Capital.com Review 2026

See the best Capital.com alternatives in your location.

Pros

- Capital.com offers a unique 1X CFD account option that lets you trade without leverage. This is great for beginners or cautious day traders who want exposure without the risks of margin or overnight fees, something few CFD brokers provide.

- The Capital.com app performed excellently during testing, with smooth orders, trade management and alerts, while it sits among the highest rated trading apps on the App Store for iOS users.

- Capital.com’s SmartFeed curates news and market updates tailored to your watchlist and trading style. This proactive feature helps day traders stay on top of relevant events without feeling overwhelmed by generic market noise.

Cons

- Capital.com offers primarily one standard CFD account and a professional account with higher leverage, but it lacks ECN/raw spread accounts or tiered pricing, which can limit trading flexibility for high-volume scalpers.

- The broker’s research resources focus on educational content and in-house analysis but lack deep third-party tools such as Trading Central, Autochartist, sentiment indicators, and professional-level screeners that some top competitors offer.

- While Capital.com supports MT4, it lacks MT5 integration, limiting access to advanced trading features, including additional timeframes, indicators, and order types.

Capital.com Review

This Capital.com review evaluates the broker in eight key areas that matter to active trades, with section ratings, various data points and the hands-on observations of our testing team, which includes experienced traders and brokerage experts.

Regulation & Trust

Capital.com launched in 2016 as a mobile‑first CFD broker and has grown fast, adding thousands of instruments and expanding into Europe, the UK, Australia, and other regions.

Capital.com is highly trusted due to its clean track record and the strength of its regulatory credentials:

- It got its CySEC license (319/17) in 2017. A ‘green tier’ body in our regulator classification system, ensuring excellent investor protection.

- The company grew quickly, adding FCA regulation (793714) in the UK by late 2018. ‘Green tier’.

- It got its ASIC in Australia (513393) in 2021. ‘Green tier’.

- It secured licenses from the Bahamas SCB (SIA-F245) in 2021. ‘Red tier’, providing weak investor protection.

- It UAE’s SCA (20200000176) in 2024. ‘Yellow tier’, providing strong investor protection.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, ASIC, CySEC, SCA, SCB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Segregated Client Accounts | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

Capital.com keeps its account options simple, which can be a plus or a minus depending on your needs.

There’s basically one main account for day trading with variable spreads, no commissions, and a low minimum deposit starting around $20, depending on region. Leverage is capped at 1:30 for retail clients under ESMA-style rules, with negative balance protection, across a wide range of CFDs.

There’s also a 1X account, which is an unleveraged CFD setup: long-only, no overnight fees, and the same spreads as the regular CFD account, with a cap of about £20,000 exposure at any one time. That’s safer for new day traders, but it also limits upside, and it’s not really a substitute for a real stock account at a multi-asset broker for long-term investments.

Capital.com also offers a professional account with higher leverage and rebates, but only for experienced, high-volume traders.

Unlike brokers such as IC Markets or XM, Capital.com doesn’t provide account tiers or ECN-style pricing, but it’s generally easier and cheaper to get started.

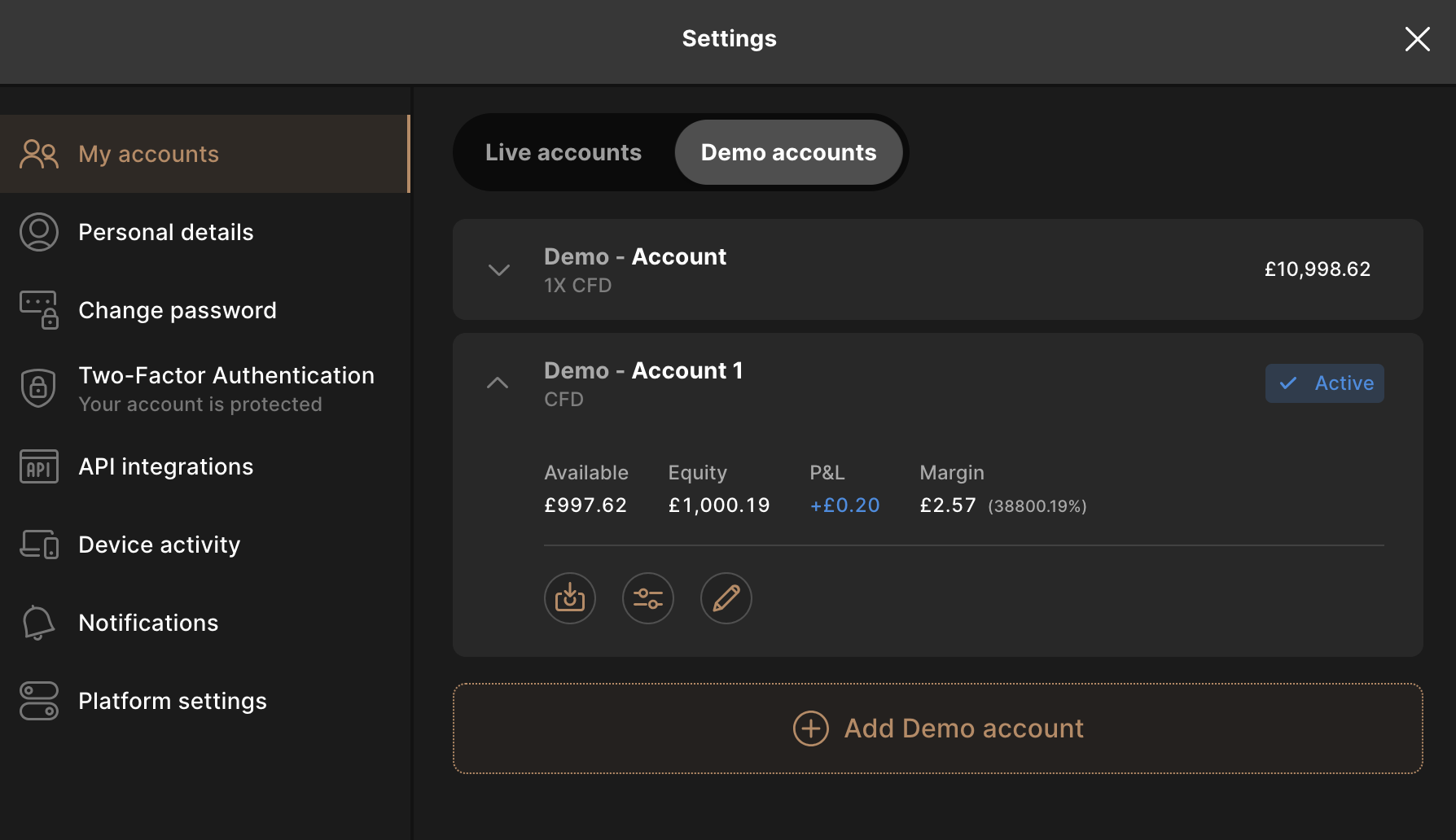

Demo Accounts

We tested Capital.com’s demo account and found it genuinely straightforward to set up – no deposit required, just basic registration details.

We immediately received virtual funds (we topped up to $10k when needed) and got our hands on both the web platform and the mobile app, with access to many – but not all (such as interest rates and bonds) – of the same CFD markets we’d trade live.

We worked with charts across 23 timeframes, experimented with 90+ technical indicators, and used the drawing tools while monitoring live news feeds – perfect for testing our day trading setups without putting real money on the line.

There’s also MT4 demo access with more sophisticated tools like automation.

What we appreciated most was the option to open multiple accounts with unlimited access. We’re not racing against a 30-day cutoff as we’ve encountered with other brokers. The demo closely mirrors live conditions – we saw spreads as low as 0.6 pips and the same 1:30 leverage caps we’d face when trading for real.

Deposits & Withdrawals

We’ve found Capital.com’s deposit process refreshingly straightforward, with a low $20 minimum via debit card, credit card, e-wallets (PayPal, Skrill, Neteller, Apple Pay, Google Pay), or bank wire transfer (minimum of $250). However, funding options depend on your jurisdiction.

We tested several methods – deposits landed almost instantly and were fee-free, except for wire transfers, which took a few days. Capital.com doesn’t charge conversion fees, though we’d recommend you watch for bank-side charges.

For withdrawals, we had to use the same method as for deposits, with a $50 minimum for bank transfers and $20 for cards and e-wallets. Capital.com claims withdrawals are processed within 24 hours in 99% of cases (we’ve seen some clear in minutes), with a maximum of five days.

Crucially, we could only withdraw profits to a verified bank account. We also needed to complete KYC first – uploading ID, address proof, and bank documents via ‘My requests’ – or face AML delays.

For day traders funding small and cashing out fast, we’ve found Capital.com competitive, with zero fees and low minimums, beating IG and FOREX.com on costs, though e-wallet provider fees can add up, and there are no crypto funding options.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Apple Pay, Credit Card, Debit Card, Google Pay, Neteller, PayPal, Skrill, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $20 | $0 | $100 |

| Fast Withdrawals | No | No | Yes |

| Islamic Account | Yes | No | Yes |

| Demo Account | Yes | Yes | Yes |

| Demo Competitions | No | No | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

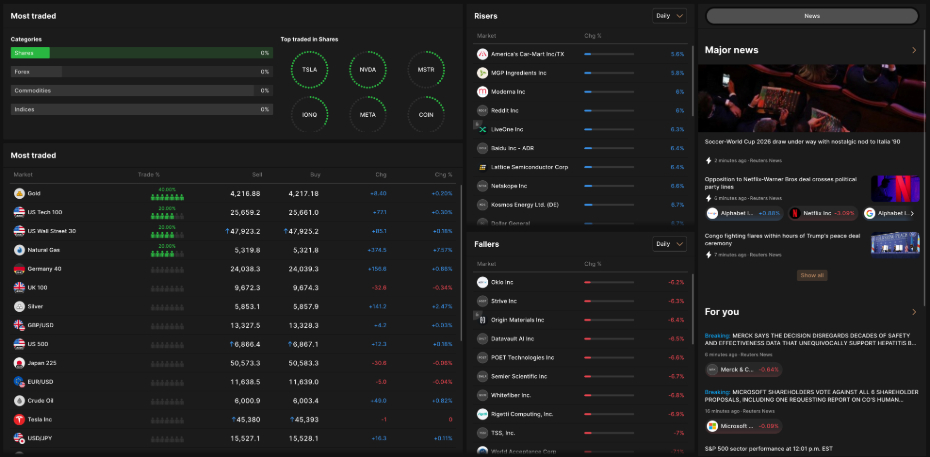

We’ve dug into Capital.com’s 5,000+ CFD offerings and found the headline number somewhat inflated – it’s padded with obscure stocks and altcoins most people will rarely trade.

The forex selection impressed most with over 120 pairs, including majors like EUR/USD and GBP/JPY, as well as exotics like USD/TRY. We counted over 35 global indices, including the Nasdaq-100, US Dollar Index, DAX 40, and Nikkei 225, alongside 4,000+ global stock CFDs, including Tesla, Nvidia, and Barclays.

There are around 70 commodities – including energy (such as Crude Oil, Brent Oil, Natural Gas), metals (such as gold, silver, copper), and agricultural products (such as wheat, sugar, coffee) – plus over 10 bonds, including the US 10-Year T-Note.

The crypto CFD range stood out with 500+ options (unavailable to UK retail), including Bitcoin, Ethereum, and niche picks like Pepe and Sui. Crucially, we found no real stocks, ETFs, or options – just derivatives.

For day trading, there’s a great variety for quick forex and index scalps, though the depth lags behind IG’s 15,000+ instruments. The crypto selection is strong, but retail leverage caps limit appeal.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Extended Hours Trading | No | Yes | No |

| Fractional Shares | No | Yes | No |

| Margin Trading | Yes | Yes | Yes |

| Maximum Leverage | 1:30 | 1:50 | 1:50 |

| Fast Execution | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

We tested Capital.com’s commission-free structure and found it refreshingly clean for day traders. Our costs came purely from spreads: we saw EUR/USD at 0.6 pips, GBP/USD at 1.3, gold at 0.25 points, and the S&P 500 index at about 0.9.

We’ve deposited and withdrawn multiple times without incurring any fees – genuinely zero charges.

When we hold positions overnight, swap fees are calculated based on the leverage used rather than the full position size. We’ve noticed this adding up on volatile trades, particularly crypto longs at 0.06% daily.

For day traders closing same-day, it’s cost-effective enough – unless you’re a high-volume scalper looking for zero spreads. We’d recommend checking its ‘Charges and fees‘ page for your specific market’s rates before sizing positions.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Fixed Spreads | No | No | No |

| Inactivity Fee | $10 | $0 | $15 |

| EUR/USD Spread | 0.6 | 0.08-0.20 bps x trade value | 1.2 |

| FTSE Spread | 3.0 | 0.005% (£1 Min) | 1.0 |

| Oil Spread | 0.030 | 0.25-0.85 | 2.5 |

| Crypto Spread | $50 (Bitcoin) | 0.12%-0.18% | BTC 1.4%, ETH 2% |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

We extensively tested Capital.com’s proprietary TradingView-powered web platform and found it clean and fast – genuinely helpful for beginners to learn to read charts and place orders.

We particularly like the ability to drag and drop TP and SL levels directly on the chart, which makes adjusting trades feel intuitive and visual.

Capital.com also excels at making risk and reward crystal clear before you place trades – we can instantly see our potential profit and loss, which helps us size positions confidently without second-guessing ourselves.

We’ve used one-click trading, price alerts, integrated news, and enough indicators and drawing tools to run basic intraday setups without feeling overwhelmed.

Beginner day traders will find it easier to grasp than MetaTrader 4, though it sacrifices some of the advanced customization available at brokers like IG.

We rely on the Capital.com mobile app for monitoring and light scalping. The layout matches the web version, our watchlists sync seamlessly, and we receive in-app notifications for price levels and news.

Order tickets work simply, though editing stops and targets on small screens feels fiddly when we trade very short timeframes.

We also appreciate Capital.com’s MT4 support, letting us tap into custom indicators, EAs, and external journals like TradeZella. Direct TradingView integration offers stronger charting and community ideas while routing orders through Capital.com.

This mix competes well with top CFD brokers, though there’s no MT5 yet, and advanced users might find the built-in tools somewhat thin.

Beginners may also prefer to learn the ropes at a broker that offers copy trading, trading signals, or actionable technical analysis provided by third-parties like Trading Central and Autochartist.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Web Platform, MT4, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Automated Trading | Expert Advisors (EAs) on MetaTrader | Capitalise.ai, TWS API | Expert Advisors (EAs) on MetaTrader |

| Copy Trading | No | No | No |

| VPS | No | No | Yes |

| Guaranteed Stop Loss | Yes | No | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

We’ve dug into Capital.com’s research tools and found them centered on in-house articles and videos – hundreds of them covering the impact of news on currencies and cryptocurrencies.

We’ve worked through the YouTube channel’s short explainers on strategies, market recaps, and beginner tips, updated weekly with real trading examples. What we appreciate is the straightforward approach without fluff – perfect for our quick pre-session prep.

We’ve used the built-in news feed pulling live headlines, economic calendars, and personalized Smart Feed alerts tailored to our watchlist for forex volatility and index moves.

There is a lack of third-party depth though, with no Reuters news integration, Autochartist, or Trading Central technical and sentiment analysis as we’ve seen at other brokers. On the plus side, the YouTube-hosted videos are genuinely helpful rather than sales-driven.

Against category leaders like FOREX.com or IG, we’d call Capital.com newbie-friendly but light on professional-grade research tools.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Research Rating | |||

| Autochartist | No | No | No |

| Trading Central | No | Yes | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Capital.com takes education more seriously than most CFD brokers – genuinely unusual in this space. We’ve navigated the Learn hub’s content split by level (beginners and experienced traders), which clearly explain trading ‘essentials’ including risk management that actually address drawdowns and realistic expectations, not just chart patterns.

Newbies should definitely work through structured series like ‘Getting to your first trade,’ as well as glossaries and quizzes, to build a solid foundation before executing your first trade.

As day traders, we’ve found the most value in strategy explainers, risk management pieces, and the excellent YouTube videos walking through timeframes, volatility, and position sizing in plain language.You can pair this with the demo account to practice what you’ve learned without risking real capital immediately.

On the downside, the content skews toward beginner-level strategies rather than advanced intraday ones.

Two resources mostly impressed us: the comprehensive Glossary, which provides quick, plain-English definitions for hundreds of terms, such as ‘AMM’ and ‘Hedging strategy,’ and the Investmate mobile app, which offers 30+ bite-sized courses, quizzes, and lessons with different learning paths based on your experience level and goals.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

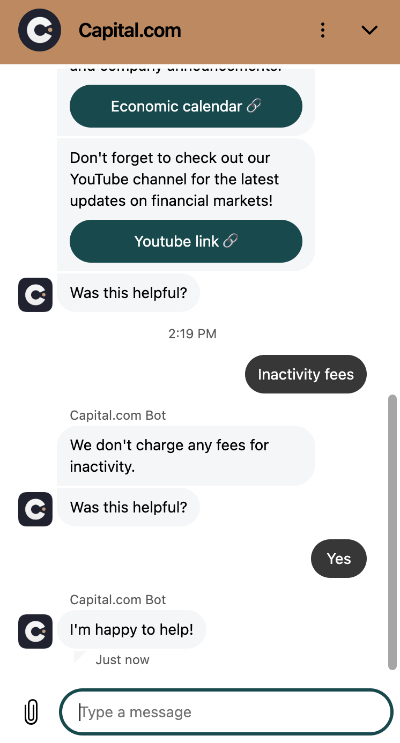

We’ve tested Capital.com’s support and found it very good. We accessed 24/7 coverage via live chat, email, phone, and in-app messaging – more than sufficient for most account or platform issues we encountered mid-session.

We’ve had to work through a chatbot first before reaching a real person, however, which slowed us down when markets were moving fast. On the plus side, support has resolved our fundamental issues quickly: login problems, KYC document queries, and ‘where’s this feature?’ questions.

There’s no true 24/7 dealing desk phone line, fewer local-language desks than the biggest brokers, and less robust escalation paths for serious trading issues, but it’s fine for most beginners and everyday traders.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Capital.com?

Capital.com works well for beginner day traders if you want a simple account structure, competitive spreads, fast execution, and CFD access without commissions or high funding requirements.

The proprietary platform is clean, with solid TradingView-powered charts and news feeds, education resources to build habits, plus a safer 1X option for newer traders. There’s also MT4 support for automated trading.

But it’s not for everyone. No MT5, raw spreads, high leverage, or third-party trading signals means scalpers or high-volume traders might prefer deeper tools.

Try the unlimited demo first. If your style fits retail CFDs, it’s an excellent option.

FAQs

Is Capital.com Legit Or A Scam?

Based on our assessment, Capital.com is legit, not a scam – regulated by top-tier bodies like the UK’s FCA, Cyprus’ CySEC, Australia’s ASIC, plus SCA and SCB offshore. Client funds stay segregated, with compensation up to £85k (FCA) or €20k (CySEC).

For day traders, it’s trustworthy if you verify your entity and stick to regulated regions. Test with demo first – scams don’t offer that transparency.

Is Capital.com Suitable For Beginners?

Capital.com suits beginners well with its unlimited demo account, low $20 minimum deposit, and simple web/app platforms that explain leverage and risk upfront.

Hundreds of free articles, videos, and step-by-step guides cover basics like first trades or candlesticks, plus negative balance protection caps losses at your deposit.

Sadly, there’s no hand-holding like Plus500’s more straightforward interface, or market-leading copy trading found at eToro – it’s more self-serve than some beginner brokers. But if you’re new and want to learn CFD day trading hands-on with a wide range of assets, Capital.com is an excellent place to start.

Best Alternatives to Capital.com

Compare Capital.com with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Capital.com Comparison Table

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 4 | 4.3 | 4.5 |

| Markets | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $20 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, ASIC, CySEC, SCA, SCB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | – | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | Web Platform, MT4, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 | 1:50 | 1:50 |

| Payment Methods | 8 | 6 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Capital.com and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Capital.com | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | No |

| Futures | Yes | Yes | Yes |

| Options | Yes | Yes | Yes |

| ETFs | Yes | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | Yes | Yes | No |

| Spreadbetting | Yes | No | No |

| Volatility Index | Yes | No | No |

Capital.com vs Other Brokers

Compare Capital.com with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Capital.com yet, will you be the first to help fellow traders decide if they should trade with Capital.com or not?