Macroeconomic Relationships and Currency Valuations [Comprehensive Guide]

Welcome to a comprehensive guide on currency trading and macroeconomic relationships.

Currencies are a macro asset class. In a previous article, we looked at currency valuation models.

In this article, we’ll delve more specifically into dozens of concepts that are critical to understanding how macroeconomic factors affect currency values and how to use this knowledge to make better currency trading decisions.

We will cover a wide range of topics, from the relationship between interest rates and currency values to the impact of global capital flows on currency values.

By the end of this article, you will have a solid understanding of the key concepts that are necessary for successful currency trading.

How to use the balance of payments to forecast exchange rate movements

The balance of payments (BoP) is a key indicator of a country’s economic health, as it measures the flow of goods, services, and financial transactions between a country and its trading partners.

The BoP is divided into two main components – the current account and the capital account.

The current account measures a country’s trade balance, including exports, imports, and other income and expenses.

The capital account measures the flow of capital, including foreign investment, portfolio investment, and loans.

One way to use the BoP to forecast exchange rate movements is to look for imbalances between the current account and the capital account.

For example, if a country is running a large trade deficit and there is a net outflow of capital, this could put downward pressure on the exchange rate (if this deficit is not funded).

Conversely, if a country is running a trade surplus and there is a net inflow of capital, this could put upward pressure on the exchange rate.

Another factor to consider when using the BoP to forecast exchange rate movements is the quality of the capital inflows.

For example, if a country is attracting investment in its productive sectors, this could have a positive impact on the exchange rate.

However, if a country is attracting speculative capital (“hot money”) that is only seeking short-term gains, this could be less beneficial for the exchange rate.

Key Takeaway: Using the BoP to forecast exchange rate movements involves analyzing the current account and capital account to identify imbalances and considering the quality of the capital inflows.

Understanding the relationship between interest rates and currency values

The relationship between interest rates and currency values is a big factor in currency trading.

In general, higher interest rates (i.e., higher returns) tend to attract foreign investors and increase demand for a country’s currency, which can lead to an appreciation of the currency.

Conversely, lower interest rates tend to discourage foreign investment and decrease demand for a country’s currency, which can lead to a depreciation of the currency.

However, the relationship between interest rates and currency values is not always straightforward. It depends on the context.

Other factors, such as inflation, political stability, and economic growth, can also influence the exchange rate.

Real interest rates are most important for domestic buyers of the currency and assets denominated in that currency. They’ll take their nominal return and subtract out the inflation rate to make sure they’re getting good real returns.

Foreign buyers care more about the nominal returns in addition to the currency movement.

Additionally, central bank policies can affect interest rates, which in turn can affect currency values.

For example, if a country’s central bank raises interest rates more than what’s discounted by markets to combat inflation, this could attract foreign investment and increase demand for the currency, leading to an appreciation of the currency.

Conversely, if a country’s central bank lowers interest rates, this could discourage foreign investment and decrease demand for the currency, leading to a depreciation of the currency.

Of course, this is an “all else equal” type of thing, as not the real world is not so black-and-white.

Key Takeaway: The relationship between interest rates and currency values is complex and influenced by a variety of factors. Currency traders must carefully analyze economic data and central bank policies to make informed decisions about currency trading based on interest rates.

The role of inflation in determining currency values

Inflation is highly relevant in determining currency values.

In general, high inflation tends to decrease the value of a currency, while low inflation tends to increase the value of a currency.

This is because high inflation erodes the purchasing power of a currency, making it less attractive to traders/investors.

Additionally, inflation can affect a country’s trade balance, which can also influence currency values.

For example, if a country experiences high inflation, its exports may become more expensive, leading to a decrease in demand and a trade deficit or less of a trade surplus.

This, in turn, can put downward pressure on the exchange rate.

Furthermore, inflation can affect a country’s interest rates (i.e., the return on their assets), which can also impact currency values.

When a country wants to prevent inflation from hitting its currency, policymakers will need to raise the interest rate high enough to offset the inflation rate and any depreciation from the underlying capital flow. (Sometimes support can come in other forms outside the tightening of monetary policy, such as IMF support to restructure their liabilities.)

Especially in crisis situations, knowing how this mechanically happens is the means by which you can identify the exact bottoms in these currencies.

Key Takeaway: Inflation is an important factor in determining currency values, as it affects the purchasing power of a currency and can impact a country’s trade balance and interest rates.

The effect of central bank policies on currency values

Central bank policies are a crucial factor in determining currency values.

Central banks use a variety of tools to manage their economies, including adjusting interest rates, implementing quantitative easing programs, and intervening in currency markets.

One of the primary ways that central bank policies affect currency values is through interest rate adjustments.

When a central bank raises interest rates, this can increase demand for a country’s currency, as foreign investors seek higher returns on their investments.

This, in turn, can lead to an appreciation of the currency.

On the other hand, when a central bank lowers interest rates, this can decrease demand for the currency, leading to a depreciation of the currency.

Central banks may also implement quantitative easing programs, which involve buying large quantities of government bonds or other securities to inject liquidity into the economy.

This can lead to a depreciation of the currency, as the increased money supply can lead to inflation and decreased demand for the currency.

Finally, central banks may intervene in currency markets by buying or selling their own currency to influence its value.

This can have a short-term impact on the exchange rate, but the long-term impact depends on the effectiveness of the intervention and other factors that influence currency values.

Key Takeaway: Central bank policies have an impact on currency values through interest rate adjustments, quantitative easing programs, and currency market interventions.

How to use economic indicators to make currency trading decisions

Economic indicators provide information on the health of an economy, which can affect the value of a country’s currency.

There are a variety of economic indicators that currency traders use to analyze an economy, including Gross Domestic Product (GDP), inflation, employment data, trade balances, and consumer confidence.

For example, GDP is a measure of the total value of goods and services produced in a country.

A higher GDP typically indicates a stronger economy, which can lead to an appreciation of the currency.

On the flip side, a lower GDP can indicate a weaker economy and lead to a depreciation of the currency.

Inflation data is also important, as high inflation can lead to a decrease in the value of a currency.

Traders will closely monitor inflation data to make informed decisions about where interest rate are likely to go, which can also impact currency values.

Employment data, trade balances, PMI, and consumer confidence are also important economic indicators that can provide insight into an economy’s health and affect currency values.

Key Takeaway: Economic indicators are a tool for currency traders to make informed trading decisions.

The impact of political instability on currency values

Political instability can have a significant impact on currency values, as it can affect investor confidence and the stability of a country’s economy.

Political instability can take many forms, including government corruption, civil unrest, elections, and geopolitical tensions.

When a country experiences political instability, foreign investors may become more hesitant to invest in that country, leading to decreased demand for the country’s currency and a depreciation of the currency.

Additionally, political instability can lead to economic instability, as businesses may be hesitant to invest in a country experiencing political turmoil, and consumer confidence may decrease.

Geopolitical tensions can also have a significant impact on currency values, as uncertainty about international relations can lead to decreased demand for a country’s currency.

For example, tensions between countries that rely heavily on each other for trade can lead to decreased demand for both countries’ currencies.

Key Takeaway: Political instability can affect investor confidence and the stability of a country’s economy. Currency traders must monitor political developments and understand how they may impact currency values to make informed trading decisions.

What currencies do best during a global economic crisis?

During a global economic crisis, some currencies tend to perform better than others.

Reserve currencies, such as the US dollar, euro, and Japanese yen, are often seen as safe havens during times of crisis, as they are widely traded and held as reserves by central banks around the world.

These currencies tend to benefit from increased demand as investors seek safety and stability during times of uncertainty.

Non-reserve currencies, such as those in emerging markets, typically have more cyclicality and perform less well.

Some of those with little reserve status, such as the Swiss franc and the Singapore dollar, are also often seen as safe havens during times of crisis, due to their stability and low levels of debt relative to their output.

These currencies may benefit from increased demand during times of crisis, as investors seek alternative safe haven options.

Additionally, precious metals such as gold and silver are often considered safe havens during times of crisis, as they are seen as a store of value that’s not anyone’s liability and they can’t be printed.

It is important to note that the performance of currencies during a crisis can also depend on the specific circumstances of the crisis.

Key Takeaway: During a global economic crisis, reserve currencies such as the US dollar, euro, and Japanese yen, as well as some non-reserve currencies such as the Swiss franc and Singapore dollar, may perform well due to their perceived safety and stability. Additionally, precious metals such as gold and silver are often considered safe havens during times of crisis. However, the performance of currencies during a crisis can also depend on the specific circumstances of the crisis.

The relationship between oil prices and currency values

The relationship between oil prices and currency values is complex and multifaceted. Oil is a globally traded commodity and every country needs it to some extent, and changes in oil prices can have significant impacts on economies. Some are exporters; some are importers, so oil price impact their balance of payments.

When oil prices rise, countries that are net oil exporters, such as Saudi Arabia or Russia, may experience an increase in revenue, which can lead to increased demand for their currency and a strengthening of the currency.

Conversely, countries that are net oil importers, such as Japan or India, may experience increased costs, which can lead to decreased demand for their currency and a weakening of the currency.

Oil prices can also impact inflation rates, as changes in oil prices can affect the cost of producing goods and services.

This can lead to changes in interest rates, which can also affect currency values.

Additionally, changes in oil prices can affect investor sentiment, as higher oil prices may lead to concerns about inflation and decreased economic growth.

This can lead to decreased demand for a country’s currency and a weakening of the currency.

Key Takeaway: The relationship between oil prices and currency values is complex and influenced by a variety of factors, including a country’s net oil exporting or importing status, inflation rates, and interest rates. Currency traders should monitor oil prices and understand how they may impact currency values.

The impact of international trade agreements on currency values

International trade agreements can have a significant impact on currency values, as they affect the flow of goods and services between countries and can influence investor sentiment.

When countries enter into trade agreements, it can lead to increased trade and investment between them, which can lead to increased demand for each other’s currencies.

For example, if the US and Canada enter into a trade agreement that leads to increased trade, this can lead to increased demand for the US dollar and Canadian dollar.

Additionally, trade agreements can influence investor sentiment, as they can signal a country’s commitment to free trade and economic growth.

This can lead to increased confidence in a country’s economy and a strengthening of its currency.

However, trade agreements can also have negative impacts on currency values.

For example, if a trade agreement leads to increased imports from a particular country, this can lead to a trade deficit and decreased demand for the country’s currency.

Furthermore, trade tensions and disagreements over trade agreements can also have significant impacts on currency values.

For example, with the US and China tensions, the uncertainty surrounding the situation leads to more unknowns about the future of both countries’ currencies.

Key Takeaway: International trade agreements can have both positive and negative impacts. FX traders will monitor trade agreements and understand how they may impact currency values to make informed trading decisions.

Understanding the carry trade and its implications for currency trading

The carry trade is a popular strategy in currency trading that involves borrowing money in a low-interest-rate currency and investing it in a higher-interest-rate currency.

The idea behind the carry trade is to profit from the interest rate differential between two currencies.

For example, suppose a trader/investor borrows money in Japanese yen at a low-interest rate and invests it in Brazilian real at a higher interest rate.

The trader/investor can earn a profit on the interest rate differential, as long as the exchange rate remains relatively stable – i.e., the higher interest currency doesn’t fall enough to offset the carry.

Accordingly, the carry trade can be risky, as exchange rate fluctuations can wipe out potential profits or even lead to losses.

If the high-interest-rate currency depreciates significantly against the low-interest-rate currency, the trader/investor may end up owing more money than they borrowed.

Additionally, changes in interest rates can impact the carry trade, as higher interest rates in the low-interest-rate currency can make the cost of borrowing more expensive and decrease potential profits.

This may lead to borrowers covering their short position and leading to an appreciation in the low-interest currency.

Key Takeaway: The carry trade is a popular strategy in currency trading that involves borrowing money in a low-interest-rate currency and investing it in a higher-interest-rate currency. While the carry trade can be profitable, it’s also risky, and traders need to monitor exchange rate fluctuations and interest rate changess.

The effect of commodity prices on currency values

Commodity prices and currency values are closely linked because commodities, such as oil, gold, and agricultural products, are traded in global markets in US dollars.

The relationship between commodity prices and currency values is known as the “commodity-currency” correlation.

In general, when commodity prices rise, the currency of the commodity-producing country tends to appreciate because higher commodity prices lead to increased demand for the currency to purchase the commodities.

Conversely, when commodity prices fall, the currency of the commodity-producing country tends to depreciate because lower commodity prices lead to decreased demand for the currency.

However, the relationship between commodity prices and currency values is not always straightforward, and there are many other factors that can influence currency values.

For example, a country’s economic policies, political stability, and interest rates can all impact its currency value.

Key Takeaway: Commodity prices and currency values are closely linked, but the relationship is complex and subject to many different factors. When commodity prices rise, the currency of the commodity-producing country tends to appreciate, and when commodity prices fall, the currency tends to depreciate. However, other factors such as economic policies, political stability, and interest rates can also impact currency values.

How to hedge currency risk in international trade

Hedging currency risk is an essential part of managing the risks associated with international trade.

Currency fluctuations can have a significant impact on the profitability of a transaction, and hedging is a way to reduce that risk.

One way to hedge currency risk is to use forward contracts.

A forward contract is a binding agreement between two parties to exchange a specific amount of currency at a future date at a predetermined exchange rate.

This allows the buyer or seller to lock in a future exchange rate and avoid the risk of adverse currency fluctuations.

Another way to hedge currency risk is to use currency options.

A currency option is a contract that gives the holder the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined exchange rate on or before a specific date.

Currency options provide flexibility to manage currency risk, as they allow the holder to choose whether or not to exercise the option.

Lastly, businesses can also use natural hedging strategies to mitigate currency risk.

This involves aligning cash inflows and outflows in the same currency, for example, by pricing goods in the same currency as the payment terms.

Key Takeaway: There are various ways to hedge currency risk in international trade, including using forward contracts, currency options, and natural hedging strategies. It is essential to carefully evaluate the options available and choose the best one for the specific transaction and the company’s risk management objectives.

The role of gold in global currency markets

Gold has been an important asset in global currency markets for centuries.

Historically, gold was used as a currency itself and served as the standard by which all other currencies were valued.

Today, gold continues to play an essential role in currency markets, although its function has changed.

One of the key roles of gold in global currency markets is as a safe-haven asset.

In times of wider economic unknowns, geopolitical turmoil, and low real interest rates on domestic assets, investors often flock to gold as a safe-haven asset to protect their wealth.

This increased demand for gold can lead to a rise in its price and can have an impact on currency markets.

Another role of gold in global currency markets is as a hedge against inflation.

As the price of goods and services rises, the value of paper currency can decrease. Gold, on the other hand, tends to hold its value over time and can protect against the erosion of purchasing power.

In addition, gold is often used as a reserve asset by central banks.

Many central banks hold significant amounts of gold in their reserves, which provides a measure of stability and confidence in their currencies.

When there is less trust in the value of credit assets denominated in a certain currency – because of their worsening financial situation or poor yields – or there’s a deterioration in the political relationships, diversification in FX reserves toward gold becomes more likely.

Key Takeaway: Gold plays an important role in global currency markets as a safe-haven asset, a hedge against currency debasement and low real interest rates, and a reserve asset for central banks. Its value and significance in currency markets are likely to continue for a long time.

The relationship between the US dollar and other major currencies

The US dollar is the world’s most widely used currency and is the dominant currency in international trade and finance.

As such, the relationship between the US dollar and other major currencies is of great importance to the global economy.

One of the most significant relationships in the currency markets is the relationship between the US dollar and the euro.

The euro and the US dollar are the two most traded currencies in the world, and their exchange rate has an impact on global trade and investment.

A strong US dollar relative to the euro can make US goods and services more expensive and less competitive in Europe, while a weaker US dollar can make US exports more attractive.

The US dollar also has a significant relationship with the Japanese yen.

Japan is the world’s third-largest economy and a significant trading partner with the US.

A stronger US dollar relative to the yen can make Japanese goods and services more expensive and less competitive in the US, while a weaker US dollar can make Japanese exports more attractive.

Lastly, the US dollar is closely related to the Chinese yuan. China is the world’s second-largest economy and a major trading partner with the US.

The relationship between the US dollar and the yuan is complex and influenced by many factors, including trade tensions, interest rates, and geopolitical considerations.

China also manages its currency because of its capital controls.

Key Takeaway: The US dollar has important relationships with other major currencies such as the euro, yen, and yuan. Changes in the exchange rates between these currencies can have significant impacts on global trade and investment, and understanding these relationships is essential for businesses and investors operating in the global economy.

Reserve currencies vs. Non-reserve currencies

Reserve currencies

Reserve currencies and non-reserve currencies play different roles in the global economy.

Reserve currencies are currencies that central banks hold in significant quantities as part of their foreign exchange reserves.

These currencies are typically used in international transactions, and their stability and liquidity make them attractive to central banks and investors.

The US dollar is the world’s most widely used reserve currency, followed by the euro, the Japanese yen, and the British pound.

Other currencies, such as the Swiss franc, the Canadian dollar, and the Australian dollar, are also held in reserves, although to a lesser extent.

Having a reserve currency is an extraordinary privilege because it allows countries to borrow in it because they can sell these bonds to investors who will fund their excess spending.

This extra government spending helps the citizens of the country enjoy a positive income effect.

Non-reserve currencies

Non-reserve currencies, on the other hand, are currencies that are not widely held in central bank reserves or used in international transactions.

These currencies are typically less liquid and less stable than reserve currencies and can be subject to greater volatility.

Non-reserve currencies include many emerging market currencies, such as the Brazilian real, the Indian rupee, and the Chinese yuan.

These currencies may have higher yields than reserve currencies, but they are also subject to greater political and economic risk.

Key Takeaway: Reserve currencies are widely held in central bank reserves and used in international transactions, while non-reserve currencies are less widely held and more subject to volatility. Understanding the roles of these currencies is important for investors and businesses operating in the global economy.

The effect of demographic trends and population growth on currency values

Demographic trends and population growth are two key factors that can significantly impact currency values.

Demographics refers to the study of the composition of human populations, including age, gender, race, and ethnicity, while population growth refers to the rate at which a population is increasing or decreasing.

One of the most significant impacts of demographic trends on currency values is through the aging population.

As the population ages, there is typically a decrease in consumer spending and a rise in savings rates, which can lead to decreased economic growth and a weaker currency.

Additionally, an aging population can lead to a shrinking workforce, which can result in a lower productivity rate and a weaker currency.

Population growth can also have an impact on currency values. Countries with rapidly growing populations may experience growth due to increased demand for goods and services.

This can lead to an increase in the value of a currency.

Key Takeway: Demographic trends and population growth have influence through their effects on economic growth, inflation, trade balance, and workforce productivity. Traders/investors and policymakers will closely monitor these trends when making decisions related to currency investments and economic policies.

The relationship between bond yields and currency values

The relationship between bond yields and currency values is complicated.

Bonds are essentially loans made to governments or corporations, with yields representing the return investors will receive on their investment.

When bond yields increase, this generally indicates that interest rates are rising, which can have an impact on currency values.

Higher bond yields can attract foreign investment, as investors seek to take advantage of higher returns.

This can lead to increased demand for a country’s currency, driving up its value.

Conversely, lower bond yields can lead to decreased demand for a currency, as investors seek higher returns elsewhere.

Additionally, bond yields can also impact a country’s economic growth prospects. Higher bond yields may signal that inflation is expected to increase, which can lead to concerns about economic growth and a weaker currency.

Conversely, lower bond yields may indicate lower inflation expectations and stronger economic growth prospects, which can lead to a stronger currency.

Another factor to consider is the relationship between bond yields and central bank policies.

Central banks can influence bond yields by adjusting interest rates and implementing monetary policy measures.

When a central bank raises interest rates, this can lead to an increase in bond yields and a stronger currency.

Conversely, when a central bank lowers interest rates, this can lead to a decrease in bond yields and a weaker currency.

Key Takeaway: The relationship between bond yields and currency values is influenced by various factors, including inflation expectations, economic growth prospects, foreign investment, and central bank policies. It is essential for investors and policymakers to closely monitor these factors when making decisions related to currency investments and economic policies.

The effect of international capital flows on currency values

International capital flows refer to the movement of financial capital across borders in search of profitable investment opportunities.

These flows have a significant impact on the currency values of countries.

The currency of a country is determined by the demand and supply of its currency in the global foreign exchange market.

International capital flows can affect the demand and supply of a country’s currency in various ways.

When a country receives a large inflow of foreign capital, its currency value tends to appreciate, especially when it more than makes up for any balance of payment deficit.

This happens because the increased demand for the country’s currency pushes up its exchange rate.

On the other hand, when there is a large outflow of capital, the country’s currency value tends to depreciate, as the increased supply of the currency in the market leads to a decrease in its exchange rate.

Moreover, the direction and nature of the capital flow can also impact the currency value.

For instance, if foreign investors invest in productive sectors such as manufacturing, it can enhance the competitiveness of the country’s economy, leading to a higher demand for the country’s goods and services.

This, in turn, can increase the demand for the country’s currency, leading to a stronger exchange rate.

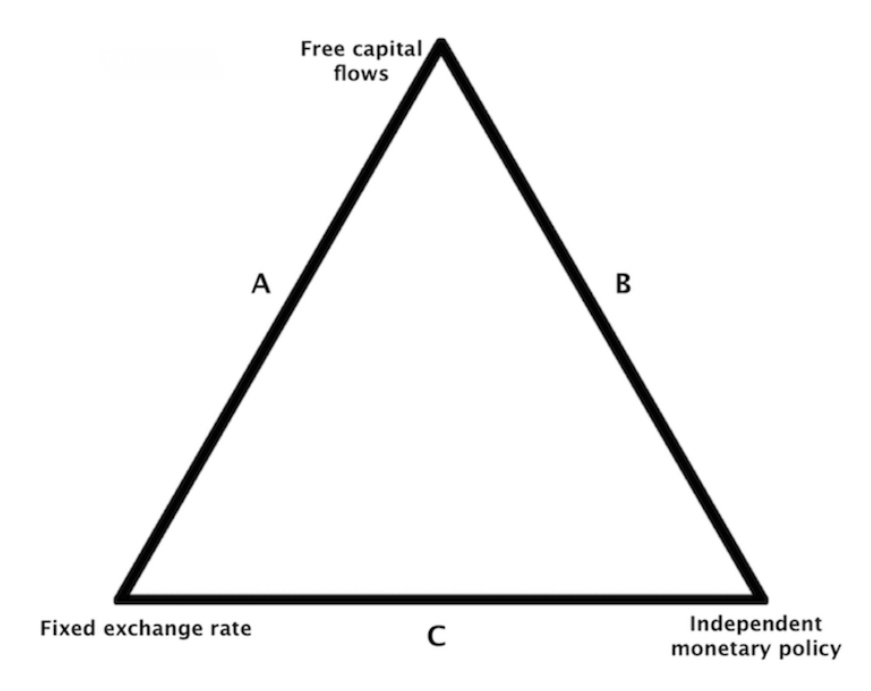

This is why some countries – like China and other emerging markets – tend to restrict their capital flows. In doing so, they restrict some level of monetary autonomy.

This is called a trilemma.

When a country wants to restrict its capital flows and still have independent monetary policy, they will need to restrict the movement of their exchange rate.

In other words, they’ll be on Side C of the triangle below.

Key Takeaway: The direction, nature, and volume of capital flows can impact the demand and supply of a country’s currency in the global market, leading to changes in its exchange rate. Therefore, countries need to carefully manage their capital flows to maintain the stability of their currency values.

The role of global economic growth on a currency’s value

Economic growth refers to the increase in the production and consumption of goods and services in an economy.

When the global economy experiences robust growth, it creates an environment of optimism and confidence among investors, leading to increased investments in countries around the world.

The currency of a country experiencing economic growth tends to appreciate in value.

The increase in demand for goods and services from that country can lead to a higher demand for its currency, driving up its exchange rate.

Moreover, as economic growth improves the overall economic conditions of a country, it makes it a more attractive destination for foreign investment (often called FDI), further boosting the value of its currency.

Conversely, a global economic downturn can lead to a decline in the value of a country’s currency.

A sluggish global economy can lead to reduced demand for goods and services, causing a fall in the value of a country’s exports.

This can reduce the demand for its currency, leading to a decline in its exchange rate.

Key Takeaway: Robust economic growth can lead to an increase in demand for goods and services from that country, resulting in an appreciation of its currency. OTOH, a weak global economy can lead to a decline in demand for a country’s goods and services, leading to a depreciation of its currency.

The impact of trade tensions and tariffs on currency values

Trade tensions occur when two or more countries engage in policies that restrict or inhibit trade between them.

These tensions can have a significant impact on the value of currencies.

Trade tensions often lead to increased uncertainty, which can make investors nervous about investing in a particular country, leading to a fall in the value of its currency.

For example, when the United States and China were engaged in a trade war, both countries imposed tariffs on each other’s goods, which led to increased uncertainty in the global economy.

The Chinese yuan depreciated significantly against the US dollar during this time, as investors feared the impact of the trade war on China’s export-oriented economy.

Trade tensions can also have a significant impact on commodity prices.

For example, when the United States imposed tariffs on steel and aluminum imports from countries like Canada and Mexico, it led to a rise in the price of these commodities.

This rise in commodity prices can lead to a higher demand for the currencies of countries that are major exporters of these commodities, leading to an appreciation of their currencies.

Tariffs on exchange rates – the math

We’ve mostly used words in this article, so let’s use some math to illustrate an example.

Suppose the US imposes higher tariffs on China. That’s a direct threat to China’s national income and therefore weakens the currency.

Some basic math can be used to show what kind of a shock on the currency might ensue.

For example:

- 10 percent tariffs on $300 billion worth of goods is $30 billion (multiplying the two together) in terms of the change in national accounting.

- The US imports approximately $500 billion from China each year.

- Dividing these two quantities, $500 billion by $30 billion, that comes to an estimated currency adjustment of about 6 percent.

So, it’s likely that Chinese policymakers would allow for some depreciation in their currency if trade tensions were intensified.

Key Takeaway: Increased tensions and a decline in international trade can lead to a fall in the value of a country’s currency. Conversely, rising commodity prices due to trade tensions can lead to an appreciation of currencies of countries that are major exporters of those commodities.

Understanding the impact of political elections on currency values

Political elections can have a significant impact on the value of a country’s currency.

The outcome of an election can lead to changes in government policies and direction, which can affect investor confidence and expectations.

Uncertainty and fear of instability can lead to a decrease in the value of a country’s currency, while confidence and stability can lead to an increase in its value.

For example, during the 2016 US presidential election, the value of the US dollar fluctuated significantly in response to the uncertainty surrounding the election outcome.

After the election, the US dollar initially appreciated as investors welcomed the promises of increased fiscal spending and tax cuts made by the incoming administration.

Similarly, during the 2019 UK general election, the value of the British pound increased in response to the Conservative Party’s victory, which reduced uncertainty and provided a clearer path for Brexit negotiations.

In contrast, during the 2020 US presidential election, the value of the US dollar remained relatively stable despite a highly polarized political environment due to the perceived stability and predictability of the US political system.

Key Takeaway: The outcome of an election can affect investor confidence and expectations, leading to fluctuations in currency values. Factors such as stability, predictability, and clarity regarding government policies can influence the value of a country’s currency.

The relationship between fiscal policy and currency values

Fiscal policy is the use of government spending and taxation to influence the economy.

The implementation of fiscal policies by a government can have a significant impact on the value of its currency.

Fiscal policies can affect a country’s currency in several ways.

One of the most significant impacts of fiscal policy on currency values is through interest rates.

When a government spends more than it collects in taxes, it has to borrow to finance the deficit.

This increased borrowing can lead to an increase in interest rates, which can make a country’s currency more attractive to investors seeking higher returns.

This, in turn, can lead to an appreciation of the currency.

If a government implements contractionary fiscal policies, such as reducing government spending or increasing taxes, it can lead to a decrease in interest rates, which can make a country’s currency less attractive to investors seeking higher returns.

This, in turn, can lead to a depreciation of the currency.

Another way in which fiscal policy can impact currency values is through government debt.

If a government has a high level of debt relative to its GDP, it can make investors nervous about the country’s ability to repay its debts.

Currency may need to be “printed” down the line because they don’t take in enough revenue to pay all their liabilities.

This can lead to a decline in the value of its currency.

Key Takeaway: Fiscal policy has an impact through its impact on interest rates and government debt. A government’s decision to increase or decrease spending or taxation can lead to changes in interest rates, which can influence the value of its currency. Additionally, a high level of government debt can lead to a decline in the value of a country’s currency.

The effect of global debt levels on currency values

We covered this a bit in the preceding section, but global debt levels have a significant impact on currency values.

Debt levels represent a country’s ability to repay its obligations and are closely monitored by traders/investors, who use this information to assess the risk of investing in a particular country.

High levels of debt can lead to a decrease in the value of a country’s currency.

One of the primary impacts of global debt levels on currency values is through interest rates.

Countries with high levels of debt may be viewed as riskier investments, which can lead to higher borrowing costs.

Higher interest rates can make a country’s currency more attractive to investors seeking higher returns, which can lead to an appreciation of the currency.

Conversely, if a country’s debt level leads to an increase in borrowing costs, this can lead to a depreciation of its currency.

Another way in which global debt levels can impact currency values is through the perception of a country’s economic stability.

High levels of debt can make investors nervous about a country’s ability to repay its obligations, which can lead to a decrease in confidence in the country’s economy.

This decrease in confidence can lead to a fall in the value of its currency.

Remember that not all debt is bad. If it’s productively employed it can be very good.

Debt also creates new financial assets, which can be useful for the various holders.

The trader/investor gets an asset while the borrower gets funding to help them get what they want, leading to a win-win relationship.

Key Takeaway: Debt levels influence FX valuations through their impact on interest rates and the perception of a country’s economic stability. High levels of debt can lead to higher borrowing costs, which can influence the value of a country’s currency. Additionally, high levels of debt can make investors nervous about a country’s ability to repay its obligations, leading to a decrease in confidence and a fall in the value of its currency.

The role of foreign direct investment in currency trading

Foreign direct investment (FDI) refers to the investment made by a company or an individual in a foreign country with the aim of establishing a long-term business presence.

FDI can have a significant impact on currency trading.

FDI can lead to an increase in demand for the currency of the host country, leading to an appreciation of its value.

This is because foreign investors need to exchange their domestic currency for the local currency to make investments.

The increase in demand for the host country’s currency can lead to a higher exchange rate and an appreciation of its currency.

Moreover, FDI can also lead to an increase in economic activity in the host country, leading to an increase in its export revenues.

This can also lead to an increase in demand for the host country’s currency, leading to an appreciation of its value.

On the other hand, FDI outflows can lead to a decline in the value of a country’s currency.

This happens when domestic investors invest in foreign countries, leading to a decrease in demand for the domestic currency.

This can lead to a depreciation of the currency.

Key Takeaway: Foreign direct investment can lead to an increase in demand for the host country’s currency, leading to an appreciation of its value. Conversely, FDI outflows can lead to a decrease in demand for the domestic currency, leading to a depreciation of its value.

The relationship between stock market movements and currency values

The relationship between stock market movements and currency values is complex and multifaceted.

Stock market movements can have an impact on currency values.

Positive developments in the stock market can lead to an increase in investor confidence, leading to an increase in demand for the currency of the country where the stock market is located.

When you own a financial asset denominated in a specific currency, you own a pile of that currency.

This increased demand can lead to an appreciation of the currency.

Conversely, negative developments in the stock market can lead to a decrease in investor confidence, leading to a decrease in demand for the currency and a depreciation of its value.

Another way in which the stock market can impact currency values is through its impact on a country’s economic performance.

A strong stock market is often viewed as an indicator of a healthy economy, which can lead to an increase in foreign investment and a higher demand for the country’s currency.

OTOH, a weak stock market can lead to a decrease in foreign investment and a decline in the value of the currency.

A weaker currency can also boost stock values, as stocks are a nominal asset, priced as a certain amount of dollars per share.

When there’s more money and credit going into an economy in excess of the quantity of something, that can help boost the nominal value.

Stocks, in varying forms, can act as a type of “inverse money” asset.

Key Takeaway: Positive developments in the stock market can lead to an increase in investor confidence and demand for the currency, while negative developments can lead to a decrease in demand and a depreciation of the currency. The stock market can also serve as an indicator of a country’s economic performance, which can impact its currency value.

Understanding the impact of the business cycle on currency values

The business cycle refers to the fluctuations in economic activity over time, including periods of expansion and contraction.

The business cycle can have a significant impact on the value of a country’s currency.

During periods of economic expansion, a country’s currency tends to appreciate in value due to increased economic activity and a higher demand for goods and services.

The increased demand for goods and services can lead to an increase in exports, which can lead to an appreciation of the currency.

Conversely, during periods of economic contraction, a country’s currency tends to depreciate in value due to a decrease in economic activity and a lower demand for goods and services.

Moreover, the stage of the business cycle can also impact the value of a country’s currency.

During the early stages of an economic expansion, the demand for imports tends to increase, leading to a decline in the value of the currency.

During the later stages of an expansion, the economy tends to be at full capacity, leading to a decrease in the supply of goods and services, which can lead to an increase in the value of the currency.

Key Takeaway: Economic expansions tend to lead to an appreciation of the currency, while economic contractions tend to lead to a depreciation of the currency. The stage of the business cycle can also impact the value of the currency, with the early stages of an expansion leading to a decline in currency value and the later stages leading to an increase in currency value.

The impact of currency pegs on currency values

A currency peg is a fixed exchange rate system in which the value of a country’s currency is tied to the value of another currency, typically the US dollar.

It’s typical for countries to peg their currency to that of the world’s top reserve currency or to that of their top trading partner.

Pegs can also include a commodity-linked system – i.e., a gold standard and to a lesser extent pegs to silver – to give the currency credibility.

The Bretton Woods system that lasted from 1945 to 1971 was such a system.

Currency pegs can have a significant impact on the value of a country’s currency and its economy.

One of the primary impacts of currency pegs is the loss of control over monetary policy.

Countries that adopt currency pegs must maintain the fixed exchange rate, which means they cannot adjust their monetary policy to address domestic economic issues.

For example, if a country’s economy is experiencing inflation, it cannot lower interest rates to combat inflation because that would lead to a devaluation of its currency relative to the pegged currency.

In short, currency pegs means forgoing an independent monetary policy or preventing free capital flows, as we discussed earlier when it comes to the trilemma problem.

Making the Bretton Woods system work was reasonable for a while because capital flows were small, but it was eventually unsustainable because of liabilities that had been built up (e.g., “guns and butter” policies of the 1960s).

Moreover, currency pegs can lead to a loss of competitiveness in international markets.

If a country’s currency is pegged to another currency that appreciates in value, its exports become more expensive and less competitive in international markets.

This can lead to a decrease in export revenues and a decline in economic activity.

However, currency pegs can also provide stability and predictability for businesses and investors, which can lead to increased investment and economic growth.

Additionally, currency pegs can provide a way for countries with unstable currencies to maintain stable exchange rates and avoid currency fluctuations.

However, currency pegs that are inconsistent with the economic fundamentals are inevitably broken.

Key Takeaway: While currency pegs can provide stability and predictability, they can also lead to a loss of control over monetary policy and a decrease in competitiveness in international markets.

The relationship between currency values and tourism

The value of a country’s currency plays a significant role in determining the level of tourism it receives.

When a country’s currency is weak, it becomes a more affordable destination for tourists, leading to an increase in the number of visitors, all else equal.

Conversely, when a country’s currency is strong, it becomes a more expensive destination, leading to a decrease in the number of visitors.

A weak currency can make a country’s tourism industry more competitive in the global market.

Tourists can benefit from lower prices for accommodations, meals, and other tourist activities, leading to increased spending and revenue for the country’s tourism industry.

This increased spending can lead to an increase in economic activity and job creation in the tourism sector.

On the other hand, a strong currency can make a country’s tourism industry less competitive.

Tourists may choose to visit other destinations with weaker currencies that offer more affordable options.

This can lead to a decrease in revenue for the country’s tourism industry and a decrease in economic activity and job creation in the sector.

Moreover, currency fluctuations can impact tourism in the short term.

A sudden depreciation or appreciation of a country’s currency can lead to a temporary increase or decrease in the number of visitors.

However, sustained currency fluctuations can lead to long-term impacts on tourism, as businesses and consumers adjust to the new exchange rates.

Key Takeaway: A weak currency can make a country’s tourism industry more competitive, while a strong currency can make it less competitive. Currency fluctuations can impact tourism in the short term, but sustained fluctuations can lead to long-term impacts on the industry.

Understanding the impact of global supply chains on currency values

Global supply chains refer to the interconnected networks of producers, suppliers, and distributors that span multiple countries.

One of the primary impacts of global supply chains on currency values is through the balance of trade.

A country with a strong presence in global supply chains is likely to be a major exporter of goods and services.

The increased demand for its exports can lead to an increase in the value of its currency as foreign buyers must exchange their currencies for the exporter’s currency to purchase its goods and services.

Conversely, a country with a weaker presence in global supply chains may have a trade deficit, which can lead to a decrease in the value of its currency.

Moreover, global supply chains can also lead to changes in the demand for currencies based on the relative costs of production.

For example, if the cost of production in a country increases, businesses may choose to shift production to a country with lower costs.

This can lead to a decrease in the demand for the currency of the country with higher production costs and an increase in the demand for the currency of the country with lower production costs.

In addition, global supply chains can impact the value of a currency through the availability of inputs.

If a country is a major supplier of key inputs such as raw materials or intermediate goods, an increase in demand for those inputs can lead to an increase in the value of its currency.

Key Takeaway: Supply chains and their influence on the balance of trade, relative costs of production, and availability of inputs can all lead to changes in the demand for a currency.

The effect of tax policies on currency values

Tax policies are an important tool for governments to manage their economies and can have a significant impact on currency values.

Tax policies can influence currency values through their impact on interest rates, inflation, and the overall economic outlook.

One of the primary ways in which tax policies can impact currency values is through their impact on interest rates.

If a government reduces taxes, it can lead to an increase in disposable income, which can lead to an increase in spending and economic growth.

However, this increased demand can also lead to higher inflation, which can cause interest rates to rise.

Higher interest rates can make a country’s currency more attractive to investors seeking higher returns, leading to an appreciation of the currency.

Moreover, tax policies can also impact the overall economic outlook, which can affect the value of a country’s currency.

For example, if a government implements policies that promote investment and growth, it can lead to an increase in foreign investment and a higher demand for the country’s currency.

Conversely, if a government implements policies that discourage investment or lead to economic instability, it can lead to a decrease in foreign investment and a depreciation of the currency.

In addition, tax policies can also impact currency values through their impact on trade. If a government implements policies that make exports more attractive, it can lead to an increase in demand for the country’s currency.

OTOH, if a government implements policies that make imports more attractive, it can lead to a decrease in demand for the country’s currency.

Key Takeaway: Tax policies have an impact on currency values through their impact on interest rates, the overall economic outlook, and trade. Governments need to consider the impact of their tax policies on currency values when implementing changes to their tax system.

The role of international aid and remittances in currency trading

International aid refers to the financial assistance given by developed countries or international organizations to developing countries or countries experiencing economic crises or simply needing more economic health.

Aid and remittances are a form of wealth transfer.

One of the primary ways in which international aid can impact currency trading is through its impact on the balance of payments.

If a country receives international aid, it can lead to an increase in its foreign exchange reserves, which can lead to an appreciation of its currency.

Conversely, if a country does not receive international aid and is experiencing a balance of payments deficit, its currency may depreciate.

Moreover, international aid can also impact currency trading through its impact on investor sentiment.

International aid can provide a signal to investors that a country is stable and has the support of the international community.

This increased confidence can lead to an increase in foreign investment, which can lead to an appreciation of the currency.

However, international aid can also have negative impacts on currency trading.

If a country becomes too dependent on international aid – it’s a function of instability and the country is not being run economically – it may lead to a loss of competitiveness and a decline in economic growth.

This can lead to a decrease in foreign investment and a depreciation of the currency.

In general, aid and remittances are a much bigger factor on emerging market FX valuations than on developed market currencies.

For instance, remittances are a much bigger part of the valuation of the Malaysian ringgit than the US dollar.

Key Takeaway: International aid can impact the balance of payments, investor sentiment, and economic growth, which can lead to changes in the value of a country’s currency. However, countries must be cautious not to become too dependent on international aid, as it may lead to negative impacts on their economy and currency.

The effect of natural resource abundance on currency values

The abundance of natural resources in a country can have a significant impact on its currency values.

When a country has abundant natural resources, it can increase the supply of commodities and raw materials available for export, which in turn can increase demand for the country’s currency.

This demand can help increase the value of the country’s currency relative to other currencies in international markets.

One of the key ways that natural resource abundance can help increase exports and trade surplus is by making the country’s goods and services more competitive in international markets.

For example, a country with abundant oil reserves may have lower production costs for oil-based products than other countries, which can make its exports more attractive to foreign buyers.

As demand for these products increases, the country can earn more revenue from its exports, which can help boost its trade surplus.

Moreover, natural resource abundance can also provide an opportunity for a country to diversify its export base.

When a country relies on a single export commodity, such as oil or gas, it can be vulnerable to fluctuations in global commodity prices.

However, if the country has abundant natural resources, it can explore new export opportunities, such as agricultural products or mineral resources.

This diversification can help reduce the country’s reliance on a single export commodity, which can help stabilize its export revenues and trade balance.

Key Takeaway: Natural resource abundance can influence a country’s currency values, as well as its export revenues and trade balance. But natural resources alone do not guarantee economic success, as factors such as effective governance and investment in infrastructure are also crucial for maximizing the benefits of natural resource abundance.

The impact of technological advancements on currency values

The advancements in technology have had a significant impact on currency values.

The increased use of electronic payments, online trading platforms, and other digital technologies have transformed the way in which currencies are traded and valued.

One major impact of technology on currency values is the speed at which information is disseminated.

With the internet and social media, news and data that can affect currency values can be shared instantly across the globe.

This has increased the volatility of currencies and the speed at which they can appreciate or depreciate in value.

Another impact of technology is the increase in electronic trading platforms.

These platforms have made it easier for individuals and institutions to trade currencies around the clock, resulting in higher trading volumes and greater liquidity.

This, in turn, has made it more difficult for any one entity to manipulate currency values, as the market is more efficient and transparent.

The rise of cryptocurrencies has also had some impact on traditional currency values.

Cryptocurrencies are decentralized, digital currencies that can be used to buy goods and services.

In some cases, crypto, as a form of private money, could compete with domestic currency in cases where there is higher levels of instability.

Key Takeaway: Technological advancements have an impact on currency values, increasing the speed at which they can fluctuate and improving market efficiency and transparency. As technology continues to evolve, it is likely that the impact on currency values will grow.

The impact of global military conflicts on currency values

Global military conflicts can have a significant impact on currency values.

The uncertainty and instability caused by conflicts can cause investors to shift their funds to safe-haven currencies, such as the US dollar, Swiss franc, or Japanese yen. Or commodity-based currencies like gold.

These currencies tend to appreciate during times of geopolitical tension as investors seek shelter from uncertainty.

Moreover, military conflicts can disrupt trade, causing a decline in the demand for goods and services from the affected countries.

This can lead to a decline in the value of the currencies of those countries, as well as currencies of countries that depend on their exports.

For example, if there were to be a conflict that disrupted oil supplies from the Middle East, the value of the currencies of countries that rely heavily on oil exports would likely decrease.

Additionally, the cost of war and the allocation of resources toward military efforts can have an impact on a country’s economic health and ultimately its currency value.

The costs of a prolonged conflict can strain a country’s finances, leading to inflation and a weakening currency.

Key Takeaway: Global military conflicts can cause uncertainty, disrupt trade, and strain a country’s economy, all of which can lead to fluctuations in currency values. Safe-haven currencies tend to appreciate during times of geopolitical tension, while the currencies of countries affected by the conflict may depreciate.

Variables in the US Treasury’s GERAF Model

Here are the variables in the US Treasury’s publicly released GERAF model that they use to assess other countries’ exchange rates and any misalignment.

Cyclical Factors:

- Output gap

- Commodity terms of trade gap

Macroeconomic Fundamentals:

- Trade openness (exports + imports) / GDP

- Net foreign assets (NFA) / GDP (lagged)

- NFA / GDP * NFA debtor (lagged)

- Relative output per worker

- Real GDP growth (forecasted in 5 years)

- Safe asset index

Structural Fundamentals:

- Old-age dependency ratio (OADR)

- Population growth

- Prime savers share

- Life expectancy at prime age

- Life expectancy at prime age * Future OADR

- Institutional and political environment (ICGR-12)

- Oil and natural gas trade balance * Resource temporariness

Policy Variables:

- Cyclically adjusted fiscal balance / GDP

- Public health spending / GDP (lagged)

- Foreign exchange intervention (FXI):

- FXI / GDP

- FXI / GDP * Capital account openness

- Detrended private credit / GDP

- Capital controls:

- Relative output per worker * Capital account openness (lagged)

- Demeaned VIX * Capital account openness (lagged)

- Demeaned VIX * Capital account openness * Safe asset index (lagged)

How Each of the GERAF Model Variables Affects a Currency Value / Exchange Rate

Now let’s look at how each of these input variables affects a currency’s value.

Cyclical Factors

Output gap:

- Effect: An economy operating above potential (positive output gap) typically leads to higher inflationary pressures (which can be bad) but it can also lead to higher interest rates, Higher interest rates make a currency more attractive and valuable.

- Conversely, a negative output gap can reduce currency value.

Commodity terms of trade gap:

- Effect: An improvement in commodity terms of trade (export prices relative to import prices) enhances national income and demand for the currency, thus increasing its value. A deterioration has the opposite effect.

Macroeconomic Fundamentals

Trade openness (exports + imports) / GDP:

- Effect: Greater trade openness can enhance currency value through increased foreign demand for domestic goods (and currency) and better resource allocation. But it can also expose the economy to external shocks, potentially affecting stability.

Net foreign assets (NFA) / GDP (lagged):

- Effect: Higher NFA suggests a country is a net creditor, increasing confidence and demand for its currency, thus boosting its value. Lower NFA or being a net debtor can decrease currency value.

NFA / GDP * NFA debtor (lagged):

- Effect: This variable modifies the impact of NFA based on whether the country is a significant debtor. High debt levels relative to GDP can weaken the currency due to repayment risks and potential default. Also, in the future, if debt levels are too high, a company is likely to “print” money to devalue the debt.

Relative output per worker:

- Effect: Higher productivity per worker indicates a more competitive economy. Can potentially lead to stronger economic performance and currency appreciation due to higher demand for efficient and high-quality goods and services.

Real GDP growth (forecasted in 5 years):

- Effect: Higher future GDP growth expectations typically increase investor confidence and attract foreign investment, leading to currency appreciation. Lower growth expectations can have the opposite effect.

Safe asset index:

- Effect: A higher safe asset index indicates a currency and its government securities are viewed as safe havens. Increased demand for safe assets during periods of global uncertainty leads to currency appreciation.

Structural Fundamentals

Old-age dependency ratio (OADR):

- Effect: A higher OADR suggests a larger proportion of dependents relative to the working population, potentially leading to lower economic growth and productivity, which can depreciate the currency.

Population growth:

- Effect: Higher population growth can increase economic output and potential growth, making the currency more valuable. However, if not managed well, it can strain resources and infrastructure, possibly leading to currency depreciation. So, mostly a positive, but with some nuance.

Prime savers share:

- Effect: A higher share of prime savers (middle-aged individuals) typically leads to higher savings rates and investment, supporting economic stability and currency appreciation.

Life expectancy at prime age:

- Effect: Longer life expectancy at prime age reflects better health and productivity, contributing to economic growth and currency strength. It also implies a potentially larger and more experienced workforce.

Life expectancy at prime age * Future OADR:

- Effect: This variable combines life expectancy with future old-age dependency, highlighting long-term sustainability. Better prospects generally lead to currency appreciation, while higher future dependency ratios can have negative effects.

Institutional and political environment (ICGR-12):

- Effect: Stronger institutions and stable political environments increase investor confidence, attract foreign investment, and enhance currency value. Weak institutions and political instability can lead to currency depreciation.

Oil and natural gas trade balance * Resource temporariness:

- Effect: A positive trade balance in oil and natural gas boosts national income and currency value. However, if resources are deemed temporary, it can limit long-term appreciation due to sustainability concerns.

Policy Variables

Cyclically adjusted fiscal balance / GDP:

- Effect: A higher (positive) fiscal balance suggests better fiscal health, reducing borrowing needs and increasing investor confidence, leading to currency appreciation. Persistent deficits can weaken the currency.

Public health spending / GDP (lagged):

- Effect: Higher public health spending enhances human capital and productivity, potentially strengthening the currency. However, excessive spending without revenue support can lead to deficits and currency depreciation.

Foreign exchange intervention (FXI):

- FXI / GDP:

- Effect: Active intervention to buy domestic currency can increase its value by reducing supply in the market. Selling domestic currency can depreciate it.

- FXI / GDP * Capital account openness:

- Effect: The effectiveness of FXI depends on capital account openness. In more open economies, interventions might be less effective due to greater capital flows, moderating their impact on the exchange rate.

Detrended private credit / GDP:

- Effect: Higher private credit availability can stimulate economic activity and strengthen the currency. However, excessive credit growth can lead to financial instability and potential depreciation.

Capital controls:

- Relative output per worker * Capital account openness (lagged):

- Effect: Higher productivity in a more open capital account regime can attract foreign investment, boosting the currency.

- Demeaned VIX * Capital account openness (lagged):

- Effect: Higher market volatility (VIX) typically depreciates the currency in more open capital accounts as investors seek safer assets.

- Demeaned VIX * Capital account openness * Safe asset index (lagged):

- Effect: In times of high volatility, currencies with higher safe asset indices appreciate as they are considered safer investments, especially in open capital regimes.