Trade Idea: Delta Hedging

Delta hedging a single position in your portfolio – or even delta hedging your entire portfolio – is a relatively common strategy. It involves options, which are equity derivatives. The philosophical basis behind delta hedging is to be price neutral to a market rather than be directionally biased.

Delta Hedging

At the beginning of December, we’ve seen the aggressive purchasing of put options on US bank and financial stocks. This has been especially true in the mid-December expiries.

There are several reasons for this:

1) Headlines of yield curve inversion in the US Treasury curve, particularly in the 5-year / 3-year and 5-year / 2-year maturities (i.e., lower maturities are yielding more than the 5-years). This is generally bad for bank stocks whose business models often heavily rely on borrowing and lending, where they borrow at the short end of the curve and lend at the long end.

2) Banks are heavily intertwined with the business cycle. If traders believe that the economy is getting late in the cycle, they will be inclined to sell them, short them, or hedge them. (Put options can be used to express the latter two.) Yield curve inversions are a common harbinger or recession by signaling that monetary policy is too tight.

3) Banks will soon start to report earnings. Stocks often respond heavily to earnings. When this new data gets released publicly, this often creates large movements in their stocks. The best way to profit from short-term movements in the market is usually by buying short-term options.

A combination of these factors have led to what we’ve seen.

These various sources of demand for put options have opened up selling opportunities for those who wish to sell options.

Selling options can be a very dangerous game. Traders receive a premium upfront but the loss is theoretically unlimited.

Nonetheless, options sellers typically are able to get buyers to overpay for options, particularly of the short-term variety. This is because future realized volatility is generally lower than the present implied volatility that’s embedded in the option’s price. For buyers, this is typically accepted because buying options allows them to earn a large amount of money in a short period of time if they are right on the trade.

But for sellers, because you usually (but not always) have the odds slanted in your favor, you will usually win. The problem with selling options, however, is that it’s like picking up pennies in front of the proverbial steamroller. You usually win, but when you lose, you lose in a big way. So the sellers of options, typically investment banks though sometimes retail and institutional traders, will choose to delta hedge their position to offset the associated price risk.

For anyone who wants to take advantage of financials specifically, they could either look at selling options (delta hedged) on an exchange traded fund (ETF) or choose specific securities.

In terms of an actual example, let’s go with JPMorgan Chase stock (NYSE: JPM).

Example of Delta Hedging: JPMorgan Chase (JPM)

Let’s use one contract to simplify things and choose an approximate at-the-money (ATM) contract:

Sell: 1 JPM 109 Dec 14 ’18 Put @ $585 per contract (Delta = -.807)

Short sell: -.807 * 100 = -81 JPM shares (rounded)*

*Formula for the number of shares to buy/sell:

Number of shares = number of options contracts * delta of the option * number of shares per options contract (100)

What are the margin requirements?

Puts: Likely around $500 per contract but each broker will set this independently

Stock: 81 shares * $107/share = $8,667 (for cash account); $4,333 (Reg-T)

Margin requirements will be lower for portfolio margin accounts, but it will depend on what other positions are in your portfolio as portfolio margin penalizes traders with concentrated risk exposures.

So if this trade were to pertain to a Reg-T account, your expected premium received from selling the options relative to your total cash outlay (i.e., margin requirements) would be around 9 percent, or what would amount to $439 in premium divided by the total margin requirements (slightly above $4,800).

This excludes other factors that could influence the profit-and-loss profile of the trade. This does not mean that your total expected return is necessarily 9 percent.

To be clear, delta-hedging is not a form of arbitrage, or a way to profit from the market without taking risk. Risks inherent in this trade are talked about more below.

What is delta and how is it hedged?

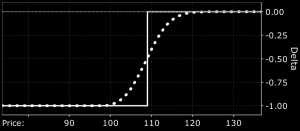

An option’s delta pertains to the change in an option’s price relative to the change in the price of the underlying stock. For long calls, the delta is always between 0.0 and +1.0. For long puts, the delta is always between 0.0 and -1.0.

A delta of -0.807 would direct you to buy or short sell 81 shares per contract, depending on the type of option (whether you are buying or selling the options) and how you round. Usually you would round to the nearest whole number.

If you were to buy a call option with a delta of 0.50 and want to offset your price risk of the underlying stock, you would short sell 50 shares (applying 0.50 * 100, since there are 100 shares per each option’s contract).

If you were to sell a call option with the same delta, you would buy 50 shares.

Delta Hedging Risks

The most basic risk to delta hedging is that an option’s delta will change.

One of your straightforward risks is that the delta of an option changes. The more in-the-money an option is, the closer the delta will be toward 1. With respect to out-of-the-money (OTM) options, the closer the delta will be to a value of 0. For at-the-money (ATM) options, delta will be at or around 0.5.

This means that if your options were to go from ITM to ATM to OTM, or any combination thereof, your delta can be expected to change. The delta will be most sensitive when you are buying or selling options ATM. The further ITM or OTM the option goes, the less sensitive delta will be. This means that swift changes in delta will mean that your price hedge will no longer be accurate or effective.

Delta hedging can mean adjusting the position continuously by buying or selling shares. However, this entails transaction costs and potential illiquidity in the options markets causing slippage (i.e., inability to get in and out at the price you want). This would reduce the profitability of the strategy.

Delta hedged trades can lose money on factors outside of price given options are valued off more than price itself. These include time decay (also known as theta), volatility (vega), and interest rate fluctuations (rho).

Should you hedge other risks?

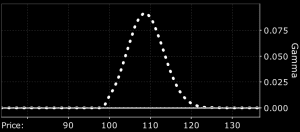

One particular factor to account for is gamma.

Gamma refers to the change in delta relative to the change in the price of the underlying stock. Mathematically, gamma is the second derivative of the change in an option’s price with respect to the change in the underlying.

Similar to delta, gamma’s value is highest when an option is ATM and lowest the further ITM or OTM it is.

When you are selling options, that means you are typically short gamma. When you are buying options, you are typically long gamma.

Many traders will want to hedge gamma such that the trade’s performance is more stable irrespective of what happens with delta and a host of other factors such that the price neutrality of the strategy remains largely intact. This could entail buying a long put at a different strike price relative to the one provided in the abovementioned example.

Conclusion

Delta hedging is fundamentally built around the idea offsetting the directional bias from either a particular position or your entire portfolio. It is especially recommended when selling options in order to help protect oneself of the unlimited downside associated with selling options. Usually when people blow out their accounts in trading, it is because of uneducated use of leverage, selling options without an appropriate hedge in place, or poor risk management more broadly (e.g., betting too much per trade).

But this strategy is one additional tool to put into your kit. Having versatility and flexibility to trade a variety of markets, assets, and using various trade structures can help you achieved diverse sources of largely uncorrelated returns.

Before using real money, ideally try out a new strategy on a paper trading account.