How to Short Stocks with Zero Downside

Short selling, commonly known as shorting, is risky. When shorting a stock, your upside is limited to 100 percent (the value of the short); the downside is theoretically infinite as the stock can go up many multiples.

Moreover, financial assets essentially “need” to appreciate over time to get the overall system to work efficiently where private actors confidently lend, invest, and create. Central banks create money over time and a lot of that ends up in financial assets.

Shorting is inherently difficult in stocks and other financial assets as those secular forces are working against you.

Management teams also control the narrative.

For those who began shorting Wirecard in 2010, over the next 8+ years, the stock went up by a factor of almost 30x (or close to 3,000 percent), aided along by narrative that it was a fintech success story and its fraudulent accounting that misrepresented its financial health. German regulators put more focus on the relationship between short-sellers and the media than the legitimate concerns about its financial reporting.

For those who were right about the company’s problems, it took a very long time (and a lot of pain) for it to pay off through a standard stock short. Some who aren’t able to tolerate a short position going up by many multiples get “squeezes” out.

Wirecard AG (WDI) Stock Chart

(Source: Trading View)

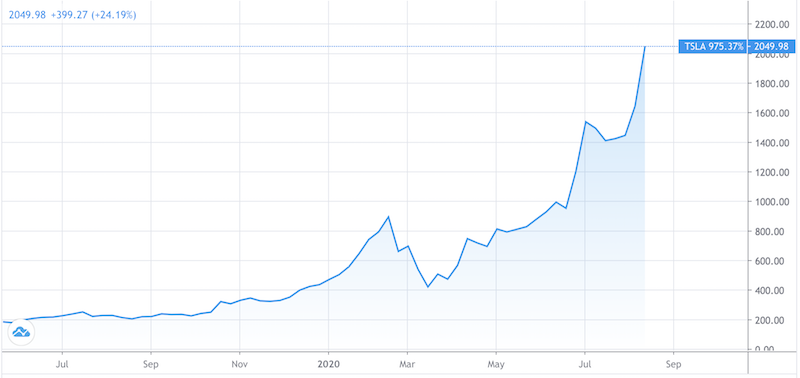

Tesla has become the most speculative stock in the market, accruing a market capitalization of north of $400 billion. This is despite being just 0.4 percent of the global auto market and similar concerns over its accounting and the legitimacy of its narratives and claims about upcoming business accomplishments.

Since the recent May 2019 bottom, it’s gone up well over 1,000 percent.

Tesla (TSLA) Stock Chart

Shorting has been risky given the momentum of the stock.

Momentum, as a strategy itself, attracts in certain market participants who buy and sell stocks for no other reason than the direction they’re currently going in. Markets tend to run in trends and “trend following” is a strategy pursued by many (e.g., CTAs and other quantitative traders) even if it has nothing to do with the underlying fundamentals of the market.

On top of that, a lot of Tesla’s stock is directly connected to the underlying options market. When there is a lot of open interest in the options market, market makers hedge their short call and put option exposure by buying or selling the stock.

For example, if there is a large demand for call options, a market maker can underwrite the option. Because of the unlimited downside risk structure associated with a short call, the market maker typically wants to buy the stock in some portion (e.g., delta hedging) to ensure the position’s risk is managed appropriately.

Buying shares increases the price, holding all else constant, even though it’s simply a technical factor that has no relevance to the fundamental health of the business.

If the stock goes up, then the delta increases as well, incentivizing additional buying of the stock. This creates momentum-related moves that feed on themselves.

So, for a trader looking to bet on a company’s share price going down, they might think the risk/reward of shorting the stock is out of whack and avoid it.

They could also turn to being long put options.

Buying options is good in theory because of the limited risk and large upside nature of the trade structure. Not necessarily in terms of expected value, but in terms of “what’s possible”.

However, with options, everything comes at a price. They can be expensive.

Let’s say you are agnostic on timing for the short and want a long-dated option. That way, the theta decay on the option won’t be so acute.

For some of the liquid, popular stocks you can go out 2-3 years in the future if there is enough of a market for them.

For Tesla, because many people don’t want to short the stock because of the risk, they get the same idea of expressing the short thesis through put options. This process bids up the prices in the options market as well.

For example, the September 2022 1000 puts cost up to $198 per share.

(Source: Interactive Brokers internal interface)

Your upside on the short – the stock going to $0 – is only about 5x. The options contracts go in-the-money (ITM) at $1,000 per share and there’s the ~$198 per share cost. Breakeven is therefore around $800 in this scenario.

If the option is out-of-the-money (OTM) by expiration ($1,000 per share or higher), they expire worthless.

There is also a wide spread, going from $182.50 to $198.00, which is common in options markets that are inherently less liquid than the underlying stock. It’s a trade that can be difficult to put on in size for larger investors.

But the prospect of “losing everything” on the options bet can be tempered a couple different ways:

i) Keeping the position small relative to the size of the equity in your portfolio

ii) Fund it through the coupon payments in a different part of the company’s capital structure

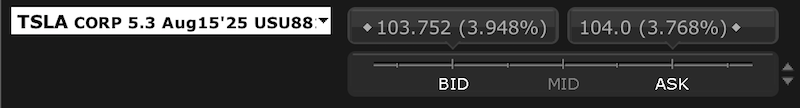

Tesla also has bonds.

Right now they offer a bit less than 4 percent annual yield, about 3.8 percent.

(Source: IBKR)

If you bought $100,000 worth of bonds, those would produce around $3,800 in income per year assuming the company doesn’t default on them.

The income received on the bonds must be matched to the duration of the options trade.

Since the example being used is a two-year option, you’d receive two years’ worth of bond coupon payments.

That would be the $3,800 in annual coupons multiplied by two, or $7,600.

That $7,600 could, in turn, fund the short side of the trade through put options by buying up to that amount in options premium.

This has a couple advantages:

i) If everything is smooth sailing for the company and the short thesis doesn’t pan out, and/or the stock rockets higher, you don’t lose anything. The put options expire worthless, but you received the coupon payments on the bonds. It nets out to a wash.

ii) If the bonds of a company are defaulted on, that means there are some serious problems for the equity. Common stock in a company is the most junior in a capital structure. That means the owners of a business get paid last after all expenses are paid (including payments to bondholders).

In the event of a liquidation bankruptcy, the common stockholders are paid last. They often don’t receive anything while bondholders (also known as creditors) may receive some being senior in the capital structure.

If the bond payments stop, that means the stockholders may be zeroed and that put options part of the trade is very likely going to pan out.

There is a high level of speculation in the stock market – for example, fundamentally worthless Hertz stock went up 10x after declaring bankruptcy – but the stock being as bad (and typically worse) than the bonds in an “implosion” scenario is usually something you can rely on.

With $7,600 in income to use on put options, you could buy long-dated 100 puts (around 96 percent OTM). These are highly convex and a good fit for anyone who might believe a company isn’t fundamentally worth something.

These currently trade at around $560 apiece.

With $3,800 to worth with, you could buy 14 put options ($7,600 / $560 = ~13.6) rounded to the nearest whole number. Or 13 contracts rounded down to ensure the funding covers the entire amount.

Downside

If the company does at least okay, you’ll get paid on the bonds even if the put options expire worthless.

There could also be a case where the bonds are defaulted on and the stock remains above your strike price on the options. It’s unlikely, but it theoretically could happen.

But generally, if the bonds implode, the stock certainly will implode as well. Creditors are senior to equity holders.

Upside

If you bought 14 put options contracts at a 100 strike price, your upside is $140,000 (14 contracts multiplied by 100 strike price multiplied by 100 shares per contract) minus the total cost ($560 per put option contract multiplied by 14, which is $7,840). So, about $132,160.

If the bonds were to also collapse, you could be out as much as your $100,000 investment minus any coupons received.

In a case of a default where the equity is zeroed, even if you had zero recovery on the bonds, you would still come out with $32,160 plus any bond coupon payments received. (This relies on the equity market realizing the reality of the situation, which is not always a guarantee.)

Recovery rates are generally 40-75 cents on the dollar in bankruptcies for unsecured creditors, but it varies case by case.

In a case where the prospective loss on the bonds swamps the prospective gain on the options, you could either do one of a few things:

i) Not enter the trade until you get a higher yield on the bonds so you can cover the purchase of more put option premium.

ii) Buy cheaper options that give a more convex structure and give a potentially enhanced payout. However, this is not always possible. On top of that, the further OTM you with the options, the lower the probability of earning a return on them.

iii) Buy more options contracts to cover your potential downside on the bonds. This comes at the cost of suffering a loss in the “smooth sailing” case for the company because the options premium will exceed the coupon payments. Namely, if the cost of options premium is higher than your prospective total bond payments, you would lose money.

Summary

In this article we covered a relatively safe way of expressing a bearish opinion on a stock.

Markets can move to places they aren’t expected to go for reasons that don’t make much fundamental sense. This can make standard equity shorts risky. It’s especially true for a stock or general market going off narrative and/or a management team that’s heavily interested in seeing appreciation in their share price.

Instead of shorting the stock directly, where you have fixed upside and unlimited downside, you can try a different approach.

If the company sells bonds that have a reasonable coupon attached to them, you can go long the bonds and effectively use the proceeds from bond coupons to fund the cost of put options used to short the stock.

If the trade doesn’t work out, you net out with roughly zero gains and zero losses. The bond coupon payments offset the losses from the put option premium.

In today’s world, few companies have high bond yields. Nonetheless, the companies that are the best shorts tend to already have decent yields on their credit – they are riskier.

The bond market tends to do a better job of pricing risk than the equity market. The former (with its fixed upside) is more heavily focused on cash flow and risk than the equity market, which is more about how good things can get.

An annual bond yield of 3-5 percent is generally sufficient to buy OTM put options that give the upside if the short thesis pans out without having the unacceptable downside.