What ETFs and ETF Options Trade After Hours?

Option values are based on the price of the underlying asset or exchange traded product (ETP).

Accordingly, once the underlying asset stops trading, there is no need for options to continue trading.

Nonetheless, many underlying ETPs are now being traded in after hours sessions until at least 4:15 PM ET that are open to both institutional and retail investors. This is an additional 15 minutes past the standard 4:00 PM ET close of trading.

The following ETFs and options trade for an extra 15 minutes after the bell.

- DBA

- DBB

- DBC

- DBO

- DIA

- EFA

- EEM

- GAZ

- IWM

- IWN

- IWO

- IWV

- JJC

- KBE

- KRE

- MDY

- MLPN

- MOO

- NDX

- OEF

- OIL

- QQQ

- SLX

- SPY

- SVXY

- UNG

- UUP

- UVXY

- VIIX

- VIXY

- VXX

- VXZ

- XHB

- XLB

- XLE

- XLF

- XLI

- XLK

- XLP

- XLU

- XLV

- XLY

- XME

- XRT

Most of these products are called exchanged traded funds (ETFs).

Many are ETFs, but some, like VXX (a volatility product tied to the VIX index) is an exchange traded note (ETN).

A more accurate term would be exchange traded products (ETPs).

Trading after 4 PM brings with it less liquid and wider price spreads. This adds to transaction costs.

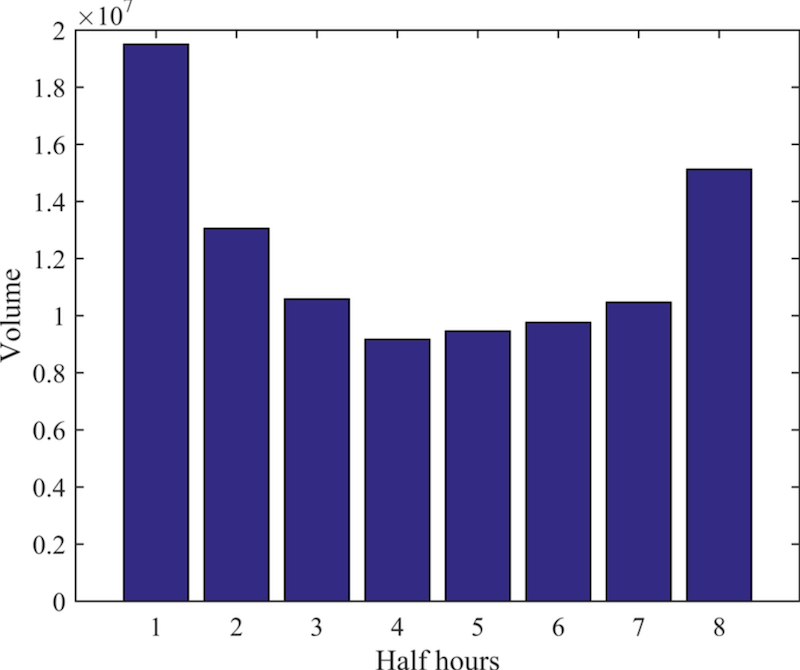

The beginning of the trading day (9:30 AM to 10:00 AM ET, roughly speaking) and the end of the trading day (approximately 3:30 PM to 4:00 PM) see the most trading activity. The first half-hour is about 25 percent more active in terms of share volume than the last half-hour.

(Source: researchgate.net)

The process of the first and last half-hours seeing the highest volume is largely self-fulfilling.

People are more likely to trade at these times because they typically see the most volume and activity. This tightens bid-ask spreads and reduces trading costs.

Many traders and market makers leave at 4:00 PM. Volume declines markedly. As a result, the bid-ask spread of options (and other securities) tend to widen out by quite a bit.

So, you might not always be able to get quality prices when you trade after 4:00. But at the same time, that extra 15 minutes is open.

Sometimes it may be worth it to close a trade, swap one option block out for another, buy something, or simply have a normal limit order trigger.

For example, if you trade intra-weekly SPY options, if Wednesday is coming to a close, you may want to swap out your Wednesday expiry options for Friday expiry options to maintain a hedging arrangement, avoid assignment, or for other reasons.