ActivTrades Review 2025

Awards

- Safest Global Broker 2023 - International Investor Magazine

- Best Online Trading Services 2023 - ADVFN International Financial Awards

- Best Forex Broker Europe 2022 - Forex-Awards.com

- Most Trusted Global FX Broker 2022 - International Investor Magazine

- Best CFD Broker 2021 - Rankia

- Safest Global Broker 2021 - International Investor Award Winners

- Best FX Broker 2021 - Le Fonti Award

Pros

- With execution speeds averaging just 4ms, an order fulfilment rate of 93.6%, and no restrictions on short-term strategies, ActivTrades offers an excellent environment for fast-paced strategies like day trading.

- Although cTrader isn’t supported, MT4, MT5, TradingView and the broker’s ActivTrader cater to diverse trading needs, with the firm’s web-accessible platform hitting the mark for beginners during testing with a slick look and feel.

- ActivTrades offers tight spreads, particularly for forex trading with spreads starting from 0.5 pips on major currency pairs without additional commissions. The €/£10 inactivity fee doesn’t kick in for 52 weeks either, so it doesn’t penalize active traders.

Cons

- ActivTrades still has some way to go to match firms like XTB and CMC Markets in the education department, with some well-presented, informative webinars but limited courses and quizzes for a more comprehensive and engaging learning journey.

- Its research tools are good but not great, with a growing ‘Analysis’ hub but no Trading Central or Autochartist for advanced technical summaries which could help aspiring traders identify opportunities in fast-moving markets.

- There are no copy trading or social trading features, which is a drawback for traders seeking passive investment opportunities or the ability to mimic the trades of more experienced traders, especially compared to eToro and Vantage.

ActivTrades Review

Regulation & Trust

4 / 5ActivTrades has earned our trust thanks to its mostly robust regulatory credentials:

- ActivTrades is regulated by the FCA in the UK – a ‘green tier’ body in DayTrading.com’s Regulation & Trust Rating, ensuring client funds are segregated from the company’s, offering negative balance protection so you can’t lose more than your total deposits, and covering up to £85,000 through the FSCS in case of broker insolvency. Additionally, ActivTrades provides an enhanced insurance policy of up to £1 million for UK clients – an industry-leading initiative that’s great for high-volume traders.

- ActivTrades is registered with the CMVM in Portugal and CSSF in Luxembourg, other ‘green tier’ bodies, and complies with the EU’s MiFID II, promoting financial stability and client protection across Europe.

- For non-UK and EU clients, ActivTrades is regulated by the SCB in The Bahamas, though this oversight is less stringent, offering minimal investor protection, resulting in a ‘red tier’ rating.

One downside is that, unlike Plus500 and IG, ActivTrades is not publicly traded. This means it doesn’t disclose its financial information, often reducing transparency compared to listed brokerages.

| ActivTrades | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, CMVM, CSSF, SCB | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.5 / 5Live Accounts

ActivTrades offers four main account types which cater to the full spectrum of active traders:

- Individual: This standard retail account is ideal for most traders. It offers competitive spreads from 0.5 pips and access to a wide range of markets. Leverage is capped in line with regulatory restrictions (typically 1:30 for forex) and full retail protections like negative balance protection and segregated funds are provided.

- Professional: This account is for more experienced traders who meet specific criteria, such as a sufficient trading volume or portfolio size. Professional account holders benefit from higher leverage (up to 1:400), reduced stop-out level, and a dedicated account manager.

- Islamic: This account operates without overnight swap charges and is suitable for those who wish to trade in compliance with Islamic finance principles. The account provides access to the same markets as other accounts but adjusts fee structures to maintain fairness without interest.

- Spread betting (UK only): The spread betting account lets traders speculate on price movements without owning the underlying asset. The key advantage of spread betting is that profits are tax-free for UK residents (no capital gains or stamp duty).

I found the account registration process at ActivTrades straightforward but it could be improved with social login options for added convenience.Additionally, implementing two-factor authentication would enhance security and ensure greater peace of mind.

Demo Accounts

ActivTrades offers demo accounts for CFD trading and spread betting, which are ideal resources for practising trading without risking real money.

The demo accounts take just a few minutes to set up. You can then trade under actual market conditions with €/ƒ

£10,000 virtual funds and a choice of leverage ratios, which is invaluable for beginners looking to understand how market movements can impact trading outcomes.

Deposits & Withdrawals

Funding and withdrawing options at ActivTrades are fast, convenient, and low-cost (now there’s no minimum deposit), albeit slightly restrictive compared to other brokers.

There is a flexible choice of base accounts (EUR, GBP, USD, and CHF), which can help reduce trading costs due to conversion fees. By comparison, eToro only lets you deposit, hold, and fund trades in GBP or USD.

I’ve found the deposit and withdrawal process at ActivTrades straightforward and convenient.I deposited funds through a bank transfer, which took a few days to reflect in my account. I also used my Visa debit card (Mastercard supported too) for quicker transactions, which were processed instantly.

To test different options, I also tried Skrill and Neteller e-wallets, which have allowed for immediate deposits with faster withdrawals than bank transfers.

Due to UK FCA regulations, cryptocurrency deposits and withdrawals are not supported.

While deposits were free, some withdrawal methods, like certain bank transfers, charge small fees. Generally, I use debit cards to keep costs to a minimum.

| ActivTrades | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | AstroPay, Credit Card, Debit Card, Mastercard, Neteller, PayPal, Skrill, Sofort, Visa, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $0 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.5 / 5ActivTrades offers an impressive range of assets and worldwide markets:

- There are 50 currency pairs, including major (e.g., EUR/USD), minor (e.g., GBP/AUD), and exotic pairs (e.g., USD/CNH).

- There are 20+ commodities, including gold, silver, and natural gas, which offer good opportunities for diversification.

- There are 19 major global indices, such as the FTSE 100 and S&P 500.

- There are around 1,000 stock CFDs, including big companies across markets in the US, UK, and Europe, including BP, Airbus, and Meta.

- Bonds and ETFs, equally accessible by country, are other asset classes that aren’t available from many competing brokers.

ActivTrades offers a solid selection of assets, but depending on your specific needs, other brokers might prove more suitable.

For instance, cryptocurrency enthusiasts may prefer Eightcap’s extensive crypto offering, while currency traders could find CMC Markets’ vast selection of 300+ FX pairs more appealing. BlackBull, meanwhile, caters to a wide range of traders with a comprehensive suite of over 26,000 instruments.

| ActivTrades | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (UK and EU), 1:400 (Global & Pro) | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.5 / 5ActivTrades’ trading fees are generally competitive, especially for specific markets like forex and indices.

All fees are built into the spread, eliminating the need for separate commissions. For example, the EUR/USD spread has a target of 0.5 pips but typically fluctuates around 1 pip. For other assets like commodities and ETFs, spreads tend to be favorable (around 1.5 pips) compared to industry standards.

Depositing funds is free, although bank transfers might incur a small fee, while methods like debit cards or e-wallets are not.

However, ActivTrades does impose a currency conversion fee of 0.3% when converting profits or losses from trading instruments denominated in a currency other than your account’s base currency.

Another area to watch for is inactivity fees. A monthly fee of €/£10 is imposed on an account with a positive balance that has not been used for more than 52 weeks. This shouldn’t be a problem for active day traders.

| ActivTrades | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.5 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 0.6 | 100 | 0.005% (£1 Min) |

| Oil Spread | 0.03 | 0.1 | 0.25-0.85 |

| Stock Spread | Variable | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

4 / 5ActivTrades provides access to four main platforms – its proprietary ActivTrader, MT4, MT5, and TradingView.

Each platform caters to different trading needs and preferences. However, I am hugely disappointed by the lack of support for cTrader, my go-to trading platform.

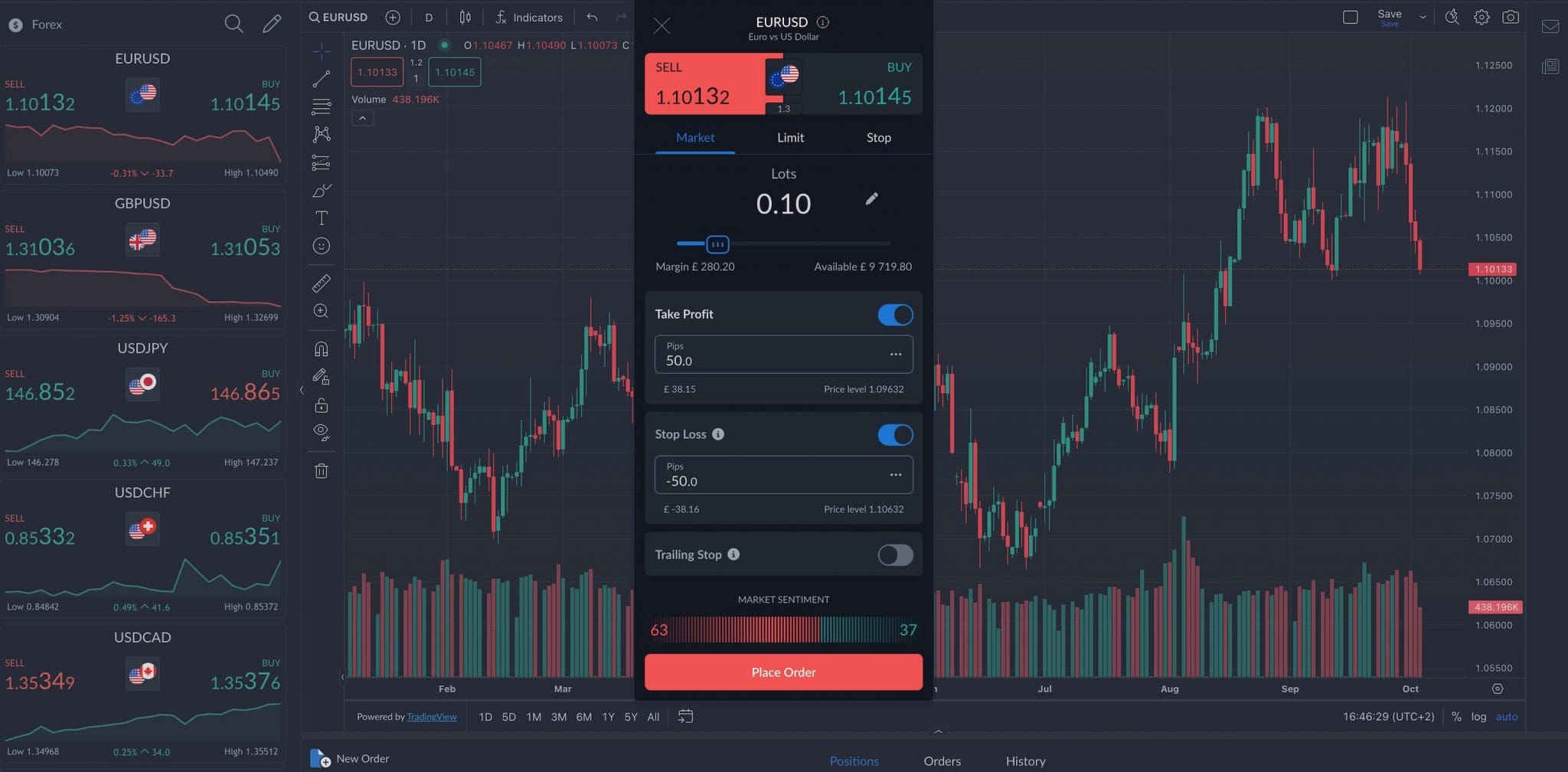

I primarily used ActivTrader during testing because it’s unique to ActivTrades. It’s also web-based (a mobile app is available too), which I prefer to the hassles associated with desktop software. It is easy to use and has a super clean interface.

Although powered by TradingView, ActivTrader puts its spin on it. There are 16 chart types (including Renko) with nine timeframes for technical analysis (100+ technical indicators included), market sentiment, one-click trading, position tracking, and trailing stop.

Still, it lacks the powerful screeners, community scripts, and social elements of the standalone TradingView app. Nonetheless, ActivTrader feels modern and responsive, even if it’s best suited to casual traders.

Switching to MT4 (desktop and mobile), I’ve been able to explore its extensive community support and automated trading features. MT4 is known for its powerful EAs, which let you automate your strategies.

The platform provides various indicators and charting tools, which help with technical analysis for short-term traders. Many will also like the familiarity of MT4, as it is widely used in the trading world.

Move to MT5 for more advanced functionalities. MT5 offers additional order types, a more detailed economic calendar, and deeper market insights. It feels like an upgrade from MT4, especially with the ability to trade more asset classes and access better data feeds.

ActivTrades also integrates with TradingView, the widely-used social network and charting tool. This integration lets you conduct in-depth technical analysis with TradingView’s advanced charts and hundreds of indicators while executing trades through your ActivTrades account.

| ActivTrades | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | ActivTrades, MT4, MT5, TradingView | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

2.5 / 5ActivTrades provides several research tools that can be helpful for beginner traders looking to improve their market analysis and decision-making skills.

The key feature I’ve found useful is the ‘Analysis’ section on its website, which offers regular reports on market trends, news, and economic events. This section breaks down complex financial data into digestible insights, making it easier for beginners to understand market movements.

An economic calendar also highlights key economic events, such as central bank meetings or employment reports. This can help you stay on top of important events that could impact market volatility.

Unfortunately, there is no technical analysis from Trading Central or Autochartist. Both are available on many other broker’s platforms, such as IG and FOREX.com, and provide insightful information regarding potential trade setups.

| ActivTrades | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

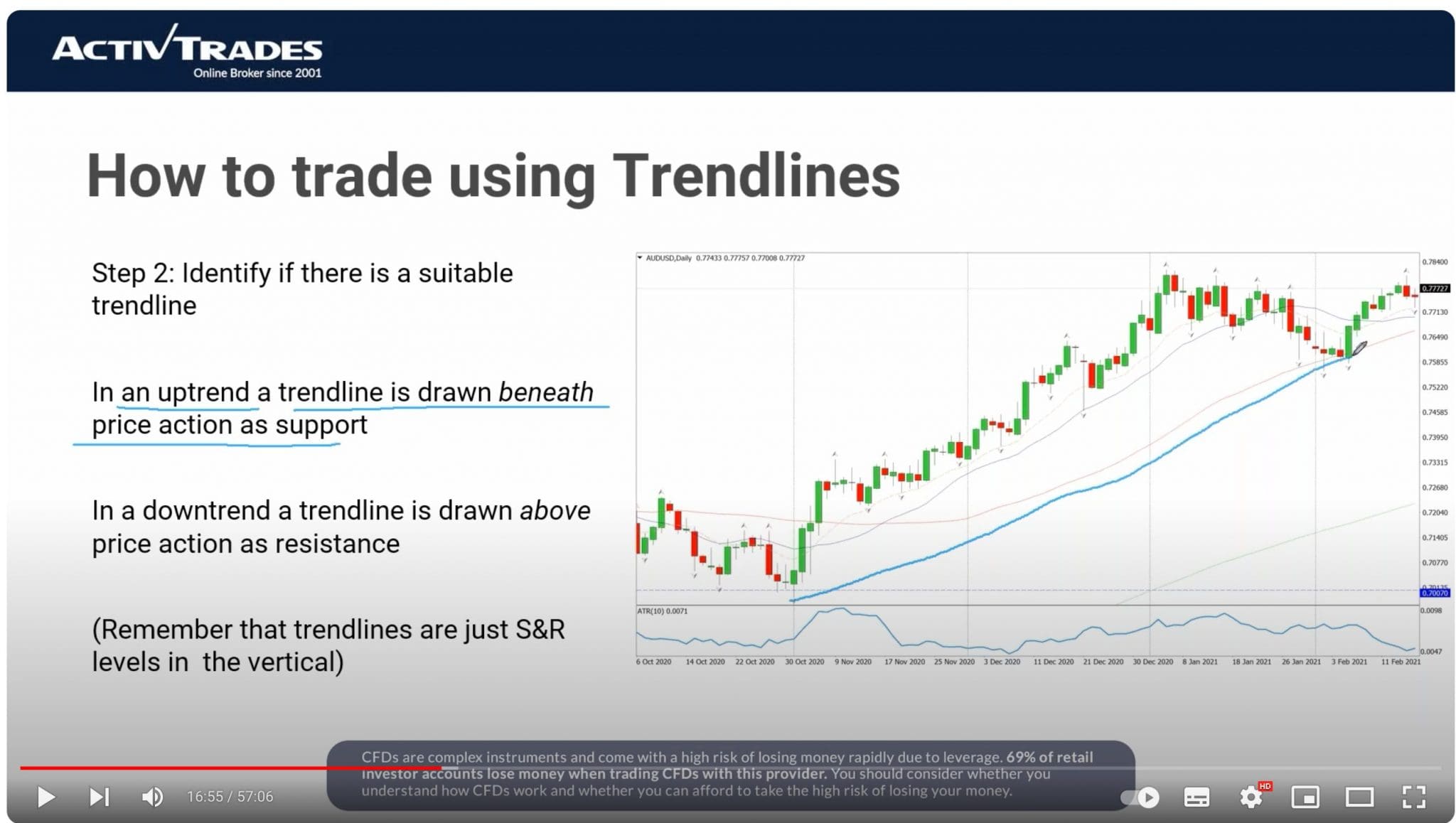

3.5 / 5ActivTrades principally deliver webinars to help new traders get started, replacing the ‘traditional’ written course approach.

I’ve participated in several live webinars covering topics ranging from basic trading principles to more advanced technical analysis. These webinars, led by experienced traders, are a great way to learn in real-time. Previous webinars can also be accessed on ActivTrades’ YouTube channel.

Traders who prefer to read educational content may be disappointed by the lack of courses or a trading blog, which many other brokers deliver to share in-depth articles on market trends, economic events, and trading tips. There’s also no FAQ glossary to get newbies up to speed on trading jargon.

ActivTrades could benefit from benchmarking itself against leading brokers like CMC Markets and XTB. Investing in comprehensive educational resources can better equip new traders with essential knowledge in trading fundamentals, risk management, and market analysis.

| ActivTrades | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

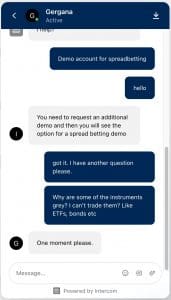

If you encounter issues while trading with ActivTrades, its customer support is responsive and helpful.

There are several ways to get in touch – live chat, email, phone, and a detailed FAQ – and I tested them all to see how quickly my inquiries are handled.

I mostly used live chat, which is available directly from the client dashboard and the ActivTrader platform. It is fast, and I am usually connected to an agent within a few minutes. The representatives were knowledgeable and were helpful in resolving my issue regarding selecting trading instruments clearly and concisely.

I have also tried reaching out via email, and while the response time was a bit longer – usually within a few hours – the support I have received has been thorough. ActivTrades also followed up to ensure my issue was resolved, which I appreciated.

On one occasion, I needed more immediate help and opted to call their phone support. I found it helpful that they had a multilingual team, which made communication smooth.

The representative I spoke with was patient, and they guided me step-by-step through my issue, which involved funding a withdrawal request. If I could only talk at a particular time, I could have also requested a callback service from 08:00 to 18:00 (CET).

ActivTrades doesn’t have an FAQ section on its website, but I found answers to many generic subjects (account deposits, withdrawals, and commissions etc) within the live chat widget. This widget helps address more straightforward issues without needing to contact support.

| ActivTrades | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With ActivTrades?

ActivTrades is a hassle-free, low-cost option for both beginners and casual traders. Beginners will find the ActivTrader platform user-friendly, especially the demo account and supporting educational webinars, and the customer support is excellent.

For experienced traders, ActivTrades offers powerful platforms like MT4/5 and advanced tools for technical analysis and automated trading.

Furthermore, the integration with TradingView and access to a growing range of markets make it an appealing option for seasoned traders seeking flexibility and low trading costs.

FAQ

Is ActivTrades Legit Or A Scam?

ActivTrades’s regulatory credentials and commitment to client protection instil a strong sense of security.

The broker has also been in business since 2001, and now has over 15,000 clients, with its long-standing presence in the industry indicating its legitimacy. A scam broker would unlikely survive for over two decades under constant regulatory scrutiny.

Furthermore, the broker advertises that multinational accounting giant PwC audits it.

Is ActivTrades A Regulated Broker?

ActivTrades is primarily regulated by the FCA in the UK, which is recognized for its stringent regulatory framework and high client protection standards.

Additionally, ActivTrades is registered with the CVMV in Portugal and CSSF in Luxembourg for its European operations, and the SCB in the Bahamas for its international operations, although the SCB provides less oversight and compliance with little to no investor protection available.

Is ActivTrades Suitable For Beginners?

ActivTrades is suitable for beginners due to its user-friendly platform, ActivTrader. This platform offers an intuitive interface that makes navigation easy for new traders.

The broker also provides various educational resources, including webinars and tutorials, to help beginners build their trading knowledge.

Importantly, ActivTrades offers a demo account, allowing traders to practice trading without risking real money, which is essential for gaining confidence.

With responsive customer support available to assist with questions, ActivTrades creates a supportive environment for novice traders.

Does ActivTrades Offer Low Fees?

Fees are competitive as ActivTrades primarily uses a spread-based pricing model, with no commissions. Spreads are generally tight, especially for major currency pairs, but vary depending on the instrument.

ActivTrades does not charge deposit and withdrawal fees, making it a cost-effective trading environment for traders looking to minimize expenses.

Scalpers and high-frequency traders looking for a zero-spread account will be left wanting, however.

Top 3 Alternatives to ActivTrades

Compare ActivTrades with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

ActivTrades Comparison Table

| ActivTrades | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Futures, Cryptos (location dependent) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, CMVM, CSSF, SCB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | Cashback on Trades | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | ActivTrades, MT4, MT5, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 (UK and EU), 1:400 (Global & Pro) | 1:50 | 1:200 | 1:50 |

| Payment Methods | 10 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by ActivTrades and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ActivTrades | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | Yes | No | Yes | No |

ActivTrades vs Other Brokers

Compare ActivTrades with any other broker by selecting the other broker below.

The most popular ActivTrades comparisons:

- ActivTrades vs IC Markets

- Plus500 vs ActivTrades

- ActivTrades vs LQDFX

- ActivTrades vs XTB

- ActivTrades vs FOREX.com

- Exness vs ActivTrades

- Vantage vs ActivTrades

- ActivTrades vs FP Markets

- ActivTrades vs BDSwiss

Customer Reviews

4.8 / 5This average customer rating is based on 18 ActivTrades customer reviews submitted by our visitors.

If you have traded with ActivTrades we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of ActivTrades

Article Sources

- ActivTrader.com

- Activtrades Plc - FCA License

- ActivMarkets - CVMV License

- ActivTrades Europe S.A - CSSF License

- ActivTrades Corp. - SCB License

- ActivTrades YouTube Channel

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I want to say that I’m trading via an individual account and the trading conditions suit my trading strategy.

I like their trading services just because they are comprehensive and clear for me as for a noob in trading.

Navigation on the website left no questions, I quickly understood how to register an account, verify it so everything was simple as 1,2,3.

Registration took some time because they do demand lots of personal information to make sure that you aren’t an intruder, cheater, scammer, but it only evidences their care about safety of the trading environment.

All in all, I am happy to work with them. Trading conditions are transparent, leverage is dynamic and can be both big and small. Cool!

Countless traders including some of my mates like to do their analysis on tradingview and then open the trades on some terminals. Making your platform powered by tradingview is just real smart, kudos for these guys for making our lifes easy. All the features I need is here starting from just a basic interface, I used to this platform and dont plan to change it. Fast executions and all the intruments one needs to feel comfortable trading, all is well

This is the second brokerage company that I have been trading with. This time I decided to choose a reputable one, and from what I could learn from reviews and other articles available online, ActivTrades is considered as one of the most trusted brokers. Their reputation is impressive.

Also, I like that they have made it simple – there are two main account types: the individual and the professional one. As a new trader, I could immediately see which one would be a better fit for me.

To all the beginners like me who are about to start their trading journey and searching for a platform to open their first real trading account, this is for you.

As it is already widely known, our broker needs to be regulated, reliable, trustworthy and also to have attractive trading terms. ActivTrades passed everything with flying colours.

They have an extraordinary reputation as one of the most reliable brokers. I was impressed to see how many of their clients gave the highest rating.

Also, they offer high-quality educational resources, including webinars.

Great place to start trading 👍

Hm… I heard of this brokerage platform as the one which is the most secure, advanced and convenient. Many people share their feedback so I decided to share mine one too.

I work with this broker for several months, trade major currency pairs and sometimes catch nice deals on shares. Leverage is dynamic which is awesome, it helps to control risks more properly.

MT also works correctly.

Traded eur/usd with tight spreads and made some first profits in my life. Profits are cool ! I am satisfied ))

The individual account type, which is actually the most common option for us retail traders, is better than I initially thought.

I like the fact that the trading costs are low. Not only that there are no trading commissions, of course except for the overnight fees, and the spreads are pretty tight too. Better than I expected.

There is a table about the spreads and swaps on their website, so everyone can see what the costs of trading are. I can confirm that the table is accurate, and these are the spreads you will see on a real trading account.

It’s cool that you can either contact client support which replies in 2 minutes typically or just search need infor in the help center not wandering around the site for a long time.

It’s valuable.

The time has come for me to open my first real trading account and according to what I have learned so far, I needed to choose a regulated broker and broker with an excellent reputation.

I read tons of customer reviews about ActivTrades, and it seems like this platform has a great customer satisfaction score. I couldn’t find any complaints from clients regarding the broker’s misdoing.

This is the reason why I decided to start trading with ActivTrades.