How to Generate Synergy in a Portfolio

Trading is like other businesses where you can achieve better results if you can achieve synergy.

Synergy refers to using various parts of a portfolio in ways that help support and reinforce the other.

We talked in separate articles about how having differentiated, uncorrelated returns streams in a portfolio and balancing and blending them well improves your returns relative to your risks better than practically anything else you can do.

- The Math Behind Portfolio Diversification

- How to Balance Risk to Achieve More Return Per Each Unit of Risk

- Building a Balanced Portfolio with Options

- Building a Balanced Portfolio with VRP Overlay

When a company ventures into new products or services either by buying other companies or building them itself, it usually does so because it believes it’ll have synergy with what it does currently.

For example, Apple built computers. Then it started building other electronic devices. Then came along the iPhone. Then the iPad tablet, which was much like the iPhone in various ways but came with a larger screen.

And they’ve used their hardware lines (iPhone, Mac, iPad) to build a services business that takes advantage of that ecosystem.

Everything helps reinforce the other.

In trading, a big focus is on what to buy or what strategies to pursue.

But there’s less focus on thinking of a portfolio more holistically.

Let’s use an example of how to achieve synergy within a more macro-focused portfolio.

Portfolio example

Let’s say a trader had the following portfolio:

- Long stocks

- Short bonds

- Long a basket of commodities

- Covered puts on oil

Correlations of stocks, bonds, commodities, oil

Let’s take a look at the historical correlations between these various parts of a portfolio.

It’s important to note that historical correlations should not be relied on. They are just fleeting byproducts of the economic environments we’ve been in.

When we say that stocks and bonds have traditionally had a negative correlation and stocks and commodities have had a positive correlation, that is largely the product of being in an environment where growth surprises were more common than inflation surprises.

In the case where the reverse is true – i.e., inflation surprises being more common than growth surprises – the opposite can hold.

It’s possible in such environments for stocks and bonds to have a positive correlation and stocks and commodities to have a negative correlation because of the respective biases of each asset class:

- Stocks = best in a rising growth, falling/neutral inflation environment

- Bonds = best in a falling growth, falling inflation environment

- Commodities = best in a rising growth, rising/neutral inflation environment

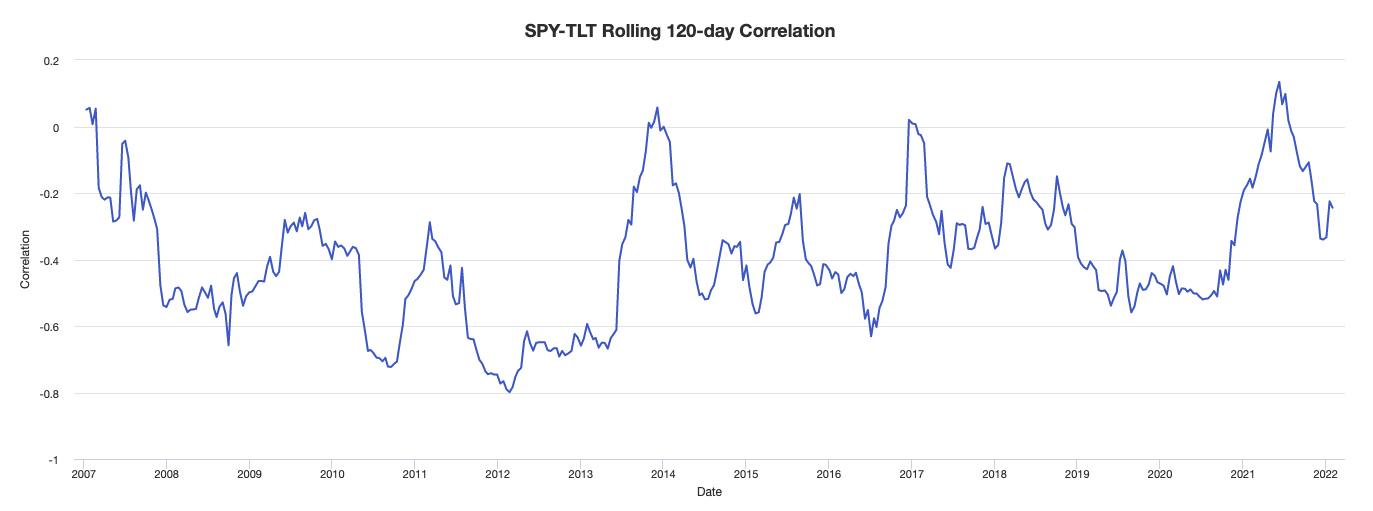

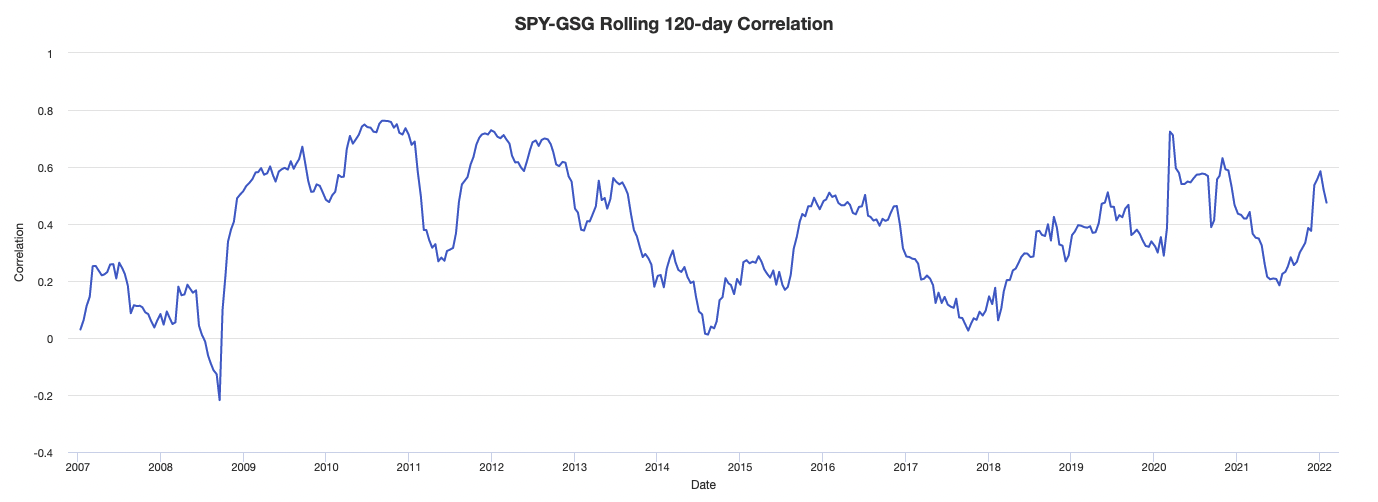

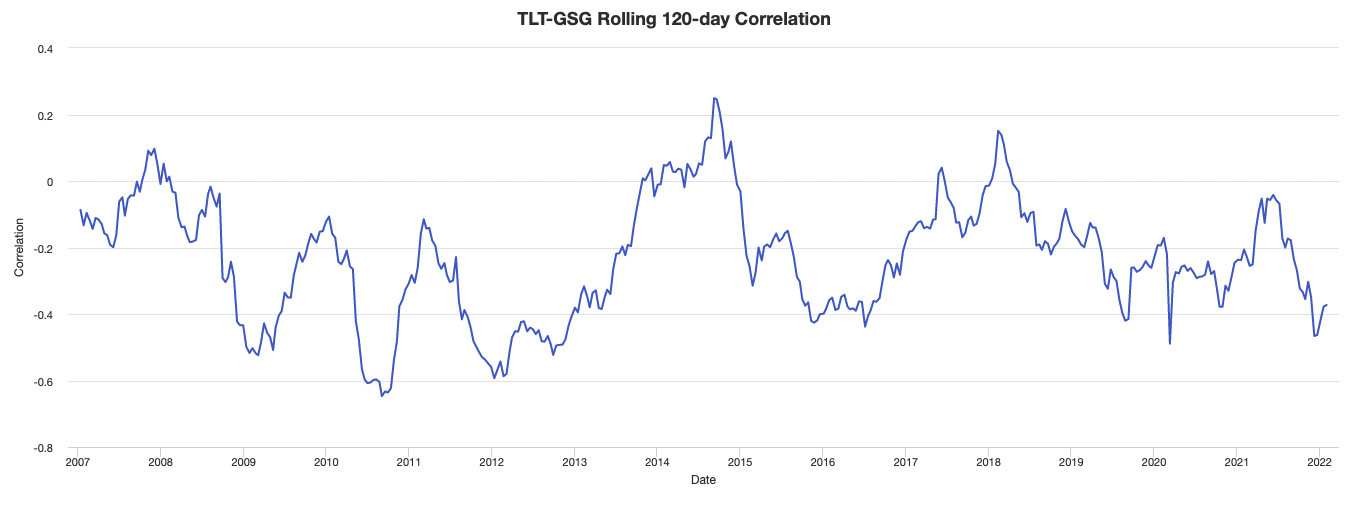

These correlations take daily returns and smooth them over a 120-day window.

Stocks-bonds

We can see that stocks and bonds have been traditionally been negatively correlated:

Stocks-commodities

Positive correlation:

Bonds-commodities

Negative correlation:

In what ways does this portfolio generate synergy?

1) Stock and commodities

Stocks and commodities are generally considered positively correlated, but it depends.

Stocks and commodities both do well in a rising growth environment (relative to discounted expectations).

However, they can diverge from each other when inflation is rising or falling.

Stocks may struggle when inflation is rising relative to expectations because it may mean the central bank will tighten monetary policy to slow things down.

However, commodities may do well in this environment. At the same time, it’s a bit of a chicken-and-egg problem because rising commodity prices are often a source of inflation.

Having both stocks and commodities can be a source of balance in a portfolio.

Commodities are more volatile than stocks as a whole, so it’s common to weight stocks higher in a portfolio than commodities to account for this.

2) Stocks and bonds

Traditionally, traders and investors would own both stocks and bonds as a type of natural hedge.

When stocks fell, bonds would usually kick in, and vice versa. Moreover, both have traditionally had a positive nominal and real yield. So bonds were a type of positive-carry hedge.

But with real rates negative and nominal rates very low, this relationship isn’t what it once was.

Many believe that the risk-reward in bonds is asymmetrically skewed the other way.

In other words, bonds don’t have much upside because the yields are so low and a lot more of them have to be created to fund deficits.

So more traders are wanting to be somewhat short the bond market.

Of course, how this trade pans out is unknown.

For decades, Japan has been in this situation with zero rates and zero or near-zero bond yields and the short Japanese government bonds (JGBs) trade didn’t work out very well.

For a while, there was a long-running joke that you’re not a true macro trader until you lose money shorting JGBs.

However, the general idea holds that interest rates can’t decrease much. But at the same time there’s theoretically no limit to how high they can go up. So the risk/reward may favor shorting bonds when yields are super low.

At the same time, the government can just print money to buy the bonds to prevent interest rates from going up (and help support the bond market).

In that case, the pressure would come from the currency side (a devalued currency).

And what a devalued currency looks like can come in various forms:

- higher stocks

- higher commodities

- higher gold (relative to the reference currency)

- higher real estate

- higher money alternatives (cryptocurrency?)

- higher physical assets

- higher goods and services (more inflation)

Moreover, if rates go up, this is a drag on stocks, holding all else equal.

So, if that happens, you might profit on your short bonds trade while losing on stocks.

3) Bonds and commodities

If commodities go up, this is usually a drag on bond prices, following this chain of logic:

Higher commodities -> more inflation -> higher yields -> lower bond prices

So going long commodities and short bonds can be, in some way, kind of the same trade.

However, getting synergy can be found in a different way, which leads us to the fourth leg of the example portfolio.

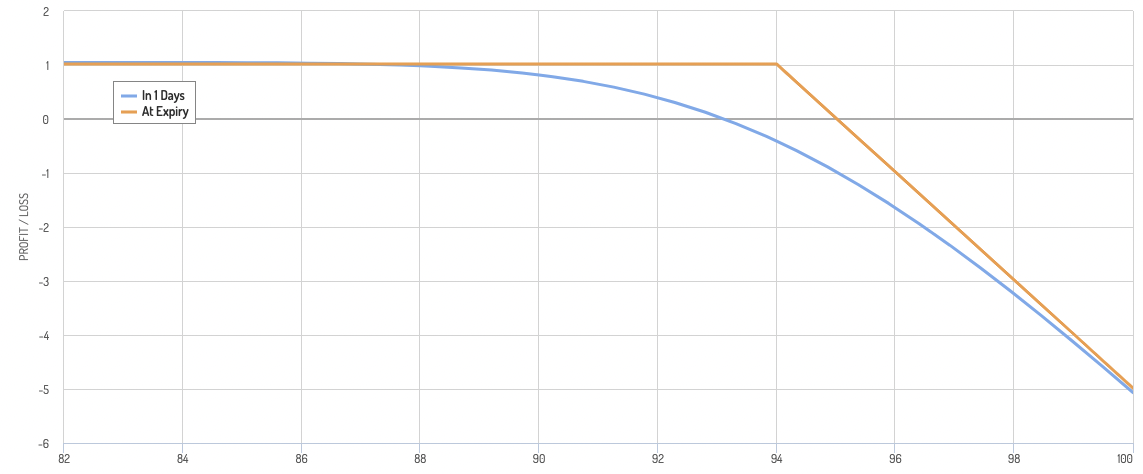

4) Bonds and commodities and covered puts on oil

Covered puts on oil achieve their maximum profitability when oil stays under the strike price of the put(s).

So if oil were to fall, that would be a knock on your commodities basket to some extent (because oil is part of that).

But you gain from the income received shorting the puts.

At the same time, the income from the short oil puts can help offset any losses on a short bonds position.

A drop in the price of oil, holding all else equal, may cause yields to fall and bonds to rise.

So having covered puts in oil can help offset this move.

Of course, this type of exposure could also be achieved by going long puts in some way and/or shorting calls on the commodities to achieve a type of covered call position on the commodities.

A risk inherent in the covered puts on oil is that oil could rise and the income received from the short puts doesn’t offset the losses from oil going up.

In that case:

a) the commodities basket would benefit from the rise in oil

b) the short bonds position would benefit from the higher yields caused by the rise in oil, which would reduce bond prices

And naturally, many more variables influence the price of a commodities basket and bond prices, so this is definitely a “holding all else equal” type of consideration.

But this outcome would help offset some (and perhaps all, but absolutely no guarantee) of the losses associated with the short oil exposure that comes with the covered oil puts trade.

But this is a case where if you were holding a simple portfolio of these themes:

- Long stocks

- Short bonds

- Long a basket of commodities

Adding an extra exposure of covered puts on oil can help:

- generate some income

- reduce exposure to the commodities market

- offset the “growth” part of the positive stocks-commodities correlation (i.e., both stocks and commodities are likely to go down in a negative growth shock, which the covered oil puts can help offset)

- offset any losses from bonds going up if oil/commodities fell in price (i.e., due to the feed-through from lower yields)

So, in that way, the covered puts can help achieve better synergy in a portfolio by diversifying each of the other three legs in the portfolio (long stocks, short bonds, long commodities).

General Takeaways

Always think about how to generate synergy in a portfolio.

How can you take logical steps to increase your returns relative to your risk?

How can you diversify a portfolio so that it has less bias to any particular economic environment?

For example, for many portfolios, they are heavily long stocks, which is essentially like making a big bet that growth will be above expectation and/or interest rates won’t rise a lot relative to what’s discounted in.

Deviations relative to this can be very harmful to the portfolio.

For those who diversify with bonds, they don’t provide much income – in fact, their inflation-adjusted (real) yields are typically negative, so it’s essentially like locking in bad returns.

And you’re still exposed to inflation shocks.

Moreover, a 60/40 portfolio isn’t very well balanced.

Stocks are more volatile than bonds, so the actual risk-weighted exposure is often something closer to 85/15 (or worse) in favor of equities.

Adding things like commodities or small amounts of gold can help better diversify a portfolio.

Even though those things don’t have outright yields, they can help offset losses in a stocks or stocks and bonds portfolio when inflation runs higher relative to expectations.

And traditionally they’ve done a good job of offsetting losses in stocks/bonds portfolios when they fell. (But this is not necessarily a guarantee going forward.)

Using options can also help you capture the distribution of whatever you want. But they are more advanced and there’s also the timing element because options have expiration dates.

And they also have a volatility element.

But in that way, you can help diversify and have more balanced outcomes.

Conclusion

Always think about synergy in a portfolio.

Having synergy means being able to have exposures that work well together so that bad outcomes are minimized or at least are less bad.

Using options in a prudent way can help offset losses.

For example, if you have a portfolio and you’re not willing to lose beyond a certain amount, you can use options to avoid these bad outcomes.

Buying options involves cost. But it’s not that costly – especially relative to what might happen in a bad outcome – so you might as well do it.

Adding an extra layer of diversification can help generate more synergy in a portfolio and improve your return relative to your risk.

The time to think about synergy in a portfolio is ideally at the outset, with monitoring to make sure it all works together well.

At the same time, you don’t want to make things overly complicated.

It’s much harder to take a complex set of ideas and ideas and turn them into something cohesive than just trying to build a simple portfolio that can do well under most scenarios and is easy to understand, monitor, and manage.

Adding complexity has only marginal benefits and can even be a negative.