Trading GBP/JPY

Every day, investors from all over the world fire up their computers to start day trading the GBP/JPY, otherwise known as the ‘Beast,’ ‘Dragon’ or ‘Geppy.’ This page will look at the history of the GBP/JPY currency pair, as well as its benefits and risks, including notable volatility and liquidity. We then break down strategy, charts, technical analysis, trading hours, plus investing tips for 2026.

Best GBP/JPY Brokers

Our in-depth assessments have revealed the following 6 brokers as the best for trading GBP/JPY:

-

1

FOREX.com

FOREX.com -

2

IC Markets

IC Markets -

3

RoboForex

RoboForex -

4

XM

XM -

5

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

6

Fusion Markets

Fusion Markets

Here is a short summary of why we think each broker belongs in this top list:

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

| Currency Pairs | USD/CNH, EUR/CNH, AUD/CNH, CNH/JPY, EUR/AUD, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, GBP/ZAR, USD/HKD, USD/SGD, USD/THB |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CHF, USD/JPY, USD/CNH, EUR/AUD, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, USD/HKD, USD/SGD, USD/THB |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, USD/JPY |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

Cons

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

| Currency Pairs | USD/CHF, EUR/AUD, EUR/JPY, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, NZD/SGD, USD/HKD, USD/SGD |

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CHF, USD/JPY, USD/CNH, EUR/CNH, GBP/CNH, NZD/CNH, EUR/AUD, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/HUF, GBP/JPY, NZD/SGD, USD/HKD, USD/INR, USD/SGD, USD/THB |

Pros

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CHF, USD/CNH, EUR/AUD, EUR/JPY, EUR/SGD, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/HUF, GBP/JPY, GBP/ZAR, NZD/SGD, USD/HKD, USD/INR, USD/SGD, USD/THB |

Pros

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

Cons

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

- Traders outside of Australia must sign up with weakly regulated global entities with limited safeguards and no negative balance protection.

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

Chart

GBP/JPY Trading Explained

What does GBP/JPY mean? It is the relative value of the British pound against the value of the Japanese yen. Both are traded enough to qualify them amongst the top six global currencies. In the BIS 2022 Triennial Survey, the yen was on one side of about 17% of global FX trades and the pound about 13%, putting both among the six most traded currencies. The pair is considered a ‘cross.’ This means the US dollar is not used when calculating the exchange rate.

Why Day Trade GBP/JPY?

With so many currency pairs and trading vehicles available, including ETFs, futures, and options, why does the GBP/JPY warrant your attention?

- Volatility – It ensures plenty of opportunities for generating profit. The pair is highly volatile, typically moving around 150–180 pips per day on average, though this can vary a lot between market regimes.

- Carry trades – Historically, UK interest rates have generally been higher than Japan’s, so GBP has often yielded more than JPY and GBP/JPY has been a popular carry-trade pair (borrowing yen to buy pounds).

- Risk tracking – When world economies look good, stocks and commodities rise while bonds fall. When things go the other way, the situation reverses. Those with an appetite and aversion to risk can utilize macro-economic sentiment to profit from market dynamics. GBP/JPY often tracks global risk sentiment, tending to move in the same direction as major stock indices and some commodities, though these correlations can change over time.

- Availability of resources – Real-time trading today is more accessible than ever before. You have direct access to graphs, candlestick charts, and amazing indicators. For example, conducting Elliott wave analysis is more straightforward. In addition, you can access knowledge-rich trading communities like forums and trading analysis blogs.

Drawbacks & Risks

Downsides to day trading GBP/JPY include:

- Amplified losses – Daily trends can be strong; you often need to set wider stop losses. Otherwise, you could experience significant losses. The UK’s Financial Conduct Authority classifies CFDs and rolling-spot forex as high-risk investments because leverage can magnify losses as well as gains.

- Volatility – As one of the most volatile currency pairs, false signals are frequent. Traders can lose money and learn painful lessons. It isn’t nicknamed the ‘widow maker’ for no reason.

- Experience required – Although the promise of pips attracts beginners, many traders suggest that novice investors stay clear. Volatile moves in a consolidation phase are just one straightforward way you can be taken out.

- Automated competition – You must compete against sophisticated trading algorithms and expert advisors. As a result, how to trade successfully is no longer clear. You need more than historical charts, average daily ranges, and forecast analysis. The best indicator for the GBP/JPY pair may no longer be enough.

Influences on Movement

Energy Commodities

The relationship between the Japanese yen and energy pricing can have a significant impact on investing. Japan buys crude oil and natural gas to satisfy domestic energy requirements. Japan is one of the world’s largest energy importers – for example, in 2019 it was the fourth-largest crude oil importer and the largest importer of liquefied natural gas.

There is an important link between energy prices and the Japanese yen: as a major energy importer, Japan often sees its currency weaken when oil and gas prices rise and strengthen when they fall, though this relationship is not perfectly stable.

Other Factors

- News – Favourable or negative events about the GBP, JPY, or their respective countries

- Indices – The UK’s FTSE 100 and Japan’s Nikkei 225 stock market index can also lead to strengthening and weakening

- Market sentiment – The market’s overall emotions and thoughts about each currency are reflected in the price of the GBP/JPY

- Currencies – The US dollar and euro, in particular, will impact the GBP/JPY. Currency pairs do not move independently of each other

- Governments – Major political elections and decisions impact the strength of respective currencies

- Bonds – Gilt (debt securities issued by the BoE) and GJGB10 (Japan Generic Govt 10Y Yield) will influence the relationship of the highly volatile pair

- Bank of England (BoE) – This central bank and lender of last resort oversees monetary policy and interest rates. Its actions significantly affect the pound and the British economy as a whole

- Bank of Japan (BoJ) – The BoJ has been applying extremely low-interest rates for years, as reflected in its monetary policy statements, impacting the strength of the Japanese yen vs. the British pound. Day traders should monitor the Consumer Price Index (CPI), a key indicator of JPY-related currency crosses

Investors can feel wars and natural disasters in the GBP/JPY relationship. The savvy day trader won’t just focus on charts from Yahoo and historical data. They will keep track of multiple global factors using various sources.

Currency Correlations

Foreign exchange currencies do not move independently of each other. Because they are traded in pairs, their movements are tied to the movements of other pairs.

For example, if you are trading the GBP/JPY, you are handling a derivative of the GBP/USD and USD/JPY pairs. This means that GBP/JPY is related to either or both of the other pairs. The problem is that they can move with each other and in opposite directions. Plus, their correlation can change.

- Positive correlation – Occurs when pairs react in line with each other. GBP/USD, AUD/USD, and EUR/USD, the three most commonly traded pairs, are all positively correlated. That is because USD is the counter currency, and any change will impact all pairs

- Negative correlation – Takes place when currency pairs move in the opposite direction. USD/CHF, USD/JPY, and USD/CAD are excellent examples. This happens because the US dollar is the base currency

Correlation is a statistical measure ranging from -1 to +1. The former is when currency pairs move in opposite directions, and the latter is when they move together.

Calculation

The best way to understand how this knowledge can assist you in day trading the GBP/JPY is to be the correlation calculator yourself. All you need is an Excel spreadsheet:

- Input price data from your currency pairs, GBP/JPY, for example

- Create two columns, one for each pair

- Fill the columns with the past daily prices over the period you are interested in

- Type =CORREL in an empty box at the bottom

- Highlight all the data in a column, and you will get a range of cells in the formula box. Type in a comma

- Now repeat steps 3 to 5 for the other currency

- Close the formula. It will then look like =CORREL (A1: A25, B1: B25)

The final figure is the correlation between the two currency pairs.

GBP/JPY Day Trading Strategy

Timing

Whether you opt for a breakout or scalping strategy, timing is essential. So, when is the best time to trade GBP/JPY? You want to focus your trading around key economic releases at 01:30, 02:00, 08:30, and 10:00 EST. Also, consider the Asian European overlap, which runs from 00:00 to 03:00 EST. This is when you will see the most liquidity for the Japanese yen, plus the European yen crosses.

Breakout Strategies

The volatility of the GBP/JPY means the pair can trade wide swings in either direction, making trading breakouts an appealing technique. You can capitalize on profits when big swings are correct and minimize losses when they move against you. A top tip is to regularly monitor your support and/or resistance lines and levels because the volatility can cause severe fluctuations in a short time frame.

20 Pips GBP/JPY Scalping Strategy

This method is straightforward. You use 5-minute time frames and free GBP/JPY signals. You will also need 25 exponential moving averages (EMAs) on the indicator front.

When the price is above 25 EMA, you are seeing an uptrend. When the price is below 25 EMA, it is considered a downtrend. The angle of the trend is essential. A relatively horizontal angle means the market is ranging. There is a solid trend if the angle is around 30 degrees or higher.

Buy Setup

- Moving average angle is 30 degrees or more

- The price has to move above the 25 EMA line

- Your buy signal is a bullish pin bar. So, buy at market price once the bullish pin bar closes

- Place your stop loss at least 10 pips under the low of the pin bar

- Your profit target will be 20 pips

Sell Setup

- Look for a moving average angle of 30 degrees or above

- Price should be moving below the 25 EMA line

- This time it is a bearish pin bar that is your sell signal. You should sell at the market price once the bearish pin bar closes

- Again, opt for a stop loss of 10 pips above the high of the pin bar

- The profit target is also 20 pips

Because the range of the GBP/JPY can be anywhere from 150-200 pips a day, there is ample scalping opportunity. However, be warned, this system may underperform in ranging, non-trending markets.

Trade Size

Whatever your strategy, the GBP/JPY can turn bullish or bearish quickly. You must set stop losses wide, with small lot sizes. You may even want to consider cutting your trade size to around a third. This allows you to aim for higher targets and reduce potential losses in a volatile currency pair.

Summing Up Strategy

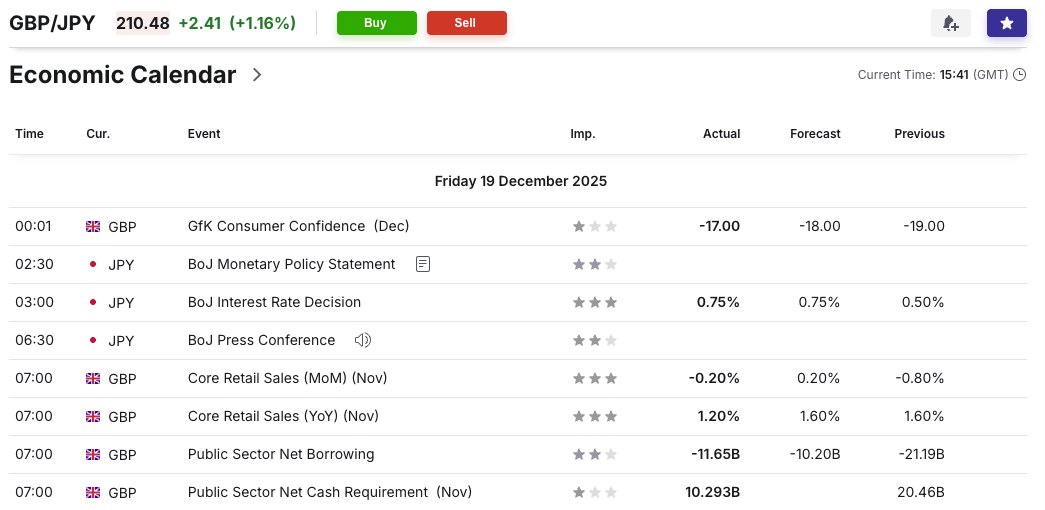

One person’s best GBP/JPY strategy may not generate consistent profits for another investor. The trick is finding a strategy that complements your trading style. Some focus on bar charts and daily pivot points, while others prefer economic calendars and news events.

For more guidance, see our strategy page.

History

Early History

The British pound is thought to be the oldest currency in the world still in use, and the Bank of England’s history highlights its role over more than 300 years. A turning point came in 1940 when the British government pegged sterling to the US dollar at £1 = $4.03. A few years later, the 1944 Bretton Woods agreement formalised a wider fixed-exchange-rate system that governed post-war currency relations until the early 1970s.

The Japanese yen, which means ‘circle’ or ’round object,’ is much younger than its British pound counterpart. The Meiji government introduced it in 1871 to replace the unstable Edo period, where no standard currency exchange existed. However, the yen lost its value during World War II. From 1949 to 1971, the yen was pegged at ¥360 per US dollar under the Bretton Woods system.

Global Credit Crunch

A critical period in the currency pair’s relationship was the global financial crisis of 2008. Between 2007 and 2009, the pound was clearly under pressure. In response to this, it weakened against the yen. GBP/JPY traded from a high of 250.13 to a low of 121.21, a staggering decline of over 50%.

Brexit

The Brexit decision of 2016 also had far-reaching implications. Although the repercussions were felt for less time than the crunch of 2008, volatility was still substantial. In June 2016, the GBP/JPY traded from a high of 160.66 to a low of 133.31.

However, the all-time records for this currency pair weren’t during these periods. Instead, they were:

- All-time high – This was 1014.000 on 1st of January, 1963

- All-time low – 116.853 was recorded on the 19th of September 2011

Role of the Great British Pound

Before you start focussing on your GBP/JPY trading signals and system, it helps to have some context about the role these two currencies play.

Although the UK is relatively small in size, its economy is one of the largest in the world. It plays a leading role in international financial markets. London is thought of as the forex trading capital of the world.

The UK was at one time the global superpower, with the largest economy on the planet for over one hundred years. The British pound was considered the world’s unofficial reserve currency. However, the world wars sparked a decline. Stringent government regulations and restricted labor markets further impacted the economy.

The economy has since stabilized partially due to the UK’s role as a key global player in financial services.

Role of the Japanese Yen

Japan is one of the biggest economies in the world, boasting one of the highest GDPs, plus it is a huge exporter. However, it has had a challenging few decades. Low fertility rates and an ageing workforce have also made taxation and consumption a constant battle.

Despite troubles, their workforce is well-educated, and while industries such as shipbuilding have moved to China and South Korea, Japan remains a leading manufacturer of electronics and technological components. Japan is now heavily reliant on China as a trade partner.

The main driving forces are interest rates and price action. However, there are other economic data releases that traders should keep an eye out for:

- GDP data

- Retail sales

- Inflation data

- Trade balances

- Industrial production

- Employment rates

- Central bank policies

For the UK, official economic releases from the Office for National Statistics provide GDP, inflation, employment and other key indicators referenced above. For Japan, traders can refer to the Cabinet Office’s economic statistics and business surveys for indicators such as GDP, business conditions and consumer confidence.

Google Finance, Yahoo Finance, Bloomberg, and Reuters are also good GBP/JPY news resources. For truly yen-specific information, the Tankan survey is particularly useful. This is published quarterly online by the BoJ.

Final Word on GBP/JPY Day Trading

The GBP/JPY is thought of as a gauge for global economic health, as it reflects issues affecting both Western Europe’s monetary policies and those in the Asia-Pacific region. Phenomenal volatility and wide trading ranges attract vast numbers of day traders.

Success will be no easy challenge when you open up your live forex chart. You will need an understanding of how and what influences each currency and economy, fundamental analysis, charts, patterns, and the news to spot potential opportunities. Only then can you begin your journey to join the likes of famous forex traders, Ed Seykota and Richard Dennis.

For more guidance, see our forex day trading page.

FAQ

What Does GBP/JPY Mean?

GBP stands for the Great British pound and JPY for Japanese yen. GBP/JPY is the forex exchange pair that these two currencies generate. With it, you can speculate on the price movement between GBP and JPY.

Is GBP/JPY A Good Pair To Trade?

The pair is highly volatile and suitable for investors who can manage such conditions. Volatility is great for day or short-term trading as it offers plenty of opportunities to take advantage of the price fluctuations.

What Is The Best Time To Trade GBP/JPY?

GBP/JPY moves the most when the London and the Japanese markets are open at the same time, between 03:00 and 04:00 EST. This creates liquidity and substantial price movements.

Why Is The GBP/JPY Highly Volatile?

Both GBP and JPY are highly volatile currencies; when combined, this results in an exciting pairing. GBP/JPY is also tied to distinct types of economies, which creates big up and down swings in price. The pair also has ample liquidity due to its popularity.

What Affects GBP/JPY?

Japan is a big importer of crude oil and natural gas, with the IEA noting its heavy reliance on imported fossil fuels, so JPY is highly dependent on the cost of energy. The UK is one of the most influential economies in the world. Its policies often have a knock-on effect on regional and international markets.