium is $3.50 per share (also based on real-life data).

These contracts can be ATM (to maximize your options premiums). Or they can be somewhat OTM to better how much you could earn if price falls and your call spread expires worthless.

ATM, or close to it, is preferred as the strategy discussed here is an actively managed strategy.

The rationale for the covered put

With the put option premium (covered by being short the underlying) we now have an additional source of income coming in to increase our reward relative to the risk.

If the call spread doesn’t work out, we lose the long call premium, but we gain:

- the short call premium

- the short put premium that is covered by the short position, plus

- any capital gains from being short the underlying, if applicable

And if the trade works in our favor, we’ll profit from the:

- call spread working out

- collect the put option premium

And lose on the short position.

But losing on the short position is acceptable as that was just 25 percent of the size of the long position.

We also have a final rule for this long-short strategy:

Maximum profitability on this trade comes at the strike price of the short calls (in our example, 433).

Once it goes past 433, you stop gaining on the trade. But the short position keeps losing as the stock climbs.

So once it hits the strike price of the short calls, the short position in the underlying should be covered. The short puts should be covered as well.

It can be tempting to keep the short puts on because they’ve lost a lot of their value. They seem likely to expire worthless, which is good for the seller.

But if the short position in the underlying is taken off, the short puts represent an uncovered exposure that can lose a lot if price falls again.

If that’s the case, it’s better to only lose the premium from the call spread, and not lose on naked short puts as well.

Profit/loss

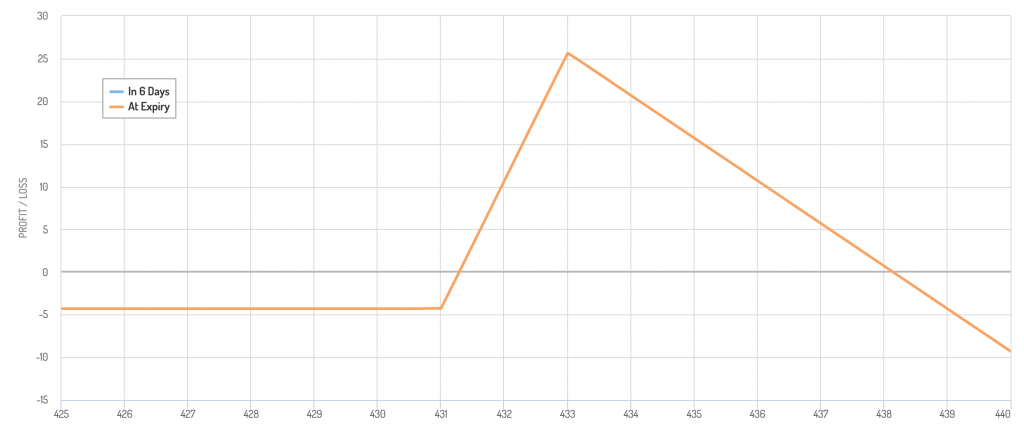

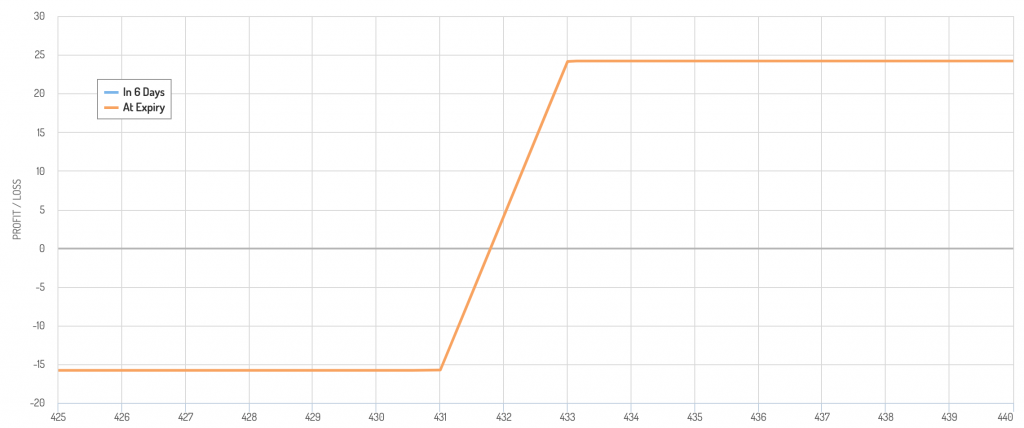

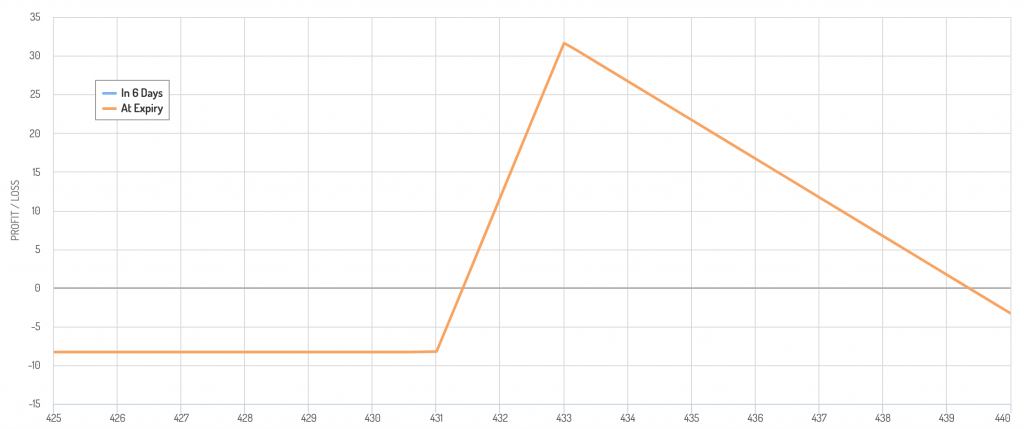

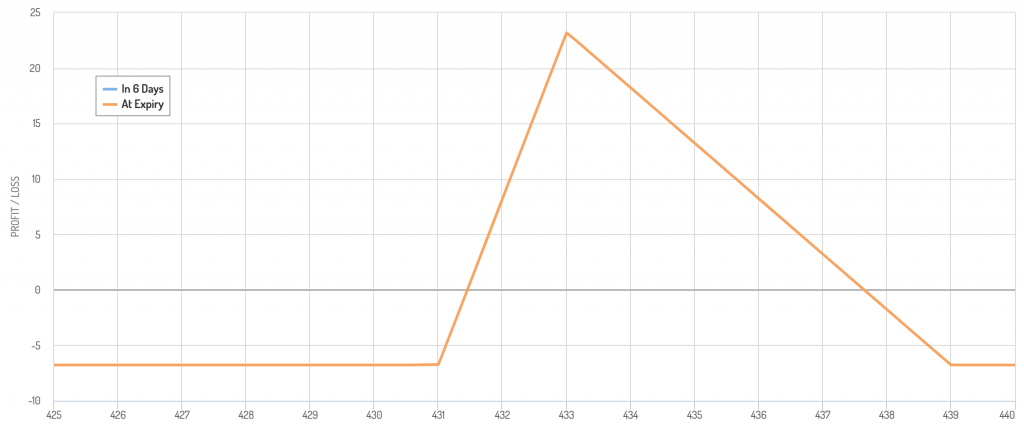

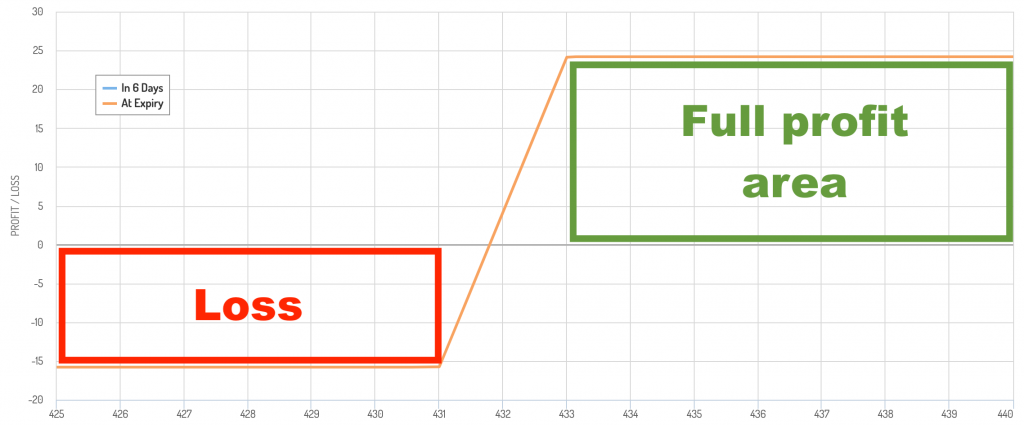

Let’s draw up an options profit/loss diagram of this strategy.

This options diagram doesn’t take into account that we’re taking off the short position if and when it hits 433.

In that case, you would not have the declining P/L part after 433.

Your diagram would have a flat top and shift down slightly (to reflect the fact that the short puts have not expired worthless yet and you would forgo some premium).

You could also just cover the previous set of puts and sell new ATM puts. This would lessen your downside if the trade were to reverse.

But it would also still mean that you would start being less profitable if the underlying continued to go up.

It’s all about trade-offs.

Another possibility is to buy an OTM call to cover any losses sustained by the short position past a point. Then it takes more of a condor shape.

This requires an outlay of premium and will reduce reward relative to risk but prevent any tail risk on the upside if the trader wanted to run this as more of a passive position.

Core Setup

Going back to the core setup, if you’re wrong and the trade goes against you, you don’t lose too much once you cover the short in the underlying and the short puts. The left tail is less than what you gain.

(Of course, you need to be okay with losing that prospective amount. It’s no good to risk, e.g., $2,000 to win $10,000 if you’re not able or willing to cover the $2,000 loss.)

You will need to actively manage the trade. If you choose to keep the short position on, your P/L will decline if the underlying continues to increase.

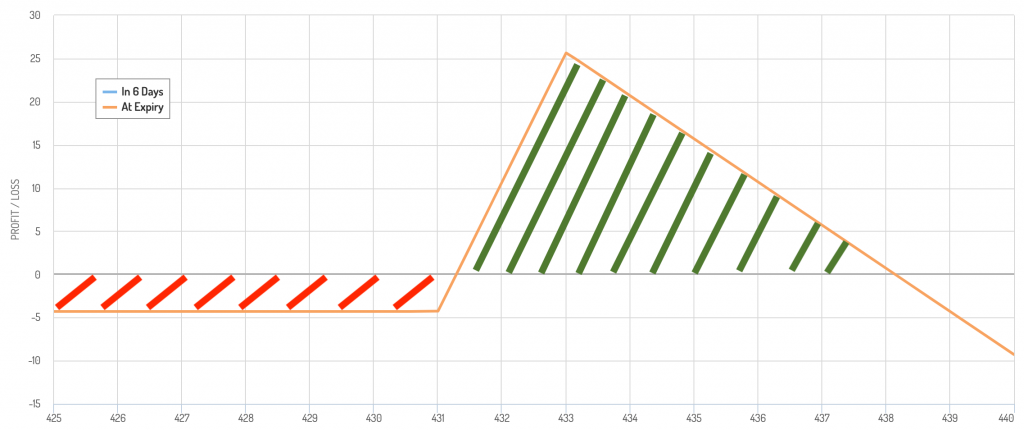

Potential upside

On this example trade, your potential profit is:

- the $4,000 from the call spread…

- minus the cost of the call spread($1.09 per share, $109 per contract, or $2,180 for 20 contracts)…

- plus up to the $1,750 received from the short puts…

- minus the $1,000 capital loss from the short position.

So, there’s a maximum profit of $2,570 excluding transactions costs.

And a potential maximum loss of the call spread ($2,180) minus the premium received from the short puts ($1,750), or $430.

These are best-case scenarios.

But as an actively managed strategy there are more variables.

If you cover the short underlying and short put position, a big part of your potential reward relative to your risk is how much premium you’ve received from the short puts.

As the trade went in your favor, the puts declined in value, which is income for you.

But how much?

It could vary anywhere from “almost all” to “very little” depending on how fast the move happened, the circumstances (e.g., the relative level of volatility), and the time to expiration.

So if you take the short underlying and short puts part of the trade off, only to see the trade reverse and the call spread expire worthless, your loss would be the cost of the call spread plus the capital loss from the underlying minus whatever premium you received from the short puts.

Suffice to say, there are a virtually infinite number of ways to skin a cat. Several examples of how to set up this type of trade structure were mentioned.

It’s ultimately up to the trader to put on a trade that best expresses the goal or conviction and set that up in the most favorable way possible.

Just one part of a portfolio

Any given trade should just be one part of a portfolio. The key is to generate synergies through prudent portfolio construction.

We’ve discussed how to do this in other articles.

Having a good strategic asset allocation mix is a good starting point. Striving to have good uncorrelated themes in a portfolio will improve reward to risk at the broad portfolio level. Then structuring these trades in the most favorable, convex way possible.

Being able to go long and short in a portfolio is a key way to go about achieving this.

Conclusion

Many traders prefer trading spreads relative to pure long options bets. Options are expensive because of the volatility risk premium.

Spreads cap your upside but can improve your reward relative to your risk. For ATM to OTM spreads, the potential upside is greater than the downside.

Adding an additional part to the spread – an ATM covered put (or covered call for put spreads) – involves taking the opposite position to the options bet to establish a long-short strategy.

To keep the bullish bias to the trade, the covered put will generally be a smaller size. Therefore, if the trade goes in a favorable direction, the losses from the short position won’t eat up the gains from the call spread.

The premium from the covered put (or covered call) can help enhance reward-to-risk further relative to other ways of expressing a bullish trade:

- owning the underlying

- owning call options

- owning a call spread

As a trader, you inherently want to minimize your risk. Most of your mistakes in trading are fundamentally about mismanaging risk.

There will always be some risk that needs to be taken. But the goal is to get as much return per each unit of risk taken on.

Like any trading strategy, it should be tried out in a limited- to no-risk way before deploying it at any scale.