Capital Account – Impact on Macroeconomics & Currency Trading

In macroeconomics, the capital account is a record of a country’s international transactions that involves tangible physical assets, such as financial instruments and real estate.

The capital account is one of two primary components of a country’s balance of payments, the other being the current account.

The balance of payments is a record of a country’s international transactions over a given period of time, typically a year.

Key Takeaways – Capital Account

- The capital account is a record of a country’s international financial transactions, including the movement of capital in and out of the country.

- Changes in the capital account can have significant impacts on the exchange rate of a country’s currency.

- An influx of capital can lead to an appreciation of the domestic currency, while an outflow of capital can lead to a depreciation of the domestic currency.

- Capital controls, which are measures that a government can use to regulate the flow of capital in and out of a country, can also impact the exchange rate.

- FX traders may need to pay attention to the capital account and any capital controls that may exist in the markets they trade in order to make informed trading decisions.

What the Capital Account Includes

The capital account includes transactions in physical assets, such as investments in foreign real estate or the purchase of foreign stocks and bonds.

It also includes transactions in financial instruments, such as loans made to foreign governments or businesses.

The capital account is important because it reflects a country’s level of international investment and borrowing, which can have an impact on the country’s exchange rate and overall economic stability.

Capital Account vs. Current Account

It is important to note that the capital account is separate from the current account, which includes transactions in goods, services, and income.

The balance of payments must always be in balance, meaning that the sum of the capital account and the current account must be zero.

If the balance of payments is not in balance, it can lead to exchange rate fluctuations and other economic disruptions.

Naturally, for this reason, the balance of payments is a major point of interest for currency traders.

Capital Account Formula

The capital account can be simplified into:

Capital Account = Change in foreign ownership of domestic assets – Change in domestic ownership of foreign assets

Basically, how much is flowing in (improves capital account) vs. how much is flowing out (worsens capital account).

The capital account contains and is the sum of:

- Foreign direct investment (FDI)

- Buying and selling of assets in foreign capital markets

- Other investment (often “hot money” flows based on changes in interest rates or exchange rates)

- Reserve account (e.g., FX reserves)

Capital Account Surplus vs. Capital Account Deficit

Capital Account Surplus

A capital account surplus is a situation in which a country’s capital account, which is a record of its international transactions that involve tangible physical assets, such as financial assets and real estate, is in surplus.

A capital account surplus occurs when a country is receiving more foreign investment and borrowing than it is providing.

All else equal, this appreciates the domestic currency.

Capital Account Deficit

A capital account deficit is the opposite of a capital account surplus.

It is a situation in which a country’s capital account is in deficit.

A capital account deficit occurs when a country is providing more foreign investment and borrowing than it is receiving.

All else equal, this depreciates the domestic currency.

How the Central Bank Influences Its Reserve Account

A central bank has several tools at its disposal to influence its reserve account, which is a type of account held by the central bank that is used to hold foreign currencies and other international reserve assets.

The reserve account is an important tool for a central bank because it allows it to manage the supply of its own currency, stabilize exchange rates, and ensure financial stability.

Open Market Operations

One of the primary tools that a central bank can use to influence its reserve account is through open market operations.

Open market operations involve the central bank buying or selling securities, such as government bonds, in the open market in order to increase or decrease the supply of money in the economy.

By buying securities, the central bank can increase the supply of money and add to its reserve account.

By selling securities, the central bank can decrease the supply of money and reduce its reserve account.

Changes in Interest Rates

Another tool that a central bank can use to influence its reserve account is through changes in interest rates.

By raising interest rates, the central bank can make it more attractive for banks and other financial institutions to hold funds in the reserve account. In turn, this can increase the balance of the account.

Conversely, by lowering interest rates, the central bank can make it less attractive for banks and other financial institutions to hold funds in the reserve account, which can decrease the balance of the account.

FX Intervention

A central bank can also influence its reserve account through the use of foreign exchange intervention, which involves the central bank buying or selling foreign currencies in the foreign exchange market in order to stabilize exchange rates and manage the supply of its own currency.

By buying foreign currencies, the central bank can add to its reserve account and increase the supply of its own currency.

By selling foreign currencies, the central bank can decrease its reserve account and decrease the supply of its own currency.

Why the Capital Account is Important for Currency (FX) Traders

Currency (FX) traders may need to pay attention to a country’s capital account for a number of reasons.

The capital account is a record of a country’s international financial transactions, including the movement of capital in and out of the country.

Changes in the capital account can have significant impacts on the exchange rate of a country’s currency and can therefore be of interest to FX traders.

For example, if a country experiences a large influx of capital, it can lead to an appreciation of the domestic currency as demand for the currency increases.

Conversely, if a country experiences a large outflow of capital, it can lead to a depreciation of the domestic currency as demand for the currency decreases.

FX traders may need to take these changes into account when making trading decisions.

In addition, capital controls, which are measures that a government can use to regulate the flow of capital in and out of a country, can also impact the exchange rate.

If a government imposes capital controls, it can reduce the supply of foreign currency in the market and lead to appreciation of the domestic currency.

FX traders may need to be aware of these measures and how they could affect the exchange rate.

Sterilization

In international finance, sterilization refers to the process of offsetting the effects of foreign exchange intervention on the domestic money supply.

Foreign exchange intervention is when a central bank buys or sells foreign currencies in the foreign exchange market in order to stabilize exchange rates and manage the supply of its own currency.

When a central bank buys foreign currencies, it adds to its foreign exchange reserves and increases the supply of its own currency.

This can lead to inflationary pressures if the money supply grows too rapidly (either financial asset bubbles or traditional inflation in the sense of too much spending relative to goods and services in the real economy).

To sterilize the effects of foreign exchange intervention on the domestic money supply, a central bank can use a variety of tools, such as open market operations or changes in interest rates.

Contractionary Sterilization vs. Expansionary Sterilization

For example, if a central bank buys foreign currencies, it can offset the increase in the money supply by selling securities in the open market, which removes money from circulation.

This is known as contractionary sterilization.

Alternatively, if a central bank sells foreign currencies, it can offset the decrease in the money supply by buying securities in the open market, which adds money to circulation.

This is known as expansionary sterilization.

Sterilization as a Policy Tool

Sterilization can be an important tool for central banks to manage the domestic money supply and maintain financial stability.

However, it can also have implications for the capital account and international finance. If a central bank engages in contractionary sterilization, it can lead to a decrease in demand for domestic assets, which can affect the capital account.

Similarly, if a central bank engages in expansionary sterilization, it can lead to an increase in demand for domestic assets, which can also affect the capital account.

International Monetary Fund (IMF) and the United Nations System of National Accounts (SNA)

The terms “capital account” and “financial account” are often used interchangeably to refer to the same thing in macroeconomics.

The capital account, as mentioned, is a record of a country’s international transactions that involve tangible physical assets, such as various types of financial assets and real estate.

The capital account is also known as the financial account (by the IMF and SNA) because it includes transactions in financial instruments, such as stocks, bonds, and loans.

The financial account is a measure of a country’s financial transactions with the rest of the world, and it reflects a country’s level of international investment and borrowing.

As we mentioned earlier, the capital account and the financial account are not the same as the current account, which includes transactions in goods, services, and income.

The balance of payments will need to always be in balance, meaning that the sum of the capital account (or financial account) and the current account must be zero.

Capital Controls and the Capital Account

Capital controls are measures taken by a government to regulate the flow of capital in and out of the country.

They are often used by governments to manage exchange rates, stabilize the domestic financial system, and protect domestic industries.

There are various types of capital controls, including limits on foreign exchange transactions, restrictions on foreign investment, and taxes on capital outflows.

Capital controls can be used to influence the capital account.

The capital account is one of the two primary components of a country’s balance of payments (BOP), the other being the current account.

By imposing capital controls, a government can limit the amount of capital that flows into or out of the country, which can affect the balance of the capital account.

For example, if a government imposes limits on foreign exchange transactions, it can make it more difficult for residents to buy foreign assets or for foreigners to buy domestic assets, which can reduce the demand for domestic assets and decrease the balance of the capital account.

Conversely, if a government removes capital controls, it can increase the demand for domestic assets and increase the balance of the capital account.

It is important to note that capital controls can have both benefits and costs.

On the one hand, they can help a government:

- manage exchange rates

- stabilize the domestic financial system, and

- protect domestic industries

On the other hand, they can also:

- limit the free flow of capital, which can discourage foreign investment

- reduce efficiency, and

- limit economic growth

As such, the use of capital controls is a controversial topic in international economics, and the decision to impose or remove capital controls depends on the specific circumstances of a country.

Capital Account Convertibility

Capital account convertibility is the ability to freely buy and sell foreign assets, such as stocks, bonds, and real estate, without any restrictions or limitations imposed by the government.

In other words, capital account convertibility refers to the freedom to convert domestic financial assets into foreign financial assets and vice versa.

Capital account convertibility is an important aspect of international finance because it allows for the free flow of capital between countries.

This can lead to increased foreign investment, which can stimulate economic growth and development.

It can also allow domestic investors to diversify their portfolios and access a wider range of investment opportunities.

However, capital account convertibility can also have risks and costs.

For example, if a country has a large influx of foreign capital, it can lead to asset price bubbles and overheating of the economy.

In addition, capital account convertibility can expose a country to external shocks, such as financial crises or exchange rate fluctuations, which can have negative consequences for the domestic economy.

As such, the decision to adopt capital account convertibility is a complex one, and it requires careful consideration of the potential benefits and costs.

Many countries have implemented capital account convertibility to varying degrees, depending on their specific economic circumstances.

Issues with Capital Account Convertibility in Emerging Markets

Capital account convertibility is an important aspect of international finance because it allows for the free flow of capital between countries.

However, it can also have risks and costs, particularly for emerging markets.

As mentioned in the preceding section, one issue with capital account convertibility – in emerging markets and all economies more generally – is that it can lead to lots of foreign capital pouring in, which can create asset price bubbles and inflation in the real economy.

This can lead to economic instability, exchange rate fluctuations, and financial crises.

This can have negative consequences for the domestic economy, particularly if the country has a large current account deficit or a high level of foreign debt.

It is important to note that the decision to adopt capital account convertibility is complicated, as there are benefits and costs.

Balance of payments: Capital account | Foreign exchange and trade | Macroeconomics

Capital Controls and the Bretton Woods System

The Bretton Woods system was a monetary system that was in place from 1944 to 1971 and was named after the location of the conference where it was agreed upon, Bretton Woods, New Hampshire.

Under the Bretton Woods system, countries pegged their currencies to the US dollar, and the US dollar was pegged to gold at a fixed exchange rate of $35 per ounce.

Under the Bretton Woods system, capital controls were widely used by governments to regulate the flow of capital in and out of the country.

Capital controls were seen as a way to manage exchange rates, stabilize the domestic financial system, and protect domestic industries.

There were various types of capital controls used under the Bretton Woods system, including limits on foreign exchange transactions, restrictions on foreign investment, and taxes on capital outflows.

These measures were used to limit the demand for foreign assets and reduce the supply of domestic assets, which helped to maintain the fixed exchange rates of the Bretton Woods system.

The Bretton Woods system collapsed in 1971 when the US government suspended the convertibility of the US dollar to gold.

Since then, many countries have adopted more liberalized capital account regimes and have largely abandoned the use of capital controls.

However, some countries still use capital controls to varying degrees, depending on their specific economic circumstances.

Capital Controls and the 1997 Asian Financial Crisis

The 1997 Asian financial crisis was a period of economic turmoil that affected several countries in Asia, including Indonesia, South Korea, and Thailand.

The crisis was triggered by a combination of factors, including the overvaluation of currencies, the high level of foreign debt, and the lack of transparency in the financial sector.

During the crisis, several countries in Asia implemented capital controls as a way to stabilize their economies and prevent further financial instability.

Capital controls are measures taken by a government to regulate the flow of capital in and out of the country.

They can include limits on foreign exchange transactions, restrictions on foreign investment, and taxes on capital outflows.

In the case of the 1997 Asian financial crisis, several countries implemented capital controls in an effort to stem the outflow of capital and stabilize their exchange rates.

For example, Indonesia imposed limits on foreign exchange transactions and restricted foreign investment in an effort to prevent further depreciation of its currency, the rupiah.

South Korea also imposed limits on foreign exchange transactions and introduced a tax on capital outflows in an effort to stabilize its currency, the won.

While capital controls were seen as a necessary measure to stabilize the economies of the affected countries in the short term, they also had negative consequences.

Capital controls can limit the free flow of capital, which can discourage foreign investment, reduce efficiency, create distortions, and limit economic growth.

In the long term, many economists argue that structural reforms, such as improving transparency, imposing prudent regulations, and strengthening the financial sector, are more effective in addressing the root causes of financial crises.

Capital Controls and the 2007-08 Financial Crisis

The 2007-2008 financial crisis was a global economic crisis that was triggered by the collapse of the US housing market and the subsequent failure of several major financial institutions.

The crisis had a significant impact on the global economy and led to a deep recession in many countries.

During the crisis, some countries implemented capital controls as a way to stabilize their economies and prevent further financial instability.

Capital controls are measures taken by a government to regulate the flow of capital in and out of the country.

They can include limits on foreign exchange transactions, restrictions on foreign investment, and taxes on capital outflows.

In the case of the 2007-2008 financial crisis, several countries implemented capital controls in an effort to stem the outflow of capital and stabilize their exchange rates.

For example, Iceland implemented capital controls in November 2008 in response to the collapse of its banking sector.

The capital controls included limits on foreign exchange transactions and restrictions on foreign investment.

The impact of capital controls on the 2007-2008 financial crisis was mixed.

In some cases, capital controls were seen as a necessary measure to stabilize the economies of the affected countries in the short term.

However, they also had the negative consequences of restriction free capital flow, which can reduce economic growth and efficiency, and discourage FDI.

Capital Controls and Emerging Markets

Capital controls are more common in emerging markets for a number of reasons.

One reason is that emerging markets often have weaker financial systems and are more vulnerable to financial instability.

As a result, they may be more prone to capital flight, which is the sudden outflow of capital from a country due to economic or political instability.

To prevent capital flight and stabilize their economies, emerging markets may implement capital controls as a way to regulate the flow of capital in and out of the country.

Another reason why capital controls are more common in emerging markets is that they may have less developed financial markets and may rely more on foreign capital to finance their development.

In these cases, capital controls can be used as a way to manage the inflow of foreign capital and prevent asset bubbles or inflation.

It is important to note that capital controls are not without costs.

They can limit the free flow of capital, which can discourage foreign investment, reduce efficiency, and limit economic growth.

As such, the decision to implement capital controls is a complex one, and it requires careful consideration of the potential benefits and costs.

Many countries have implemented capital controls to varying degrees, depending on their specific economic circumstances.

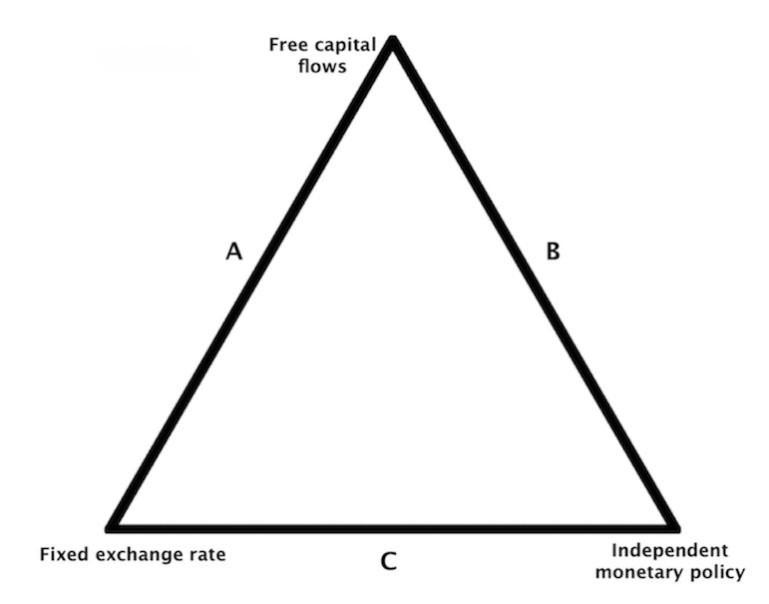

Capital Controls and Economic Trilemma

The economic trilemma – also known as the “impossible trinity” – is a concept in international economics that refers to the trade-off between three policy goals:

- exchange rate stability

- monetary policy independence, and

- capital mobility

The economic trilemma suggests that it is not possible for a country to achieve all three policy goals simultaneously.

Instead, a country must choose two of the goals and give up the third, or basically pick a certain side of the triangle it wants to be one.

Capital controls are measures taken by a government to regulate the flow of capital in and out of the country.

They can include limits on foreign exchange transactions, restrictions on foreign investment, and taxes on capital outflows.

Capital controls can be used as a way to manage the trade-off between exchange rate stability, monetary policy independence, and capital mobility.

For example, if a country wants to maintain exchange rate stability and monetary policy independence, it can implement capital controls to limit the inflow or outflow of capital.

This can help to stabilize the exchange rate and allow the central bank to independently set monetary policy without being influenced by capital flows.

However, this comes at the cost of giving up capital mobility.

Alternatively, if a country wants to maintain capital mobility and monetary policy independence, it can allow the free flow of capital and give up exchange rate stability.

This can lead to increased foreign investment and economic growth, but it also means that the exchange rate may be more vulnerable to fluctuations and that the central bank may not have as much control over monetary policy.

The decision to implement capital controls and the specific policy goals that a country chooses to prioritize depend on its specific economic circumstances.

There is no one-size-fits-all solution, and the trade-offs involved must be carefully considered.

FAQs – Capital Account

Why would a country want to impose capital controls?

Capital controls are measures that a government can use to regulate the flow of capital in and out of a country.

These measures can be used to manage the exchange rate, stabilize the domestic currency, and protect the domestic financial system.

Governments may impose capital controls in order to achieve certain economic policy objectives, such as reducing the risk of financial instability or limiting the impact of speculative capital flows on the domestic economy.

Capital controls can take many forms, such as limits on foreign exchange transactions, restrictions on the movement of capital across borders, or taxes on capital inflows or outflows.

Are capital controls more common in developing countries than developed countries?

Capital controls are often more prevalent in developing countries than in developed countries. There are several reasons for this.

First, developing countries may be more vulnerable to financial instability and economic shocks due to their weaker financial systems and less diversified economies (e.g., many are dependent on commodity exporting or the exporting of value-added goods).

As a result, they may be more prone to financial crises and may need to use capital controls as a tool to stabilize the domestic currency and protect the domestic financial system.

Second, developing countries may have weaker institutions and less developed financial markets, which can make them more vulnerable to speculative capital flows.

Capital controls can be used to reduce the impact of these flows on the domestic economy and to prevent rapid currency appreciation or depreciation.

Finally, developing countries may have different economic policy objectives than developed countries.

For example, they may be more focused on promoting domestic investment and economic development, and capital controls can be used as a tool to achieve these goals.

It is worth noting that capital controls are not limited to developing countries, and many developed countries have also used capital controls at various points in their history.

However, capital controls are generally less common in developed countries due to their stronger financial systems and more developed financial markets.

Conclusion – Capital Account

The capital account in economics is a record of a country’s international financial transactions, including the movement of capital in and out of the country.

It is a component of a country’s balance of payments, which is a summary of all international economic transactions between a country and the rest of the world.

The capital account includes transactions related to the purchase and sale of financial assets, such as stocks, bonds, and currencies, as well as the borrowing and lending of money across borders.

The capital account can be influenced by a number of factors, including changes in the domestic and global economy, the exchange rate, and government policies such as capital controls.

Changes in the capital account can have significant impacts on the exchange rate of a country’s currency and can be of interest to currency traders and other market participants.

Capital controls are measures taken by a government to regulate the flow of capital in and out of the country.

They can include limits on foreign exchange transactions, restrictions on foreign investment, and taxes on capital outflows.

In some cases, they may be necessary to stabilize an economy in the short term. However, they can also have negative consequences such as discouraging foreign investment and limiting economic growth.

Therefore, it is important for governments to consider all options before implementing capital controls and ensure that any measures taken are carefully balanced between long-term economic stability and short-term financial stabilization.

It is also important that governments focus on structural reforms such as improving transparency and strengthening the financial sector which can address underlying problems more effectively.